Department of Revenue - City of Philadelphia, Pennsylvania Forms

The Department of Revenue for the City of Philadelphia, Pennsylvania is responsible for managing and enforcing the local tax laws and regulations within the city. They collect various taxes, such as income tax, property tax, and business taxes, in order to fund and support public services and government operations within the city. Additionally, they handle the administration and processing of tax forms, applications, and payments for residents and businesses in Philadelphia.

Documents:

124

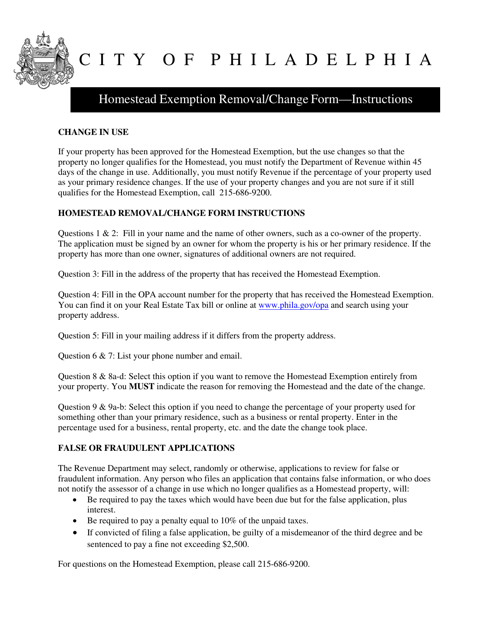

This form is used for removing or changing the homestead exemption in the City of Philadelphia, Pennsylvania. It allows homeowners to update their exemption status for property tax purposes.

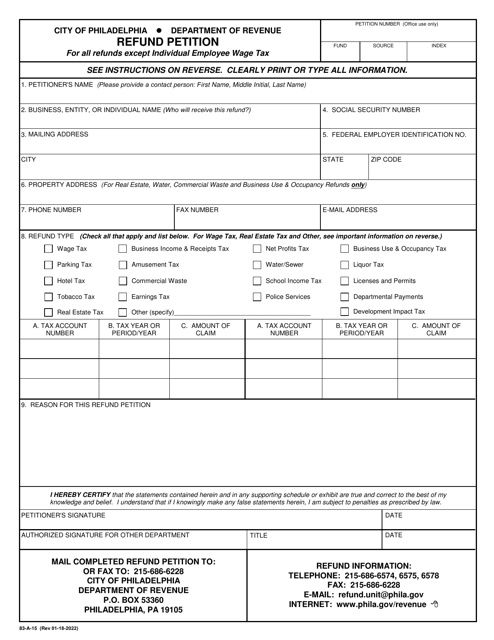

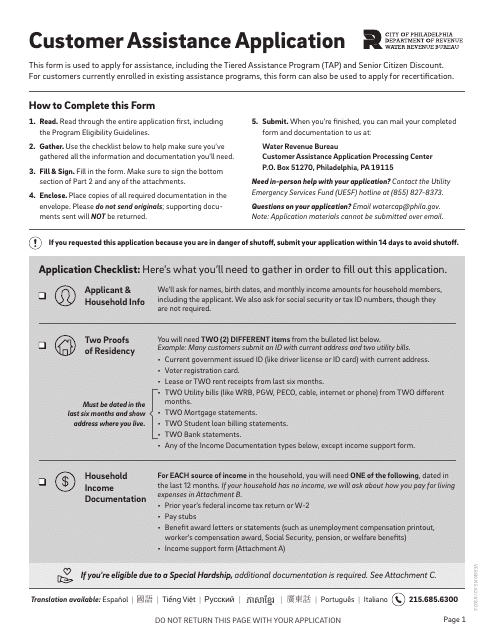

This form is used for submitting a refund petition to the City of Philadelphia, Pennsylvania. It allows residents to request a refund for specific reasons, such as overpayment or incorrect charges.

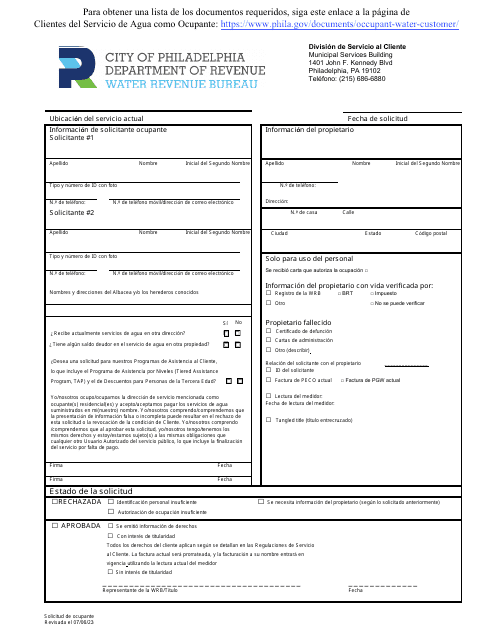

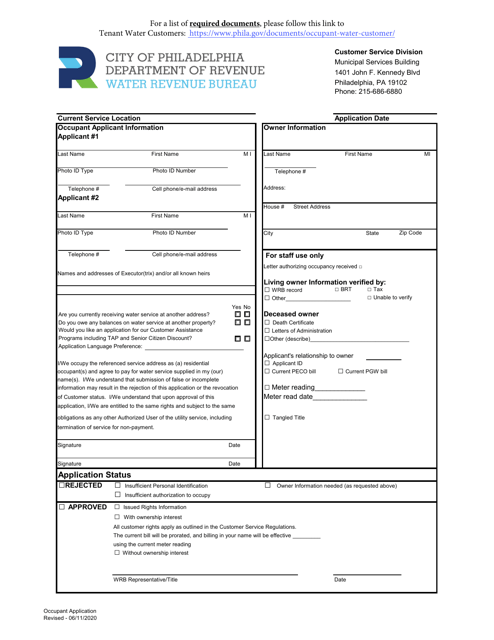

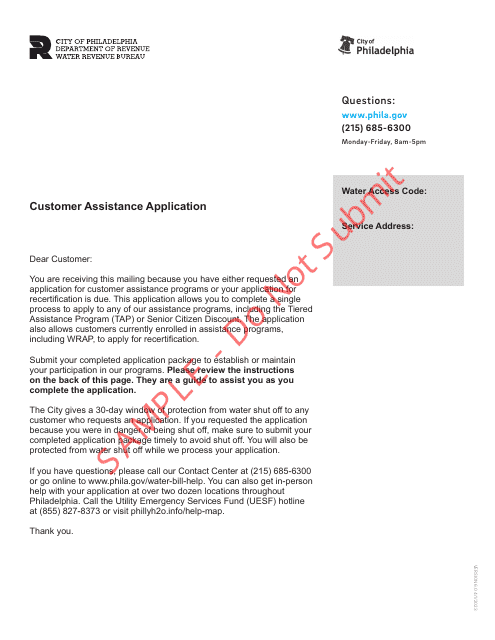

This form is used for new customers who want to apply for water service in Philadelphia, Pennsylvania.

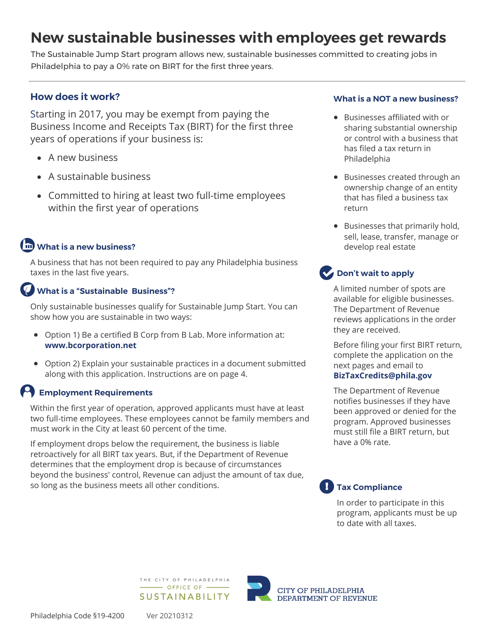

This document is an application form for the Sustainable Jumpstart program offered by the City of Philadelphia, Pennsylvania. It is designed to help individuals or organizations apply for funding and support for sustainable projects that promote environmental conservation and green initiatives in the city.

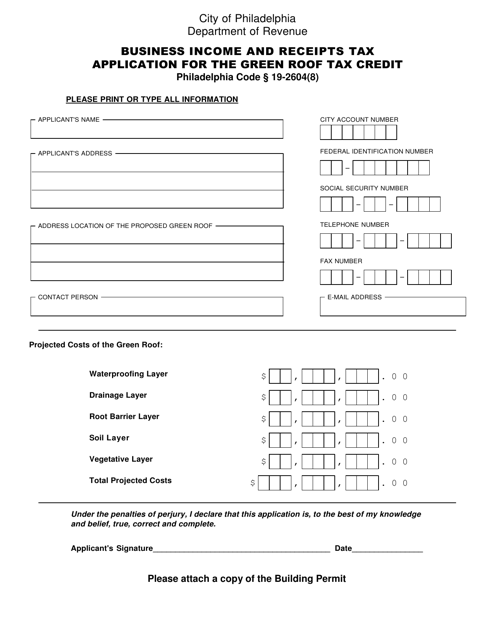

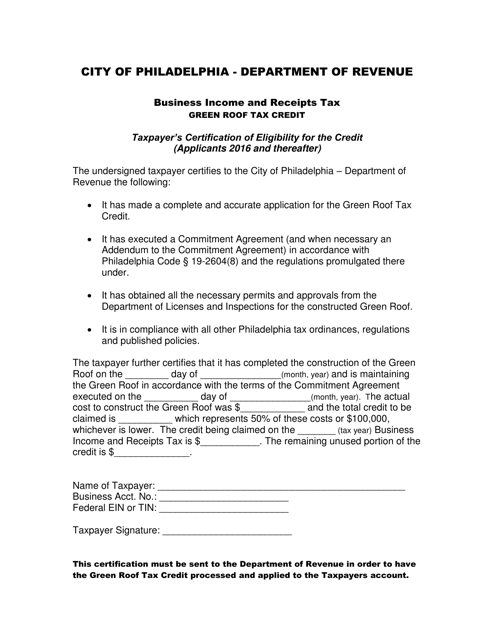

This Form is used for applying for the Green Roof Tax Credit in the City of Philadelphia, Pennsylvania.

This document is used for taxpayers in Philadelphia, Pennsylvania to certify their eligibility for the Green Roof Tax Credit.

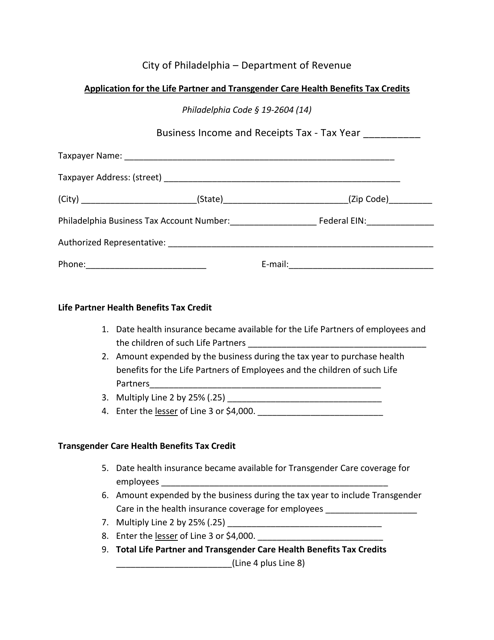

This form is used for applying for tax credits for health benefits related to life partners and transgender care in the City of Philadelphia, Pennsylvania.

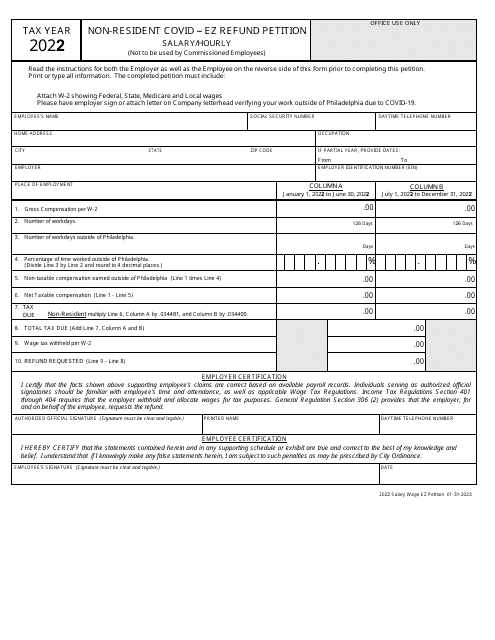

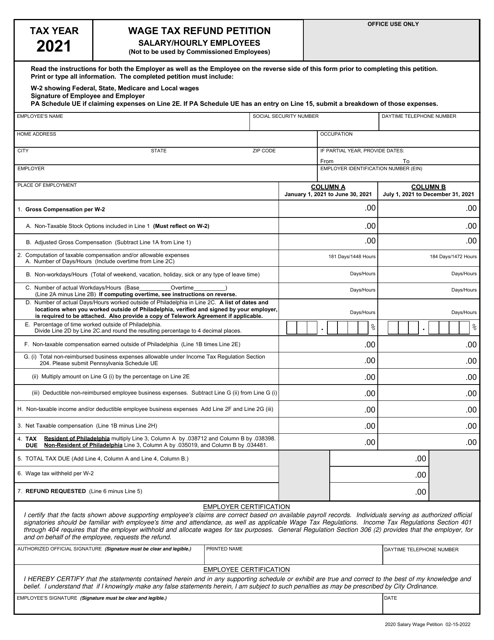

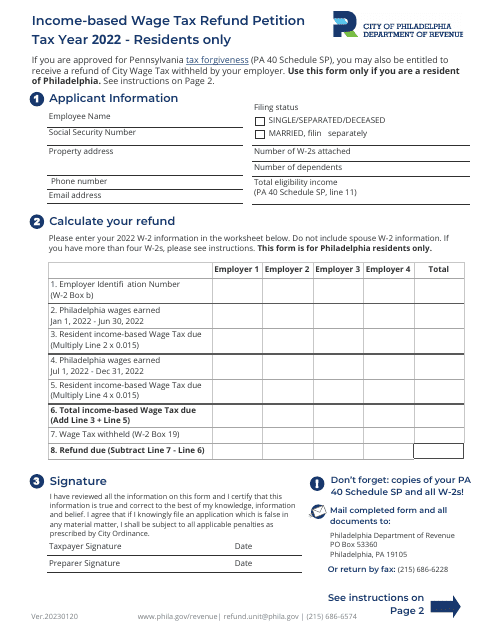

This Form is used for salary or hourly employees in Philadelphia, Pennsylvania to petition for a refund of wage tax.

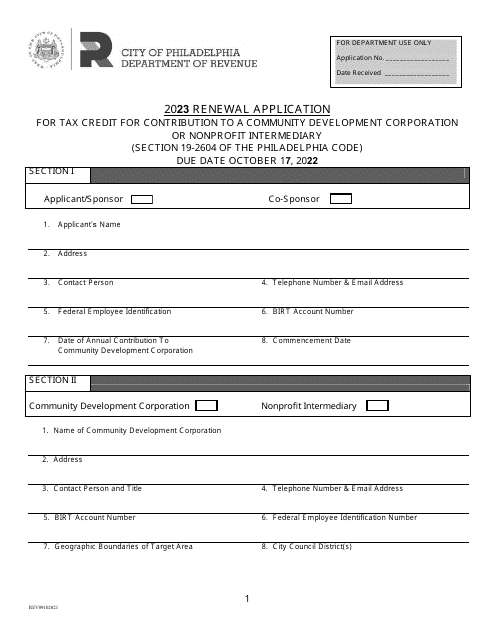

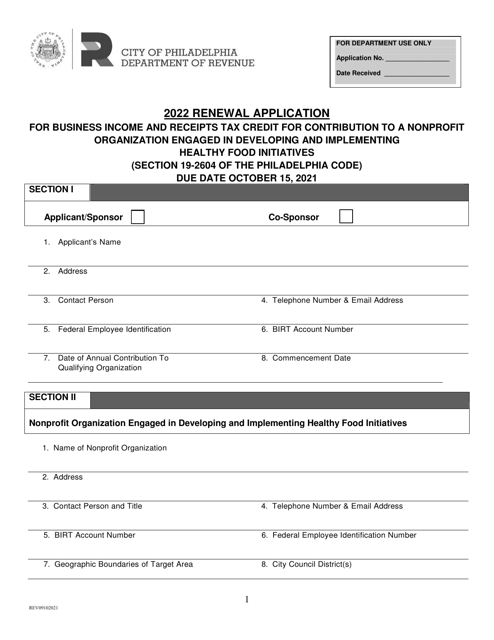

This document is used for renewing the Healthy Food Initiative Tax Credit in the City of Philadelphia, Pennsylvania.

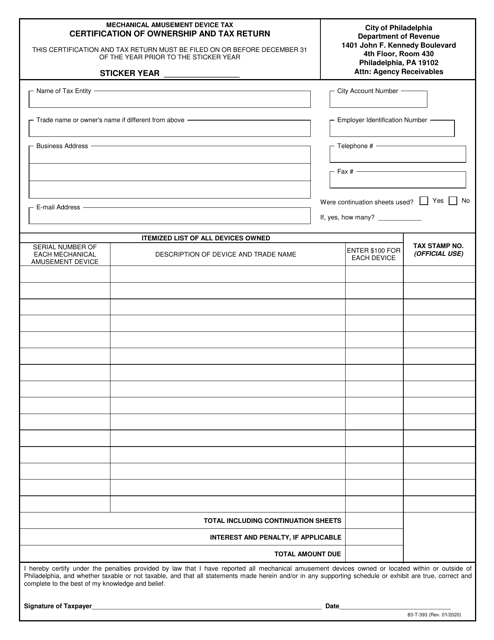

This Form is used for certifying ownership and filing tax return for mechanical amusement devices in the City of Philadelphia, Pennsylvania.

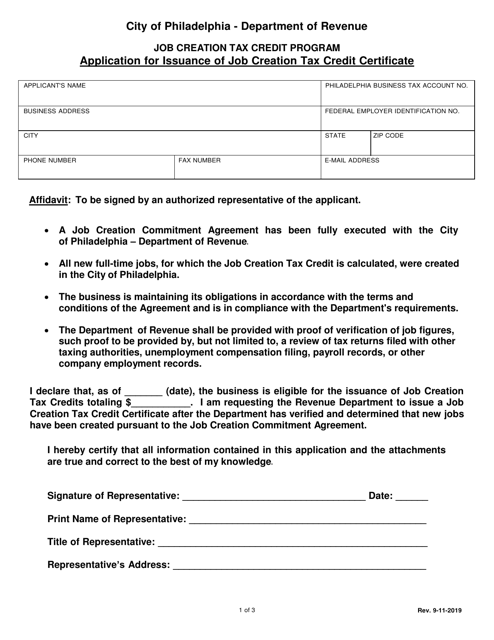

Application for Issuance of Job Creation Tax Credit Certificate - City of Philadelphia, Pennsylvania

This document is used for applying for a Job Creation Tax Credit Certificate in the City of Philadelphia, Pennsylvania. This tax credit is given to businesses that create new jobs in the city, encouraging economic growth and job opportunities.

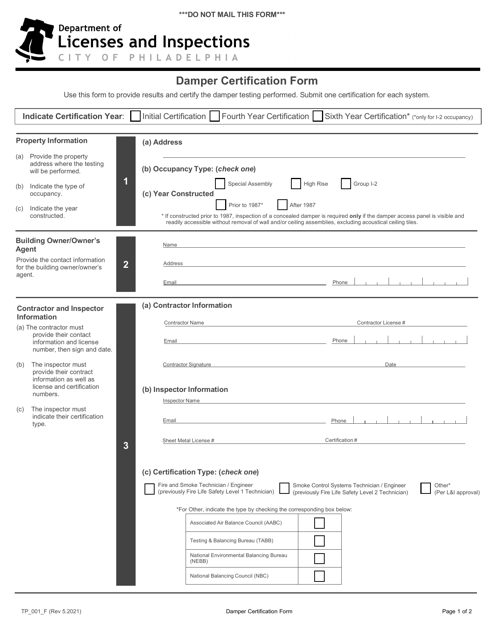

This form is used for certifying dampers in the City of Philadelphia, Pennsylvania.

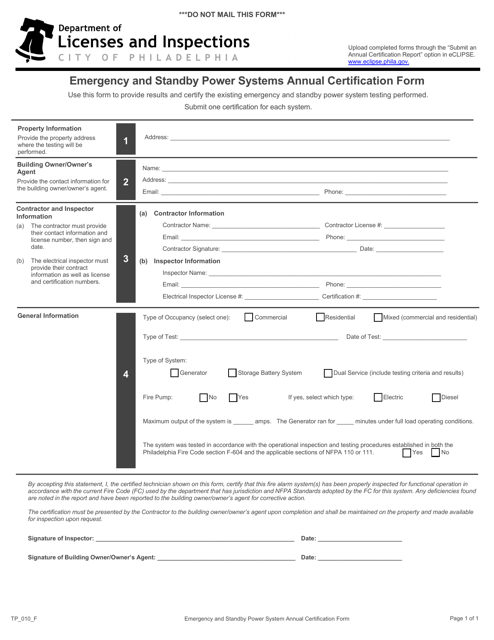

This Form is used for the annual certification of emergency and standby power systems in the City of Philadelphia, Pennsylvania.

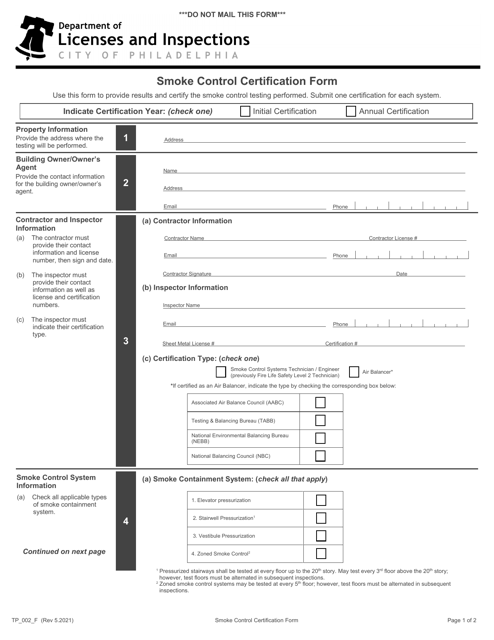

This form is used for obtaining smoke control certification in the City of Philadelphia, Pennsylvania.

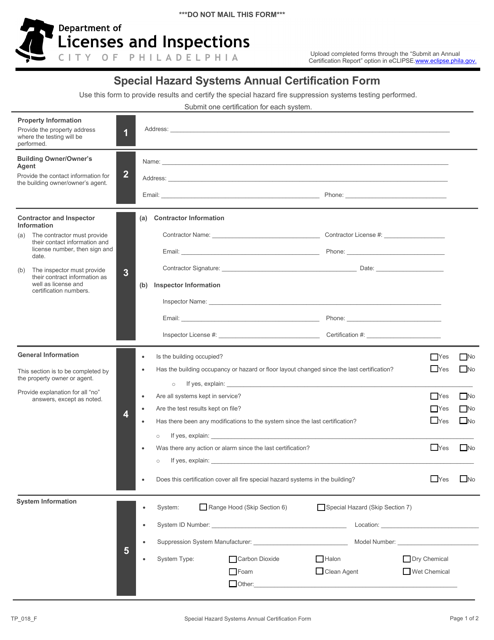

This form is used for the annual certification of special hazard systems in the City of Philadelphia, Pennsylvania. It ensures that these systems meet safety requirements and are properly maintained.

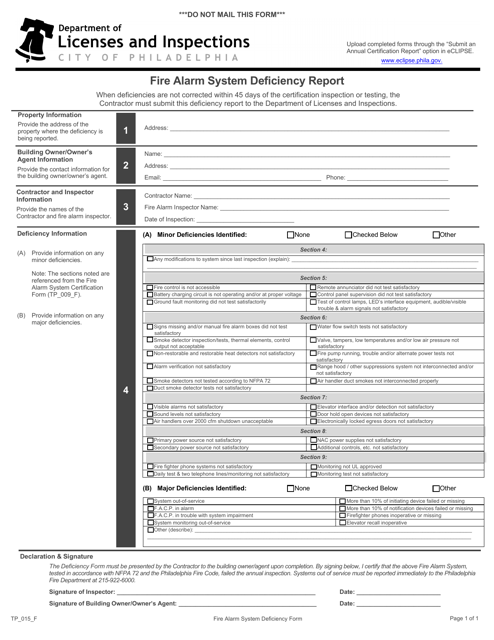

This form is used for reporting deficiencies in fire alarm systems in the City of Philadelphia, Pennsylvania. It helps ensure that fire safety standards are met.

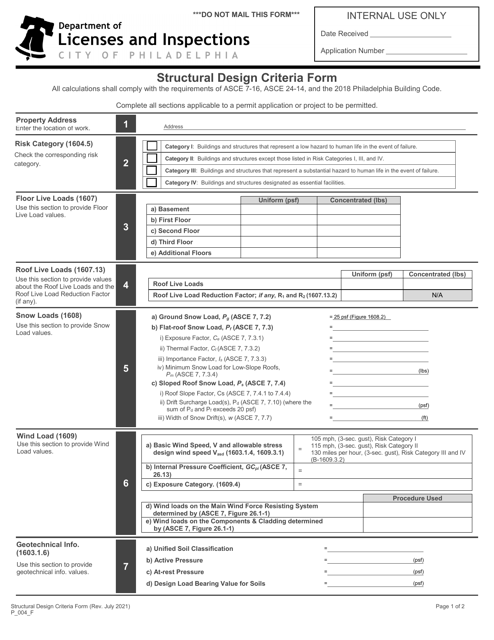

This form is used for submitting structural design criteria for construction projects in the City of Philadelphia, Pennsylvania. It ensures that the design meets the city's requirements for safety and structural integrity.

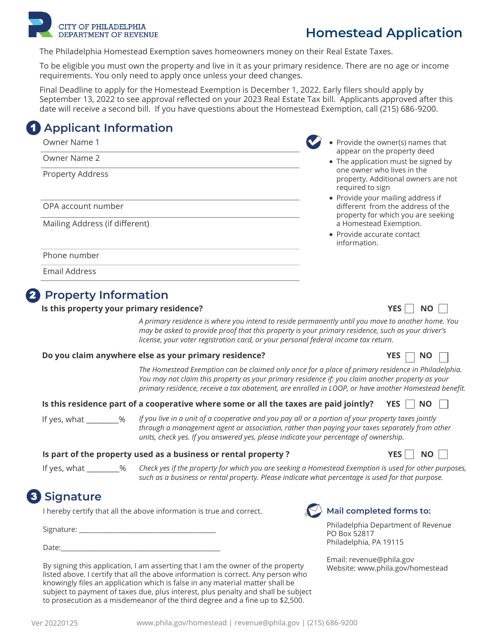

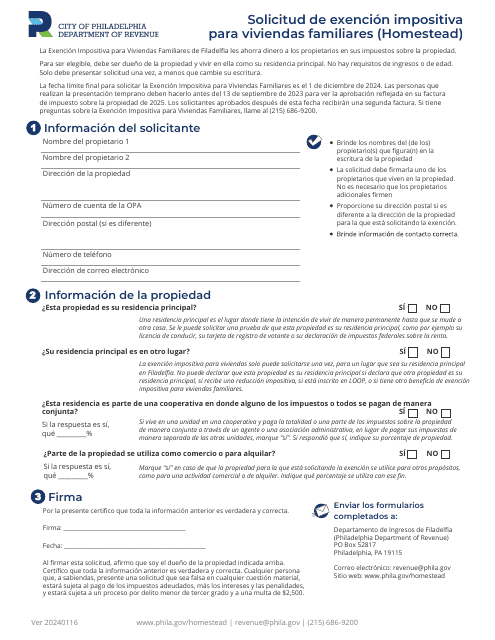

This form is used for applying for the Homestead Exemption in the City of Philadelphia, Pennsylvania. The Homestead Exemption provides a reduction in property taxes for eligible homeowners.

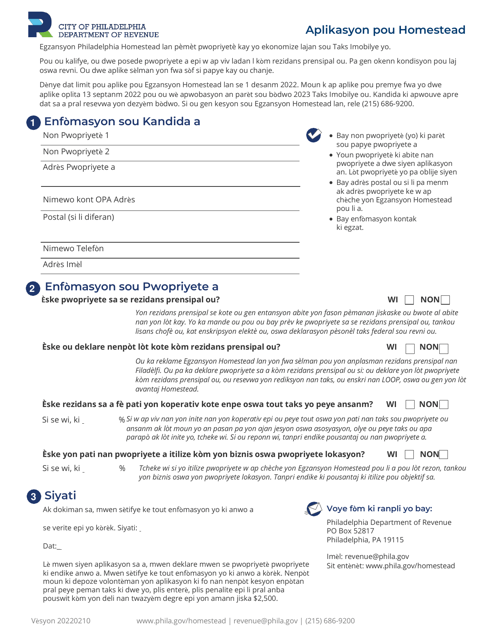

This document is an application for the Homestead Exemption in the City of Philadelphia, Pennsylvania. It is available in Haitian Creole language. The Homestead Exemption provides property tax relief for homeowners in Philadelphia.

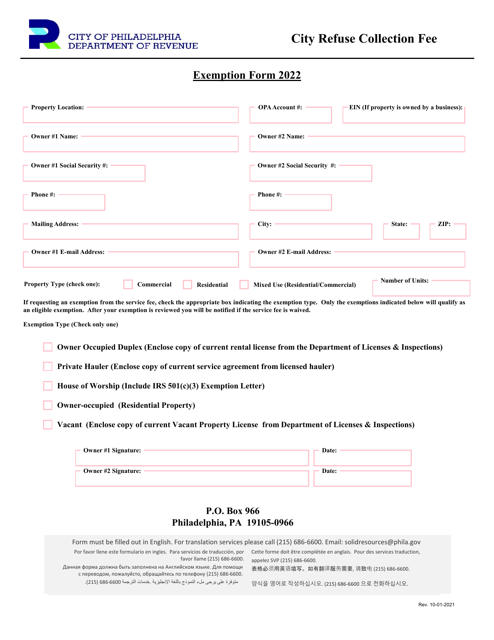

This form is used for requesting an exemption from paying the city refuse collection fee in Philadelphia, Pennsylvania.

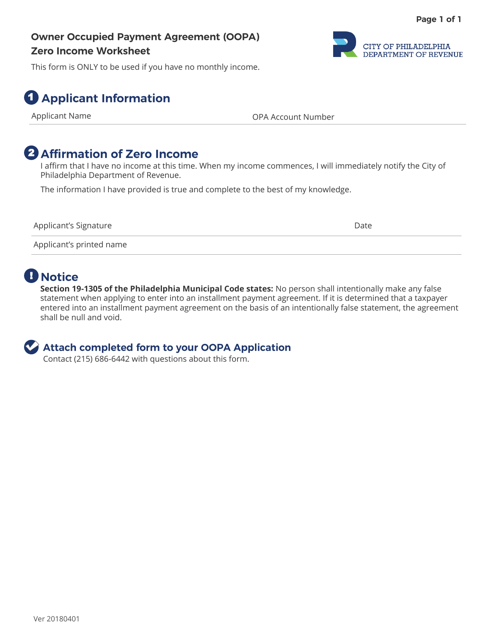

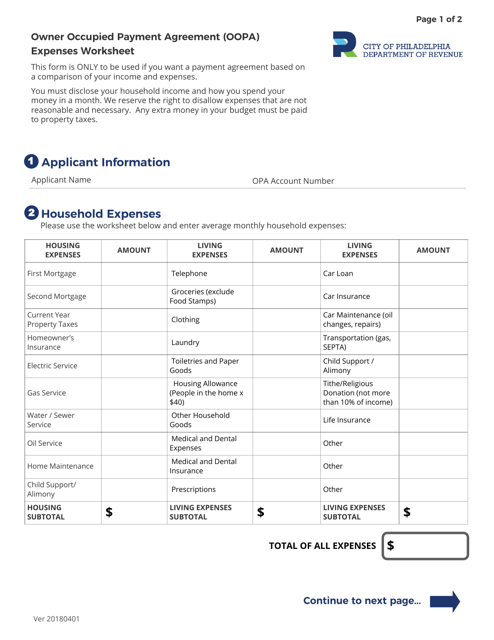

This document is used for calculating payments under the Owner Occupied Payment Agreement (OOPA) in Philadelphia, Pennsylvania. The worksheet takes into account zero income situations.

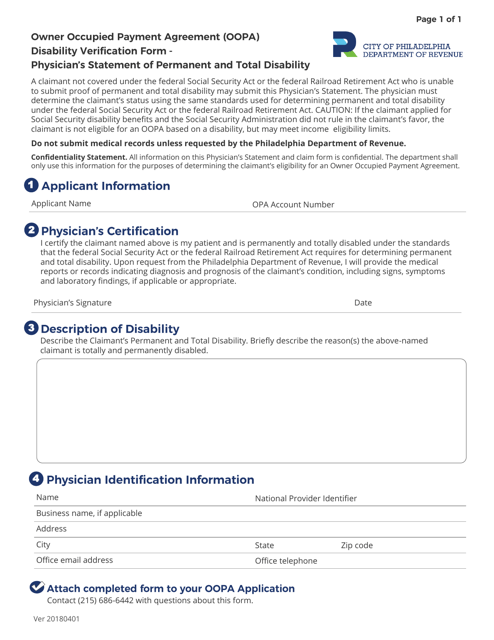

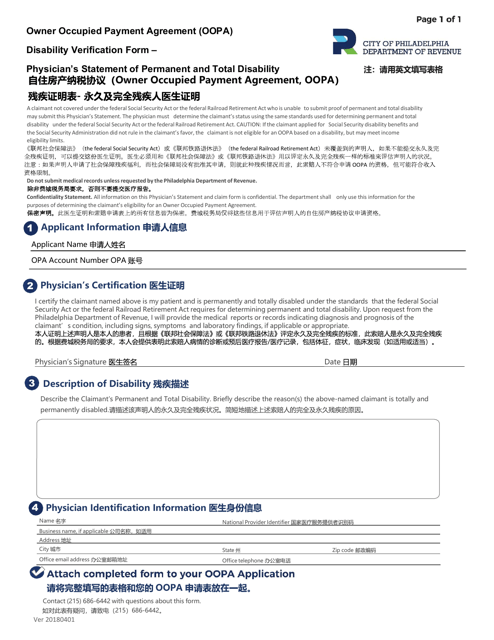

This Form is used for Disability Verification for the Owner Occupied Payment Agreement (OOPA) program in the City of Philadelphia, Pennsylvania. It requires a physician's statement of permanent and total disability.

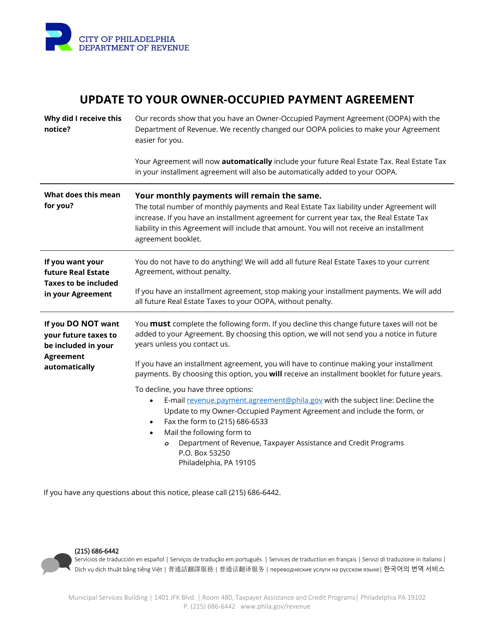

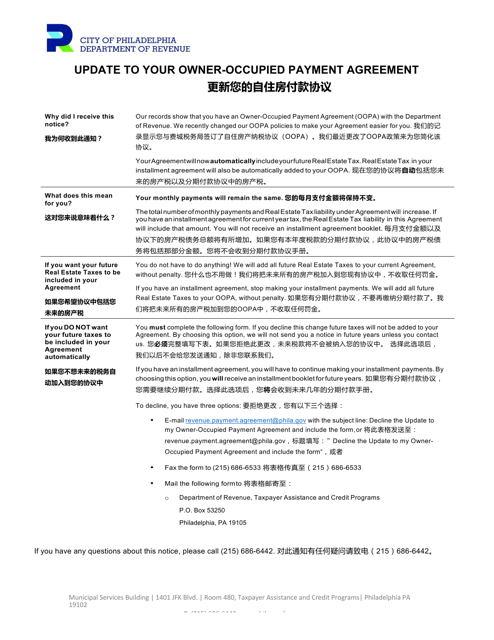

This document is used to opt out of the Owner-Occupied Payment Agreement (OOPA) in the City of Philadelphia, Pennsylvania.

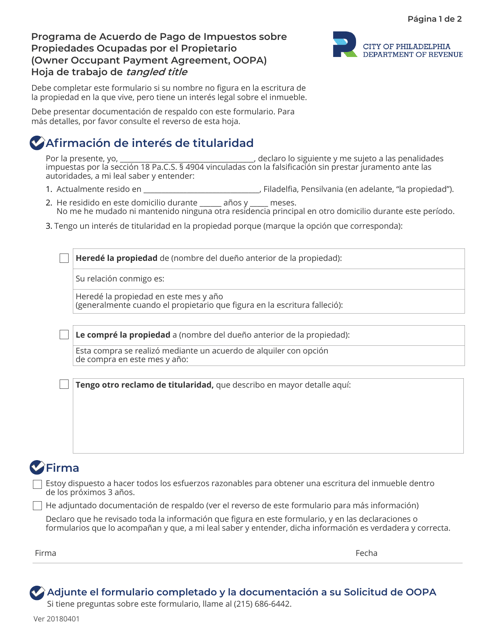

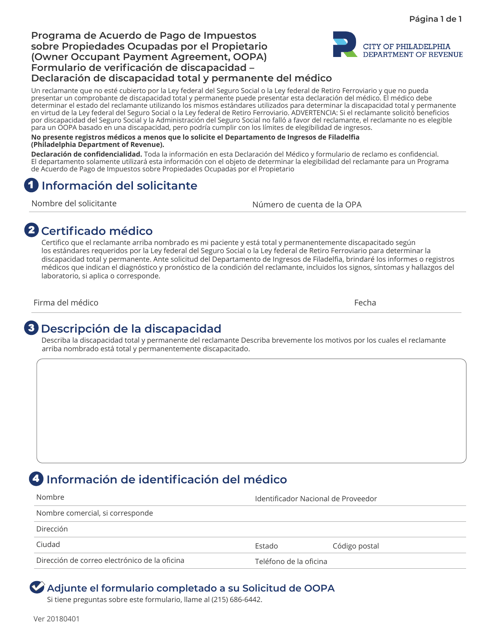

This type of document is a worksheet for a payment agreement for property taxes in Philadelphia, Pennsylvania. It is in Spanish and specifically designed for properties occupied by the owner.

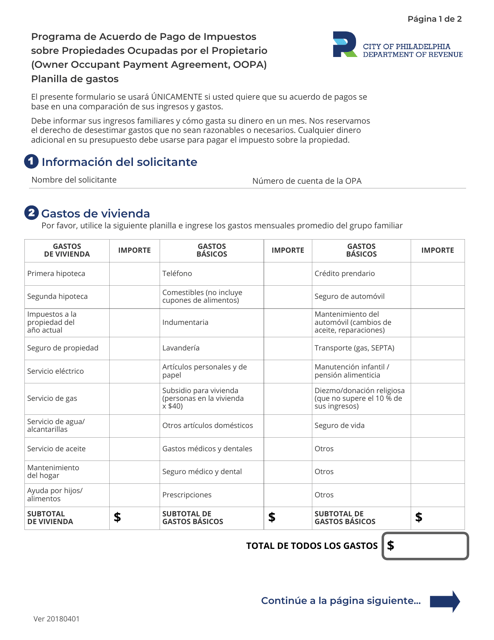

This document is a Programa De Acuerdo De Pago De Impuestos Sobre Propiedades Ocupadas Por El Propietario (Oopa) Planilla De Gastos provided by the City of Philadelphia, Pennsylvania. It is used for making payment arrangements for property taxes on owner-occupied properties.

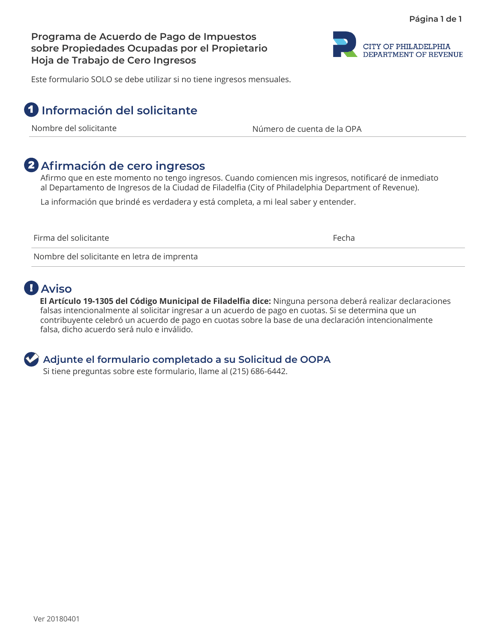

Este documento es utilizado por la Ciudad de Filadelfia, Pensilvania, para que los propietarios de propiedades ocupadas por ellos mismos puedan acordar un plan de pago para los impuestos sobre la propiedad. La hoja de trabajo está diseñada específicamente para aquellos propietarios que no tienen ingresos.

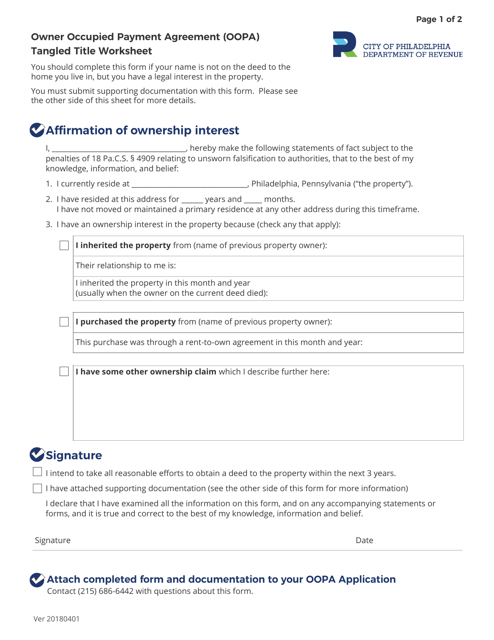

Owner Occupied Payment Agreement (Oopa) Tangled Title Worksheet - City of Philadelphia, Pennsylvania

This document is used to determine the payment agreement for a property in Philadelphia, Pennsylvania that has a tangled title.

This document is for calculating and tracking expenses related to an Owner Occupied Payment Agreement (OOPA) in the City of Philadelphia, Pennsylvania. It helps homeowners keep record of their payments and ensure they can afford their OOPA expenses.

This document is for verifying permanent and total disability for the Owner Occupied Payment Agreement (OOPA) in the City of Philadelphia, Pennsylvania. It is available in both English and Chinese.

This Form is used for opting out of the Owner-Occupied Payment Agreement (OOPA) in the City of Philadelphia, Pennsylvania. It is available in English and Chinese.

This document is for verifying disability and declaring total and permanent disability by a physician in the City of Philadelphia, Pennsylvania. It is used for requesting an agreement to pay property taxes on owner-occupied properties.