New York City Tax Commission Forms

The New York City Tax Commission is responsible for reviewing and addressing property tax related issues in New York City. Their main purpose is to provide a fair and impartial forum for property owners to dispute and seek corrections to their property tax assessments. The commission is also responsible for setting the rules and guidelines for property tax assessments and ensuring that they are applied consistently and accurately.

Documents:

4

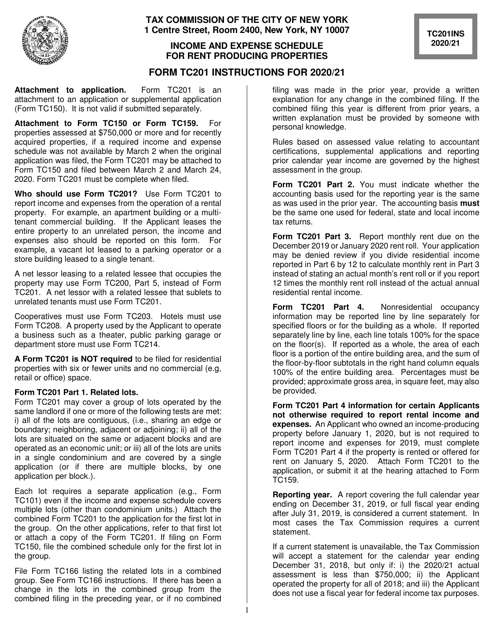

This form is used for reporting the income and expenses related to rent-producing properties in New York City.

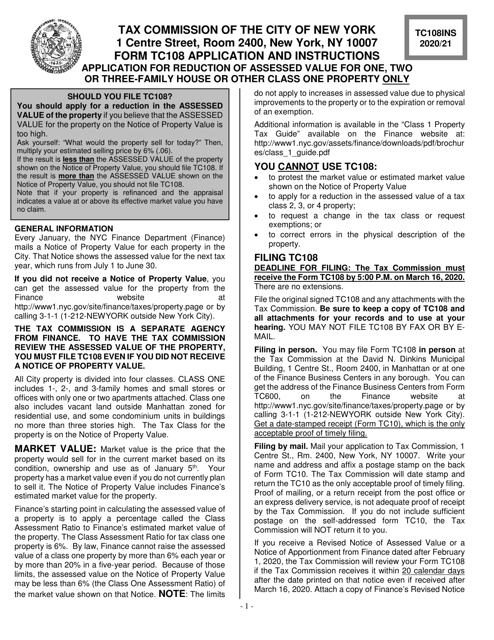

This Form is used for applying to correct the assessed value of a one, two, or three-family house or other class one property in New York City.

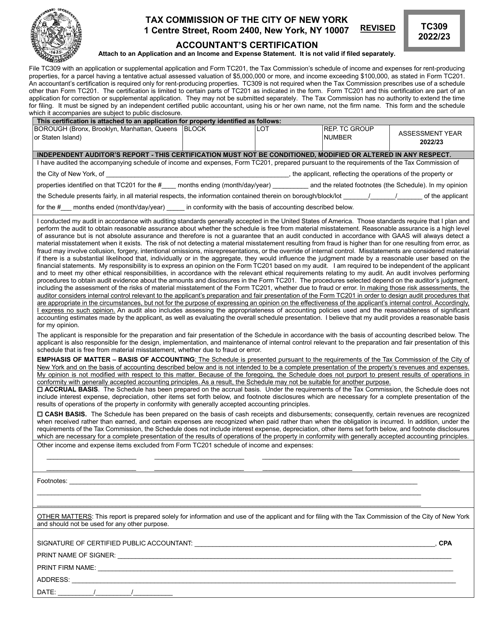

This Form is used for Accountants in New York City to certify financial information.

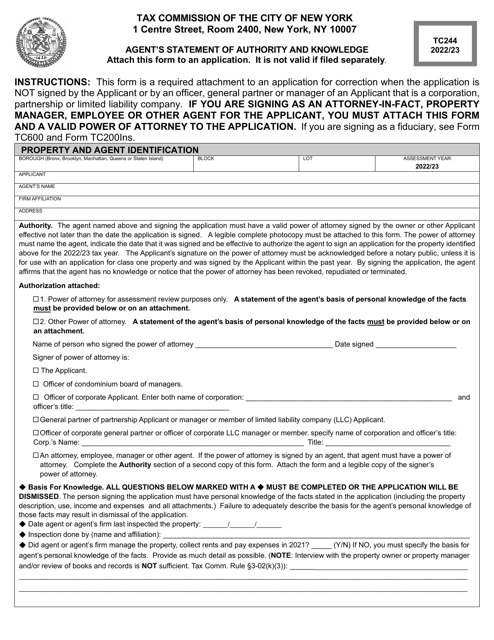

This Form is used for agents in New York City to make a statement about their authority and knowledge.