Free Rent Rebate Forms

What Is a Rent Rebate Form?

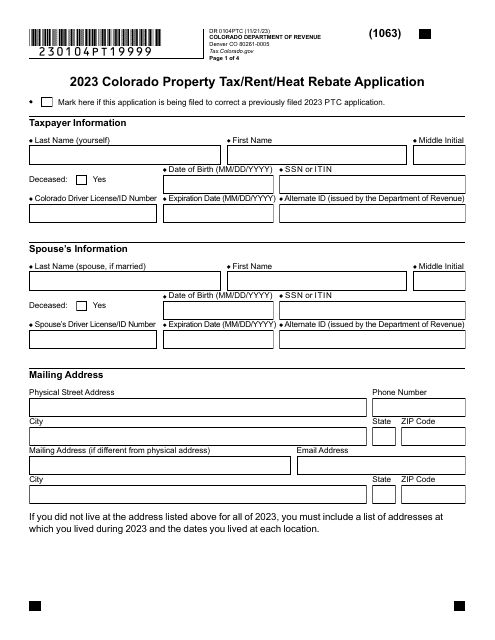

A Rent Rebate Form is a tax rebate for people in lower incomes, who have lost a spouse or have a disability, that they can use to help offset their rental costs from the previous tax year. The maximum amount of the rebate will differ based on income level and the type of issue impacting you as the applicant (such as disability, death of a spouse, or income alone). Once you have included the Rent Rebate Form with your taxes for the previous year, you can expect to receive the money with any other tax return you expect to receive from that year’s filing.

Alternate Name:

- Rent Rebate Application Form.

Depending on the state, the form can differ in the information required for proof of eligibility and how much an applicant can expect to receive after filing their taxes (a sample rent rebate in California can be as much as $900 for married couples or $700 for individuals). Most states will also have different tiers of how much an applicant can expect to receive based on their income, with people earning less receiving a greater rebate. To see our Rent Rebate forms check out our library below.

How to Write a Rent Rebate Form?

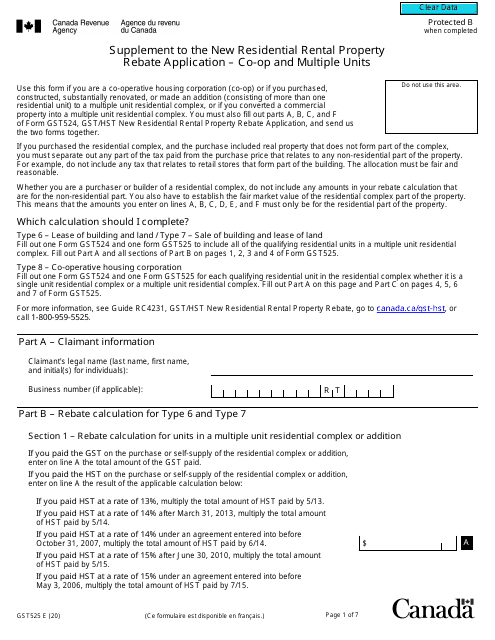

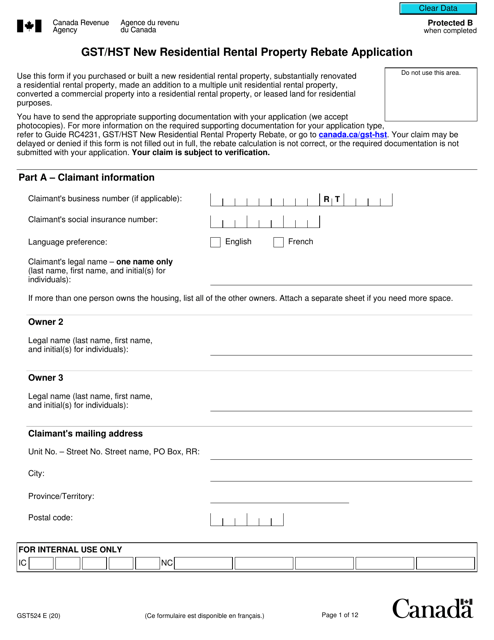

To begin filling in a Rent Rebate Application Form, you will need to include the following information:

- Your and your spouse’s full name and social security number.

- Mailing address and location of the rental property you reside at.

- How many months of the year you resided in the state you are filing the rent rebate form.

- How many months of the year you resided at the rental property you claimed as your place of residence.

- The total amount you spent on rent for the year.

- If any of the rented space was used for business purposes (such as a home office or storage). In many states, if you are using the rental property for business use, you may also be required to fill outadditional tax forms to claim this on your tax filings.

- The total household income (including your spouse’s income if applicable).

- Most Rent Rebate Forms will also include steps where you will multiply your income or rental costs by a certain percentage, which will then give you the total amount you can expect for your rebate.

- A final signature section for the applicant(s) and additional space for a tax preparer’s signature.

Still looking for a particular document? Take a look at these related forms below:

Documents:

9

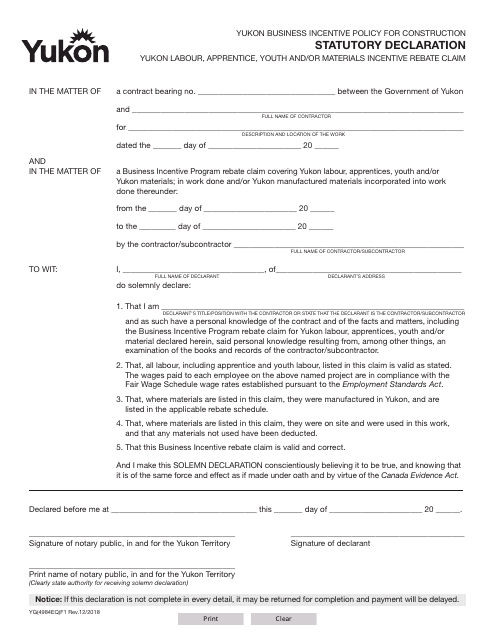

This form is used for declaring eligibility for the Labour, Apprentice, Youth, Materials Incentive Rebate in the Yukon, Canada.

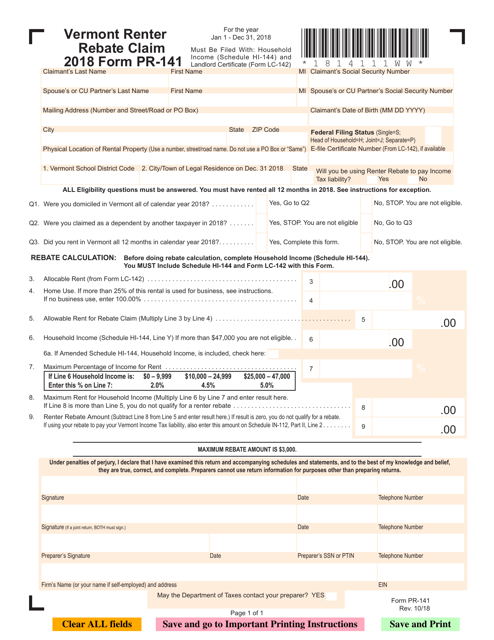

This Form is used for claiming a renter rebate in the state of Vermont.

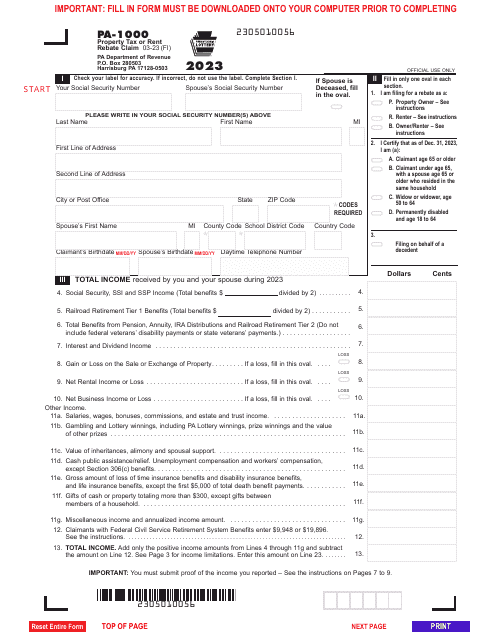

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

This guide provides instructions for preparing the Property Tax/Rent Rebate application in Pennsylvania. It explains the eligibility criteria and necessary documentation required for the rebate.

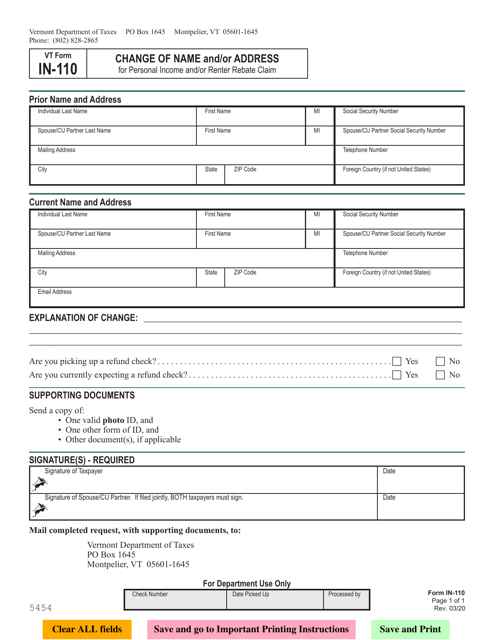

This form is used for residents in Vermont to request a change of name and/or address for their personal income and/or renter rebate claim. It is important to keep your personal information up to date for accurate processing of your claims.