Fuel Tax Application Form Templates

Fuel Tax Application Forms are used to apply for licenses, permits, or registrations related to the payment of fuel taxes. These forms are typically utilized by individuals or businesses engaged in the sale, distribution, transportation, or use of motor fuels. The purpose of the form is to provide the necessary information for the tax authorities to track, assess, and collect fuel taxes from the relevant parties.

Documents:

2

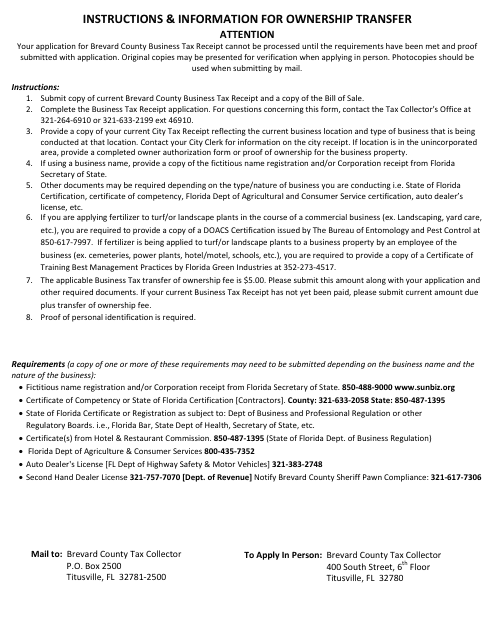

This Form is used for applying for a Business Tax Receipt in Brevard County, Florida.

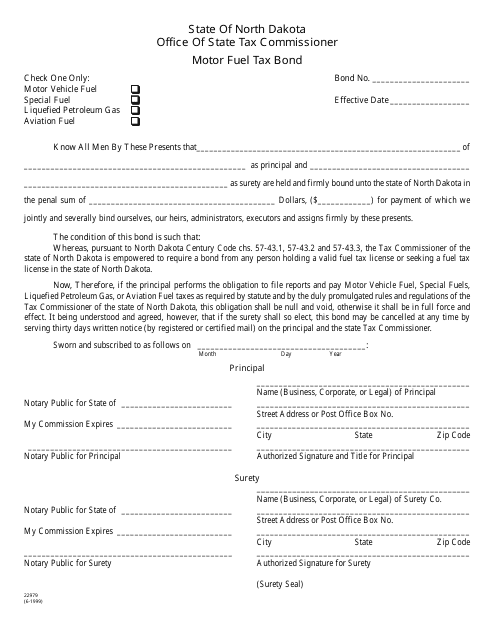

This Form is used for obtaining a motor fuel tax bond in North Dakota.