Free Loans and Credit Forms

Whether you are looking for new financial opportunities for your business or thinking about personal loans and credit , our guide will let you discover more about these financial instruments. See our library of templates below to start the loan process.

Loans and Credit: Agreement Templates

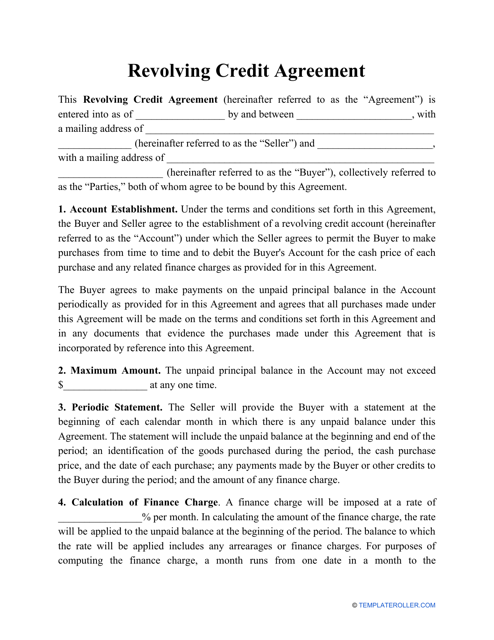

- Revolving Credit Agreement. It is signed by the financial institution and its customer to allow the use of extra funds in case the customer has exceeded the established credit limit.

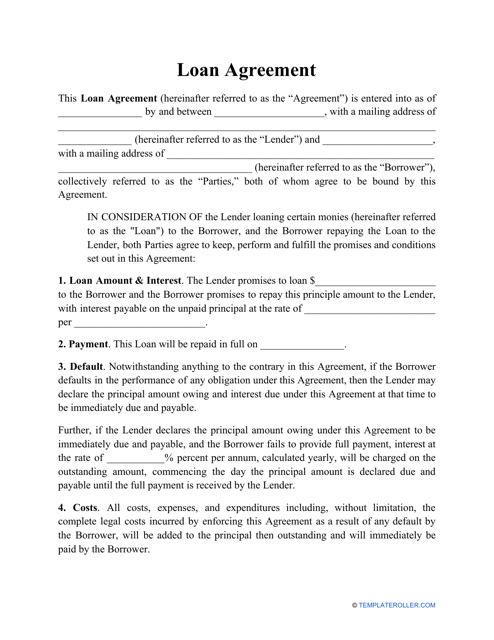

- Loan Agreement. These are the main documents that outline the rights and responsibilities of the lender and the borrower regarding the loan.

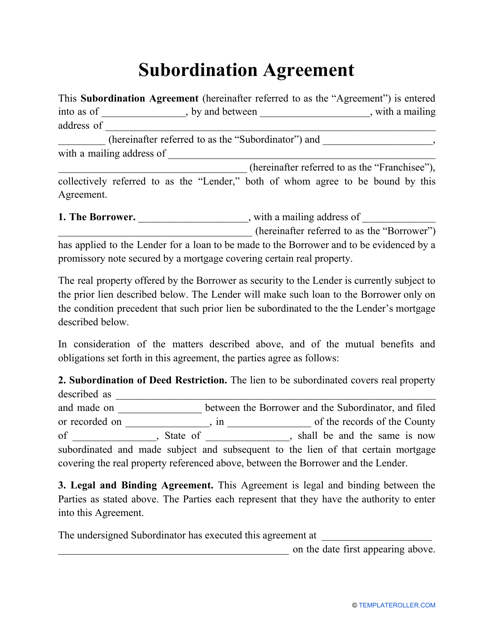

- Subordination Agreement. This agreement confirms that a borrower's existing debt has a preference before other debts of the borrower.

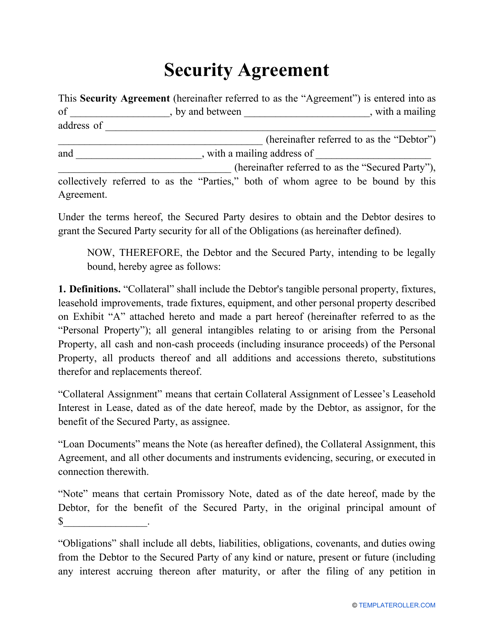

- Security Agreement. Security Contracts provide the lender with a security interest in a specified asset or property pledged as collateral.

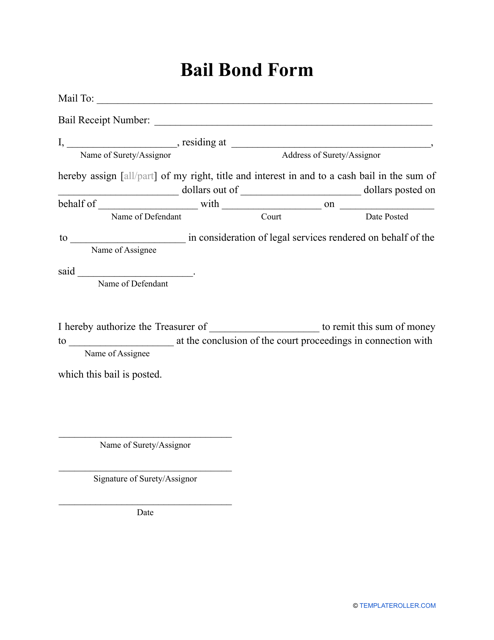

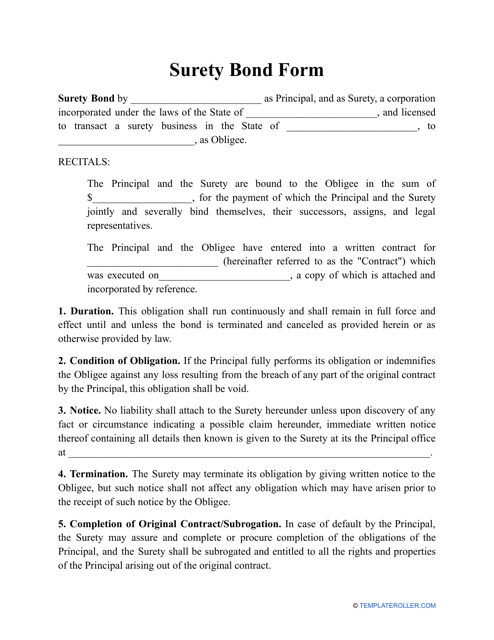

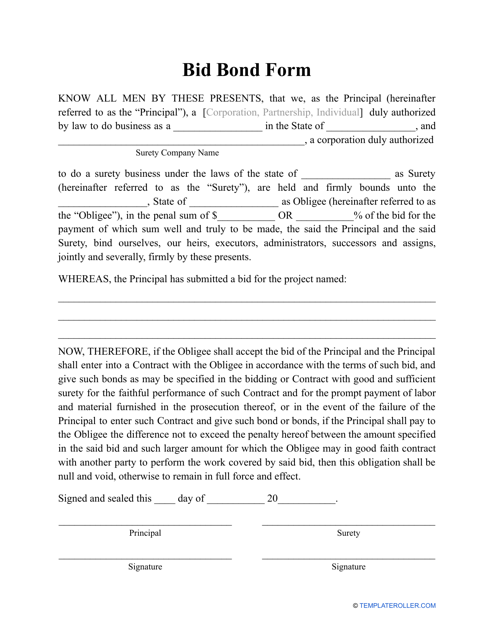

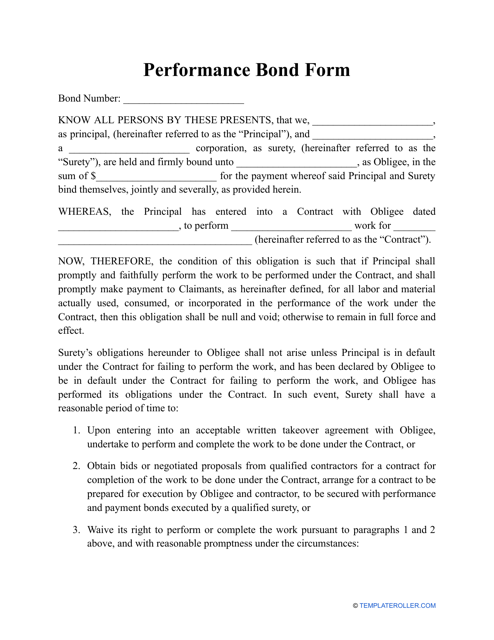

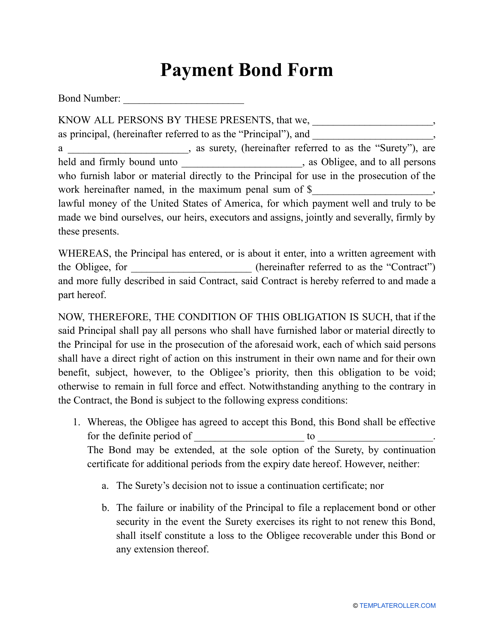

- Bond Form. This debt instrument represents a Loan Contract and specifies an obligation to return borrowed funds.

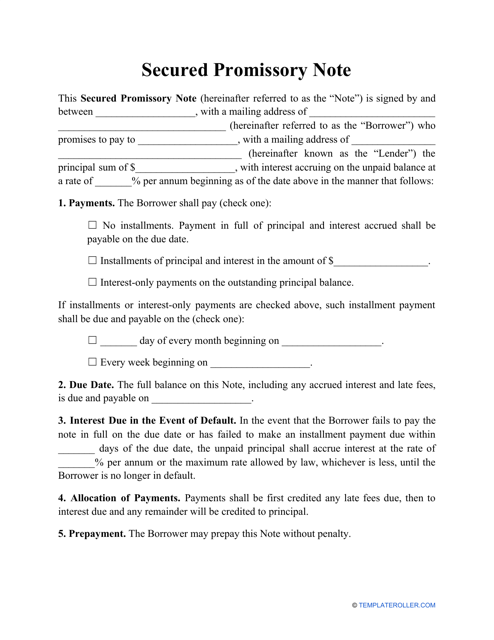

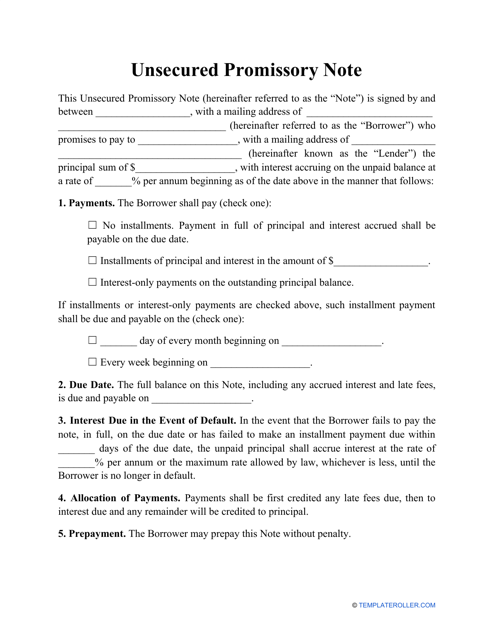

- Promissory Note. These are agreements that state how much money the borrower owes to the lender and break down the repayment structure.

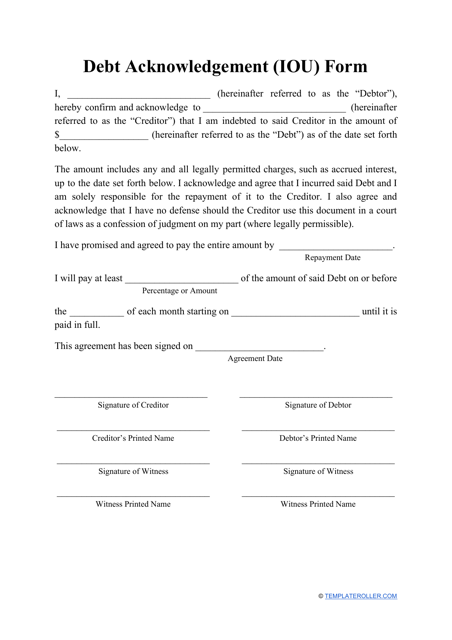

- IOU Template. When you need to borrow money from a close friend or relative, you can create this short document that establishes your promise to pay back the debt.

Loans and Credit: Letter Templates

- Credit Dispute Letters. These are written by borrowers and debtors to point out the omissions and discrepancies in their credit reports.

- Credit Denial Letters. If your application for credit was not approved, a lender will draft a statement explaining their reasoning and send it to you.

- Demand Letters. These are filled out by individuals and companies that want to notify their business partners, customers, and third parties about actions they must stop or payments they still owe.

Loans and Credit: Miscellaneous Templates

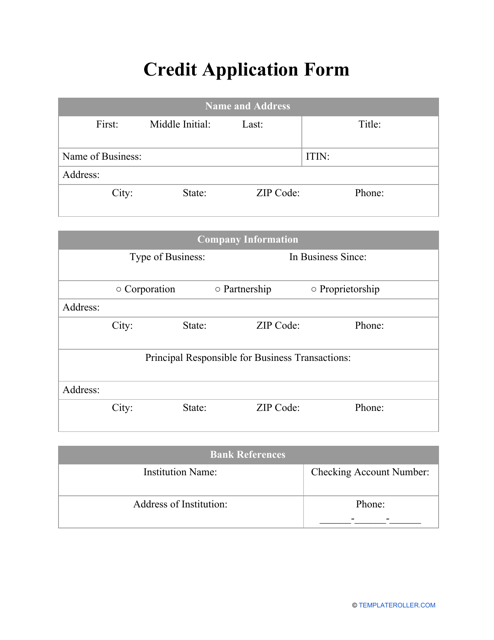

- Credit Application Form. Complete this form to introduce yourself to a prospective lender and show why you would be a good candidate for a loan.

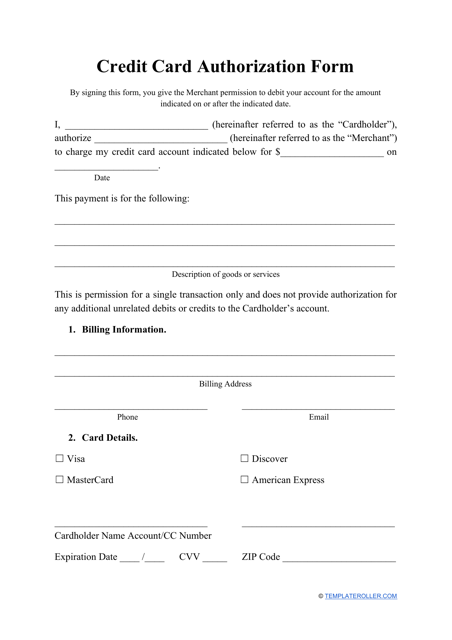

- Credit Card Authorization Form. Cardholders sign this document to give other parties permission to charge their credit card for various payments, usually on a regular basis.

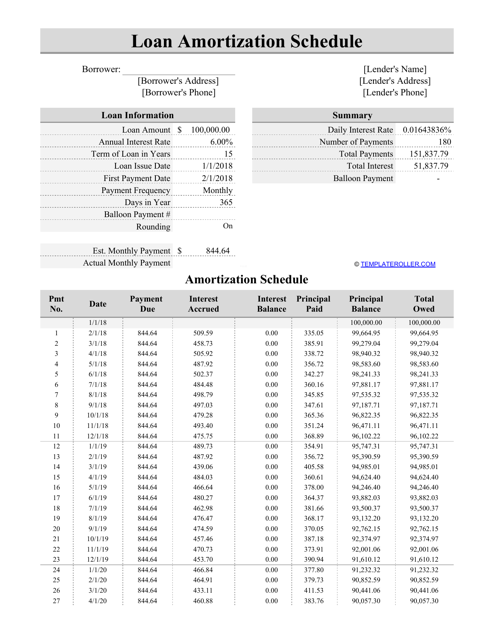

- Loan Amortization Schedule. Typically created in the form of a table or spreadsheet, this document will show you how much money you need to pay each month towards the loan until you fulfill your financial obligations.

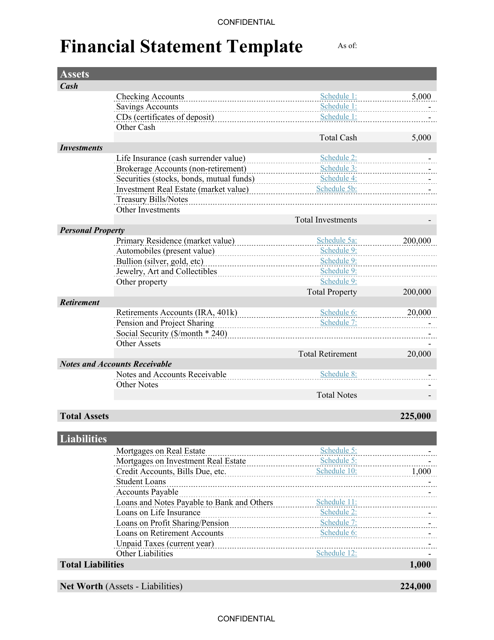

- Financial Statements. These describe in full detail the financial operations of the organization.

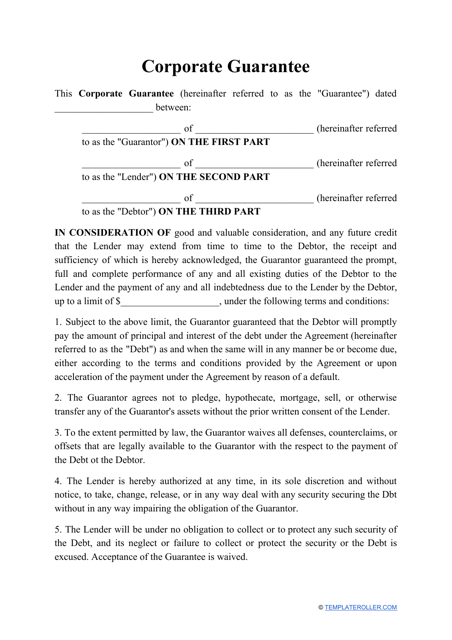

- Corporate Guarantee. It is composed when an insurance company provides financial protection to the loan.

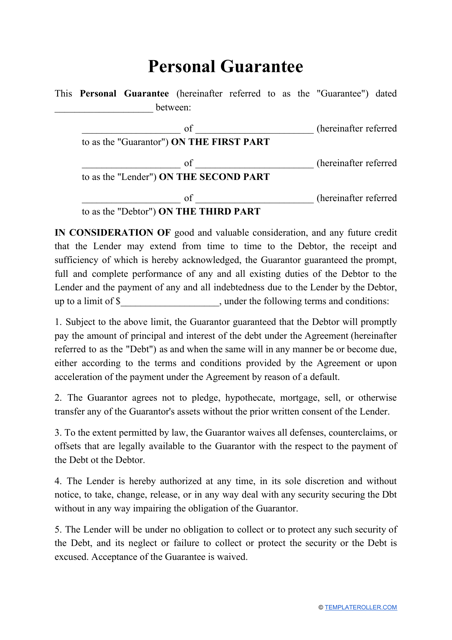

- Personal Guarantee. Draft this document when an individual promises to pay back the loan in case the original borrower fails to do so.

How Do Loans Work?

Before you negotiate and sign any loan agreements, you need to learn the basics about loans and credit and find out how you can borrow money at the lowest cost:

- The loan usually refers to a sum of money borrowed from a financial institution or an individual with the obligation to pay it back, generally with interest and fees;

- You pay the loan over time – several months or even years;

- Potential lenders will require a lot of documents from you before your loan application is approved – they will examine your credit history, financial situation, employment history, and other factors before agreeing to a loan;

- Interest rates are fixed or variable – they depend on your credit rating, amount of money borrowed, and the term of the loan.

The loan process includes four general steps:

- Applying for a loan. Contact a bank or individual that provides loans and notify them about your intention to take out a loan.

- Qualifying for a loan. Once the lender receives your application and supplemental documents, they will determine your eligibility for a loan.

- Receiving the loan funds in case of approval. Within weeks a loan will be sent to the account you indicate for a lender.

- Paying the loan balance. Your agreement with a lender will list the full loan amount and the due dates of installment payments that include interest.

Related Tags and Topics:

Documents:

73

You may use this legal agreement when an entity is facing bankruptcy between a borrower, lender, and guarantor, where a corporation (usually an insurance company) takes on the responsibility of ensuring a borrower repays their debt.

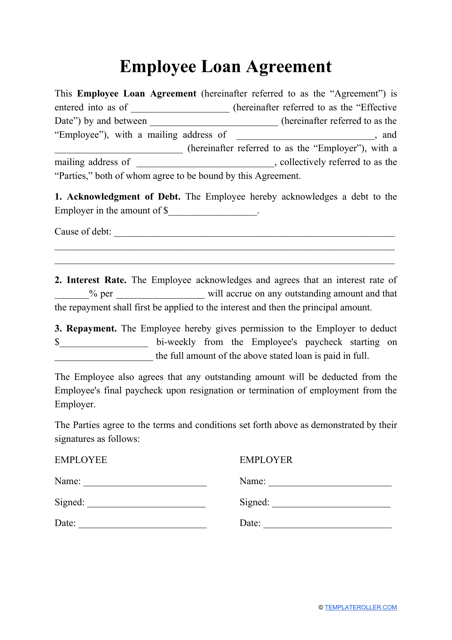

This contract contains the consent of an employer to provide a loan to an employee, which will be further deducted from the employee's payroll.

This form expresses a written promise by a guarantor to take responsibility for a debtor if they fail to pay their debt to a lender.

An IOU is a typed or handwritten document that outlines the details about the debt owed by one party (borrower, or debtor) to another (creditor, or lender).

The purpose of this document is to give permission to a seller to request payment once or on a regular basis when a credit card is not present.

According to a Revolving Credit Agreement, a seller allows a buyer to make purchases under this account on the terms and conditions established in the agreement.

This is a contract used to document and formalize all obligations that regulate receiving the loan and paying it back.

This document serves as a way for financial institutions to assess the creditworthiness of a potential individual or corporate customer.

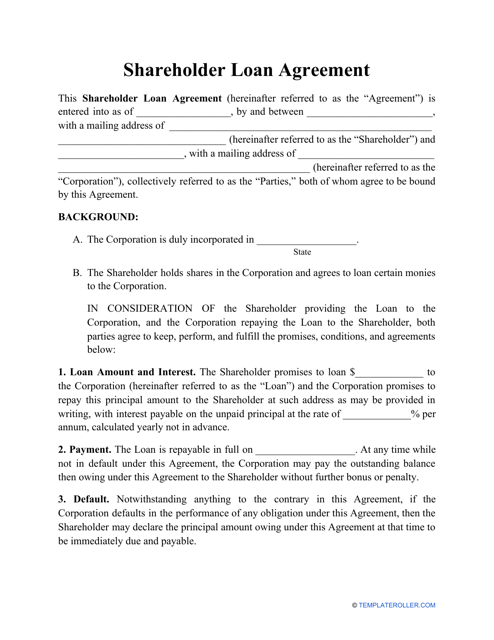

This type of agreement is used when a corporation borrows money from a shareholder in order to explain the details of the loan and to serve as evidence of the debt.

This is a formal document signed by a lender and a debtor by means of which the parties confirm the existing debt owed by the borrower has a preference before other debts of the borrower.

This is a formal document signed by a lender and a borrower in which the borrower provides their property or interest in an asset as collateral for a loan.

An individual can use this spreadsheet to outline payments for a loan, to calculate the money that goes towards the lender and to the interest until the borrower has paid off the entire amount of a loan.

This is a written record that conveys the activities and the financial performance of your business or company.

Individuals may use this template when they would like to secure a financial obligation to legally bind a borrower to pay their loan back to a lender.

This template establishes the basic terms of the agreement between a lender and a borrower regarding the money the former has provided the latter with.

A defendant may use this legal document to stay away from jail until their court date comes, provided that the court has received a financial guarantee that obliges the person to appear in person when the trial takes place.

This bond obligates the principal to perform some kind of work for the obligee, and the third party promises to compensate the obligee if the principal fails to comply with their responsibilities.

This is a financial agreement that guarantees that a contractor selected for a specific job will fulfill all of the obligations listed in the text of the bid.

This form confirms the surety's obligation to make a payment towards the owner of a construction project in case their contractor failed to comply with their responsibilities.

You may use this document to protect the interests of subcontractors and suppliers that are working on a specific project.

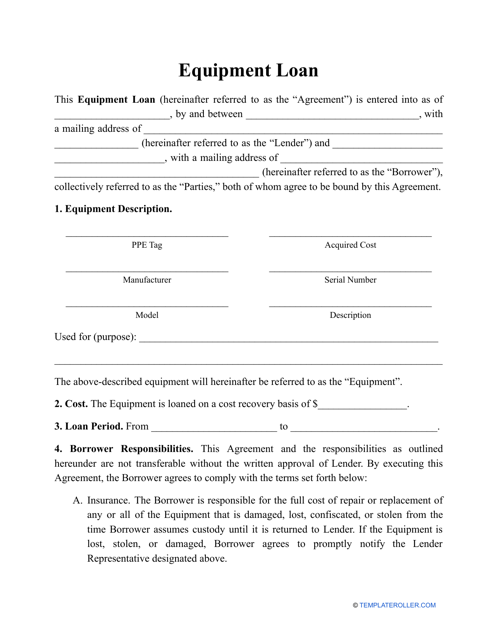

An individual or organization may use this type of template to loan out specific equipment to colleagues in various departments.

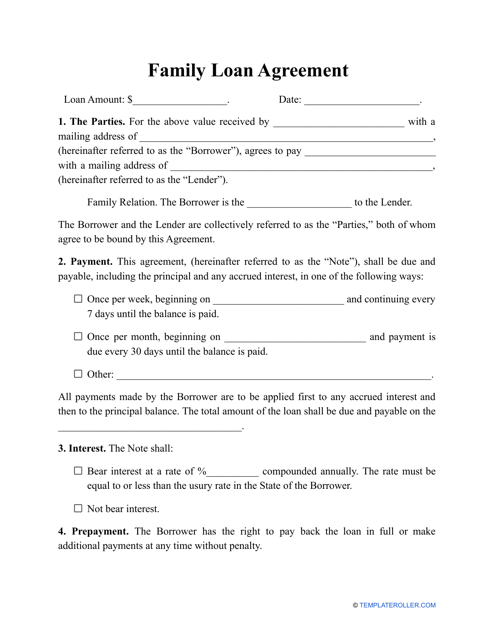

This type of template is used by individuals that are related by marriage or blood and want to record the amount of money one of the relatives gives to the other and the terms of repayment.

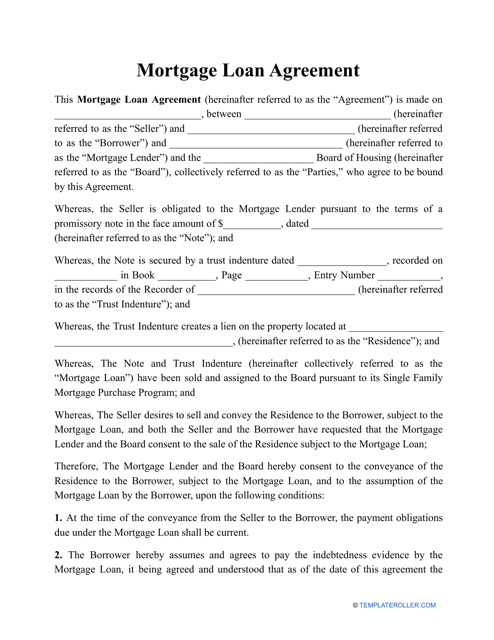

Upon signing this type of template, this legal instrument gives the latter access to the lender's money creating a lien on the real estate.

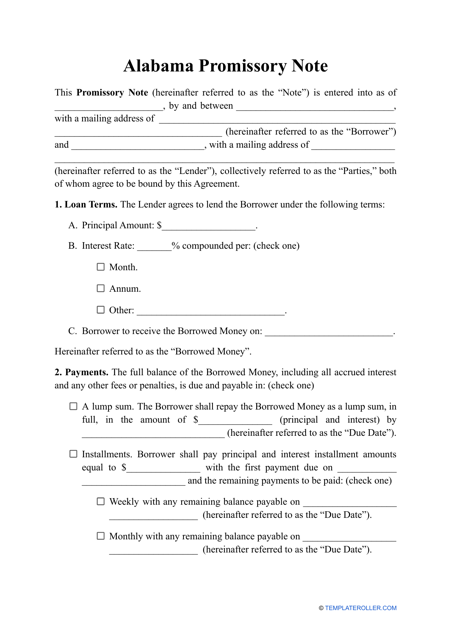

This document provides a template for a promissory note in the state of Alabama. A promissory note is a written agreement that outlines the terms and conditions of a loan or debt. It includes information such as the amount borrowed, repayment terms, and interest rate. The template can be customized to suit the specific needs of the borrower and lender.

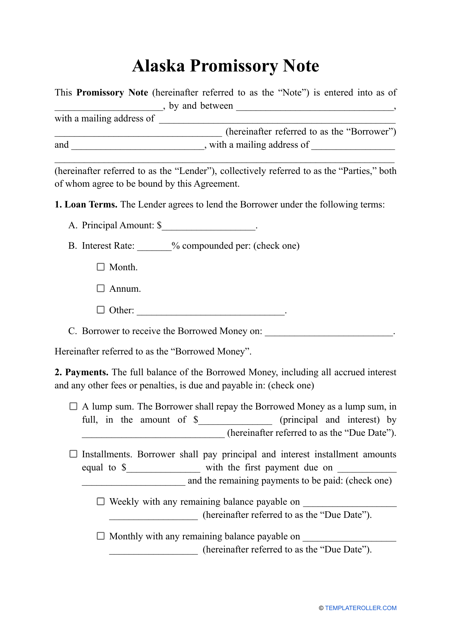

This type of document is used for creating a promissory note in the state of Alaska. It outlines the terms and conditions of a loan or debt agreement between a borrower and a lender.

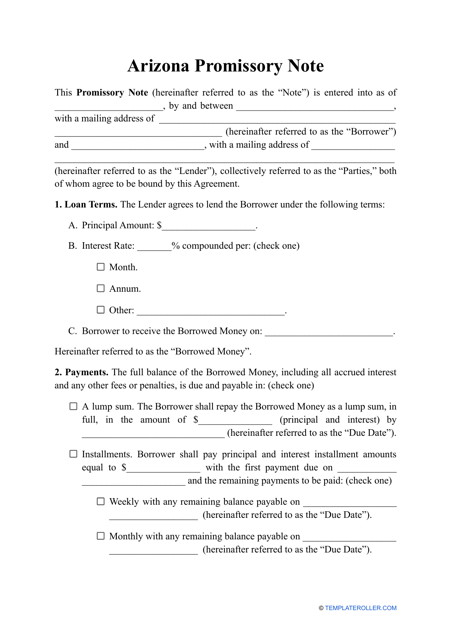

This document provides a template for a promissory note in Arizona. It establishes a legal agreement between a borrower and a lender regarding a loan.

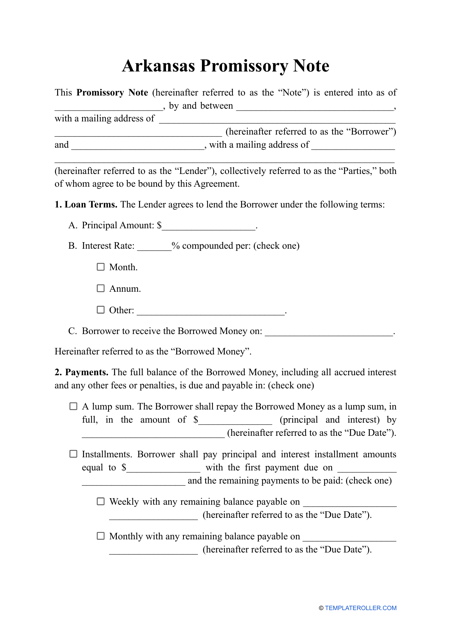

This type of document is a promissory note template specific to the state of Arkansas. It is used for creating a legally binding agreement between a borrower and a lender regarding the repayment of a loan.

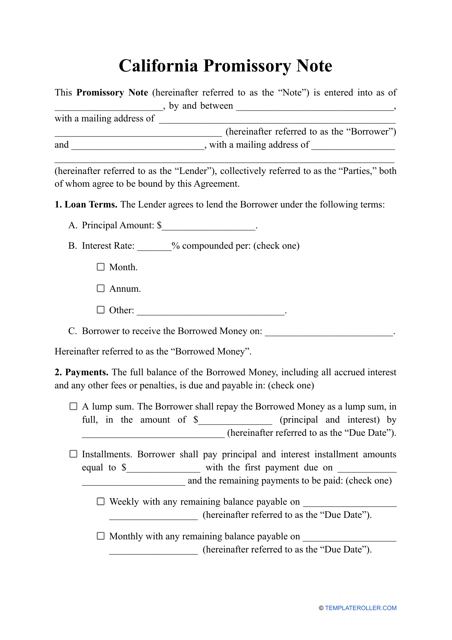

This document is a template for a promissory note in the state of California. It outlines the terms and conditions of a loan, including the repayment schedule and interest rate.

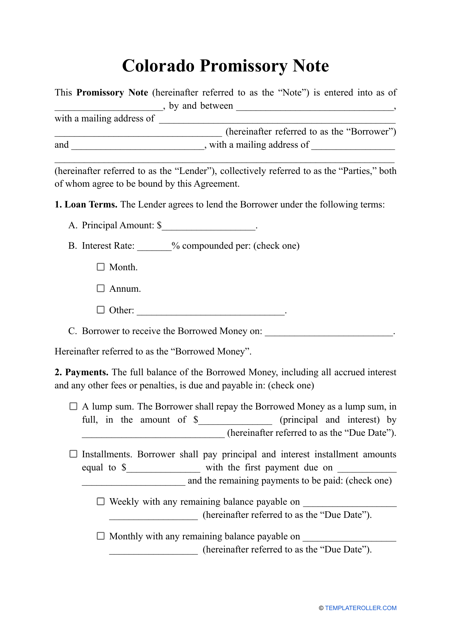

This form is used for creating a legally binding agreement in Colorado where one party agrees to pay a specified amount of money to another party by a specified date in the future.

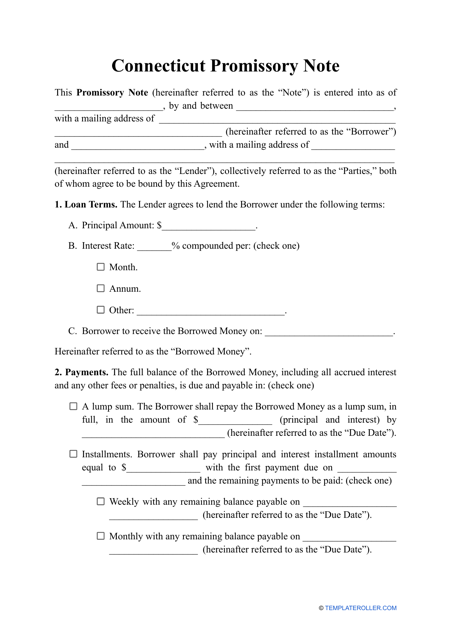

This document is a promissory note template specifically designed for use in Connecticut. It outlines the terms and conditions for repayment of a loan or debt.

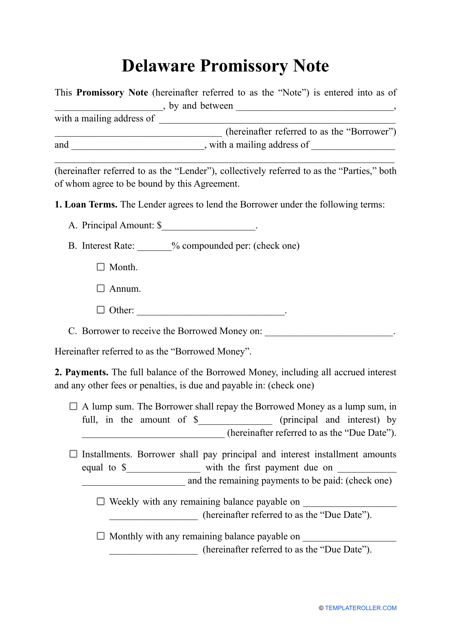

This document is a template for a promissory note, which is a written agreement outlining a borrower's promise to repay a loan to a lender. It is specifically designed for use in the state of Delaware.

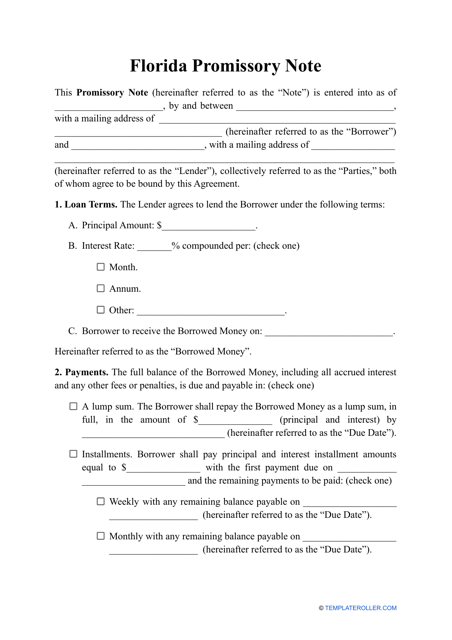

This document template is used for creating a promissory note in the state of Florida. A promissory note is a legal agreement where one party promises to pay a specific amount of money to another party at a designated time.

This document is a Promissory Note template specific to the state of Georgia in the United States. It is used to record a promise to repay a debt.

This type of document is a promissory note template specific to the state of Hawaii. It is used to record a promise to pay back a loan or debt.

This document is a template for a promissory note in the state of Idaho. It outlines the terms and conditions of a loan agreement between a borrower and a lender.

This document is a template for creating a promissory note in the state of Illinois. A promissory note is a legal document that outlines a promise to repay a loan or debt. It includes details such as the amount borrowed, interest rate, repayment terms, and any penalties for non-payment. Using a template can help ensure that all necessary information is included and the note is legally binding.

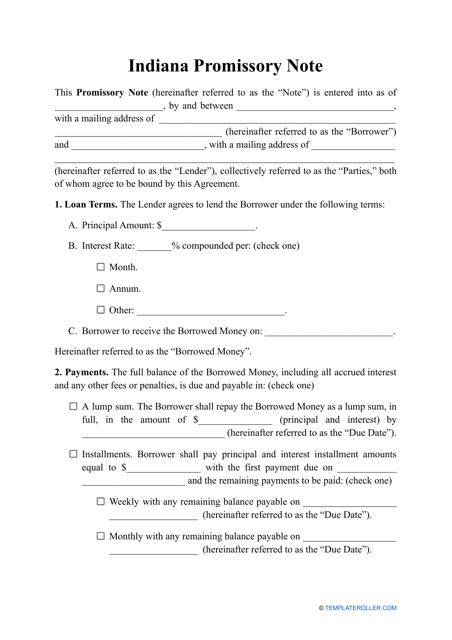

This document is a template for creating a promissory note in Indiana. A promissory note is a legal document that outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. This template can be customized to meet the specific needs of the borrower and lender in Indiana. Use this template to ensure a clear and legally binding agreement for a loan in Indiana.

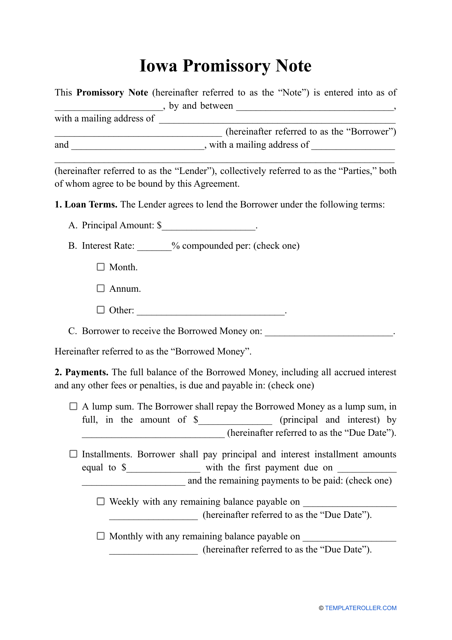

This document template is used in Iowa to create a legally binding agreement between a borrower and a lender, outlining the repayment terms and conditions of a loan.

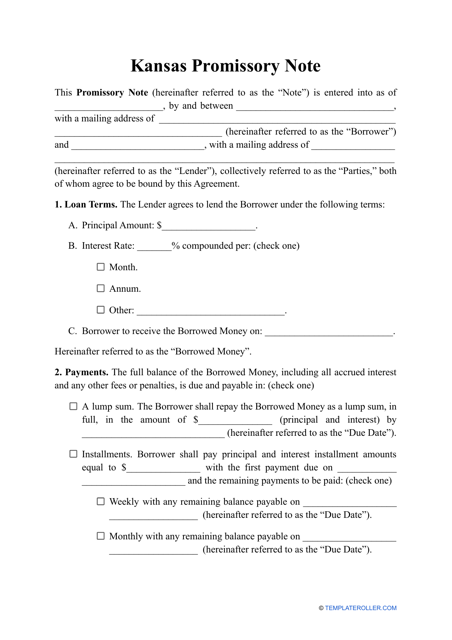

This document is a Promissory Note template specific to the state of Kansas. It is used to outline the terms and conditions of a loan or debt agreement between two parties.

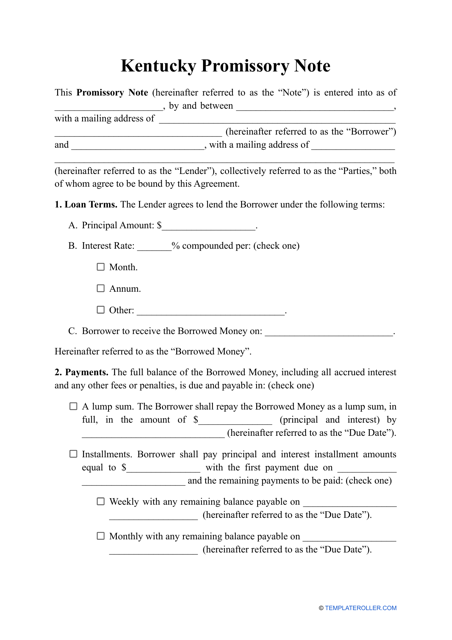

This document is a legally binding agreement between a borrower and a lender in the state of Kentucky. It outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and consequences of defaulting on the loan. This template can be used to create a promissory note specific to Kentucky.