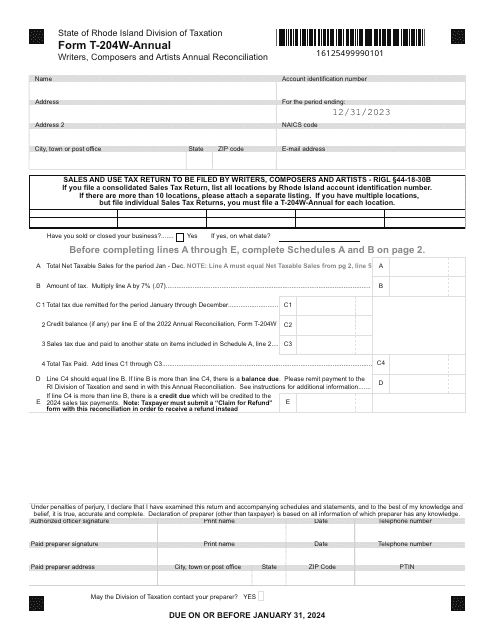

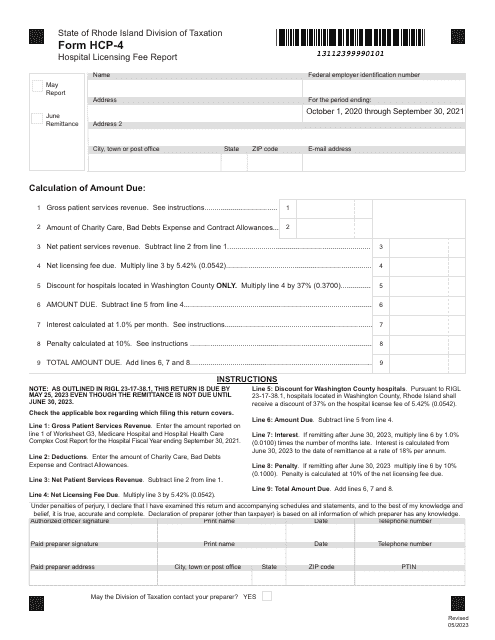

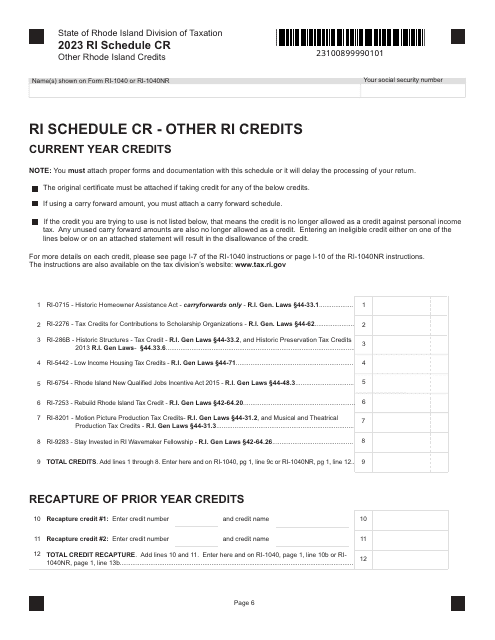

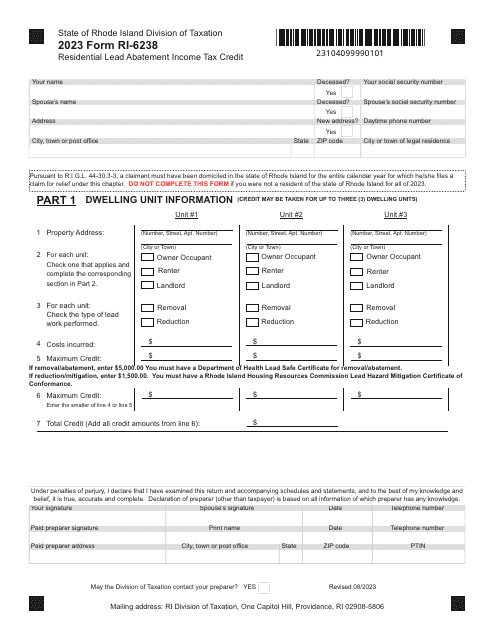

Rhode Island Department of Revenue - Division of Taxation Forms

Documents:

744

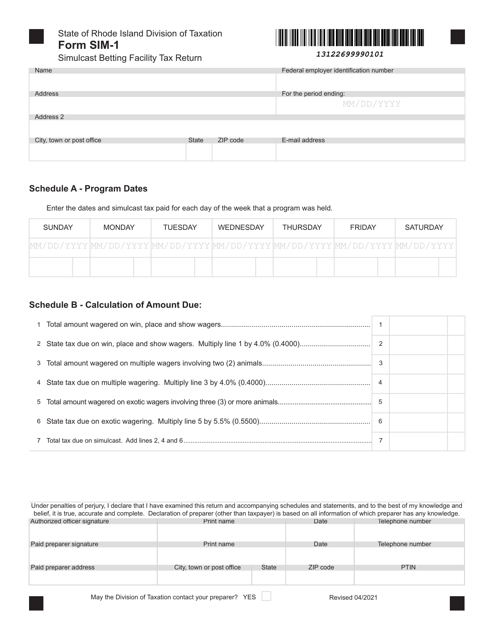

This Form is used for reporting and paying taxes for simulcast betting facilities in Rhode Island.

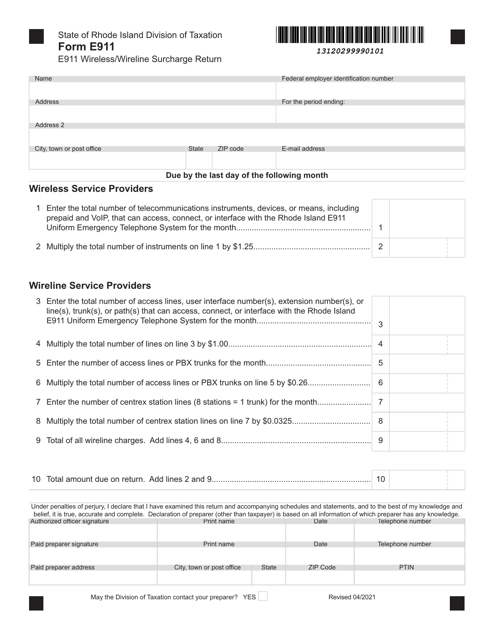

This form is used for filing the E911 Wireless/Wireline Surcharge return in the state of Rhode Island.

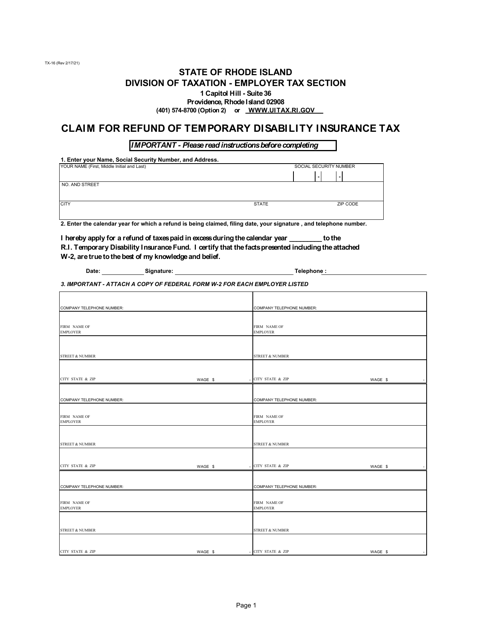

This form is used for claiming a refund of temporary disability insurance tax paid in Rhode Island.

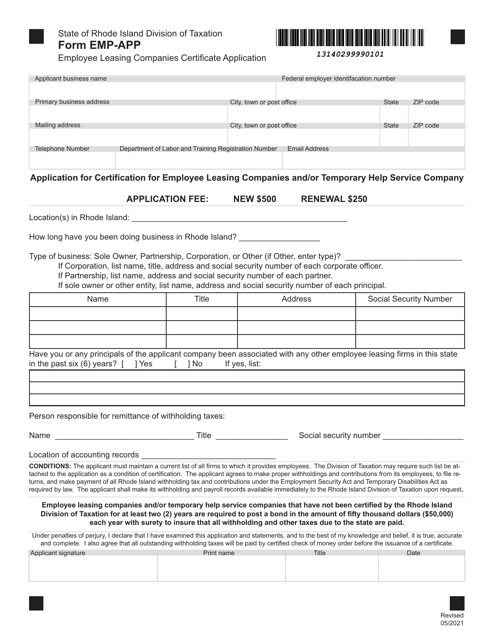

This Form is used for applying for an Employee Leasing Companies Certificate in Rhode Island.

This document is an addendum for renters, tenants, lessees, or purchasers in Rhode Island who prefer to have the Spanish language version.

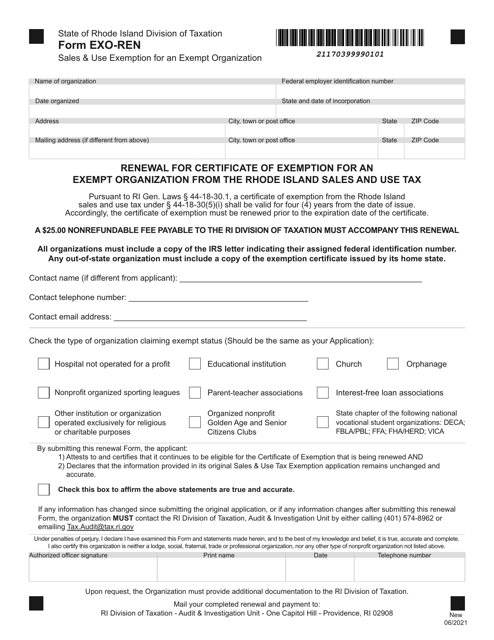

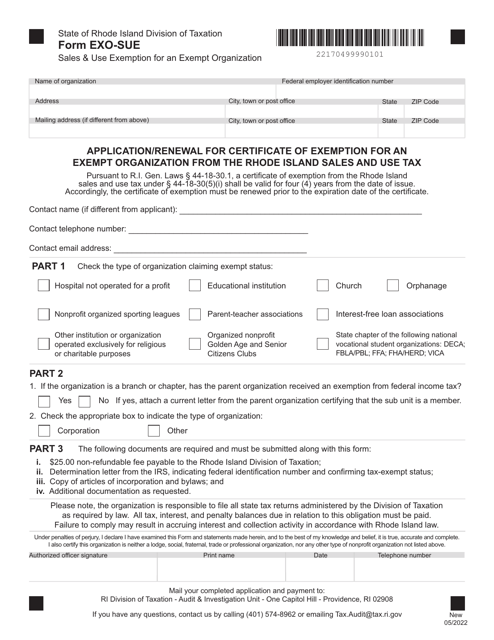

This Form is used for renewing the Certificate of Exemption for an Exempt Organization from the Rhode Island Sales and Use Tax in Rhode Island.

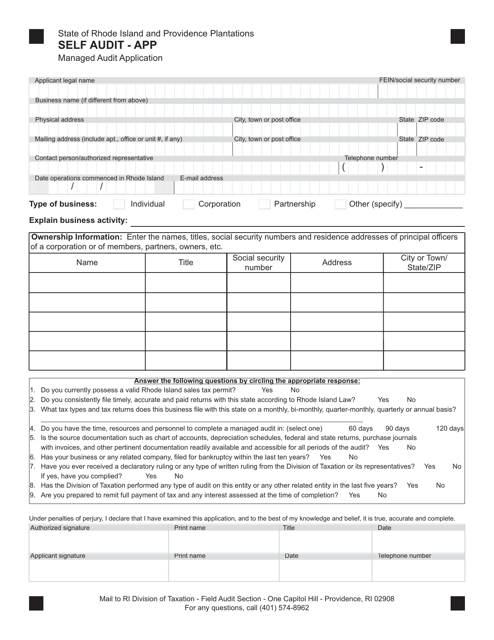

This document is a self-audit application form specific to Rhode Island. It is used for individuals or businesses to evaluate their compliance with state regulations and report any discrepancies.

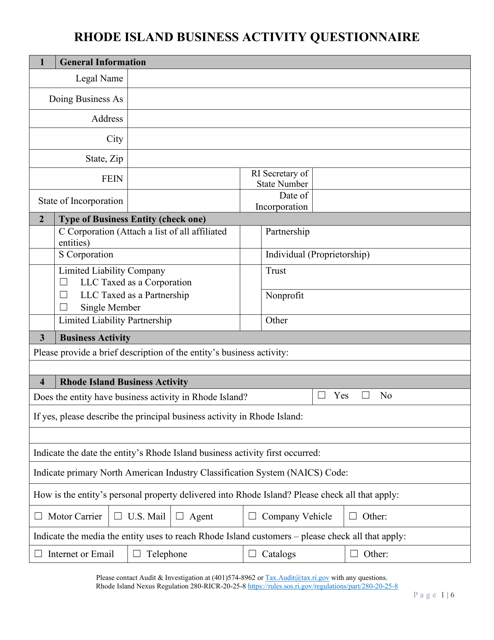

This form is used for Rhode Island businesses to provide information about their business activities.

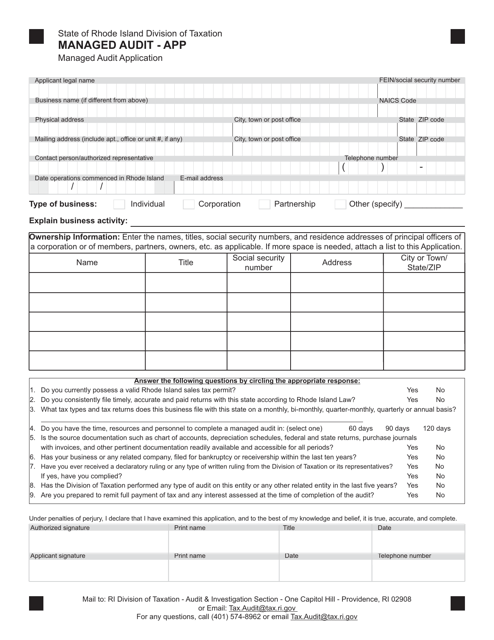

This document is an application form for Rhode Island residents to participate in a managed audit program. This program assists taxpayers in resolving any tax compliance issues and potential errors.

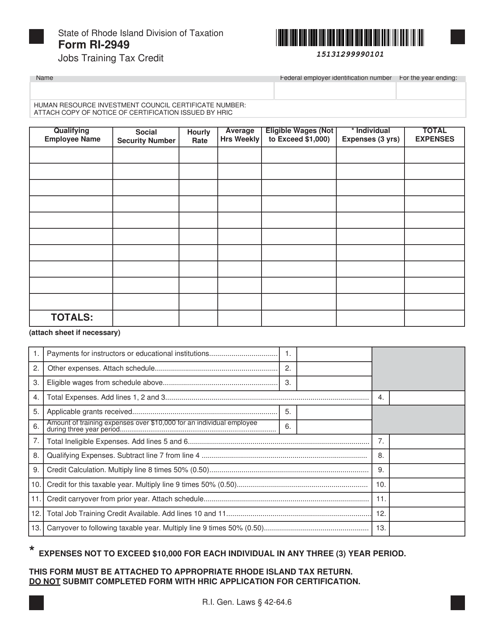

This form is used for claiming the Jobs Training Tax Credit in Rhode Island. It provides businesses with a tax credit for the costs of training employees for new or expanded job opportunities.

This form is used for applying or renewing a certificate of exemption for an exempt organization from the Rhode Island sales and use tax.

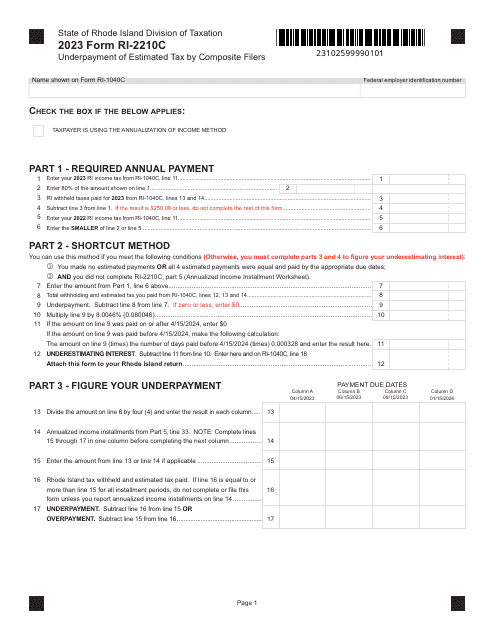

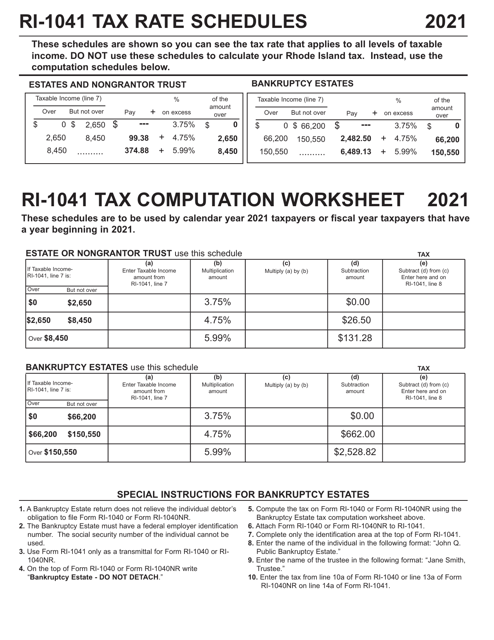

This document is a tax computation worksheet specifically for calculating taxes in the state of Rhode Island.