Free Michigan LLC Operating Agreement Templates

A Michigan LLC Operating Agreement refers to a legally enforceable document that clarifies the organizational form chosen by the company owners, sets short- and long-term aspirations of the business, and describes how it will function. It is recommended to draft an operating agreement despite the lack of a law that obliges the companies to have one - whether you have a conflict between the owners or are asked to confirm the status of your organization before you sign a contract with a business partner or file an application for a loan with the bank. While it is not necessary to submit a copy of the instrument to any governing bodies, you should keep an updated version in the internal documentation of the organization and amend it by mutual agreement of the members.

Michigan LLC Operating Agreement Template Types

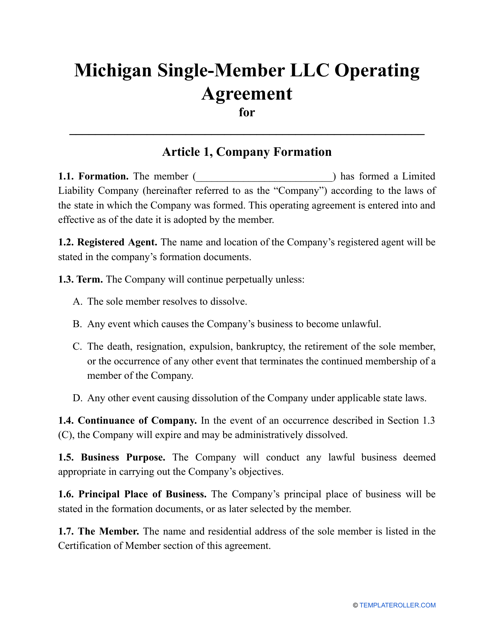

- Michigan Single-Member LLC Operating Agreement Template. Even though a single owner of the company will not struggle with internal disputes since they are the one and only person or corporation managing the business and establishing the rules to adhere to, consider filling out this template - companies with one member do not file a federal tax return; moreover, it will certify the separation of your personal property from what your business owns;

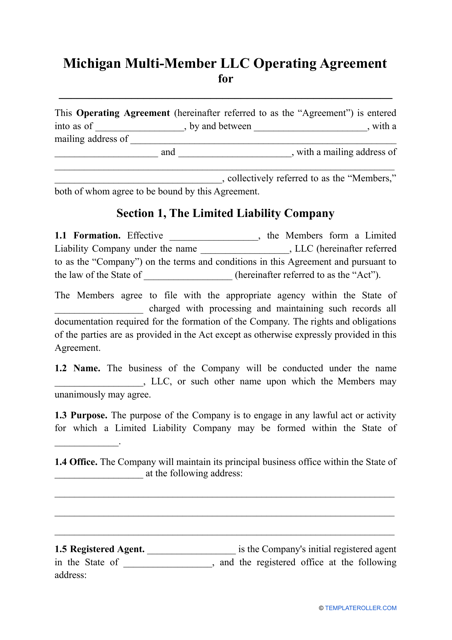

- A Michigan Multi-Member LLC Operating Agreement Template is going to be useful for organizations managed by several owners at once to define their voting rights in advance, explain how they will work through disagreements regarding the company policy, and indicate the allocation of profits and stock.

How to Form an LLC in Michigan?

Follow these instructions to start an LLC in Michigan:

- Find the person or organization willing to assume the responsibilities of your representative - they will receive formal letters from the authorities in the name of the company. You may select an individual residing in Michigan or a local business.

- Reach out to the Corporations Division to register the company . Choose the right paperwork - there are different documents for domestic and foreign businesses respectively, prepare to pay the required amount of the filing fee, and send the documentation via traditional mail - or file it in person.

- Customize the Michigan LLC Operating Agreement Template to accurately reflect the goals, values, and internal structure of your organization . The particulars you include in the instrument vary from one business to another since the members are free to negotiate the provisions of the agreement but, at a minimum, it usually verifies the legal name of the company and its address, the intentions of the business - what the owners are determined to accomplish, the identification of members and managers, the description of rights and duties of the people that run the business, the distribution of revenue and liabilities, and additional organizational matters like the measures to implement when the members have to convene a meeting or purchase the share from the member that decided to retire.

- To ensure your organization is able to hire employees and pay salaries, get a bank account, and strengthen its standing in the industry, you will require an employer identification number - you can obtain it from the Internal Revenue Service by filing an application by mail or on their website.

Haven't found the template you're looking for? Take a look at the related forms below:

Documents:

2

This type of agreement is used in Michigan to establish the rules and regulations within the company, set out the roles and responsibilities of other staff, as well as provide information about the management team and ownership details.

This is a legally binding contract that is used in Michigan and signed by several owners of a business that want to create an internal set of rules for their company.