Nonresident Alien Individual Templates

Are you a nonresident alien individual in the United States or Canada? Do you need guidance on your tax obligations and exemptions? Look no further! Our comprehensive collection of documents specifically caters to nonresident alien individuals, providing you with all the necessary information to navigate through the complex tax system.

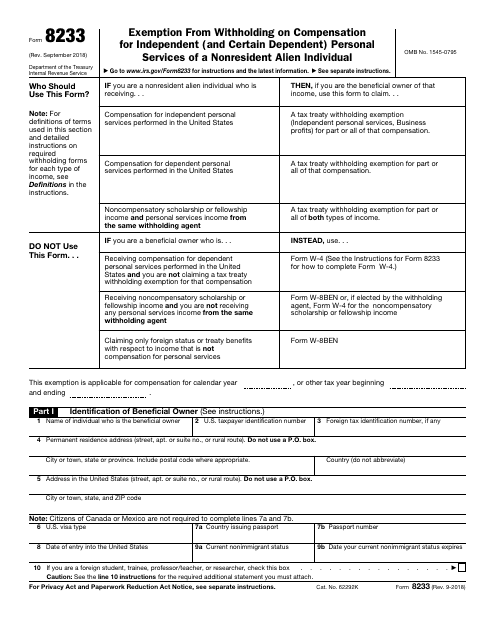

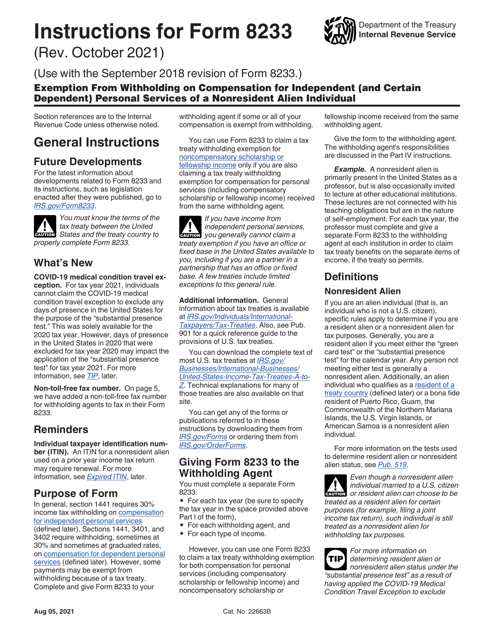

Our collection includes instructions for IRS Form 8233, a crucial document that exempts nonresident alien individuals from withholding taxes on compensation for independent and certain dependent personal services. By following these instructions, you can ensure that you are not overpaying or facing unnecessary tax burdens.

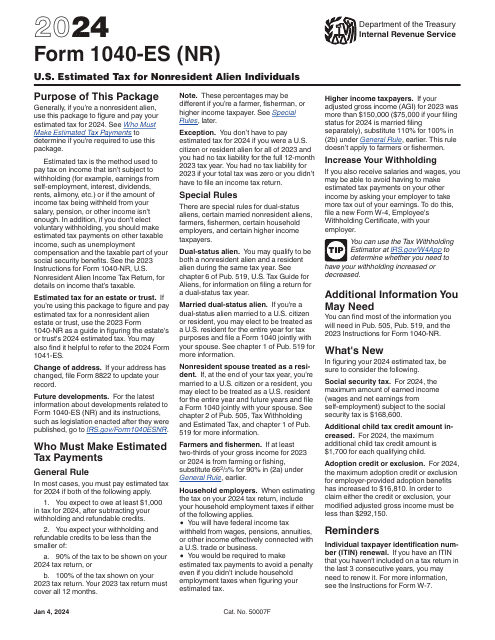

Additionally, our range of resources encompasses IRS Form 1040-ES (NR), which is designed specifically for nonresident alien individuals to estimate their tax liability accurately. This form enables you to pay your estimated taxes promptly and avoid any penalties or interest charges.

We understand that the tax system can be overwhelming, especially for nonresident alien individuals. Our documents provide clear and concise instructions, ensuring that you have all the information you need to fulfill your tax obligations accurately and efficiently.

Whether you are an international student, temporary worker, or any other nonresident alien individual, our collection of documents will serve as your ultimate guide. Don't let tax complications stress you out - access our documents today and take control of your tax responsibilities!

Documents:

8

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.