Tax Adjustments Templates

Documents:

90

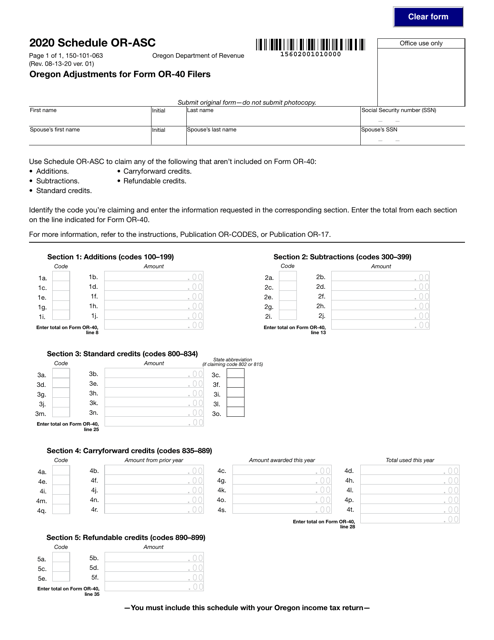

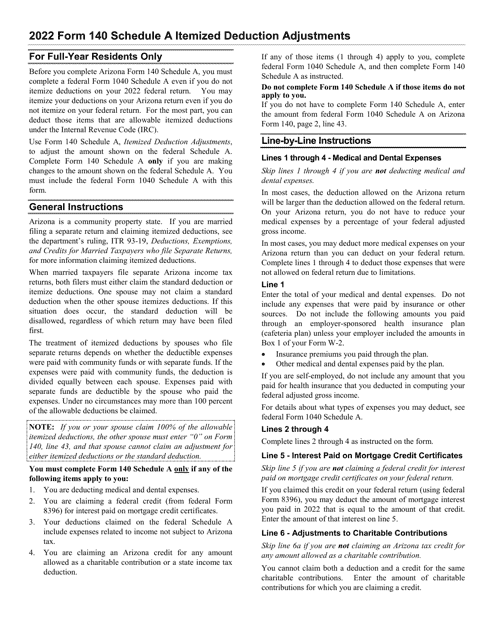

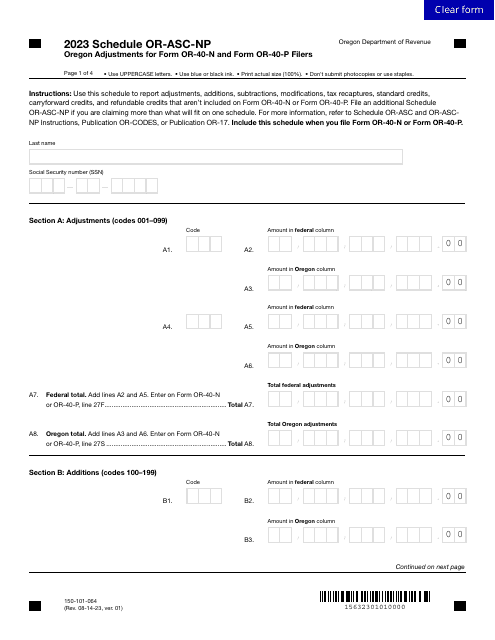

This form is used for making adjustments to the Oregon tax return (Form OR-40) filed by individuals in Oregon. It is specifically designed for Oregon residents and allows them to make corrections or additions to their original tax return. This form helps taxpayers in Oregon ensure that their tax returns are accurate and complete.

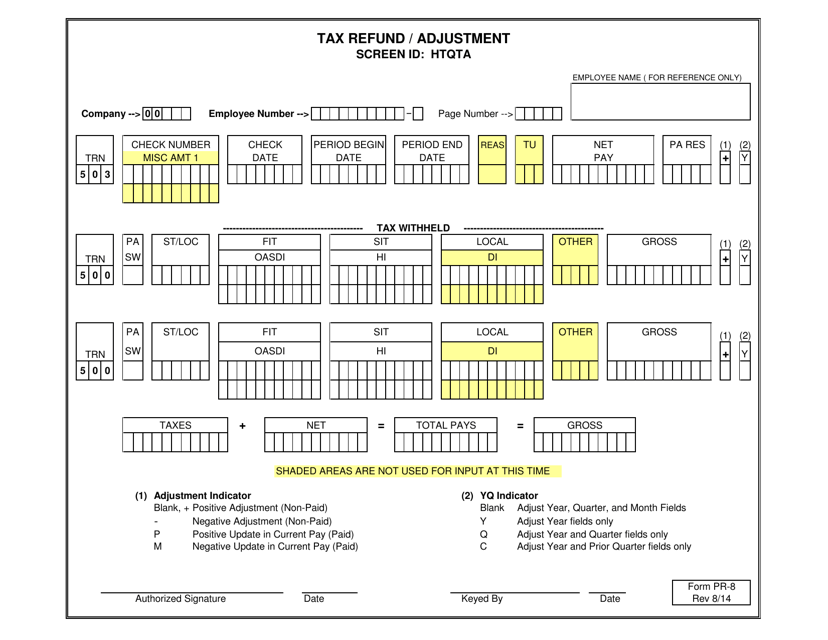

This Form is used for requesting a tax refund or adjustment in the state of Virginia.

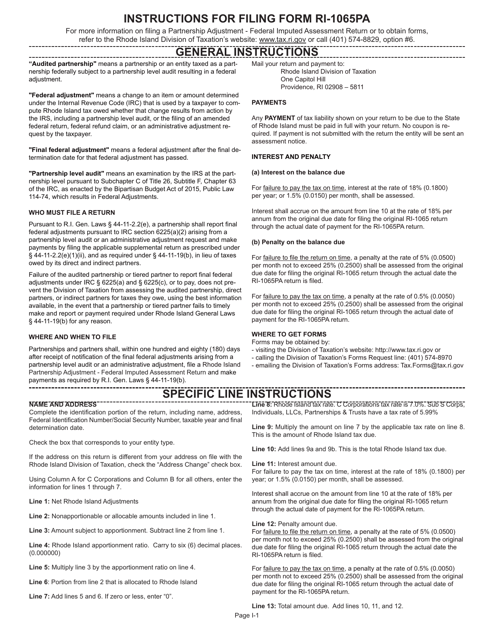

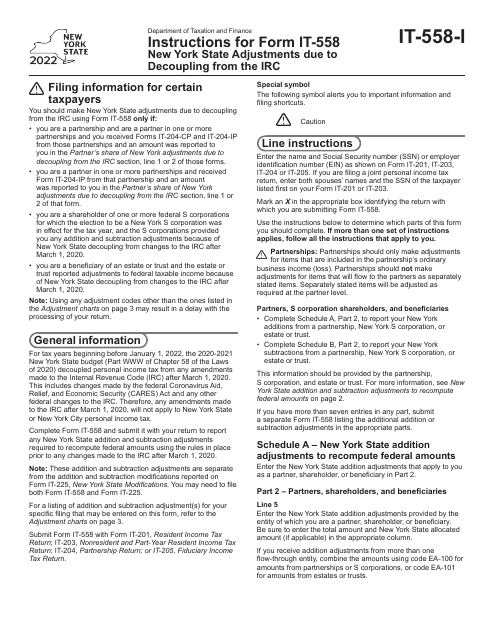

This document provides instructions for completing Form RI-1065PA Partnership Adjustment for Federal Imputed Assessment in Rhode Island.

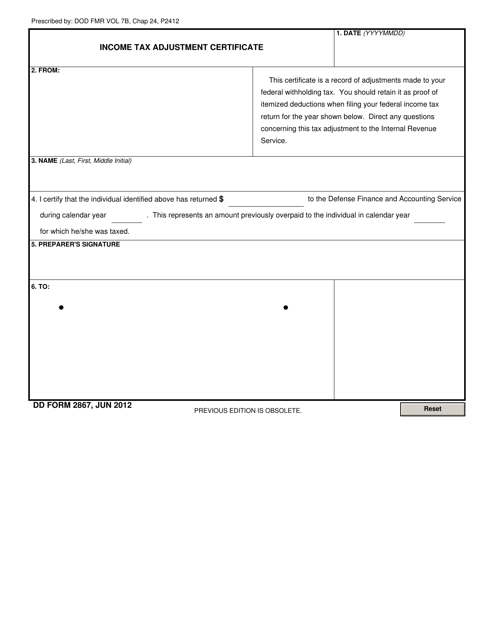

This form is used for filing an income tax adjustment certificate for military personnel.

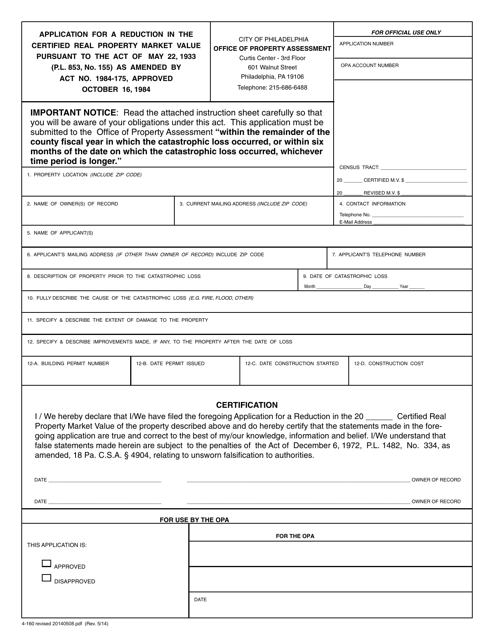

This form is used for applying for a tax adjustment on real estate damaged by a catastrophic event in Philadelphia, Pennsylvania.

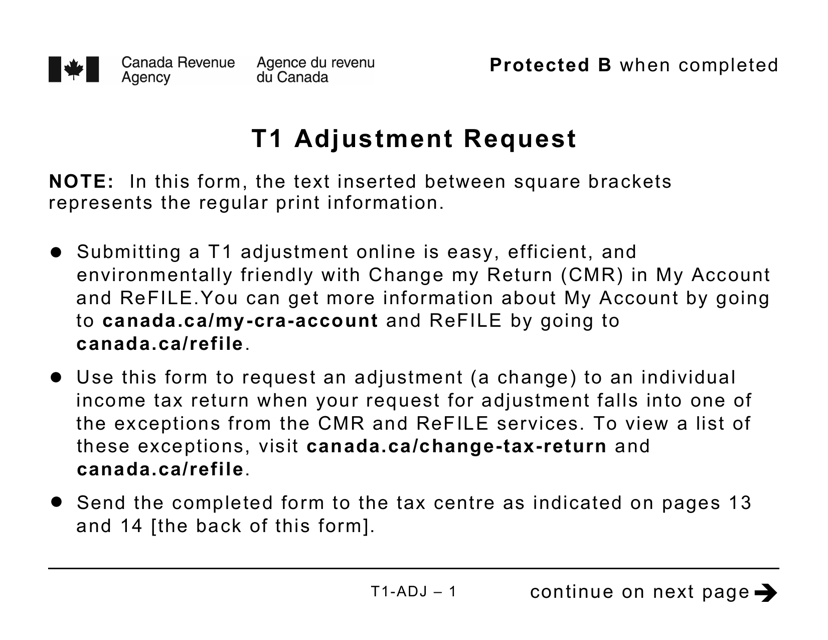

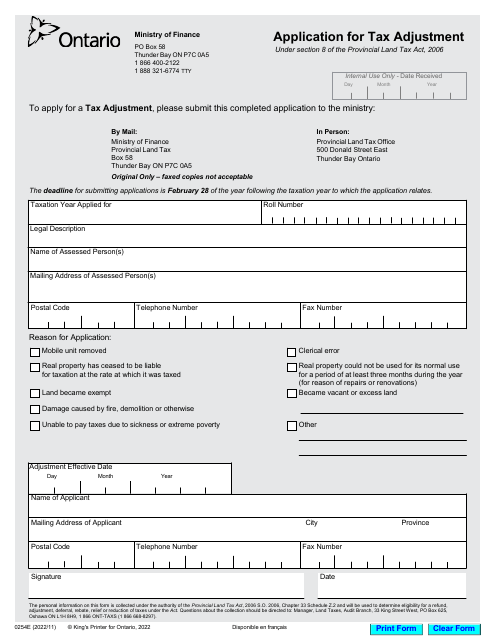

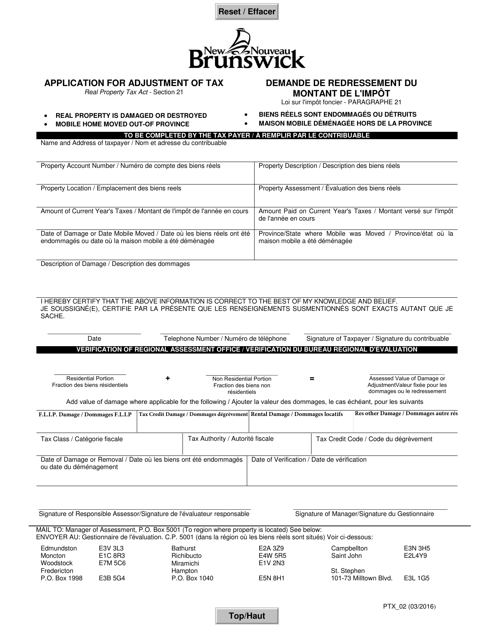

This form is used for applying for an adjustment of tax in New Brunswick, Canada. It is available in both English and French.

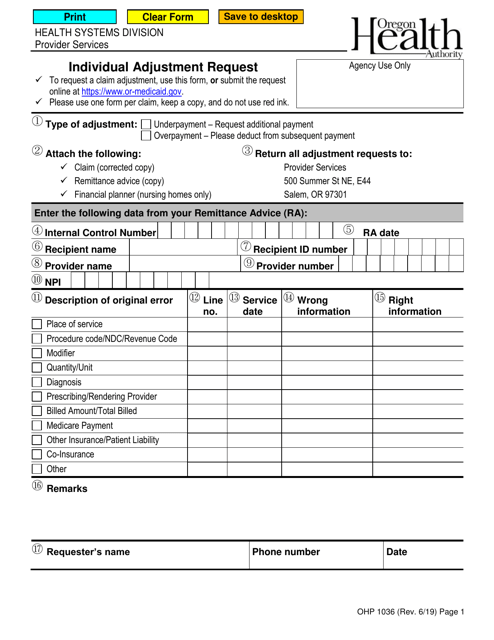

This Form is used for individuals in Oregon to request an adjustment to their taxes or other financial matters. It allows individuals to make changes or corrections to information previously reported to the Oregon Department of Revenue.