Lodging Tax Templates

Looking for information on lodging tax? Look no further! Whether you're a business owner or an individual looking to understand and comply with lodging tax regulations, we have you covered. Our comprehensive collection of lodging tax documents includes a wide range of resources to help you navigate this complex area.

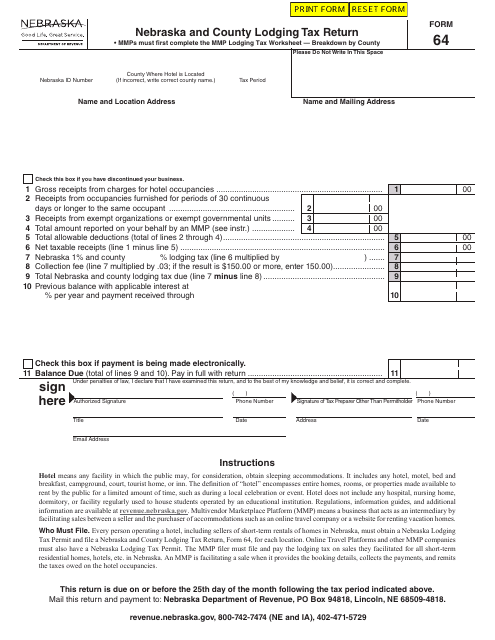

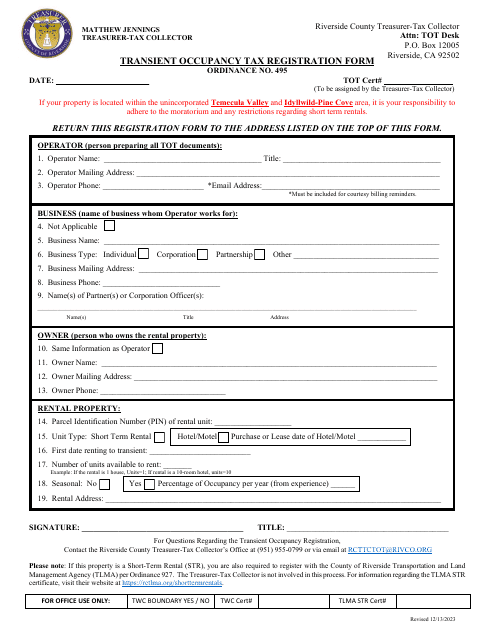

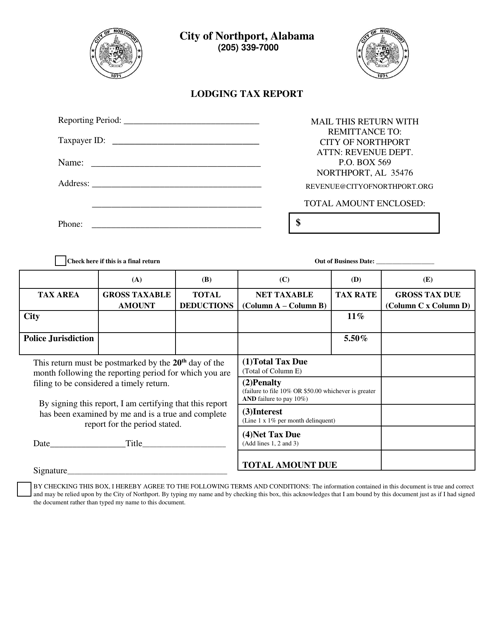

The lodging tax documents, also known as lodging tax forms, provide guidance and instructions on how to report and remit taxes related to lodging services. From Form 64 Nebraska and County Lodging Tax Return in Nebraska to the Lodging Tax Report in the City of Northport, Alabama, our collection covers documents from various jurisdictions across the United States and beyond.

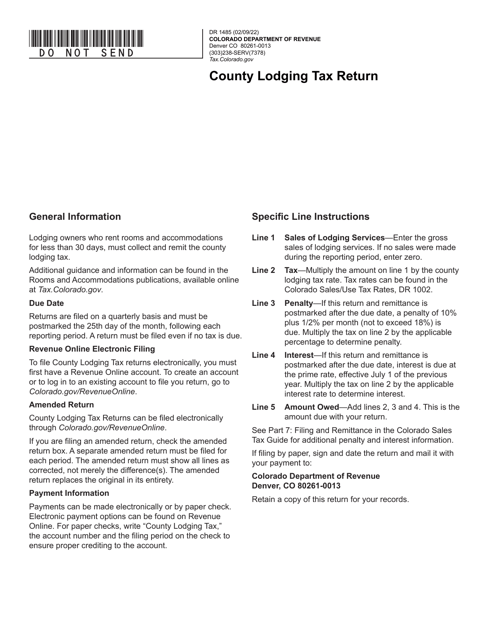

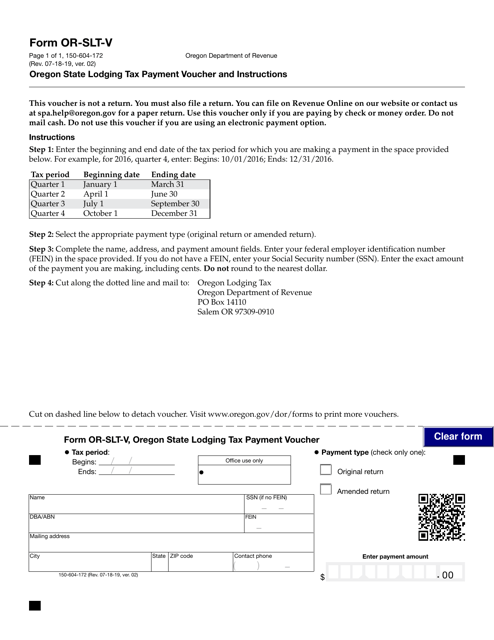

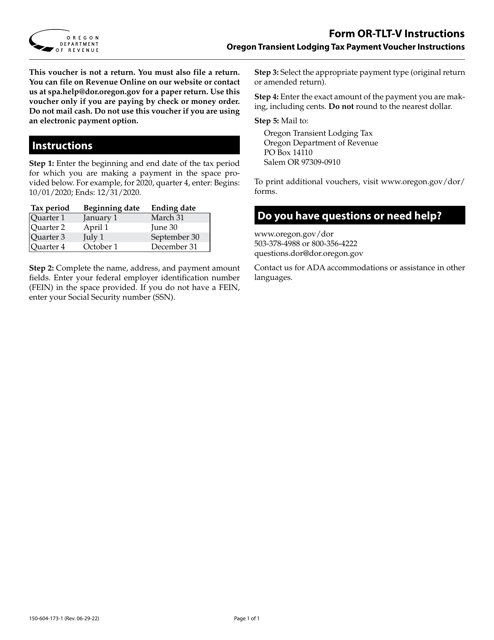

If you're operating a business that offers lodging services, it's essential to stay up-to-date with the lodging tax regulations in your jurisdiction. Our collection includes resources such as the Instructions for Form OR-TLT-V, 150-604-173 Oregon Transient Lodging Tax Payment Voucher in Oregon and the Form DR1485 County Lodging Tax Return in Colorado. These documents provide step-by-step instructions on how to complete the necessary forms and make timely tax payments.

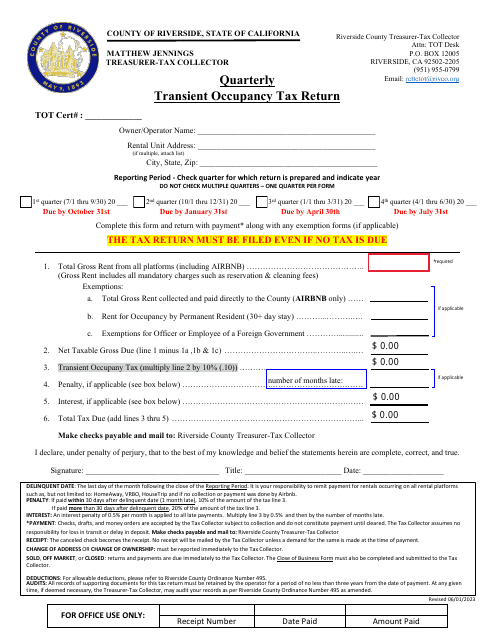

Even if you're not a business owner, understanding lodging tax regulations can still be beneficial. For example, if you're renting out a vacation home or participating in home-sharing platforms, you may be responsible for collecting and remitting lodging taxes. Our collection includes resources like the Quarterly Transient Occupancy Tax Return from the County of Riverside, California, that provide guidance for individuals in similar situations.

No matter where you are or what your specific situation may be, having access to accurate and reliable lodging tax information is crucial. Our collection of lodging tax documents is designed to provide you with the resources you need to stay compliant with lodging tax regulations. Whether you're looking for forms, instructions, or general guidance, you'll find it here.

Documents:

31

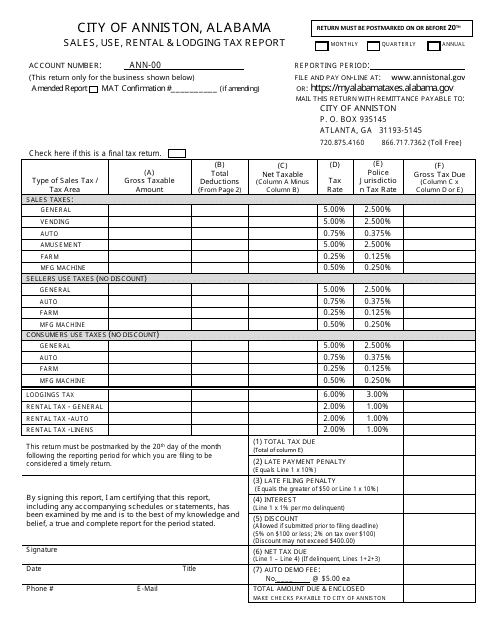

This document is used for reporting sales, use, rental, and lodging taxes in the City of Anniston, Alabama.

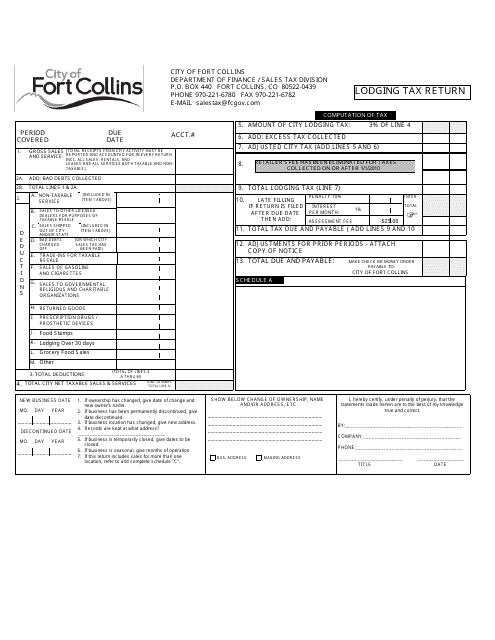

This document is used for filing a lodging tax return specifically for the city of Fort Collins, Colorado. It is required for individuals or businesses that provide lodging accommodations within the city and need to report and remit the applicable taxes.

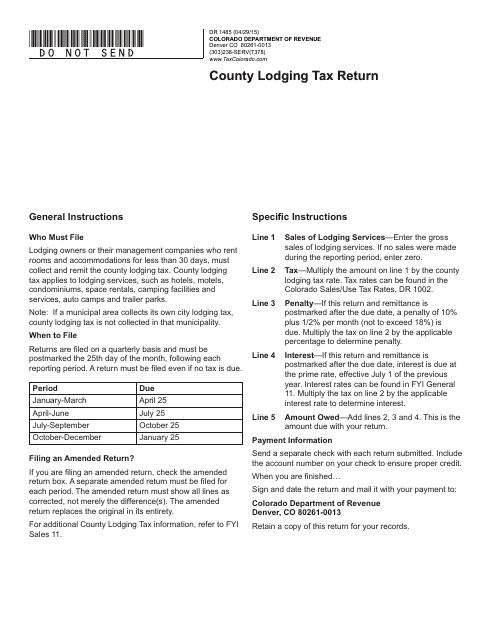

This Form is used for filing the County Lodging Tax Return in the state of Colorado. It provides instructions on how to report and pay the lodging taxes owed to the county.

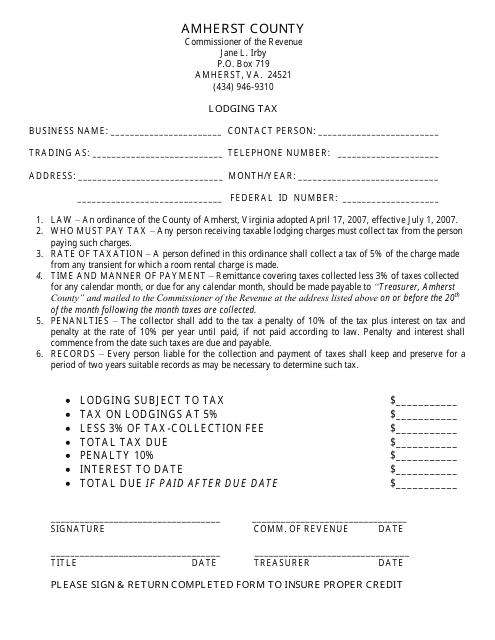

This form is used for paying lodging tax in Amherst County, Virginia.

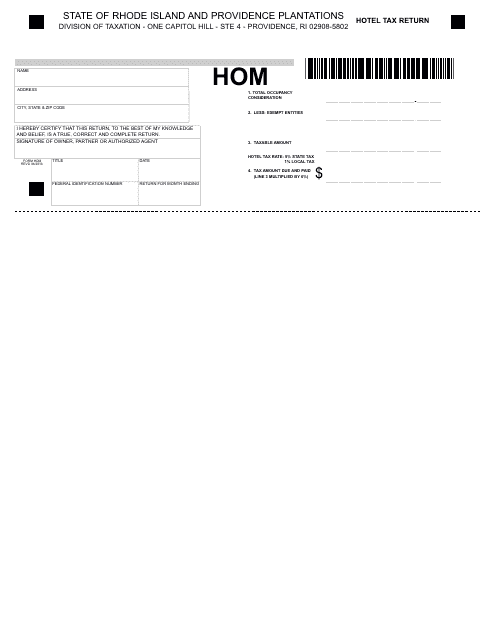

This form is used for reporting and paying hotel taxes in Rhode Island. Hotel owners and operators must complete this return to ensure compliance with tax regulations.

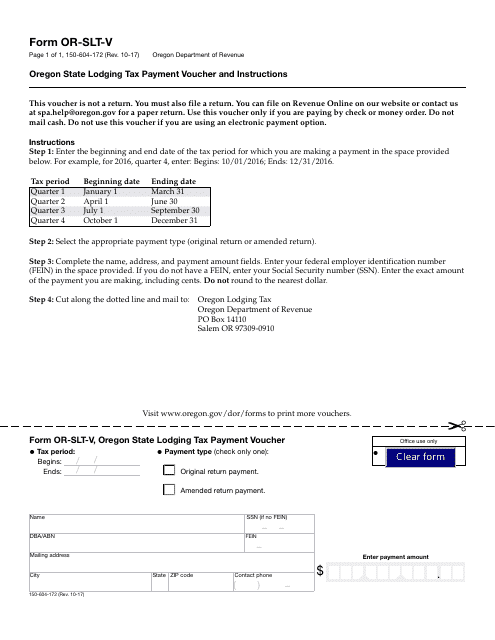

This Form is used for making lodging tax payments in the state of Oregon. It includes instructions on how to fill out the form and submit the payment.

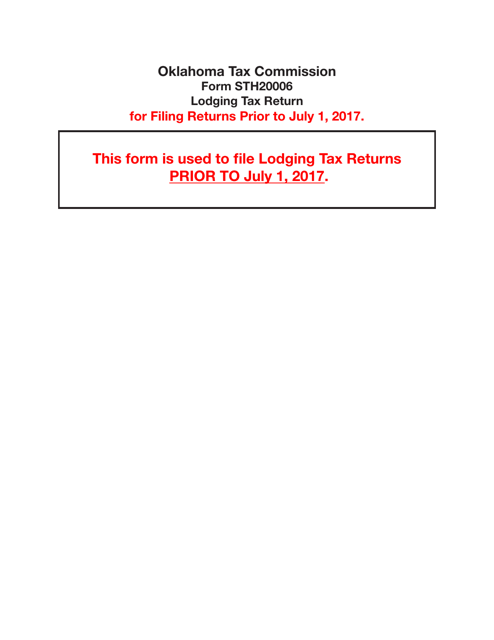

This form is used for submitting lodging tax returns in Oklahoma.

This Form is used for making lodging tax payments in the state of Oregon.

This form is used for reporting and paying lodging taxes in the state of Oklahoma.

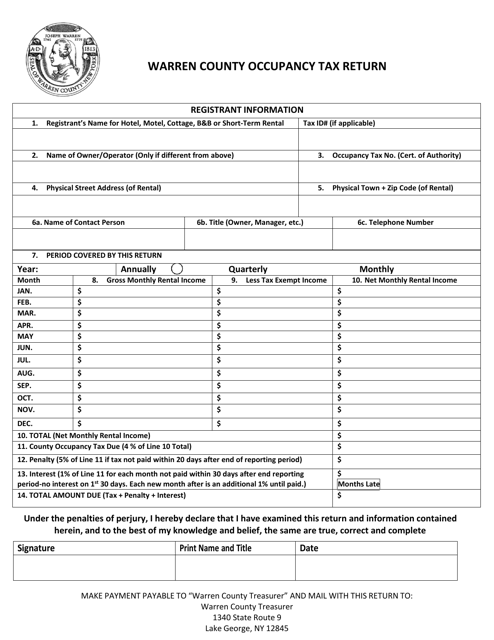

This document is used for reporting and paying occupancy taxes in Warren County, New York. It is required for businesses that provide lodging accommodations to guests.

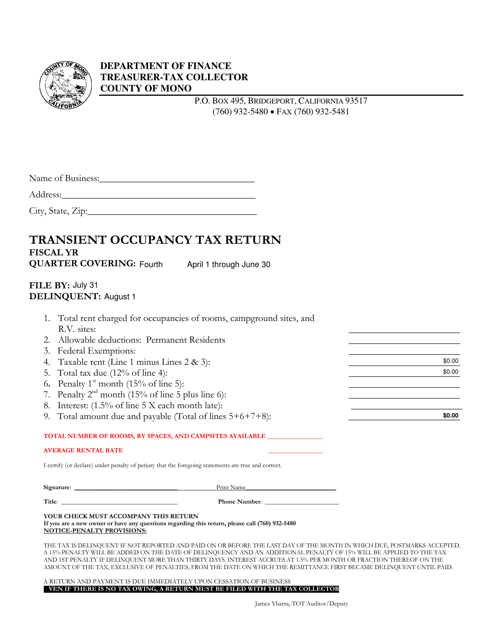

This document is used for filing the Transient Occupancy Tax Return in Mono County, California.

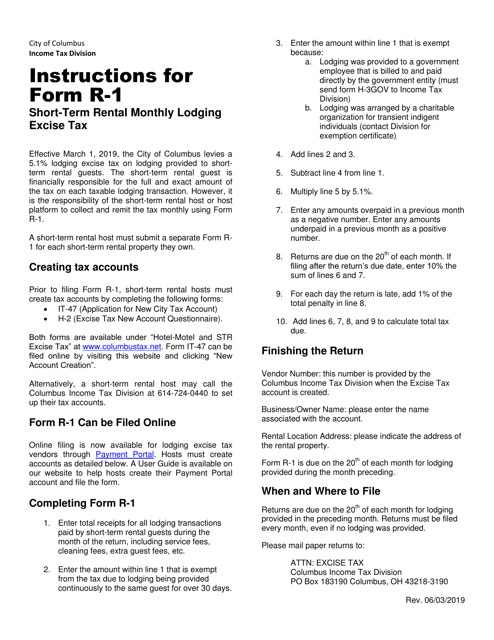

This form is used for reporting and paying the monthly lodging excise tax for short-term rentals in the City of Columbus, Ohio. It provides instructions on how to accurately complete the form and submit the tax payment.

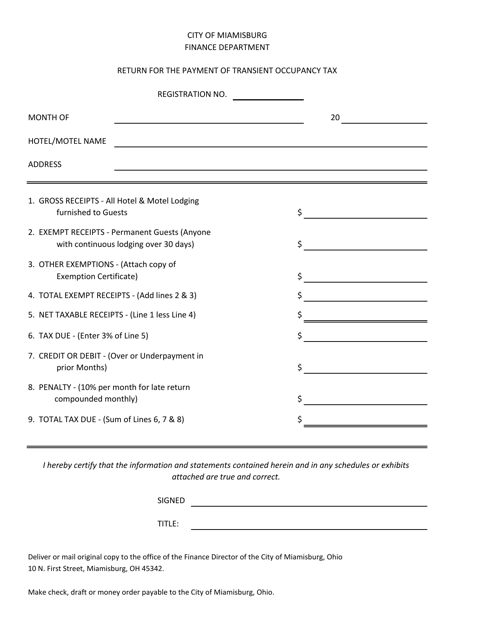

This form is used for reporting and submitting payment for the transient occupancy tax in the City of Miamisburg, Ohio.

This Form is used for reporting lodging taxes in the City of Northport, Alabama.

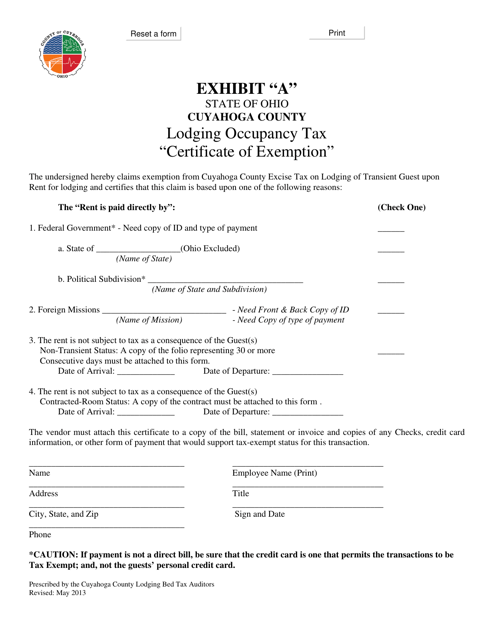

This document is a Lodging Occupancy Tax Certificate of Exemption specific to Cuyahoga County, Ohio. It is used for exempting certain types of lodging establishments from paying occupancy taxes in the county.

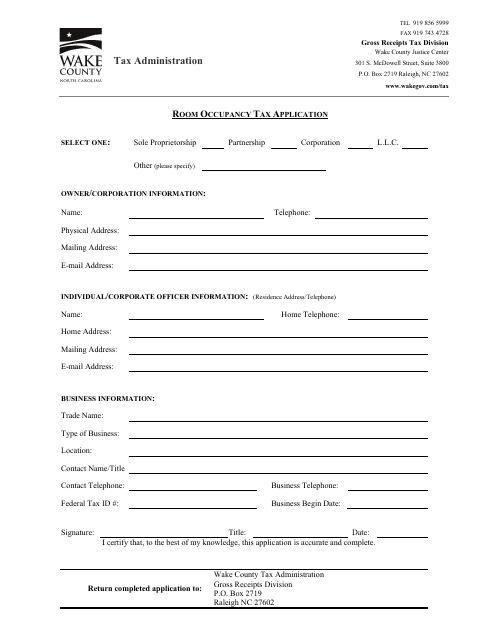

This document is an application form for individuals or businesses in Wake County, North Carolina to apply for the Room Occupancy Tax. This tax is applied to rentals of accommodations such as hotels and vacation rentals.

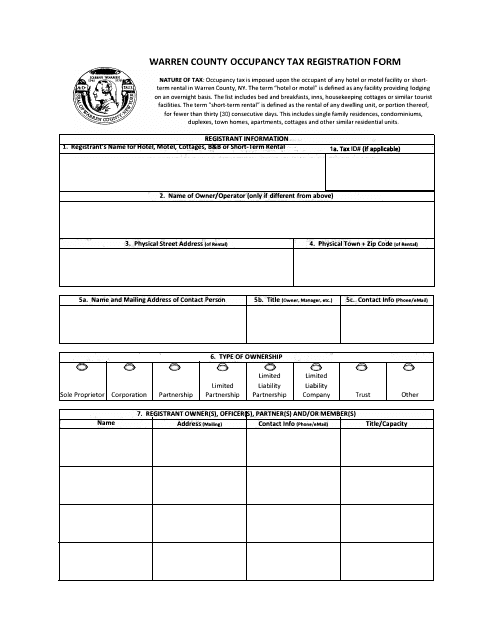

This form is used for registering for the occupancy tax in Warren County, New York.

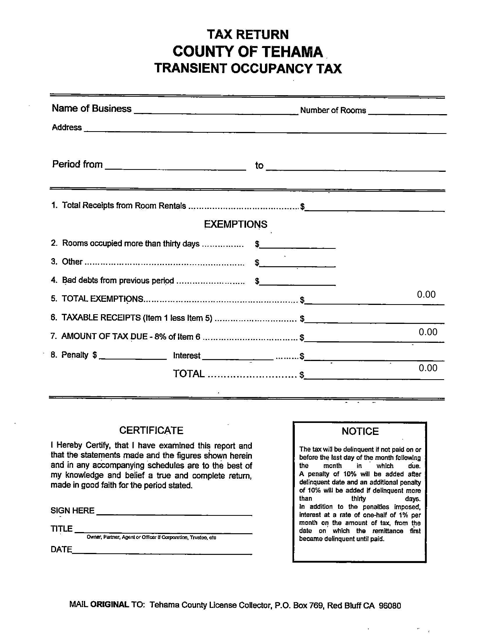

This document pertains to the Transient Occupancy Tax in Tehama County, California. It provides information about the tax and its regulations for individuals or businesses who provide temporary lodging services in the county.

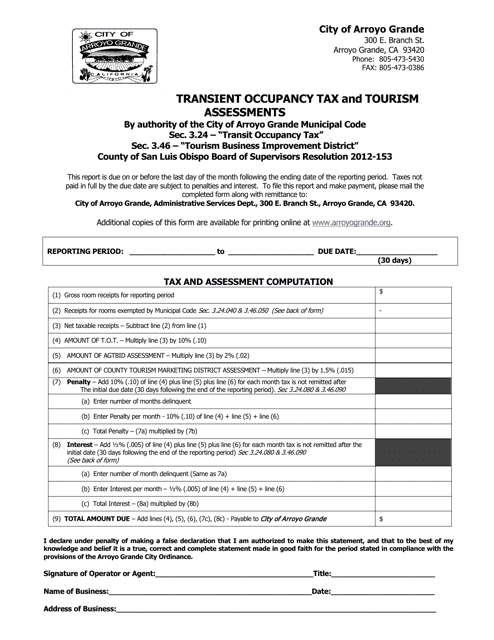

This form is used for collecting the transient occupancy tax and tourism business improvement district assessment in the city of Arroyo Grande, California.

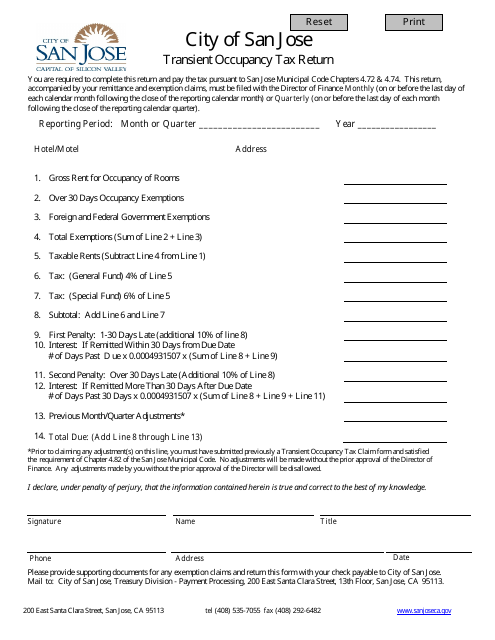

This document is used for filing a tax return for transient occupancy in the City of San Jose, California.