Rhode Island Department of Revenue - Division of Taxation Forms

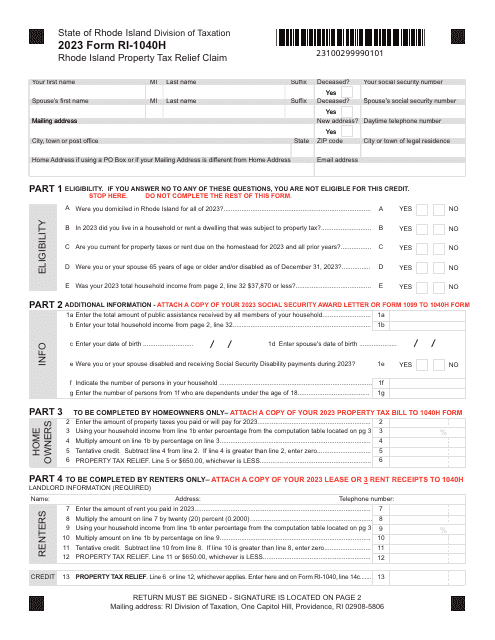

The Rhode Island Department of Revenue - Division of Taxation is responsible for administering and enforcing tax laws in the state of Rhode Island. Their primary purpose is to collect taxes, provide taxpayer assistance, and ensure compliance with the tax laws and regulations. They handle various tax-related matters such as individual and business taxes, sales and use taxes, estate taxes, and property taxes.

Documents:

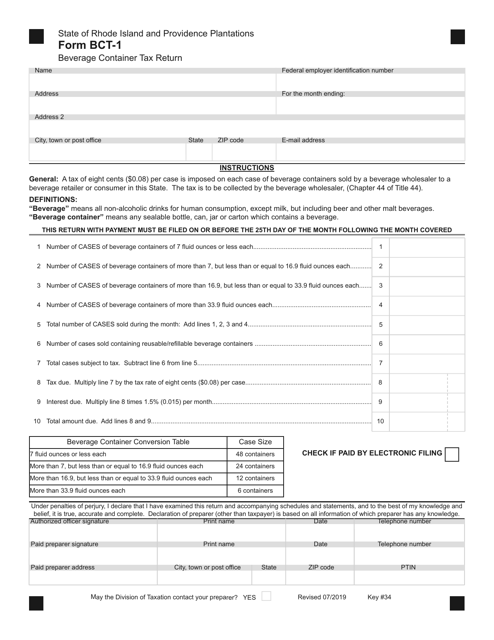

744

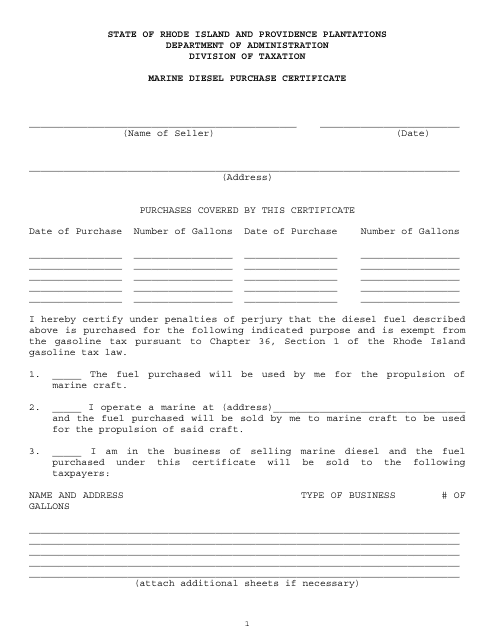

This document is used to certify the purchase of marine diesel fuel in Rhode Island.

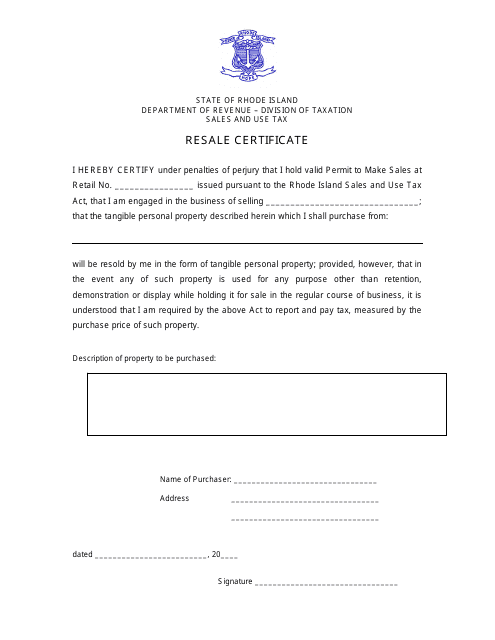

This document is for individuals or businesses in Rhode Island who want to make tax-free purchases for resale purposes. It certifies that the purchaser is eligible for sales tax exemption when buying goods for resale.

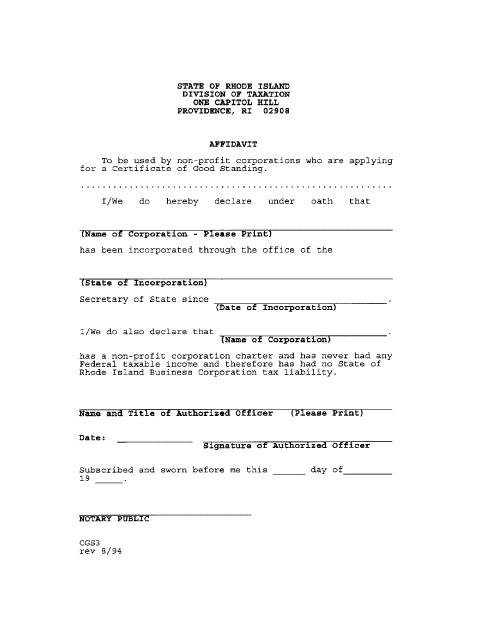

This form is used for non-profit corporations in Rhode Island to obtain a certificate of good standing. It is an affidavit confirming the corporation's compliance with state regulations.

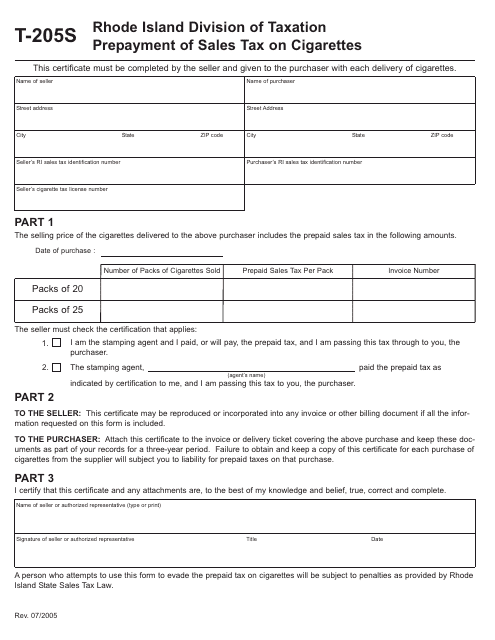

This form is used for prepaying sales tax on cigarettes in Rhode Island.

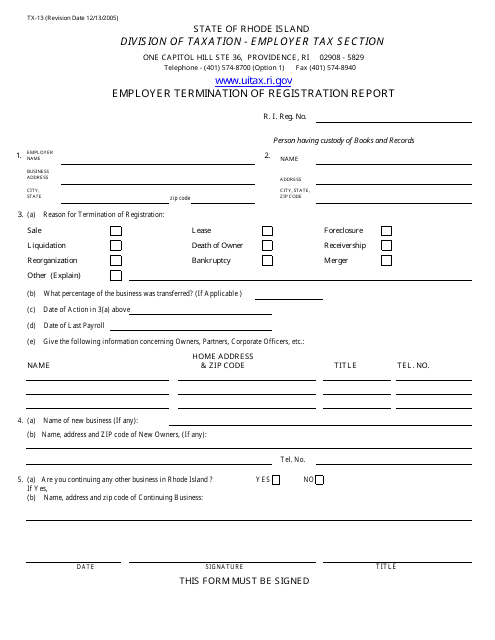

This Form is used for employers in Rhode Island to report the termination of their registration.

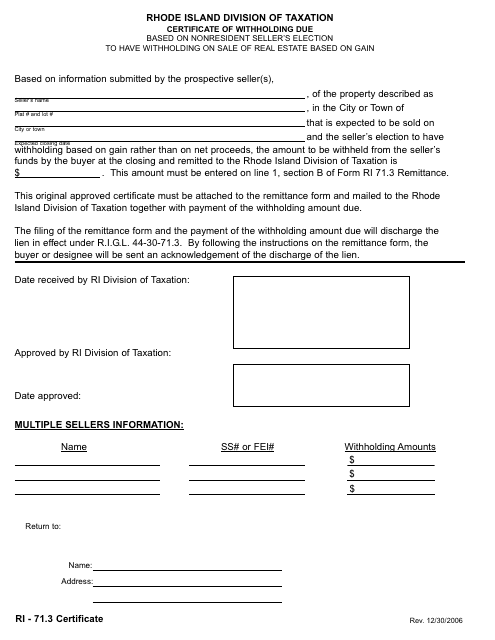

This Form is used for reporting and withholding income tax in Rhode Island. It is used by individuals or businesses to report any amounts withheld from income payments and to remit the withheld taxes to the state.

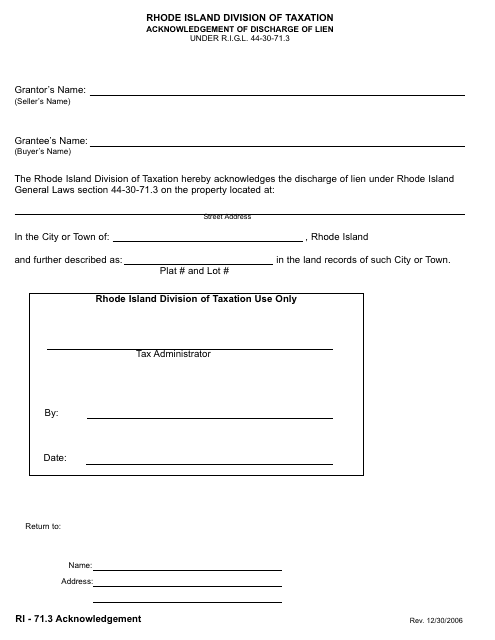

This document is used to acknowledge the discharge of a lien in the state of Rhode Island. It is a legal form that verifies the removal of a lien on a property or asset.

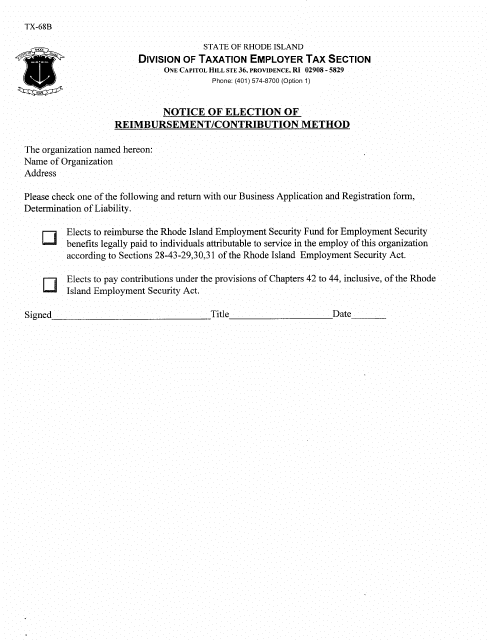

This Form is used for notifying the election of reimbursement/contribution method in Rhode Island.

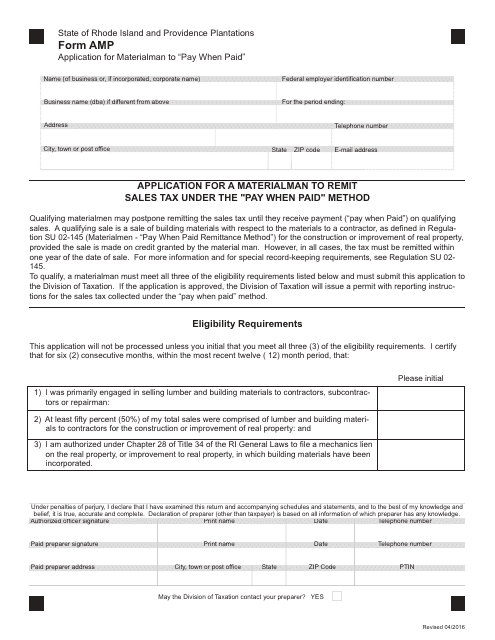

This form is used for materialmen in Rhode Island to remit sales tax under the "pay when paid" method. It allows them to report and pay the appropriate sales tax on their transactions.

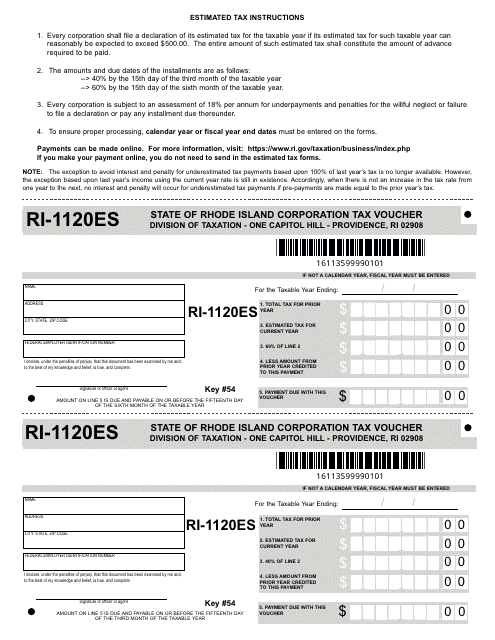

This form is used for submitting corporation tax payments to the State of Rhode Island.

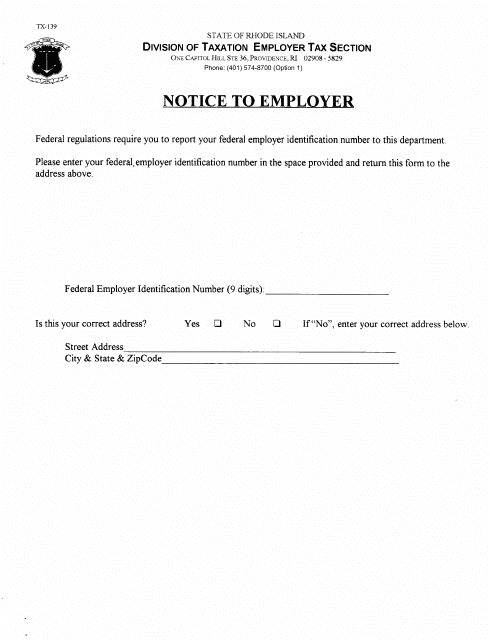

This document notifies an employer in Rhode Island of certain information or actions that they need to know or take.

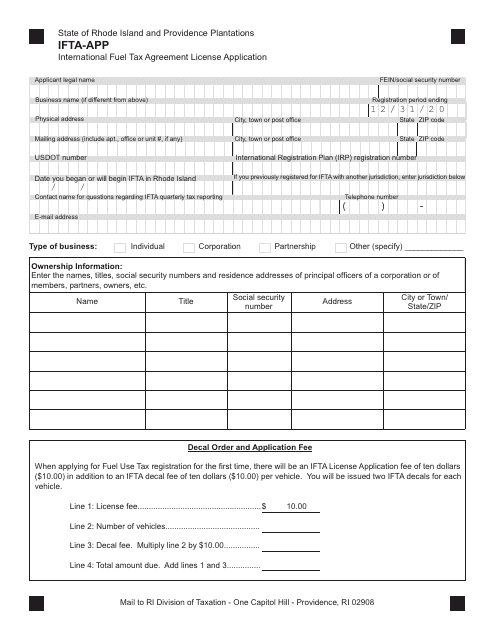

This document is an application form for obtaining an International Fuel Tax Agreement (IFTA) license in Rhode Island. It is used by individuals or businesses engaged in interstate commercial transportation to report and pay fuel taxes.

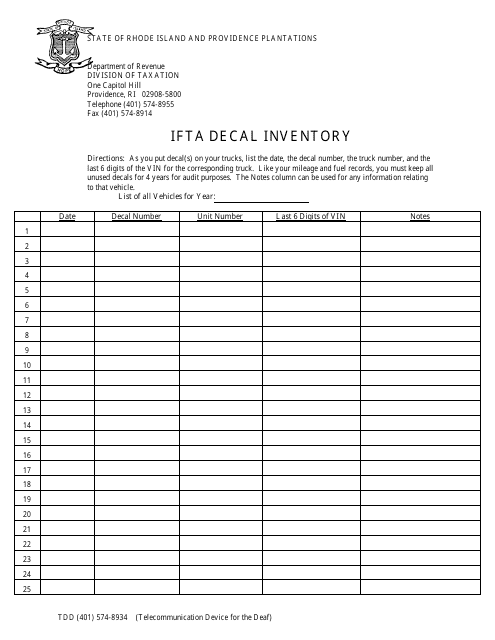

This form is used to track the inventory of IFTA decals in Rhode Island. It helps to ensure that the correct number of decals are available for distribution to qualifying vehicles.

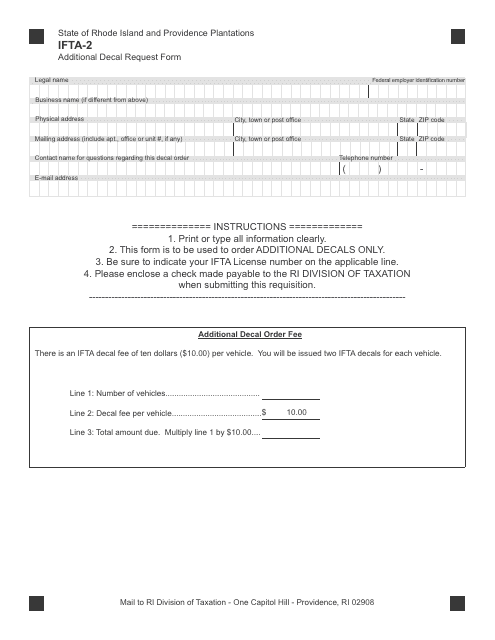

This Form is used for requesting additional decals under the International Fuel Tax Agreement (IFTA) in Rhode Island.

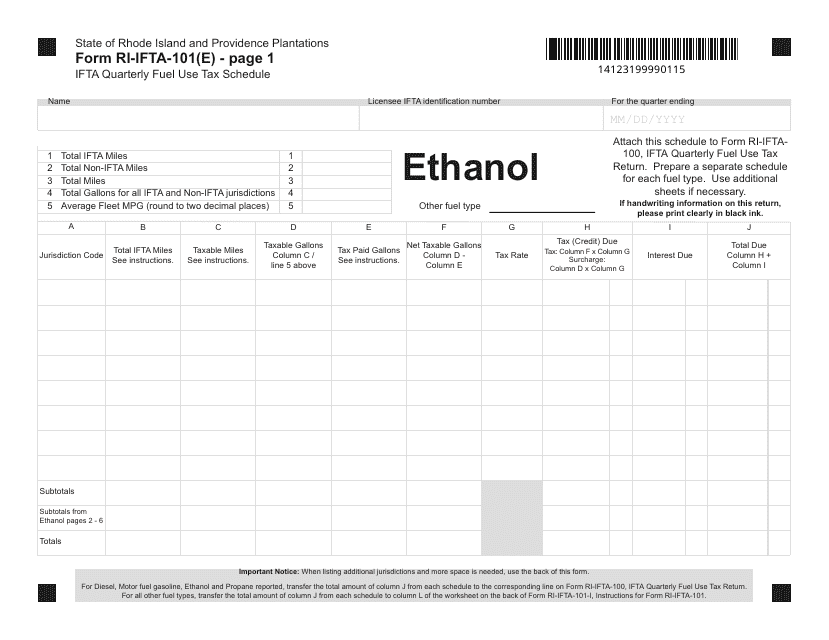

This Form is used for reporting quarterly fuel use tax for ethanol in Rhode Island.

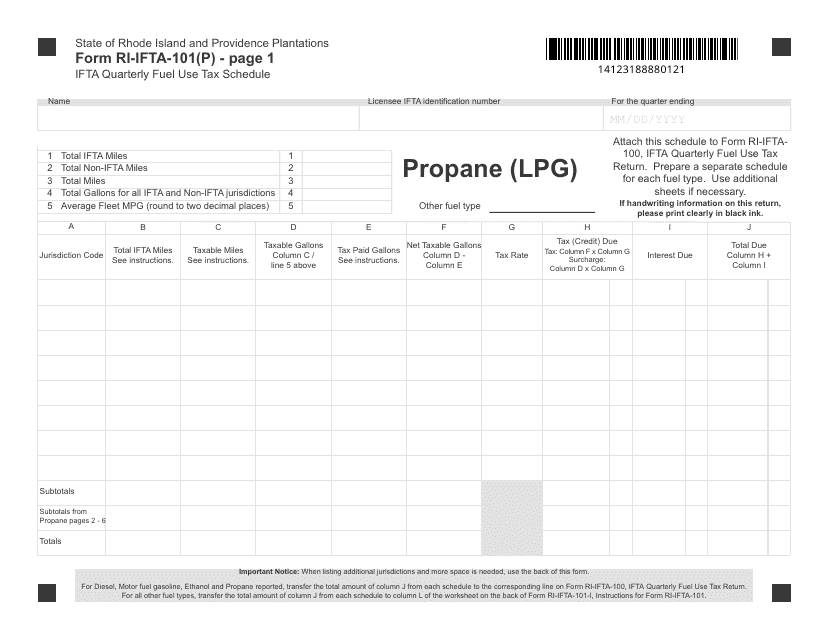

This form is used for reporting the quarterly fuel use tax for propane (LPG) in Rhode Island.

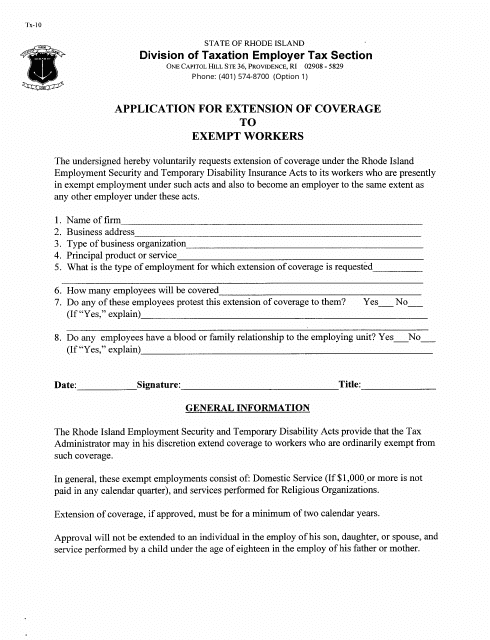

This Form is used for religious organizations in Rhode Island to apply for an extension of coverage to exempt workers.

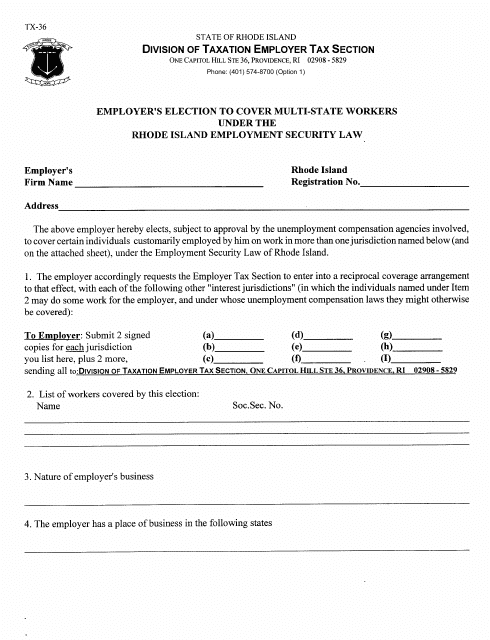

This document is for employers who have workers in multiple states and want to elect coverage for their workers in Rhode Island.

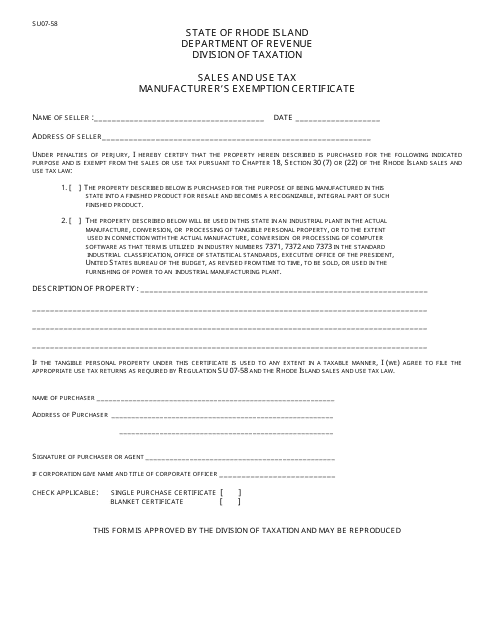

This form is used for obtaining a sales and use tax exemption for manufacturers in Rhode Island.

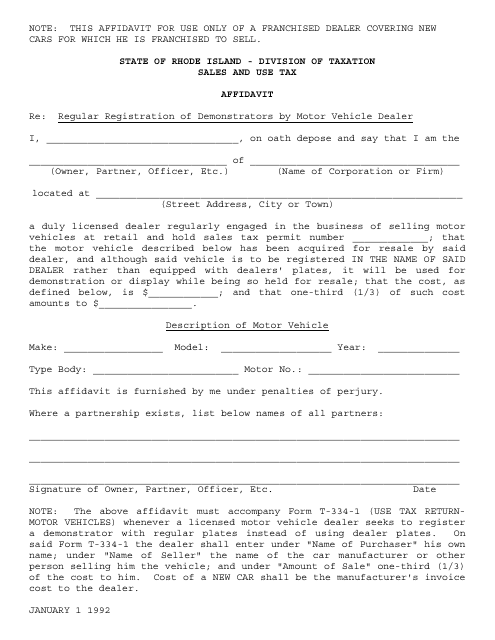

This document is for motor vehicle dealers in Rhode Island to register demonstrators for regular use.

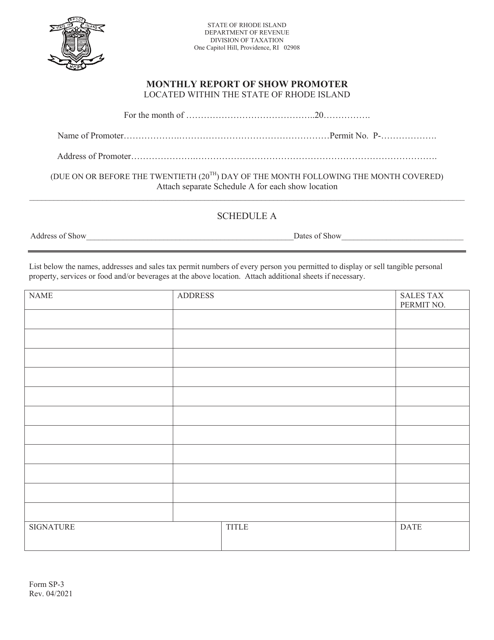

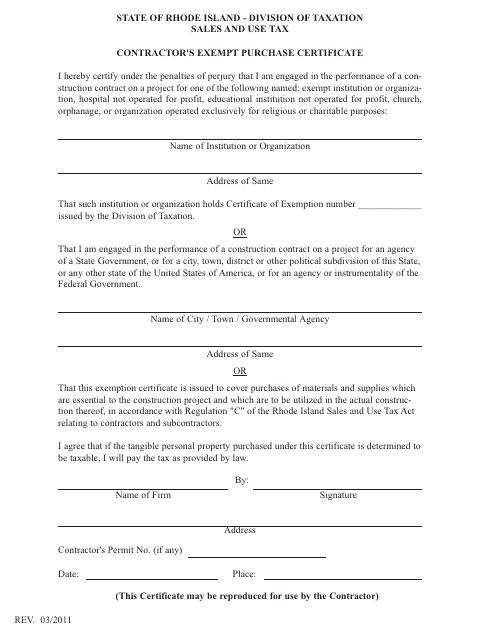

This Form is used for contractors in Rhode Island to claim exemptions on certain purchases. It allows them to avoid paying sales tax on qualifying items.

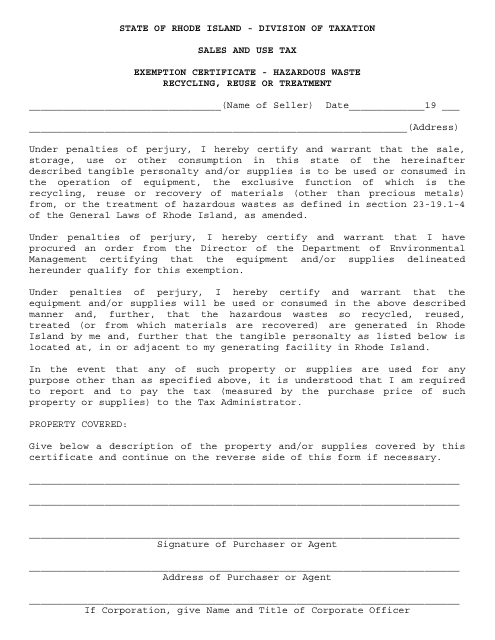

This Form is used for obtaining an Exemption Certificate in Rhode Island for the purpose of recycling, reusing or treating hazardous waste.

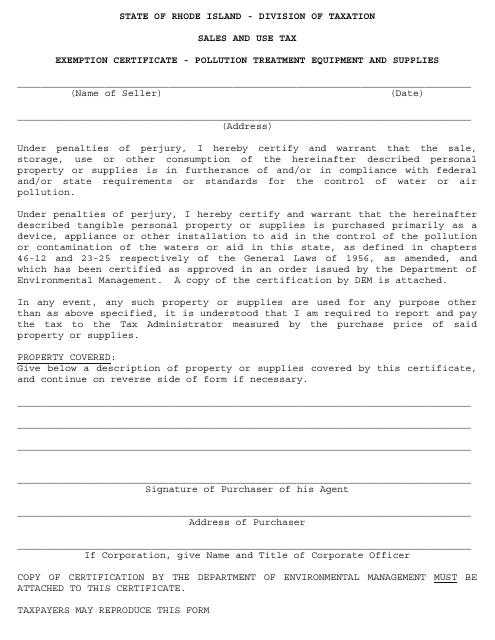

This form is used for applying for an exemption certificate for pollution treatment equipment and supplies in the state of Rhode Island.

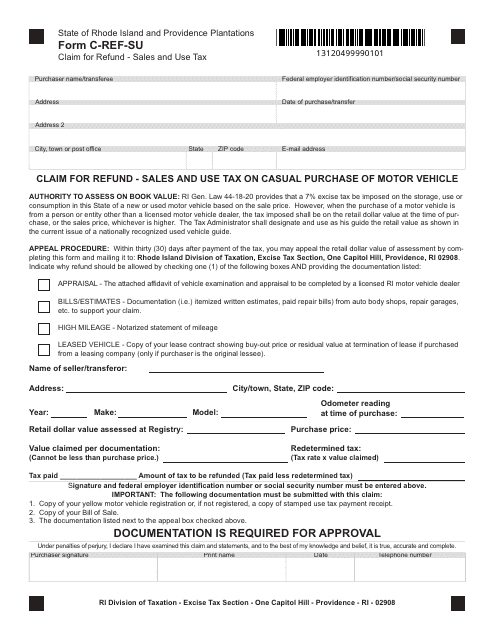

This Form is used for claiming a refund on sales and use tax paid for a casual purchase of a motor vehicle in Rhode Island.

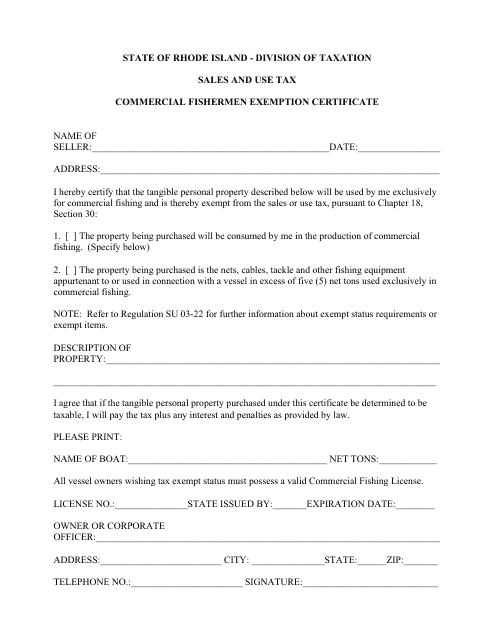

This document is for commercial fishermen in Rhode Island who are exempt from specific regulations.

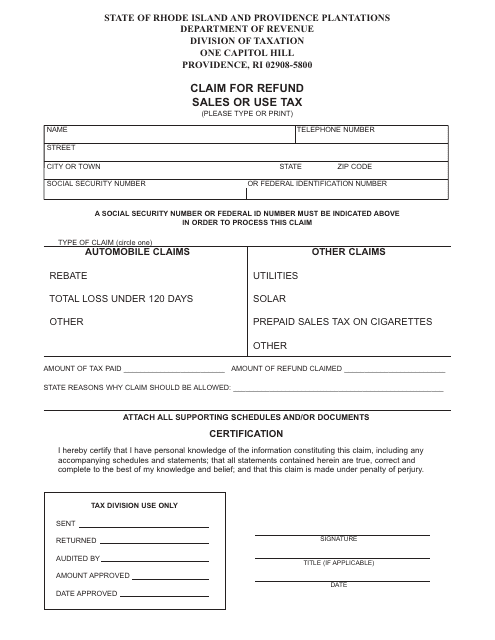

This document is for claiming a refund of sales or use tax paid in Rhode Island. You can use this form to request a refund if you believe you have overpaid or are eligible for a tax exemption.

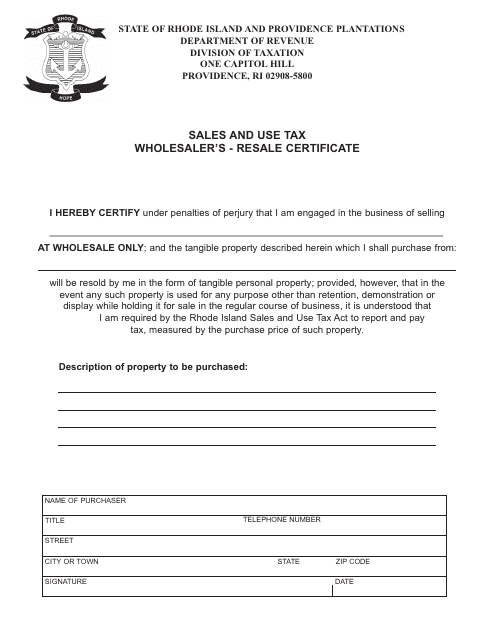

This document is used by wholesalers in Rhode Island to obtain a resale certificate, which allows them to purchase goods for resale without paying sales tax.

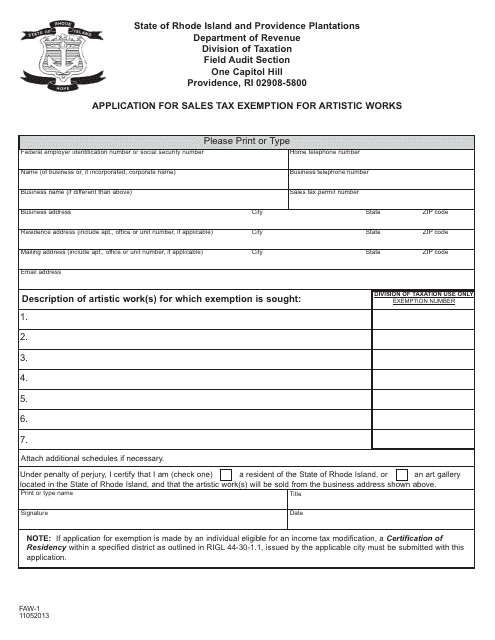

This form is used for applying for sales tax exemption on artistic works in Rhode Island. It is used by artists and sellers of artistic works to claim exemption from paying sales tax on their sales.

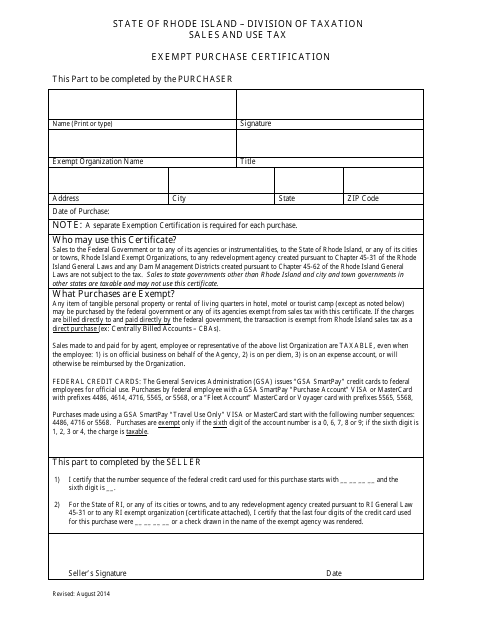

This form is used for certifying that a purchase is exempt from certain taxes in the state of Rhode Island.