Cash out Refinance Letter Templates and Samples

A Cash-Out Refinance Letter is a formal request composed by a borrower who wants to replace an existing mortgage with a larger loan to get more money in cash and have an opportunity to use it for home remodeling or dealing with other financial issues. If you have a mortgage and you require a lump-sum payment while being prepared to pay the increased loan amount, fill out a Cash Refinance Letter template to ask the lender whether your credit score lets you qualify for cash-out refinancing instead of getting a personal loan. Potentially, a borrower can receive up to 80% of the value of their home, and in certain instances, individuals are able to get 100% of the home's value.

Cash-Out Refinance Letter Template Types

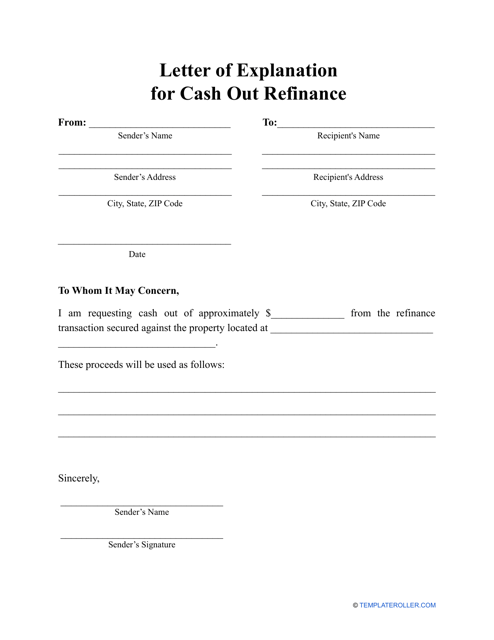

- Letter of Explanation for Cash-Out Refinance. You may complete this template to compute the amount of money you need to cover the accumulated debts or renovations to your residence. Attach this document to evidence that proves your poor financial standing and confirms your plans to improve the state of your home - you may enclose bank statements and correspondence with contractors that will certify your intentions to use the cash to figure out your financial issues;

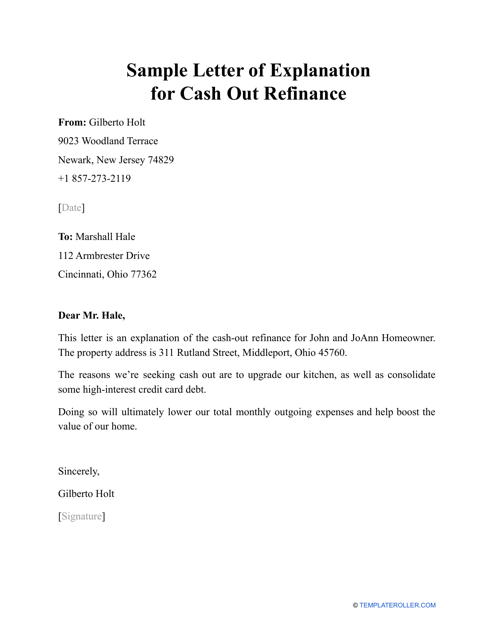

- Sample Letter of Explanation for Cash-Out Refinance. Once you have calculated the amount of money you need for a specific purpose, it is possible to fill out this Cash Out Refinance Letter template to convince the lender to enter new negotiations regarding your mortgage. Offer the letter recipient to determine a higher interest rate or a longer loan term to make sure they agree to new conditions of the agreement - the funds you get can be used to invest in real property or added to your retirement savings account.

Still looking for a particular template? Take a look at the related templates and samples below:

Documents:

2

A mortgage borrower may draft a request such as this when they are looking to use the equity they have built for their advantage and replace their old mortgage with a new one.

Individuals can use this type of letter when they want to explain to their potential lender why they need cash out refinancing.