Fill and Sign New York Legal Forms

Related Articles

Documents:

10834

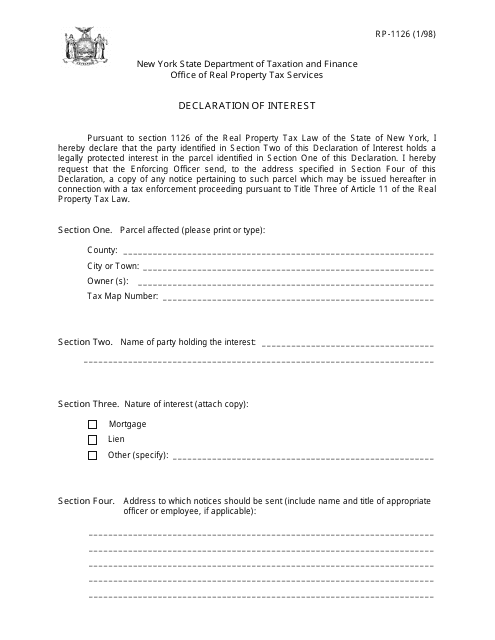

This form is used for declaring your financial interest in a property or business in the state of New York.

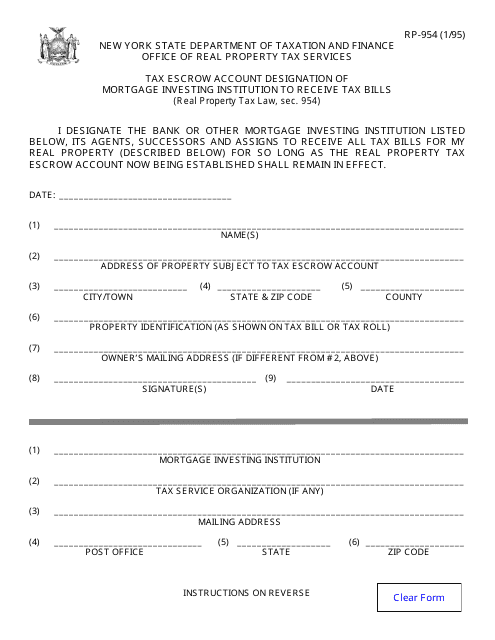

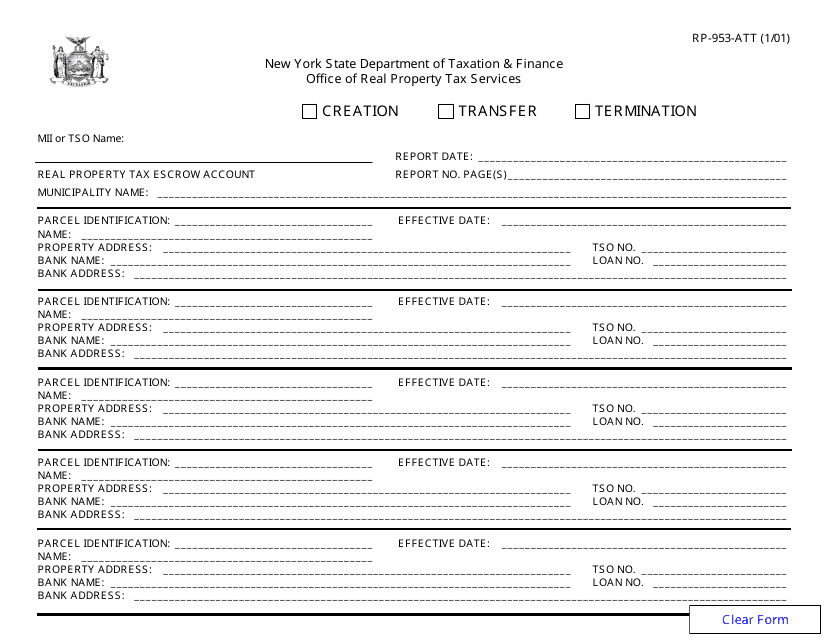

This document is used for designating a specific mortgage institution to receive tax bills for a tax escrow account in New York.

This form is used for creating a list of properties that are affected by a specific event or regulation in the state of New York. It helps to keep track of the properties that may be impacted and gather important information about them.

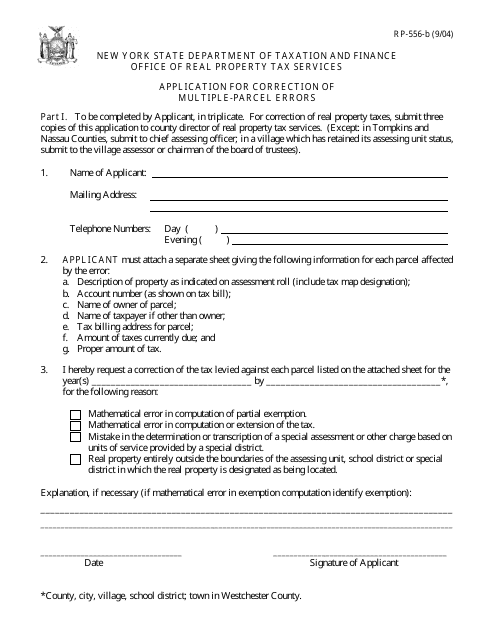

This form is used for requesting a correction of errors that involve multiple parcels of land in New York. It is necessary when there are inaccuracies or mistakes in the records related to multiple parcels of land.

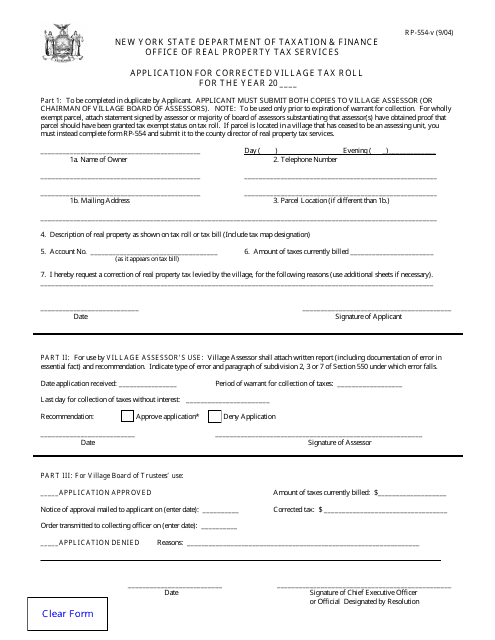

This form is used for submitting an application to correct the village tax roll in the state of New York.

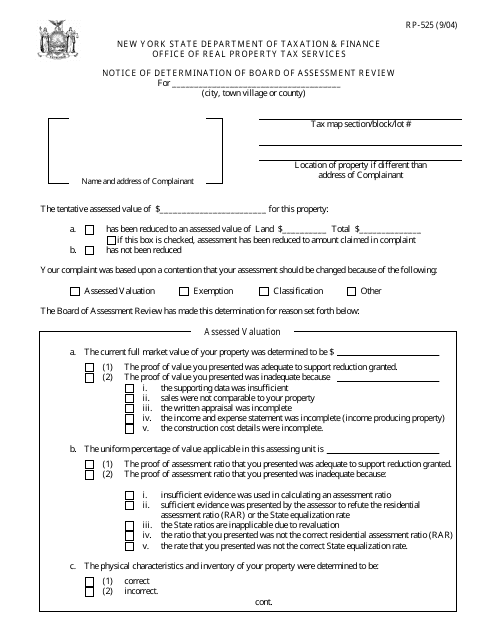

This form is used for notifying property owners in New York about the determination made by the Board of Assessment Review regarding their property assessment.

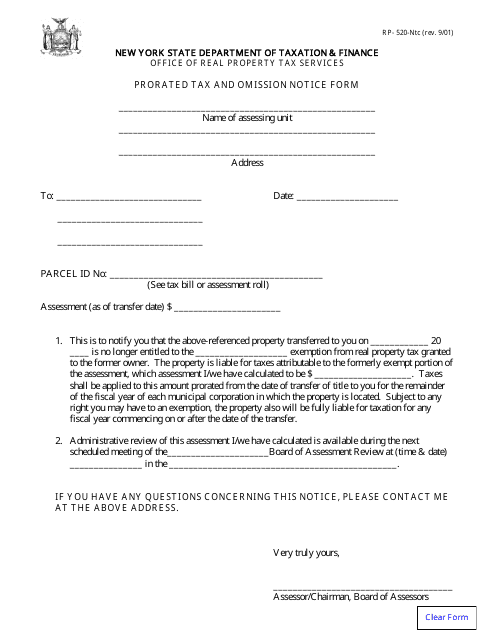

This form is used for submitting a prorated tax and omission notice in the state of New York.

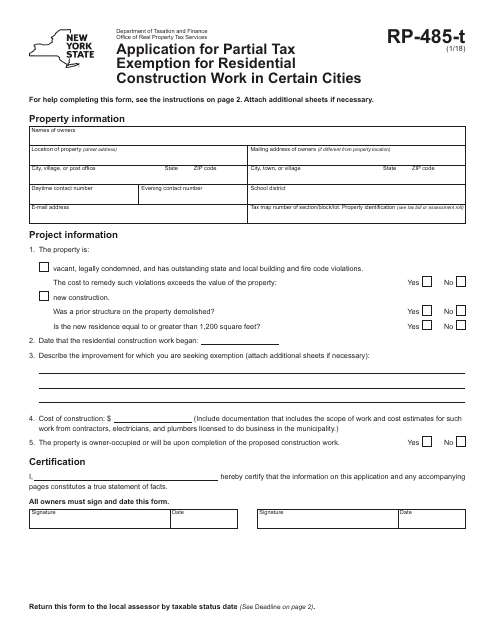

This Form is used for applying for a partial tax exemption for residential construction work in certain cities in New York. It allows individuals or businesses to request a reduction in property taxes for qualified construction projects.

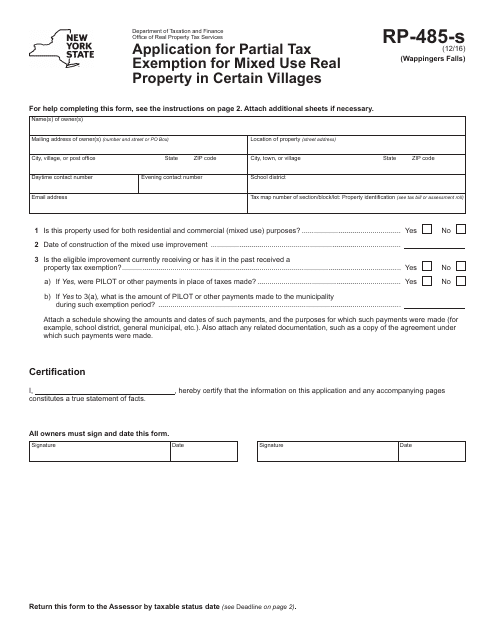

This form is used for applying for a partial tax exemption for mixed-use real property in certain villages, specifically the Village of Wappingers Falls, New York.

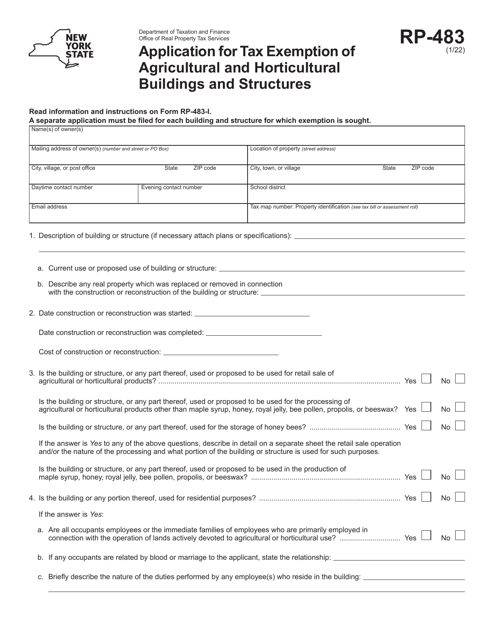

This form is used for applying for a residential investment real property tax exemption in certain school districts within the City of Utica, New York.

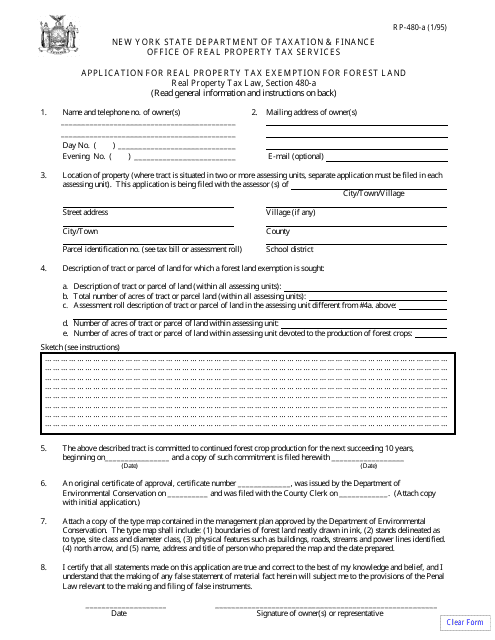

This Form is used for applying for a real property tax exemption for forest land in New York. It allows landowners to request a reduction in property taxes for qualifying forested areas.

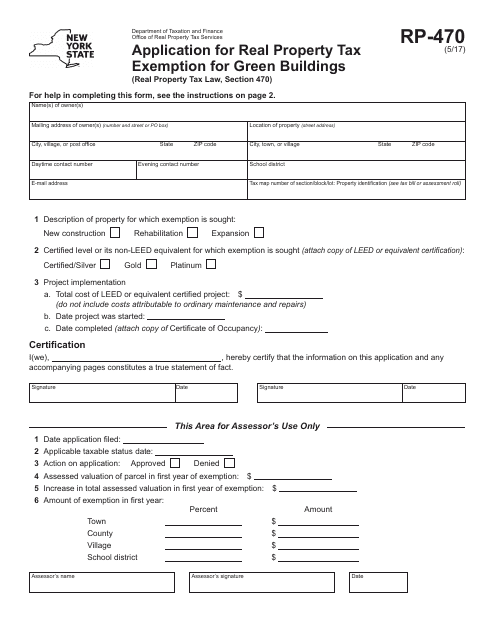

This form is used for applying for a real property tax exemption for green buildings in New York.

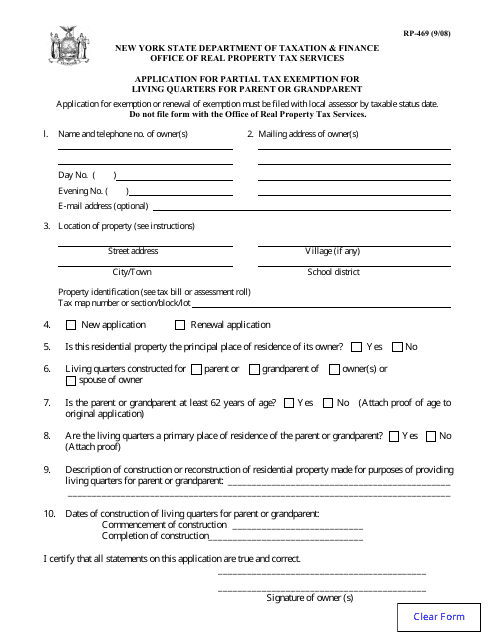

This form is used for applying for a partial tax exemption for living quarters for a parent or grandparent in New York. It allows eligible individuals to reduce their property taxes for housing their elderly family members.

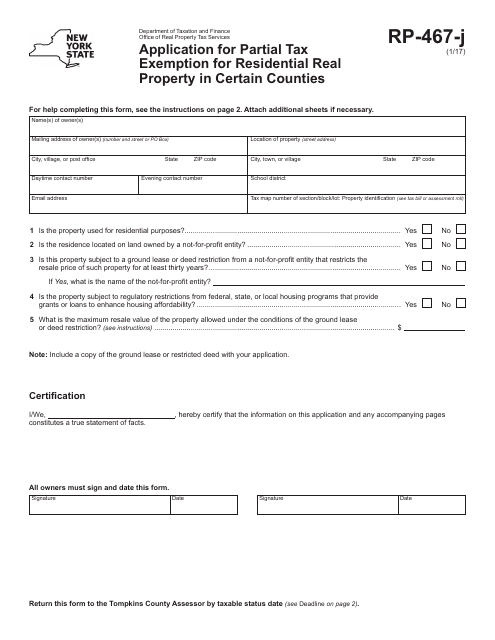

This form is used for applying for a partial tax exemption on residential real property in certain counties in New York.

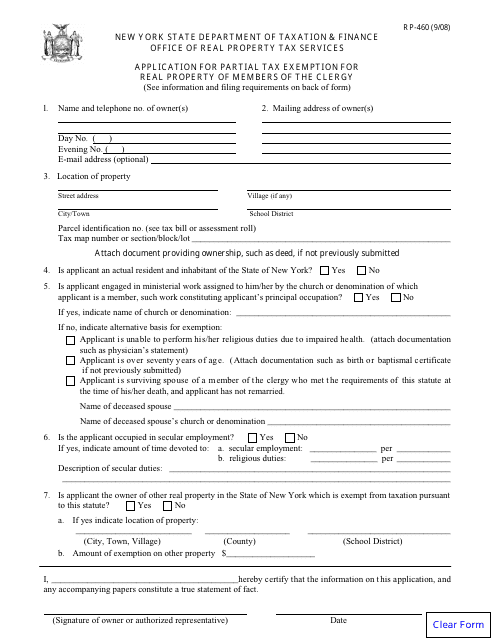

This Form is used for applying for a partial tax exemption on real property for members of the clergy in New York.

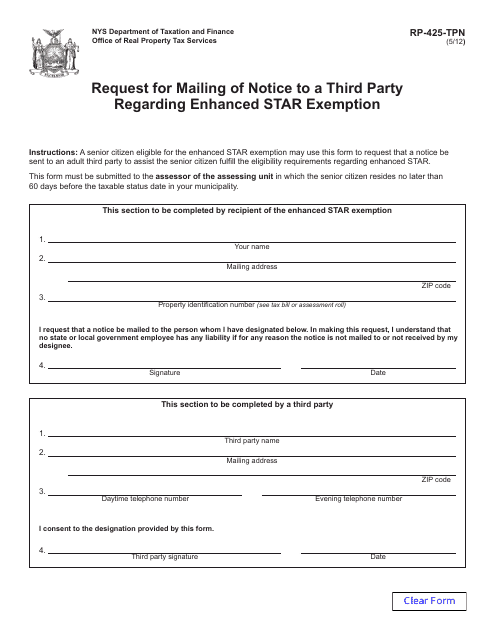

This form is used for requesting the mailing of a notice to a third party regarding the Enhanced Star Exemption in New York.

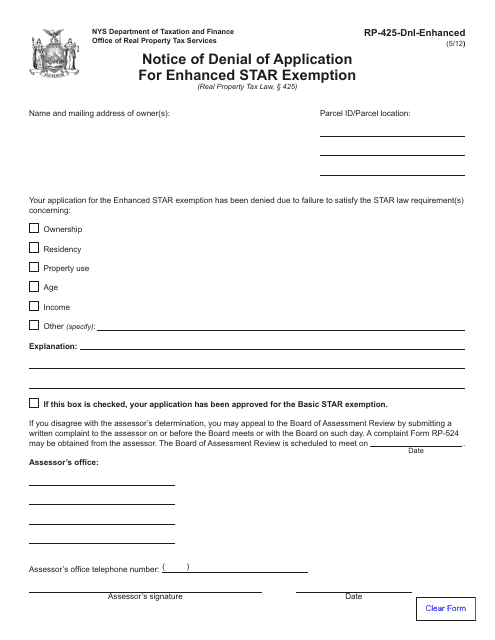

This form is used for notifying residents of New York about the denial of their application for the Enhanced Star Exemption.

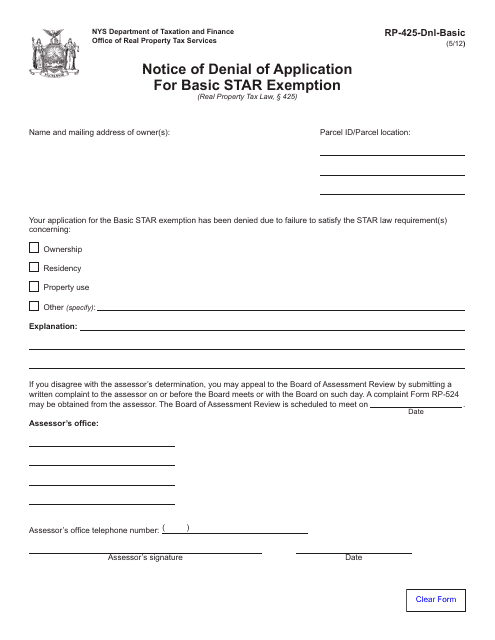

This form is used for notifying individuals in New York that their application for the Basic Star Exemption has been denied.

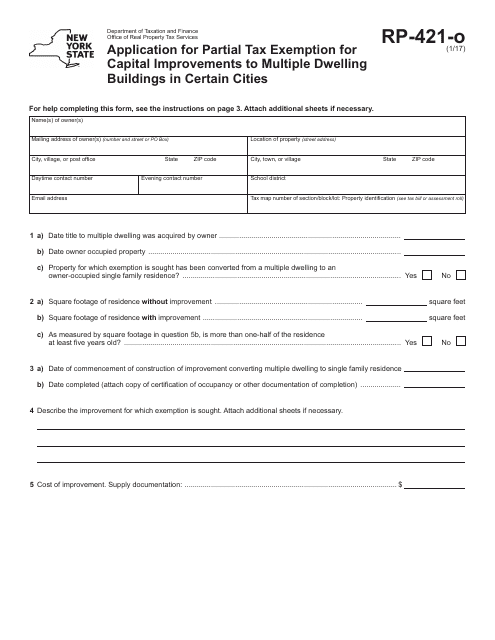

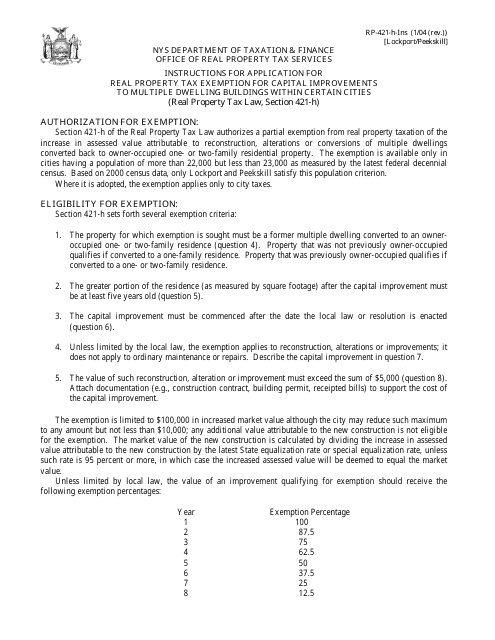

This form is used for applying for a tax exemption for capital improvements made to multiple dwelling buildings in certain cities in New York. It allows property owners to save on their taxes when making qualifying improvements to their buildings.

This Form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings within the City of Oneonta, New York. The form provides instructions on how to complete the application process.

This Form is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings within the City of Oneonta, New York.

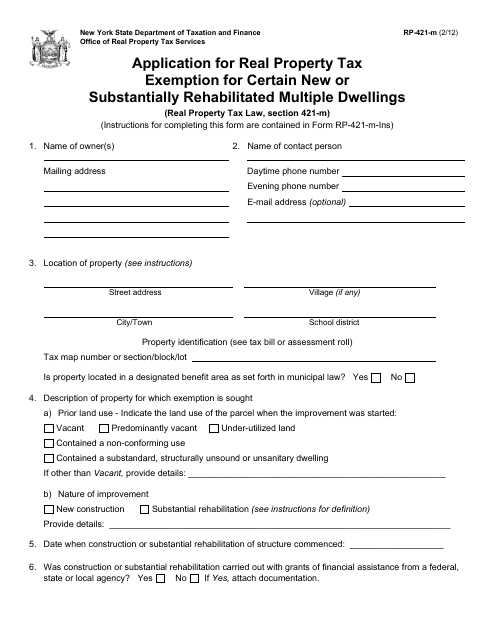

This form is used for applying for a real property tax exemption in New York for certain new or substantially rehabilitated multiple dwellings.

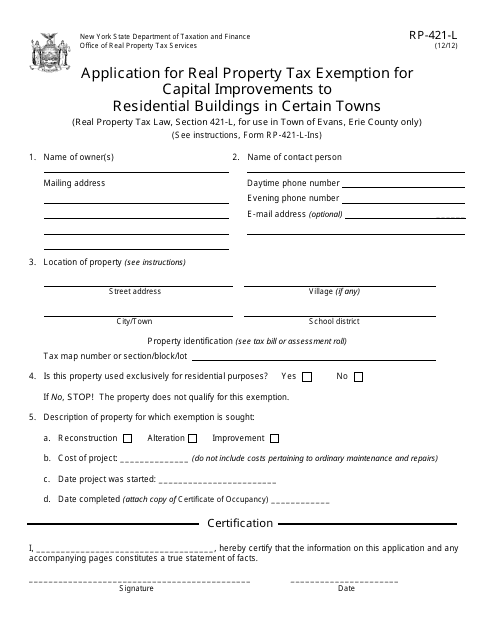

This form is used for applying for a real property tax exemption for capital improvements made to residential buildings in certain towns, specifically the Town of Evans, New York.

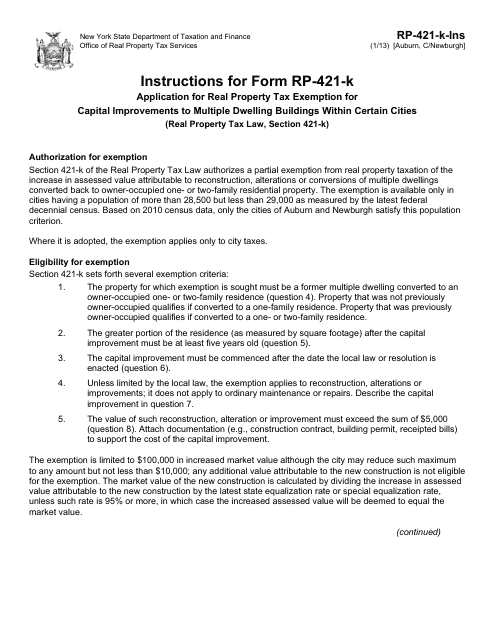

This document is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings in certain cities in New York, including Auburn and Newburgh. It provides instructions on how to fill out Form RP-421-K.

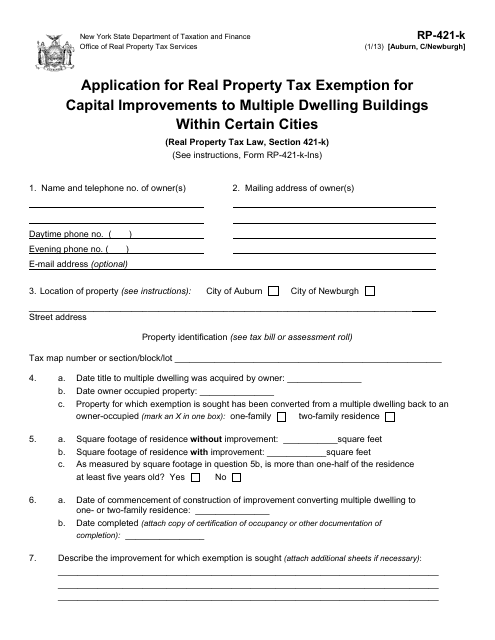

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in certain cities in New York, specifically Auburn and Newburgh.

This form is used for applying for a capital investment tax exemption on multiple dwellings in the City of Niagara Falls, New York.

This Form is used for applying for a real property tax exemption in the City of Cohoes, New York, for capital improvements made to multiple dwelling buildings in certain cities.

This form is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings in the City of Cohoes, New York.

This Form is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings within certain cities, specifically the City of Buffalo, New York. It provides instructions on how to fill out the application and includes important information regarding eligibility requirements and documentation needed.

This form is used to apply for a real property tax exemption for capital improvements made to multiple dwelling buildings within certain cities, specifically the City of Buffalo, located in New York.

This document provides instructions for completing Form RP-421-I, which is used to apply for a real property tax exemption for capital improvements made to multiple dwelling buildings within certain cities, specifically the City of Albany, New York.

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in certain cities, specifically Albany, New York.

This Form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in specific cities in New York.

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings within the cities of Lockport and Peekskill in New York.

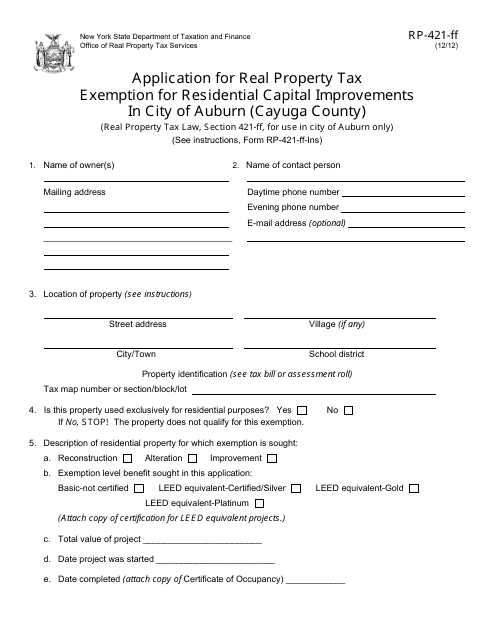

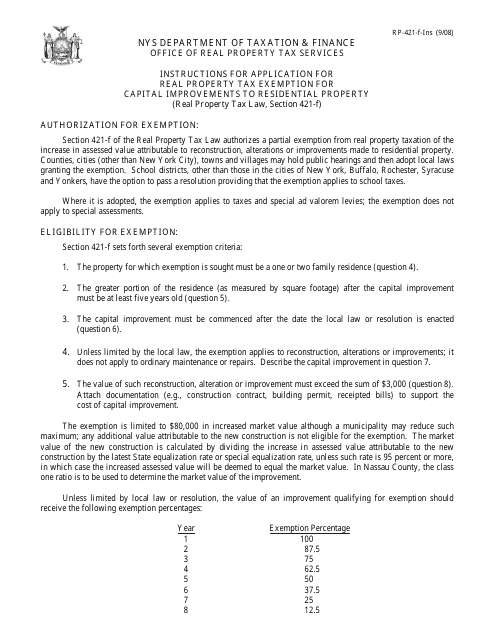

This form is used for applying for a real property tax exemption for residential capital improvements in the City of Auburn, located in Cayuga County, New York.

This Form is used for applying for a real property tax exemption for capital improvements made to residential property in New York. It provides instructions on how to complete the application and what documents are required.

![Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york_big.png)

![Instructions for Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349853/instruction-for-form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york_big.png)

![Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york_big.png)

![Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york_big.png)

![Instructions for Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349862/instruction-for-form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york_big.png)

![Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york_big.png)

![Instructions for Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349864/instruction-for-form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york_big.png)

![Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york_big.png)

![Instructions for Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349866/instructions-for-form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-albany-new-york_big.png)

![Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york_big.png)

![Form RP-421-H [LOCKPORT/PEEKSKILL] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Cities of Lockport/Peekskiill, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349869/form-rp-421-h-lockport-peekskill-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-cities-of-lockport-peekskiill-new-york_big.png)