California Annual Report Templates

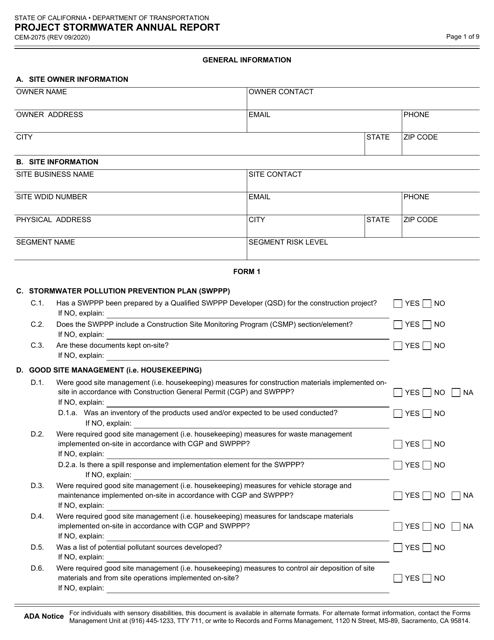

The California Annual Report is a document that certain businesses and organizations in California are required to file on an annual basis. It serves as a way for these entities to provide information about their financial statements, activities, operations, and compliance with relevant laws and regulations to the appropriate government agencies, such as the California Department of Financial Protection and Innovation. The specific contents and requirements of the report may vary depending on the type of entity and the applicable regulations.

Documents:

13

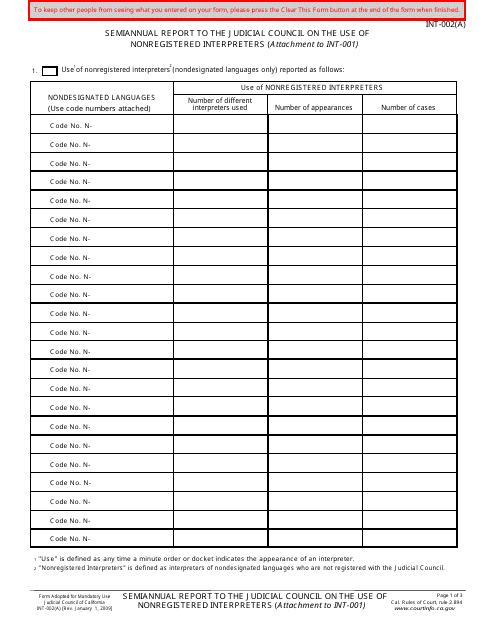

This Form is used for submitting a semiannual report to the Judicial Council in California regarding the use of nonregistered interpreters. It is an attachment to Form INT-001.

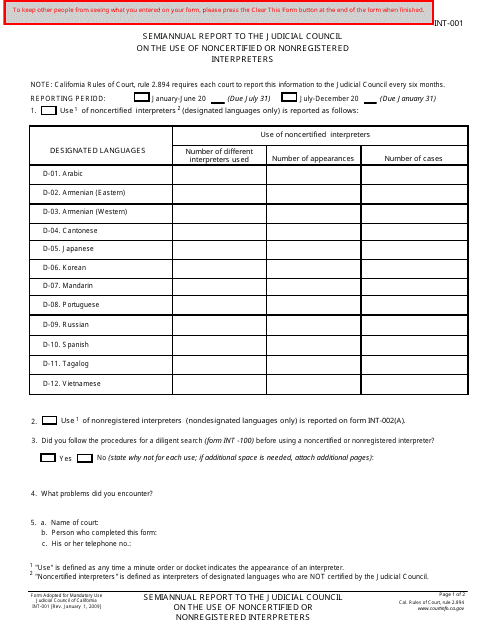

This Form is used for reporting the use of noncertified or nonregistered interpreters to the Judicial Council in California.

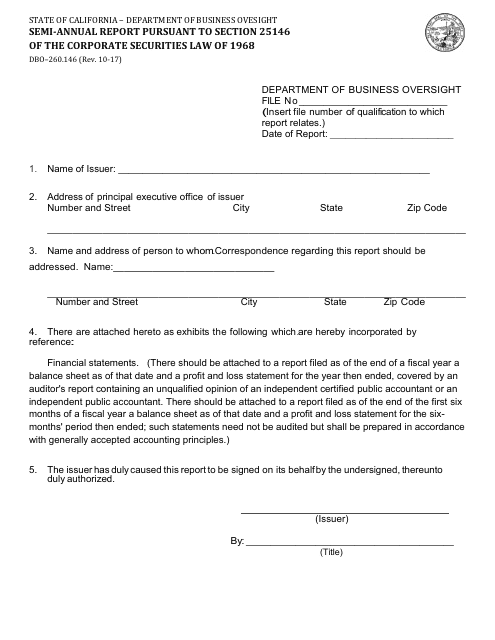

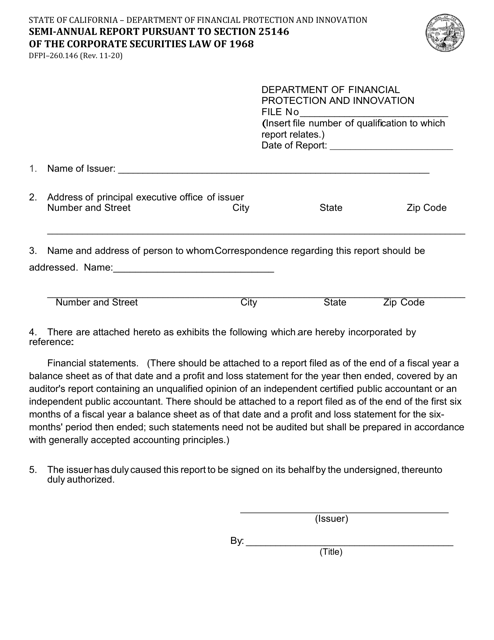

This form is used for submitting a semi-annual report as required by Section 25146 of the Corporate Securities Law of 1968 in California.

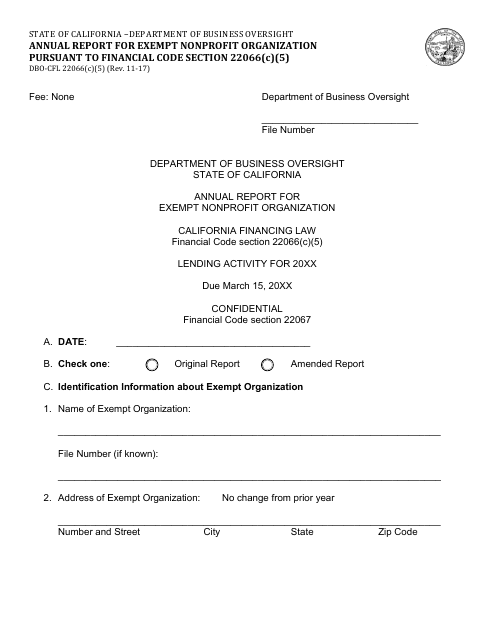

This form is used for filing an annual report for exempt nonprofit organizations in California according to Financial Code Section 22066(C)(5).

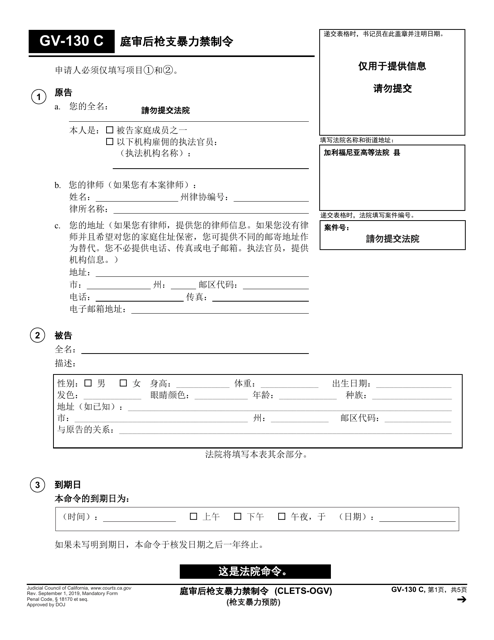

This form is used for obtaining a Gun Violence Restraining Order in California, specifically for cases that involve Chinese language documentation.

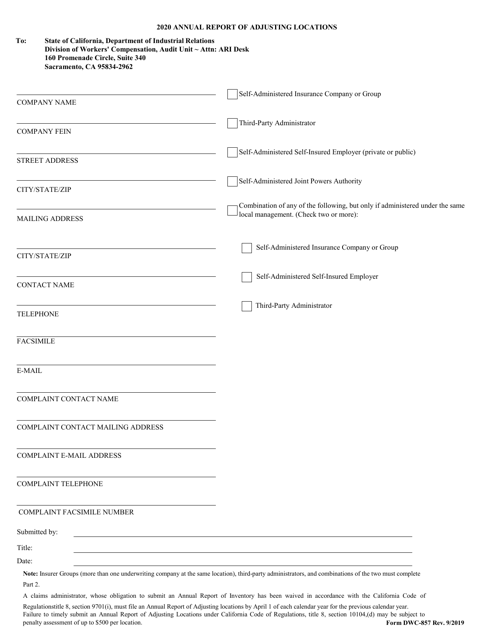

This Form is used for submitting the Annual Report of Adjusting Locations in California. It is required for businesses operating as adjusting locations in the state.

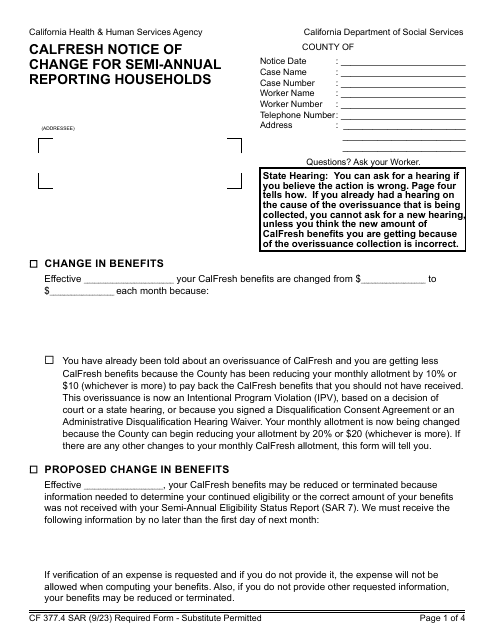

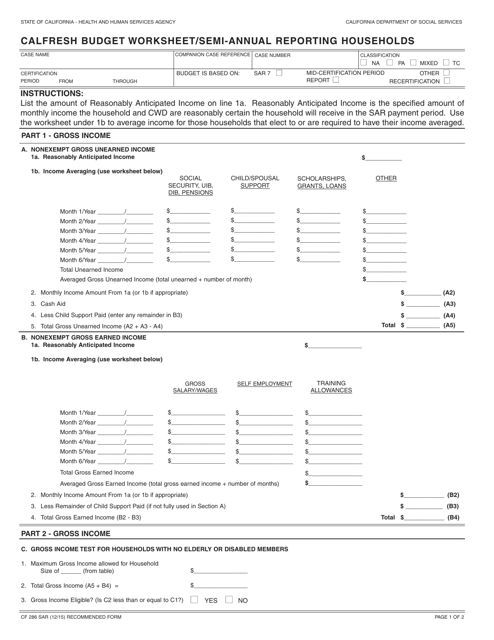

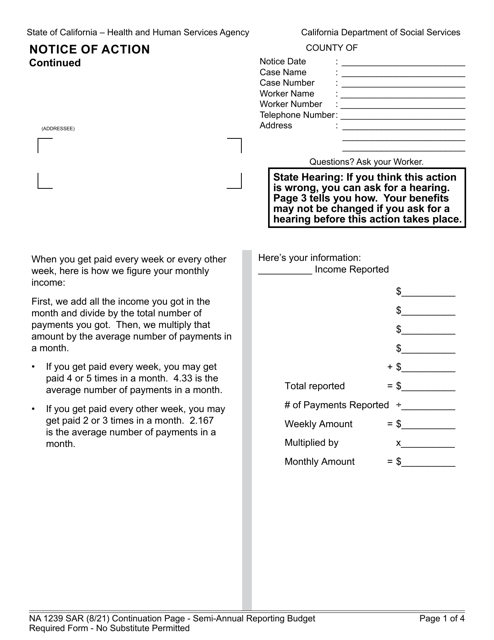

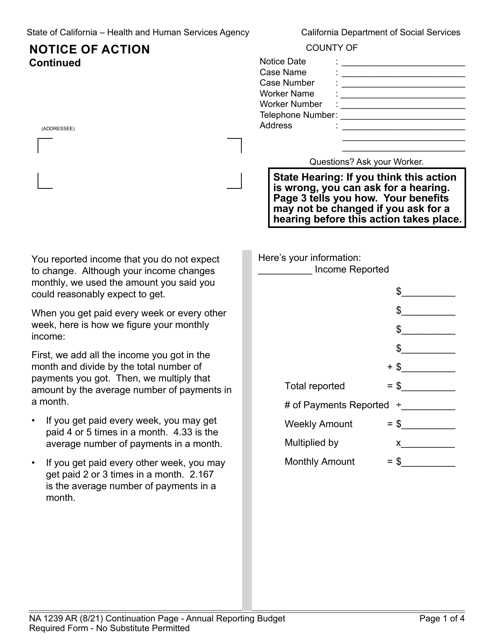

This form is used for CalFresh recipients in California to report their household's budget and expenses on a semi-annual basis.

This form is used for submitting a semi-annual report as required by Section 25146 of the Corporate Securities Law of 1968 in the state of California. It is specific to corporate securities and serves as a means for compliance and reporting purposes.