Tax Settlement Templates

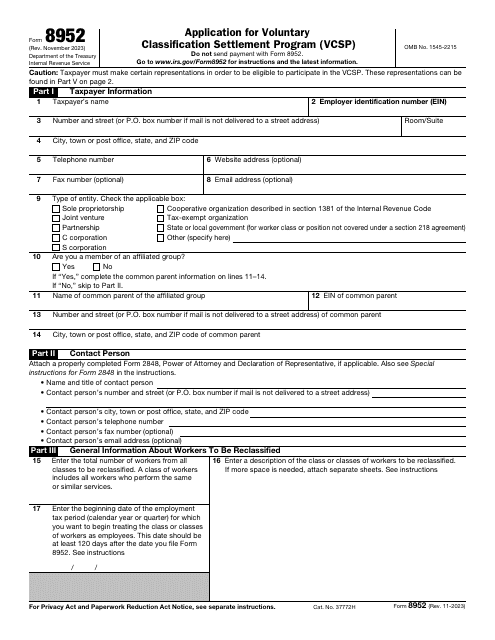

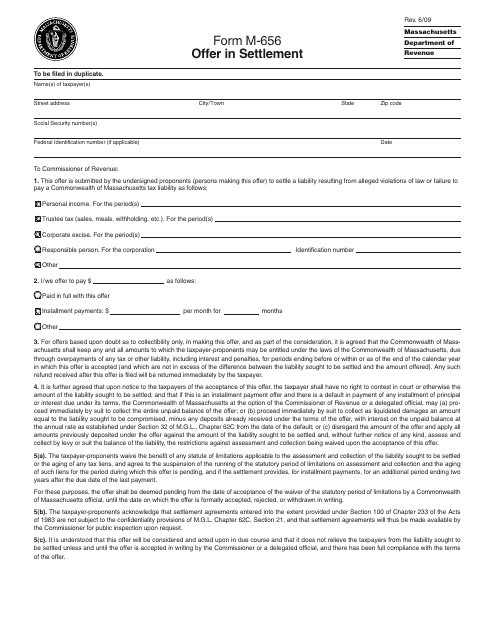

Looking for a quick and easy way to handle your tax settlements? Look no further than our comprehensive tax settlement services. Whether you need to file an IRS Form 8952 Application for Voluntary Classification Settlement Program (Vcsp) or a state-specific form like the Form R-20212A Offer in Compromise Application for Louisiana or the Form M-656 Offer in Settlement for Massachusetts, we've got you covered.

Our tax settlement services are designed to help individuals and businesses across the country navigate the complicated world of tax settlements. With our expertise and knowledge of tax laws and regulations, we can guide you through the process and help you achieve the best possible outcome.

Don't let the stress of tax settlements weigh you down. Let our team of experts handle all the paperwork and negotiations for you. With our top-notch tax settlement services, you can breathe easy knowing that your tax issues are being taken care of professionally and efficiently.

So, whether you're looking to settle your taxes with the IRS or with a specific state, we've got everything you need to make the process as smooth and seamless as possible. Contact us today to learn more about our tax settlement services and let us help you find the best solution for your tax situation.

Documents:

46

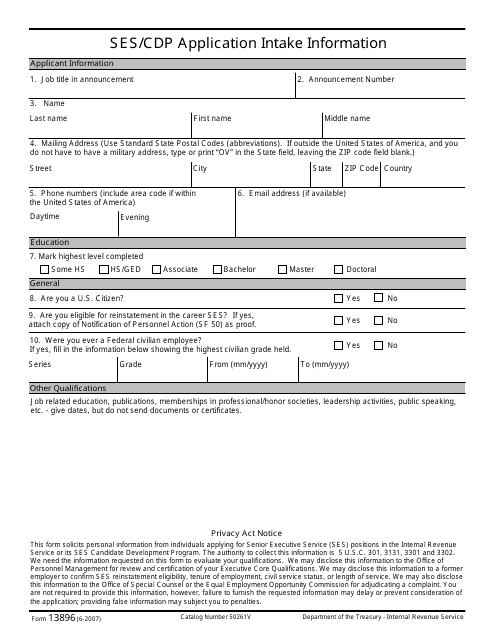

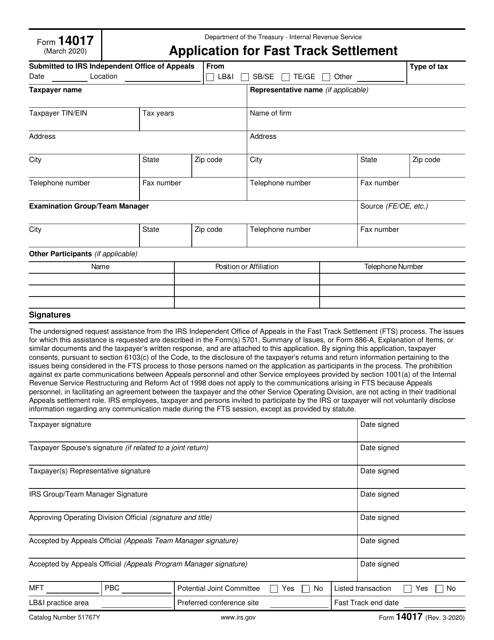

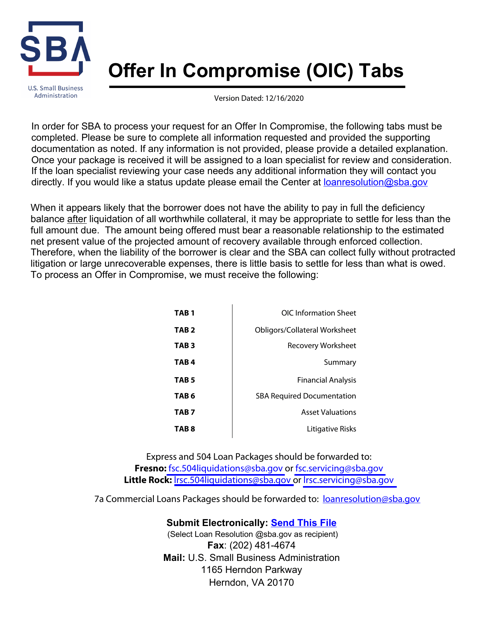

This form is used for applying for a Ses/Cdp Application Intake with the IRS.

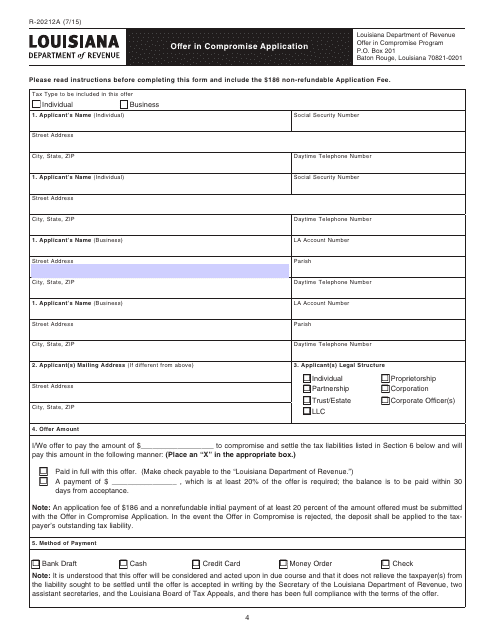

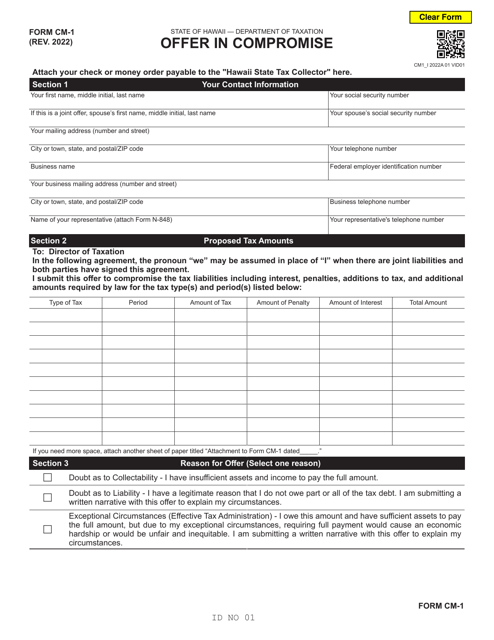

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

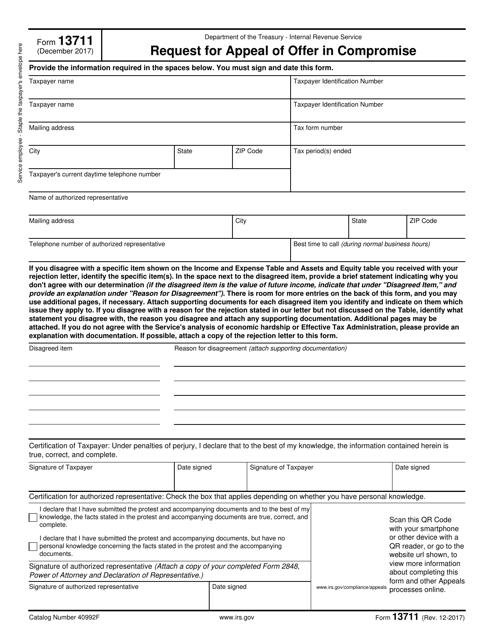

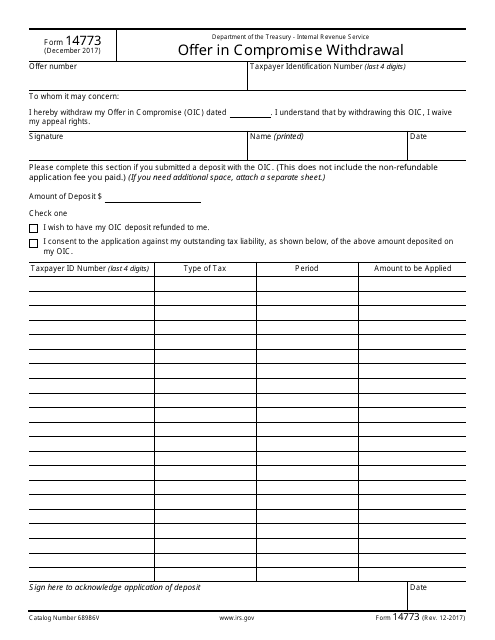

This Form is used for withdrawing an offer in compromise with the Internal Revenue Service (IRS).

This form is used for making an offer in settlement in the state of Massachusetts.

This document provides information and instructions for businesses in California who want to make an offer in compromise to settle their tax debt with the Franchise Tax Board (FTB).

This form is used for the Offer in Compromise Program in the state of Louisiana. It allows taxpayers to settle their tax debts with the state for a reduced amount.

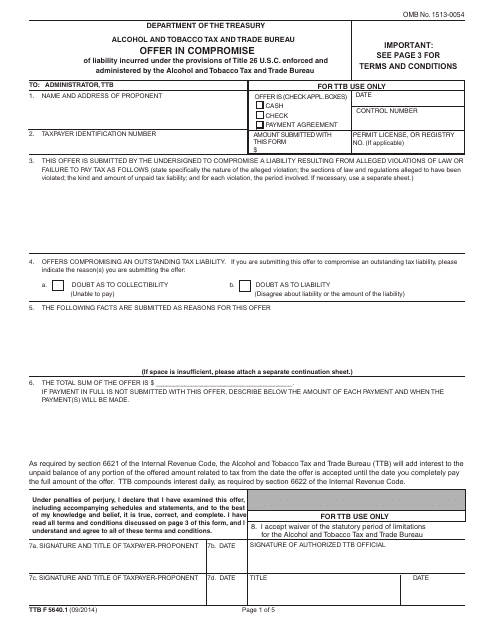

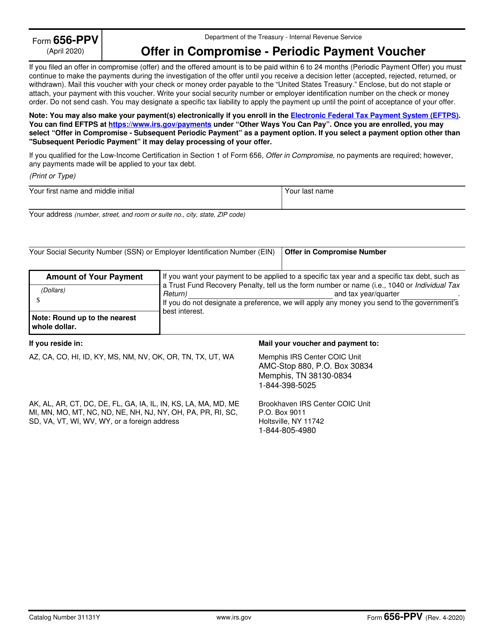

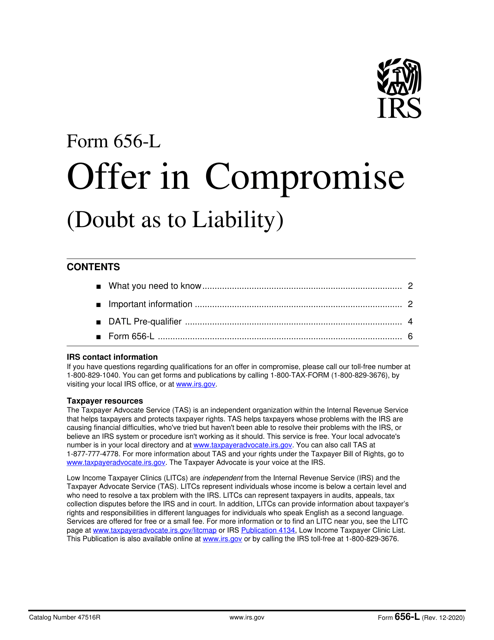

This document is used for making an offer in compromise to the Internal Revenue Service (IRS) for violations of the Internal Revenue Code (IRC).

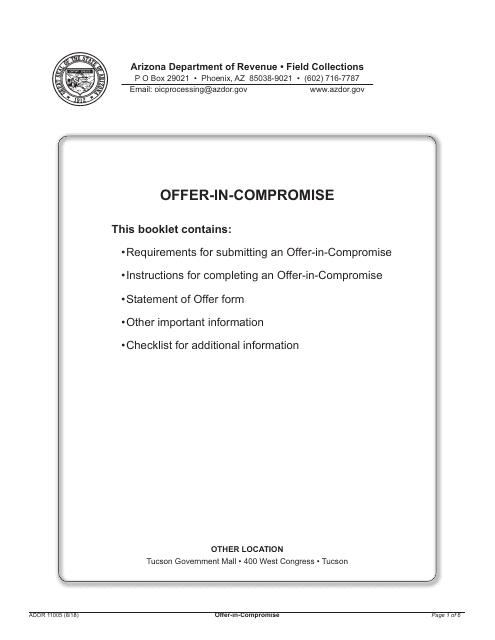

This form is used for submitting an offer-in-compromise to the Arizona Department of Revenue. It allows taxpayers to propose a settlement for their outstanding tax liabilities with the state of Arizona.

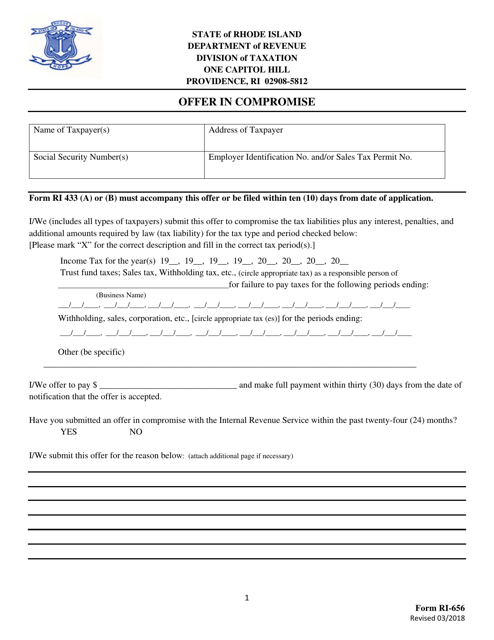

This form is used for making an offer in compromise to the state of Rhode Island to settle a tax debt.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

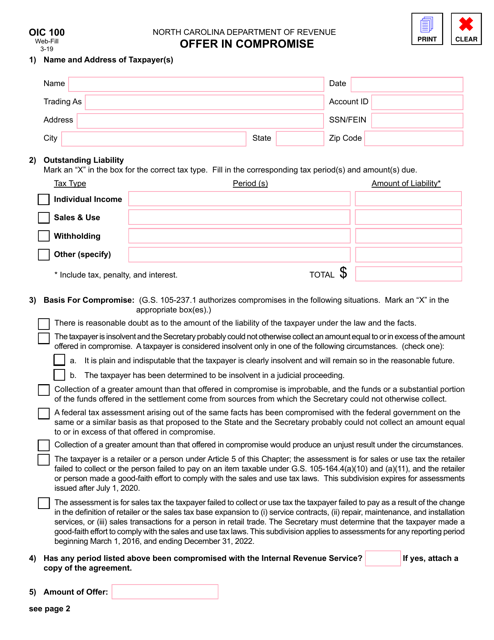

This document is used for submitting an Offer in Compromise to the state of North Carolina. It is a request to settle a tax liability for less than the full amount owed.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

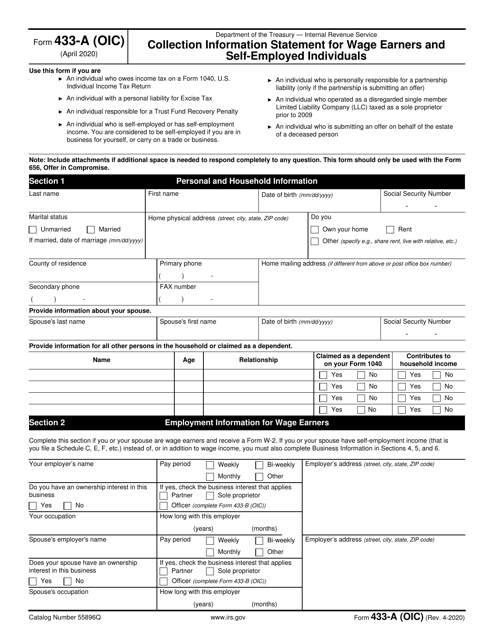

This Form is used for individuals who owe taxes to provide detailed financial information to the IRS in order to request an offer in compromise (OIC) and settle their tax debt.

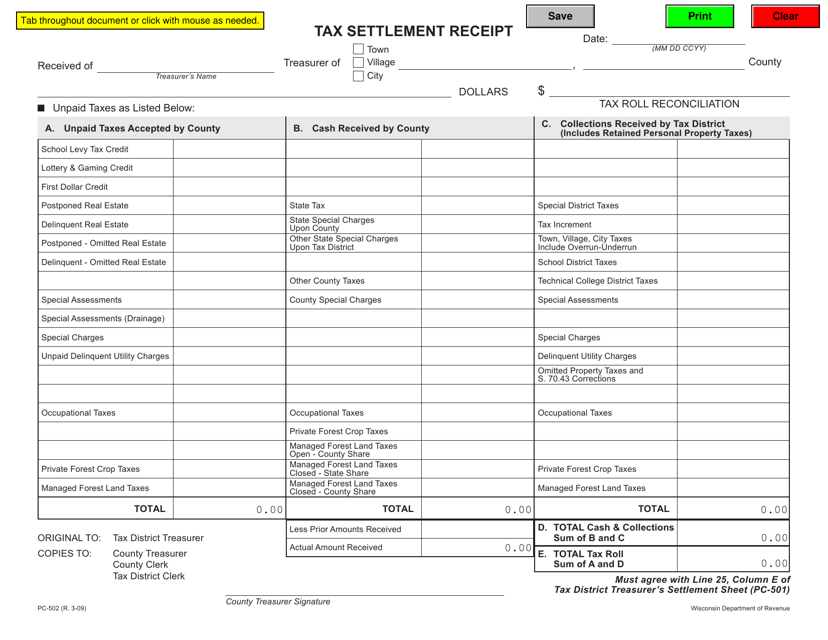

This form is used for obtaining a tax settlement receipt in the state of Wisconsin. It provides acknowledgment of a tax settlement and can be used for recordkeeping purposes.

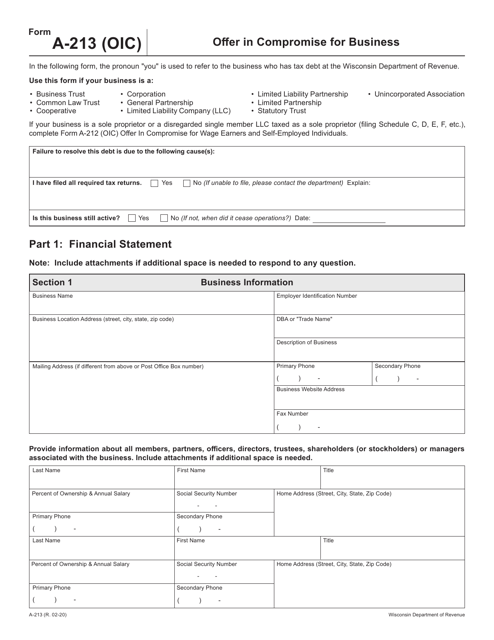

This form is used for making an offer in compromise for a business located in Wisconsin.

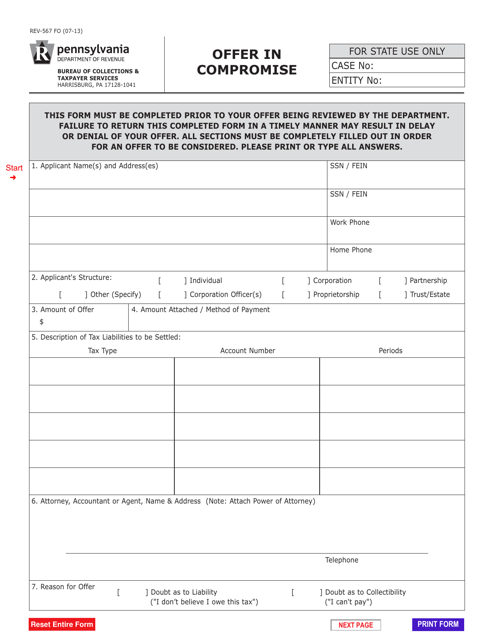

This Form is used for making an offer in compromise with the state of Pennsylvania to settle your tax debt for less than the full amount owed.

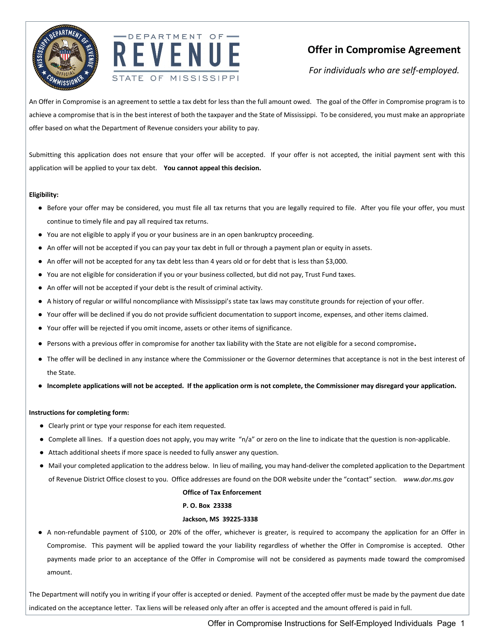

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

This document is for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to resolve their tax debt.

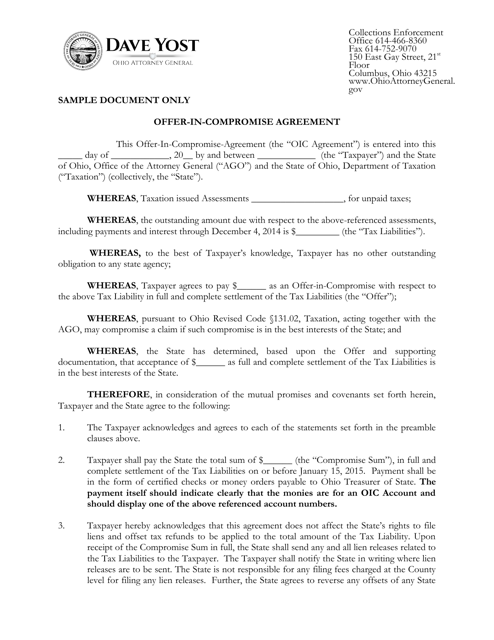

This document is a sample agreement for an offer-in-compromise in the state of Ohio. It outlines the terms and conditions for settling a tax debt with the Ohio Department of Taxation.

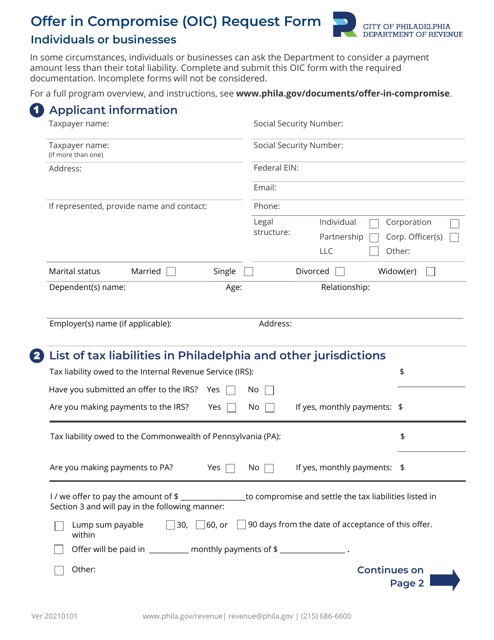

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.