Letter of Explanation for Mortgage Templates and Samples

What Is a Letter of Explanation for Mortgage?

A Letter of Explanation for Mortgage is a document that a lender or an underwriter requests from a borrower if they find something unclear in the application. It is a common practice to make sure all of the gathered information is reliable, to clear out any questions related to either your bank statement or credit report.

Letter of Explanation for Mortgage Types

Using a Mortgage Explanation Letter, borrowers can explain why a certain situation in question came about. Sometimes a borrower is not aware of the problem, so this is an opportunity to clear it out through communication. Often such inquiries are made due to negative credit history, late payments, etc. Among the issues that need explaining might be a pause in the employment or unspecified large transfers into your account. Anything out-of-the-ordinary may need to be described in detail.

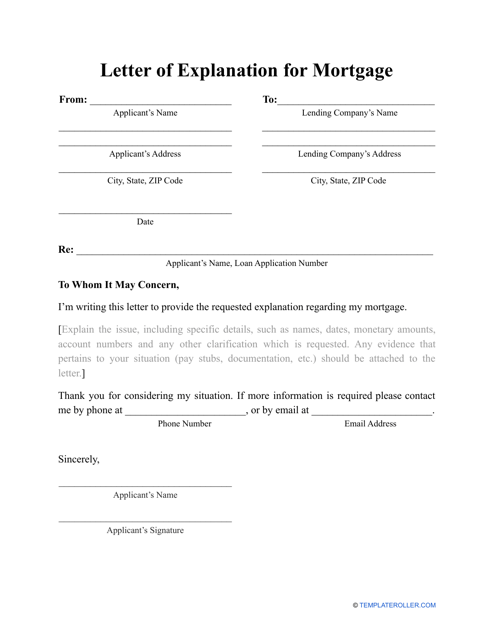

- Generic Letter of Explanation for Mortgage. Complete this pre-made template, print it out, sign it, and mail it.

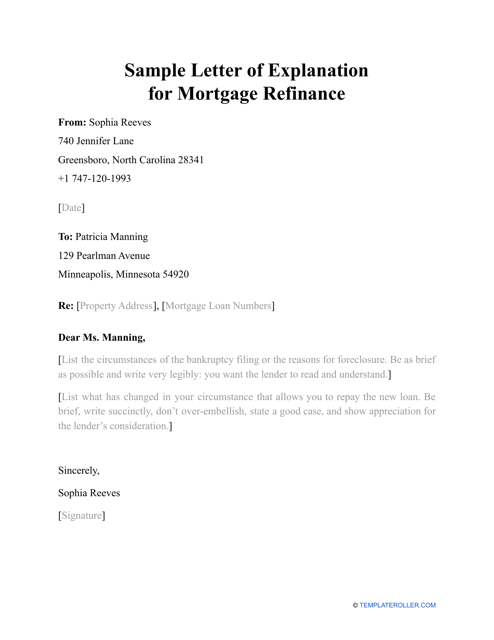

- Sample Letter of Explanation for Mortgage. Use this sample as a reference when drafting your letter. A good Mortgage Explanation Letter enhances your chances to obtain a mortgage and strengthens your relationship with the lender.

How to Write a Letter of Explanation for Mortgage?

To write a Letter of Explanation for Mortgage you will need to see from the lender’s notice what the subject is. It is of utmost importance not to take it personally and to stay as truthful as possible to keep the prospect of approval for a desired house’s purchase in mind. If there were job discrepancies or changes that are in question, clarify what circumstances lead to it. There’s no need for lengthy escapades, it is best to keep it brief and sincere. The response outline is simple:

- "Dear (the name of the underwriter or contact person)."

- "As a response to your notice, I’m replying with this statement."

- Covey the details about requested issues like address change, credit or employment history, etc.

- Ensure that if there are any other concerns, you are open for communication.

- Only include relevant specifics to present your current situation to the best of your knowledge to get a clear picture and to secure your mortgage approval.

- Sign your letter, print your name, and date it.

Not the form you were looking for? Check out these related documents:

Documents:

3

A borrower may use this type of letter in order to explain their financial situation and obtain a mortgage.

This letter is prepared by the borrower for a potential lender in order to answer certain questions that have been omitted in the mortgage application or during a personal interview.

This is a written document that can be used as a reference and prepared by a borrower who wants to improve their existing mortgage terms or receive a sum of money they can spend or invest.