Fill and Sign Washington Legal Forms

Related Articles

Documents:

12640

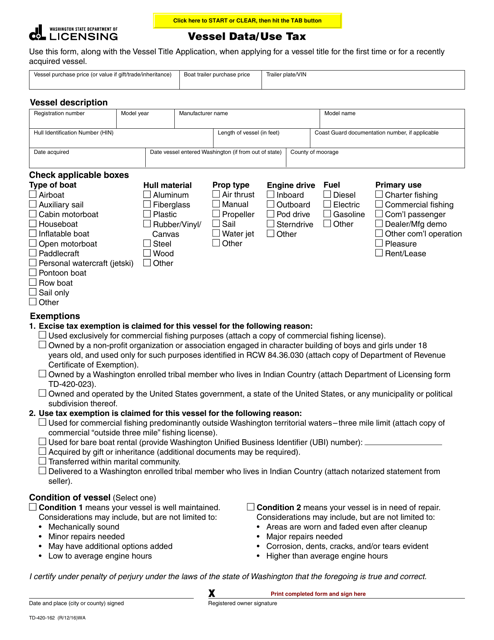

This Form is used for declaring vessel data and paying use tax in the state of Washington.

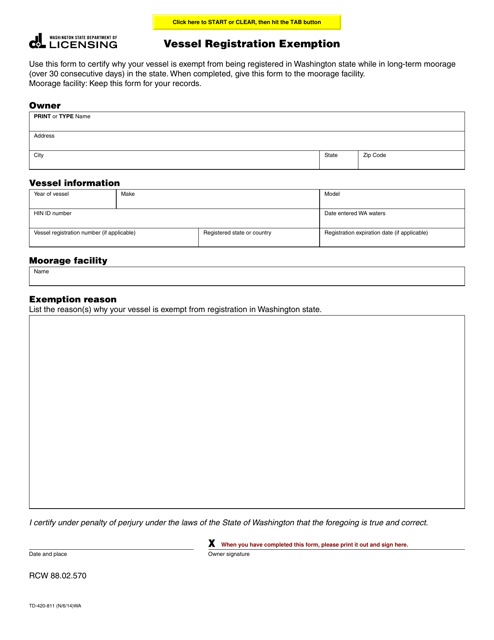

This Form is used for applying for a vessel registration exemption in the state of Washington.

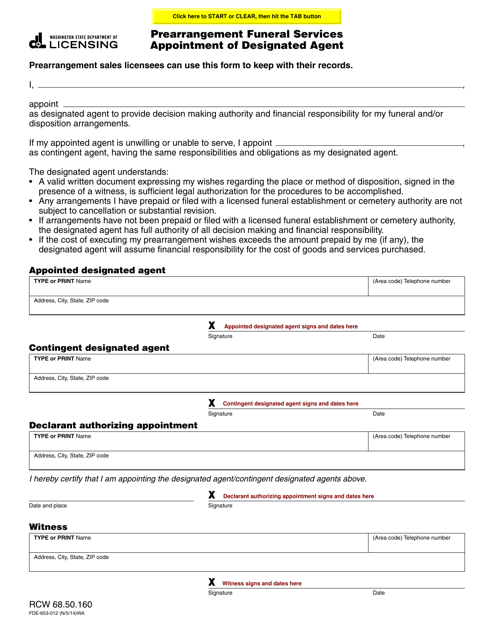

This form is used for appointing a designated agent for prearrangement funeral services in Washington.

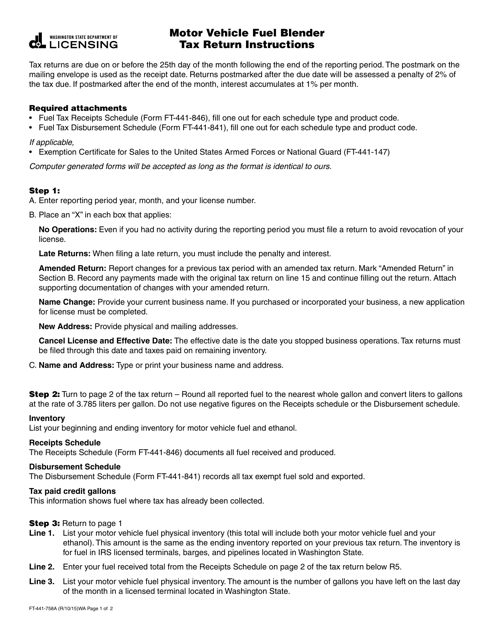

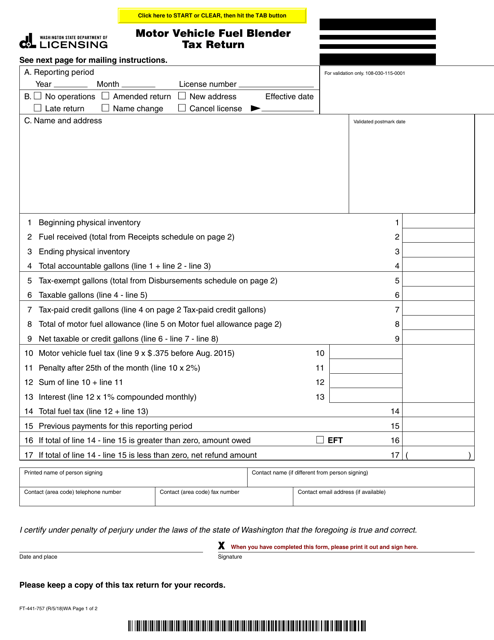

This Form is used for reporting and paying motor vehicle fuel blender tax in the state of Washington. It provides instructions on how to complete the tax return and fulfill your tax obligations as a fuel blender.

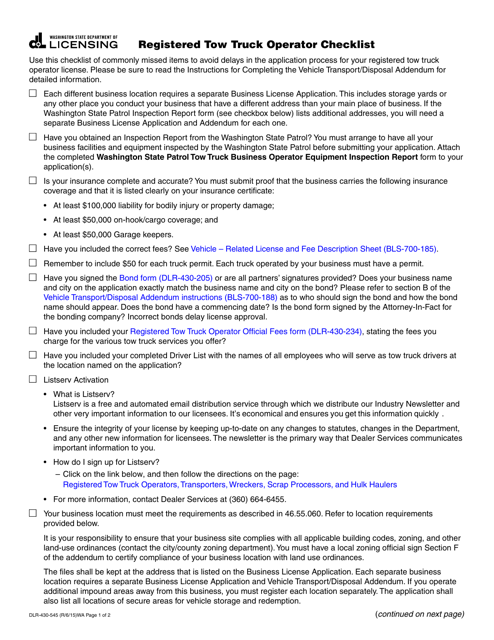

This document is used for registering and obtaining a checklist for tow truck operators in the state of Washington. It outlines the requirements and steps needed to become a registered tow truck operator.

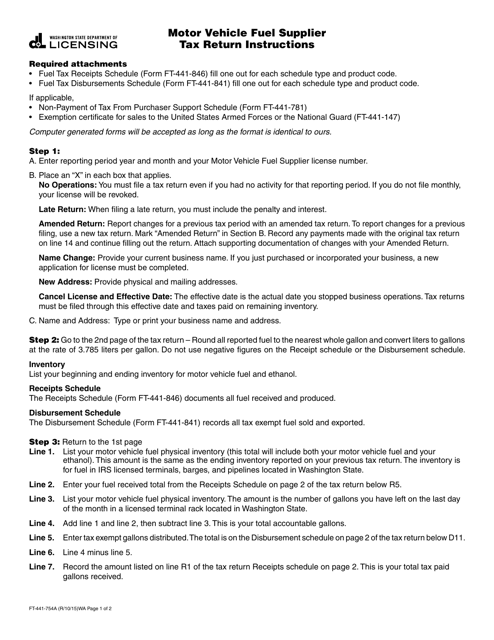

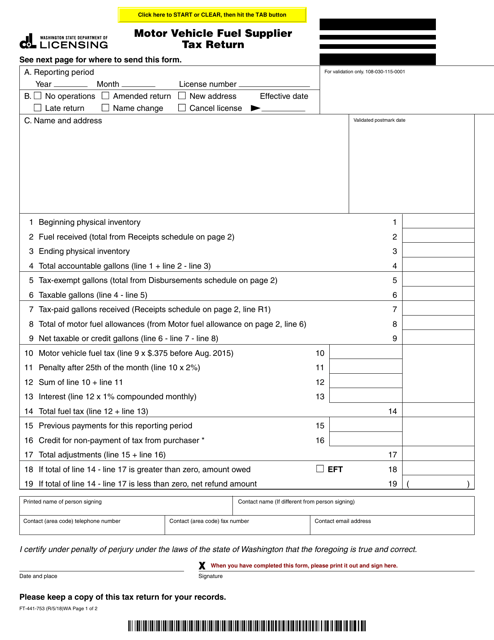

This Form is used for filing the Motor Vehicle Fuel Supplier Tax Return in the state of Washington. It provides instructions on how to complete and submit the form.

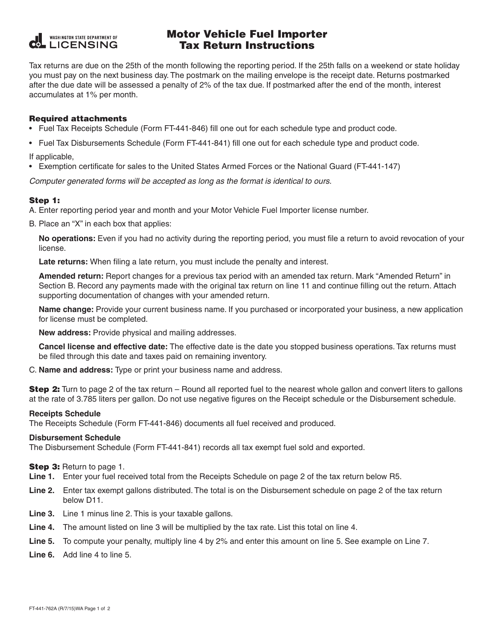

This document is used for filing the Motor Vehicle Fuel Importer Tax Return in the state of Washington. It provides instructions on how to accurately report and pay the required tax for importing motor vehicle fuel into the state.

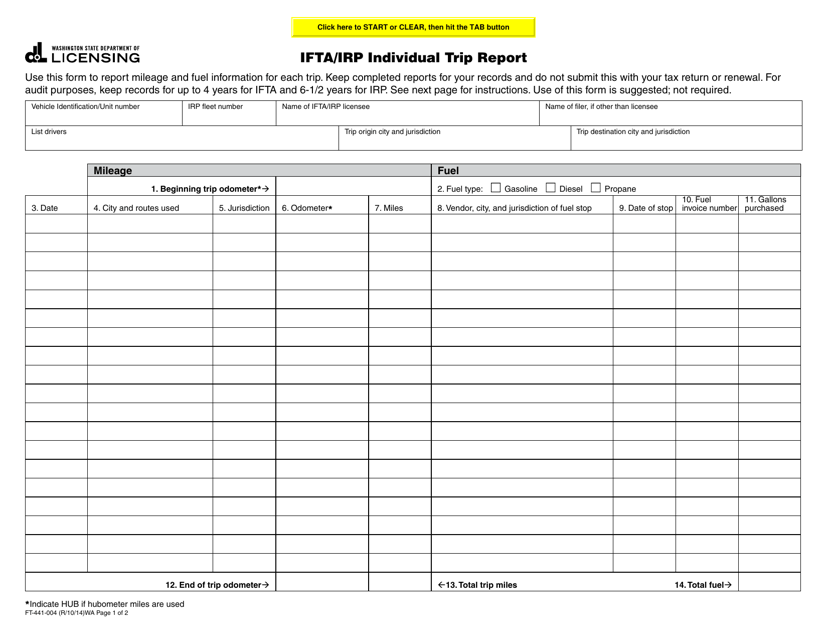

This form is used for reporting individual trips for IFTA/IRP purposes in the state of Washington.

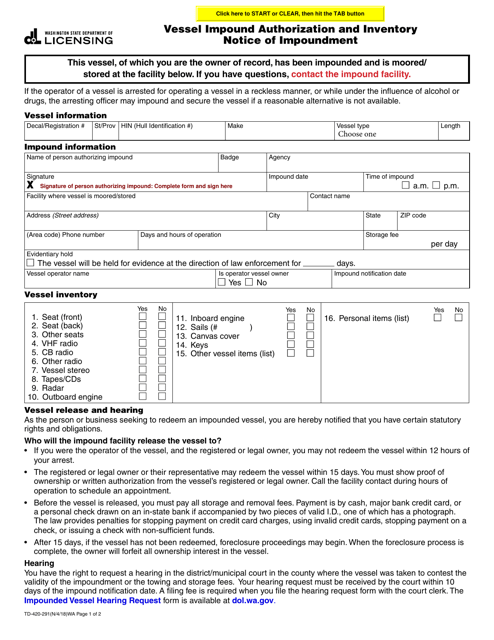

This document is used for authorizing the impoundment of a vessel and providing an inventory notice of improvement in Washington.

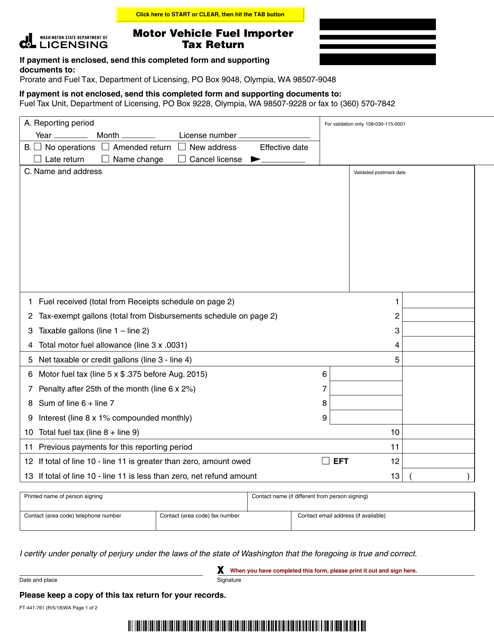

This form is used for reporting and paying the motor vehicle fuel importer tax in the state of Washington.

This form is used for motor vehicle fuel suppliers in Washington to report and pay their taxes.

This form is used for reporting and paying motor vehicle fuel blender taxes in the state of Washington.

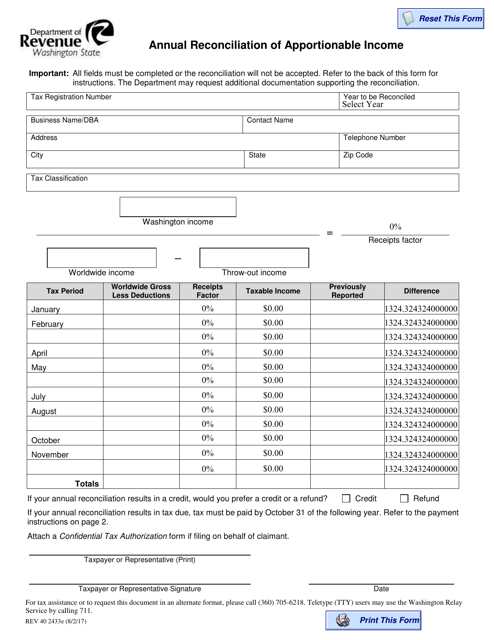

This form is used for the annual reconciliation of apportionable income in the state of Washington. It is used to determine the amount of income that is subject to taxation in the state.

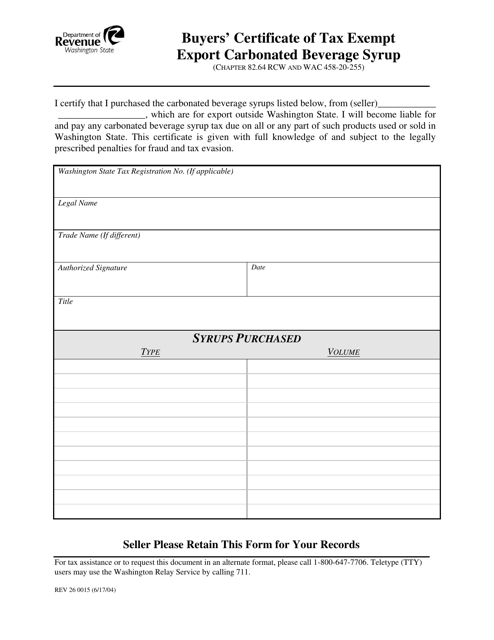

This Form is used for buyers in Washington to certify their tax-exempt export of carbonated beverage syrup.

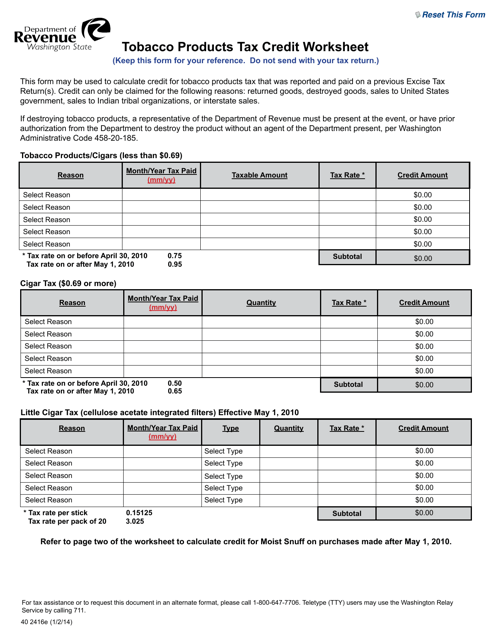

This form is used for calculating the tax credit for tobacco products in Washington state.

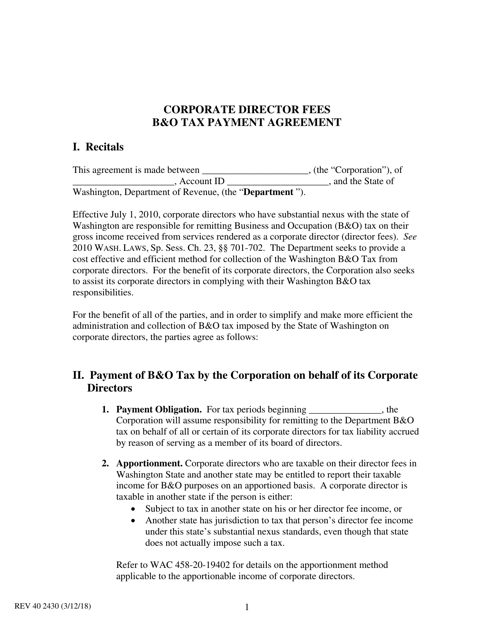

This form is used for corporate directors in Washington to make B&o tax payment agreements for their fees.

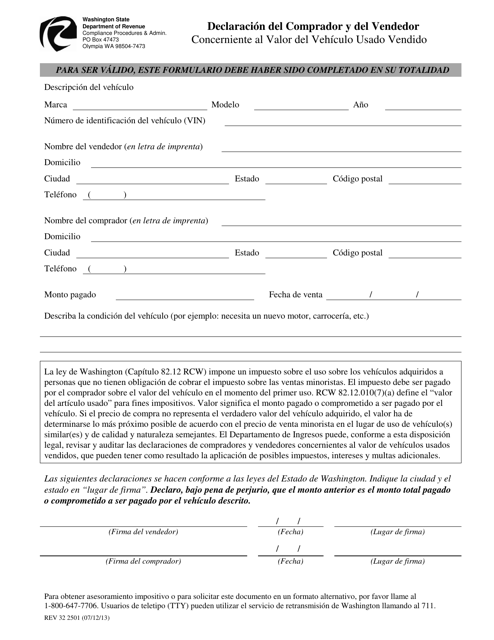

This Form is used for declaring the value of a used vehicle sold in Washington. It must be filled out by both the buyer and the seller.

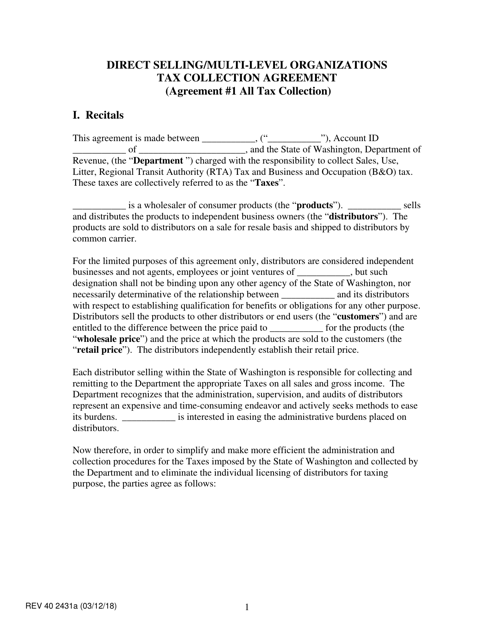

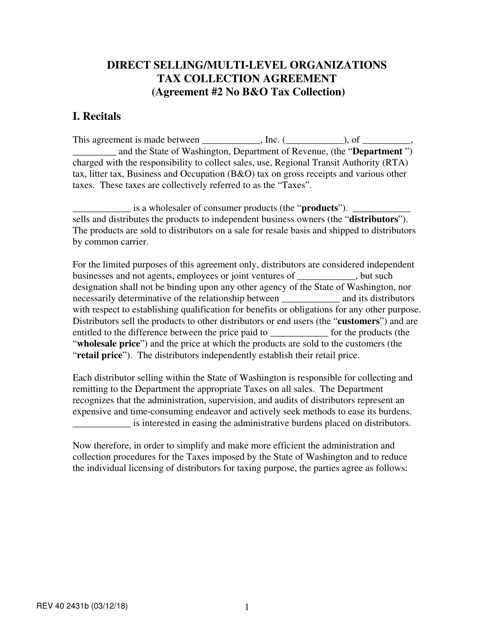

This form is used for tax collection agreements with direct selling and multi-level organizations in Washington state.

This Form is used for Direct Selling/Multi-Level Organizations to collect taxes in the state of Washington.

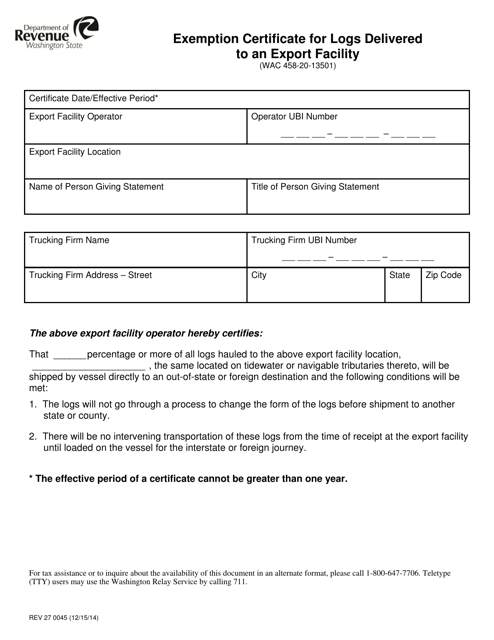

This form is used for requesting an exemption certificate for logs delivered to an export facility in Washington. It allows log exporters to certify that the logs will be exported and not subject to certain taxes.

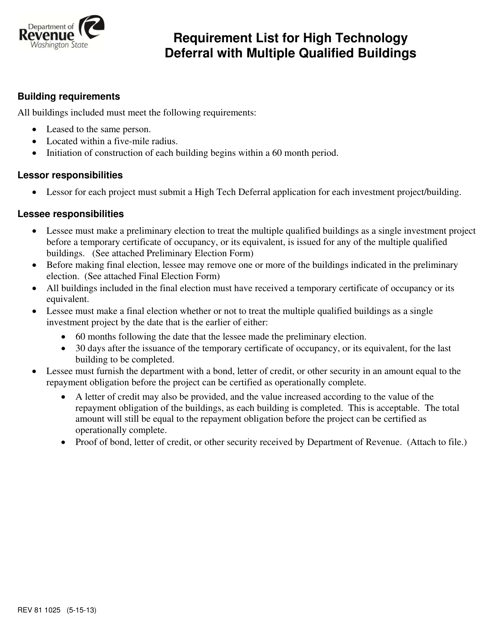

This form is used for listing the requirements for deferring high technology taxes with multiple qualified buildings in Washington.

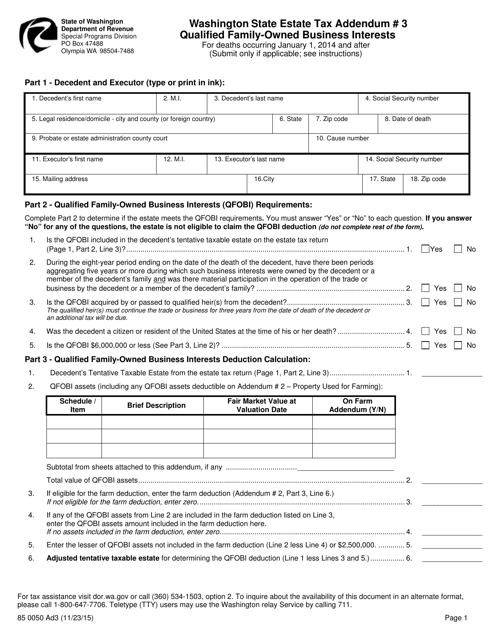

This form is used for reporting qualified family-owned business interests for Washington State Estate Tax purposes.

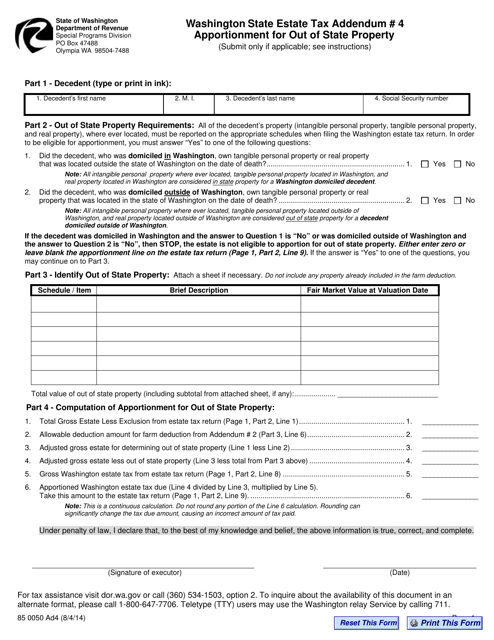

This form is used for apportioning out-of-state property for estate tax purposes in Washington State.

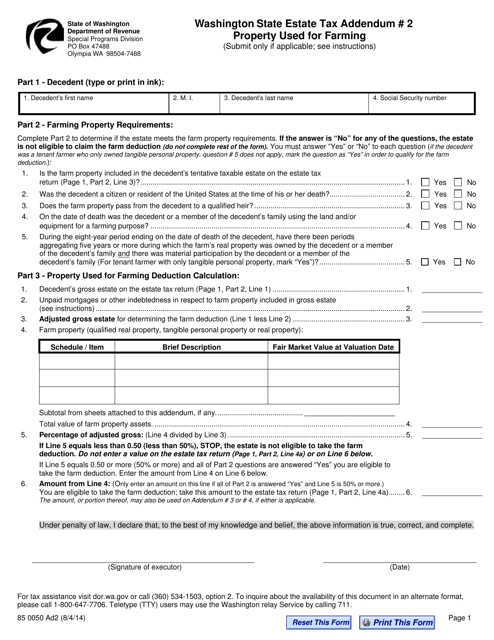

This form is used for reporting additional property used for farming in Washington state for estate tax purposes.