Ontario Legal Forms and Templates

Documents:

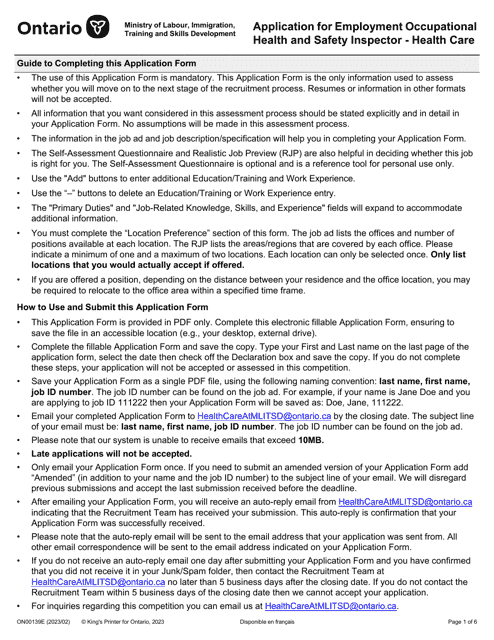

2373

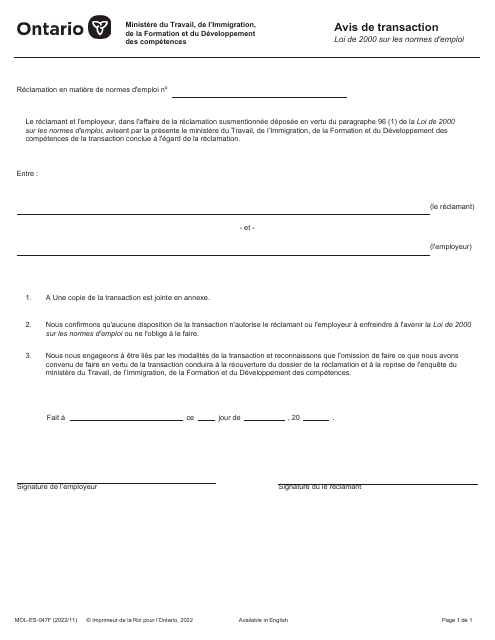

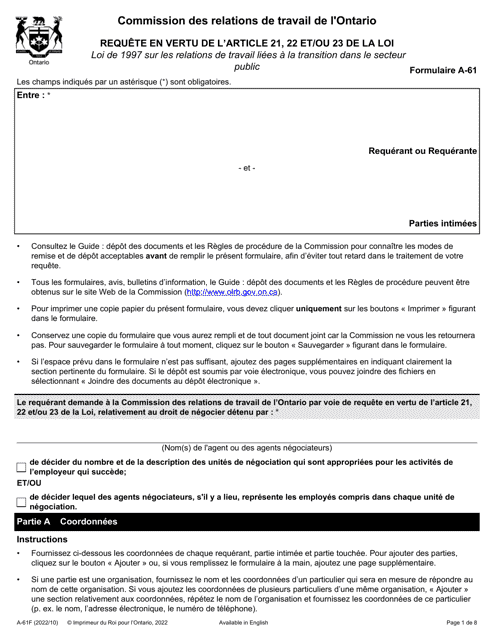

This Form is used for notifying relevant parties about a transaction under Section 112, specific to Ontario, Canada. It is a requirement in certain legal, business, or financial proceedings. The form is in French.

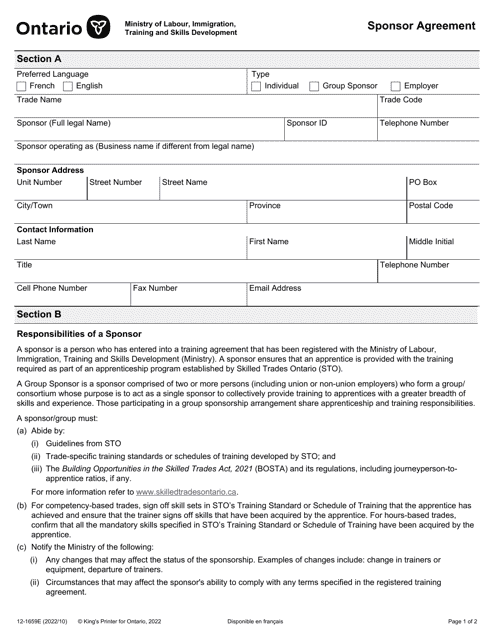

This type of document is a Sponsor Agreement form used in Ontario, Canada. It outlines the responsibilities and obligations of a sponsor for an individual seeking immigration or residency in Canada.

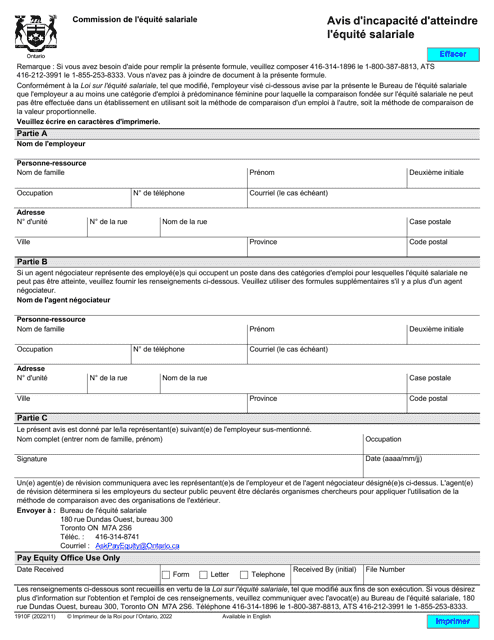

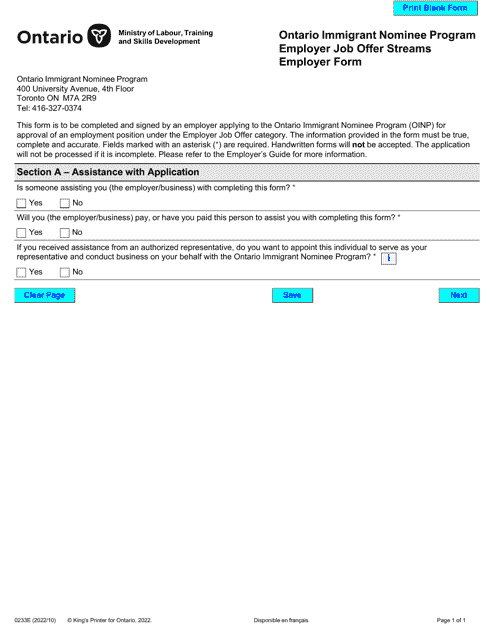

This form is used for Ontario employers to offer job opportunities to potential immigrants through the Ontario Immigrant Nominee Program. It is part of the employer stream of the program.

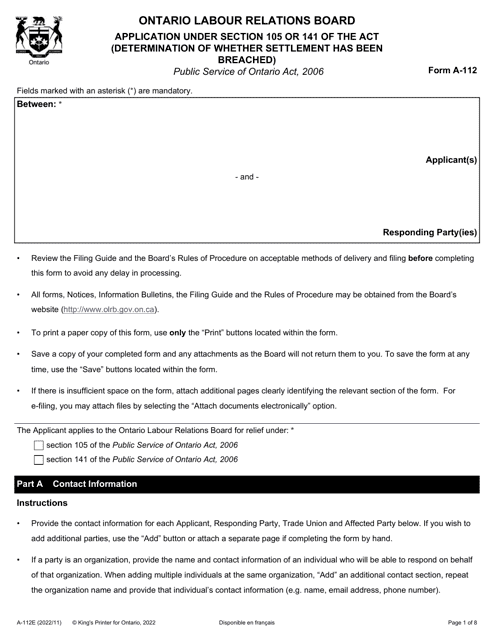

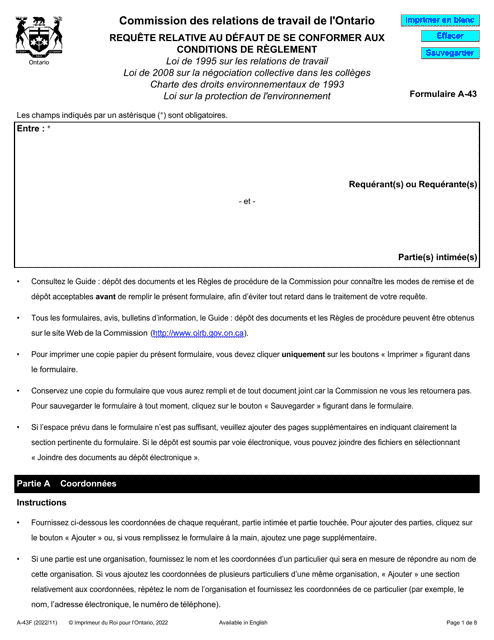

This Form is used for applying under Section 105 or 141 of the Act to determine whether a settlement has been breached in Ontario, Canada.

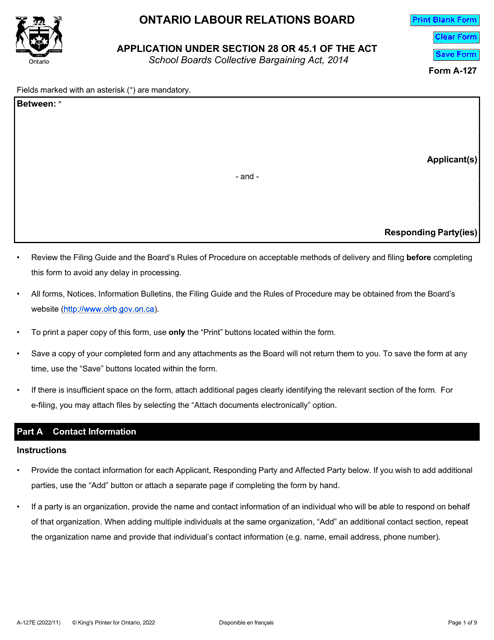

This form is used for applying under Section 28 or 45.1 of the Act in Ontario, Canada.

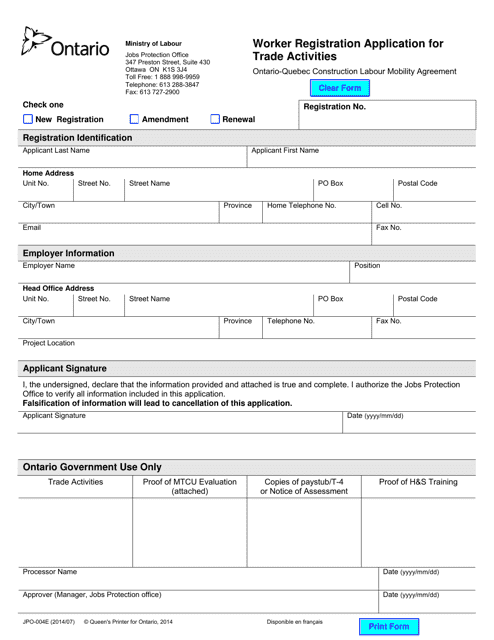

This document is used for registering workers who engage in trade activities in Ontario, Canada.

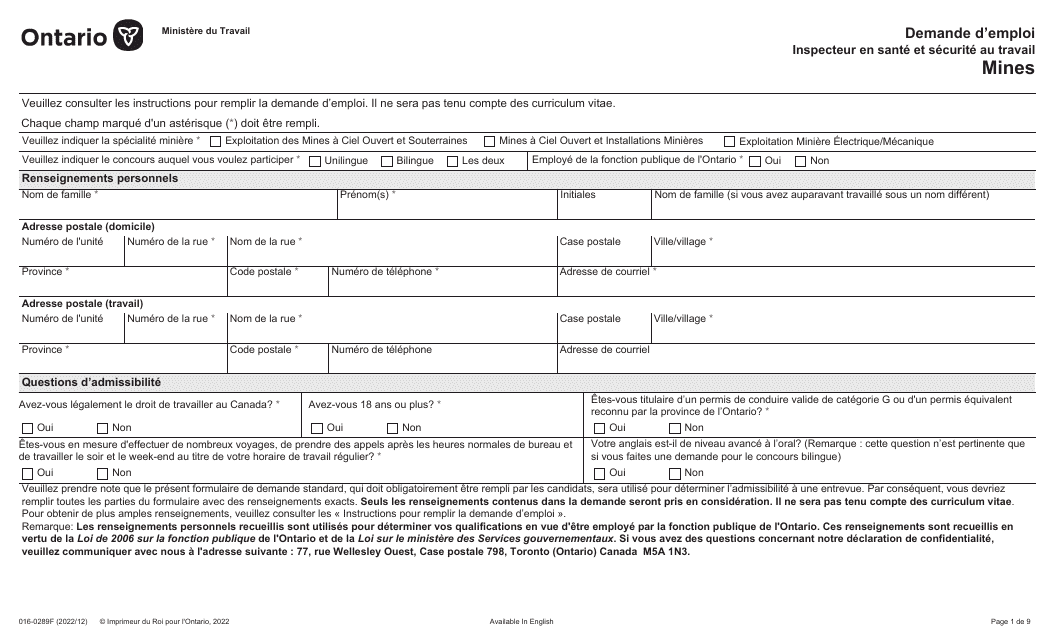

This form is used by individuals seeking employment in the mining sector in Ontario, Canada. It is specifically designed to capture all relevant information pertaining to the applicant's qualifications, previous work experience and suitability for employment within this industry. Note: The form is in French.

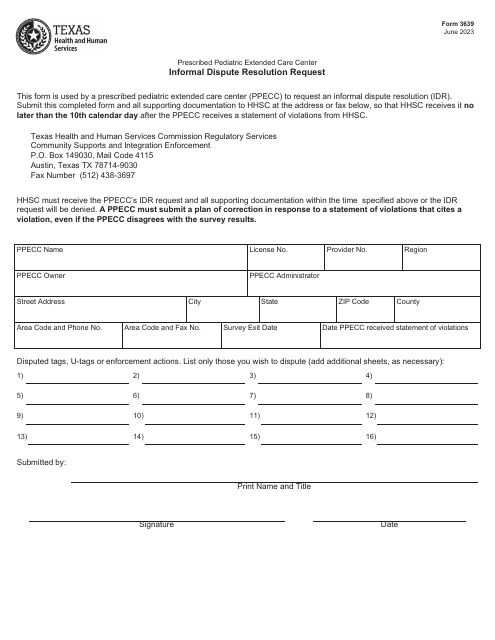

This form is used for requesting informal dispute resolution for a prescribed pediatric extended care center in Ontario, Canada.

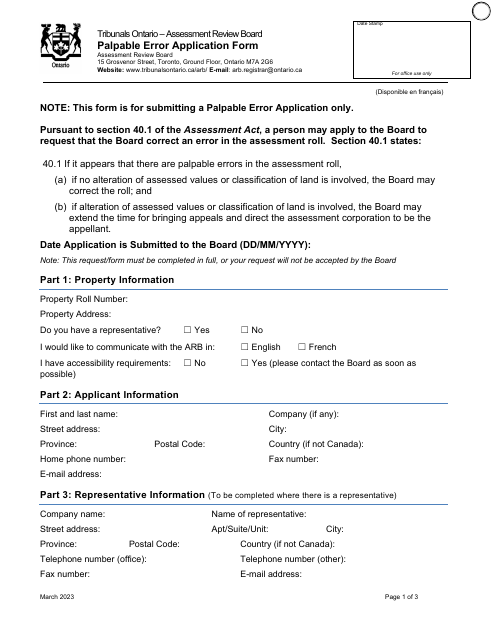

This document is an application form used in Ontario, Canada for rectifying a palpable error.

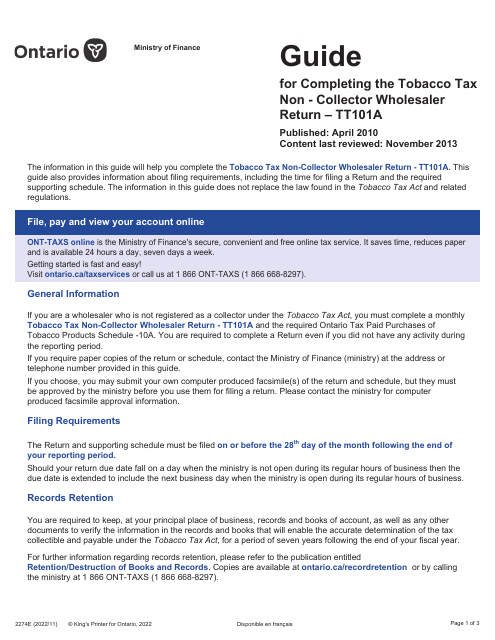

This form is used for providing guidance on how to complete the Tobacco Tax Non-collector Wholesaler Return - Tt101a in Ontario, Canada.

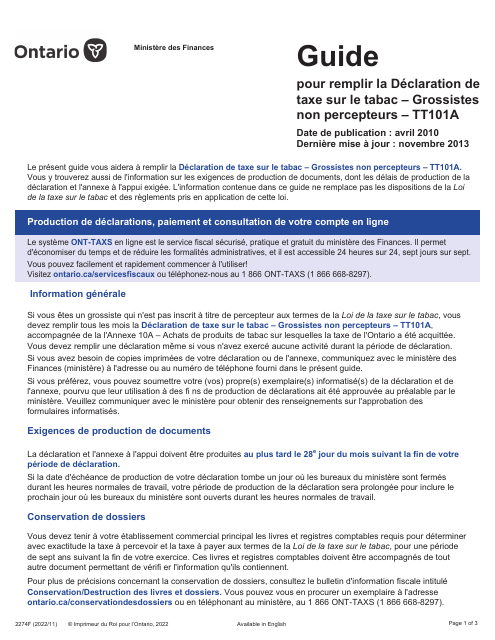

This document provides a guide for filling out the tax declaration form for tobacco wholesalers in Ontario, Canada.

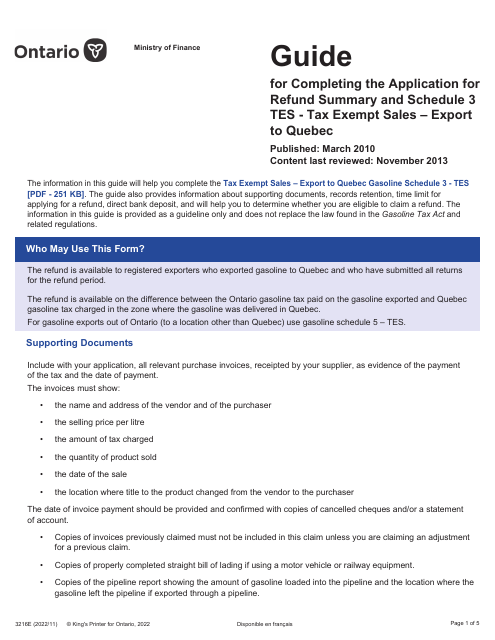

This form is used for providing a guide on how to complete the Application for Refund Summary and Schedule 3 Tes for tax exempt sales made to Quebec and Ontario, Canada.

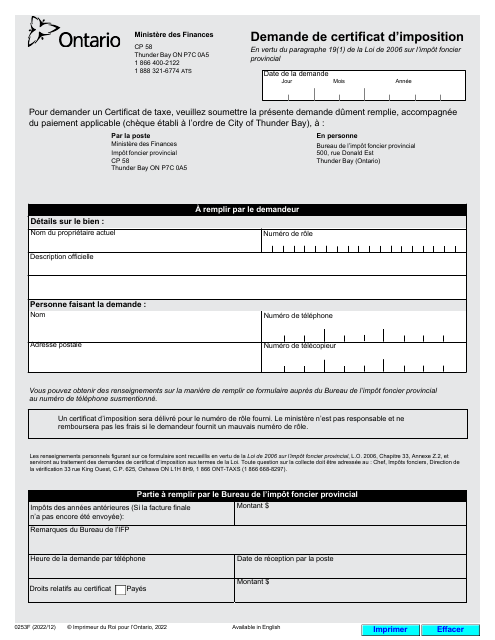

This form is used for filing a tax certificate request in Ontario, Canada. It is especially applicable to French-speaking residents. It helps in formalizing tax responsibilities and maintaining records for financial transactions with the local government.

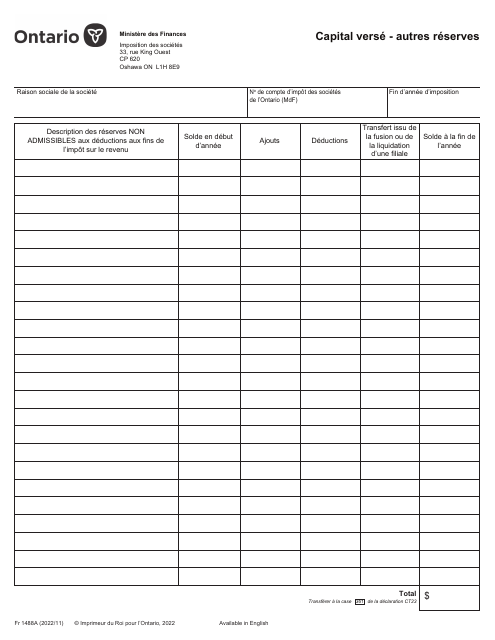

This document is used for reporting capital reserves in Ontario, Canada. (French)

This document is used for reporting the minimum tax on corporations in Ontario, Canada. (French)

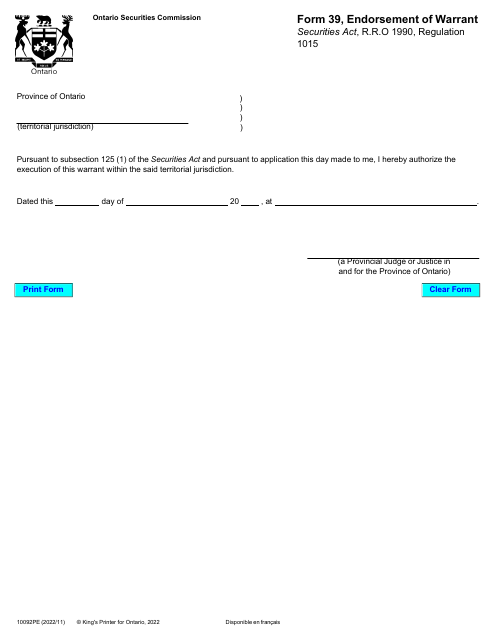

This form is used for endorsing a warrant in Ontario, Canada.

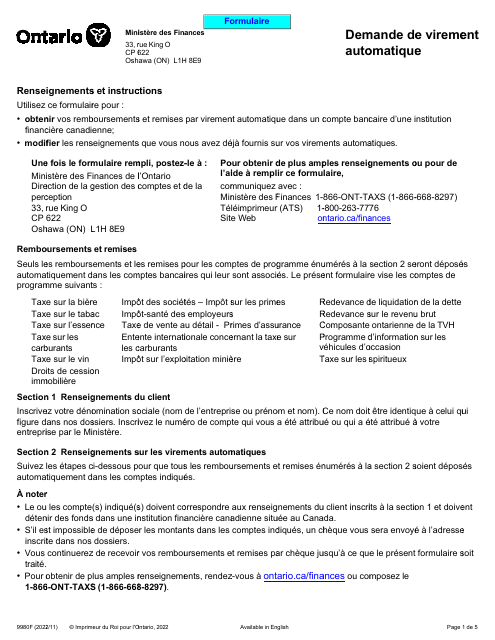

This document is used for requesting automatic transfers in Ontario, Canada.

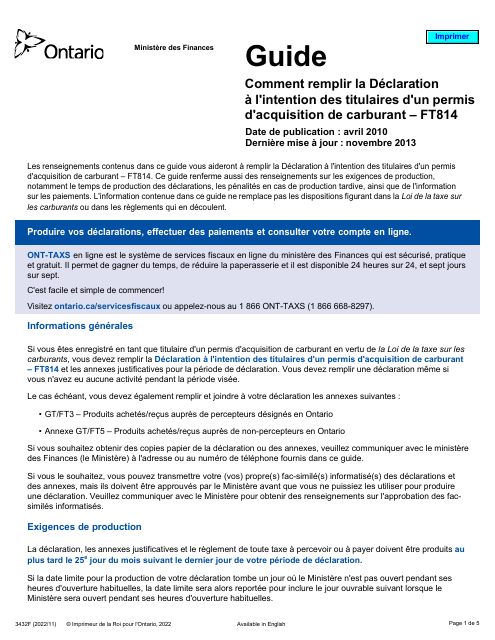

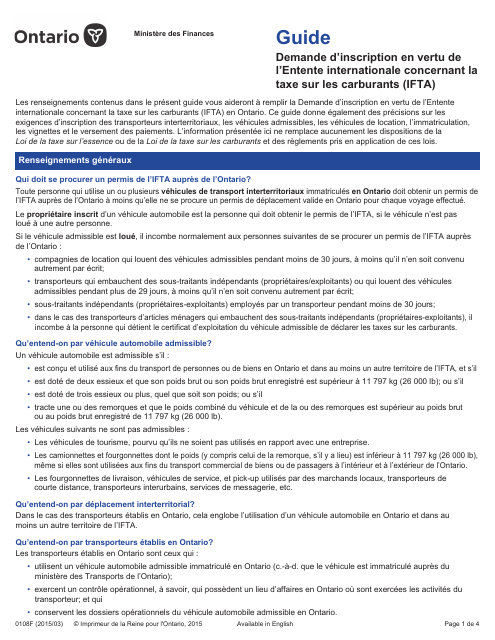

This document is a guide for completing the Forme 0108F. It provides instructions for applying for enrollment under the International Fuel Tax Agreement (IFTA) in the province of Ontario, Canada.

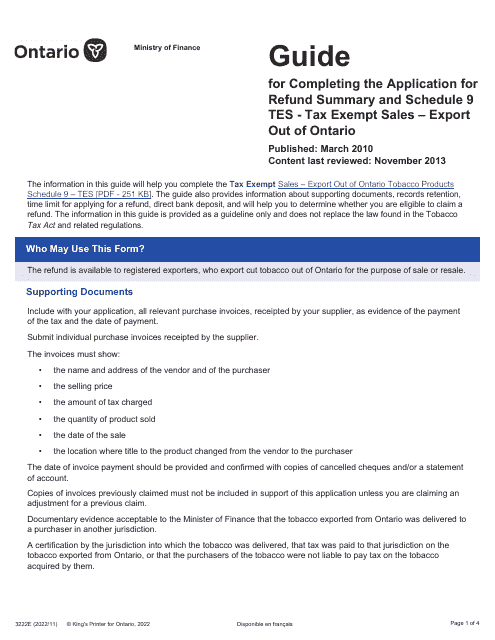

This guide provides instructions on how to complete Form 3222E, which is used for applying for a refund summary and Schedule 9 Tes for tax-exempt sales and exports out of Ontario, Canada.

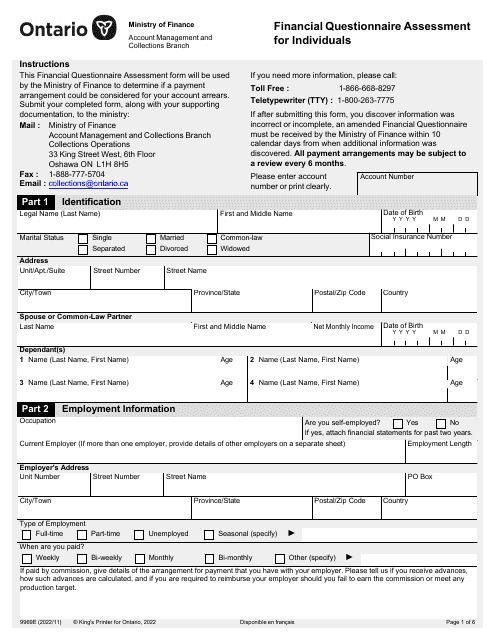

This form is used for assessing the financial situation of individuals in Ontario, Canada. It helps gather information about income, expenses, and assets to determine eligibility for various financial programs or services.

This type of document is used for applying for a refund for Auxiliary Power Take Off (PTO) Equipment in Ontario, Canada. The refund is applicable for PTO activities prior to July 1, 2017.

This form is used by foreign diplomats in Ontario, Canada to apply for a refund regarding aviation fuel in accordance with Annex 19. The guide includes a summary and appendix to assist with the reimbursement request. It's written in French.

This form is used for claiming tax refunds on sales exempted from tax to foreign armed forces present in Ontario, Canada. The guide provides step-by-step instructions in French on how to properly fill out Form 3228F and Annex 15 Tes. It is specifically designed for individuals and businesses dealing with exempted sales to foreign military forces.

This Form is used for completing the application for refund summary and schedule 7 for tax exempt sales to consumers in Ontario, Canada.

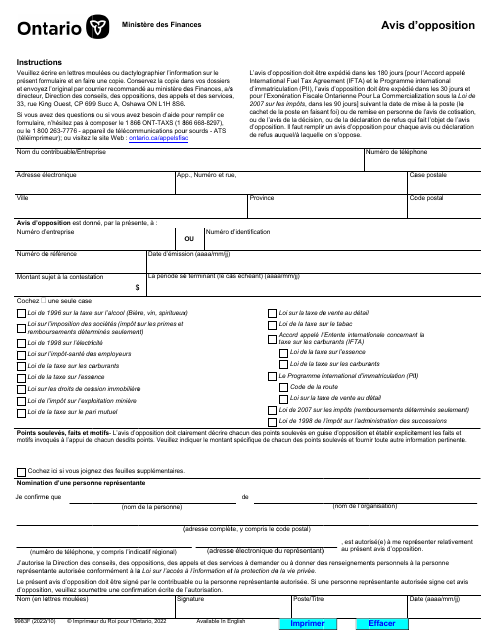

This document is used for filing an opposition notice in Ontario, Canada. It is specifically for French-speaking residents.

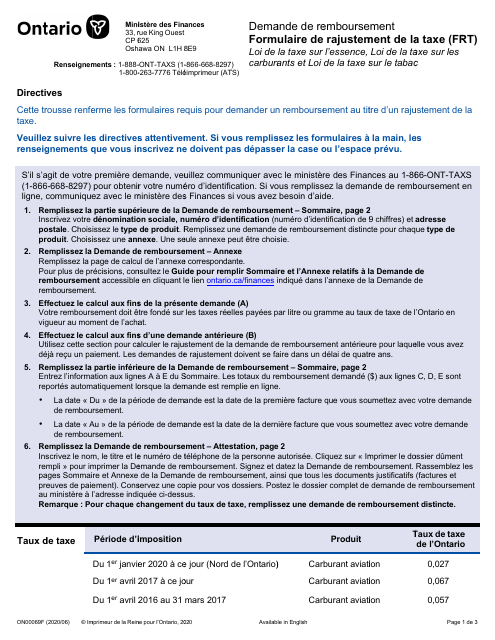

This form is used for requesting a refund and adjusting tax in Ontario, Canada.

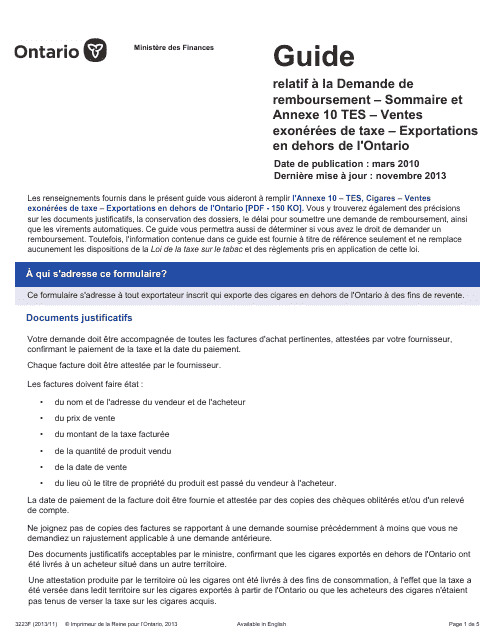

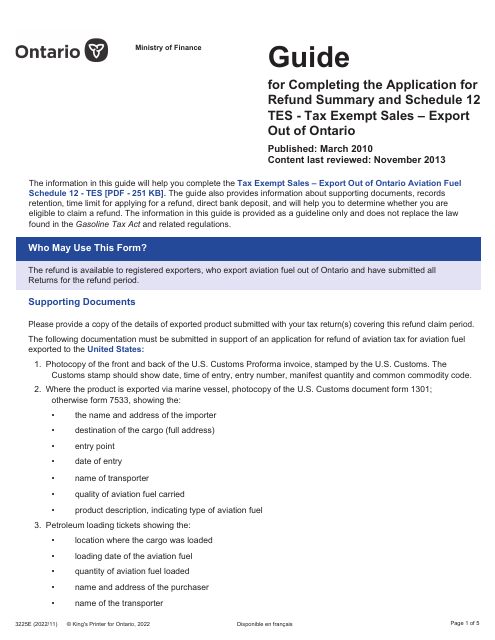

This document serves as a comprehensive guide for completing the Form 3225E in Ontario, Canada. Specifically, it aids in the application for tax refunds related to tax-exempt sales for products exported out of Ontario. It provides step-by-step instructions to ensure accurate and legal tax procedures.