Canada Legal Forms and Templates

Documents:

14555

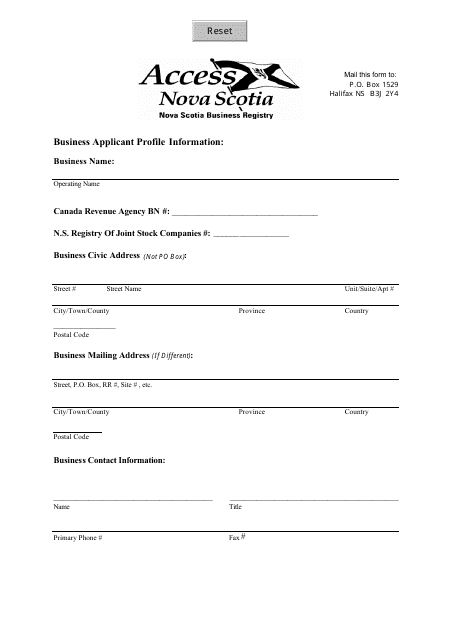

This document is for applying for a corporate insurance license in Nova Scotia, Canada. It is necessary for companies wishing to provide insurance services in the province.

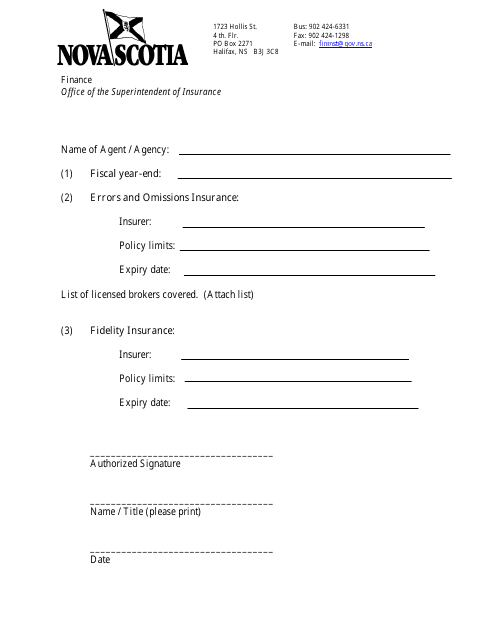

This document is for reconciling trust accounts in Nova Scotia, Canada. It helps ensure that the balances of trust accounts match the recorded transactions and statements.

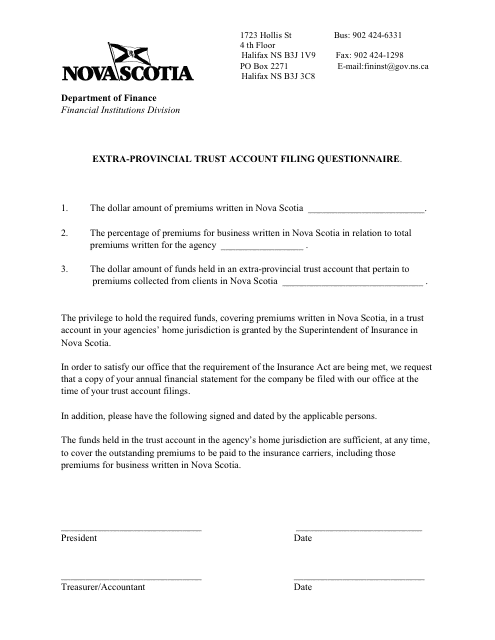

This document is used for filing a questionnaire related to an extra-provincial trust account in Nova Scotia, Canada. It is necessary for compliance with the provincial regulations for trust accounts.

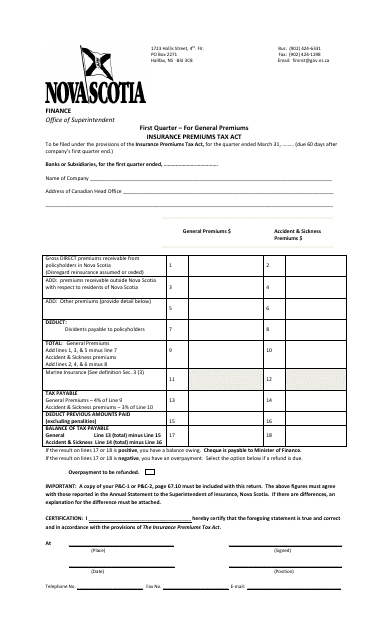

This document is used for reporting and paying insurance premiums taxes for the first quarter in the province of Nova Scotia, Canada.

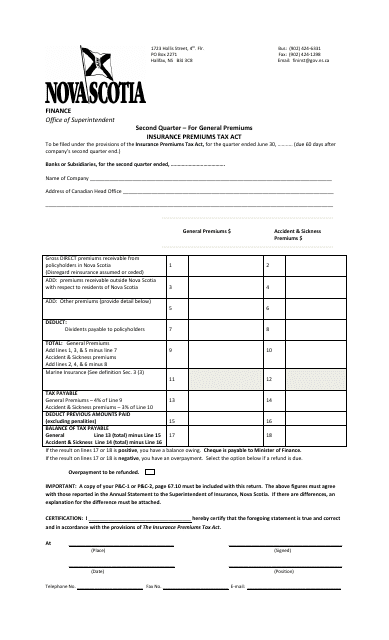

This document is related to the Second Quarter Insurance Premiums Tax Act for General Premiums in Nova Scotia, Canada. It outlines the regulations and requirements for taxing insurance premiums during the second quarter of the year.

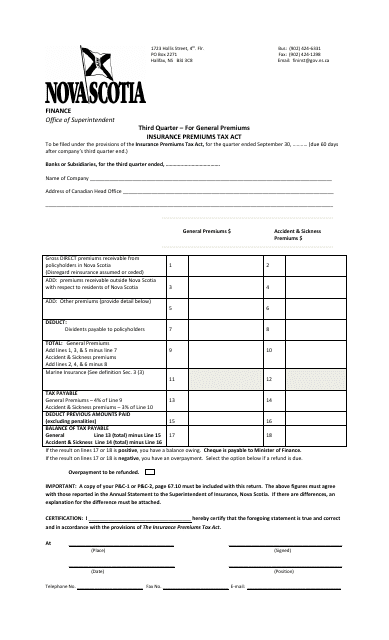

This document outlines the Third Quarter Insurance Premiums Tax Act for general premiums in Nova Scotia, Canada. It provides information and regulations regarding the taxation of insurance premiums during the third quarter.

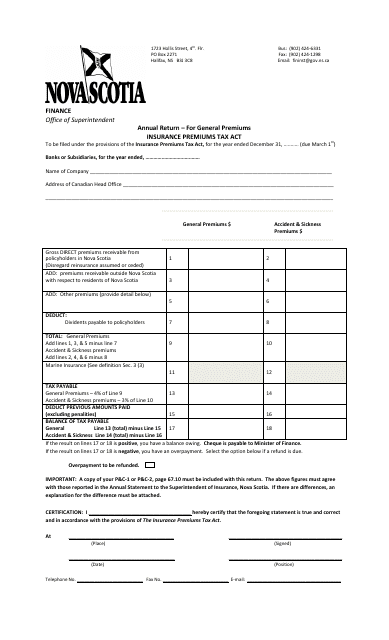

This form is used for reporting and paying the annual general premium tax in Nova Scotia, Canada. It is required for businesses operating in the insurance industry.

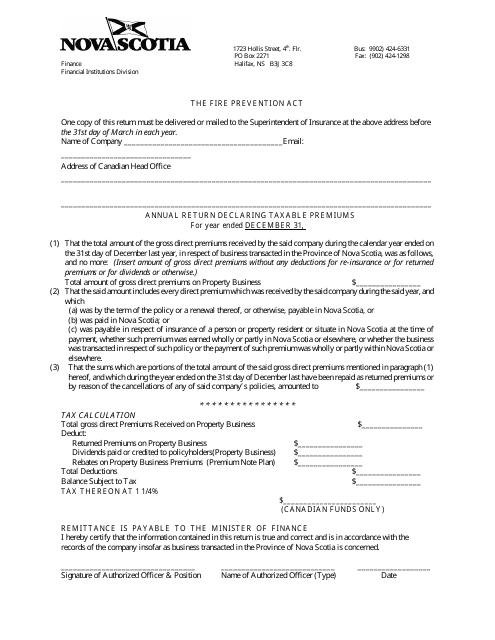

This Form is used for declaring taxable premiums on an annual basis in Nova Scotia, Canada.

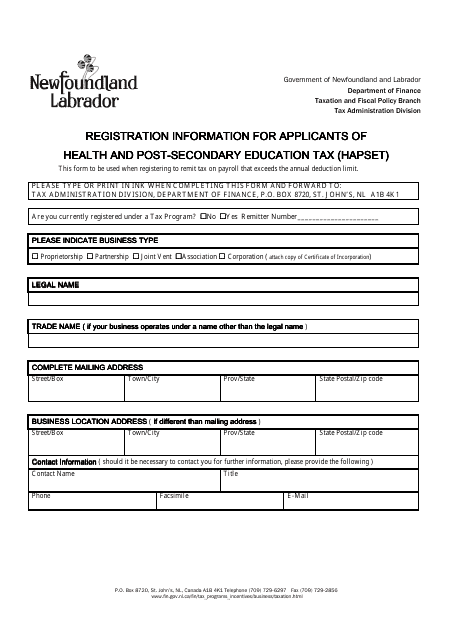

This document provides registration information for applicants of the Health and Post-Secondary Education Tax (HAPSET) in Newfoundland and Labrador, Canada. Learn how to register and fulfill your tax obligations related to health and post-secondary education.

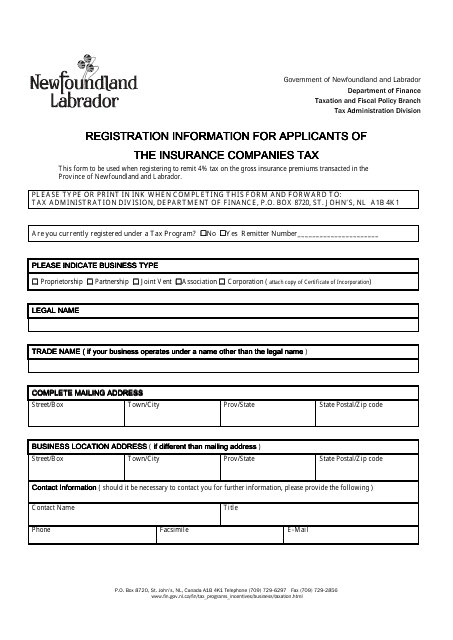

This document provides registration information for individuals who want to apply for the Insurance Companies Tax in Newfoundland and Labrador, Canada.

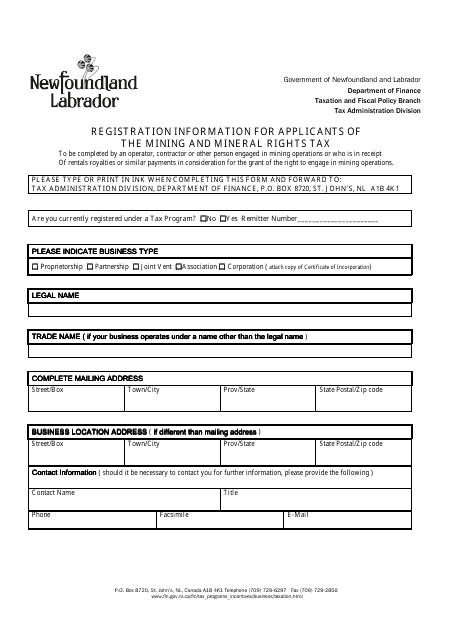

This document provides registration information for applicants applying for the Mining and Mineral Rights Tax in Newfoundland and Labrador, Canada.

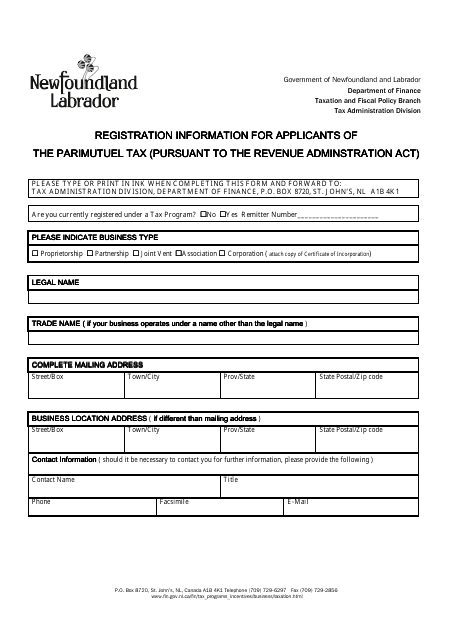

This document provides registration information for applicants of the Parimutuel Tax in Newfoundland and Labrador, Canada. It outlines the requirements and process for individuals or organizations wishing to apply for this tax.

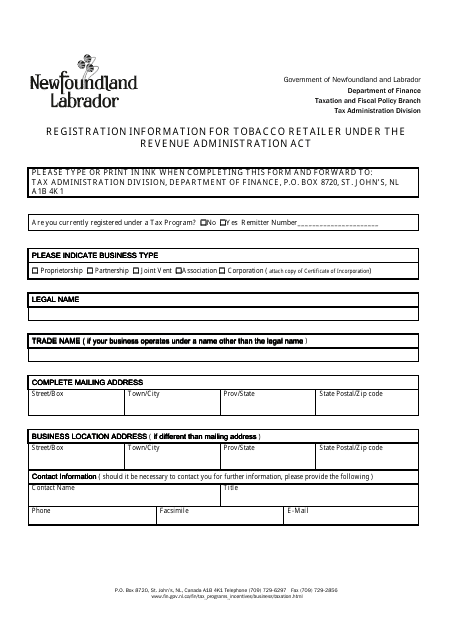

This document is for registering as a tobacco retailer in Newfoundland and Labrador, Canada under the Revenue Administration Act.

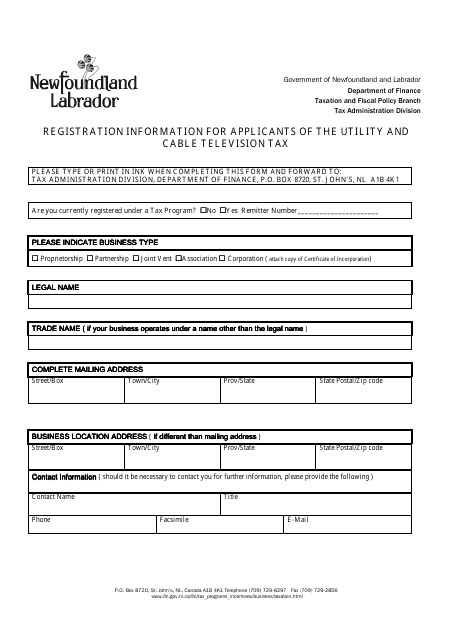

This document provides registration information for individuals applying for the Utility and Cable Television Tax in Newfoundland and Labrador, Canada.

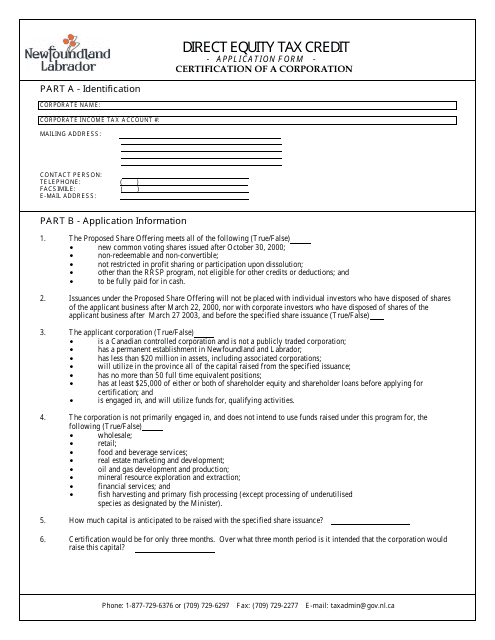

This Form is used for applying to the Direct Equity Tax Credit Program in Newfoundland and Labrador, Canada. This program offers tax credits to individuals and corporations who invest in eligible businesses.

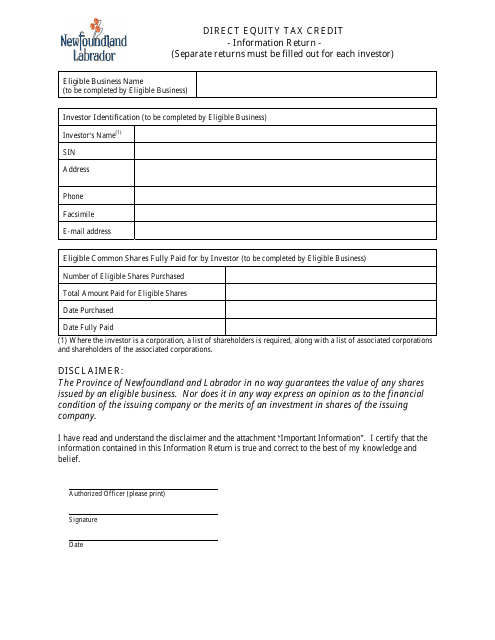

This document provides information on the Direct Equity Tax Credit Program in Newfoundland and Labrador, Canada. The program offers tax credits for investments in eligible businesses.

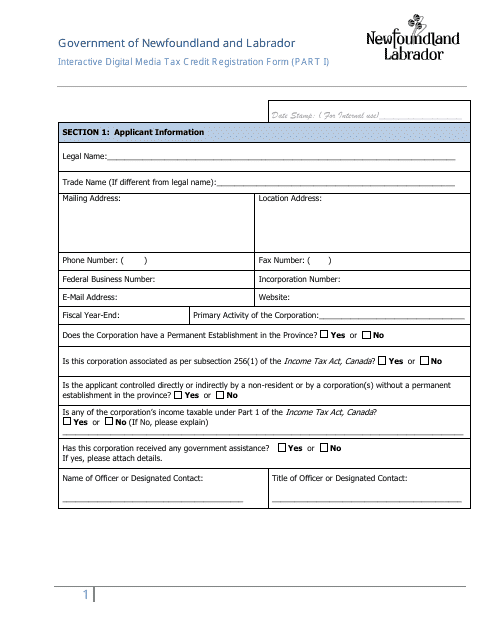

This document is used for registering for the Interactive Digital Media Tax Credit in Newfoundland and Labrador, Canada.

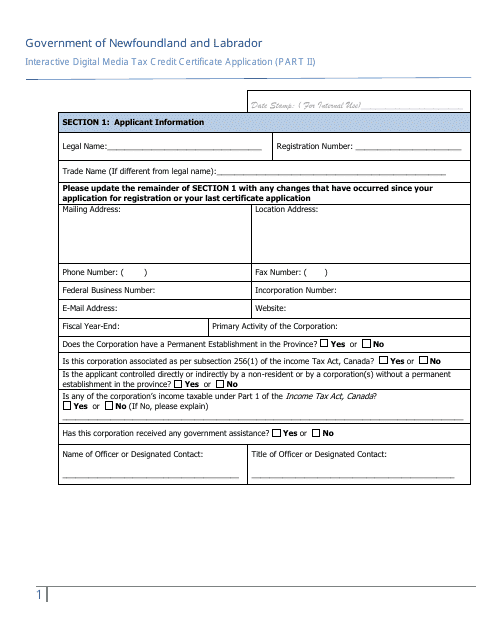

This document is an application form for the Interactive Digital Media Tax Credit Certification in Newfoundland and Labrador, Canada. It is used by individuals or companies involved in the interactive digital media industry to apply for tax credits.

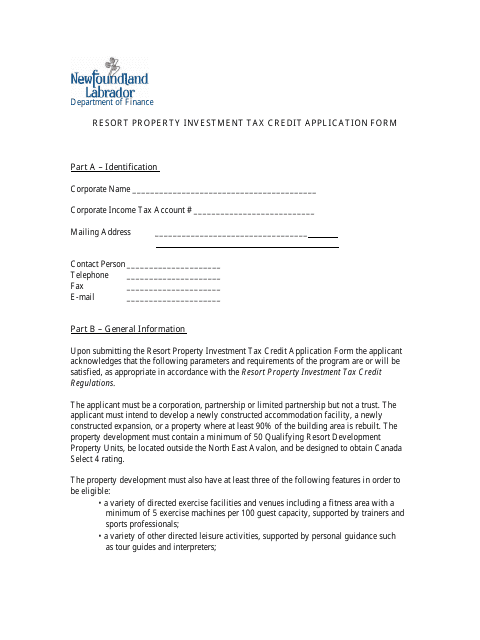

This Form is used for applying for the Resort Property Investment Tax Credit in Newfoundland and Labrador, Canada.

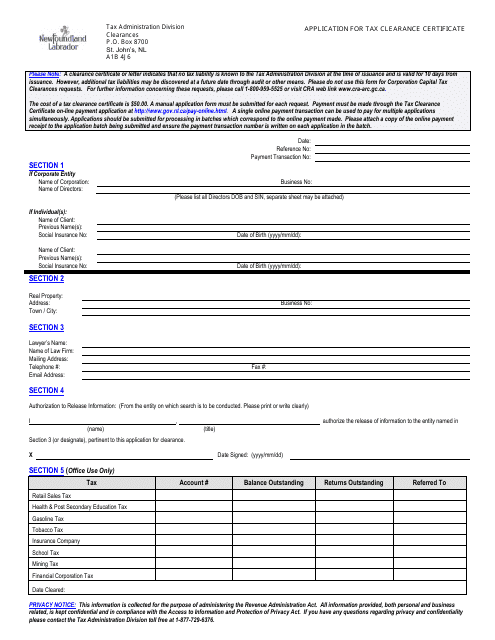

This document is used to apply for a Tax Clearance Certificate in the province of Newfoundland and Labrador, Canada. It is required when conducting certain business transactions or when closing a business.

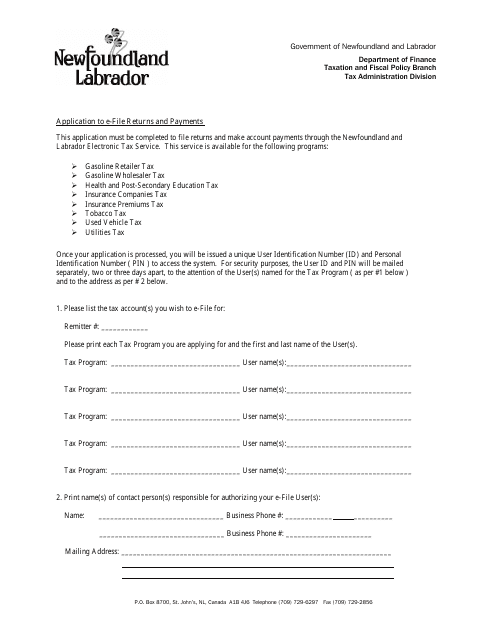

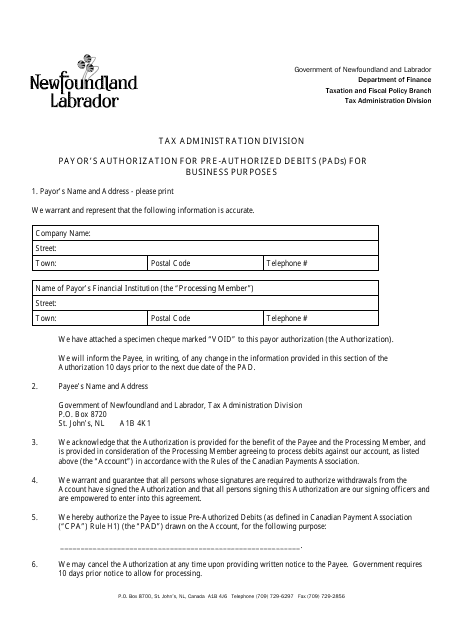

This document is an application form for individuals or businesses in Newfoundland and Labrador, Canada, who want to electronically file their tax returns and make online payments. It enables them to conveniently and securely submit their tax information and payments using electronic channels.

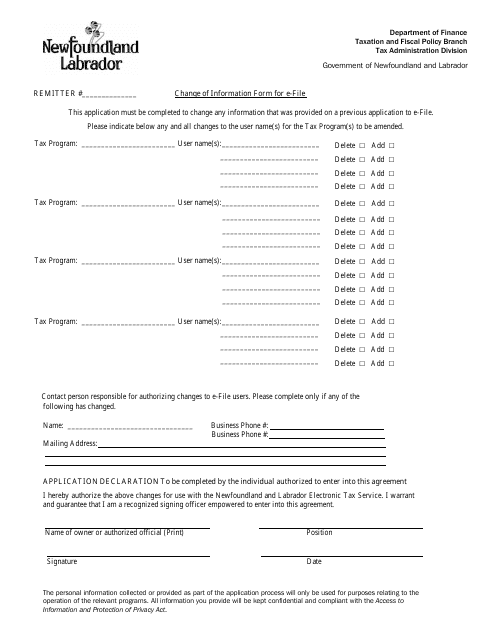

This Form is used for updating personal information for electronic filing in Newfoundland and Labrador, Canada.

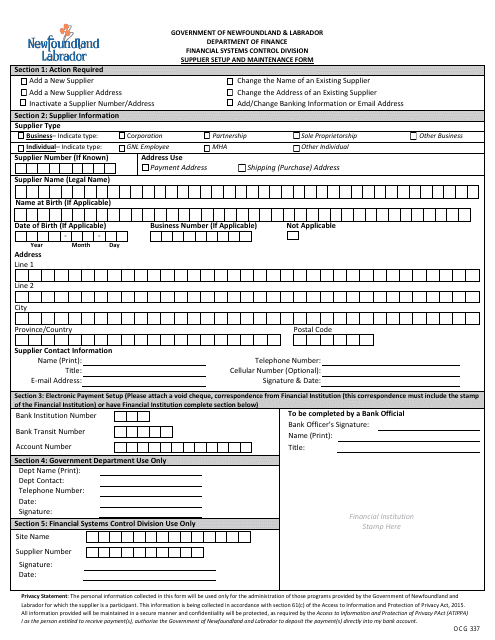

This form is used for supplier setup and maintenance in Newfoundland and Labrador, Canada.

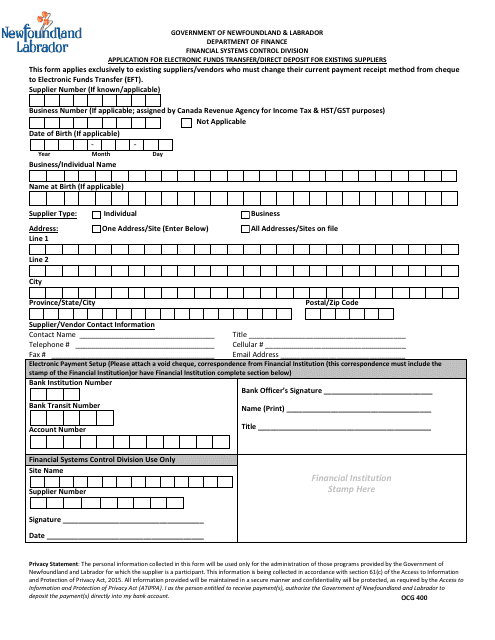

This Form is used for existing suppliers in Newfoundland and Labrador, Canada to apply for electronic funds transfer/direct deposit.

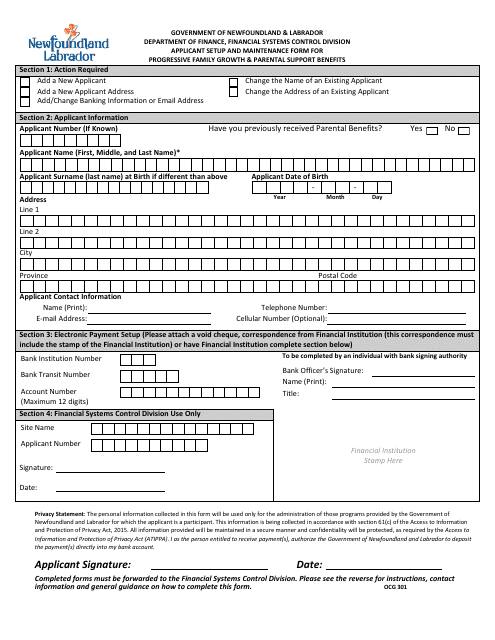

This form is used for setting up and maintaining applicant information for the Progressive Family Growth & Parental Support Benefits in Newfoundland and Labrador, Canada.

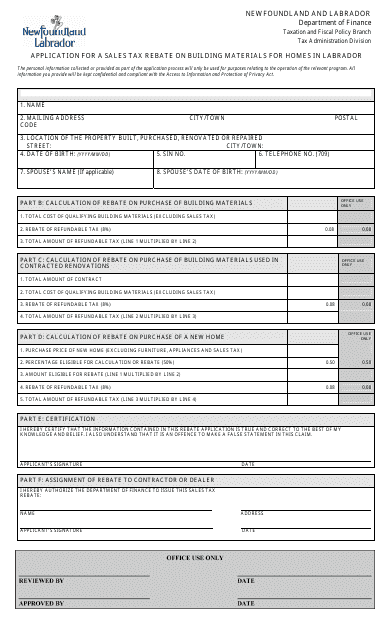

This document is used for applying for a sales tax rebate on building materials for homes in Labrador, Newfoundland and Labrador, Canada.

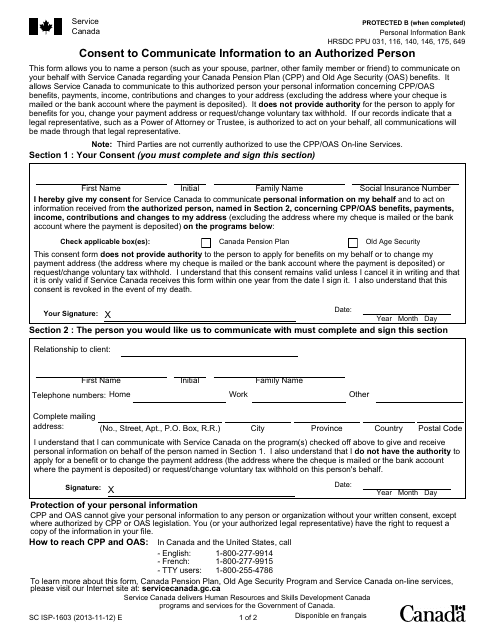

This form is used for consenting to communicate personal information to an authorized person in Canada.

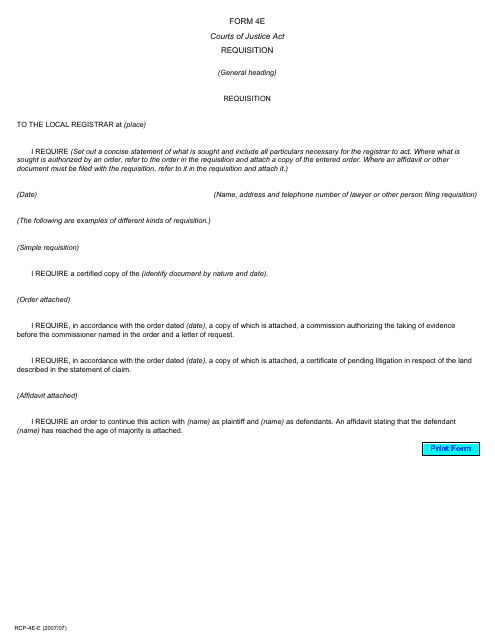

This form is used for requisition purposes in the province of Ontario, Canada.

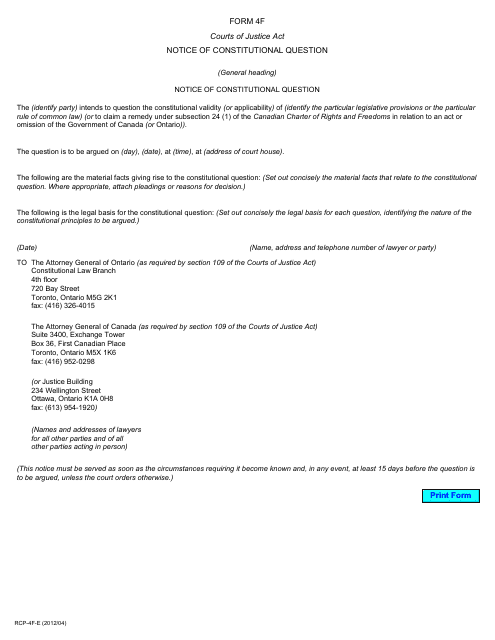

This document is for notifying the court about a constitutional question in Ontario, Canada. It is used to seek clarification on the constitutionality of a law or government action.

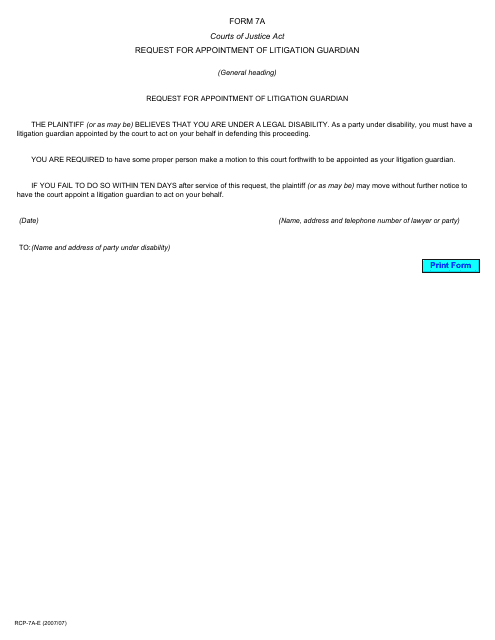

This form is used for requesting the appointment of a litigation guardian in Ontario, Canada.

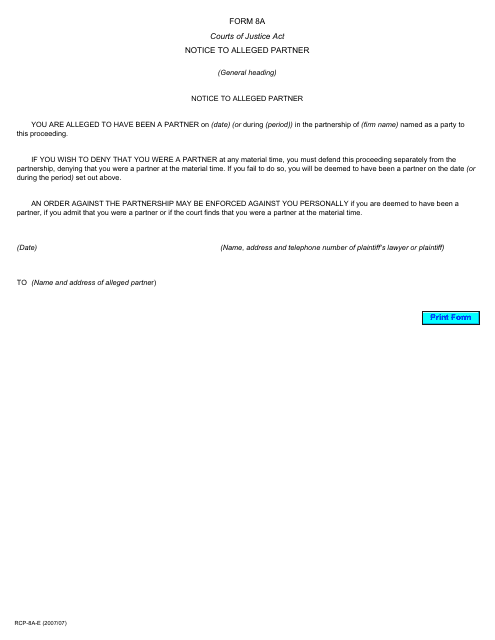

This form is used for providing notice to an alleged partner in Ontario, Canada.

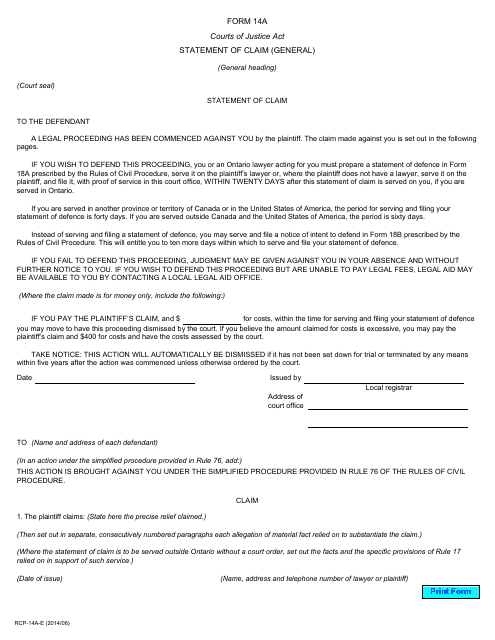

This form is used for filing a general statement of claim in Ontario, Canada. It is the initial document required to start a civil lawsuit.

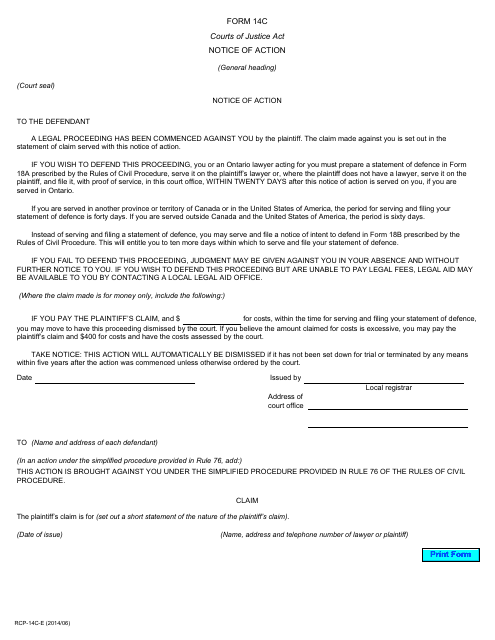

This form is used for providing notice of action in the province of Ontario, Canada. It is a legal document that informs recipients of upcoming legal proceedings or actions being taken.

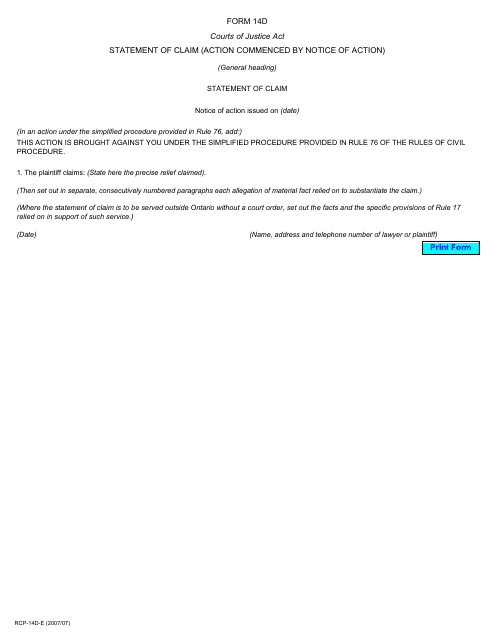

This Form is used for filing a Statement of Claim in Ontario, Canada. It is a legal document used to initiate a lawsuit by providing details of the claim being made and the relief sought.

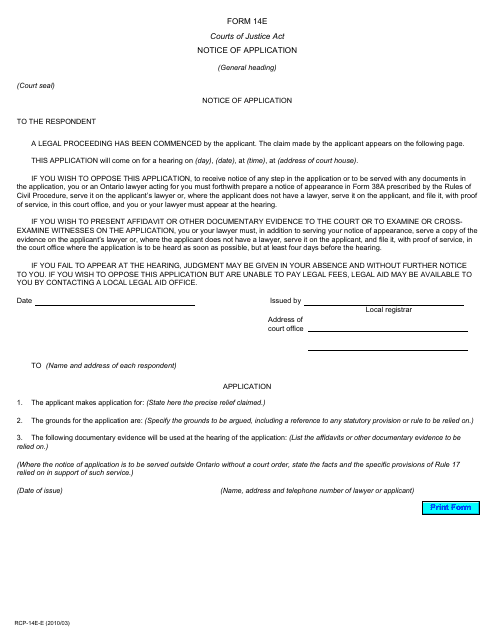

This Form is used for giving notice of an application in the province of Ontario, Canada.

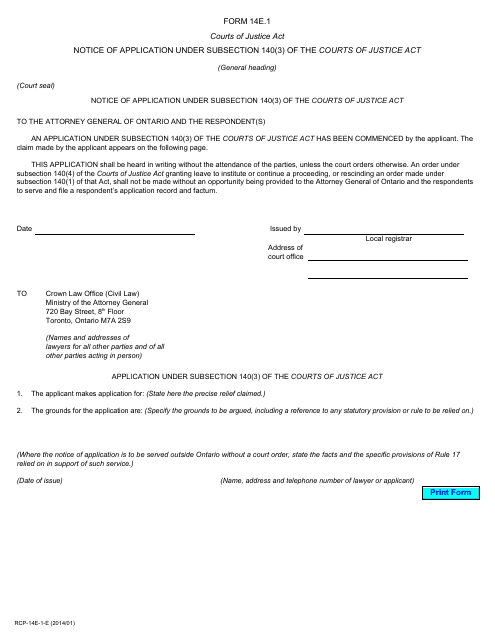

This Form is used for submitting a Notice of Application under Section 140(3) of the Courts of Justice Act in Ontario, Canada.