Insurance Requirements Templates

Are you looking for information about insurance requirements? Look no further! Our webpage provides a comprehensive overview of the insurance requirements you need to know. From different states to various forms, we cover it all.

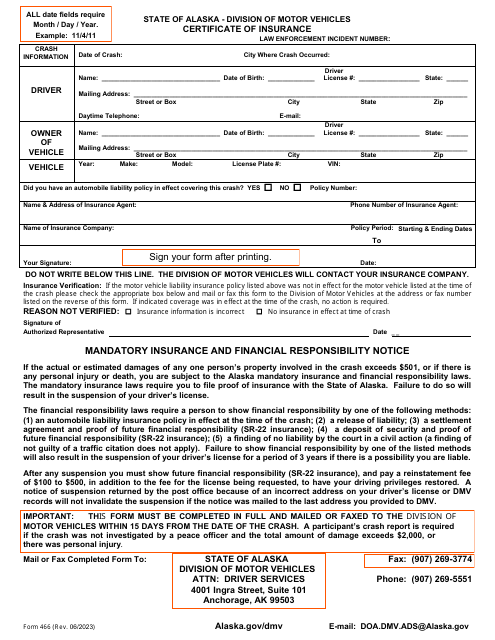

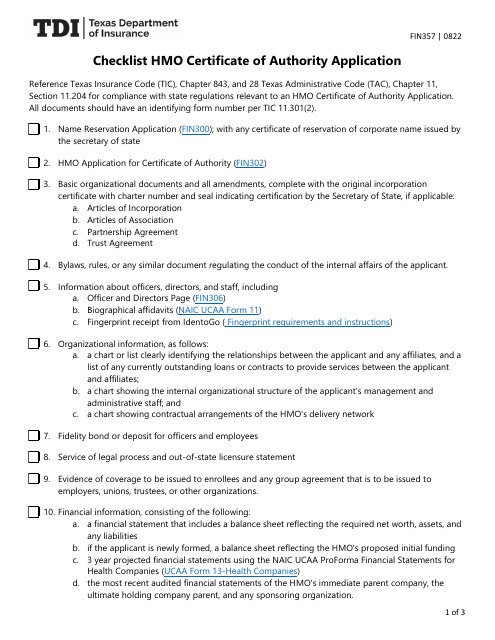

Whether you need a certificate of insurance or a statement in lieu of motor vehiclebodily injury and property damage liability insurance, our webpage has got you covered. We also provide instructions for forms such as the prior authorization/behavioral treatment attachment in Wisconsin or the checklist for HMO certificate of authority application in Texas.

Navigating the world of insurance requirements can be overwhelming, but our webpage simplifies the process. We offer valuable resources and insights to ensure you have all the information you need. Whether you're an individual, a business owner, or a contractor, understanding insurance requirements is crucial. Let our webpage be your go-to resource.

With a user-friendly interface and up-to-date information, our webpage is a one-stop shop for all your insurance requirement needs. We aim to provide accurate and reliable information to help you navigate the complexities of insurance requirements efficiently.

Don't waste time searching for scattered information. Visit our webpage today and gain the knowledge you need for insurance requirements. Stay informed and make informed decisions for your insurance needs.

Documents:

40

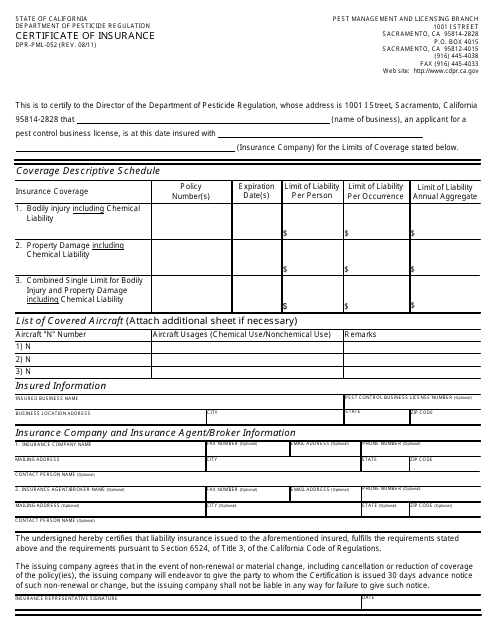

This form is used for obtaining a certificate of insurance in the state of California. It provides proof of insurance coverage for certain activities or events.

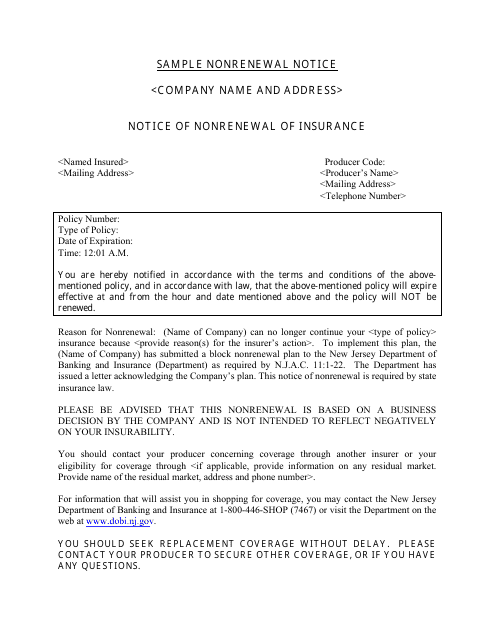

This document is used for notifying an individual or business in New Jersey that their insurance policy will not be renewed.

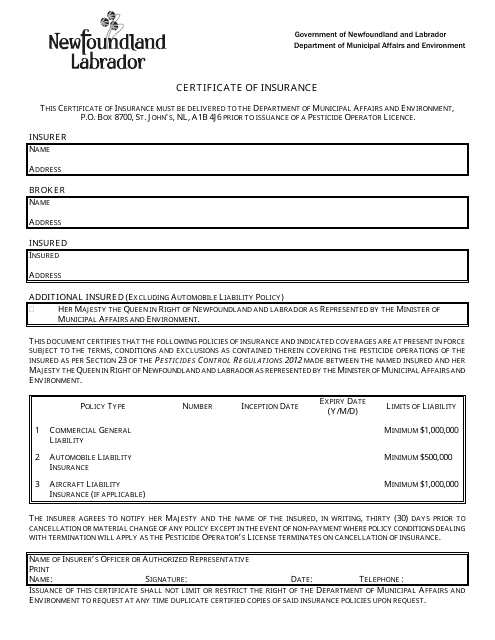

This document verifies that an individual or company has insurance coverage in the province of Newfoundland and Labrador, Canada.

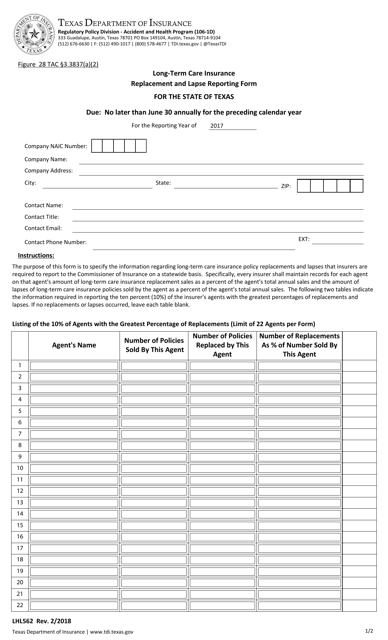

This form is used for reporting the replacement and lapsing of long-term care insurance in Texas.

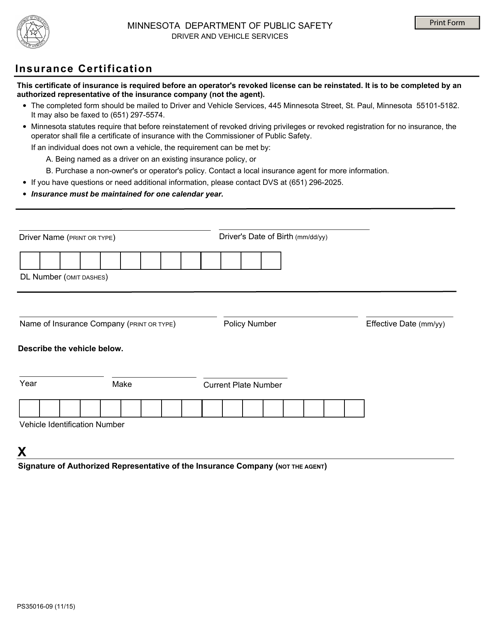

This form is used for insurance certification in the state of Minnesota. It ensures that individuals or businesses have appropriate insurance coverage.

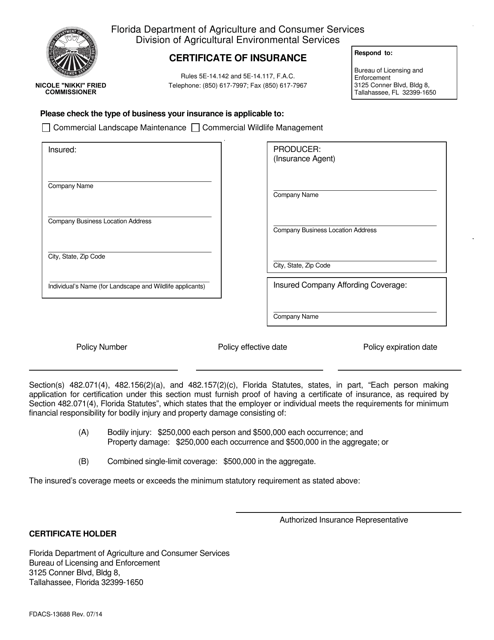

This Form is used for obtaining a certificate of insurance required in Florida. It ensures that the person or entity has the necessary insurance coverage.

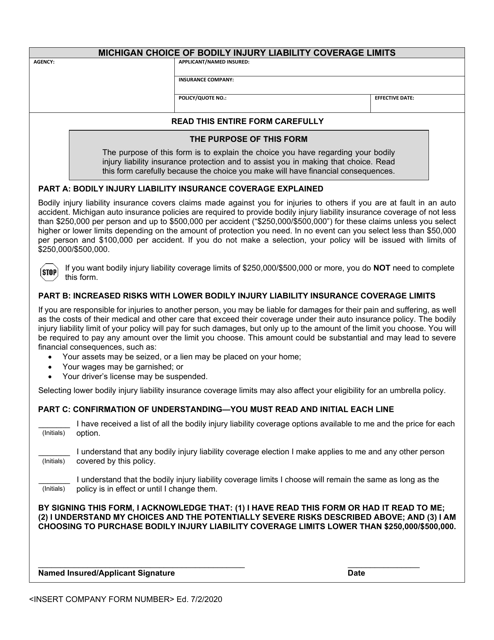

This form is used for selecting the limits of bodily injury liability coverage in the state of Michigan. It allows drivers to choose the amount of coverage they wish to have for bodily injury claims resulting from a car accident.

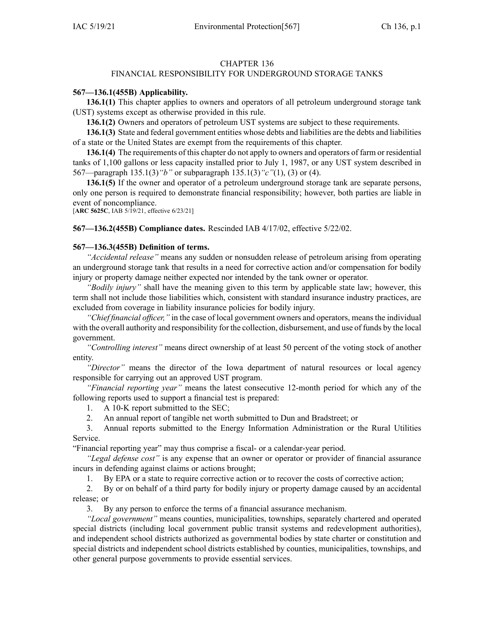

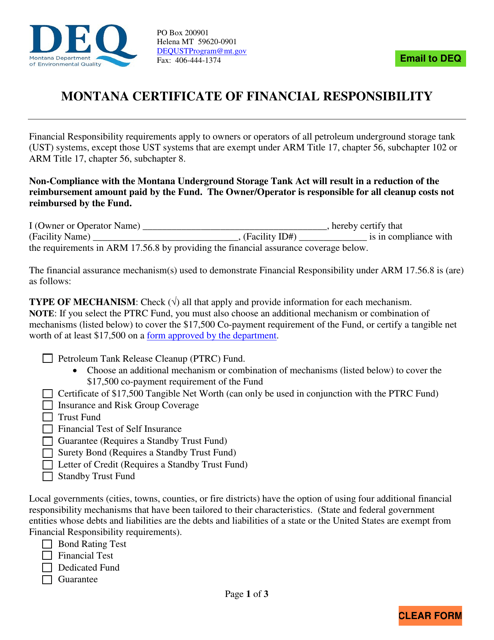

This document establishes the regulations and requirements for financial responsibility for underground storage tanks in the state of Iowa. It ensures that owners of these tanks have the means to prevent and address any potential leaks or damages.

This document is used by sellers in Oklahoma to notify the Insurance Commissioner about certain matters related to insurance.

This form is used for providing a statement in lieu of motor vehicle bodily injury and property damage liability insurance in Texas.

This Form is used for obtaining a Certificate of Insurance in the state of Texas. It is for providing proof of insurance coverage.

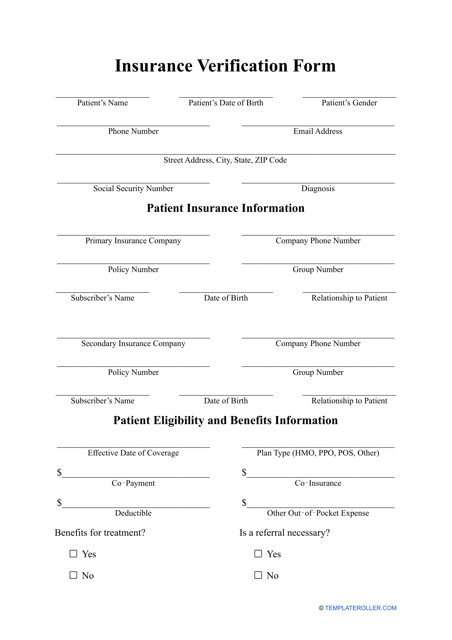

Medical institutions will send this document to check the medical coverage of an individual patient.

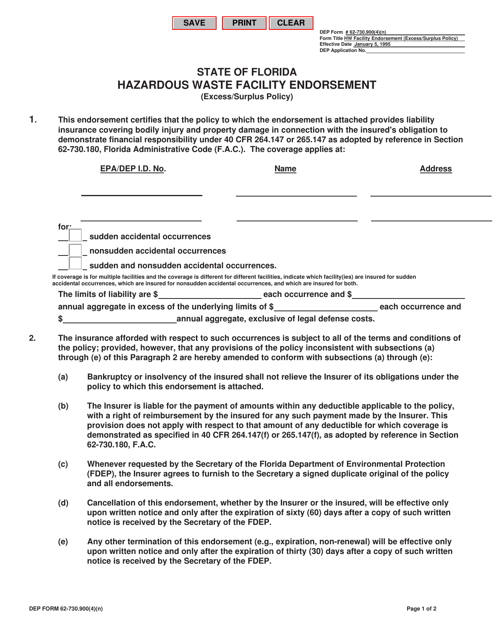

This form is used for obtaining a hazardous waste facility endorsement in Florida, specifically for the excess/surplus policy.

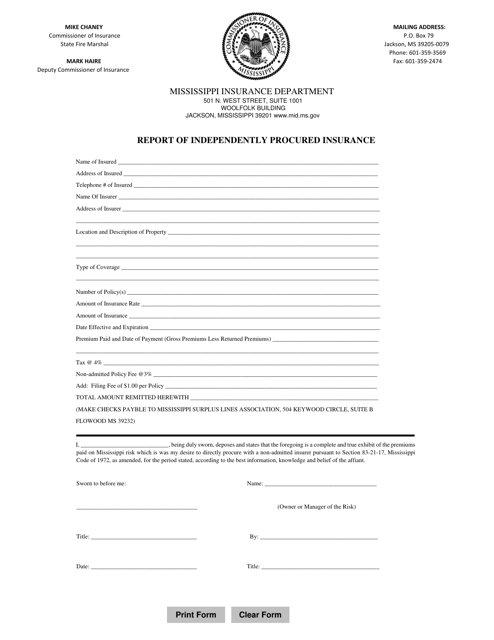

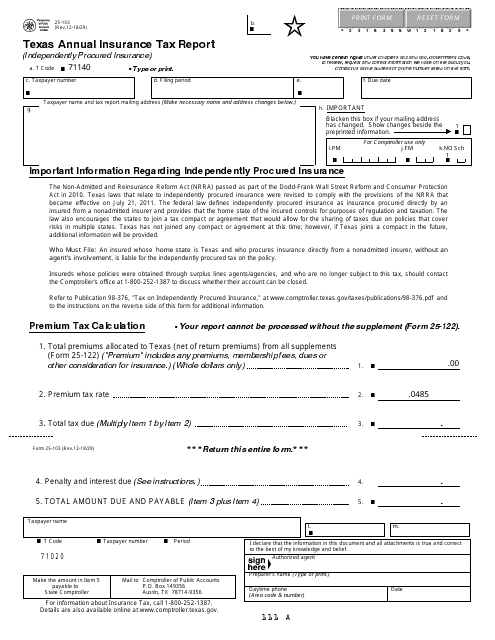

This document is a report of independently procured insurance in the state of Mississippi. It provides details of insurance coverage obtained by an individual or entity from a source other than an insurance agent or broker.

This document is used for certifying that an insurance broker or agent is authorized to operate in New York City.

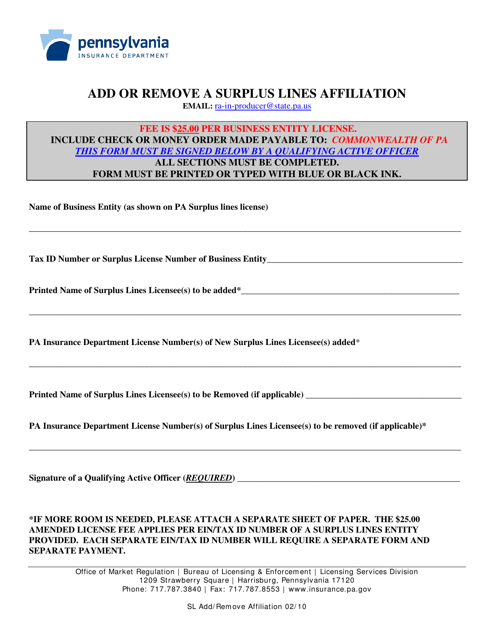

This document is used to add or remove a surplus lines affiliation in Pennsylvania.

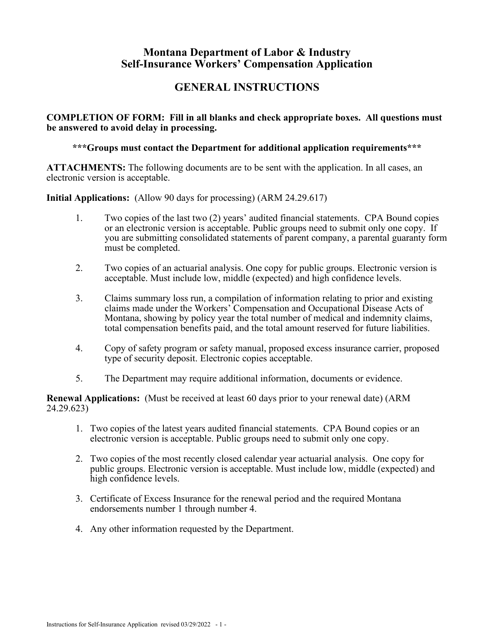

This form is used for conducting a financial test of self-insurance in the state of West Virginia. It provides instructions on how to assess the financial stability and solvency of self-insured entities.

This Form is used for obtaining a Certificate of Insurance in the state of West Virginia. It provides instructions on how to fill out Form AST FR-5 to request proof of insurance.

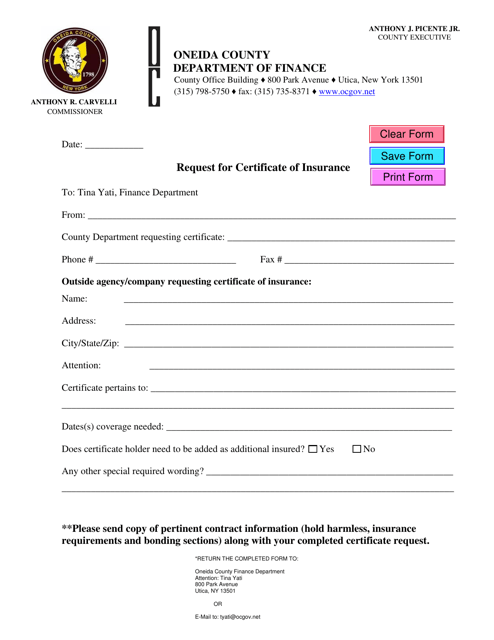

This type of document is a request for a certificate of insurance specific to Oneida County, New York. It is used to formally ask for proof of insurance coverage.

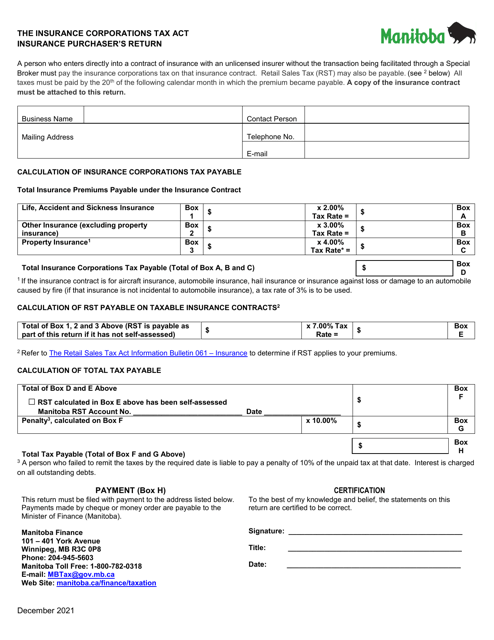

This document is for insurance purchasers in Manitoba, Canada to file a return. It is used for reporting information related to insurance purchases and ensuring compliance with the applicable regulations.

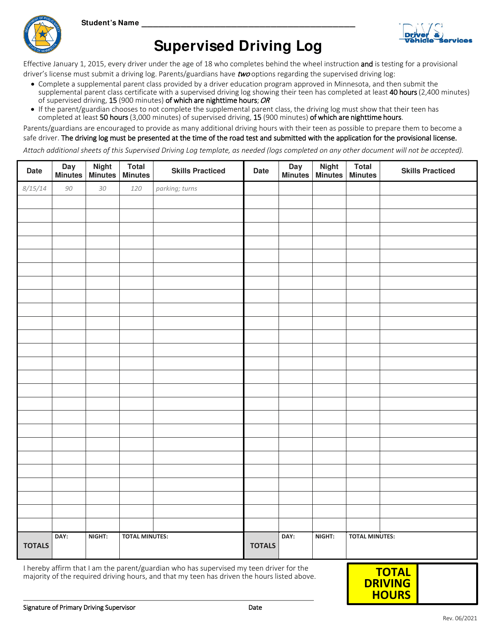

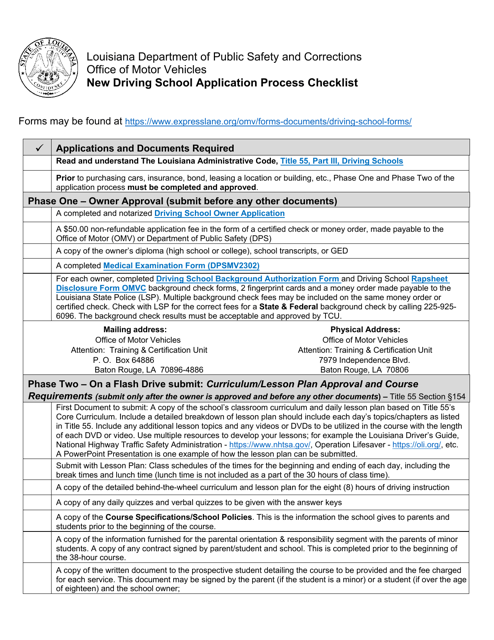

This document provides a checklist for the application process to start a new driving school in Louisiana.

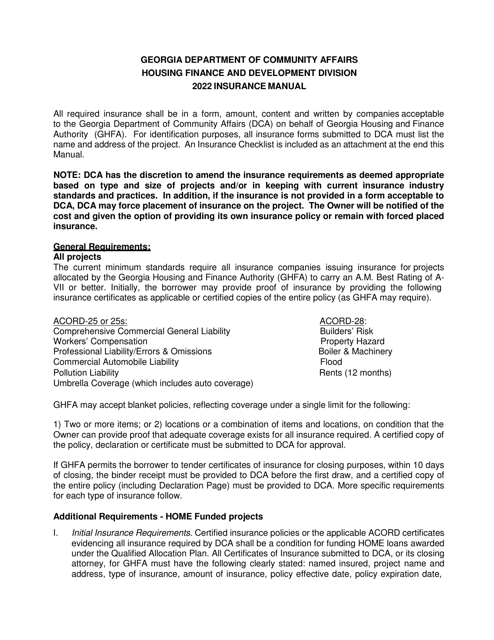

This checklist is used to guide residents in Georgia on the important factors to consider when getting insurance coverage. It covers various types of insurance such as auto, home, and medical.

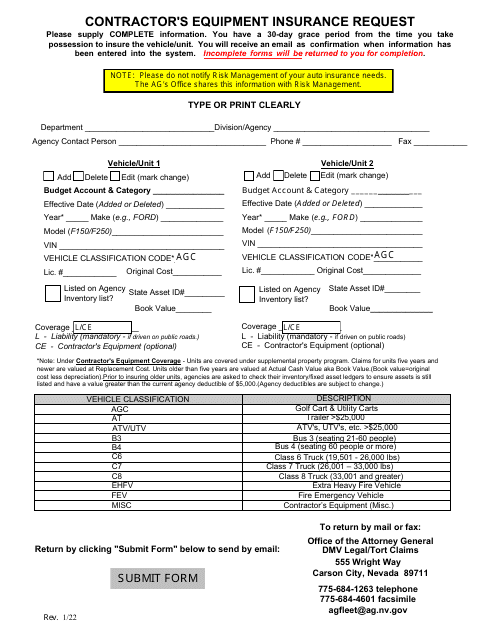

This document is used for requesting contractor's equipment insurance in the state of Nevada.

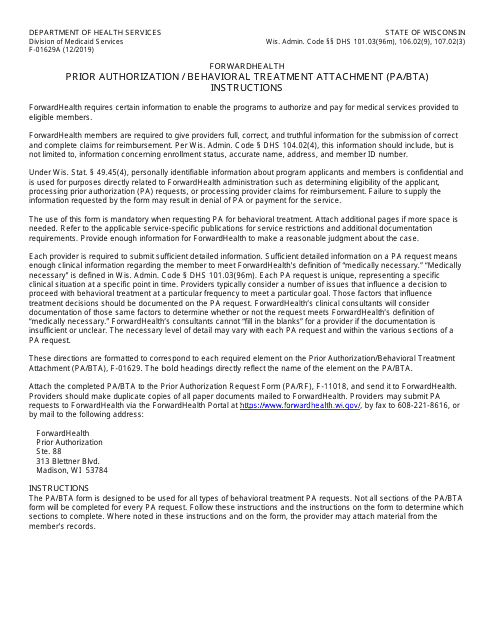

This Form is used for providing instructions on how to complete Form F-01629 Prior Authorization/Behavioral Treatment Attachment (PA/BTA) in the state of Wisconsin. It is important to follow these instructions carefully in order to ensure proper submission of the form.

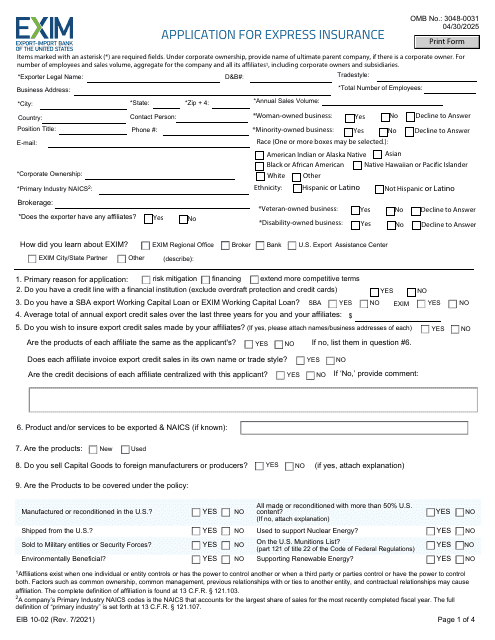

This document outlines the insurance requirements that must be met when applying for Small Business Administration (SBA) loans. It details the types of insurance coverage that businesses must have in order to qualify for an SBA loan and protect their assets.

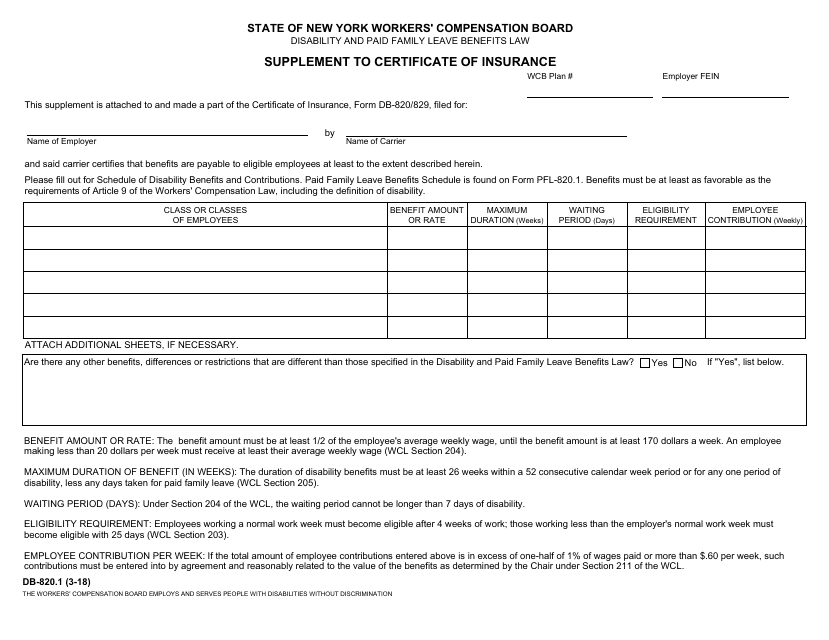

This form is used for providing additional information and details to supplement a Certificate of Insurance in the state of New York.

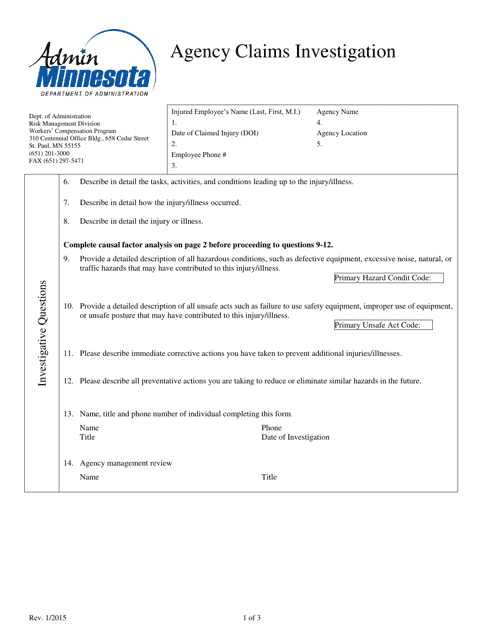

This type of document relates to the investigation of claims by an agency in the state of Minnesota. It is used to gather information and determine the validity of the claims being made.

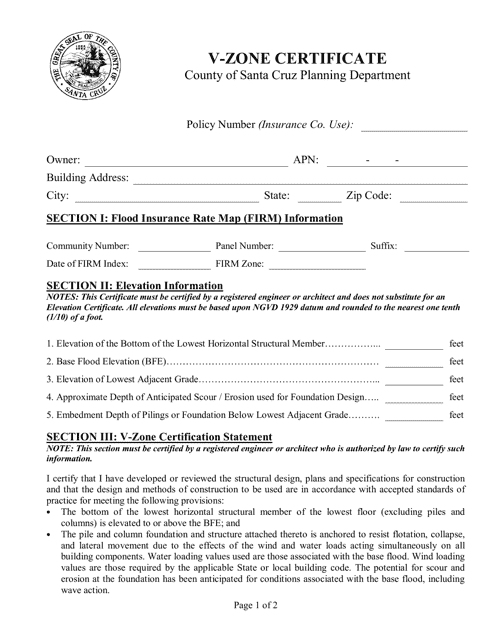

This document is a V-Zone Certificate specific to Santa Cruz County, California. This type of certificate certifies that a property is located within a Coastal High Hazard Area and is subject to certain regulations and restrictions.

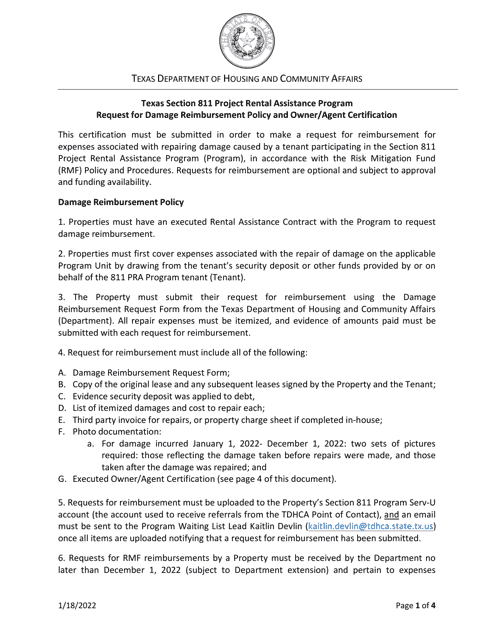

This document provides information and guidelines for requesting reimbursement for damages in the Texas Section 811 Project Rental Assistance Program. It also includes a certification form for property owners or agents.

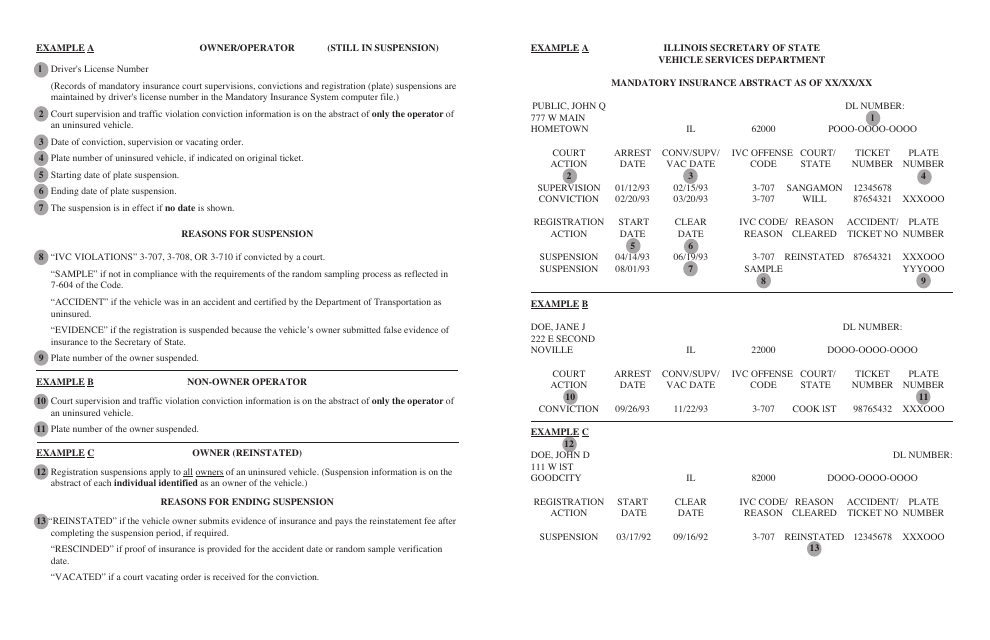

This document explains the mandatory insurance requirements for vehicle owners in Illinois. It provides information about the different types of insurance coverage and the minimum limits required. It also outlines the consequences of not carrying proper insurance.