Free Statutory Power of Attorney Forms and Templates

What Is a Statutory Power of Attorney?

A Statutory Power of Attorney is a formal statement prepared by one individual (principal) to appoint another (agent) as their legal representative in financial, legal, and health-related affairs.

Alternate Name:

- Statutory Durable Power of Attorney Form.

Whether you are planning to formalize a deal, sell an apartment, handle an issue with a bank, give the other person a right to decide your medical treatment, or simply want to be sure your interests are respected in case of sudden incapacitation, you should draft this document and give it to the person you know well (a relative or close friend) or a lawyer equipped with knowledge and skills to represent you.

Statutory Power of Attorney Forms by State

While the authorization outlined in the Statutory Power of Attorney Form is recognized all over the country as a rule, different states have adopted different regulations regarding this type of documentation. To avoid issues and make sure your power of attorney is not challenged, you should learn the requirements and rules for your location before composing the document. Below you can find a state-specific authorization and customize it to suit the particulars of your situation.

Statutory Durable Power of Attorney: How to Make?

Here is how you need to draft a Statutory Durable Power of Attorney:

- Identify the principal and their legal representative . It is better to write down the names and addresses of the parties and add driver's license numbers as well especially if either of the names is common.

- Certify your intention to provide the person mentioned above with the authorization to act as your representative . Whether the power of attorney can enter into force upon a certain event or it is legally binding immediately upon signing, is up to you - just enter this detail in the authorization.

- List the responsibilities and tasks your agent will be allowed to carry out on your behalf . Even if you trust the chosen individual to handle all your affairs, including dealing with legal issues arising during your incapacitation, it is highly recommended to point out exactly what actions they will be permitted to perform. At a minimum, you should indicate several groups of responsibilities where your representative's signature has as much legal force as yours would: for instance, you may state they can control real estate transactions, banking transactions, family maintenance, receive your salary and benefits, submit documentation to various government bodies and file lawsuits in your name.

- Give more precise instructions that limit or extend the powers you grant to the representative . For instance, if you have assigned them a duty to prepare and file a motion to a family court, include the day they should submit this document and confirm they are not allowed to exceed their authority beyond the specific task you have described.

- Record the period of validity of the document . A Statutory Power of Attorney will be used in the event of your incapacitation as a result of injury or illness so be careful to think this over and reflect your choices in writing.

- To ensure this authorization remains valid, obtain a notary seal for your document . Do not sign the papers before a notary public verifies your identity and witnesses the process of signing.

Still looking for a particular form? Take a look at the related forms below:

Documents:

50

By using this type of form in Alabama, a person may choose a representative to legally represent them in regards to their finances.

This type of form is used in Alaska when a principal decides to delegate themselves an agent with the rights to make certain financial or business decisions while representing their interests.

Residents of Arizona may use this form to give another individual the right to make specific business-related and financial choices that concern the principal.

This form is used in Arkansas to permit another individual the right to make important decisions regarding financial aspects (including business-related questions) on behalf of another individual.

In California, any person signing this type of form will legally document the fact that a principal permits specific financially related powers to their selected agent.

This form provides legal permission, by the principal, for another party to make financial and business decisions on behalf of the principal in the state of Colorado.

This form is used in Connecticut and gives an agent the power to make business decisions and take care of other financial questions on behalf of the principal.

By signing this type of form in Delaware, the principal gives the agent special rights which provides them with the power to make crucial monetary decisions on their behalf, including those that concern businesses.

This form will allow an individual residing in Florida to select an agent that will have the legal rights to make financial decisions concerning the principal.

In Georgia, this type of form provides an agent with the necessary legal rights and powers to make financial choices on behalf of a principal.

This form gives residents of Hawaii permission for an agent to represent a principal in financial matters, allowing them to make specific choices relating to businesses, properties, and any other significant financial decisions.

Residents of Idaho are required to use this form in instances when a principal wants to designate themselves an agent, legally allowing them to make important decisions concerning their finances which may also be in the form of a property or business.

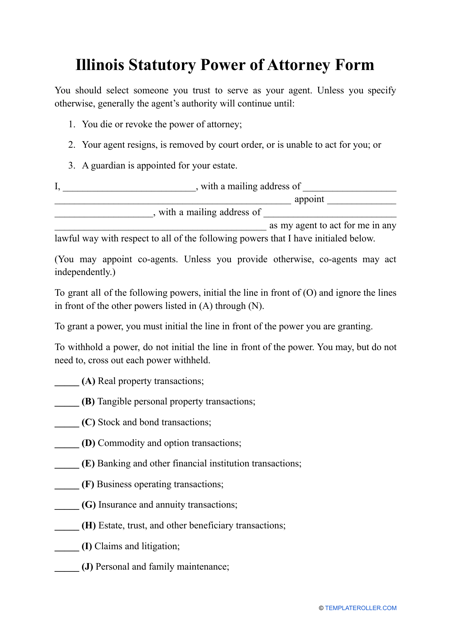

In Illinois, this type of form provides legal confirmation that another person can represent an individual in financial settings, making important decisions concerning finances.

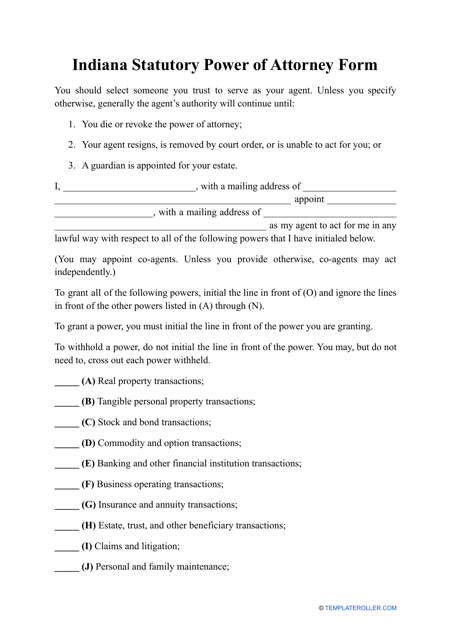

This form gives another person the legal right to represent and make monetary decisions on behalf of another person (in the state of Indiana.

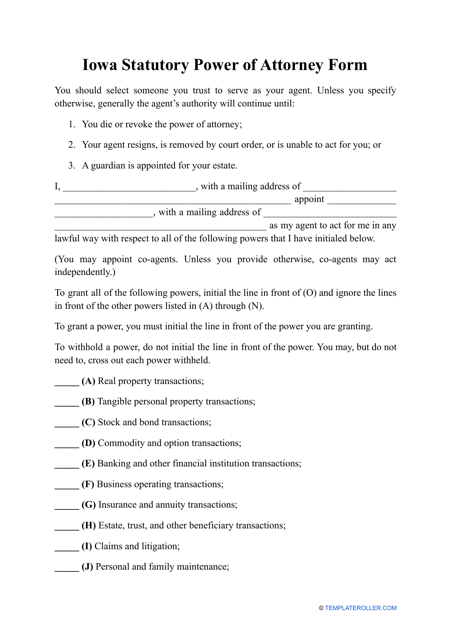

By using this type of form in Iowa, a person may choose a representative to legally represent them in regards to their finances.

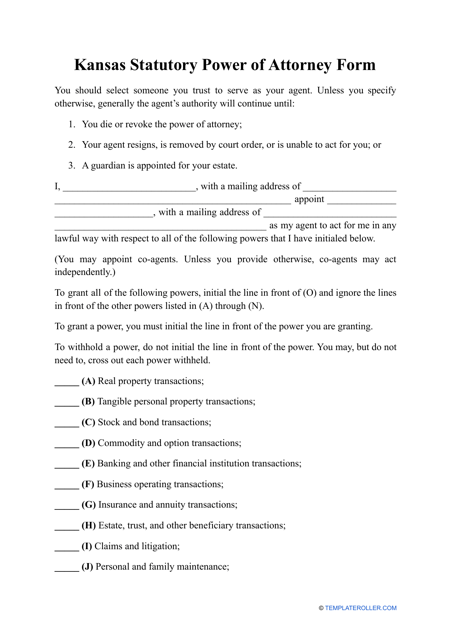

In Kansas, this type of form is used to confirm that an individual has delegated themselves an agent that will be responsible for making any decisions concerning their finances or related aspects of the individual.

This form is used in Kentucky and designates a legal representative that is within their right to make decisions on behalf of an individual.

This type of form is used in Louisiana when a principal decides to delegate themselves an agent with the rights to make certain financial or business decisions while representing their interests.

This form is used in Maine and provides an individual with the opportunity to pick a financial representative agent that will be given powers relating to finances and extend to properties as well as businesses.

This is a legal document used in Maryland that provides official permission for an agent to act on behalf of a principal and manage their finances.

By using this type of form in Massachusetts, a person may choose a representative to legally represent them in regards to their finances.

This is a document used in Michigan that allows an individual to designate and use an agent relating to financial decisions.

This is a legal form used in Minnesota by a principal for them to select a financial representative that would legally be allowed to represent them in an important financial setting.

This form is used in Mississippi and allows an individual to find and document themselves a representative that will be able to represent their interests and wishes in financial settings, particularly setting relating to properties and a business.

This is a legal document used in Missouri that grants another individual permission to make important financial decisions on their behalf.

By using this type of form in Montana an individual expresses their right to choose a representative, allowing them to represent their interests concerning financial affairs.

This form is used in Nebraska when a principal wants to give out powers to an agent with the legal rights to make financial decisions on the behalf of the principal.

This type of form is used in Nevada when a principal decides to delegate themselves an agent with the rights to make certain financial or business decisions while representing their interests.

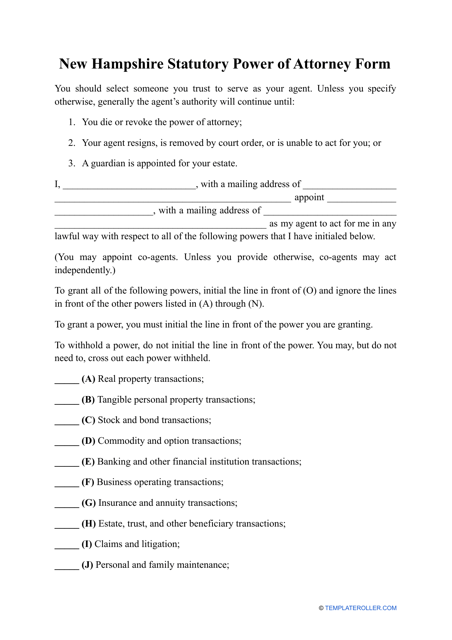

This form is used in New Hampshire to allow another individual (usually a close friend or relative) the power to make important financial choices on behalf of the principal.

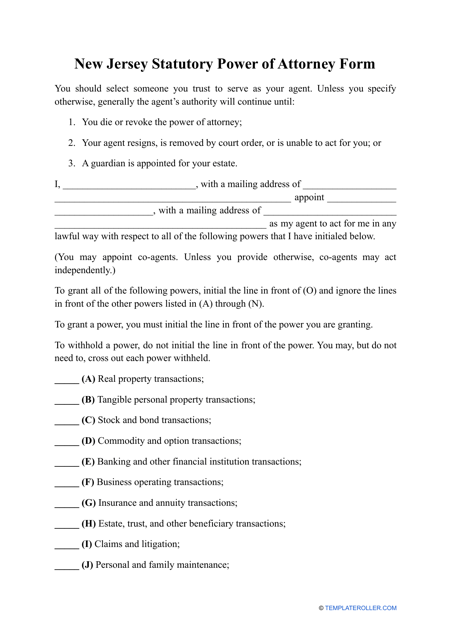

In New Jersey, any people signing this type of form will need to be aware that the principal is legally documenting the allowance of certain financial functions to the chosen agent.

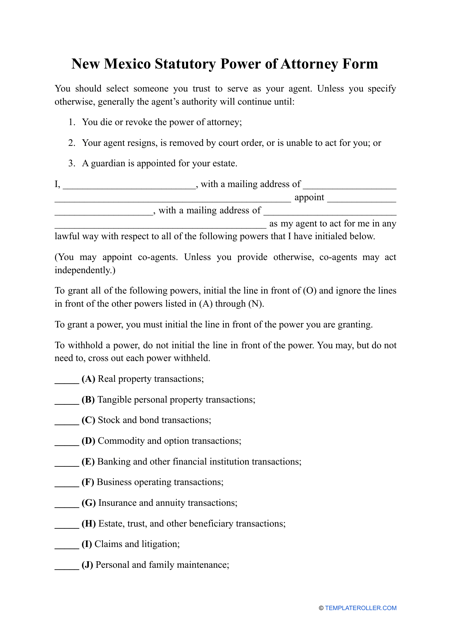

This form is used in New Mexico when permission is granted by a principal, allowing another party (the agent) to make vital financial choices on behalf of the principal.

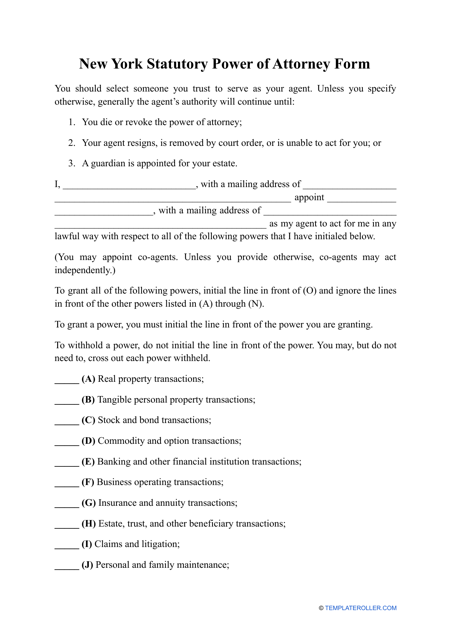

This form is used in New York and will give an agent the power to make important choices concerning monetary plans on behalf of the principal.

By agreeing to the conditions in the document in the state of North Carolina, the principal allows their representative to exert powers which gives them the authority to make crucial financial decisions on their behalf.

This form is used in North Dakota and allows for the principal to delegate themselves an agent that will hold the legal right to make financial decisions concerning the principal, particularly concerning properties and businesses.

In Ohio, this type of form provides an agent with the legal power to make financial decisions on behalf of the principal.

Residents of Oklahoma may use this form to give permission to an agent to represent a principal in financial affairs, allowing them to make certain decisions relating to the finances and/or businesses and properties of the principal.

This type of form is needed in Oregon in cases when a principal wants to delegate themselves an agent, giving them legal permission to make vital financial decisions on their behalf.

In Pennsylvania, this type of form is a legal document confirming that an agent can represent another individual in their financial affairs, making vital decisions regarding financing on their behalf.

This type of form is used in Rhode Island to give another individual the legal power to represent and make monetary decisions on behalf of another individual.

By using this type of form in South Carolina, a person may choose a representative to legally represent them in regards to their finances.