Letter to Insurance Company for Claim Templates and Samples

A Letter to Insurance Company for Claim is a formal statement completed by a person who wants their insurance company to cover past, ongoing, and future expenses if this kind of coverage is introduced or implied by the insurance policy the individual currently has. Since most insured events cannot be predicted ahead of time, the policyholder can easily find themselves in a difficult financial situation - this is why you should inform the insurer about your expenses immediately or after you have already paid the bills.

Additionally, you may have to submit an Insurance Appeal Letter if the response you receive from your insurance provider is not good enough for you - for instance, they have limited the amount of money you are supposed to receive for the property damages or injury you have suffered. Contest their decision by filling out an Insurance Claim Appeal Letter sample - this document will make them review their ruling whether you provide new evidence or not, and you may still get the compensation you are looking for.

Letter to Insurance Company for Claim Types

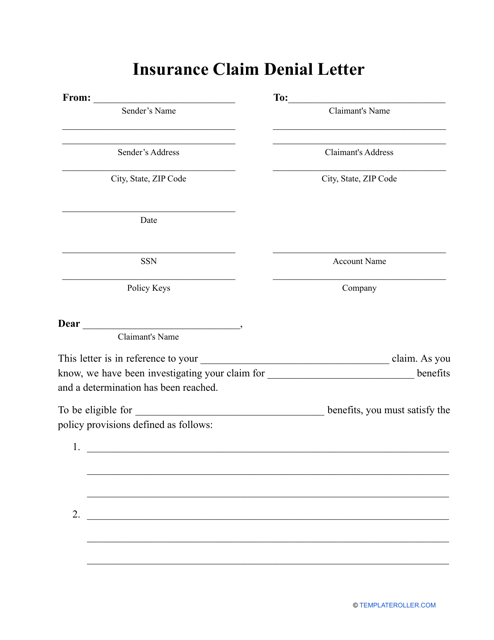

- Insurance Claim Denial Letter Template. If the insurance company does not offer you any coverage, you can draft a letter that disputes their point of view, offers new information the insurance provider did not have at their disposal before, or indicates the provisions in your insurance contract that list the risks you are financially protected from;

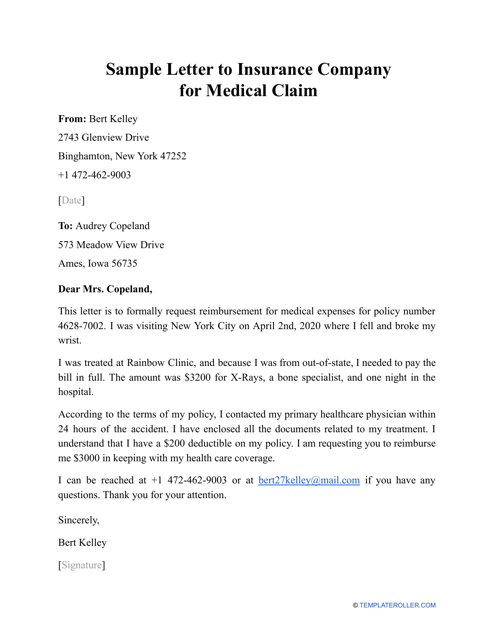

- Sample Letter to Insurance Company for Medical Claim. Whatever illness or injury you have suffered, any insurance policy that includes hospital visits, prescription medications, and medical devices should cover all medical expenses. To secure the insurance benefits, you need to write a letter that describes the costs of any treatment or procedure and asks the recipient to compensate them for you;

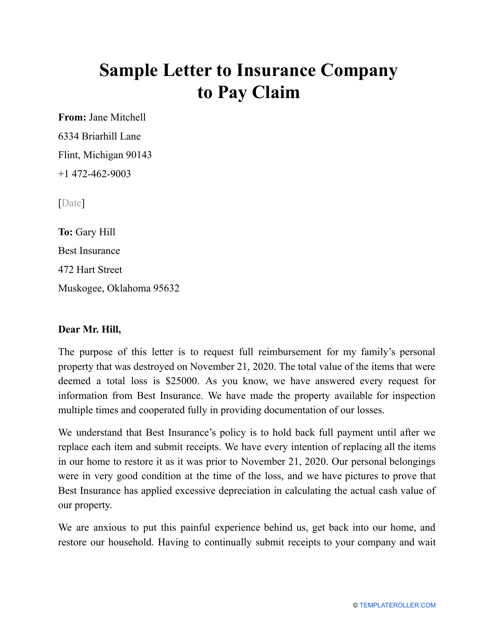

- Sample Letter to Insurance Company to Pay Claim. Usually prepared when the insured individual believes the insurer has to pay for future expenses - before the person has surgery or deals with the aftermath of the car accident, this document will help you secure the funds before going into debt;

- Insurance Claim Letter for Reimbursement. In case you have covered the medical bills or property repairs costs already, you are entitled to write a letter to your insurer and demand them to provide you with compensation which is a common situation when the injured individual cannot reach out to the company that issued their policy right away.

Still looking for a particular template? Take a look at the related templates and samples below:

Documents:

3

This is a document that can be used by individuals when they would like to request that their insurance provider pay for certain claims.

Individuals can use this type of document as a reference when they would like to claim a use for their medical insurance.

Insurance companies can use this type of letter when they would like to notify their policyholders that the services they requested are not covered by their insurance policy.