Savings Account Templates

A savings account, also known as a saving account or a savings accounts, is a type of bank account designed to help individuals save money for the future. It is a convenient and secure way to set aside funds for various purposes, such as emergencies, vacations, or long-term goals.

With a savings account, you can earn interest on the money you deposit, allowing your savings to grow over time. This interest is typically higher than what you would earn on a regular transaction account, making it an attractive option for individuals who want to maximize their savings.

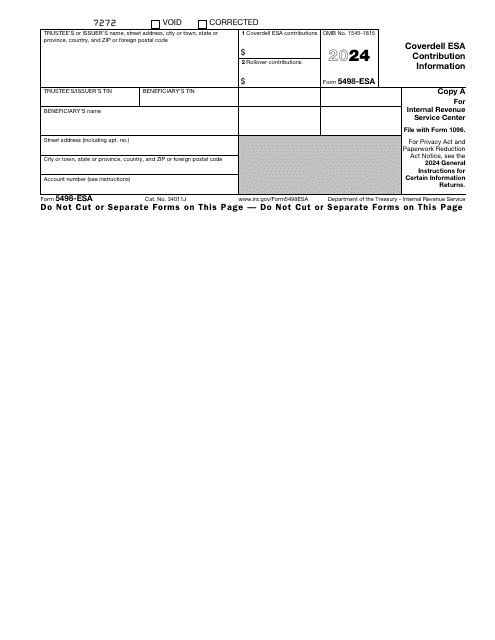

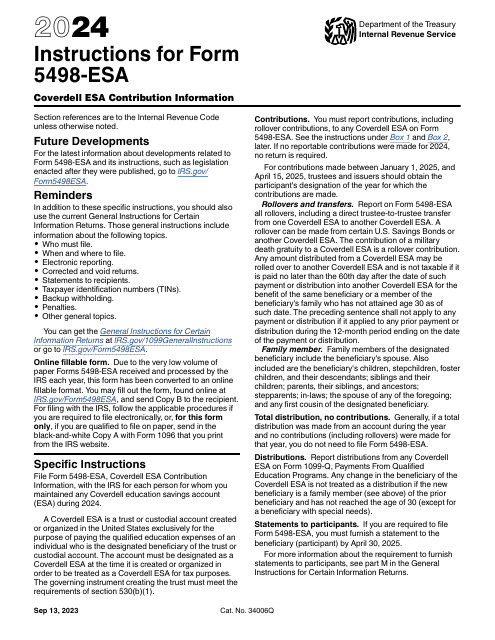

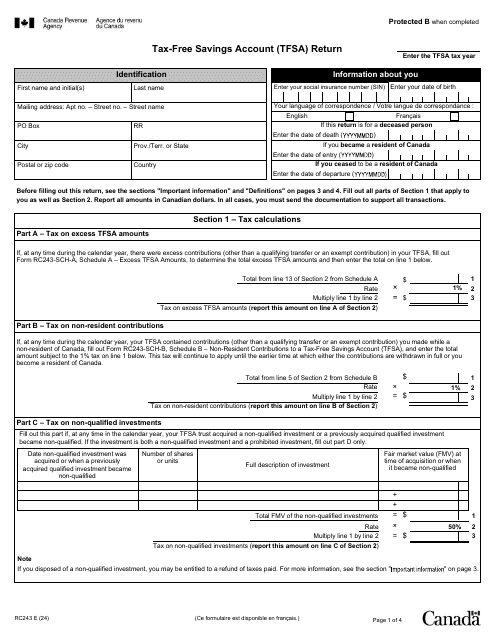

One important document related to savings accounts is the IRS Form 5498-ESA Coverdell Esa Contribution Information. This form provides information about contributions made to a Coverdell Education Savings Account (ESA), which is a type of savings account specifically designed for educational expenses. It helps individuals keep track of their contributions and ensures compliance with tax regulations.

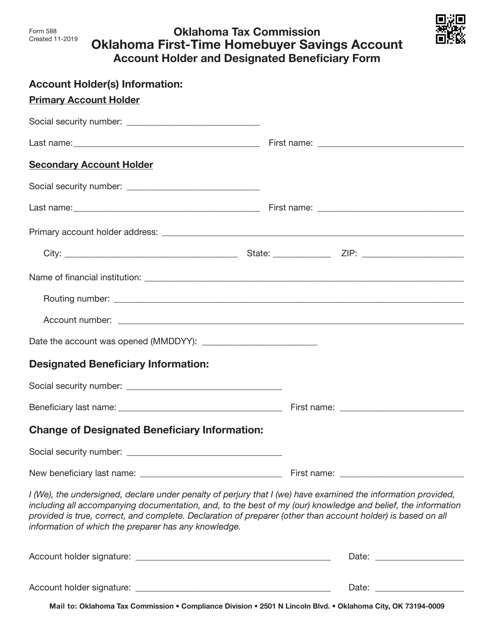

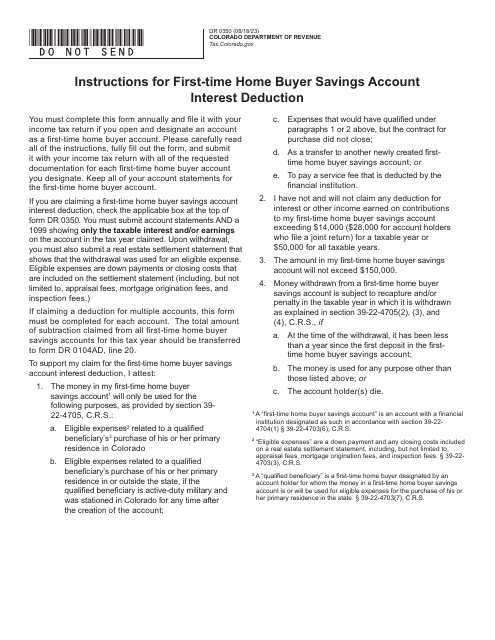

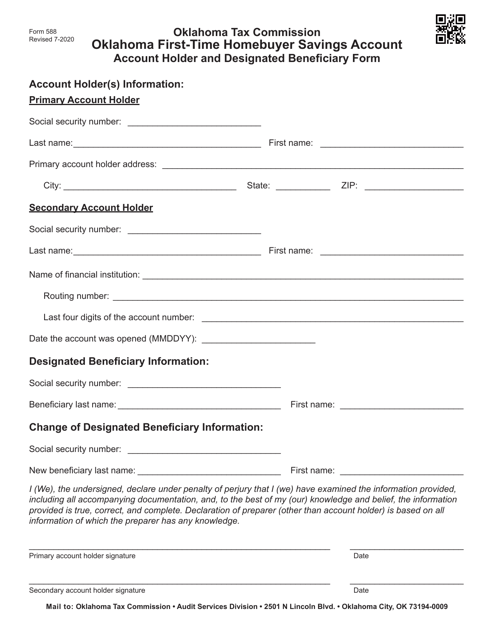

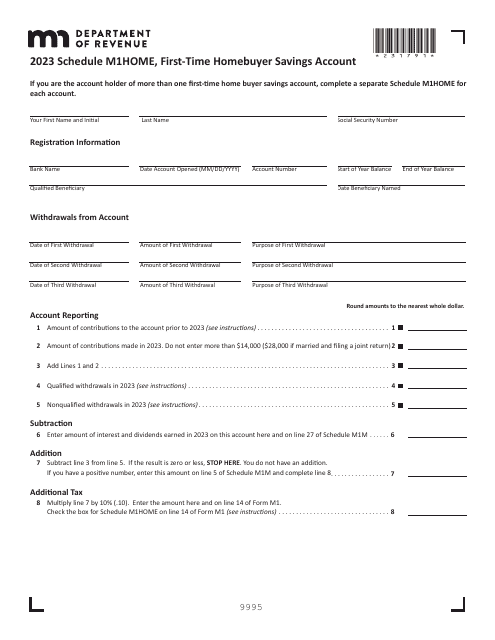

Another document is the Form 588 Oklahoma First-Time Homebuyer Savings Account - Account Holder and Designated Beneficiary Form. This form is specific to residents of Oklahoma who are saving money for their first home purchase. It outlines the requirements and rules associated with this type of savings account, allowing individuals to take advantage of special incentives and benefits offered by the state.

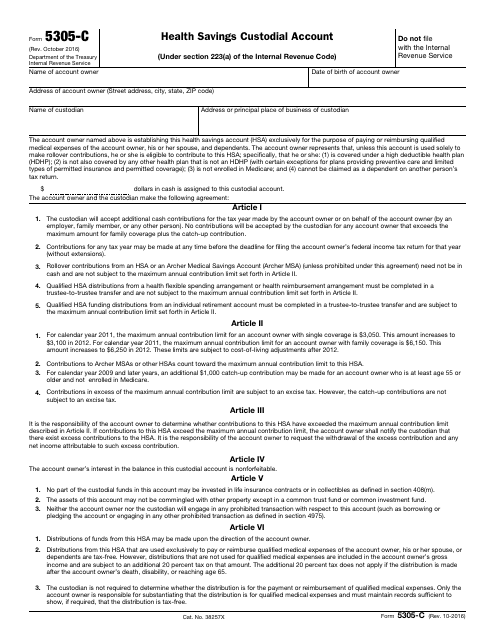

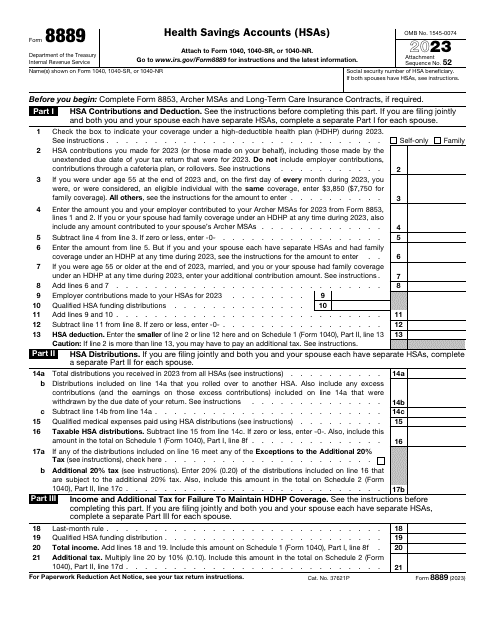

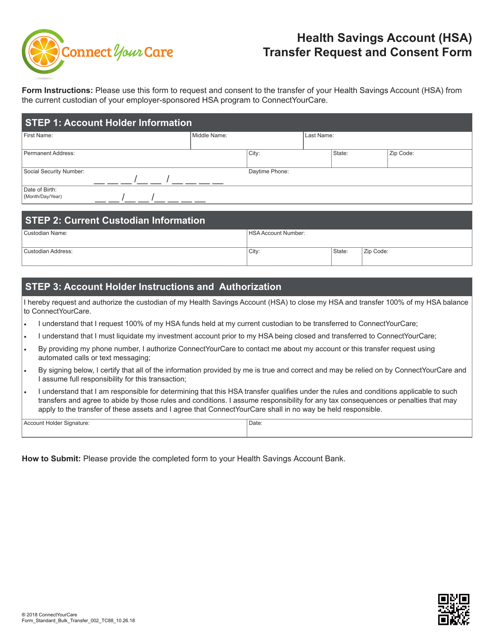

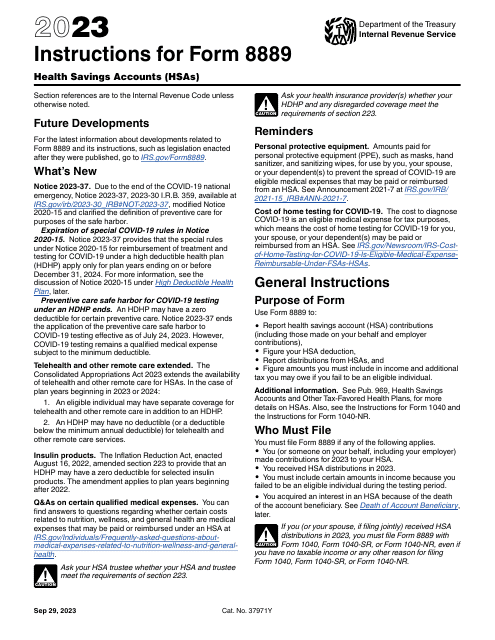

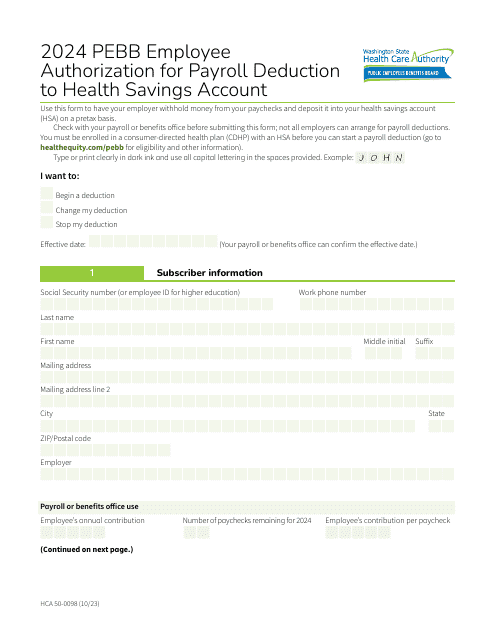

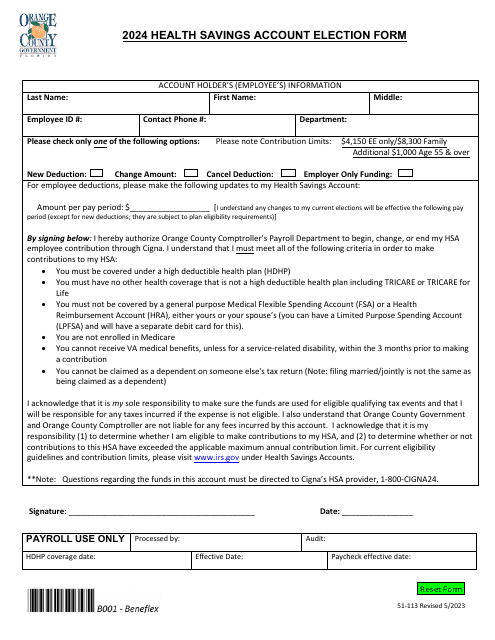

For individuals with Health Savings Accounts (HSAs), the Instructions for IRS Form 8889 Health Savings Accounts (HSAs) are a valuable resource. These instructions provide guidance on how to report contributions and withdrawals from an HSA, which is a tax-advantaged savings account that can be used to pay for qualified medical expenses. Understanding how to properly complete this form ensures compliance with IRS regulations and helps individuals maximize their tax benefits.

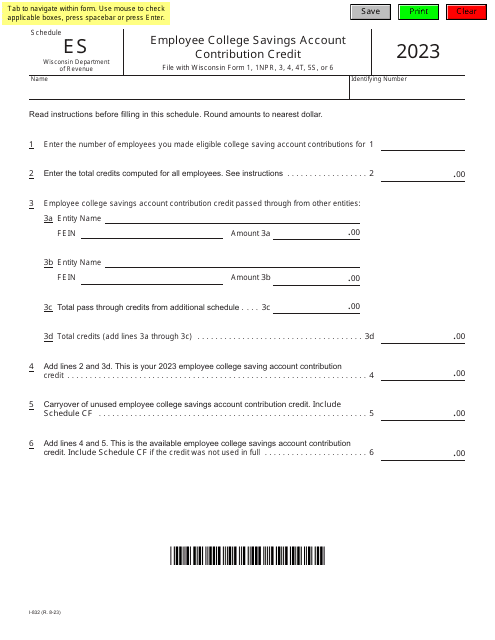

In addition, some states offer tax credits or incentives for contributing to certain types of savings accounts. For example, Form I-832 Schedule ES Employee College Savings Account Contribution Credit is specific to residents of Wisconsin who contribute to an Employee College Savings Account. This form allows individuals to claim a credit on their state taxes for their contributions, encouraging saving for higher education expenses.

Whether you're saving for a specific goal, taking advantage of tax benefits, or looking to grow your wealth, having a savings account can help you achieve your financial objectives. By understanding the various types of savings accounts and staying informed about the necessary documentation, you can make the most of your savings and secure a brighter financial future.

Documents:

42

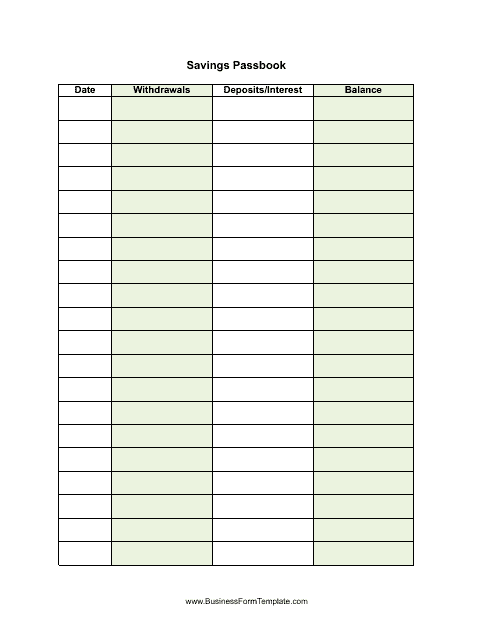

This document is a template for a savings passbook, which is a record of your savings transactions. Use this template to keep track of deposits and withdrawals from your savings account.

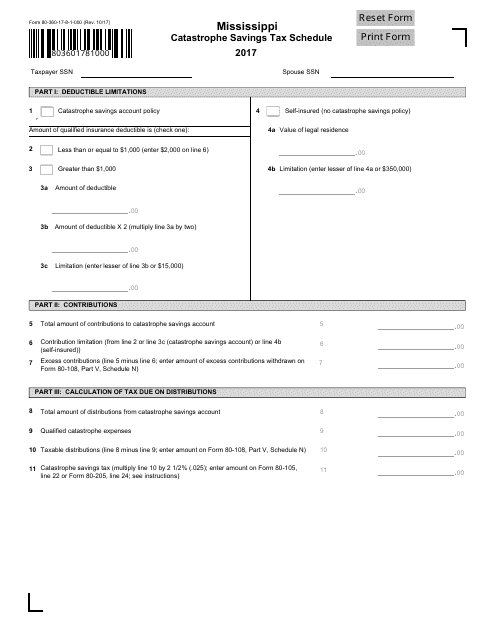

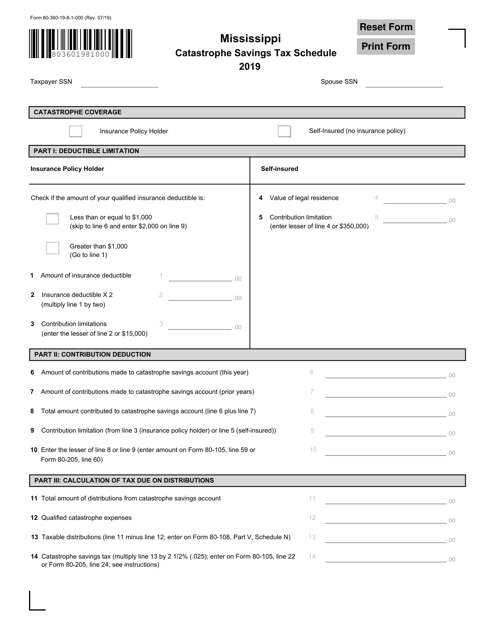

This form is used for reporting and filing taxes related to catastrophe savings in the state of Mississippi.

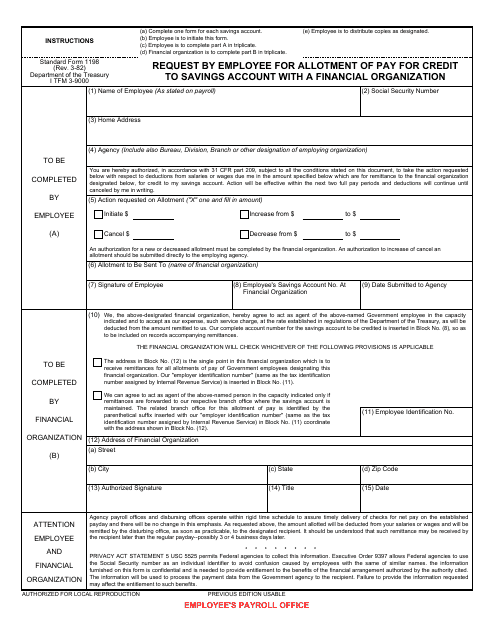

This form is used for employees to request that a portion of their pay be directly deposited into a savings account with a financial organization.

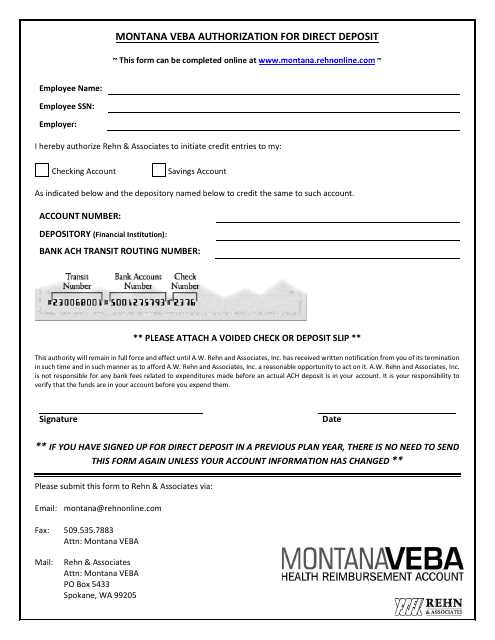

This Form is used for authorizing direct deposit of funds in Montana Veba account in Montana.

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

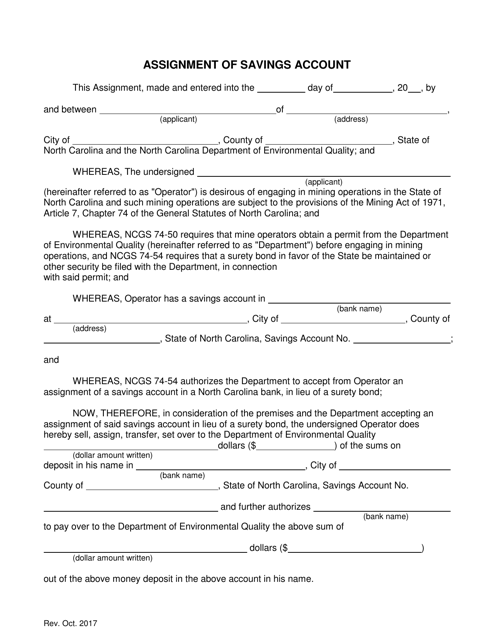

This document is used for assigning a savings account in North Carolina. It specifies the transfer of ownership and rights to the account from one person to another.

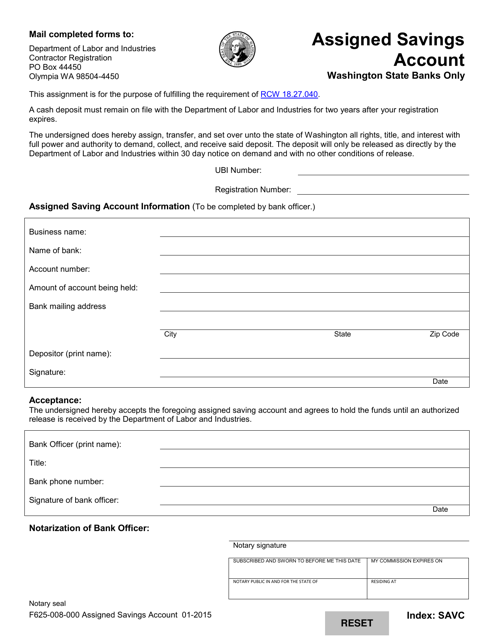

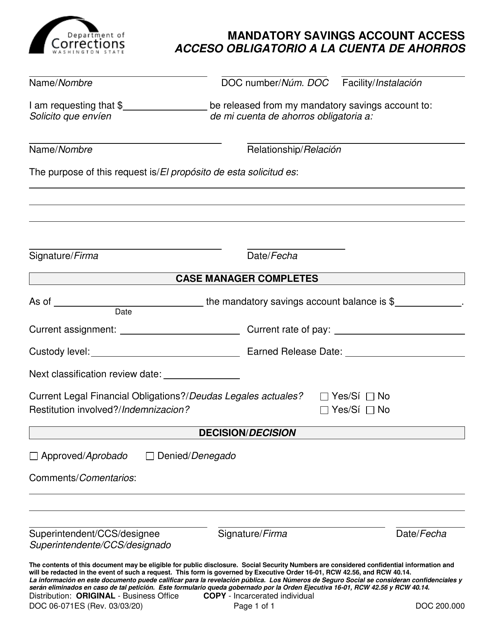

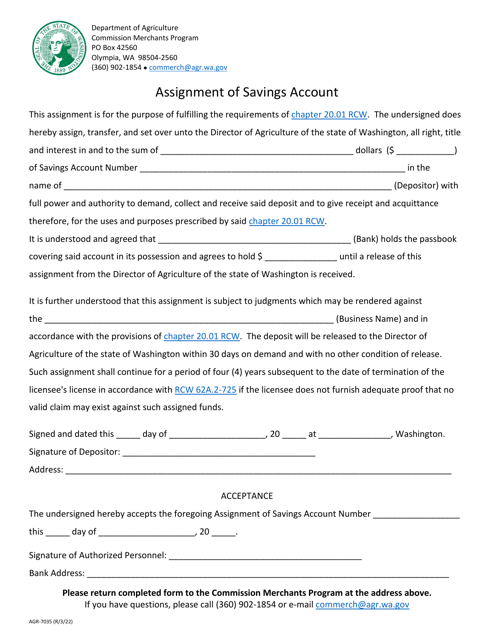

This Form is used for opening an assigned savings account in the state of Washington.

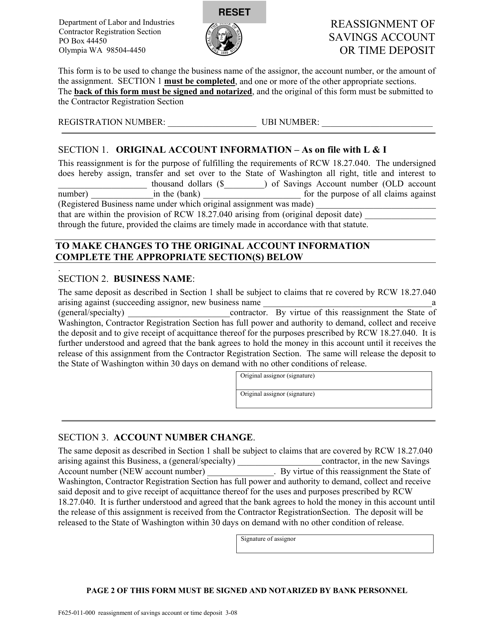

This form is used for requesting a reassignment of a savings account or time deposit in the state of Washington.

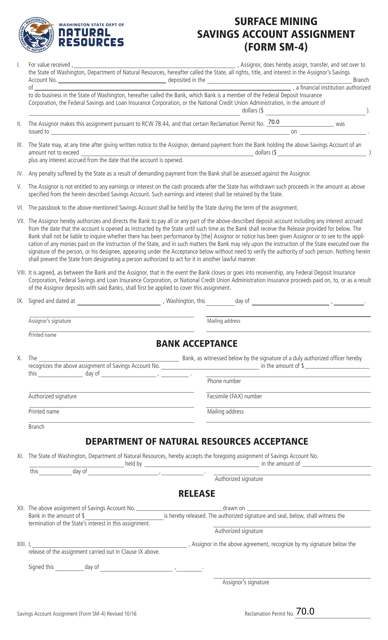

This form is used for assigning a surface mining savings account in the state of Washington.

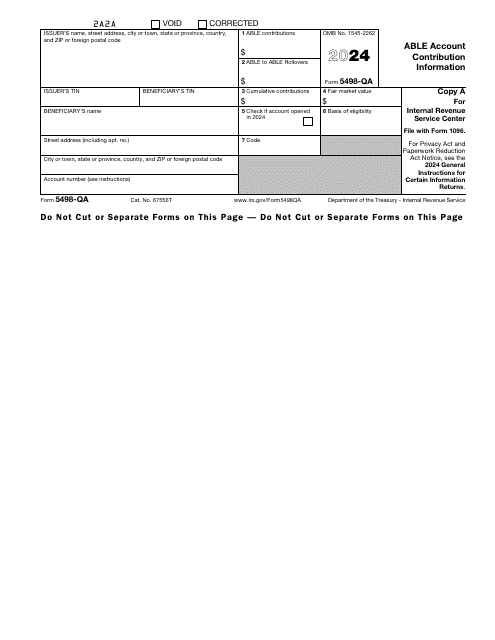

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

This form is used for opening a First-Time Homebuyer Savings Account in Oklahoma. It is for both the account holder and the designated beneficiary.

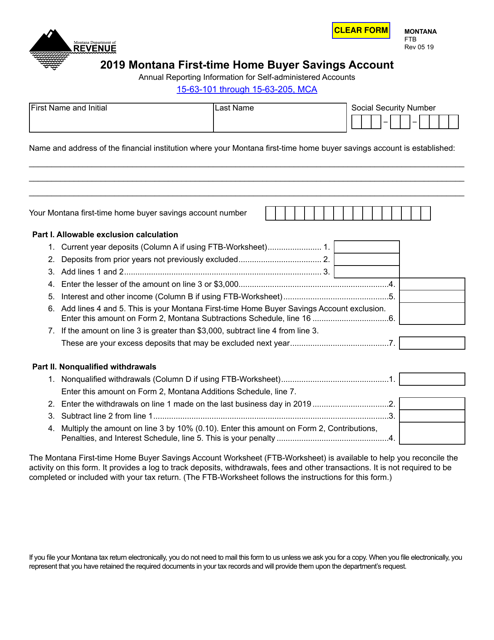

This Form is used for opening a First-Time Home Buyer Savings Account in the state of Montana. It allows individuals to save money towards the purchase of their first home and provides potential tax benefits.

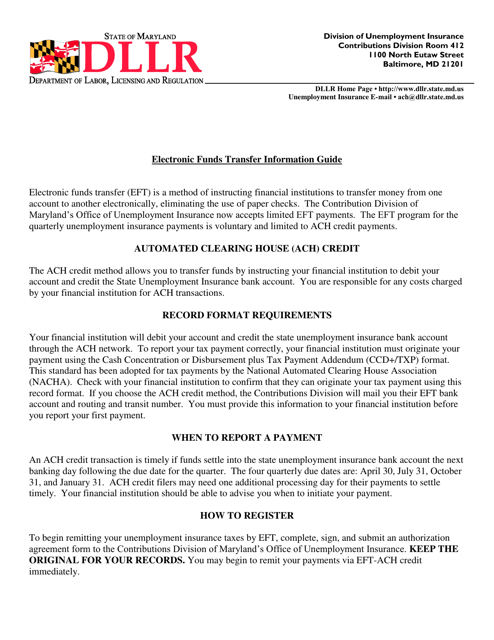

This document allows individuals in Maryland to authorize electronic funds transfers.

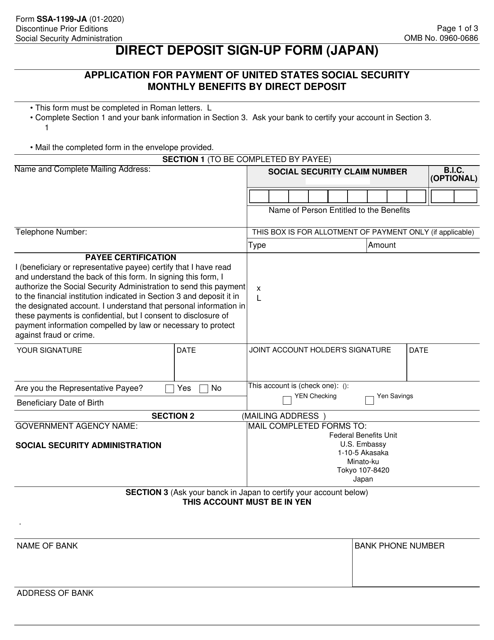

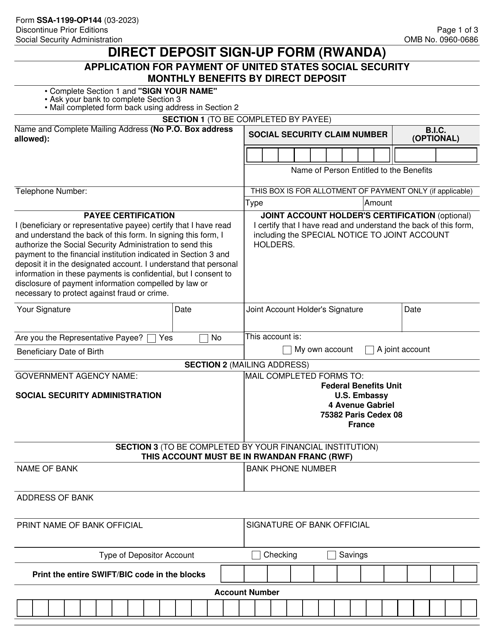

This form is used for signing up for direct deposit of Social Security benefits for individuals living in Japan.

This Form is used for accessing a mandatory savings account in Washington. It is available in both English and Spanish.

This document allows individuals to request the transfer of their Health Savings Account (HSA) funds and gives consent for the transfer in the state of Arkansas.

This Form is used for opening a First-Time Homebuyer Savings Account in Oklahoma. It includes information about the account holder and designated beneficiary.

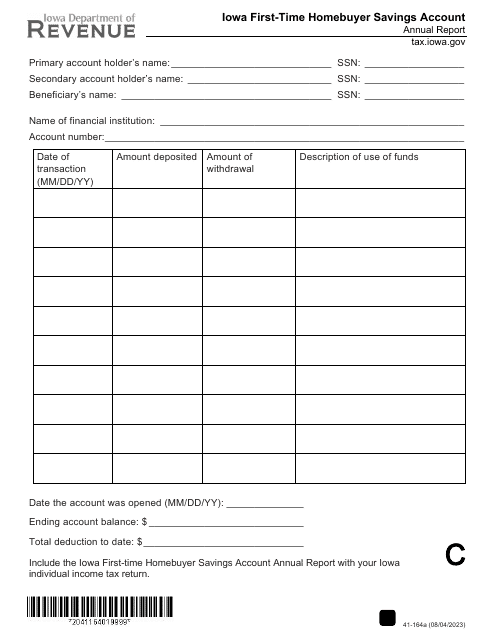

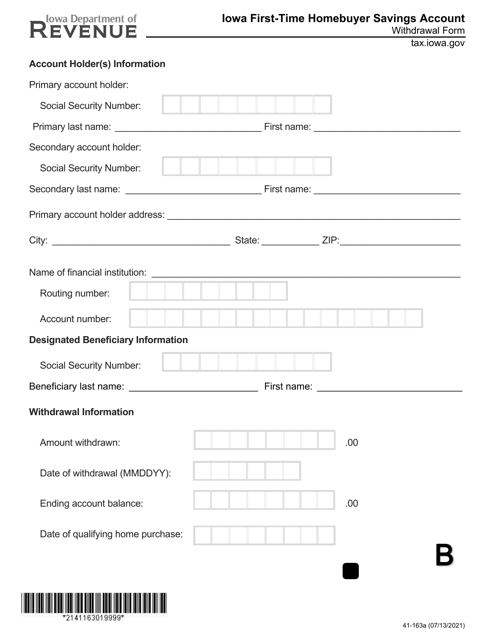

This Form is used for withdrawing funds from an Iowa First-Time Homebuyer Savings Account.

This form is used for assigning a savings account in the state of Washington.