Philippine Bureau of Internal Revenue Forms

The Philippine Bureau of Internal Revenue is responsible for the collection of taxes in the Philippines. Its main role is to ensure that individuals and businesses comply with tax laws and regulations, and to collect the necessary revenue to fund government programs and services. The bureau also enforces tax laws, issues tax guidelines, and provides taxpayer assistance and education.

Documents:

4

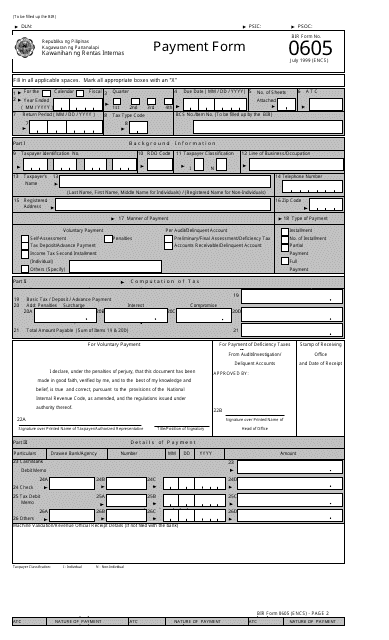

This document is used for making payments to the Bureau of Internal Revenue (BIR) in the Philippines. It is a form that individuals or businesses can use to pay their taxes and other obligations.