Tax Debt Relief Templates

Are you struggling with tax debt and need help finding relief? Look no further! Our tax debt relief services can provide you with the assistance you need to resolve your tax issues and regain your financial freedom. Whether you owe taxes to the IRS or your local tax authority, our team of experts is here to help you find a solution.

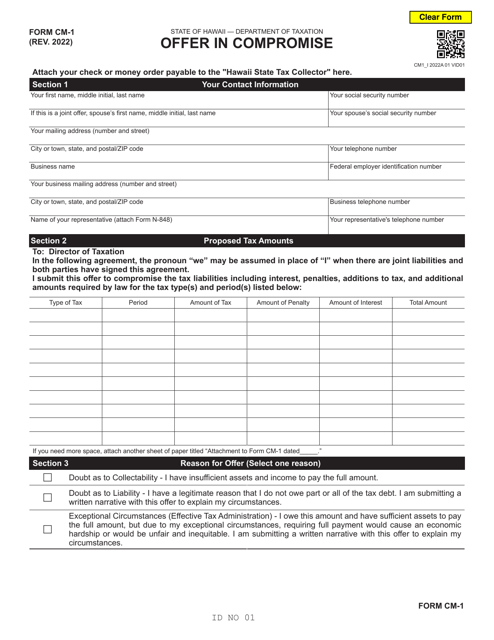

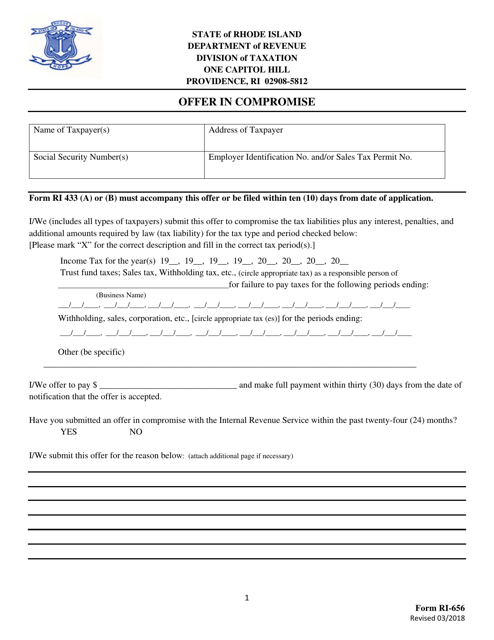

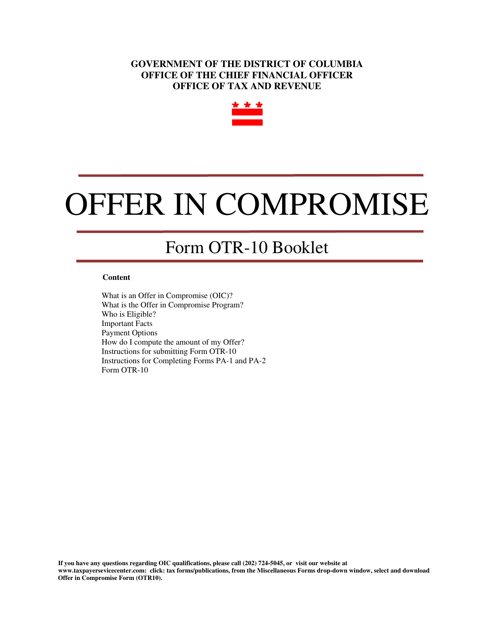

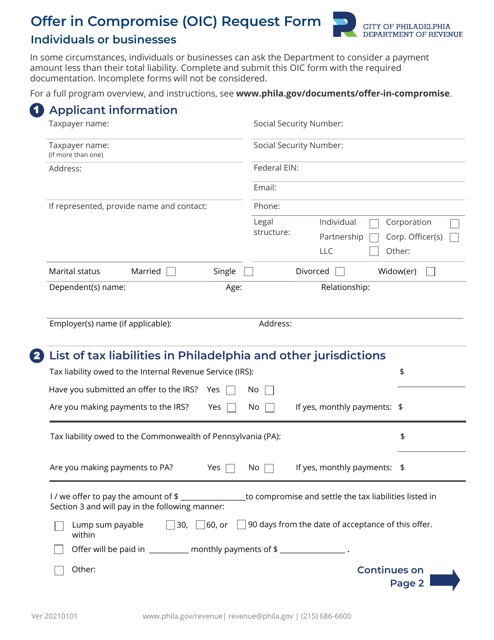

Our tax debt relief services offer a variety of options to help you settle your tax debt. One popular option is through an Offer in Compromise (OIC). This program allows eligible taxpayers to negotiate a settlement with the tax authority for less than the full amount owed. By submitting the necessary forms, such as the Form RI-656 in Rhode Island, Form OTR-10 in Washington, D.C., or Form CM-1 in Hawaii, you can begin the process of resolving your tax debt.

If you're unsure of how to navigate through the tax debt relief process, don't worry! We can guide you through it every step of the way. Our team is experienced in dealing with tax authorities and can help you understand your options and choose the best course of action for your situation.

Don't let tax debt consume your life any longer. Contact us today to learn more about our tax debt relief services and how we can help you find the relief you need. Say goodbye to sleepless nights and financial stress with our tax debt relief solutions.

Documents:

7

This form is used for making an offer in compromise to the state of Rhode Island to settle a tax debt.

This document provides information about the Taxpayer Advocate Service, a resource available to help taxpayers with their tax-related issues and concerns.

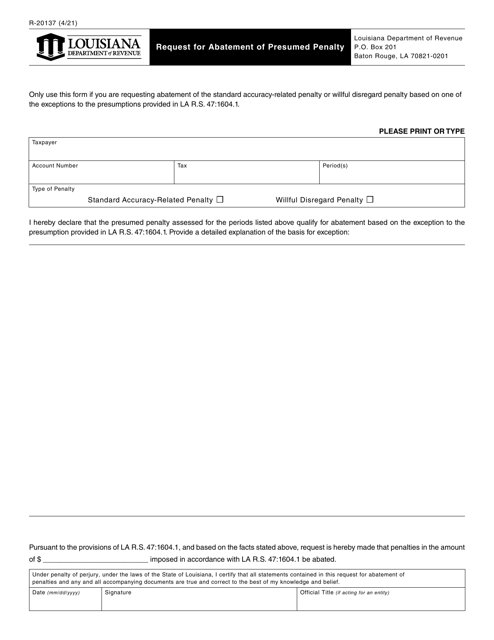

This form is used for requesting the abatement of a presumed penalty in the state of Louisiana.

This form is used for making an offer in compromise to the Internal Revenue Service (IRS) in Washington, D.C. It allows taxpayers to settle their tax debt for less than the full amount owed.

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.