Canadian Federal Legal Forms and Templates

Documents:

5112

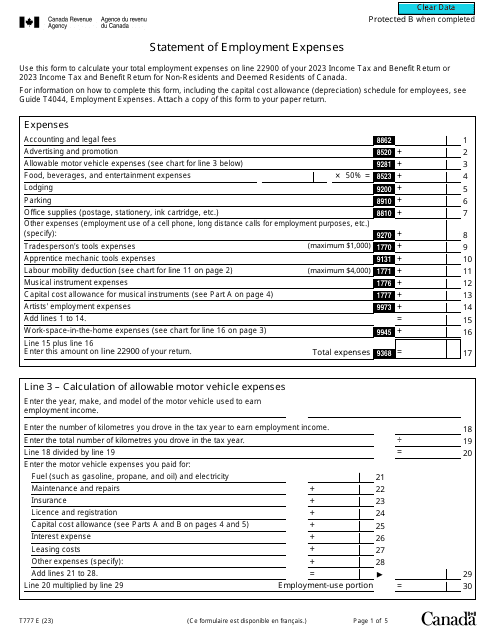

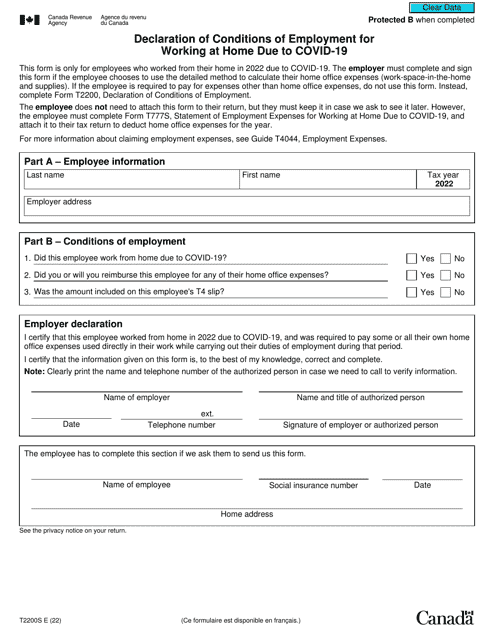

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.

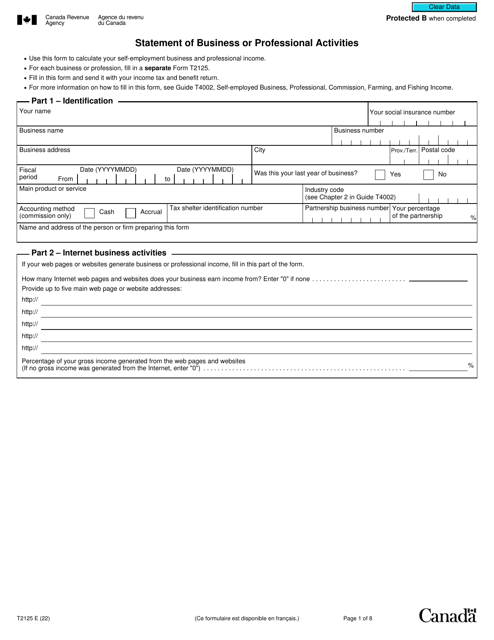

This a legal document that was specifically developed for Canadian taxpayers who receive self-employment business or professional income that they may use when they want to report their income.

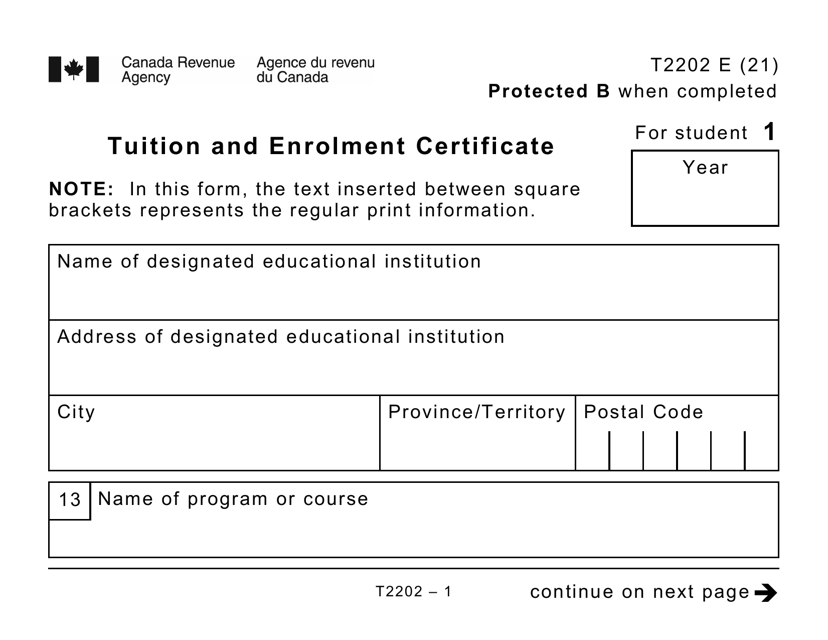

This form is used for reporting tuition and education expenses for Canadian tax purposes. It provides a breakdown of the amount paid for tuition fees, as well as the number of months enrolled in educational programs.

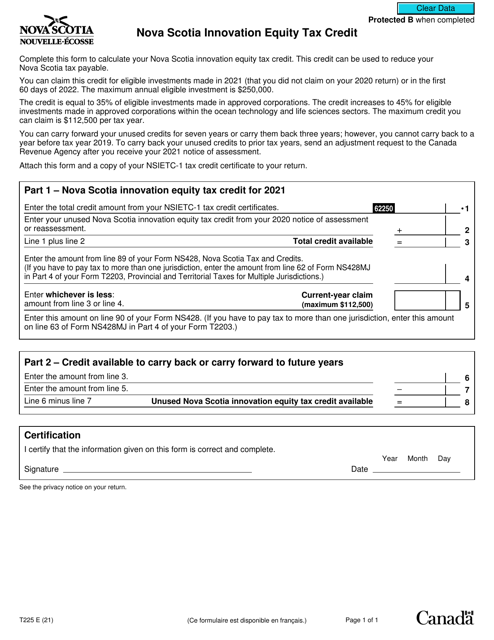

This form is used in Canada for claiming the Nova Scotia Innovation Equity Tax Credit.