Low Point Beer Templates

Low point beer, also known as low-alcohol beer or non-alcoholic beer, is a popular beverage choice for those who want to enjoy the taste of beer without the effects of high alcohol content. This collection of documents provides information and resources for individuals and businesses involved in the production, distribution, and sale of low point beer.

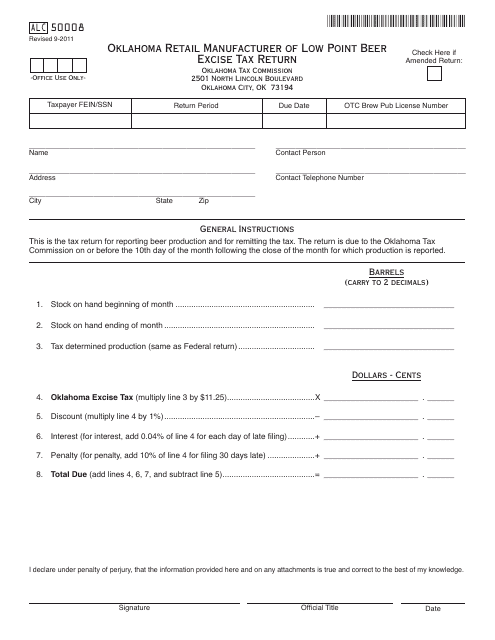

Whether you are a retail manufacturer of low point beer or a non-corporate applicant looking to sell this type of beer, there are specific excise tax returns and permit applications that you need to complete. For example, in Oklahoma, you would need to fill out the OTC Form ALC50008, which is the Retail Manufacturer of Low Point Beer Excise Tax Return. This form ensures that the appropriate taxes are paid on the production and sale of low point beer.

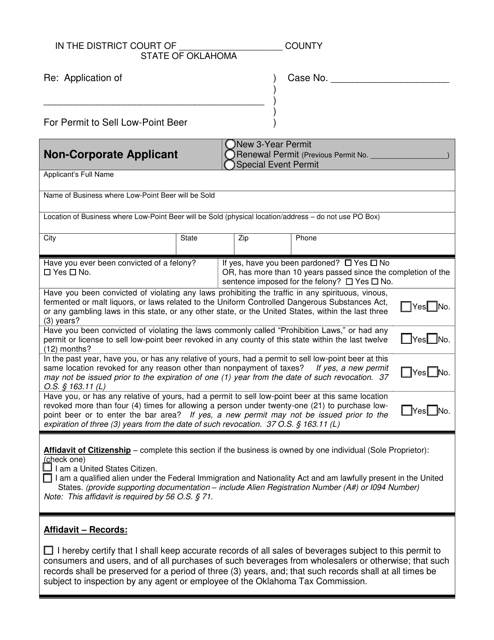

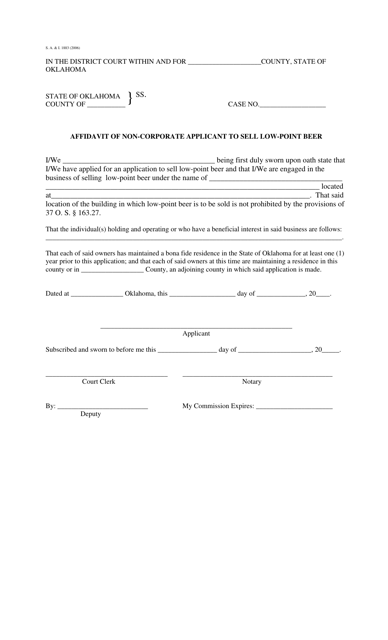

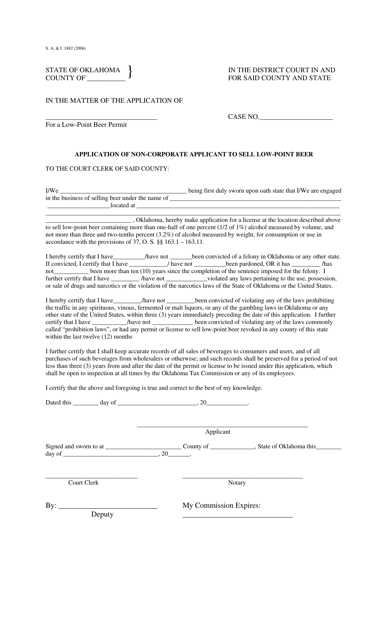

If you are a non-corporate applicant seeking a permit to sell low point beer, there are different forms and affidavits that you will need to submit. Form S.A.& I.1880 is the Application of Corporate Applicant to Sell Low-Point Beer, while Form S.A.& I.1883 is the Affidavit of Non-corporate Applicant to Sell Low-Point Beer. These forms help to verify the eligibility and compliance of applicants who wish to sell low point beer.

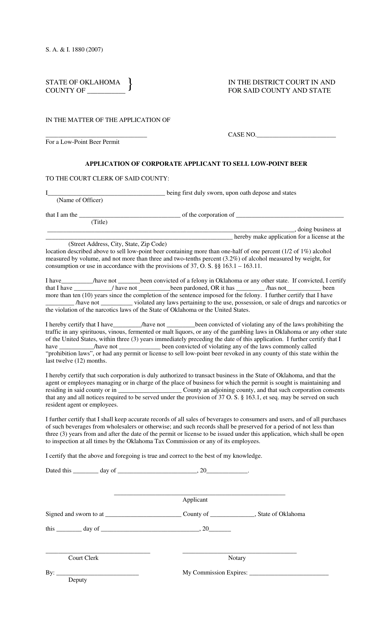

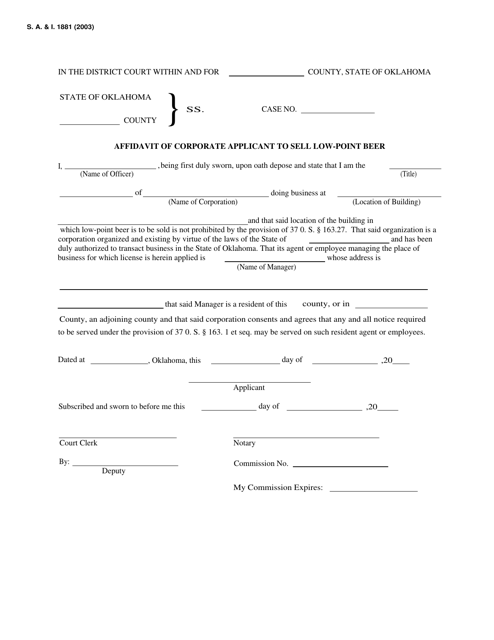

For corporate applicants, there is also the Form S.A.& I.1881, which is the Affidavit of Corporate Applicant to Sell Low-Point Beer. This form provides additional information about the corporation and its intention to sell low point beer.

Navigating the regulations and requirements surrounding low point beer can be complex, but these documents serve as a valuable resource to assist you every step of the way. From excise tax returns to permit applications, this collection provides the necessary paperwork to ensure compliance and success in the low point beer industry.

Documents:

7

This form is used for Oklahoma retailers who manufacture and sell low point beer to report and pay the excise tax.

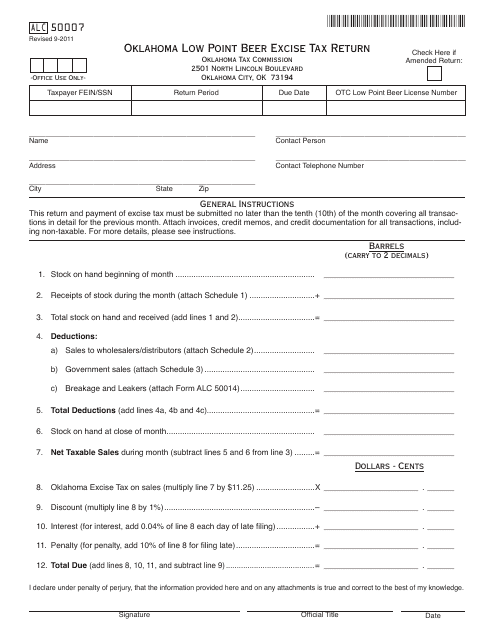

This form is used for filing the Oklahoma Low Point Beer Excise Tax Return for businesses selling low point beer in Oklahoma.

This application is used for non-corporate applicants in Oklahoma who want to obtain a permit to sell low-point beer.

This form is used for corporate applicants in Oklahoma who want to apply for permission to sell low-point beer.

This form is used for non-corporate applicants in Oklahoma to sell low-point beer. The affidavit confirms the applicant's eligibility to sell low-point beer and declares that they are not a corporation.

This form is used for non-corporate applicants in Oklahoma who want to apply for permission to sell low-point beer.

This form is used for corporate applicants in Oklahoma to sell low-point beer. The form is called Affidavit of Corporate Applicant to Sell Low-Point Beer.