Fill and Sign New York Legal Forms

Related Articles

Documents:

10834

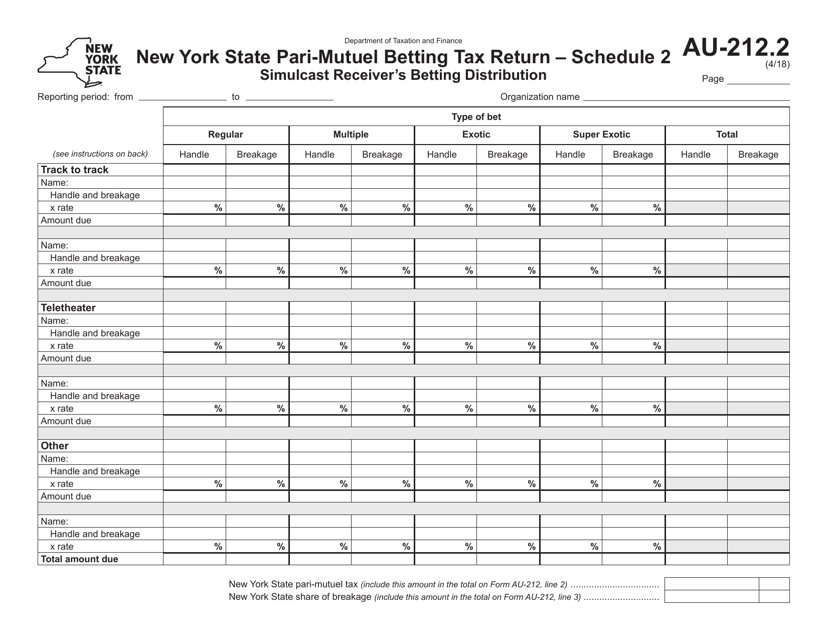

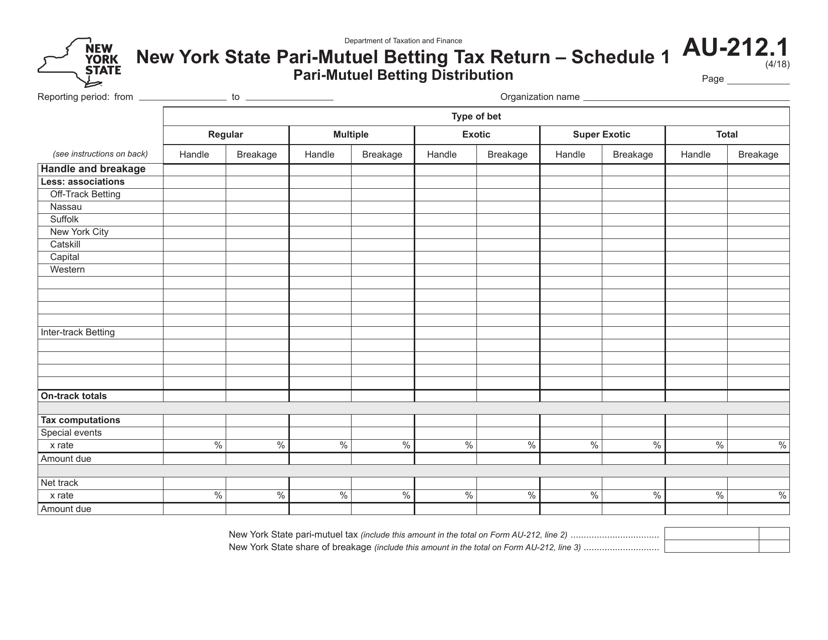

This form is used for reporting the betting distribution from simulcast receivers in New York.

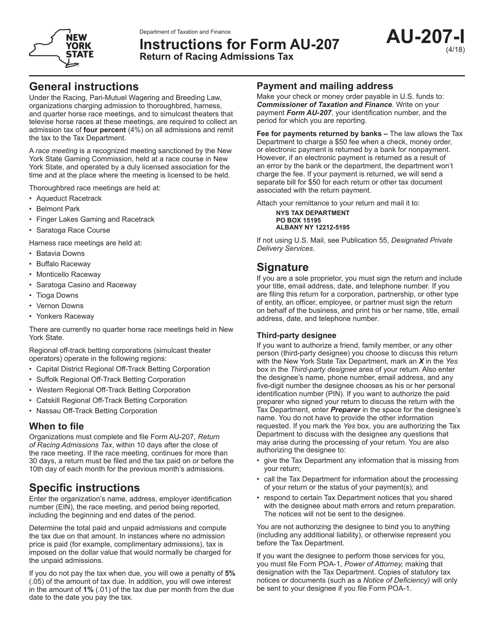

This document provides instructions for filing Form AU-207, which is used to report and pay the racing admissions tax in the state of New York. The form is required for businesses involved in racing events and provides guidance on how to accurately report and remit the tax.

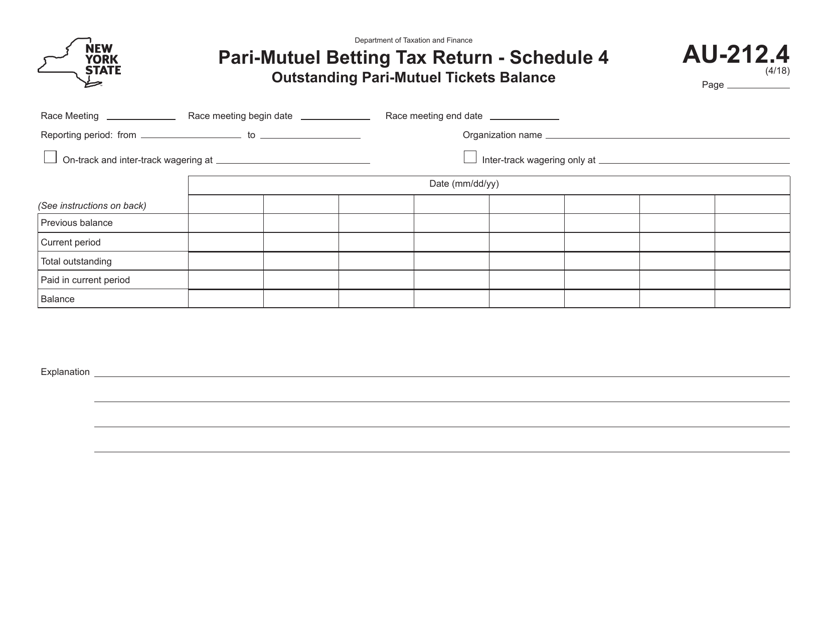

This form is used for reporting the outstanding balance of pari-mutuel tickets in the state of New York.

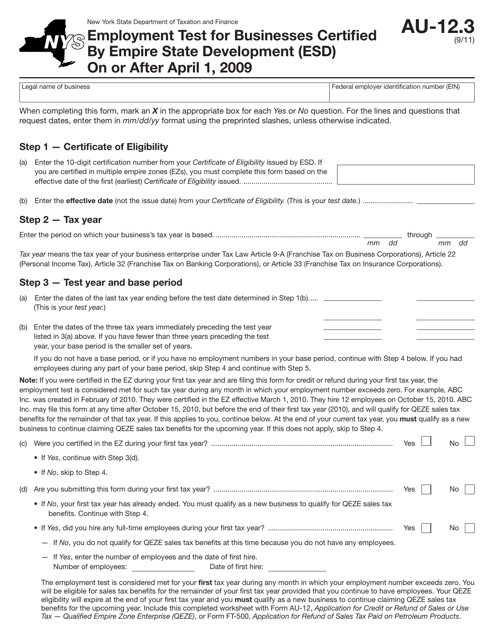

This form is used for businesses certified by Empire State Development (ESD) on or after April 1, 2009, in New York to test employment eligibility.

This Form is used for reporting the distribution of funds from pari-mutuel betting in New York.

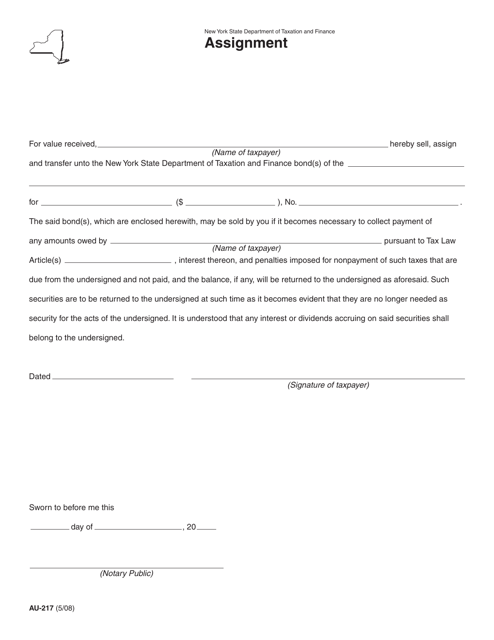

This document is used for assigning a tax lien certificate in New York.

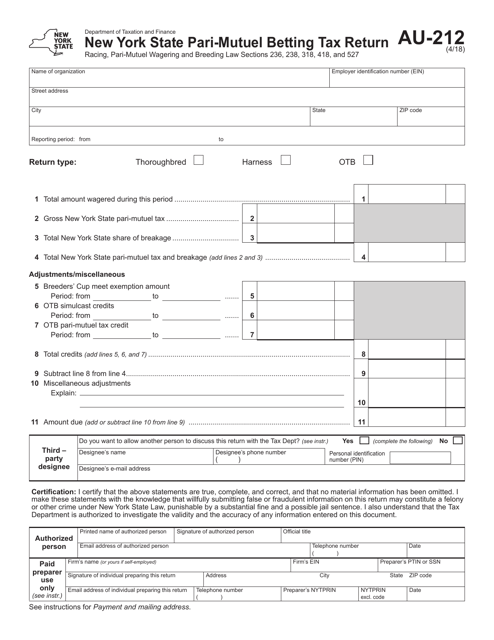

This form is used for reporting and paying the New York State Pari-Mutuel Betting Tax.

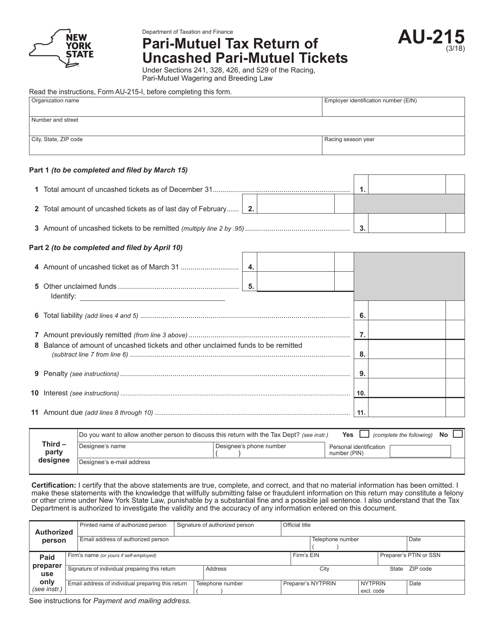

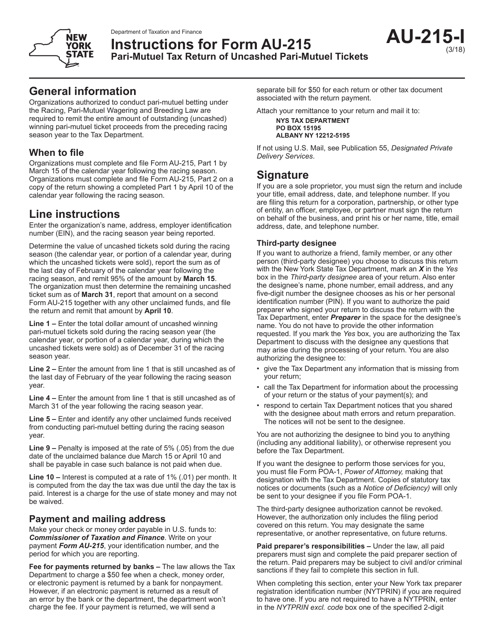

This Form is used for reporting and filing the Pari-Mutuel Tax Return of Uncashed Pari-Mutuel Tickets in the state of New York.

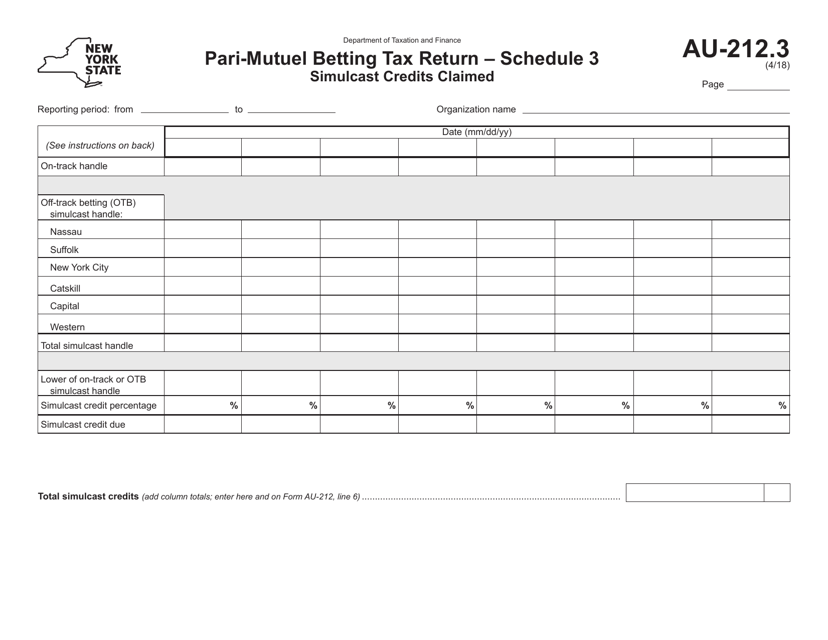

This form is used for claiming simulcast credits in New York.

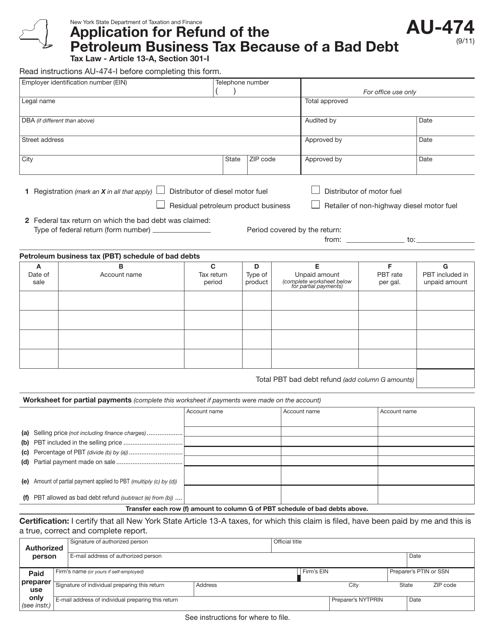

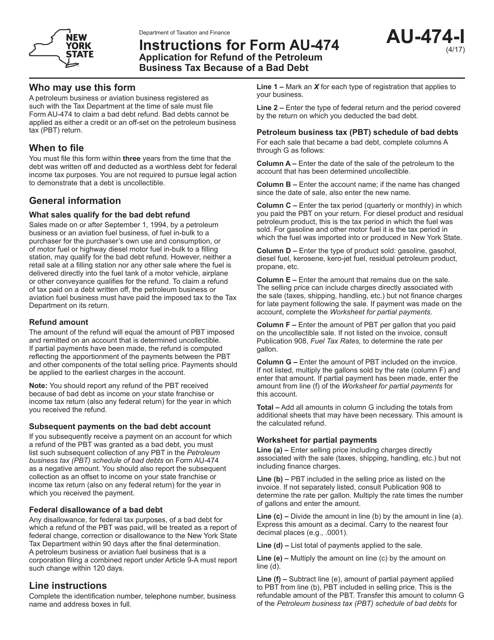

This form is used for applying for a refund of the petroleum business tax in New York due to a bad debt.

This Form is used for reporting and filing the Pari-Mutuel Tax Return of Uncashed Pari-Mutuel Tickets in the state of New York. It provides instructions on how to accurately fill out and file the form.

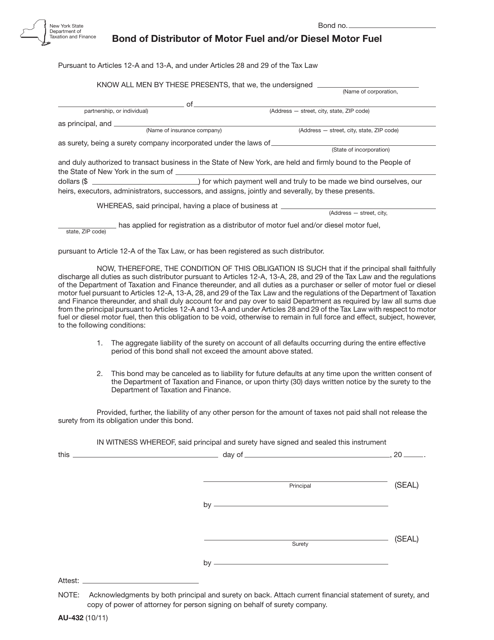

This form is used for distributors of motor fuel and/or diesel motor fuel in New York to submit a bond. It is required by the state to ensure compliance with tax obligations related to fuel distribution.

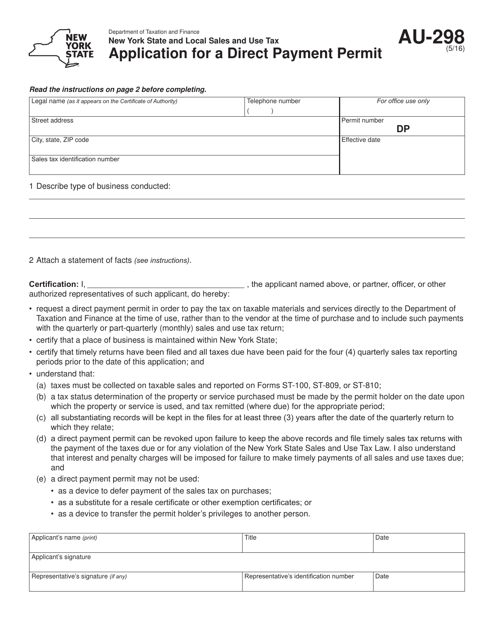

This form is used for applying for a Direct Payment Permit in New York. It allows businesses to directly pay sales tax rather than collecting it from customers.

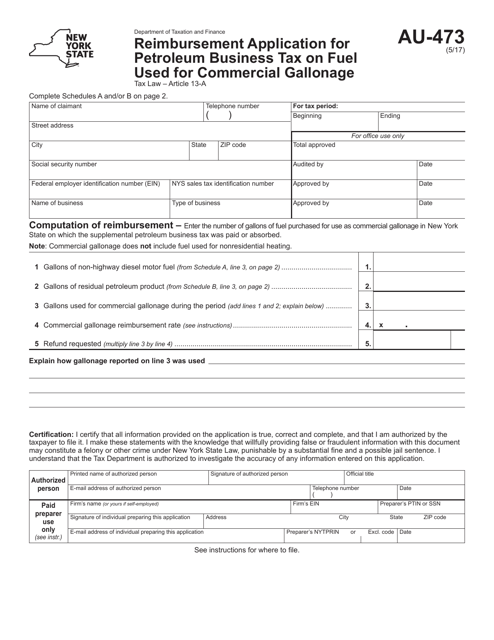

This form is used for applying for reimbursement of the petroleum business tax on fuel used for commercial gallonage in New York.

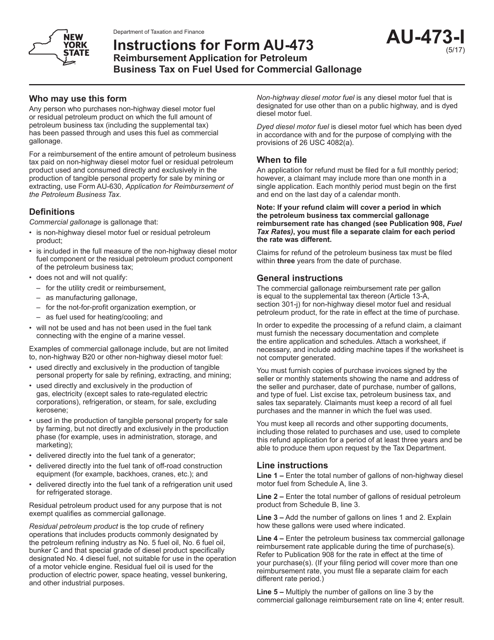

This Form is used for reimbursement of Petroleum Business Tax on fuel used for commercial gallonage in New York. It provides instructions on how to complete the reimbursement application.

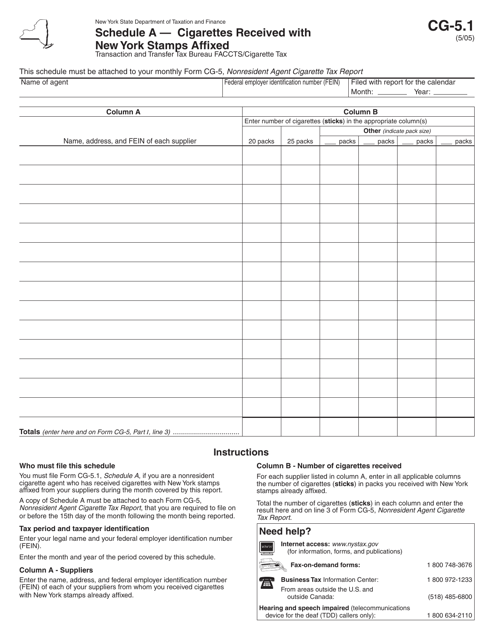

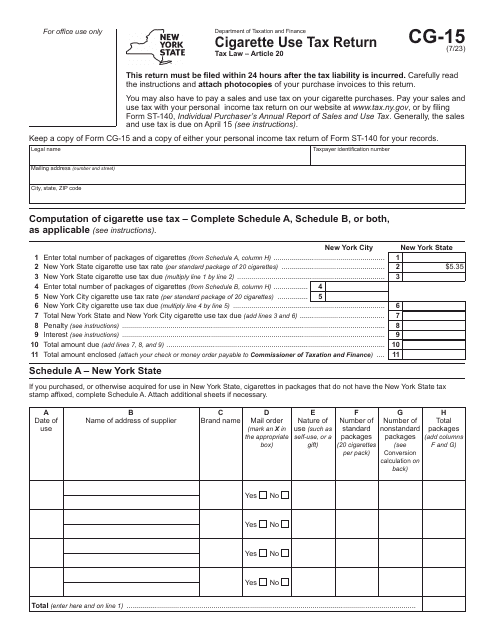

This Form is used for reporting the receipt of cigarettes with New York stamps affixed in the state of New York.

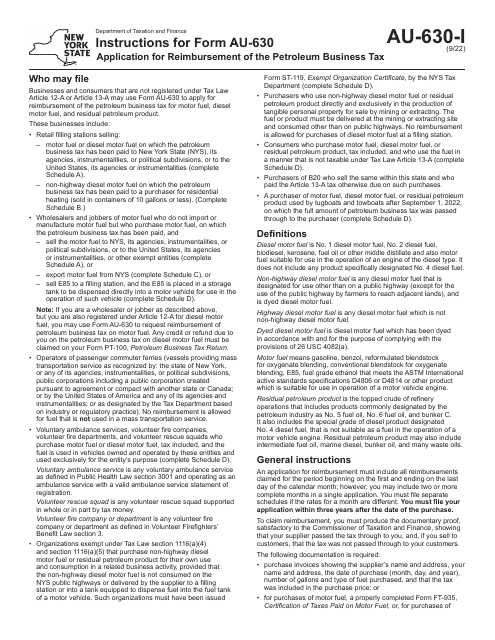

This form is used for filing an application for a refund of the petroleum business tax in New York due to a bad debt. It provides instructions on how to complete the form and apply for the refund.

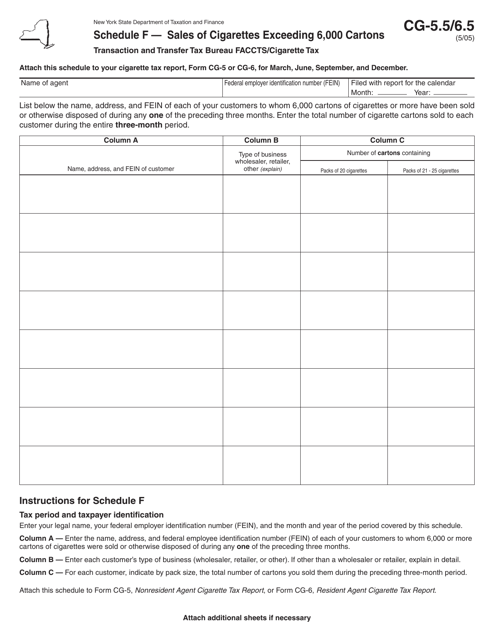

This form is used for reporting the sales of cigarettes exceeding 6,000 cartons in the state of New York.

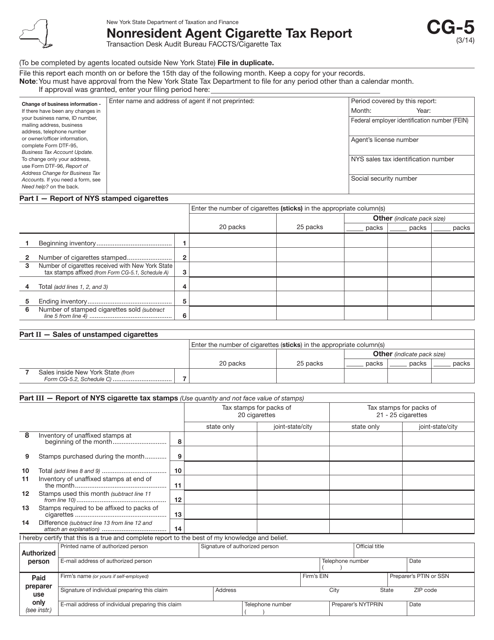

This Form is used for reporting cigarette taxes by nonresident agents in New York.

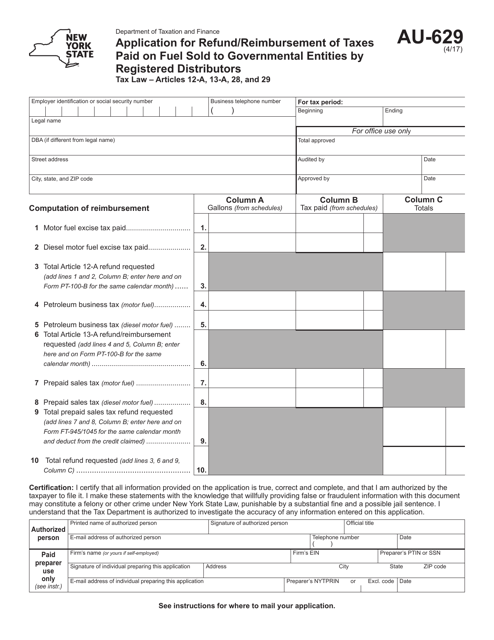

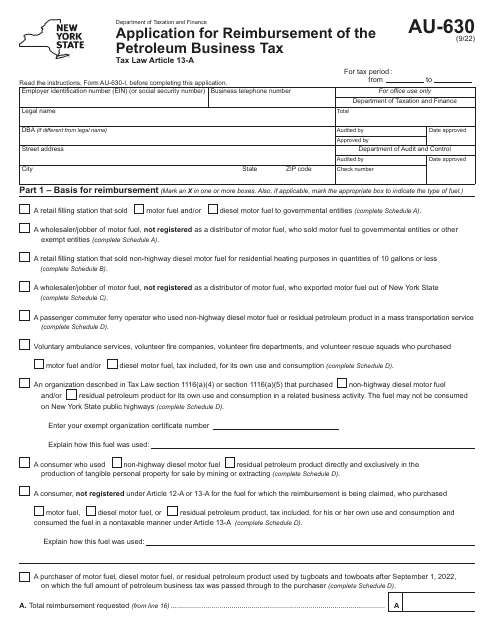

This form is used for applying for a refund or reimbursement of taxes paid on fuel sold to governmental entities by registered distributors in New York.

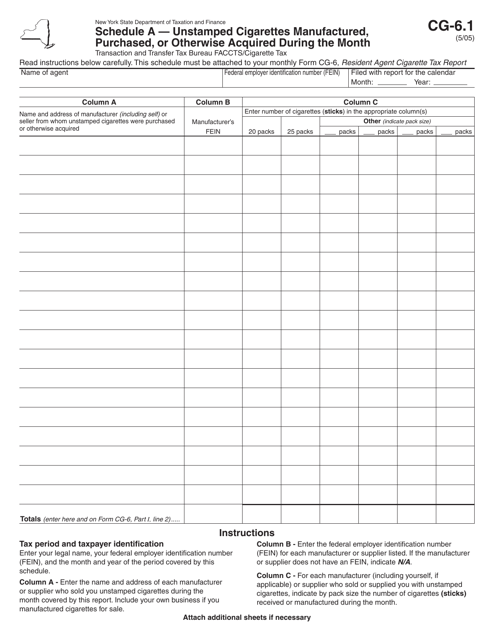

This Form is used for reporting information about the manufacturing, purchasing, or acquisition of unstamped cigarettes in New York during a specific month.

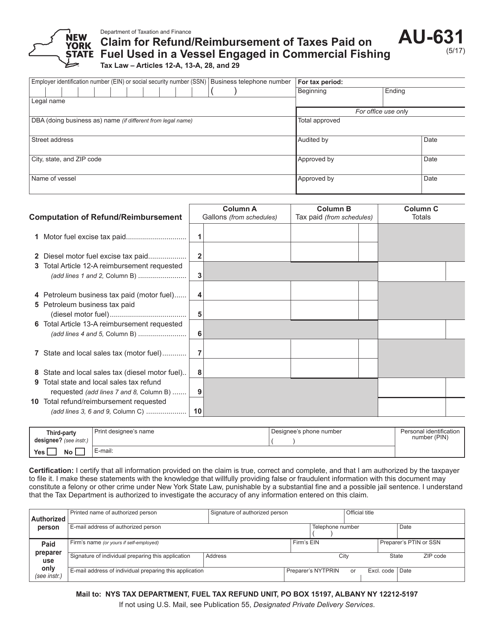

This form is used for claiming a refund or reimbursement of taxes paid on fuel used in a commercial fishing vessel in New York.

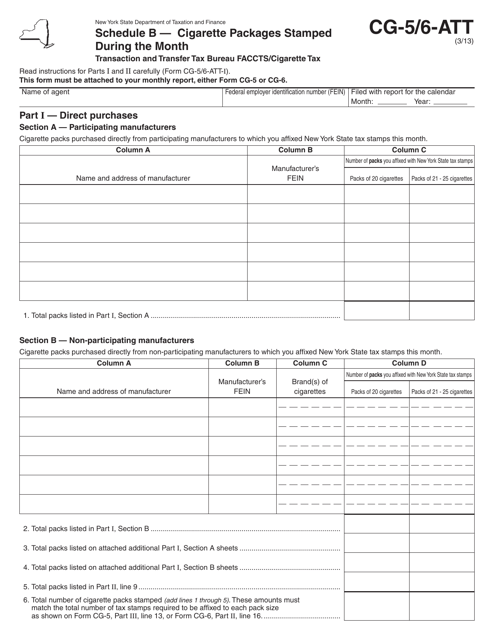

This document is a form used for reporting the number of cigarette packages stamped in the state of New York during a specific month.

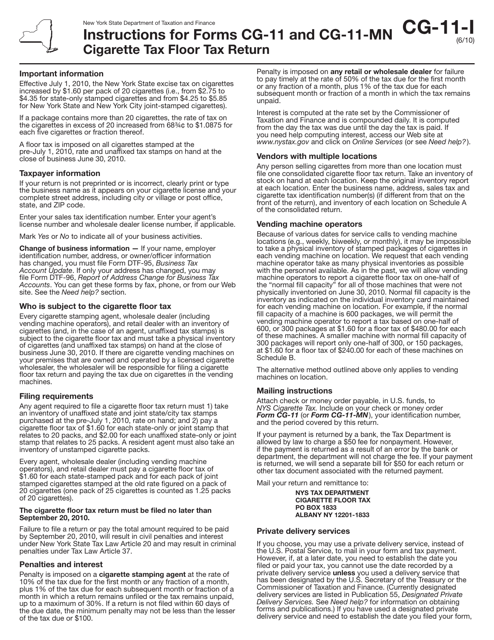

This form is used for filing the Cigarette Tax Floor Tax Return in the state of New York. It provides instructions on how to accurately report and calculate the tax owed on cigarettes.

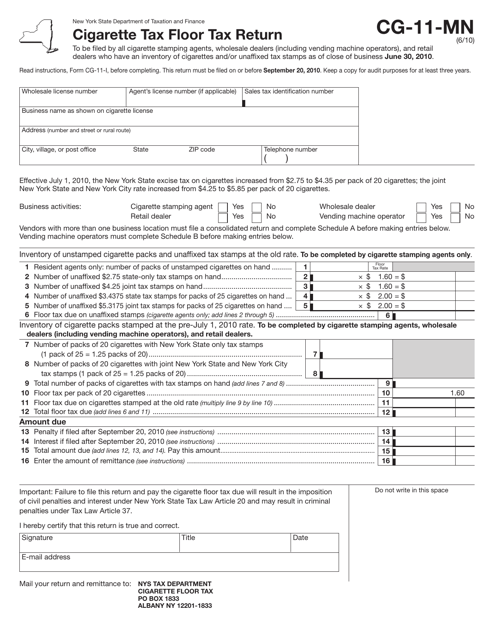

This form is used for reporting and paying the floor tax on cigarettes in New York.

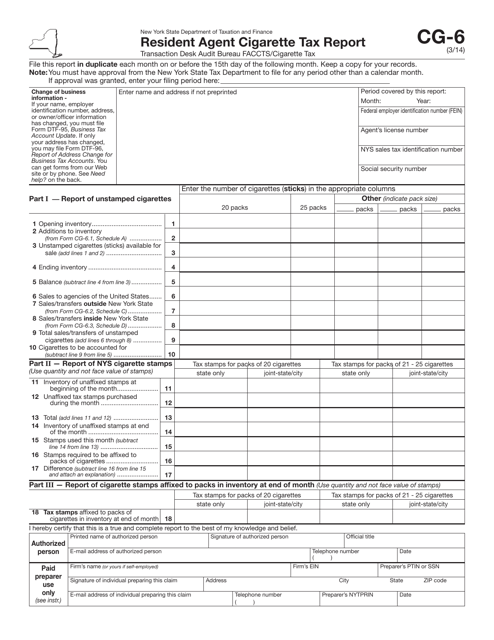

This form is used for reporting cigarette tax payments and sales made by resident agents in the state of New York.

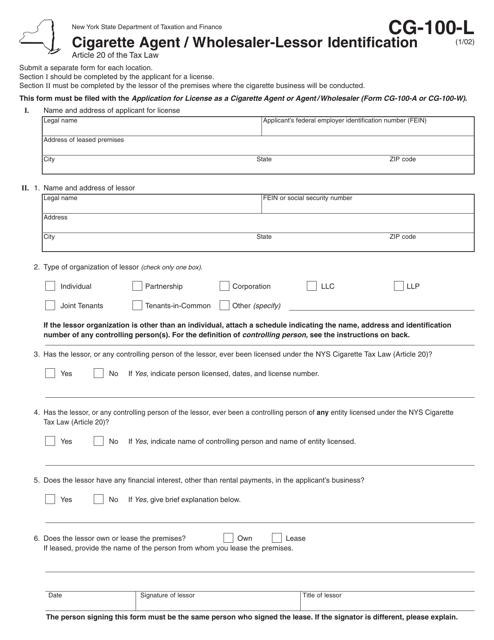

This Form is used for identifying and registering cigarette agents, wholesalers, and lessors in the state of New York.

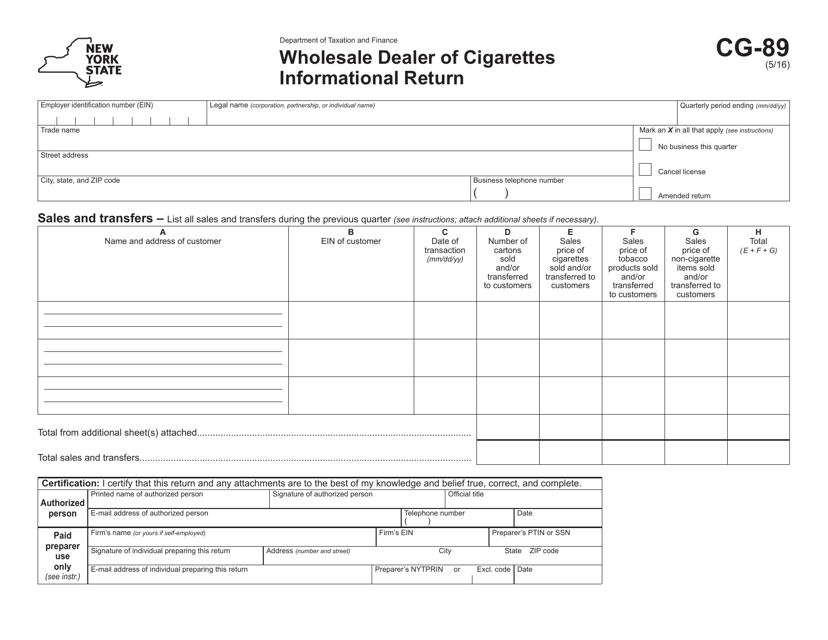

This form is used for wholesale dealers of cigarettes in New York to provide information about their business activities.

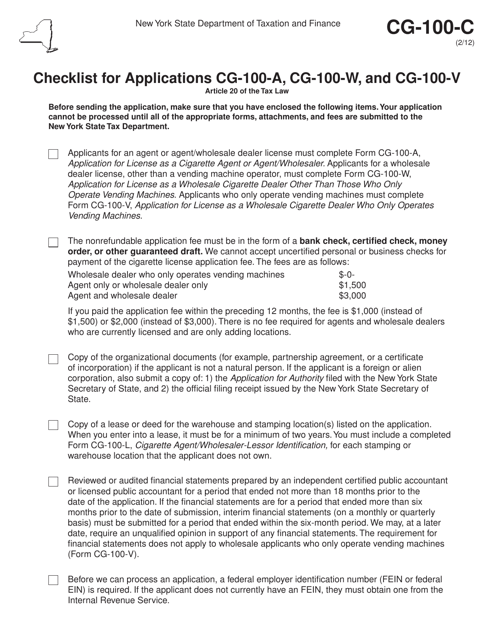

This form is used as a checklist for applications CG-100-A, CG-100-W, and CG-100-V in the state of New York. It helps to ensure that all required documents and information are provided when submitting these applications.

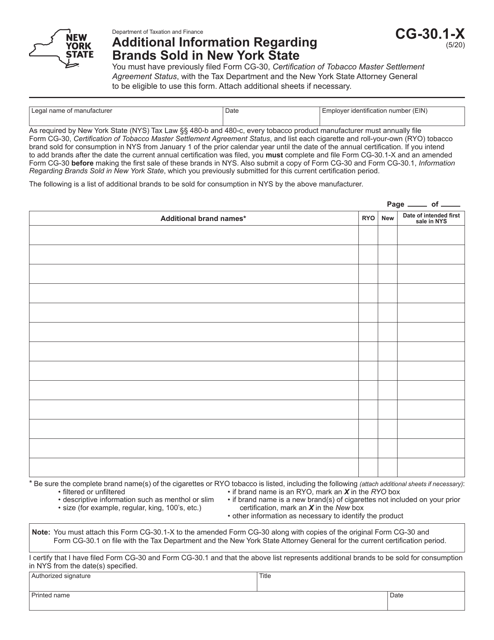

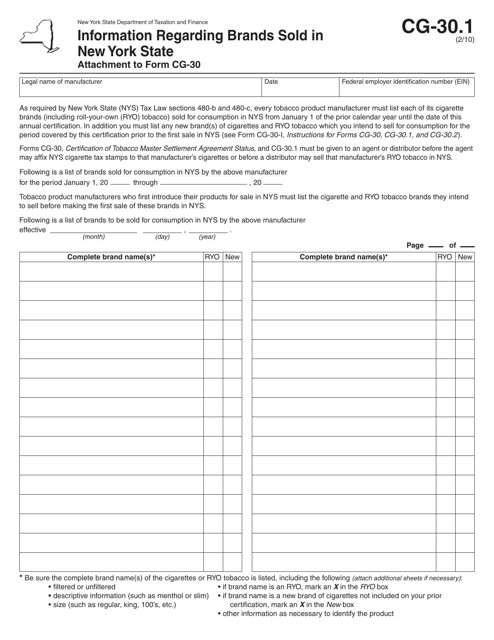

This form is used for providing information about the brands that are sold in New York State.

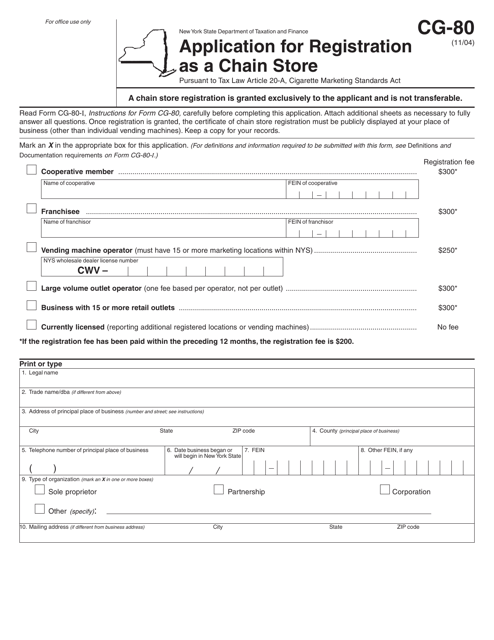

This Form is used for applying to register as a chain store in the state of New York.

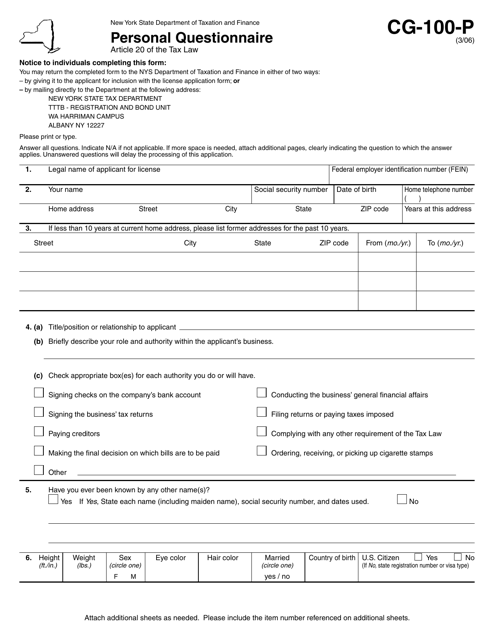

This Form is used for completing a personal questionnaire in New York. It collects basic information about an individual for various purposes, such as employment, insurance, or legal proceedings.

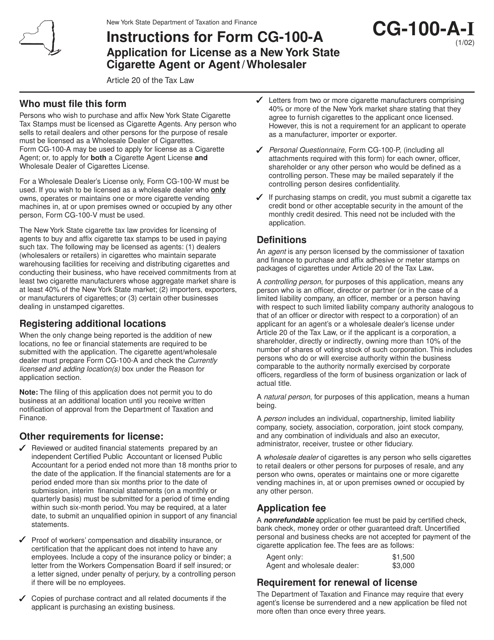

This document is for individuals or businesses in New York who want to apply for a license to become a cigarette agent or agent/wholesaler. It provides instructions on how to complete Form CG-100-A.

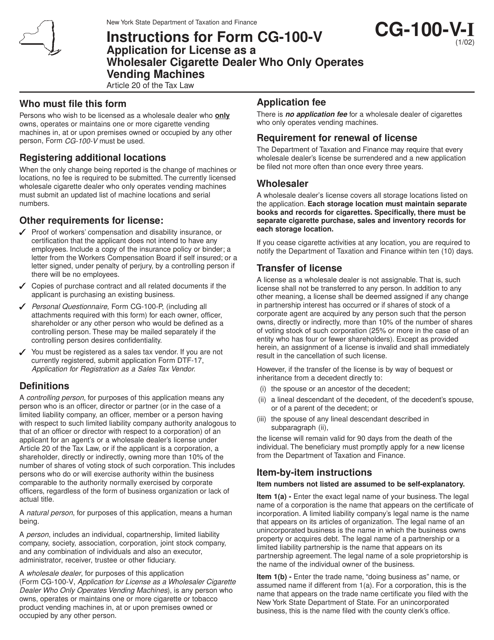

This document is used for applying for a license as a wholesaler cigarette dealer who only operates vending machines in the state of New York. The form provides instructions on how to fill out the application.

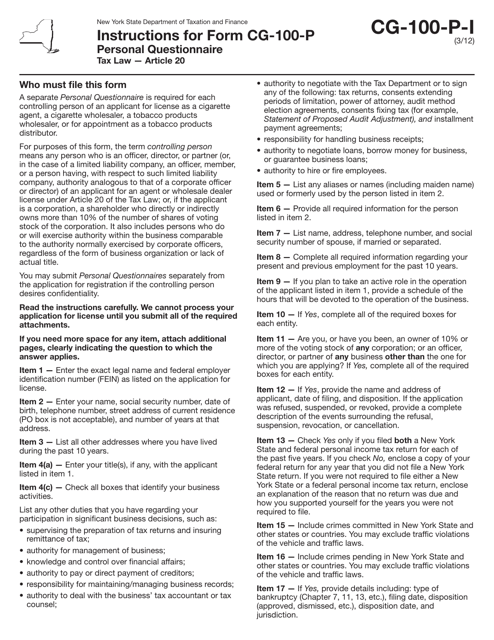

This Form is used for completing a personal questionnaire specific to the state of New York. It provides instructions on how to fill out the form accurately and contains important information for individuals to provide the required personal details.