Fill and Sign 428 Forms

What Is Provincial Form 428?

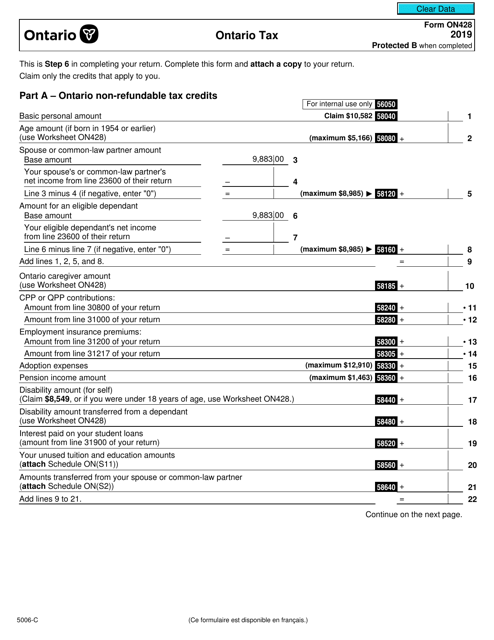

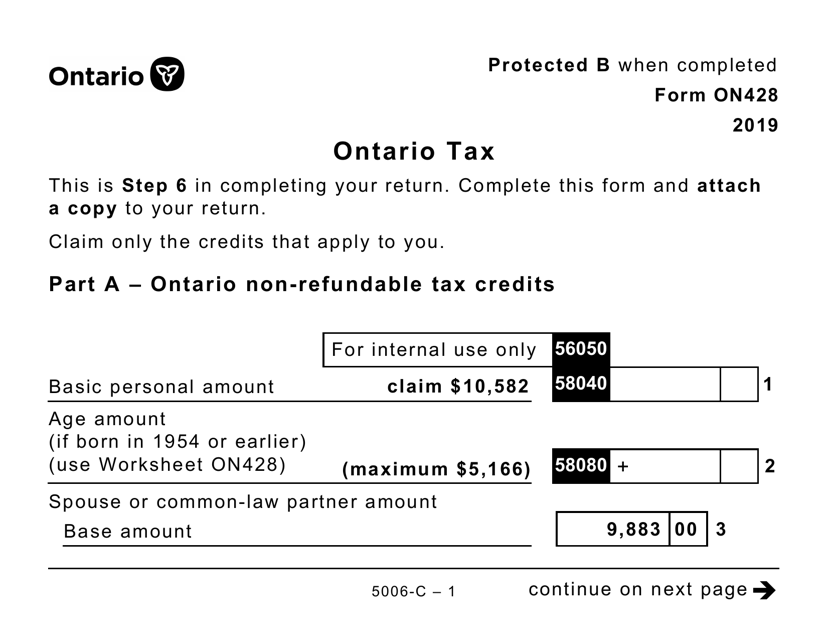

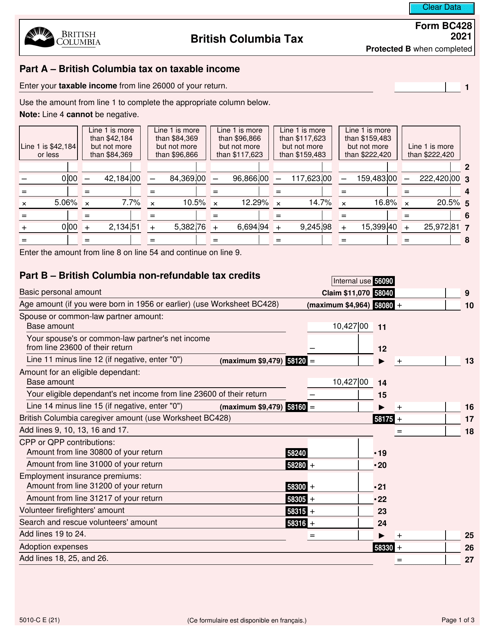

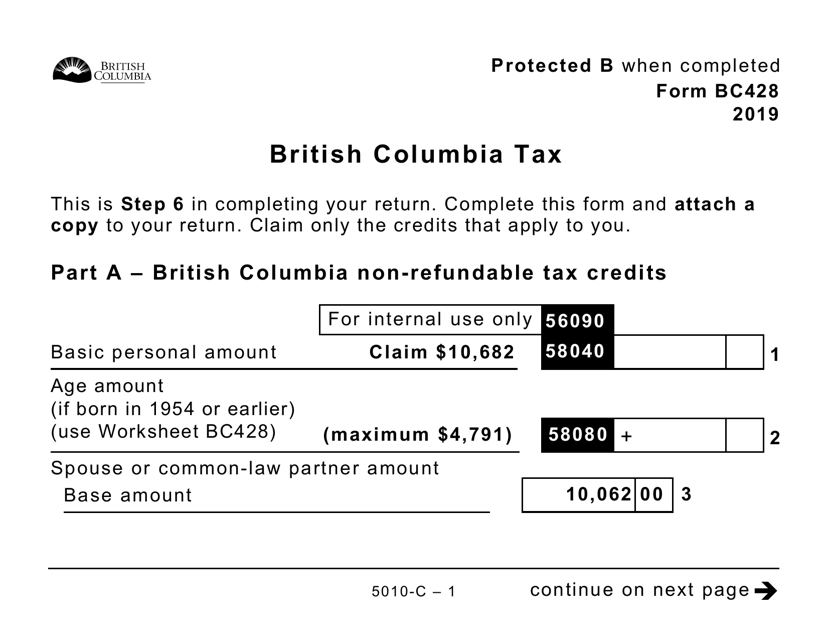

Form 428, Provincial or Territorial Tax, is a formal tax statement released by the Canadian Revenue Agency (CRA). Canadian taxpayers must fill out to figure out their provincial or territorial tax. Prepare this document if you resided in Canada by the end of the reporting year, were employed and earned wages in Canada, or obtained income from the organization established on the Canadian territory, except for Quebec. You have to indicate the correct amount of territorial and provincial taxes to let the federal government collect them later. Different locations have different rates and requirements for filing, so make sure you choose the correct tax form.

Alternate Names:

- Provincial Form 428;

- Provincial Tax Form 428

In addition to federal income tax, taxpayers must also compute their provincial and territorial income taxes using worksheets available for each form and then pay the taxes they owe. Moreover, a properly filled-out CRA Form 428 qualifies individuals for provincial and territorial tax credits they can claim along with federal credits. Even if the eventual result is zero, you must send Form 428 with your federal tax return.

Here is what you will be able to calculate with the help of CRA Form 428:

- Find out your non-refundable tax credits - for instance, contributions to the pension plan, employment insurance premiums, adoption costs, education loan interest, medical expenses, gifts, and donations.

- Determine the tax the government will collect on your taxable income using easy-to-understand formulas.

- Apply necessary reductions, record various tax credits - political contribution credit, employee investment credit, etc. - and compute the definitive amount of tax you will pay.

Documents:

4

This Form is used for reporting Ontario tax information to the Canada Revenue Agency (CRA).

This document is a large print version of Form ON428 (5006-C), which is used for filing taxes in the province of Ontario, Canada.

This document is used for filing taxes in the province of British Columbia in Canada. It is specifically designed for individuals who may require a large print format.