Wage Earners Templates

Are you a wage earner looking for important documents related to your income and employment? Look no further! Our comprehensive collection of wage earner documents will provide you with all the information you need to navigate your financial obligations.

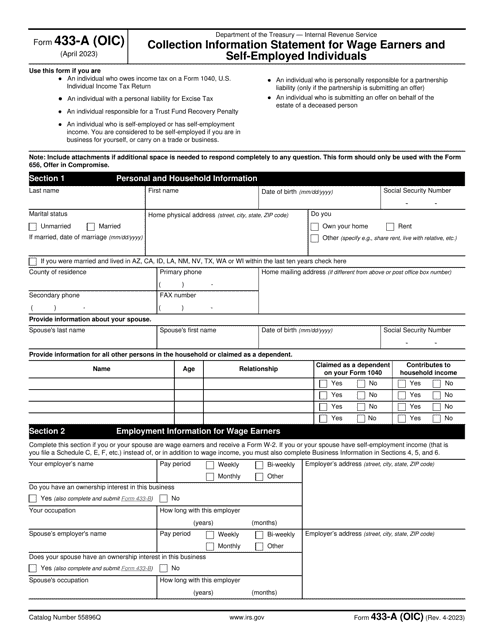

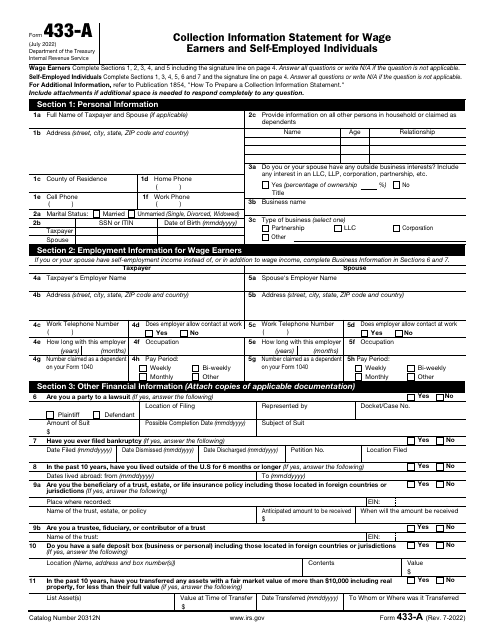

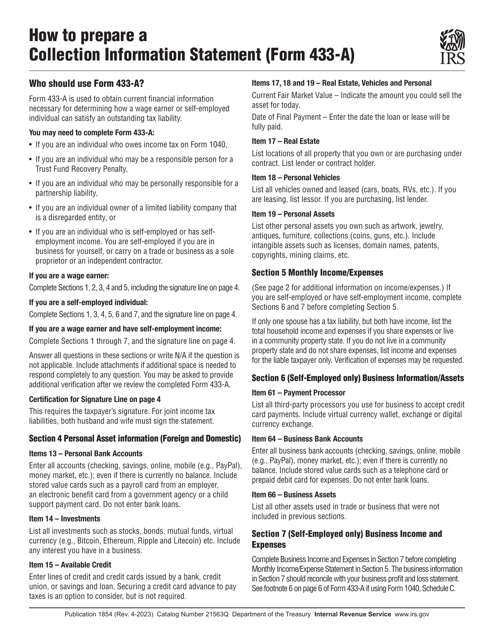

Whether you are completing an IRS Form 433-A (OIC) Collection Information Statement or looking for instructions on how tofill out this form, our collection has got you covered. We understand the unique needs of wage earners and have gathered a wide range of documents tailored specifically for individuals like you.

Our documents cover various aspects of wage earning and self-employment, ensuring that you have access to the necessary forms and instructions to accurately report your income and expenses. We understand the importance of providing accurate and up-to-date information to the IRS, and our collection of wage earner documents will help you do just that.

With our user-friendly interface and easy-to-understand instructions, completing these forms has never been easier. Take the hassle out of navigating complex financial documentation by utilizing our comprehensive collection of wage earner documents.

No need to search for alternate names like wage earner document or wage earners form – we have them all in one place, easily accessible for your convenience. We strive to provide the most comprehensive and relevant documents for wage earners, ensuring that you have everything you need to meet your financial obligations.

Don't waste any more time searching for the right documents – explore our collection now and take control of your financial situation as a wage earner.

Documents:

18

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

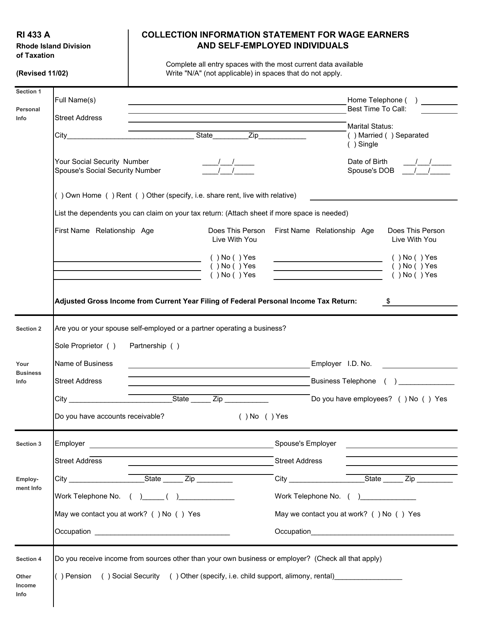

This form is used for collecting information from wage earners and self-employed individuals in Rhode Island. It helps the state assess their financial situation for tax purposes.

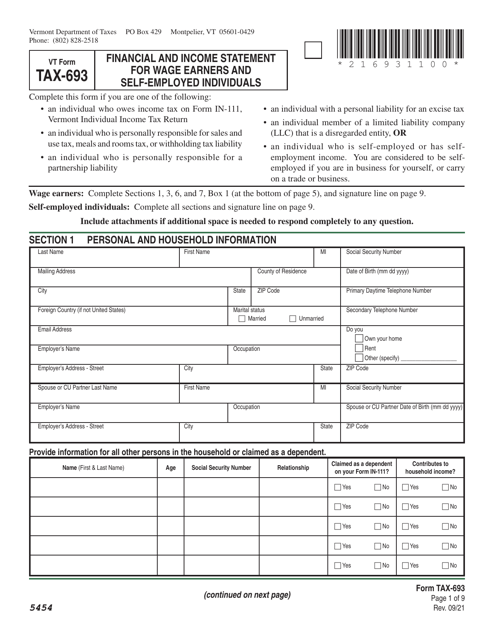

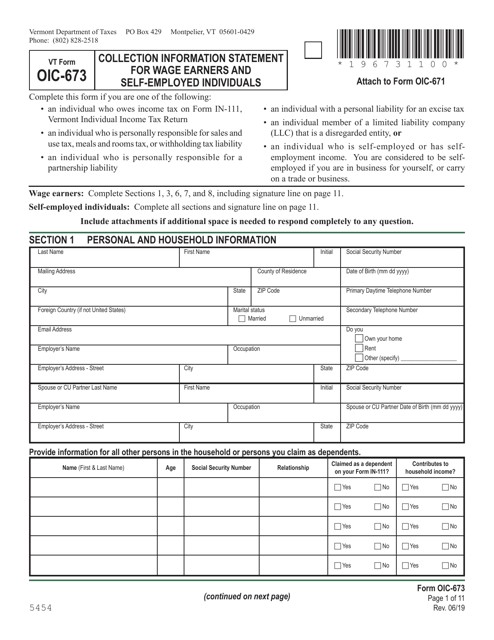

This Form is used for submitting a Collection Information Statement for wage earners and self-employed individuals in Vermont.

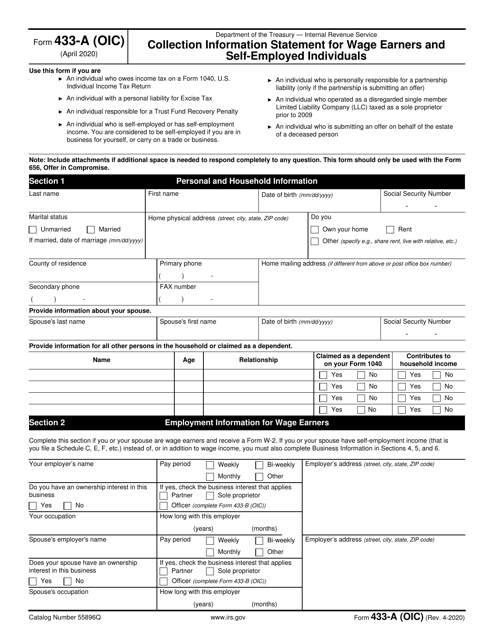

This Form is used for individuals who owe taxes to provide detailed financial information to the IRS in order to request an offer in compromise (OIC) and settle their tax debt.

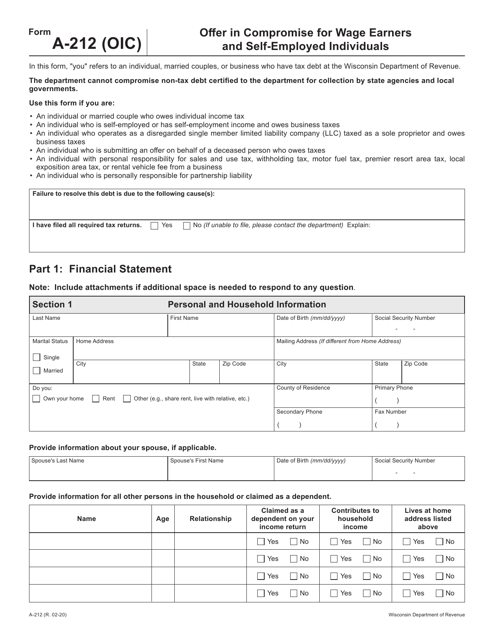

This Form is used for individuals in Wisconsin who want to make an offer in compromise for their unpaid taxes as wage earners or self-employed individuals.

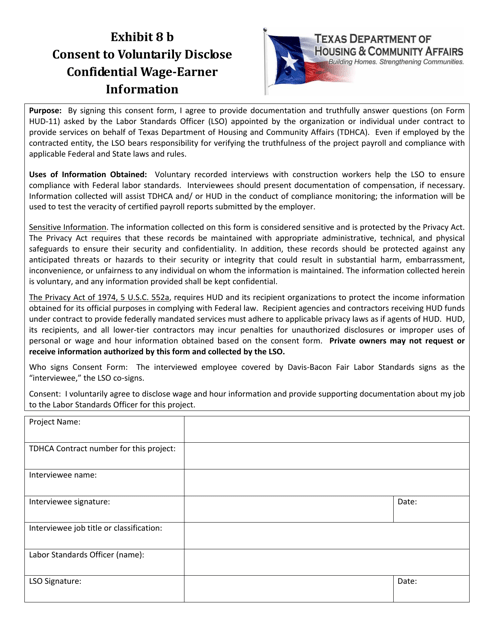

This form is used for obtaining consent from a wage earner in Texas to voluntarily disclose their confidential wage information.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

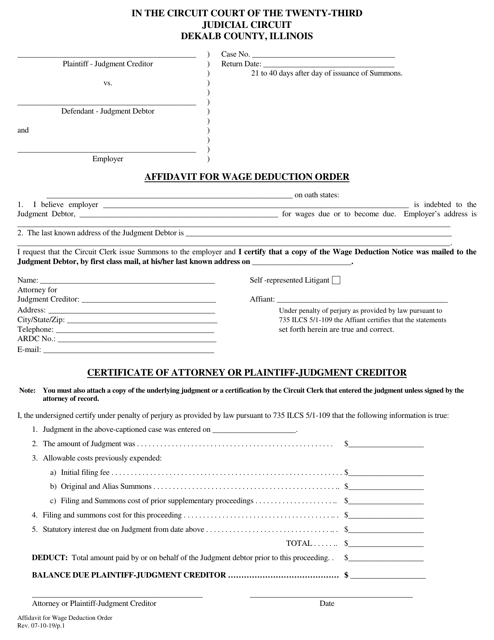

This document is for requesting a wage deduction order in DeKalb County, Illinois. It is used to provide a sworn statement regarding the need for wage garnishment in order to collect a debt owed to a creditor.