Debt Letter Templates and Samples

What Is a Debt Letter?

A Debt Letter is a document that individuals or entities can use to settle certain issues connected with a debt they have or with a debt someone else owns. The purpose of the document is to create fruitful communication between the involved parties in order to resolve different matters connected with the debt. If the parties will not achieve the outcome then the letter can be used in court as proof.

Check out the library below to download printable Debt Letter templates and samples.

A Debt Letter template usually includes several sections, which can contain information about the debtor, information about the creditor, a statement that describes the problem and how it can be solved, and a signature. Its content can be changed depending on the type of debt letter and the circumstances of the situation in which it can be used.

Debt Letter Types

There are many types of Debt Letters since they are used to resolve various matters. These matters can include issues such as validation of debt, forgiveness of debt, denial of credit, etc. Each one of them reflects on the subject and presents it in the most detailed way to help it be overcome. There is additional information on different types of debt letters and how they can be used below.

Mortgage-Related Letters:

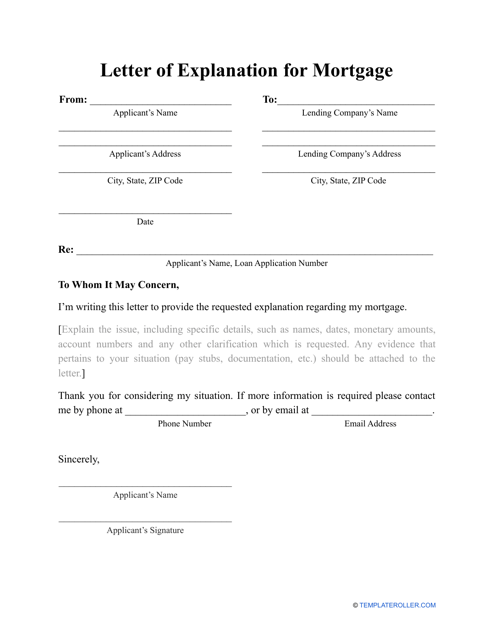

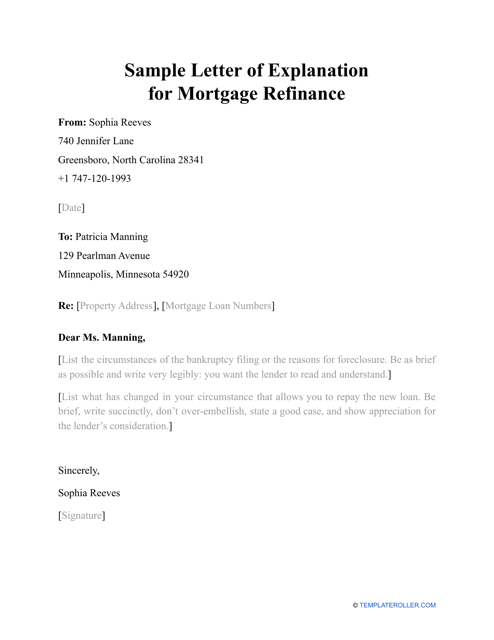

- Letter of Explanation for Mortgage. This letter can be submitted to a mortgage lender and provides specific information about the borrower. The purpose of the document is to provide an explanation on certain matters that may pause the loan application process.

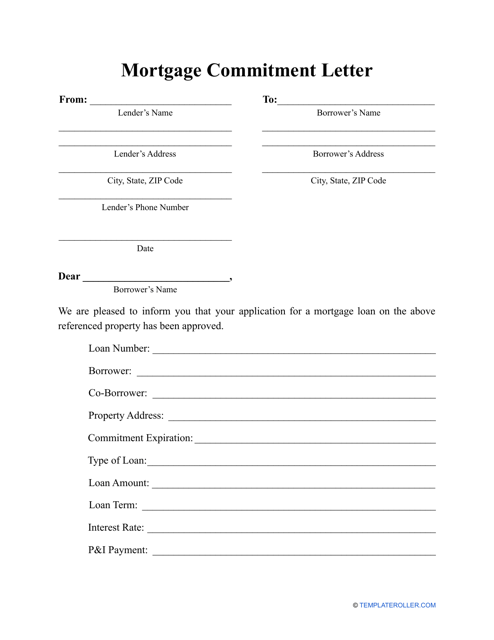

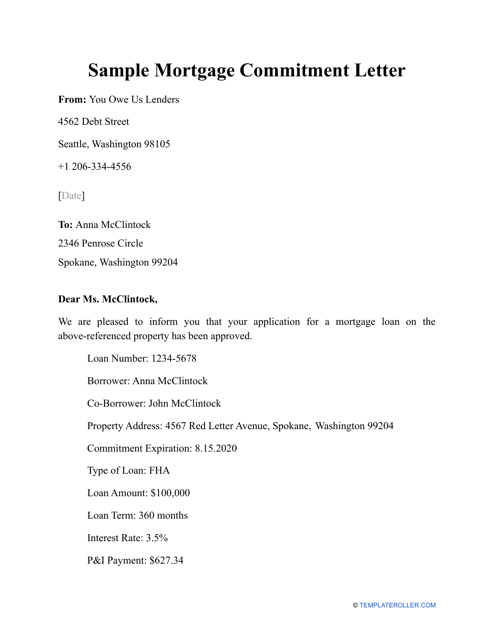

- Mortgage Commitment Letter. Can be used to inform a borrower and a home seller that the loan has been approved and the purchase can be closed now. The letter confirms that the loan application process is over and that the borrower has a loan.

- Mortgage Gift Letter. This letter can help individuals who do not have many funds to apply for a mortgage. It states that the individuals have received the down payment funds from a donor as a gift and not obliged to pay it back. The letter must be signed by the donor.

Credit-Related Letters:

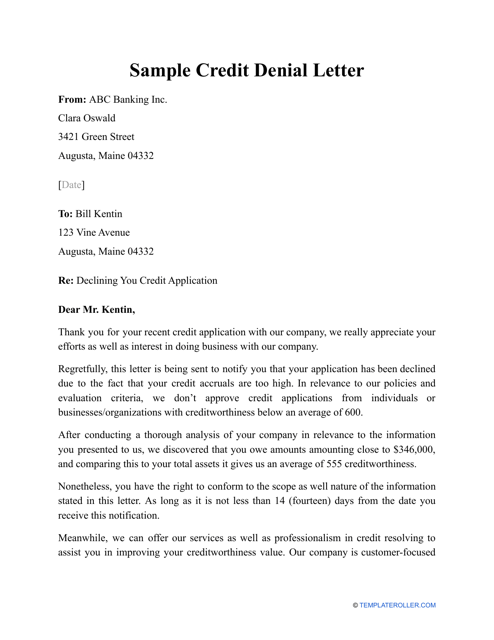

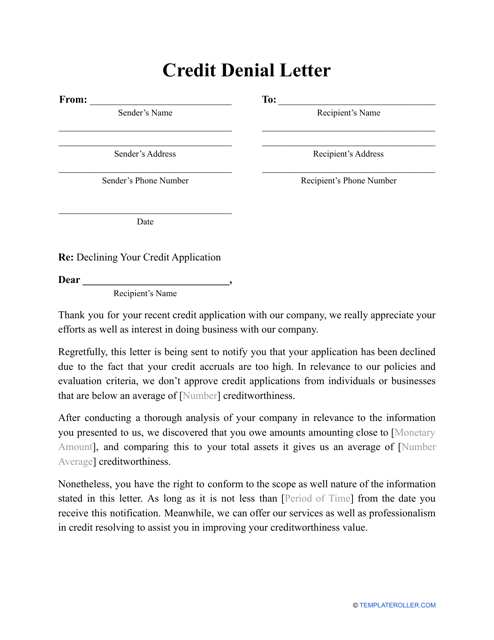

- Credit Denial Letter. Contains the rejection of a credit application by a potential lender. The letter can be used to notify prospective borrowers that their application for credit has been denied.

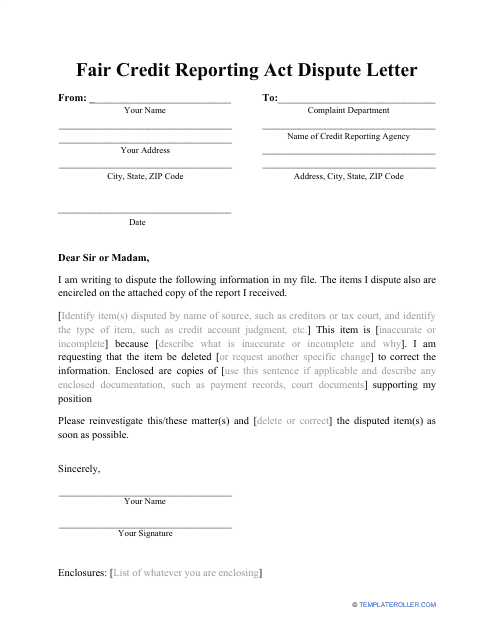

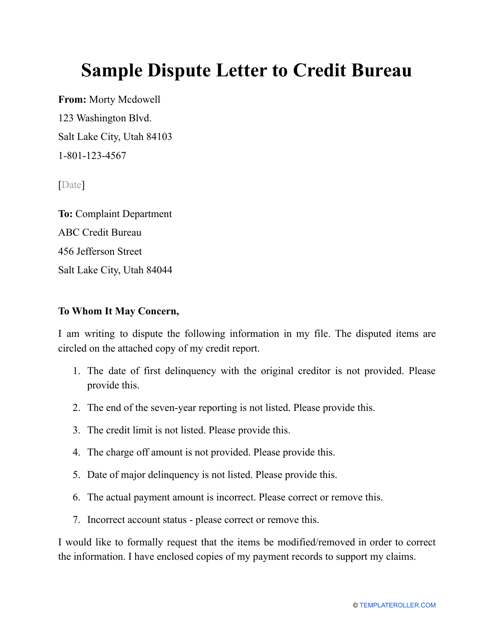

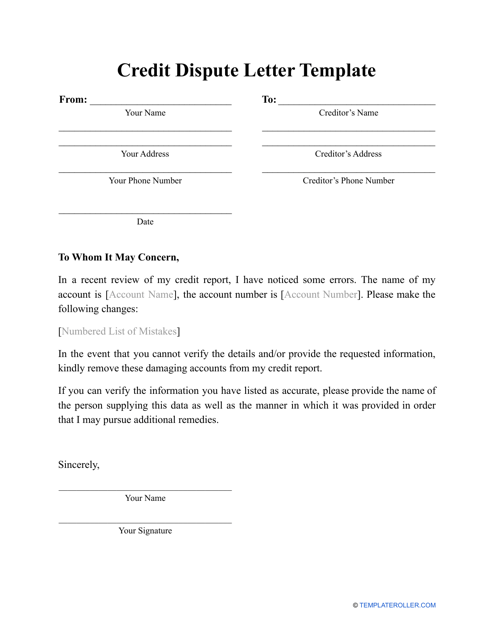

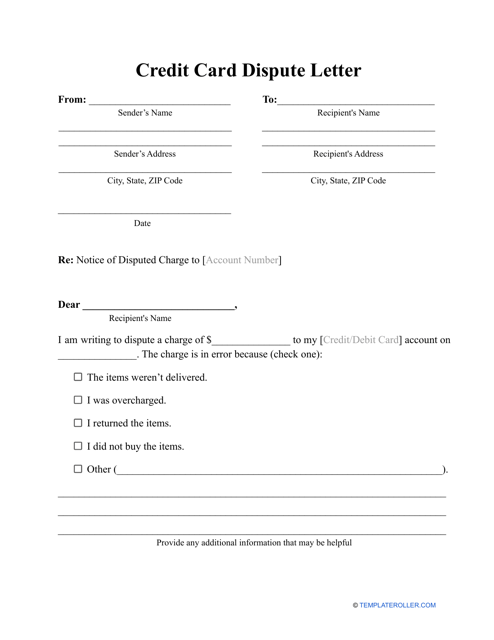

- Credit Dispute Letter. This is a document that individuals can submit to the credit bureau if they believe that their credit report contains inaccurate or incomplete information. The purpose of the document is to inform the credit bureau about incorrect data in their report.

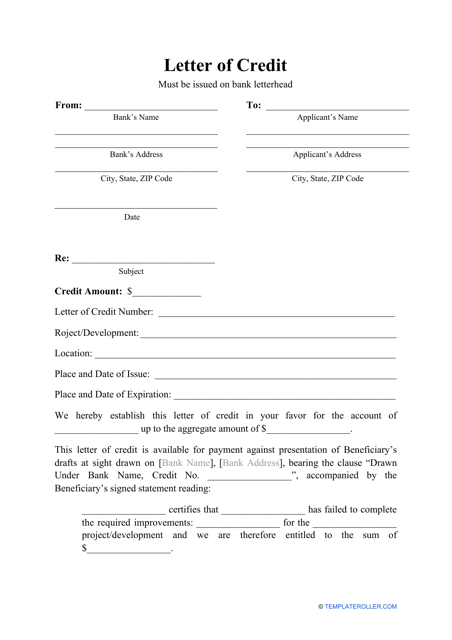

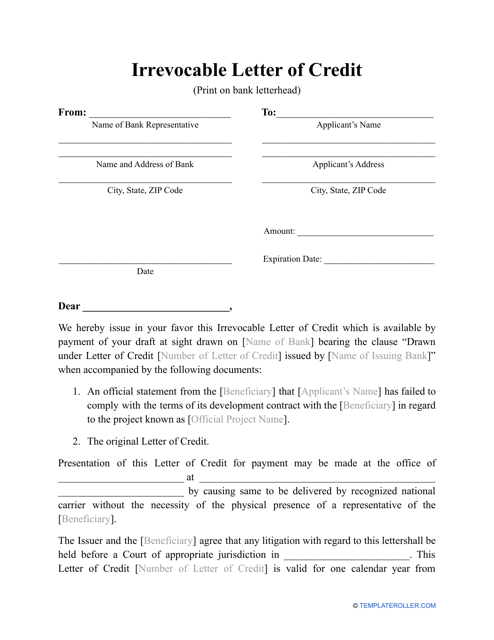

- Letter of Credit. This is a letter from a bank that guarantees that the buyer's payment to the seller will be received on time and for the correct amount.

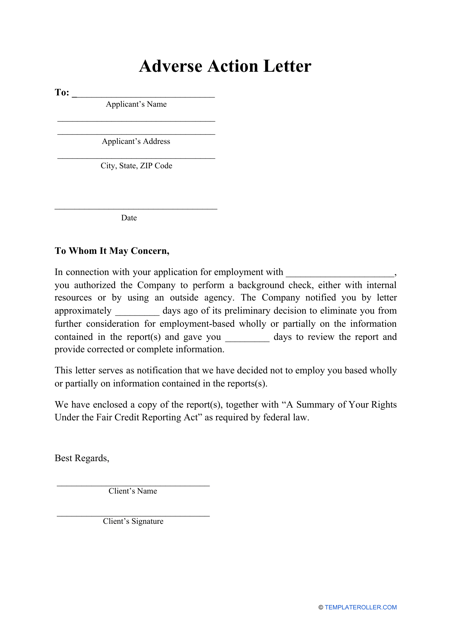

- Adverse Action Letter. This document gives the potential lessee information about why they were denied credit.

Indebtedness-Related Letters:

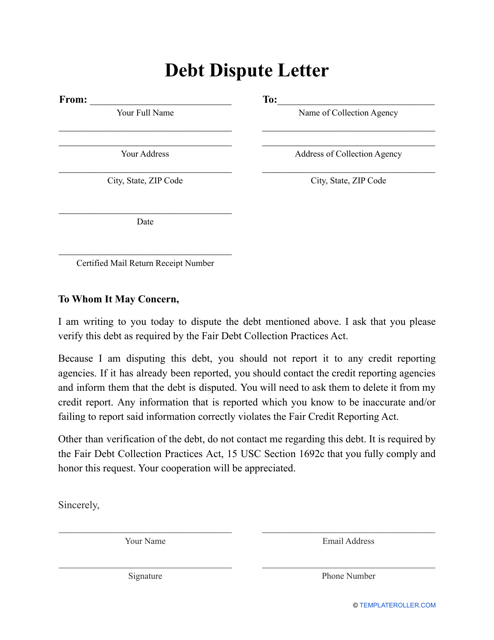

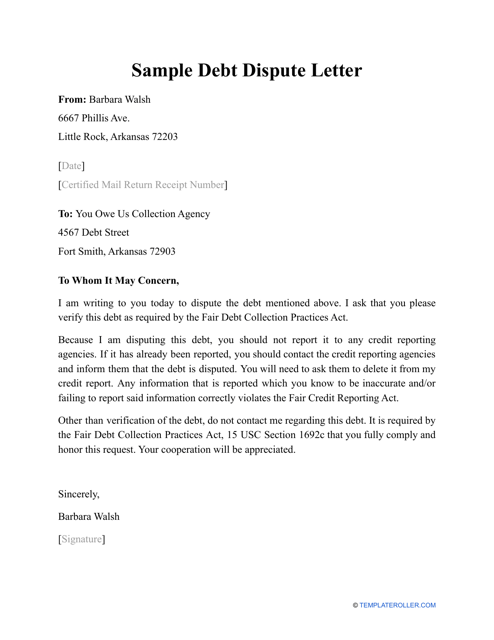

- Debt Dispute Letter. Can be used when a debtor believes that they do not own debt or own a different amount of debt. In this case, they can dispute the debt and require debt collectors to provide proof that the debtor actually owns this debt.

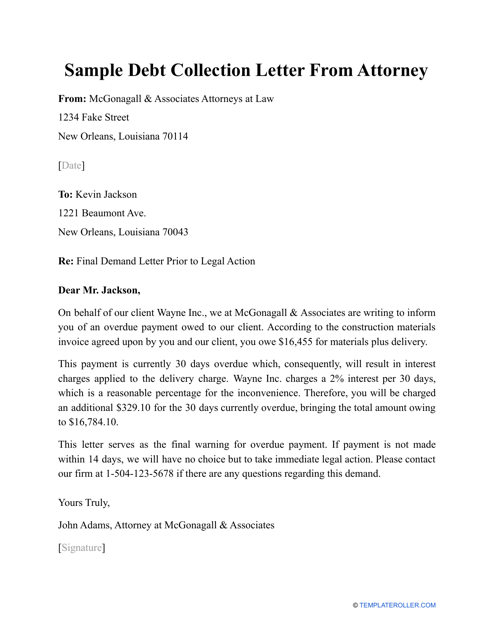

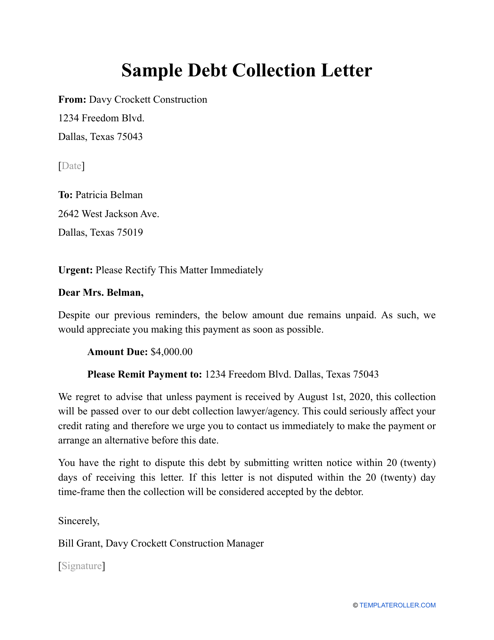

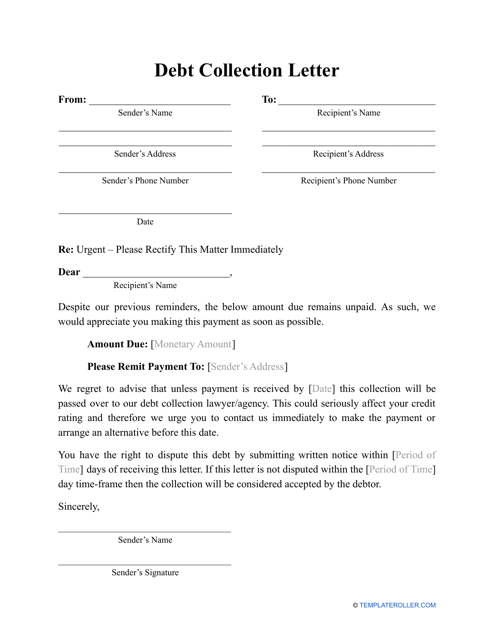

- Debt Collection Letter. This is a document sent to a debtor from a creditor who is seeking payment. The purpose of the document is to notify a debtor about their obligation to pay back their debt and provide instructions on how to do that in the most convenient way.

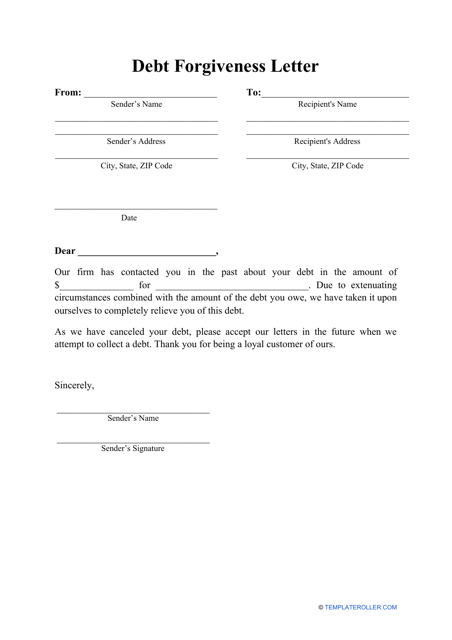

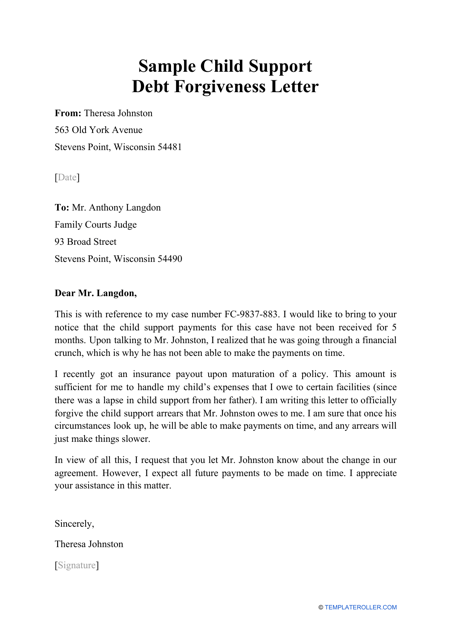

- Debt Forgiveness Letter. Informs a debtor that their debt has been canceled, so they do not have to pay it back anymore. These letters are usually sent when the lender does not consider it worth posting to collections and chooses to forgive the debt rather than go after it.

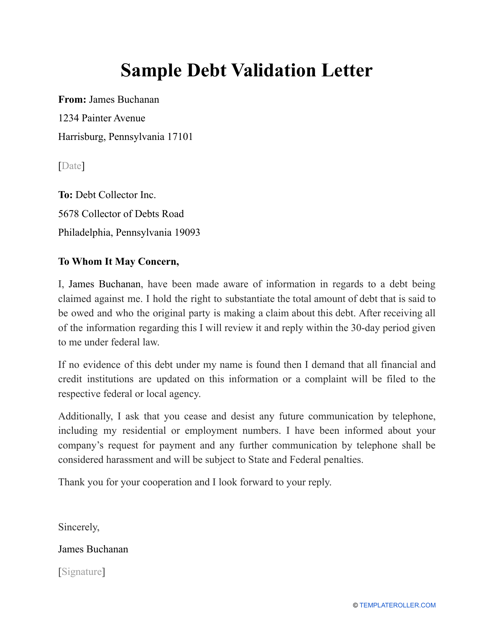

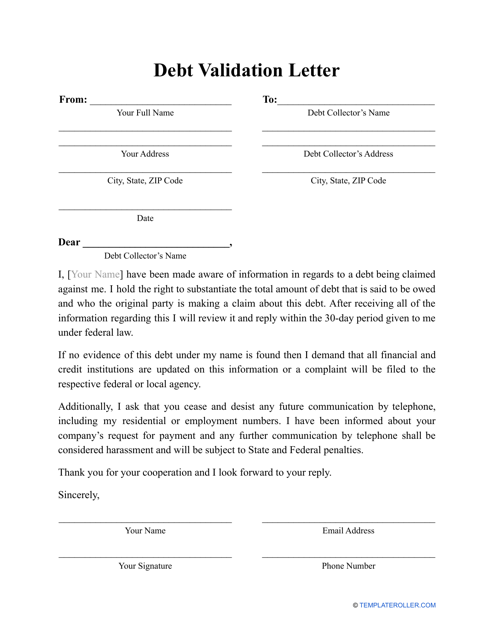

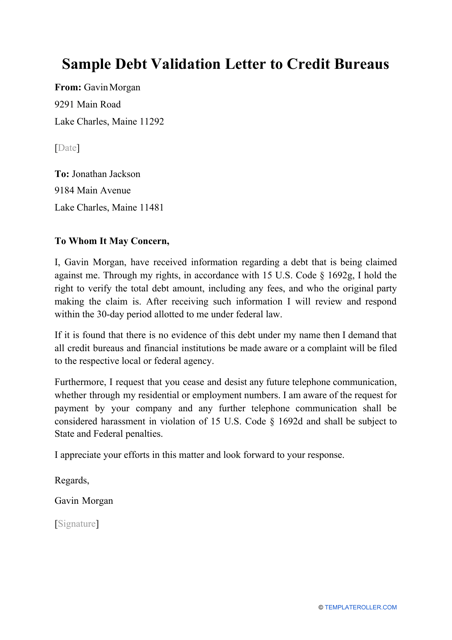

- Debt Validation Letter. Can be sent to a debtor from a debt collector in order to confirm that the debt they are required to pay back actually belongs to them. The purpose of the letter is to provide the debtor with information about what the debt is, how much is owed, etc.

Other Debt Letters:

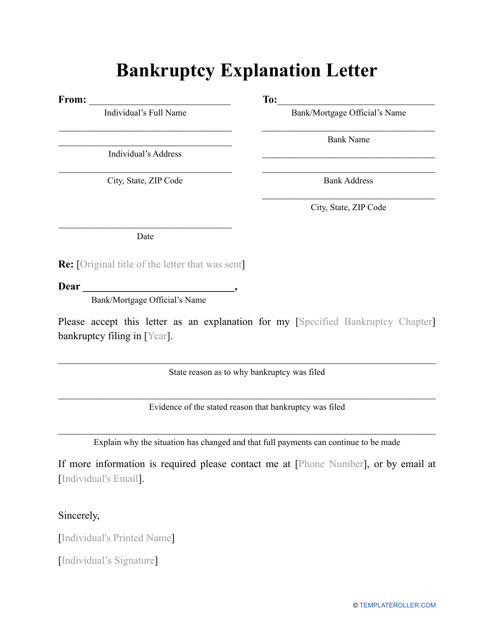

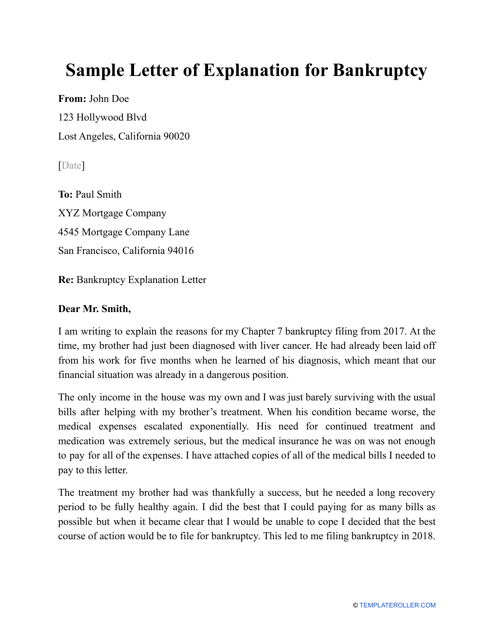

- Bankruptcy Explanation Letter. This letter can be used when an individual who filed for bankruptcy wants to explain the reasons why they had to do so to their previous or new creditor.

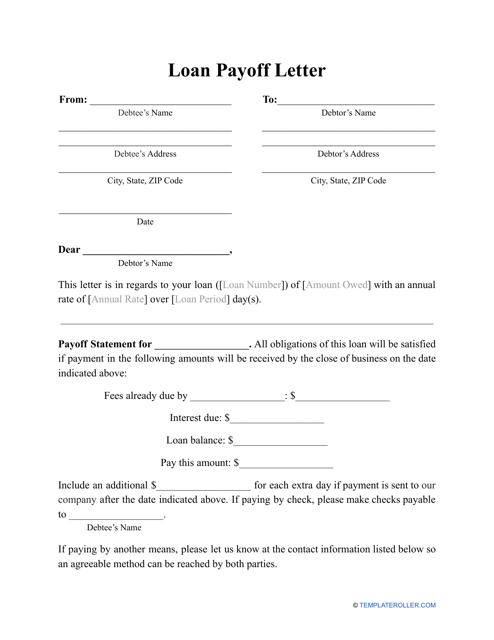

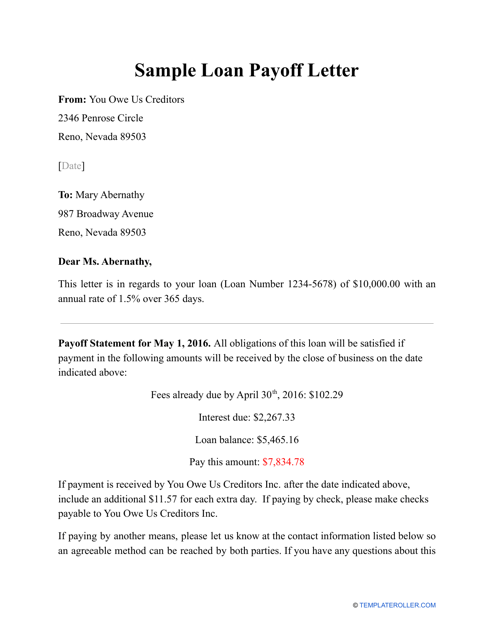

- Loan Payoff Letter. Provides individuals with information about their loan, including how much they own in total, how much they have already paid back, how much is due on the specific date, as well as the instructions on how to pay and if there are any charges.

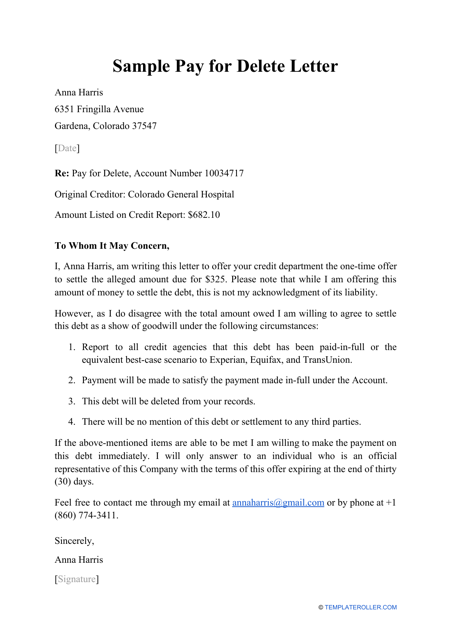

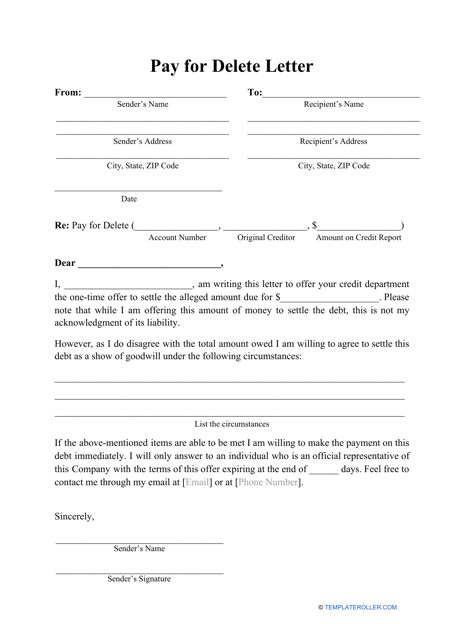

- Pay for Delete Letter. Submit this letter to your creditor in order to remove negative information from their credit report. The purpose of the document is to clear the individual’s credit history from negative marks.

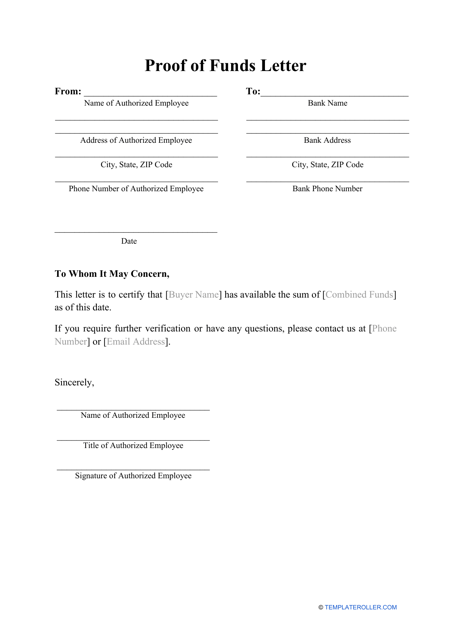

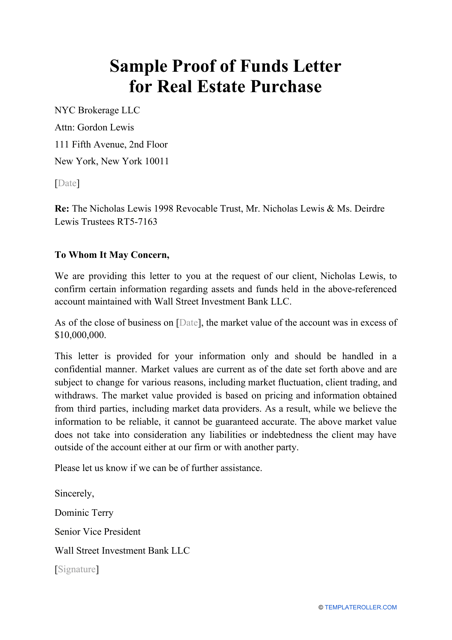

- Proof of Funds Letter. This document certifies that an individual or entity has sufficient funds to complete a transaction.

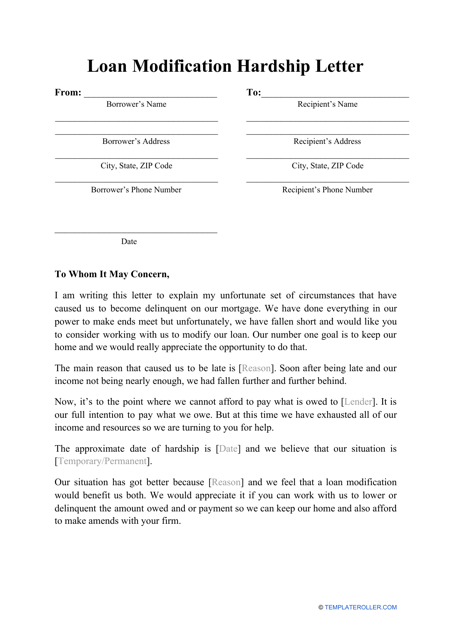

- Loan Modification Hardship Letter. This is a letter you send to your lender to request a loan modification. Check out our ready-made sample Hardship Letter for Loan Modifications to use as a reference when composing your letter.

Haven't found the template you are looking for? Take a look at these related templates:

Documents:

41

This document is a Fair Credit Reporting Act Dispute Letter. It is used to dispute any incorrect information on your credit report as per the guidelines of the Fair Credit Reporting Act.

Use this letter template to explain why you had to file for bankruptcy when you are applying for a loan with a financial lender.

This letter serves as a statement from the borrower for the potential lender that clarifies why they had to file for bankruptcy in the past.

An individual or entity may prepare this type of letter and send it to a financial institution that has notified them about a debt to find out whether this debt is legitimate.

Use this letter to request information about your credit history and any particular debts you may have.

This letter serves as a refusal to accept debt and is written in response to a collector's notice.

This is a written or typed letter that any individual can prepare when they have received a letter from a creditor or debt collector if they do not believe they owe any money or the amount of the debt indicated in the notice is not accurate.

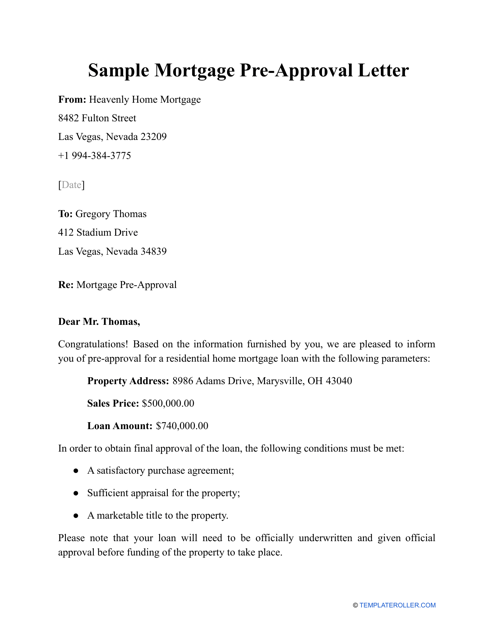

This letter is sent to the borrower after their mortgage application is accepted.

This formal letter can be used to confirm the willingness of a lender to sign a mortgage agreement with a borrower.

This letter provides detailed instructions on how to pay off a loan.

Check out this sample before drafting your own Loan Payoff Letter.

A borrower may use this type of letter in order to explain their financial situation and obtain a mortgage.

This letter is prepared by the borrower for a potential lender in order to answer certain questions that have been omitted in the mortgage application or during a personal interview.

Financial institutions may use this letter for individuals or entities that have been declined an application to obtain credit.

This letter is prepared by the attorney that represents the lender and has a purpose to convince the debtor to pay the money back or face a lawsuit.

If an individual notices an error in their credit report they can use this letter to have it corrected by the agency reporting the information.

A lender can preparer this financial statement and send it to a borrower with the request for them to handle an unpaid debt.

Complete this template and send it to a creditor who is seeking payment.

This document is sent to a potential lender and contains the rejection of their credit application.

Submit this letter to a credit bureau if you believe that your Credit Report contains inaccurate information.

An Adverse Action Letter can be used to inform an individual that they have been denied employment, credit, insurance, or other benefits based on information in a credit report.

This letter, issued primarily by banks, is used in trade finance and provides an irrevocable payment undertaking.

Writing an efficient Loan Modification Hardship Letter is crucial to the success of modifying a home loan .

This letter informs the recipient that they no longer have to pay the money owed to their creditor.

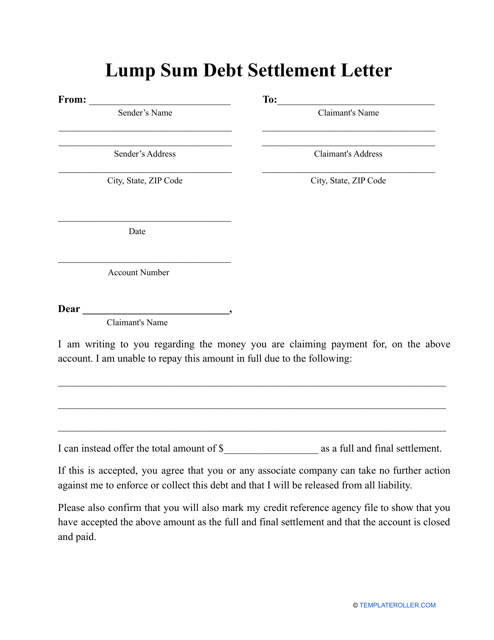

This type of letter is useful if you are in a situation where you will not be able to repay the full amount due for a credit card or bank loan and would like to ask for the debt to be forgiven.

This letter confirms that you have enough money for a large financial transaction (like purchasing real estate).

A financial institution may prepare this letter on behalf of a prospective real estate buyer to confirm that they have enough money to finance the purchase of the house, apartment, or commercial property they would like to purchase.

A debtor or their representative may prepare this letter with the intention of finding out whether their debt is real, to request information about an existing debt, and to warn the credit bureau that handles the debt to cease their harassing behavior if necessary.

Use this letter to ask a creditor to agree to remove the negative information from your credit report.

Submit this letter to a collection agency to erase information about debt and improve your overall credit score.

A parent or guardian may use this letter to inform the other parent (or guardian) that they are no longer obliged to pay the child support they owe.

This is an irrevocable agreement completed by a buyer and the buyer's bank in which the bank agrees to pay the seller as soon as certain conditions are met.

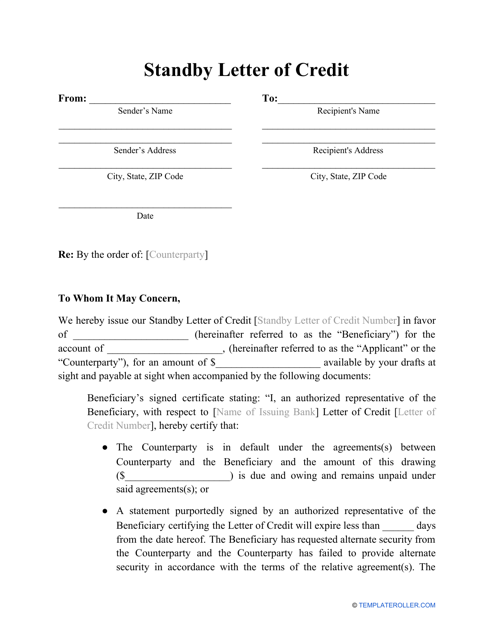

This letter is a legal instrument that secures a bank's commitment to pay the seller in the event that the buyer (the client of the bank) defaults on the agreement.

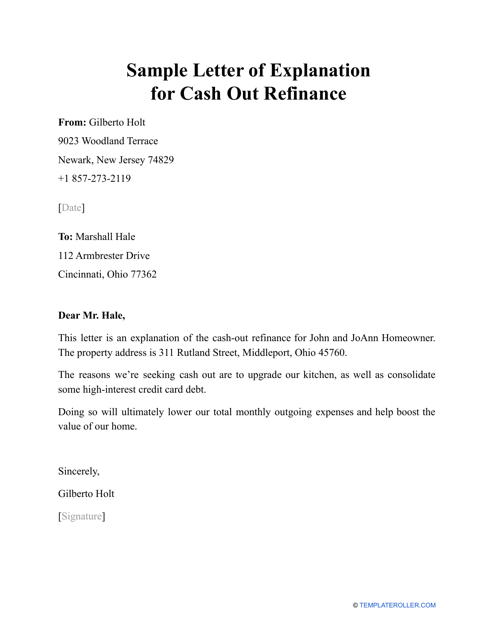

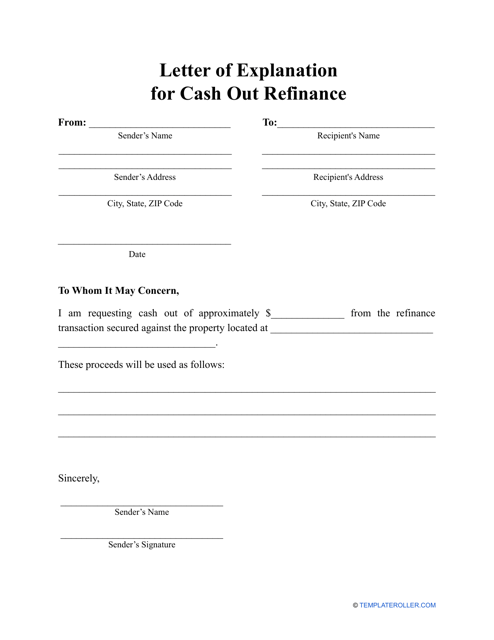

This is a written document that can be used as a reference and prepared by a borrower who wants to improve their existing mortgage terms or receive a sum of money they can spend or invest.

A mortgage borrower may draft a request such as this when they are looking to use the equity they have built for their advantage and replace their old mortgage with a new one.

This letter can be used as a reference to show that a customer has maintained a good credit history and has saved the necessary funds that will later help them qualify for a mortgage loan.

Individuals can use this type of letter when they want to explain to their potential lender why they need cash out refinancing.

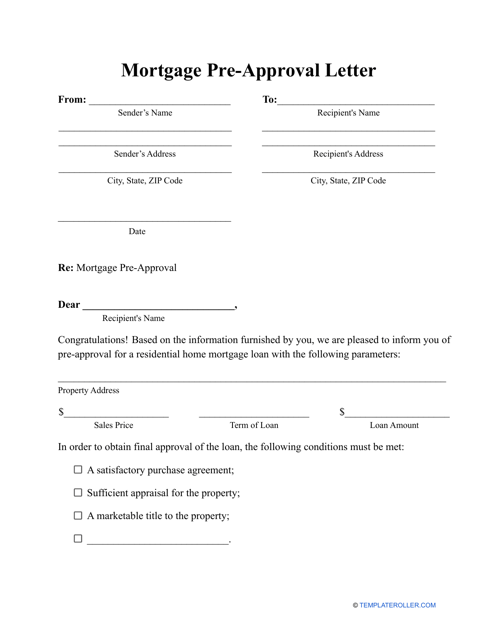

This is a written statement composed by a lender and sent to a borrower to notify the latter their mortgage application has been evaluated and approved subject to certain conditions the borrower must adhere to.

A debtor may use this type of letter as a reference when they would like to offer their creditor a sum of money in exchange for a debt settlement.

Individuals can use this type of letter when they would like to dispute and remove a charge from their credit card.