Free Nebraska LLC Operating Agreement Templates

A Nebraska LLC Operating Agreement will come in handy for those residing in the state of Nebraska with their own business. The document seeks to outline some of the key structural elements of the business. The arrangement can include but is not limited to the following information:

- Full information concerning the owner or owners of an LLC;

- The standard, daily procedures that go on in the company need to be outlined;

- The strategical management of the company needs to also be described;

- The main staff and their roles and responsibilities need to be carefully considered and included in the agreement.

The operating agreement will also safeguard all official members of the LLC by ensuring that their personal assets will be differentiated from those that belong to their LLC. At first glance this may not seem important, but in fact it can become crucial if a company enters bankruptcy or somebody takes the LLC to court. If any payouts need to be made, they will only be taken from the assets that belong to the company.

For LLC’s with several members in their company, all of these members ought to keep a copy of the agreement. Any modifications need to be discussed and signed once more by all members.

In Nebraska an LLC may operate without implementing this agreement . However, it will not protect their personal assets and as a result, we would still highly recommend that all owners of a business implement this agreement by downloading the Nebraska LLC Operating Agreement template.

Nebraska LLC Operating Agreement Template Types

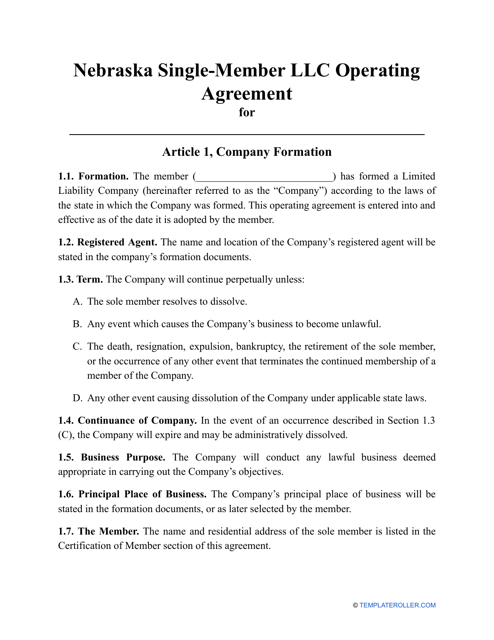

- A Nebraska Single-Member LLC Operating Agreement Template is intended for the sole owner of an LLC. The document outlines the day to day procedures and organizational structure of the LLC, detailing any ownership rights and other important information about how the way in which the company is managed;

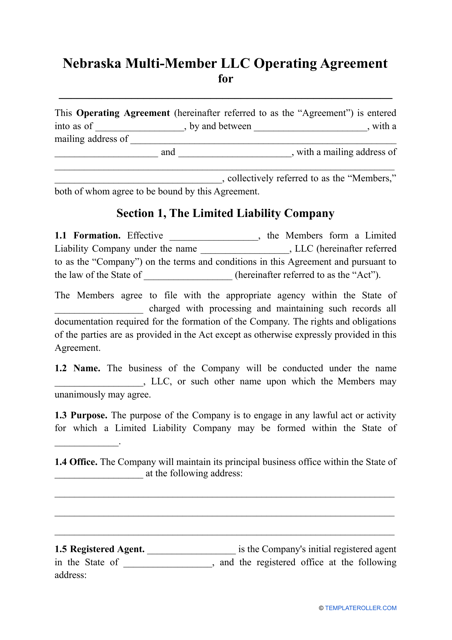

- A Nebraska Multi-Member LLC Operating Agreement Template in terms of content and purpose matches the agreement that is described above. However, if you do not have a sole owner of an LLC but instead several owners – you must fill in this agreement instead.

How to Form an LLC in Nebraska?

For the formation of an LLC in Nebraska, you need to follow the steps described below. The process is not difficult, you just need to know what to do and in what order in order for you to prevent wasting your time:

- You should be certain that the company name that you intend to register is not already registered with another company within the state of Nebraska . Even names that are very similar in nature will not be accepted;

- Your next step will mean registering an agent that will be given the right to act on behalf of your company . This role concerns accepting some very important legal documents and overlooking financial transactions. The individual must be residing in Nebraska;

- Consider the type of LLC that you want to open - domestic or foreign . With both of these types you have the option to file everything online. If applying for a foreign type, you may require additional documents;

- The filing fees are $110 regardless of type . However, you will need to pay for the certificate. For the domestic type the sum totals $30 whilst the foreign type is $20 cheaper;

- In agreement with state law, you will need to publish a note in the newspaper that is local to the county;

- Then you can implement the operating agreement;

- To conclude the process you should create a unique identification number that is used for financial purposes as well as employment . This number can be obtained online or via mail.

Still looking for a particular template? Take a look at the related forms below:

Documents:

2

This document is used in Nebraska and outlines the day-to-day procedures and organizational structure of the business, outlining ownership rights and other crucial information about how the business is managed.

This is an essential document used in Nebraska that describes how a company with several owners operates, lists key regulations the business follows, and protects individuals that formed the entity from bearing personal liability for the actions of the company.