Free Debt Management Forms and Templates

If you are struggling with unpaid loans and credit card debts, consider debt management. It is designed to help you determine how much you are currently able to pay toward your loan or debt, negotiate with your creditor, and use the money you can provide to pay the creditors until you no longer owe money.

A debt management plan means a third party that represents your interests works with your creditor to change interest rates and negotiate new monthly payments. These programs last between three to five years and help consumers, credit card owners, students, and mortgage payers to pay off their debts in their entirety. Set up a debt management plan if you can only afford to pay your creditor a small amount of money each month and your debt is unsecured – not backed by a guarantor, for instance, your car or house does not serve as collateral for the payment.

Debt Management: General Loans

General-purpose loans, also known as personal loans, allow you to use the funds at your discretion. Use these templates to communicate with your creditor or debt collector:

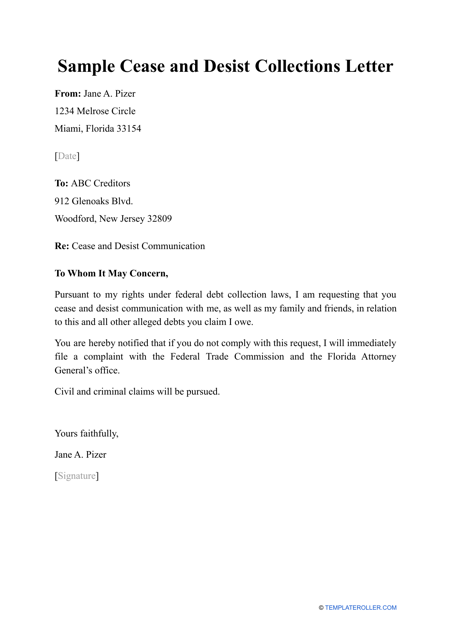

- A Cease and Desist Collections Letter is used to put an end to debt collectorphone calls.

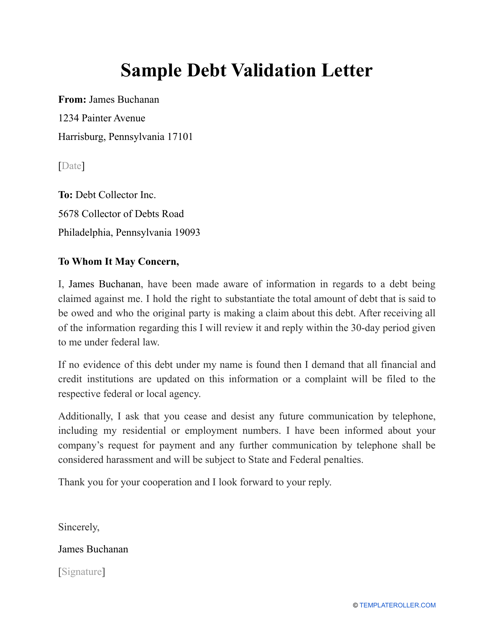

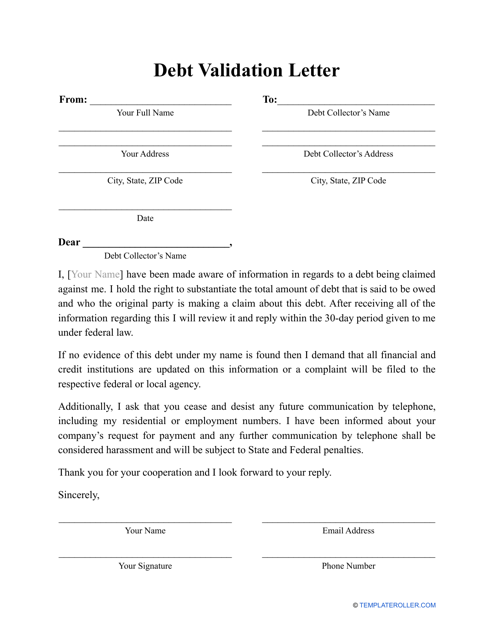

- A Debt Validation Letter is filled out to request proof of a debt from a debt collector so that you do not pay off a debt you do not owe or a debt that this collector has not been authorized to collect on.

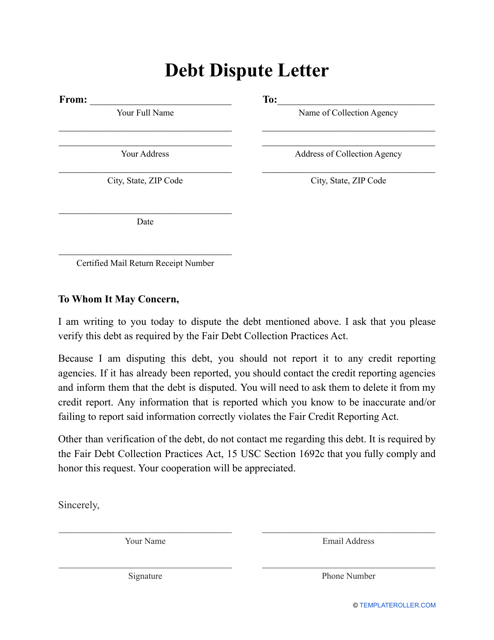

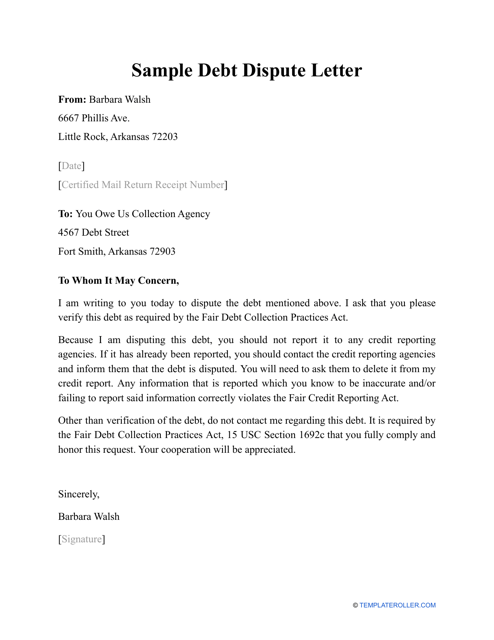

- A Debt Dispute Letter is completed if you doubt the amount owed is accurate – ask the collector to validate the debt. It may also contain any debt-related complaint you have.

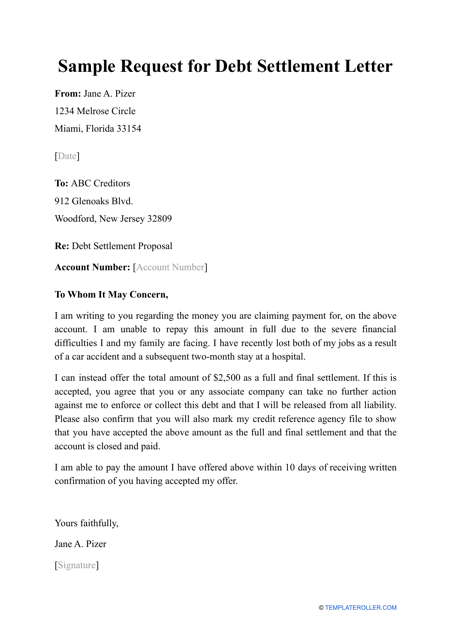

- A Request for Debt Settlement Letter is written by a debtor to ask their creditor to pay less than the debtor currently owns or agree on a different payment plan.

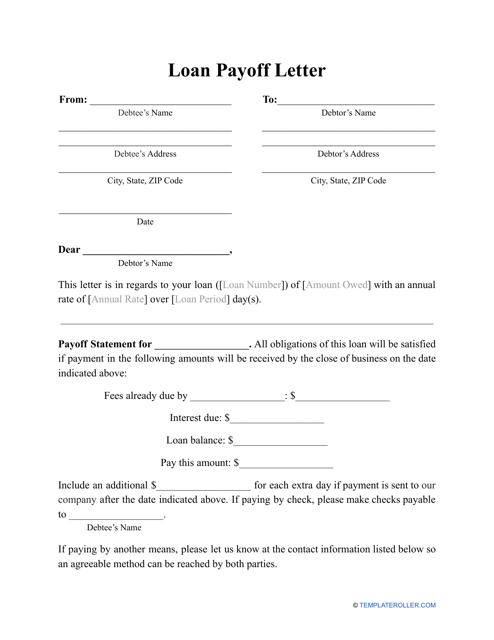

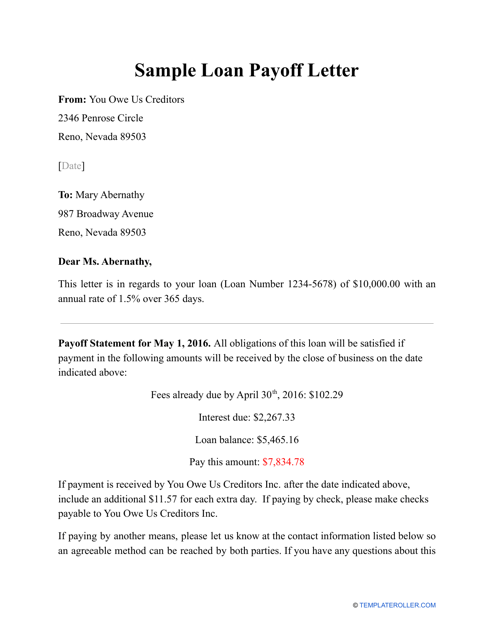

- A Loan Payoff Letter is a document that includes all the details related to your debt – how much you owe and what options you have at your disposal for paying off the debt.

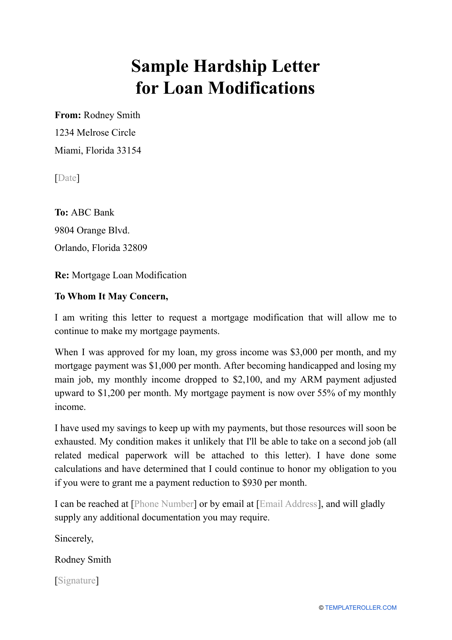

- A Hardship Letter for Loan Modifications is a statement that describes why the borrower cannot make their loan payments and states which kind of hardship you are suffering from now (loss of job or income, illness, legal expenses, etc.)

Debt Management: Credit Card Debt

If you cannot pay off the monthly balance of your credit card and look for a way to regain control over your finances, start managing debt and send these documents to your creditor:

- A Credit Card Debt Settlement Letter serves as the first step to ask the credit card company to settle for less than full balance.

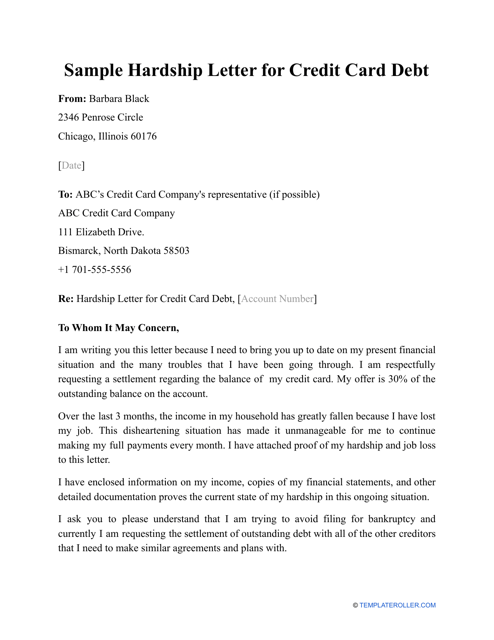

- A Hardship Letter for Credit Card Debt explains the difficult financial situation of the debtor and asks whether it is possible to suspend late fees, reduce payments for a time, or lower interest rates.

Debt Management: Student Loan Debt

See the templates below and start dealing with outstanding student loan debt if you are behind in payments and are unable to pay off the debts at the moment:

- An Unemployment Deferment Request allows borrowers to postpone the student loan payments if they do not have a stable source of income.

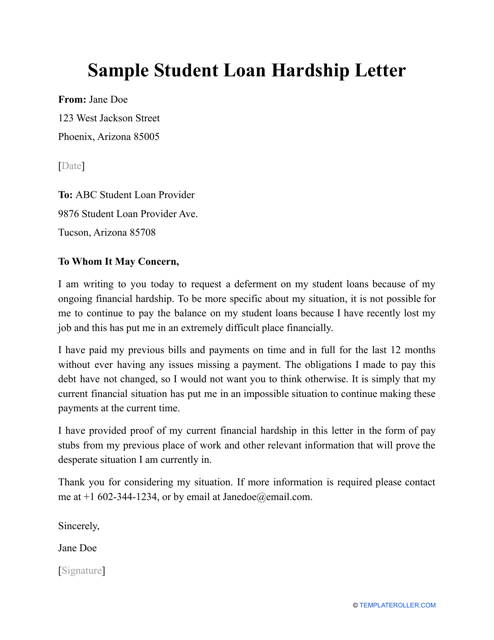

- A Student Loan Hardship Letter is a request to get relief from the student loans for borrowers with temporary financial difficulties as a result, for instance, of a medical condition or deployment in the military.

Debt Management: Mortgage

The documents below are for businesses and individuals who deal with a mortgage or struggle to make mortgage payments:

- A Mortgage Interest Tax Form (IRS Form 1098) is filled out by mortgage businesses to report mortgage interest of $600 and more received from individuals.

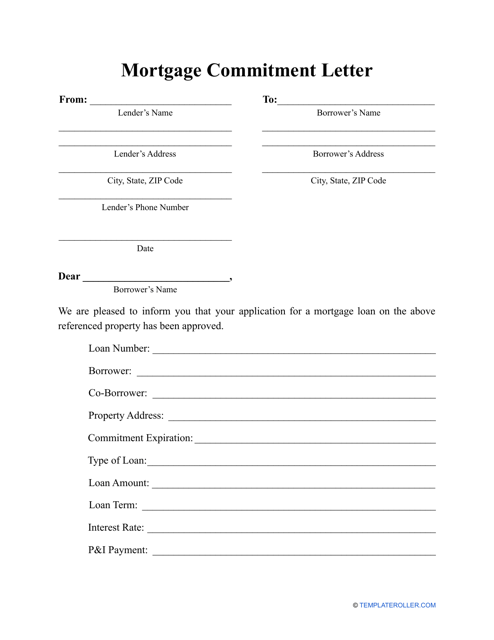

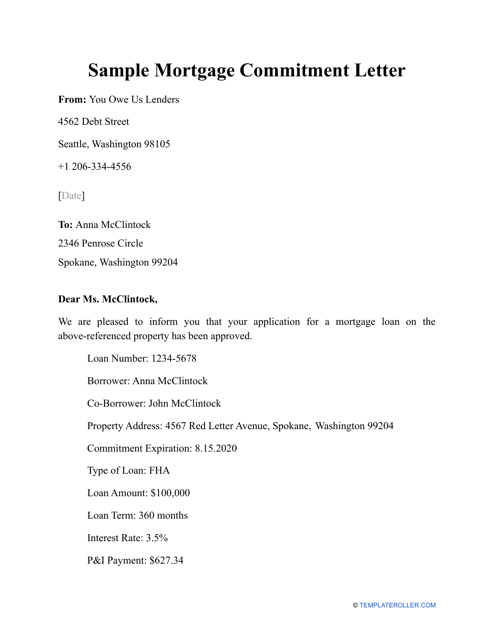

- A Mortgage Commitment Letter is sent by the lender to the potential homeowner to confirm they have passed the guidelines and to certify that the loan is completely approved.

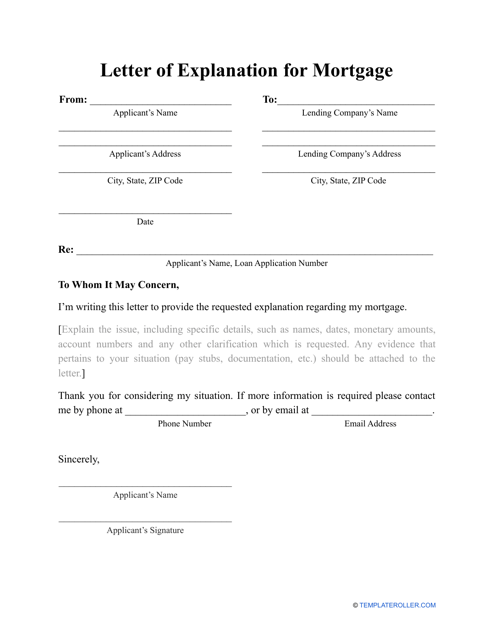

- A Letter of Explanation for Mortgage is sent by the borrower to the lender to explain the source of income, negative marks on the credit report, and other questions that arise during the loan application process.

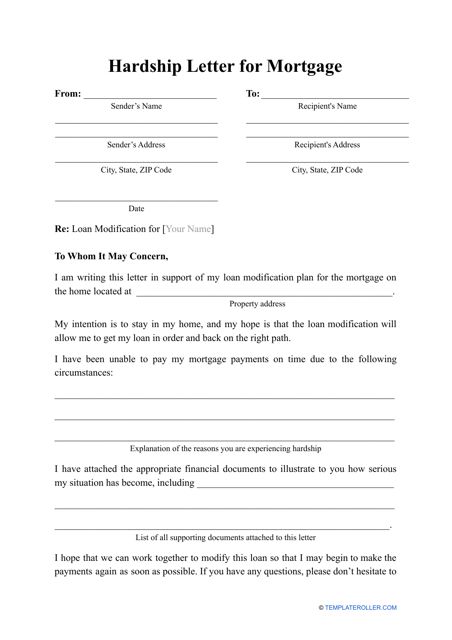

- A Hardship Letter for Mortgage explains the circumstances that affect the borrower’s ability to pay the mortgage.

Not the topic you were looking for? Check out these related articles:

- Learn how tofile bankruptcy;

- Find out how to handle an eviction notice;

- Read about small business debt relief;

- Browse unemployment claim forms by state.

Documents:

18

Owners of credit cards can reduce their debt by submitting a Hardship Letter explaining their situation to their credit card company.

This form is used when an applicant needs to defer payments on their student loan (or decrease, modify, etc.) due to a financial hardship situation.

This type of letter can be used to officially demand a debt collector to stop contacting the sender of the letter.

This type of debt settlement letter is used by filers who want to decrease the debt on their credit card.

Individuals use this letter to explain the reasons why they are applying for a loan modification and offer possible loan modifications in order to make it easier for them to pay it back.

Complete this ready-made template to explain to the bank why you're defaulting on your mortgage.

This document's purpose is to help a debtor decrease their debt or change the terms of paying it back in order to make it easier for them.

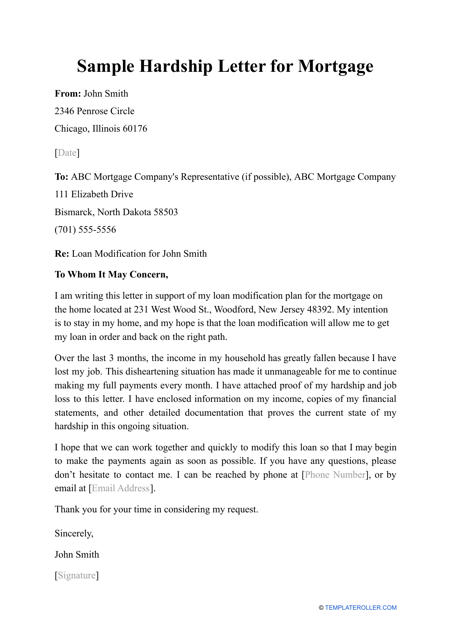

Use this sample as a reference when drafting your own Hardship Letter for Mortgage.

An individual or entity may prepare this type of letter and send it to a financial institution that has notified them about a debt to find out whether this debt is legitimate.

Use this letter to request information about your credit history and any particular debts you may have.

This letter serves as a refusal to accept debt and is written in response to a collector's notice.

This is a written or typed letter that any individual can prepare when they have received a letter from a creditor or debt collector if they do not believe they owe any money or the amount of the debt indicated in the notice is not accurate.

This letter is sent to the borrower after their mortgage application is accepted.

This formal letter can be used to confirm the willingness of a lender to sign a mortgage agreement with a borrower.

This letter provides detailed instructions on how to pay off a loan.

Check out this sample before drafting your own Loan Payoff Letter.

A borrower may use this type of letter in order to explain their financial situation and obtain a mortgage.

This letter is prepared by the borrower for a potential lender in order to answer certain questions that have been omitted in the mortgage application or during a personal interview.