Free Rhode Island LLC Operating Agreement Templates

A Rhode Island LLC Operating Agreement gives a business the opportunity to develop and put in writing crucial information about the business and any internal rules that are followed. Such details frequently, but not only, deal with the following subjects:

- The structure through which a company is administered, along with who the accountable individuals are for managing the organization;

- The identities and specific responsibilities of each LLC owner;

- A thorough description of the routine operational procedures that take place every day.

The agreement includes advantages in addition to those that were previously mentioned. This agreement was made in part to protect LLC members from the possibility of losing their private property, financial assets, and vehicles. If a corporation files for bankruptcy in order to pay off any remaining debts, only the assets that were owned by and specifically connected to the business in question may be taken.

Any operating agreement already drafted prior to the creation of the LLC may be updated if the members of the LLC express a desire to do so for any reason, provided that the adjustments are approved by all members. If they agree to it, they must put it in writing and sign it.

Such an operating agreement is not required by law in the state of Rhode Island, so an LLC may operate legally without one in place . Despite this, we strongly suggest all business owners to download a Rhode Island LLC Operating Agreement template for the reasons indicated above.

Rhode Island LLC Operating Agreement Template Types

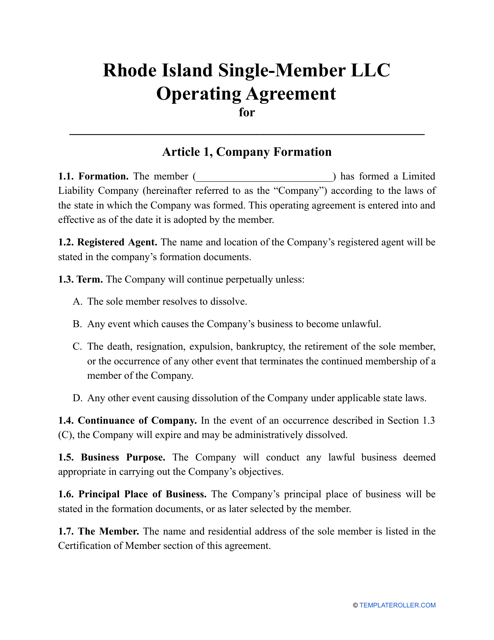

- A Rhode Island Single-Member LLC Operating Agreement Template should be carried out by the business's sole proprietor. It will include all pertinent details about the company's procedures, particularly those related to the organizational framework and regulations. The paper also lists the company's owner and other significant individuals, along with each person's roles;

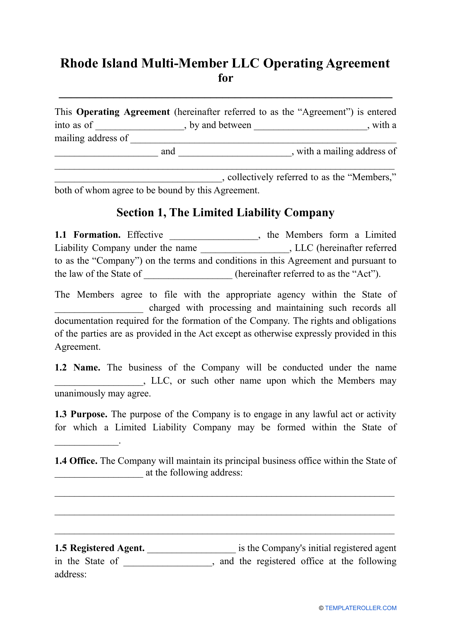

- A Rhode Island Multi-Member LLC Operating Agreement Template is necessary for businesses with numerous legitimate company owners, not simply one. There can be any amount of members, but sometimes only one individual can administer the actual business; in some cases, a third party is given complete control over these management responsibilities. Therefore, it's essential to specify each member's specific responsibilities.

How to Form an LLC in Rhode Island?

In order to form an LLC in New Mexico, one must follow the steps outlined below. This can enable you to save some crucial time and increase the likelihood of your LLC being approved and registered on the first try:

-

The business name must be distinctive . You are not permitted to use a name that is the same as or confusingly similar to one used by a New Mexico company that is already in operation;

-

Choose a representative who will accept important documents on the company's behalf . There are specific requirements concerning which individuals are permitted to do this;

-

The next step entails choosing the specific entity type and completing the appropriate application form for either a domestic or foreign LLC;

-

Only online applications are accepted for domestic LLCs . If you're thinking of forming a foreign LLC, you can only do it via mail

-

There is a filing fee of $150 that must be paid and sent along with the application;

-

The optional operating agreement is the next document that you need to consider in the process . If owners want to protect their personal assets and prevent the risk that they will be seen as corporate assets, they should fill out this form;

-

Make sure your company has a specialized number (as issued by the IRS) so that you can pay employees and monitor other financial operations.

Still looking for a particular template? Take a look at the related forms below:

Documents:

2

This form is used in Rhode Island and contains all of the necessary information regarding the practices of the business, mainly concerning the organizational structure and policies.

If your entity has more than one owner, you will greatly benefit from preparing and signing this type of template in the state of Rhode Island.