Residential Exemption Templates

Are you a homeowner looking to decrease your property taxes? Then you may be eligible for a residential exemption. A residential exemption is a program offered in various states across the United States and Canada that provides tax benefits to homeowners.

Also known as a homestead exemption or a property tax exemption, a residential exemption allows homeowners to reduce the assessed value of their property for tax purposes. This can result in significant savings on annual property taxes.

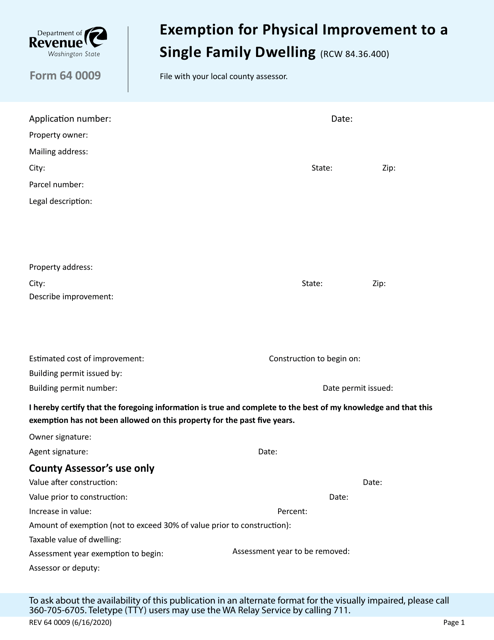

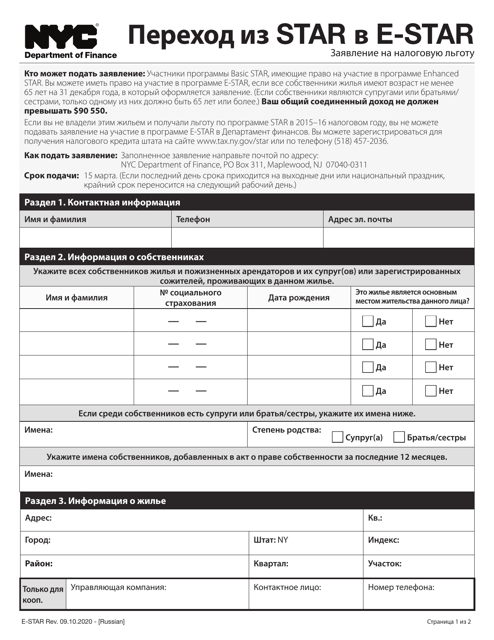

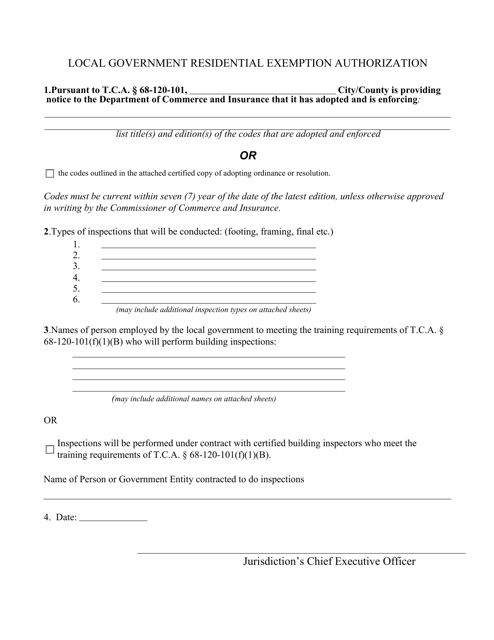

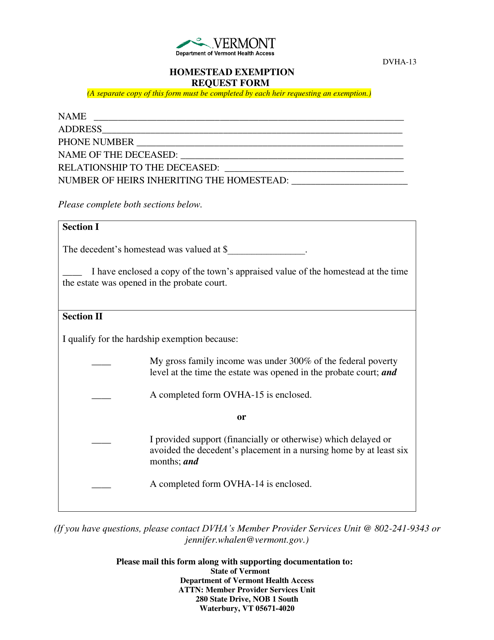

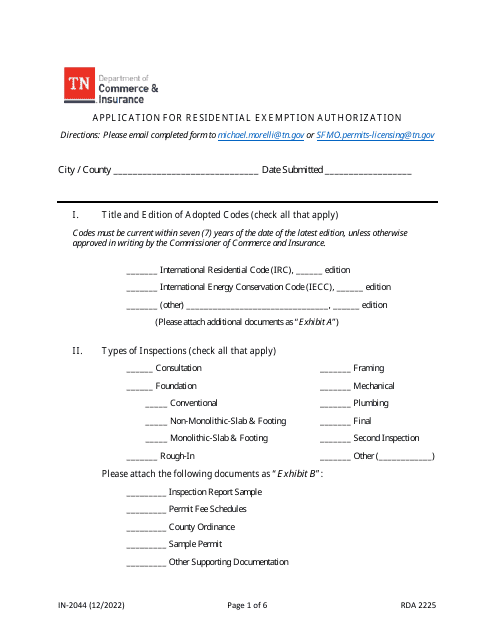

Different states and counties have different requirements and forms to apply for a residential exemption. For example, in Washington, you can apply for the "Exemption for Physical Improvement to a Single Family Dwelling" form, while in New York City (Russian), you can submit an application for the "Star to E-Star Exemption." In Tennessee, you may need to complete the "Local Government Residential Exemption Authorization" or the "Form IN-2044 Application for Residential Exemption Authorization." In Vermont, homeowners can request the "Form DVHA-13 Homestead Exemption."

If you're unsure about the eligibility criteria or the specific forms required in your area, it's best to consult with the local government or tax authorities. They can guide you through the application process and provide the necessary information to take advantage of the residential exemption program.

By applying for a residential exemption, you can potentially save thousands of dollars in property taxes each year. So why not take advantage of this opportunity and reduce your tax burden? Apply for a residential exemption today and enjoy the benefits of lower property taxes.

Documents:

7

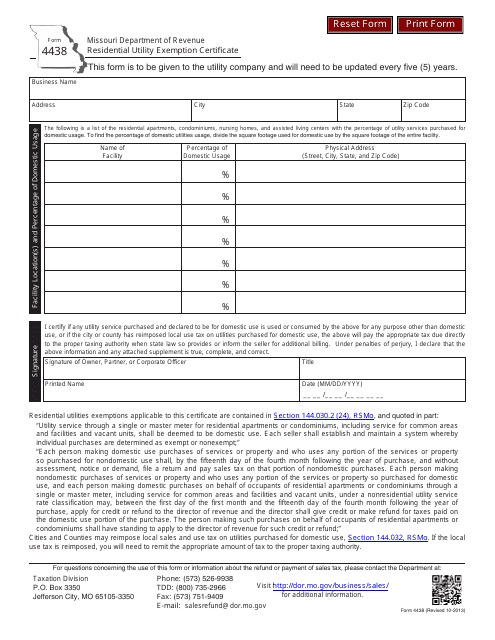

This form is used for requesting a residential utility exemption certificate in the state of Missouri.

This Form is used for claiming exemption for physical improvement to a single-family dwelling in the state of Washington.

This document is an application for the Star to E-Star exemption in New York City, written in Russian.

This form is used for obtaining a residential exemption authorization from the local government in Tennessee. It allows homeowners to apply for a tax exemption on their residential property.

This form is used for requesting a homestead exemption in the state of Vermont.

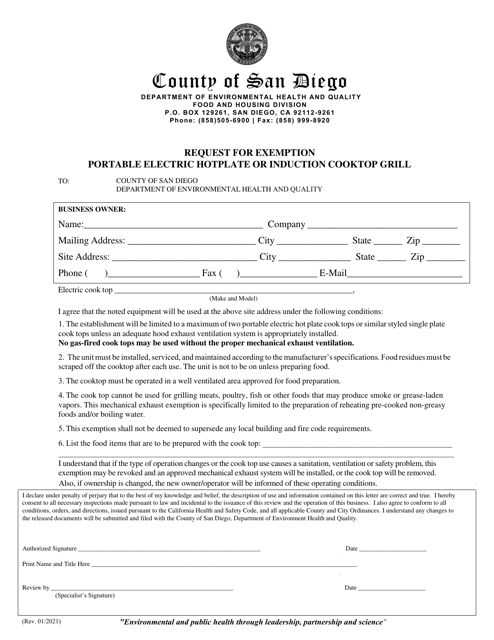

This Form is used for requesting an exemption for using a portable electric hotplate or induction cooktop grill in the County of San Diego, California.

This form is used for applying for residential exemption authorization in Tennessee.