Fill and Sign California Legal Forms

Documents:

19713

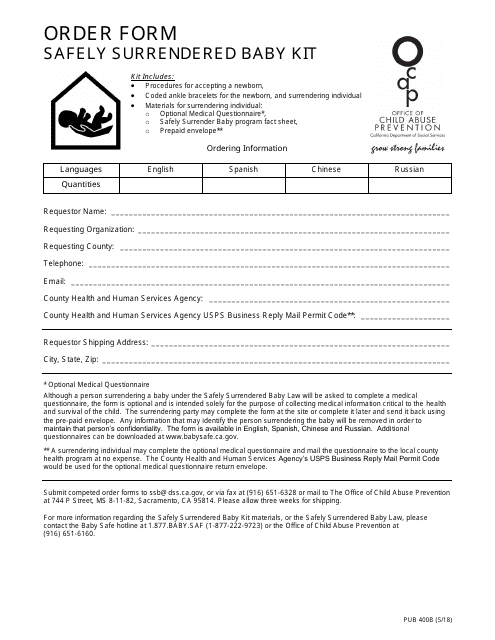

This form is used for ordering a Safely Surrendered Baby Kit in California.

Form SOC839 In-home Supportive Services (Ihss) Designation of Authorized Representative - California

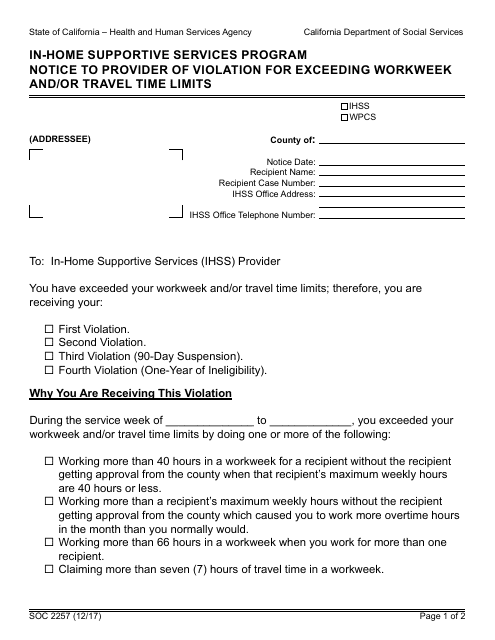

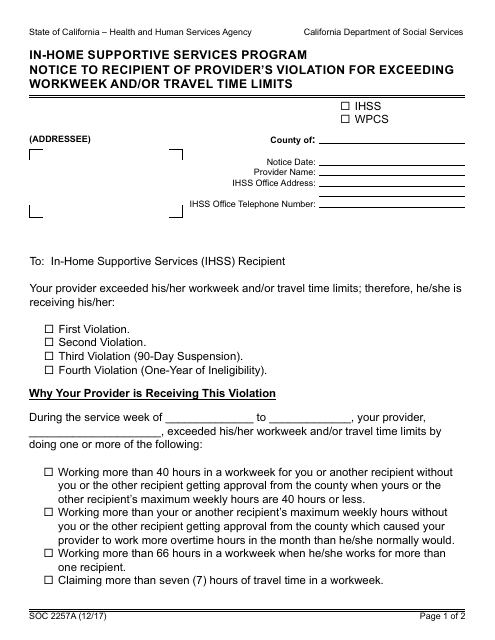

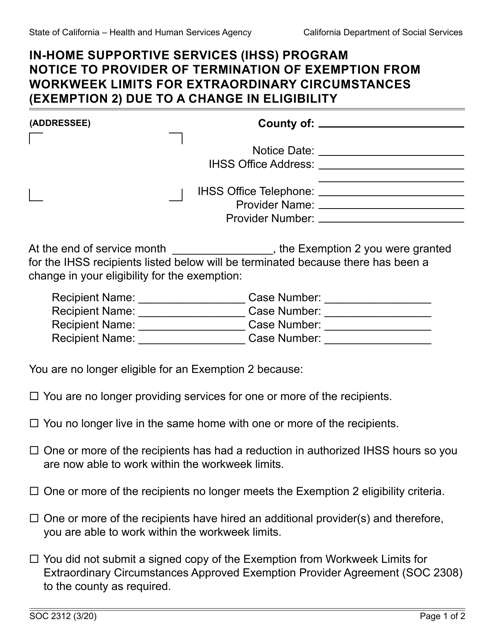

This form is used for notifying the provider of violations for exceeding workweek and/or travel time limits in the In-Home Supportive Services Program in California.

This Form is used to notify recipients in the In-Home Supportive Services Program in California of a provider's violation for exceeding workweek and/or travel time limits.

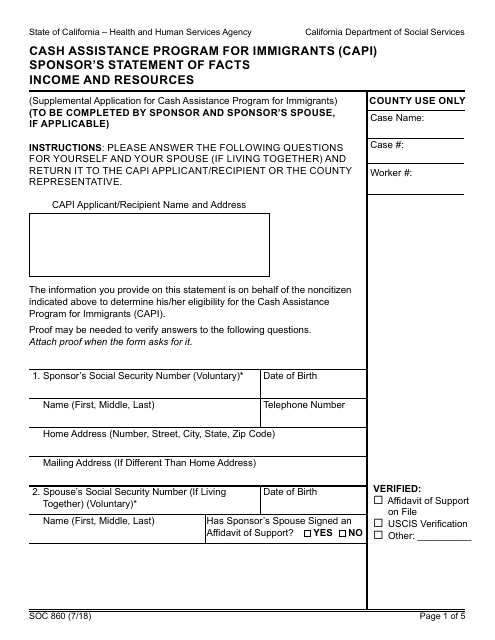

This form is used for sponsoring an immigrant applying for the Cash Assistance Program for Immigrants (CAPI) in California. It requires the sponsor to provide a statement of facts regarding their income and resources.

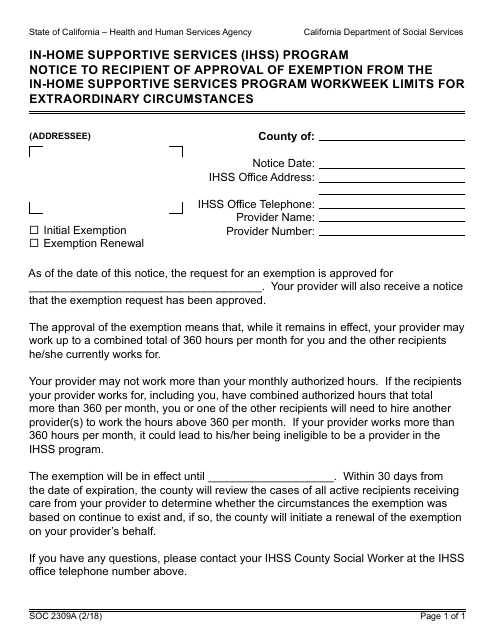

This Form is used for notifying recipients of the approval of exemption from the in-Home Supportive Services Program workweek limits due to extraordinary circumstances in California's Ihss Program.

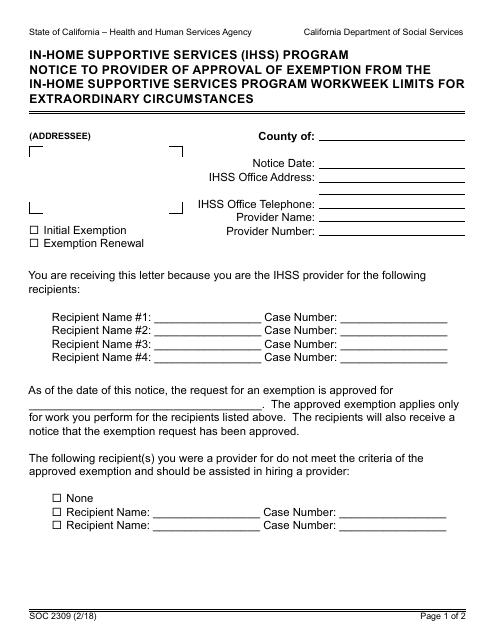

This form is used to notify the provider of the approval of an exemption from the in-Home Supportive Services (IHSS) program workweek limits for extraordinary circumstances in California.

This form is used for submitting a notice of non-receipt of exemption from workweek limits for the In-Home Supportive Services Program in California.

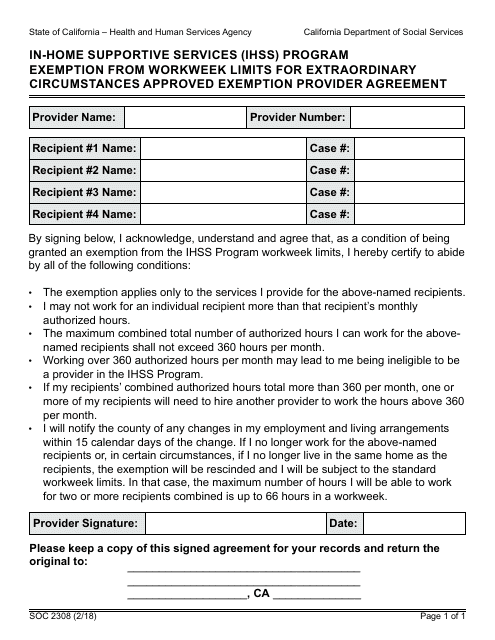

This form is used for applying for an exemption from workweek limits for extraordinary circumstances under the In-Home Supportive Services program in California.

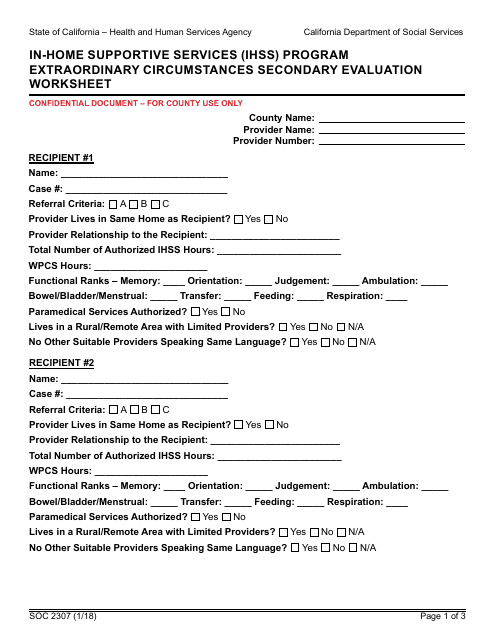

This document is for the In-Home Supportive Services (IHSS) Program in California. It is used for conducting a secondary evaluation of extraordinary circumstances.

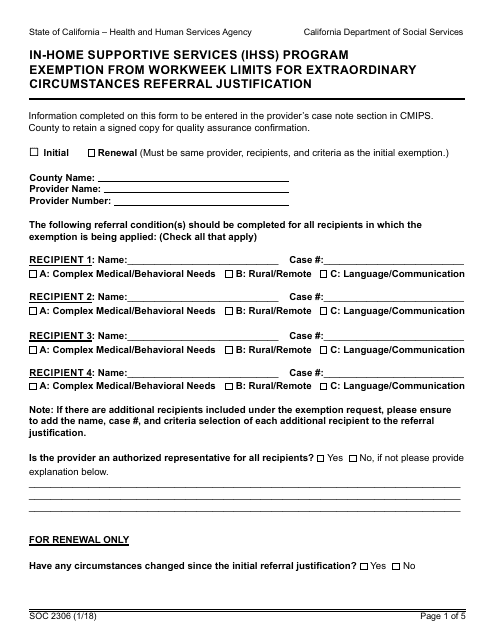

This form is used for requesting exemption from workweek limits for extraordinary circumstances in the In-Home Supportive Services (IHSS) program in California.

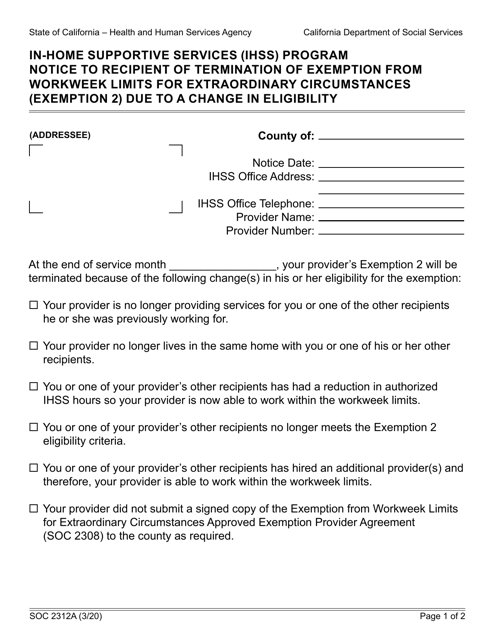

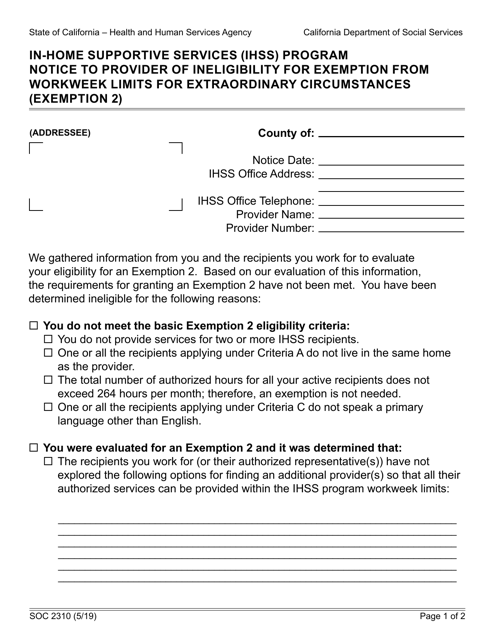

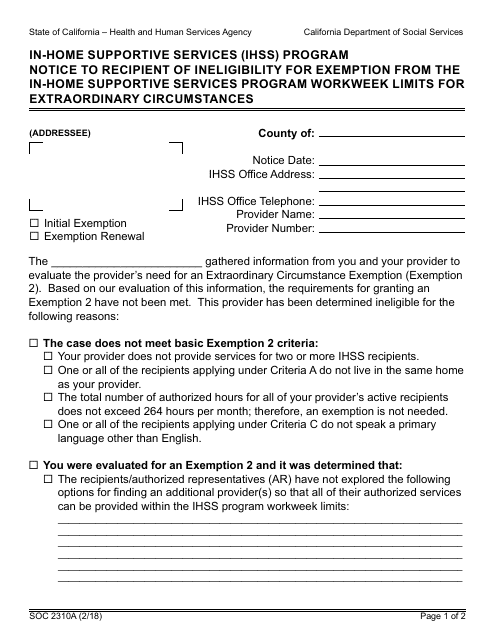

This form is used for informing recipients that they are not eligible for exemption from the in-Home Supportive Services Program workweek limits due to extraordinary circumstances in California.

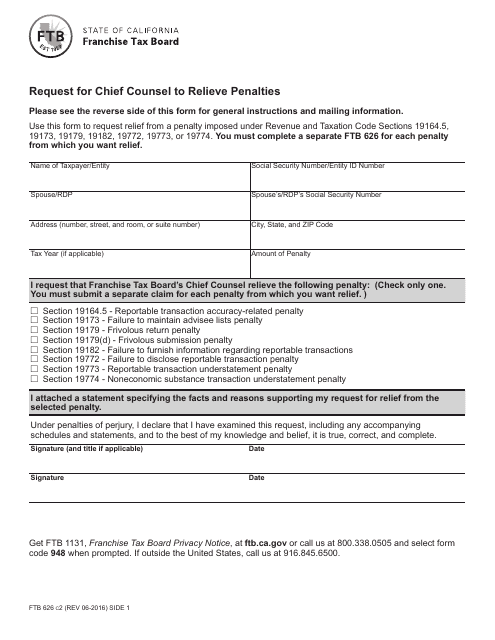

This form is used for requesting the Chief Counsel to relieve penalties in the state of California.

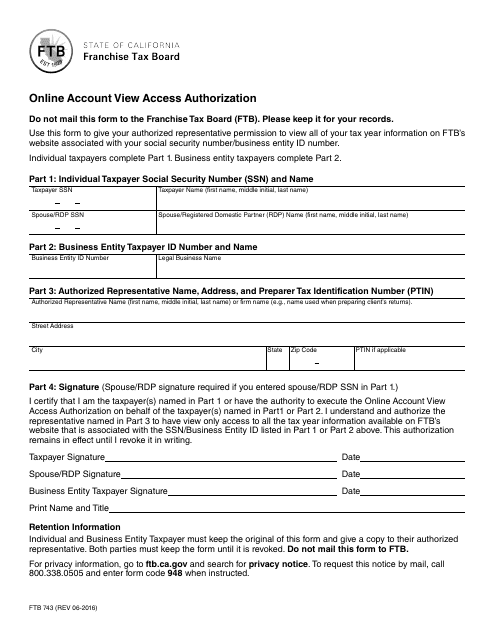

This Form is used for granting online account view access authorization in California.

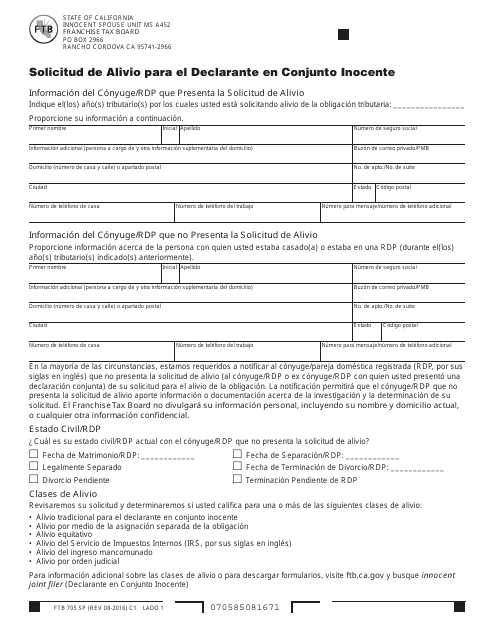

This Form is used for requesting relief for innocent joint filer in California. (Spanish)

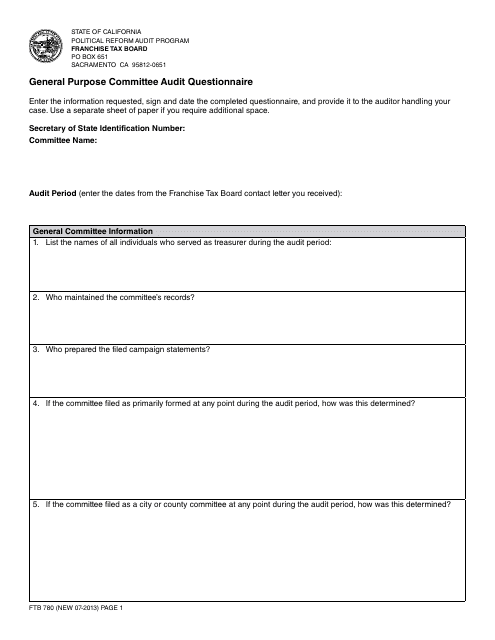

This form is used for conducting an audit of general purpose committees in California. It includes a questionnaire to gather information and ensure compliance with campaign finance laws.

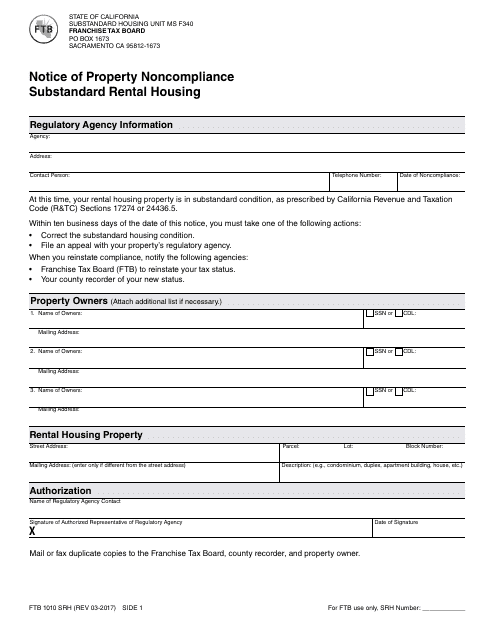

This form is used for reporting substandard or noncompliant rental housing properties in California.

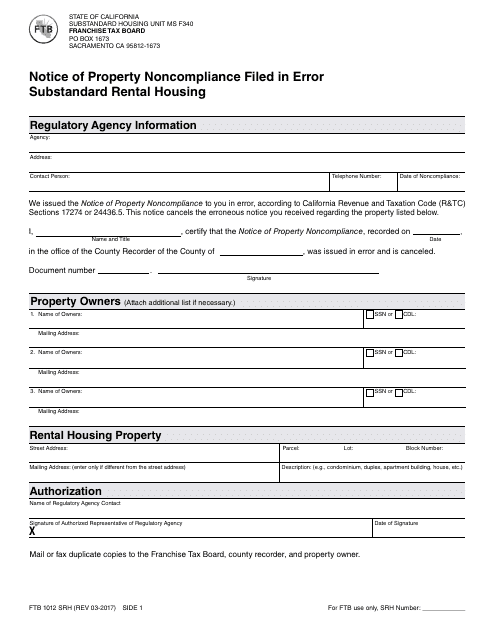

This form is used for notifying the state of California about a property that was mistakenly reported as substandard rental housing.

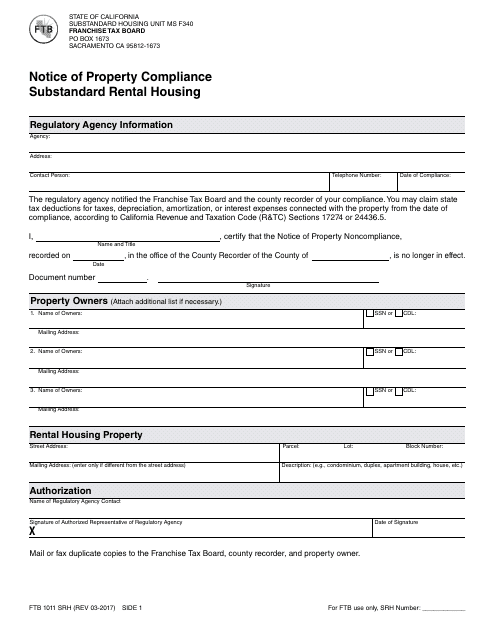

This form is used for informing the authorities about substandard rental housing properties in California.

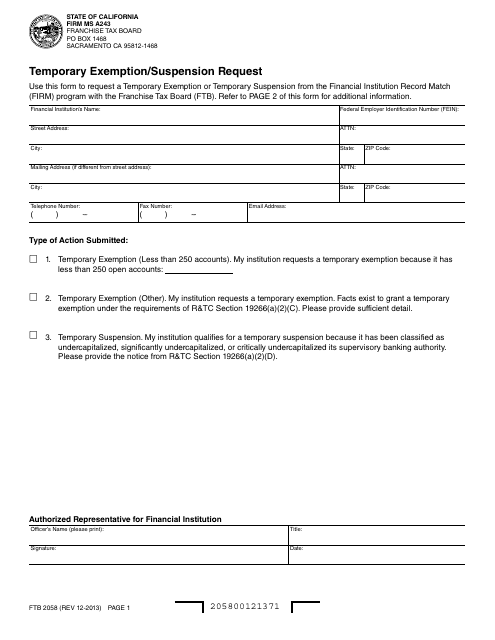

This form is used for requesting temporary exemption or suspension in California.

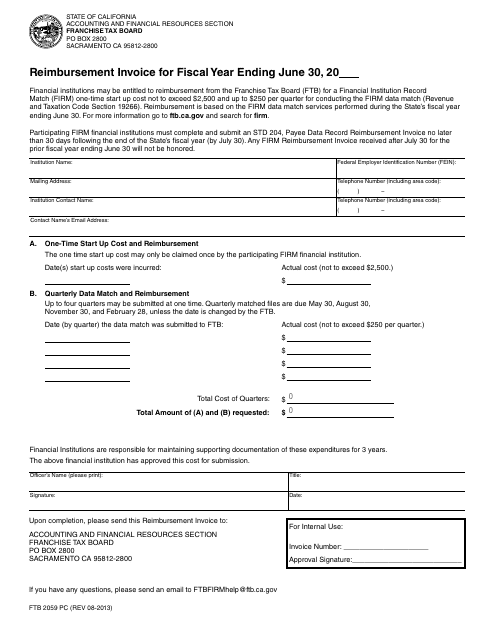

This form is used for submitting reimbursement invoices for the fiscal year ending June 30th in the state of California.

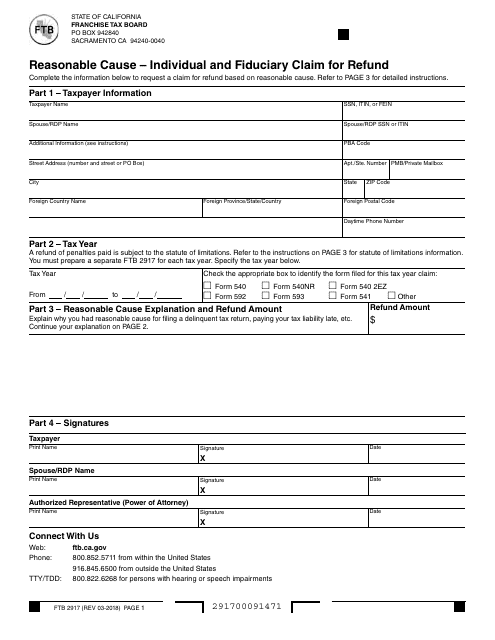

This form is used for individuals and fiduciaries in California to claim a refund and provide a reasonable cause for doing so.

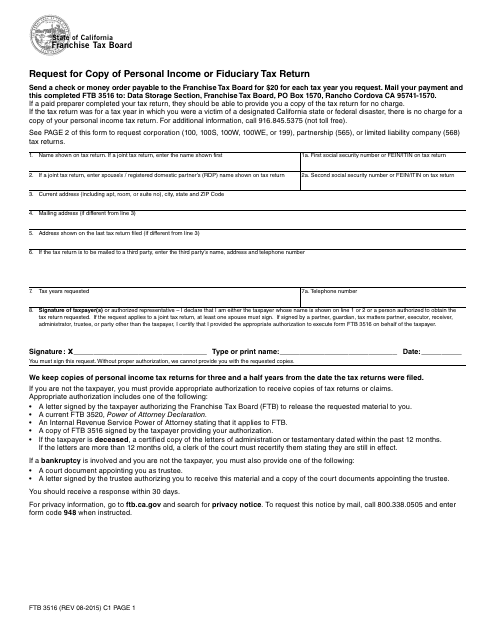

This form is used for requesting a copy of your personal income or fiduciary tax return in California.

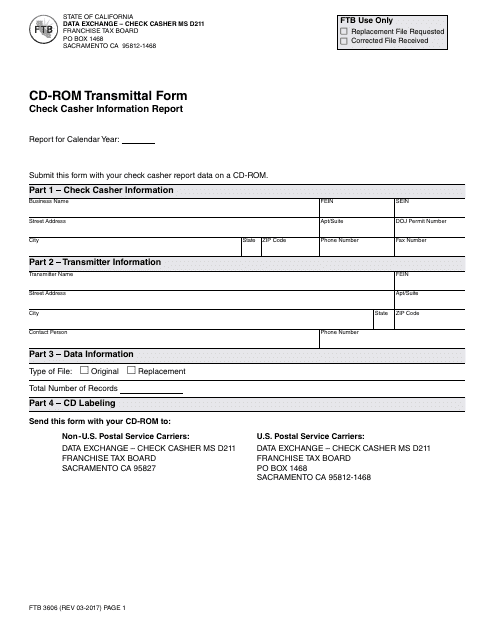

This Form is used to transmit the Check Casher Information Report on CD-ROM to the California Franchise Tax Board (FTB).

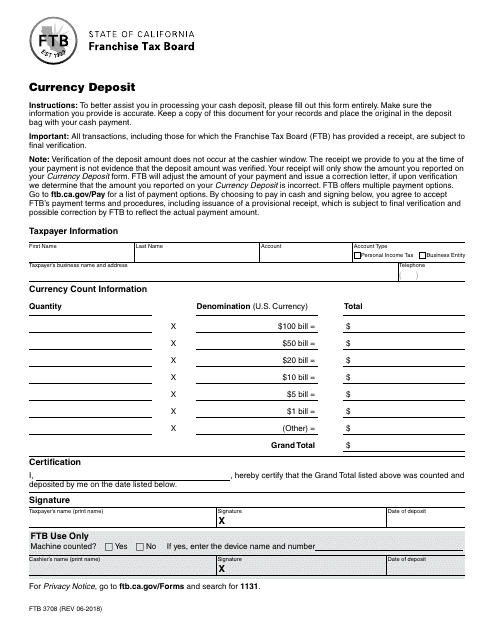

This Form is used for reporting currency deposits in California for tax purposes.

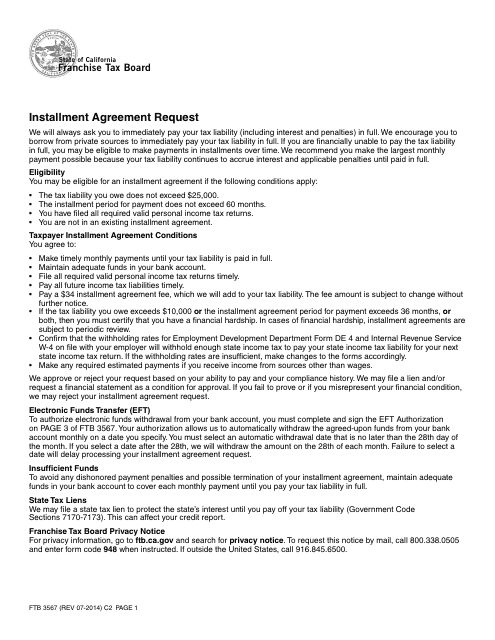

This Form is used for requesting an installment agreement with the California Franchise Tax Board (FTB) to pay taxes owed over time.

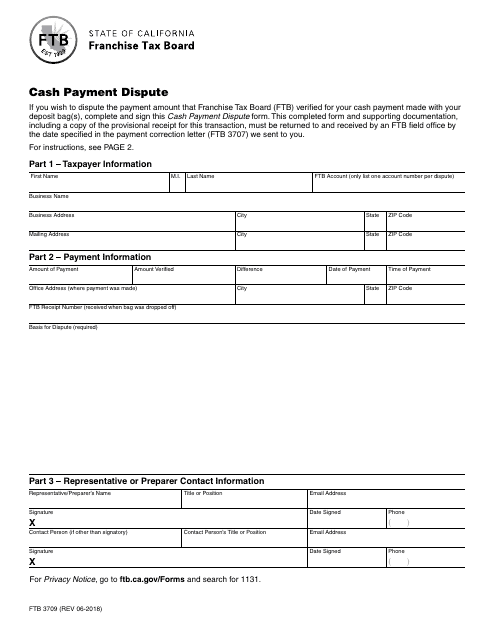

This form is used for disputing cash payments made to the Franchise Tax Board (FTB) in California.

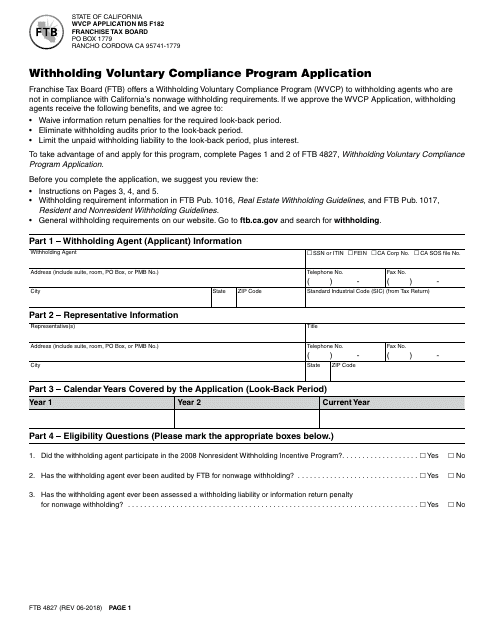

This form is used for applying to the Withholding Voluntary Compliance Program (WVCP) in California. It allows taxpayers to voluntarily come into compliance with their withholding obligations.

This form is used for requesting a suspension of the statute of limitations in California due to being financially disabled. It helps individuals who are unable to pay their taxes to temporarily stop collections activities.

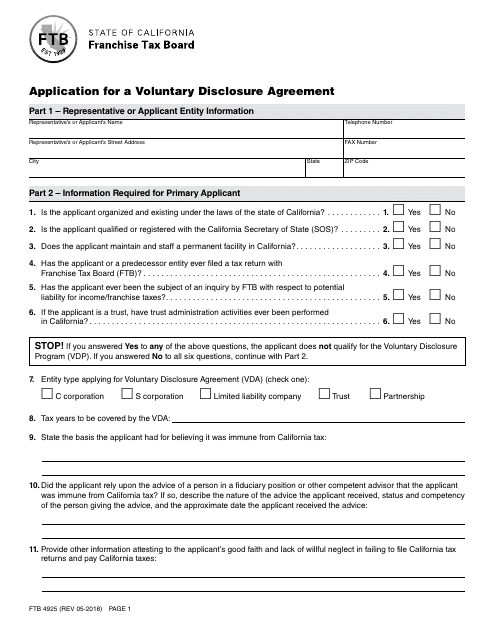

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.