Credit Counseling Templates

Are you facing financial difficulties and need help managing your credit? Look no further than our comprehensive credit counseling services. We understand that dealing with debt can be overwhelming, but our experienced credit counselors are here to guide you towards a brighter financial future.

Our credit counseling services are designed to assist individuals and families in improving their financial well-being. Whether you are dealing with credit card debt, medical bills, or other financial obligations, our trained professionals will work closely with you to develop a personalized action plan.

By working with a credit counselor, you can gain valuable insights into your financial situation and learn effective strategies to manage your debt. We provide helpful resources and tools to help you create a budget, prioritize debt repayment, and build a solid financial foundation.

Our credit counseling services are available to individuals and families in the USA, Canada, and other countries. We offer various programs to meet your specific needs, including credit counseling, debt management plans, and financial education workshops.

Don't let overwhelming debt control your life. Take the first step towards financial freedom by reaching out to our credit counseling services. Our dedicated team is ready to assist you on your journey towards a brighter financial future. Contact us today to learn more about our credit counseling services or to schedule an appointment with one of our experienced credit counselors.

[Insert call-to-action button: Contact Us Now]

Documents:

23

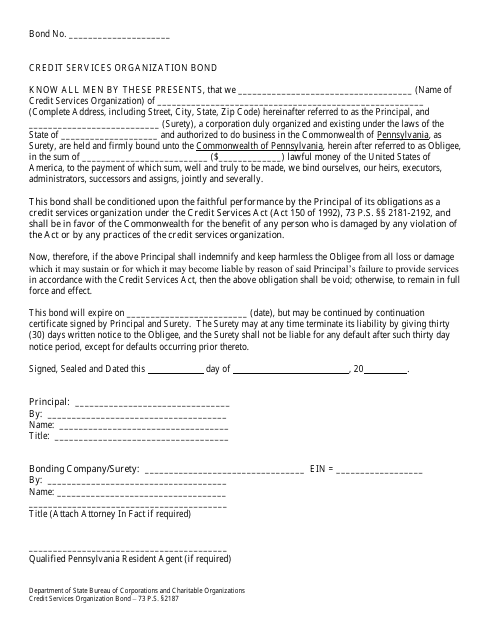

This document is for obtaining a bond for Credit Services Organization (CSO) in Pennsylvania. The bond is required for companies that provide credit repair services to consumers in the state.

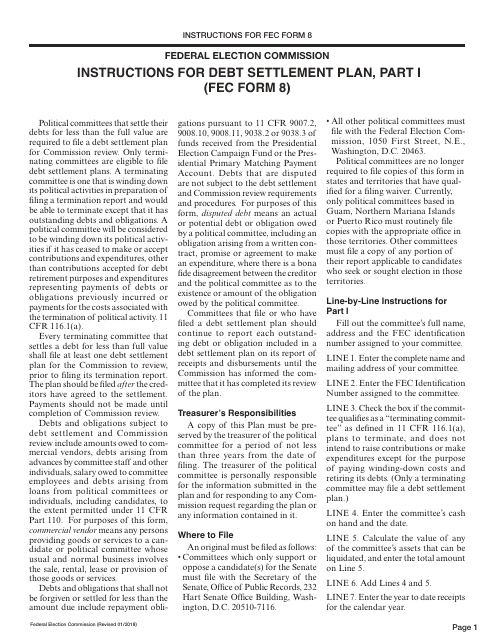

This document provides instructions for completing the FEC Form 8 Debt Settlement Plan.

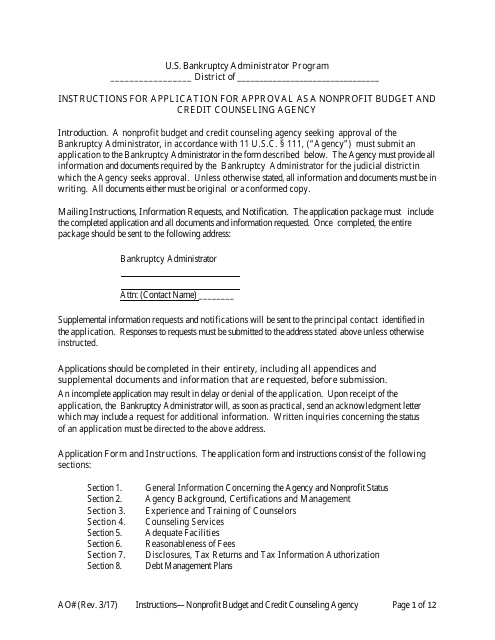

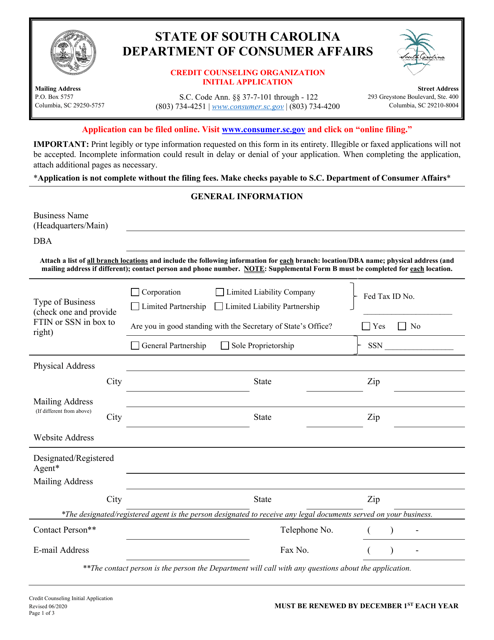

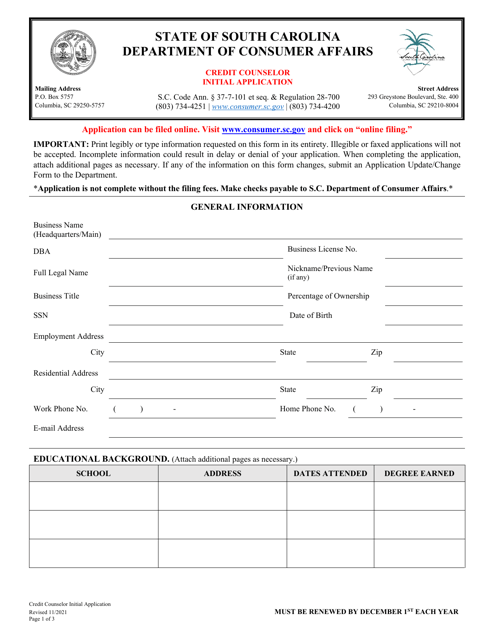

This document is for those who want to apply for approval as a nonprofit budget and credit counseling agency. It provides instructions on how to complete the application process.

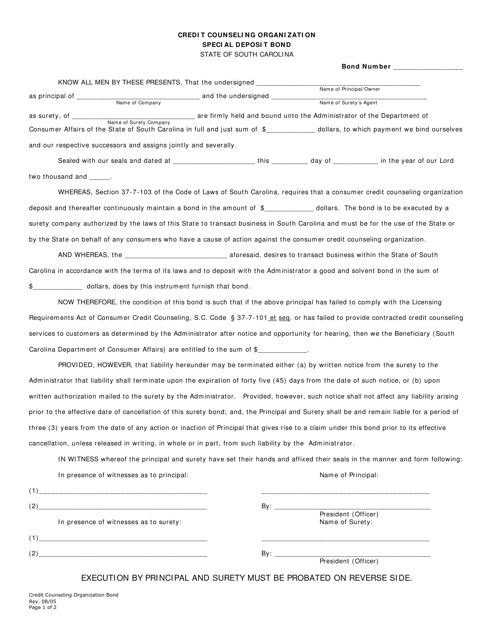

This type of document is a special deposit bond used by credit counseling organizations in South Carolina.

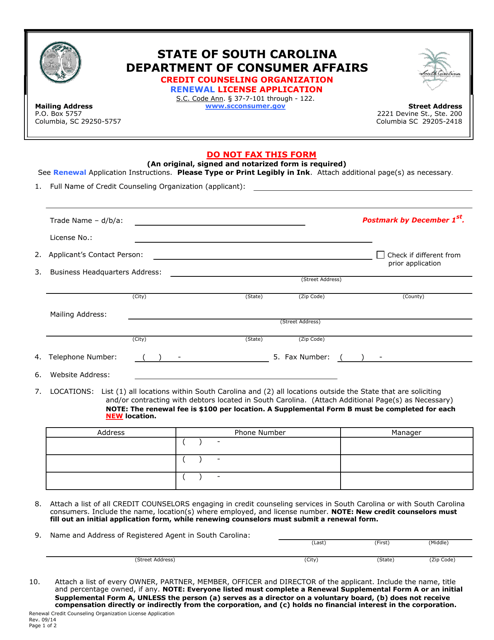

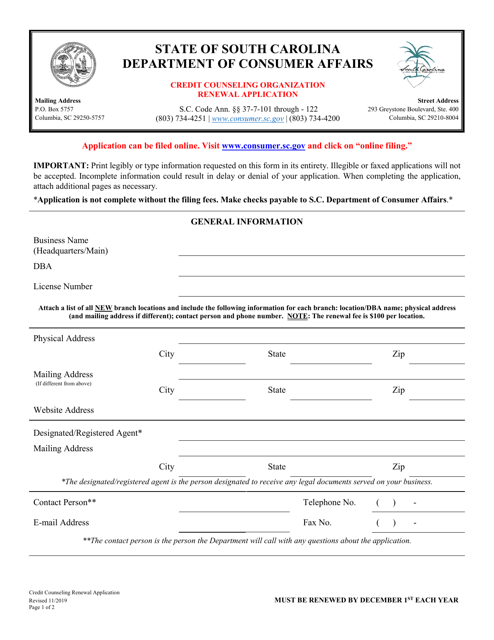

This application form is used for renewing the license of a credit counseling organization in South Carolina.

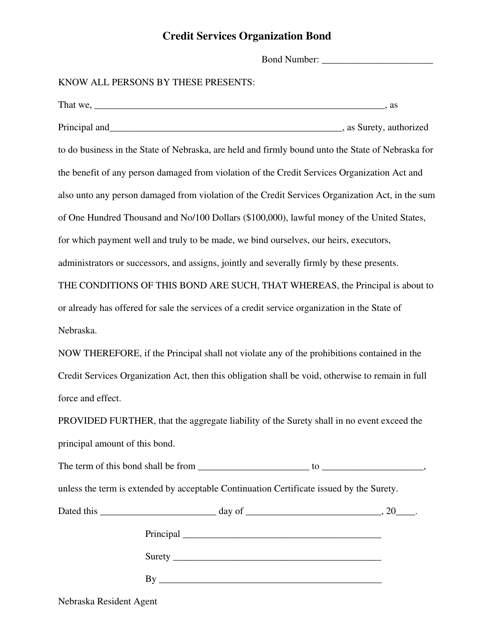

This document is a bond required for Credit Services Organizations operating in Nebraska.

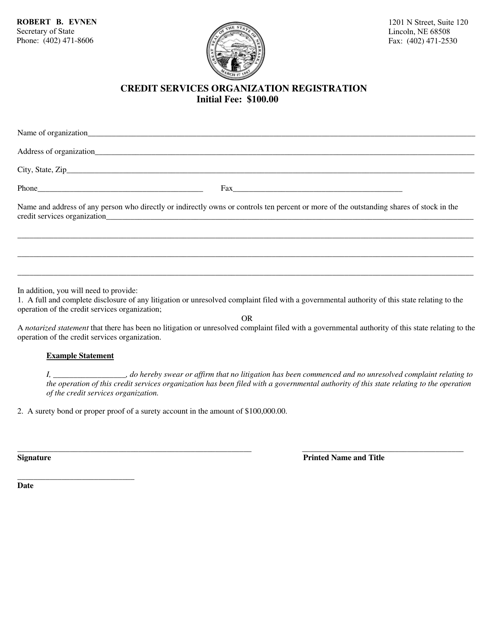

This document is for registering a Credit Services Organization in the state of Nebraska. It outlines the requirements and process for obtaining the necessary registration.

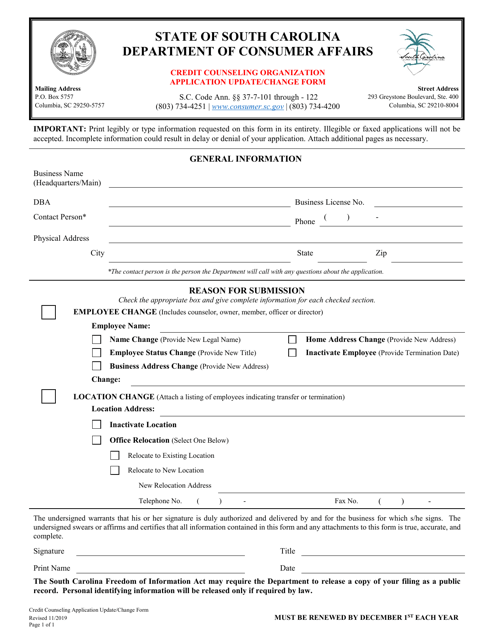

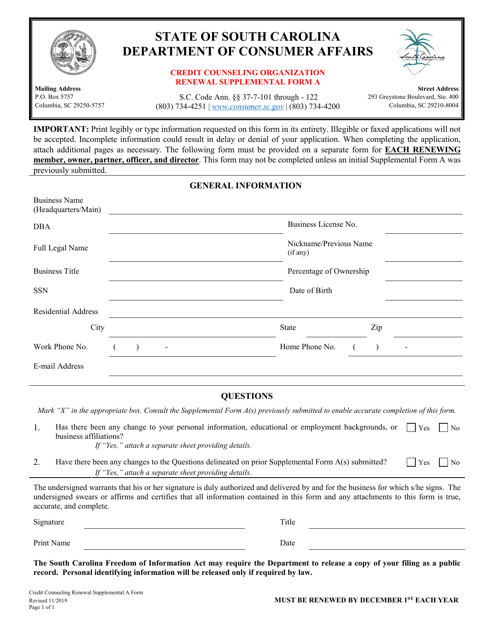

This form is used for updating or changing information for a credit counseling organization application in South Carolina.

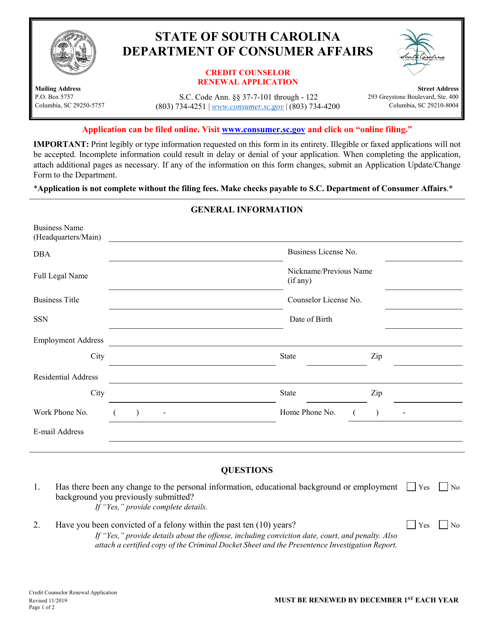

This document is used for renewing the license of a credit counselor in South Carolina.

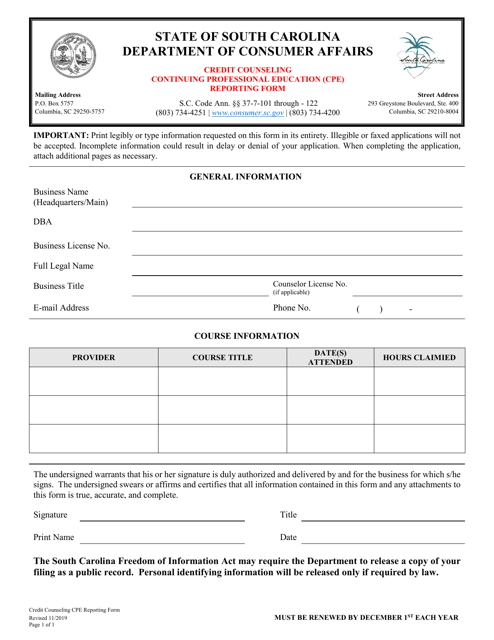

This document is used for reporting continuing professional education (CPE) for credit counseling in South Carolina.

This Form is used for renewing the application for a Credit Counseling Organization in South Carolina. It is required for organizations that provide financial counseling services to individuals in the state.

This form is used for credit counseling organizations in South Carolina to renew their license.

This form is used for consumer credit counseling proctors to register in South Carolina.

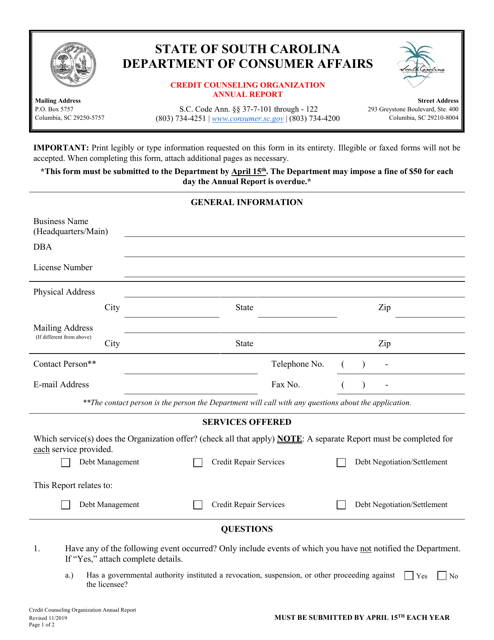

This document provides the annual report for a credit counseling organization in South Carolina. It contains information about the organization's financial activities, services provided, and impact in the community.

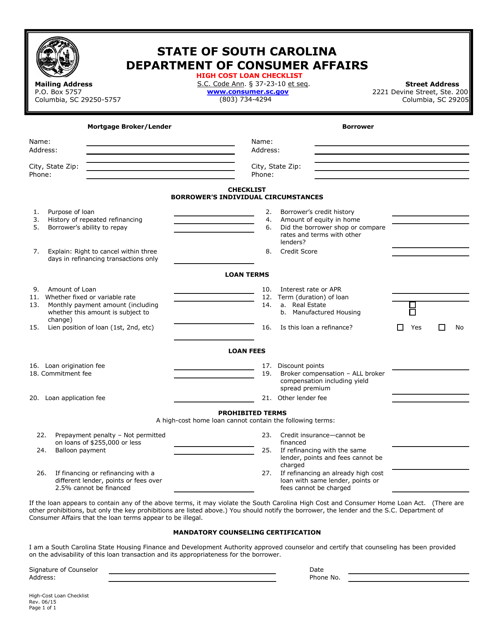

This document is a checklist that helps South Carolina residents assess the expenses and terms associated with high-cost loans in order to make informed decisions.

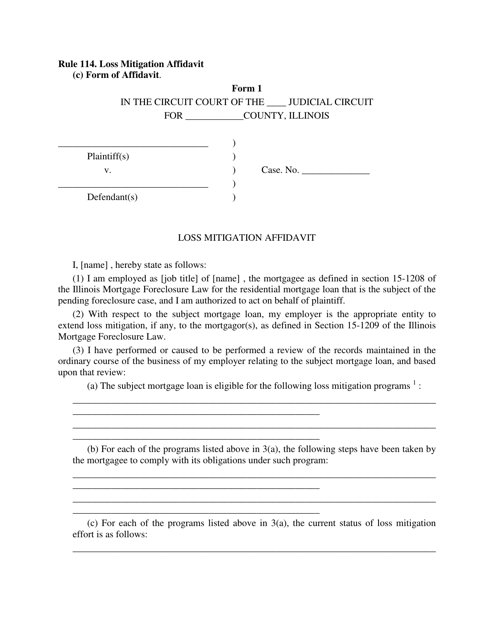

This document is used for submitting a Loss Mitigation Affidavit in the state of Illinois. It is a legal form that helps homeowners in financial distress provide information about their situation to their mortgage lender in order to potentially receive assistance in avoiding foreclosure.

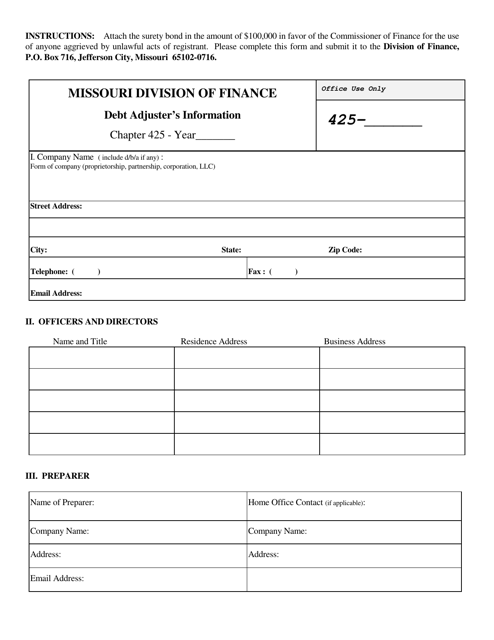

This document provides information about debt adjusters in the state of Missouri.

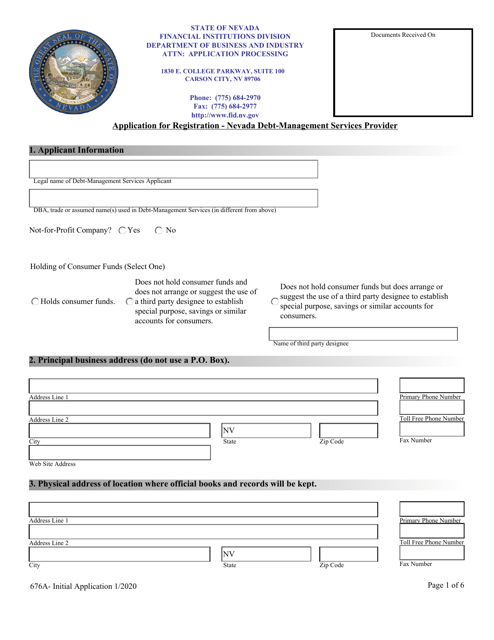

This document is the application for registration for a debt-management services provider in Nevada. It is used to apply for the necessary registration to operate as a debt-management services provider in the state of Nevada.