Division of Taxation - City of Cleveland, Ohio Forms

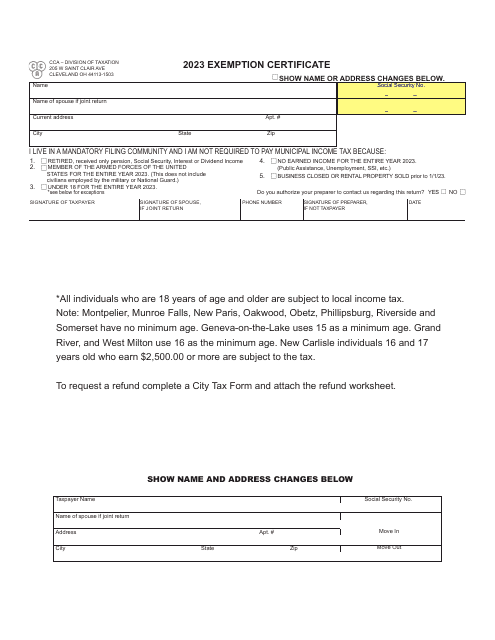

The Division of Taxation - City of Cleveland, Ohio is responsible for administering and enforcing tax laws and regulations within the city. They collect taxes from individuals and businesses to fund various public services and infrastructure projects in Cleveland.

Documents:

26

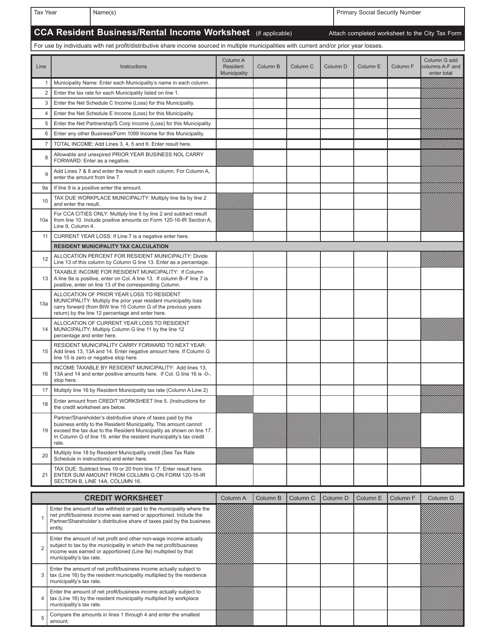

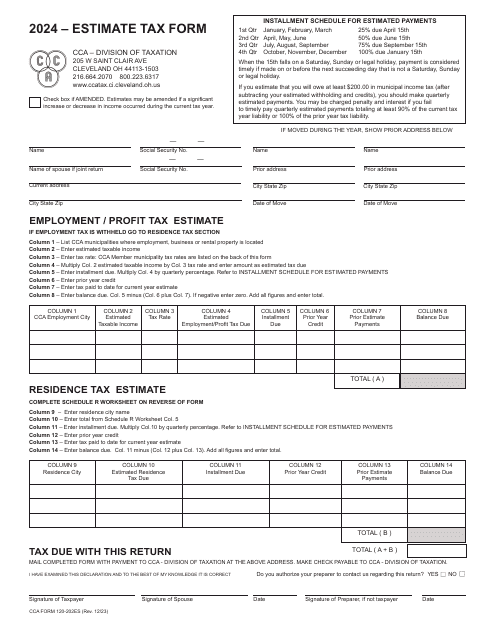

This form is used for residents of Cleveland, Ohio who have business or rental income. It is a worksheet to calculate and report income for tax purposes.

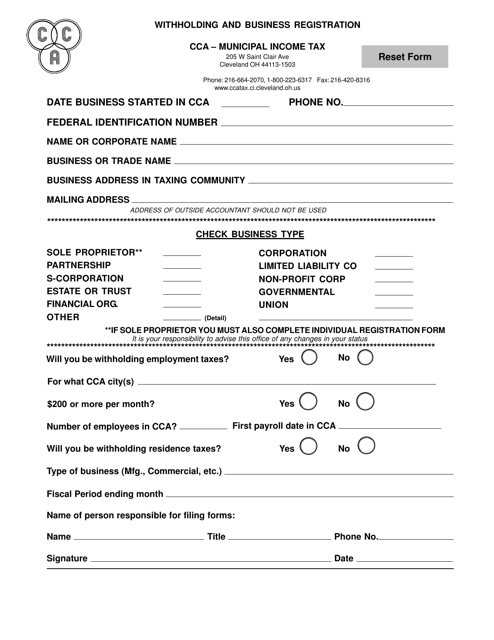

This document is for businesses in the city of Cleveland, Ohio who need to register for withholding taxes and obtain a business registration.

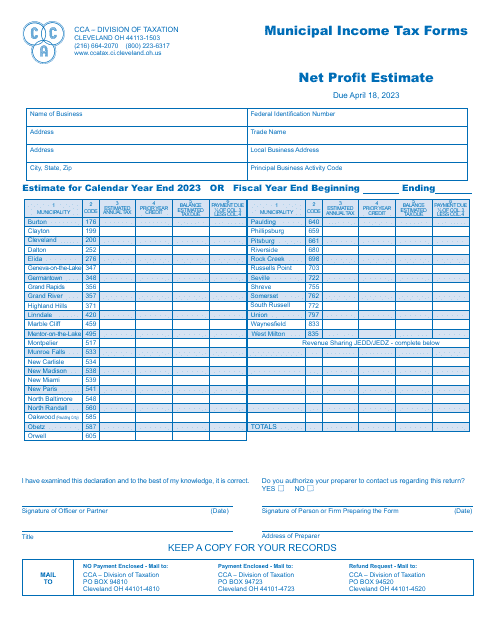

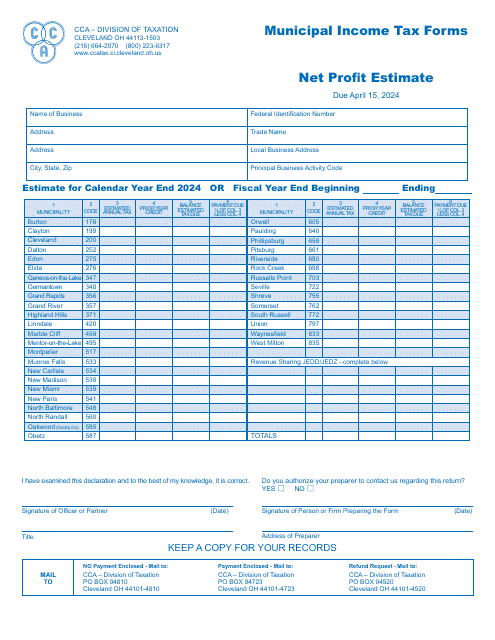

This document provides an estimate of the net profit for the City of Cleveland, Ohio. It helps in analyzing the financial performance of the city and determining the amount of profit generated after expenses.

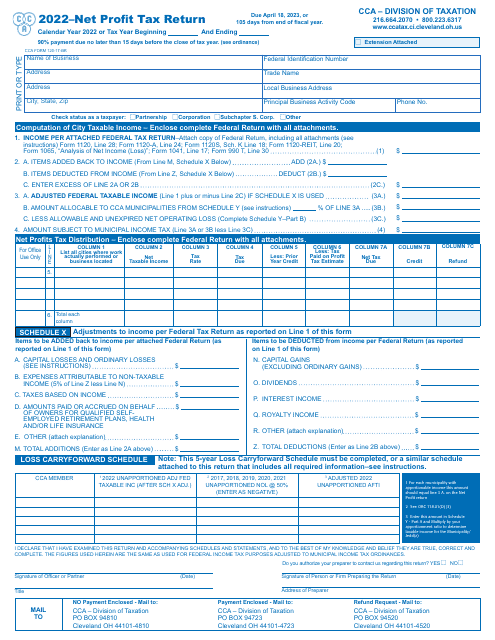

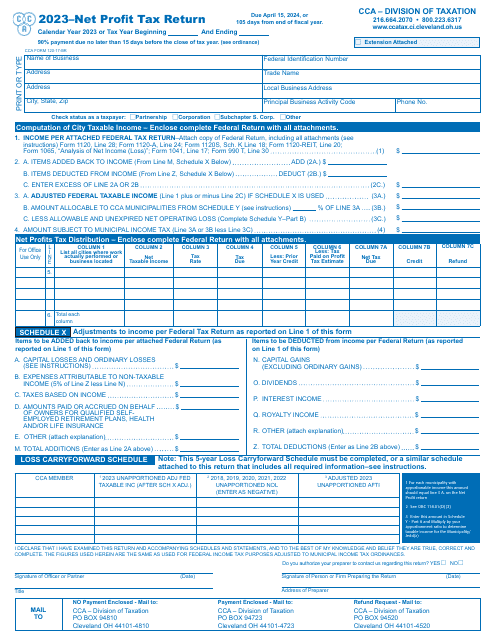

This form is used for filing the net profit tax return with the City of Cleveland, Ohio.

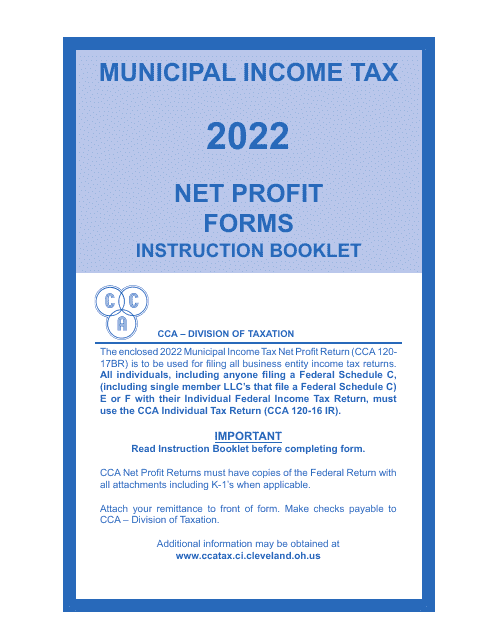

This booklet provides instructions on how to fill out net profit forms for businesses located in the City of Cleveland, Ohio. It includes step-by-step guidance to help businesses accurately report their net profits.

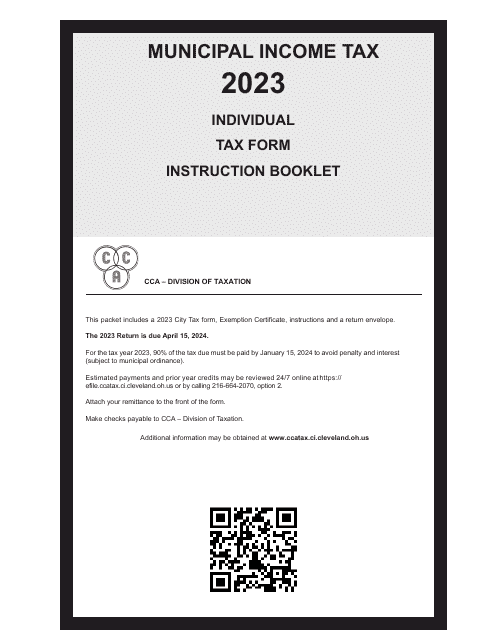

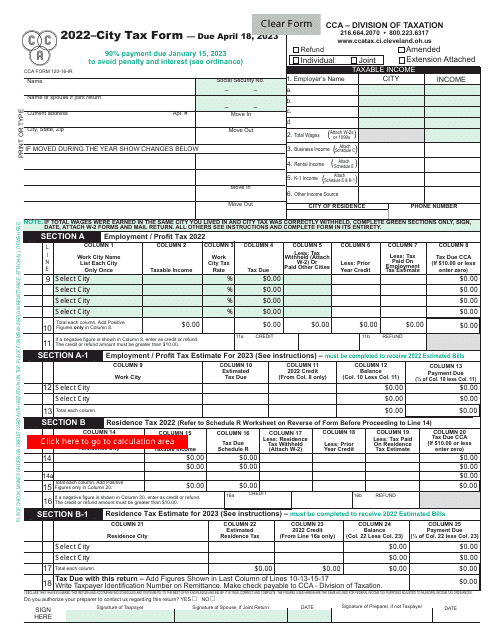

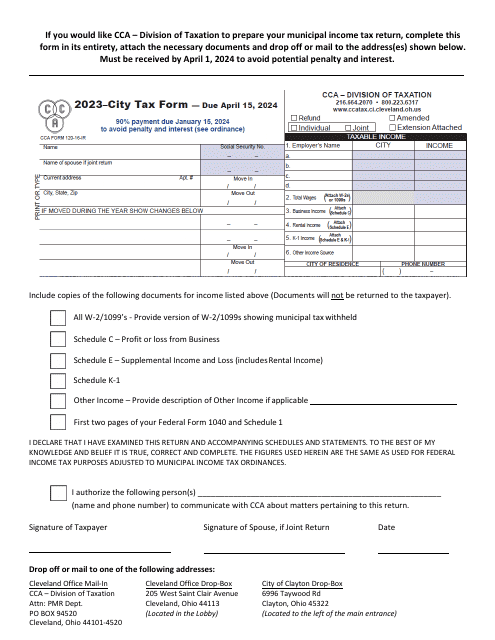

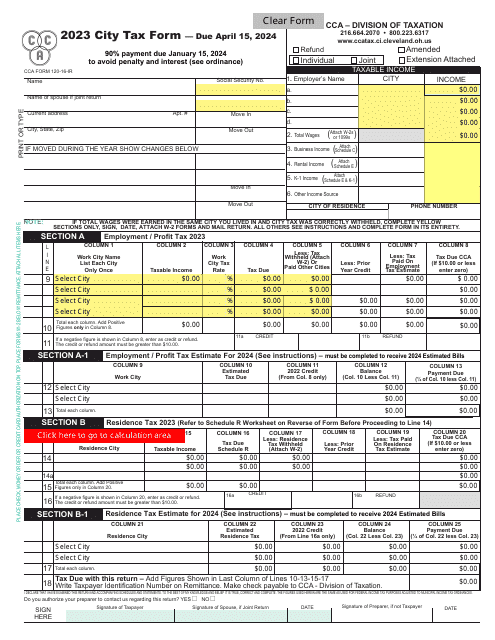

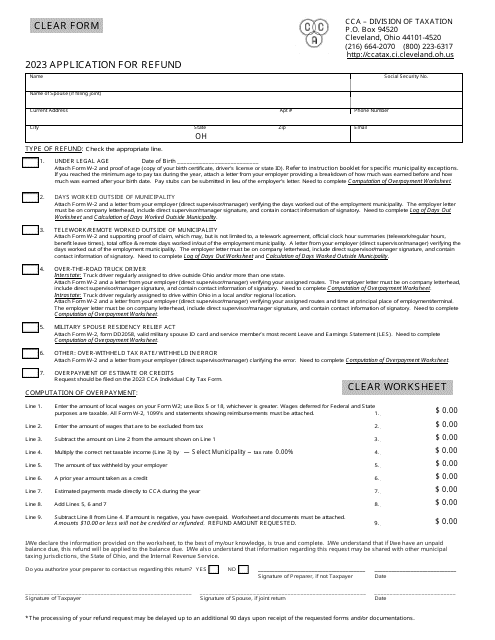

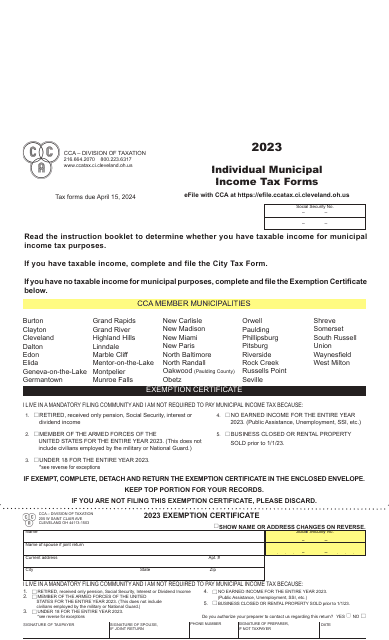

This Form is used for reporting and paying city taxes to the City of Cleveland, Ohio. It is a mandatory requirement for all residents and businesses within the city to submit this form annually.

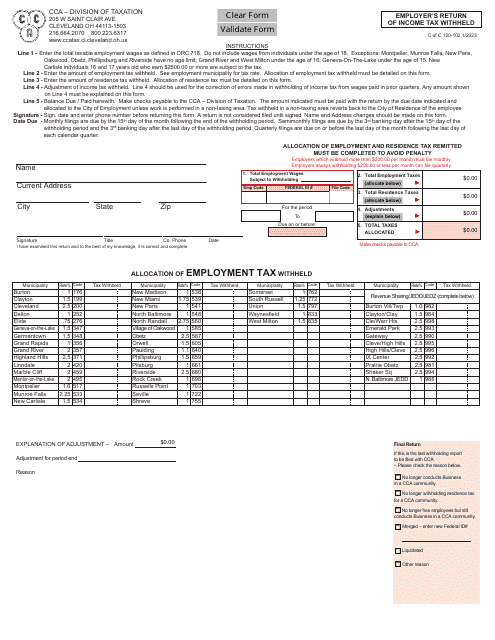

This form is used for employers in the City of Cleveland, Ohio to report and submit income tax withheld from employees' wages.

This document is used for reconciling the municipal income tax withheld by employers with the wage and tax statements submitted to the City of Cleveland, Ohio. It ensures accuracy and compliance with local tax regulations.

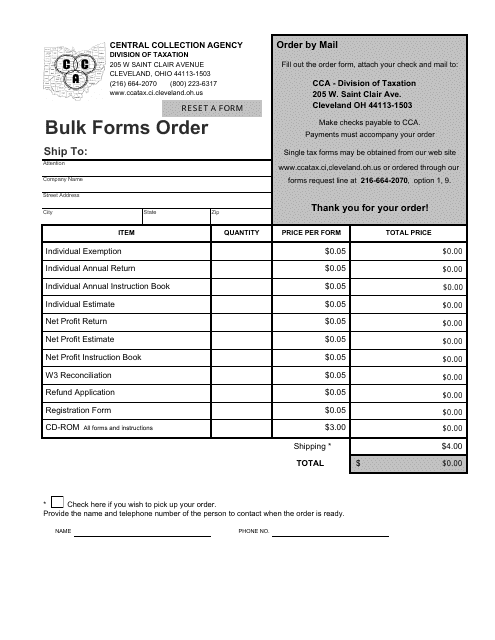

This form is used for ordering bulk forms from the City of Cleveland, Ohio.

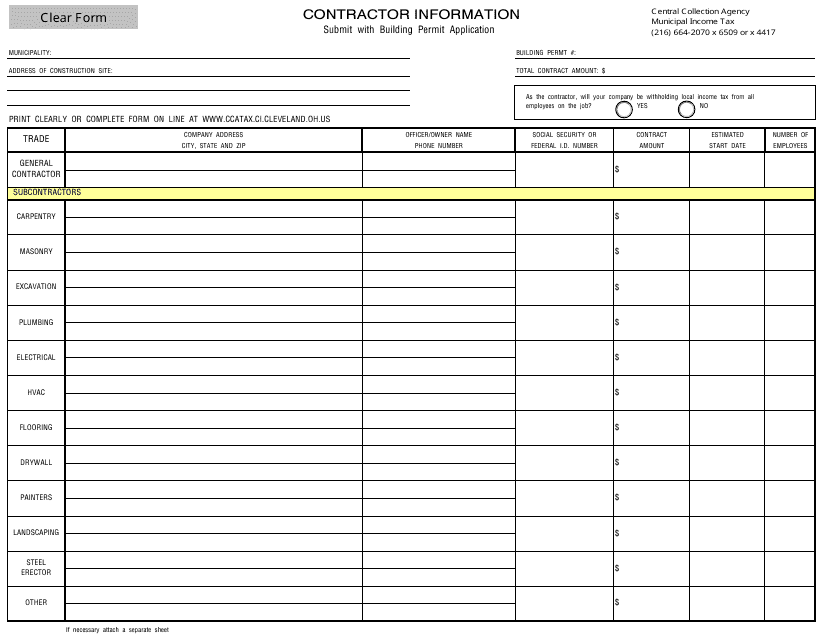

This document provides information about contractors working in the City of Cleveland, Ohio. It includes details about their qualifications, licenses, and any required certifications.