Fiduciary Income Templates

Fiduciary Income: Instructions, Forms, and Resources for Taxpayers

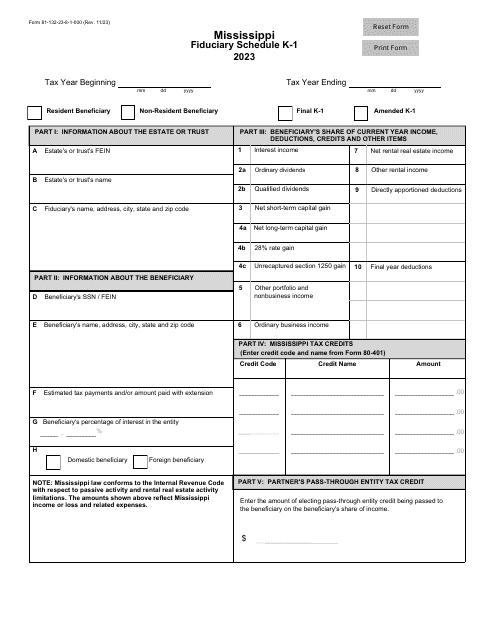

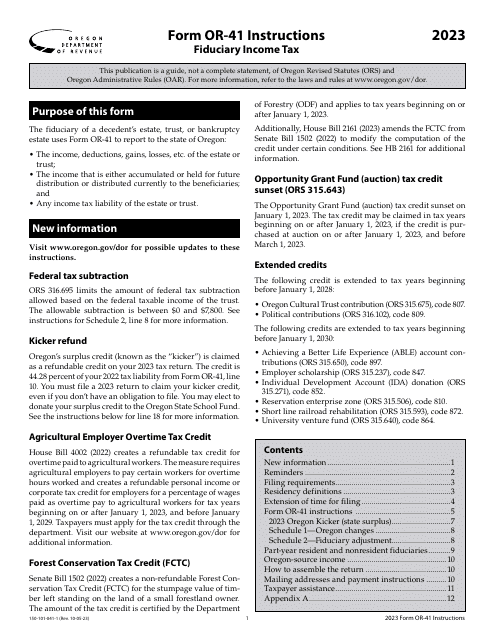

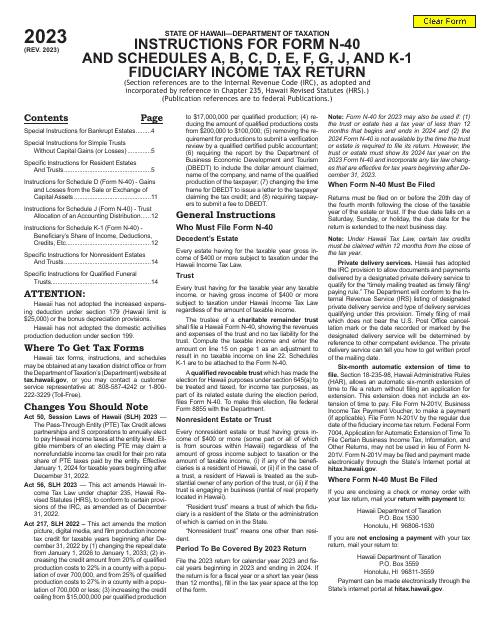

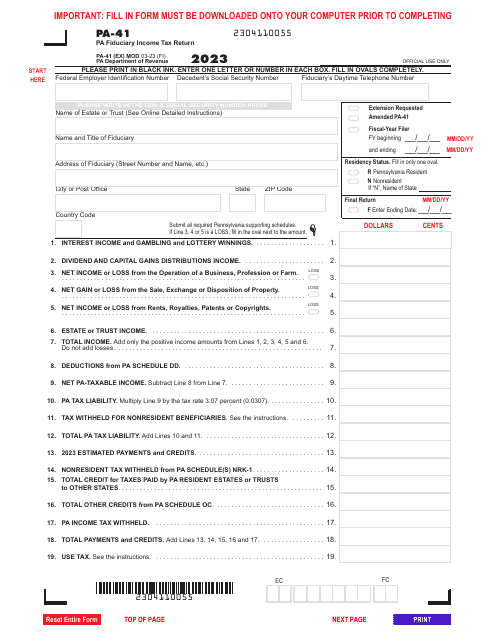

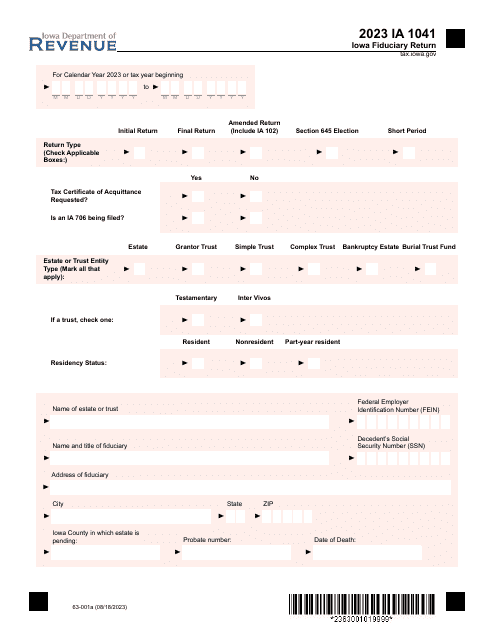

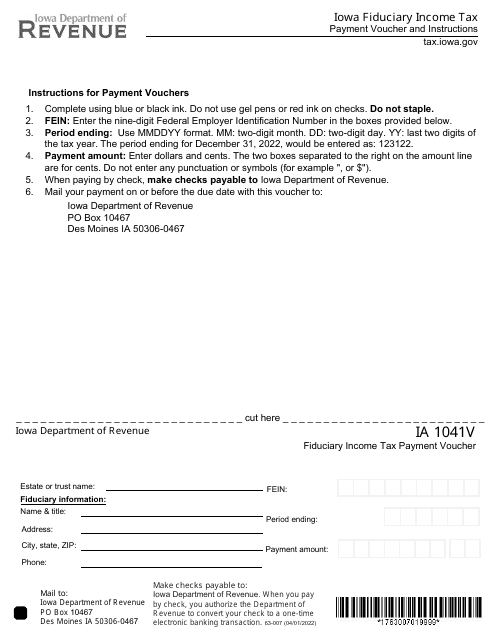

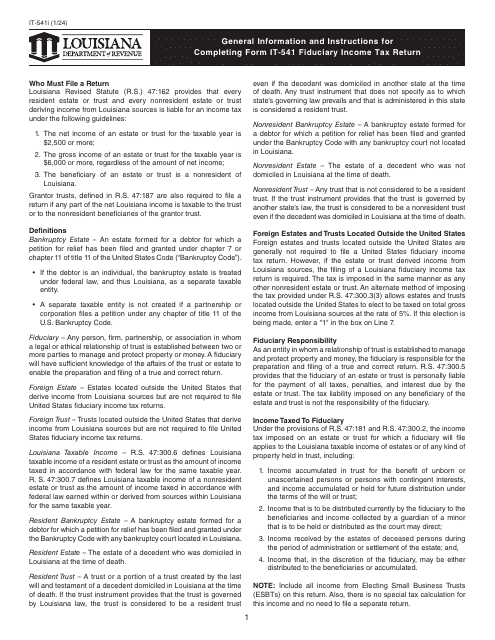

Ensure accurate reporting of fiduciary income with our comprehensive collection of resources. Whether you are a trustee, executor, or administrator, understanding the intricacies of filing fiduciary income tax returns is crucial. Our curated set of instructions and forms from various states, including Pennsylvania, Illinois, New York, and Maryland, will guide you through the process seamlessly.

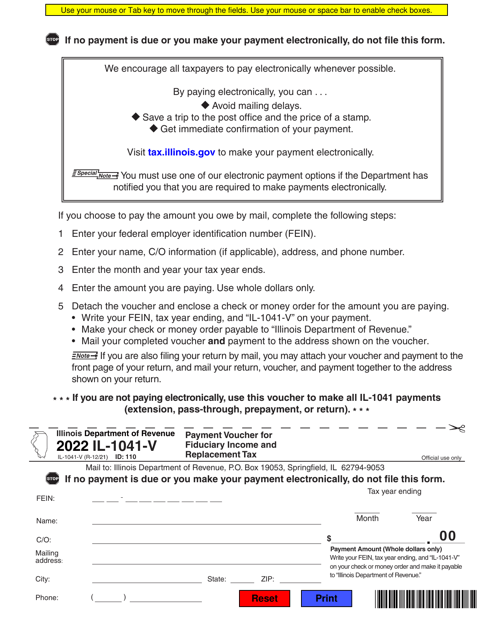

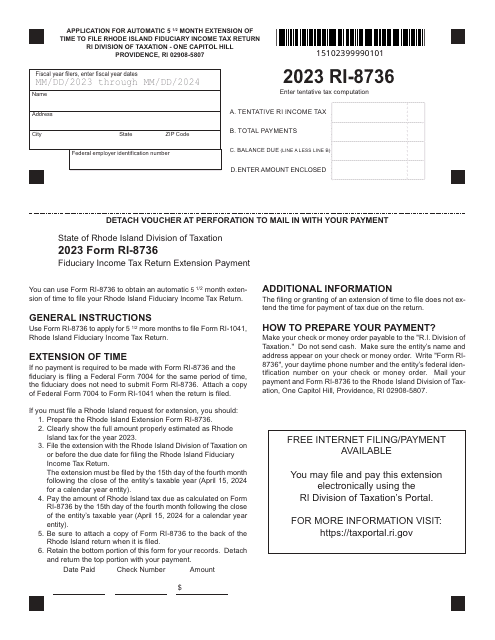

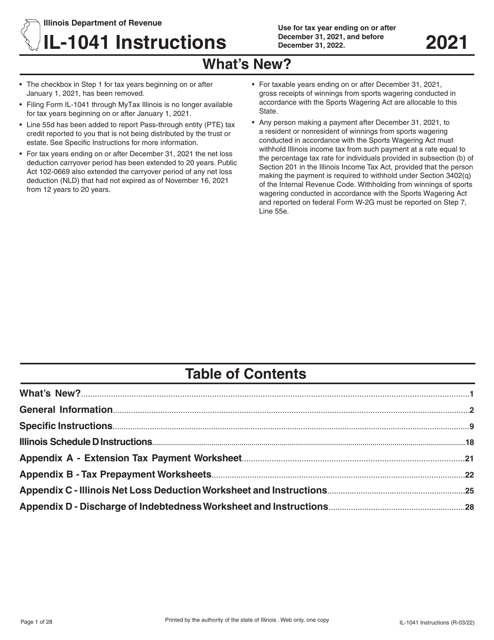

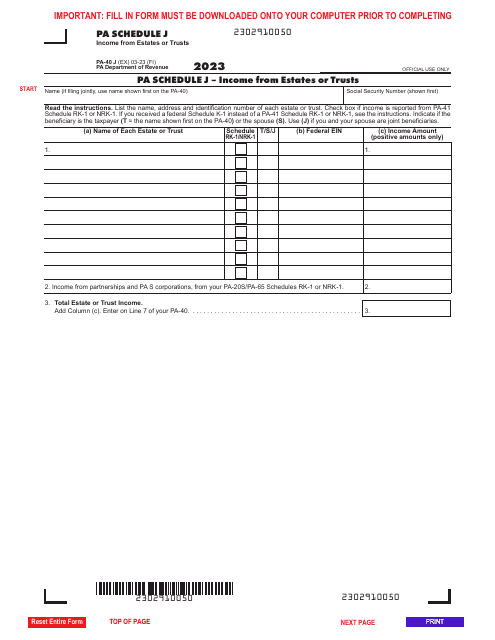

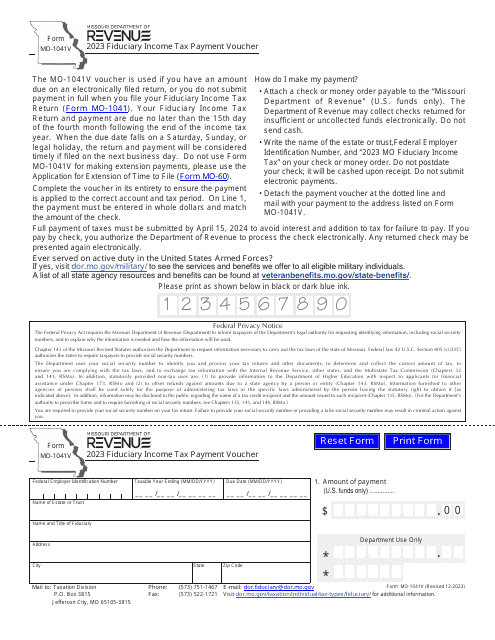

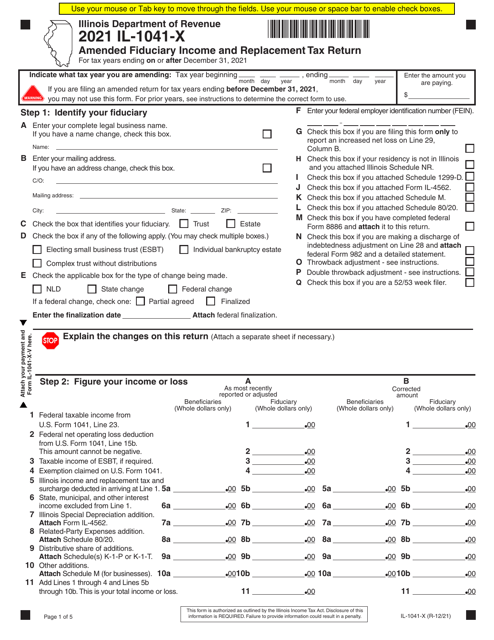

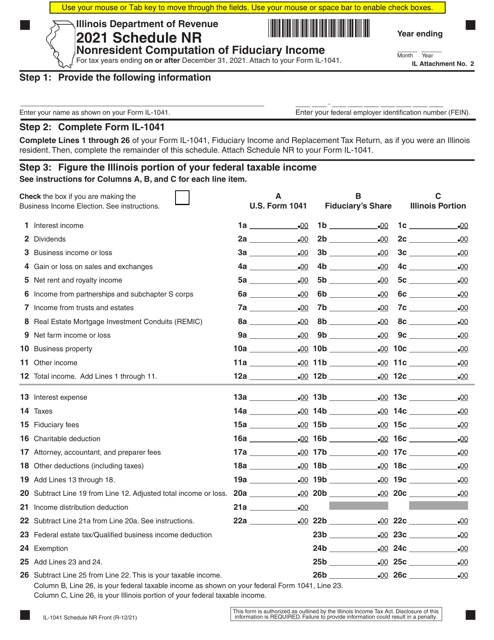

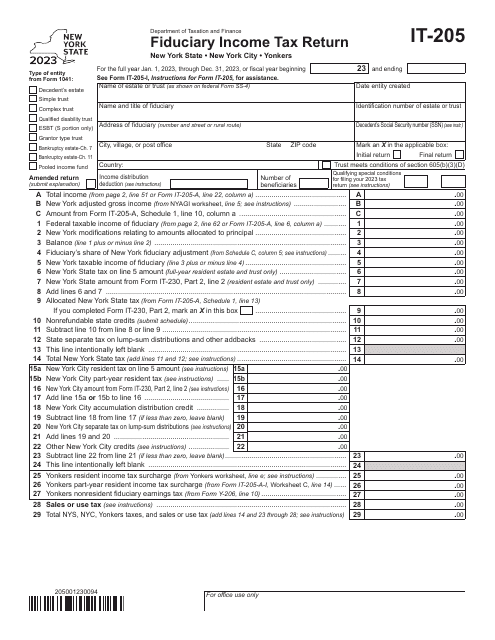

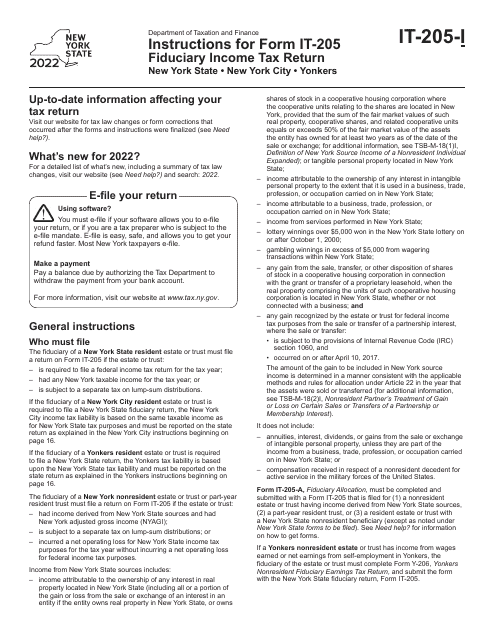

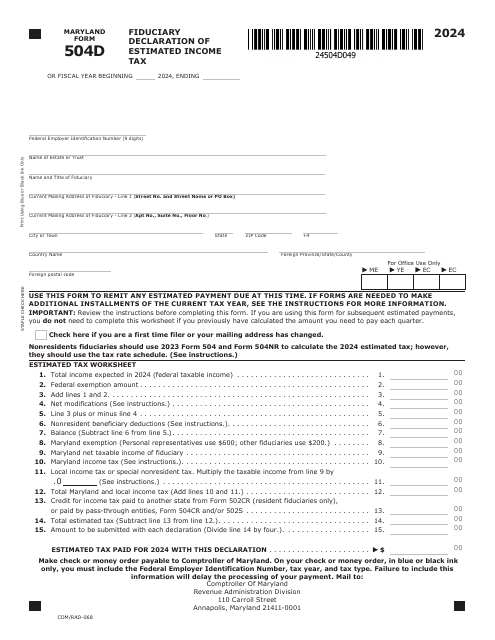

Uncover the nuances of filing the Form IL-1041 Fiduciary Income and Replacement Tax Return in Illinois with our easy-to-follow instructions. Discover how toreport income from estates or trusts with the Form PA-40 Schedule J in Pennsylvania. Furthermore, explore the Amendments to the Form IL-1041 for Illinois and the Form IT-205 Fiduciary Income Tax Return in New York. Our collection also includes the Maryland Form 504D (COM/RAD-068) Fiduciary Declaration of Estimated Income Tax.

Navigating the intricacies of fiduciary income taxation is made effortless with our user-friendly resources. Stay updated on the latest regulations and ensure compliance with our instruction guides and forms. Trust in our collection of fiduciary income resources to simplify your tax filing process and avoid any potential penalties.

Documents:

33

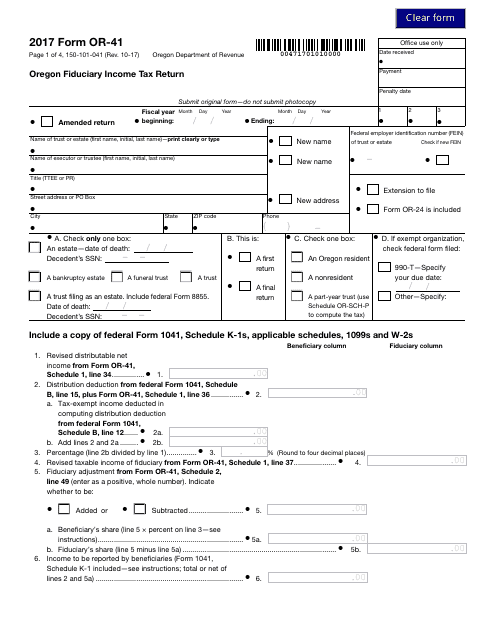

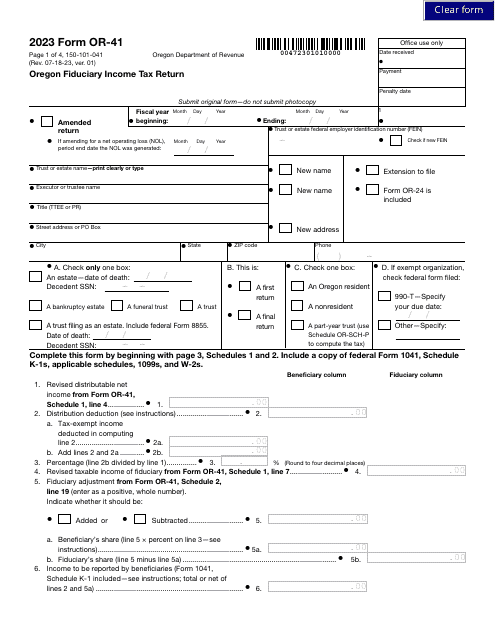

This form is used for filing the Oregon Fiduciary Income Tax Return in the state of Oregon. It is specifically used by fiduciaries to report income earned by an estate or trust.

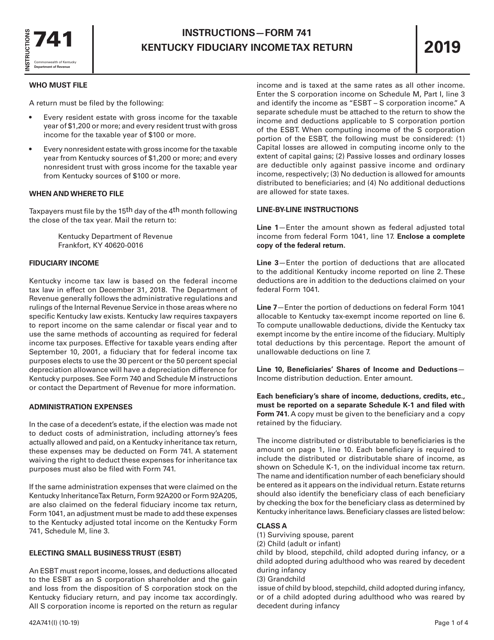

This type of document is used for filing the Kentucky Fiduciary Income Tax Return. It provides instructions on how to fill out and submit Form 741, also known as the 42A741.

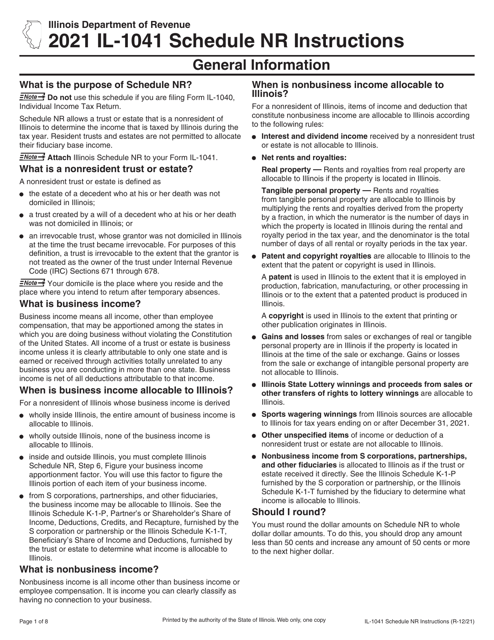

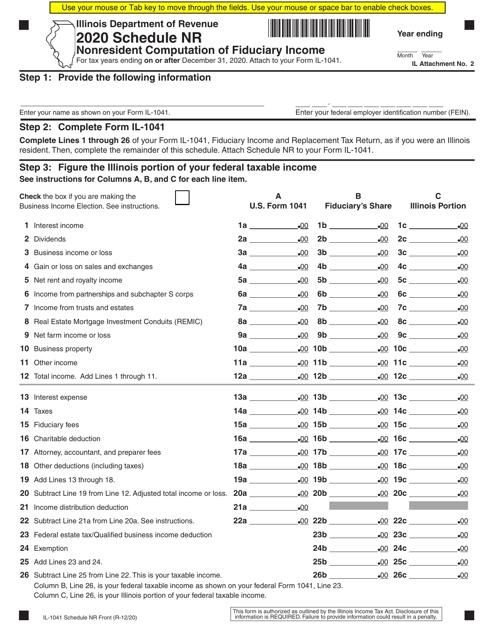

This document is used for calculating the fiduciary income for nonresidents in Illinois.

This form is used for filing an amended fiduciary income and replacement tax return in the state of Illinois.

This form is used for nonresidents to calculate their fiduciary income in the state of Illinois. It is specifically for individuals who are the beneficiaries of trusts or estates in Illinois.