Old Age Security Templates

Are you a senior citizen looking for financial assistance in your old age? Look no further than the Old Age Security program. This program, also known as old age security, provides income support to eligible seniors in the form of a monthly payment. Whether you're a Canadian citizen or a resident of another country, this program can help you maintain a decent standard of living during your retirement years.

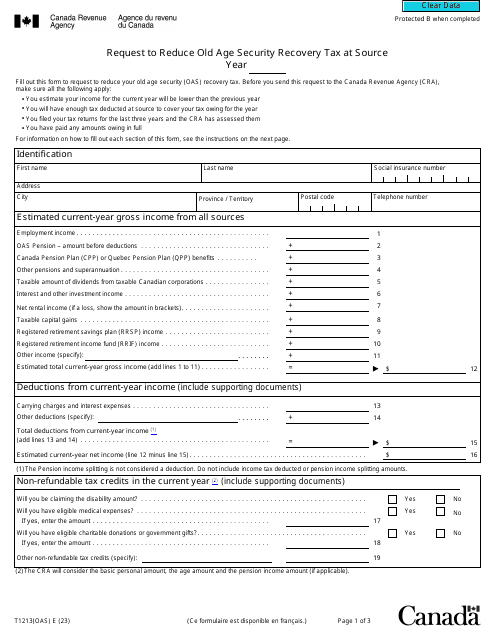

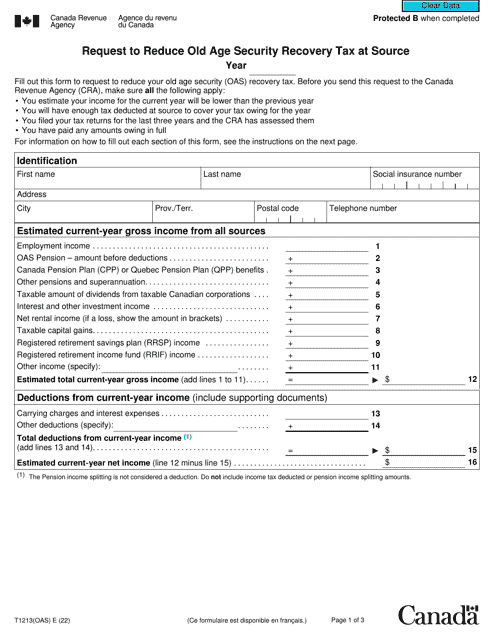

The Old Age Security program offers various forms and documents to ensure a smooth process when applying for or managing your benefits. One important document is the Form T1213(OAS) Request to Reduce Old Age Security Recovery Tax at Source. This form allows you to request a reduction in the amount of tax deducted from your Old Age Security payments. By submitting this form, you can potentially increase the amount of money you receive each month.

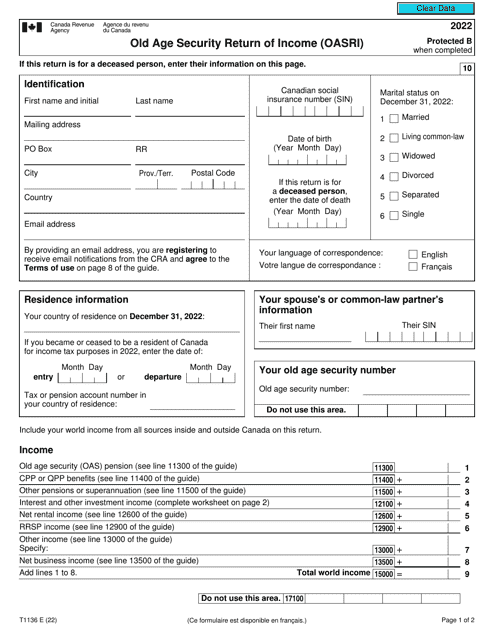

Another crucial document is the Form T1136 Old Age Security Return of Income. This form is used to report your income and provide information about your eligibility for Old Age Security benefits. By accurately completing this form, you can ensure that you receive the correct amount of benefits based on your income.

There are also variations of these forms, such as the Form T1136 Old Age Security Return of Income (Oasri) and the Form T1213OAS Request to Reduce Old Age Security Recovery Tax at Source. These variations serve similar purposes and can be used interchangeably depending on your specific situation.

The Old Age Security program is designed to provide financial support to seniors and help them maintain a decent standard of living throughout their retirement. By understanding and utilizing the various forms and documents available, you can make the most of this program and ensure that you receive the benefits you're entitled to.

So, if you're a senior citizen looking for financial assistance in your old age, don't hesitate to explore the Old Age Security program. Take advantage of the different forms and documents, such as the Form T1213(OAS) Request to Reduce Old Age Security Recovery Tax at Source and the Form T1136 Old Age Security Return of Income, to maximize your benefits. Say goodbye to financial worries and embrace a comfortable retirement with the help of old age security.

Documents:

8

This form is used for Canadian residents who are eligible for the Old Age Security (OAS) benefit and want to request a reduction in the tax deducted from their monthly payments.