Canadian Federal Legal Forms and Templates

Documents:

5112

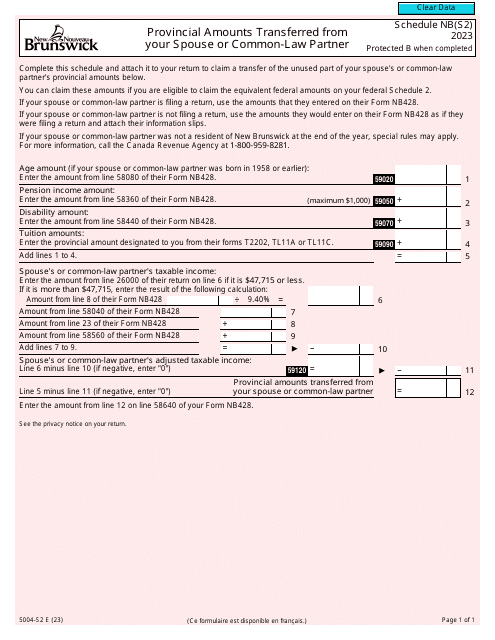

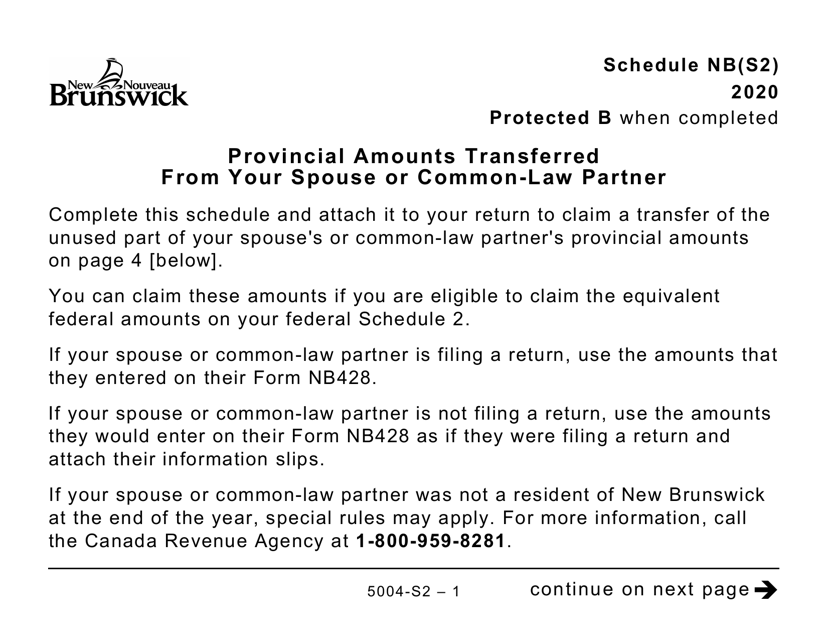

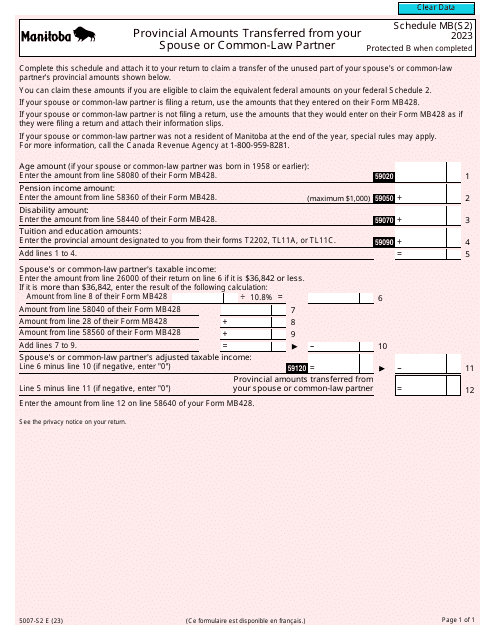

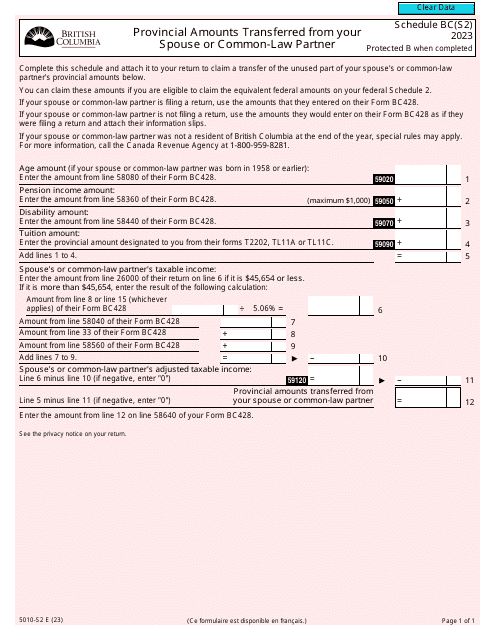

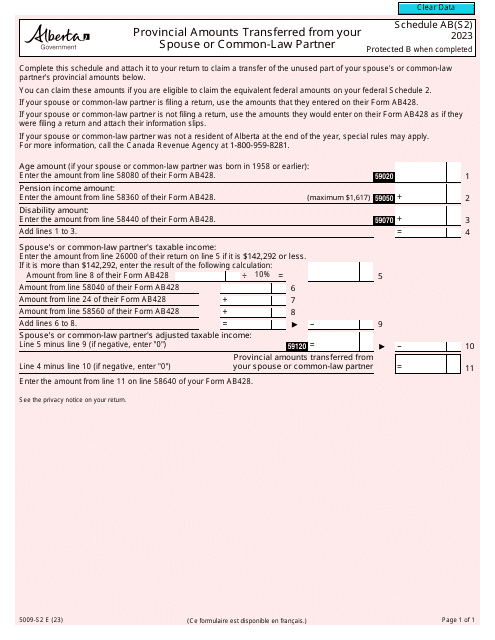

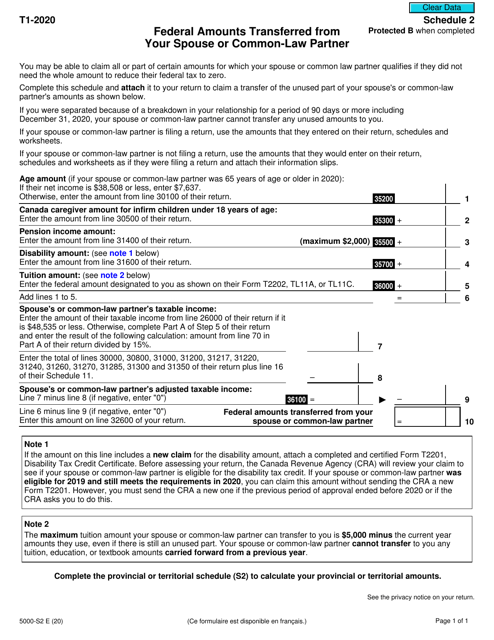

This Form is used for reporting provincial amounts transferred from your spouse or common-law partner on Form 5004-S2 Schedule NB(S2) in Canada. It is available in large print format.

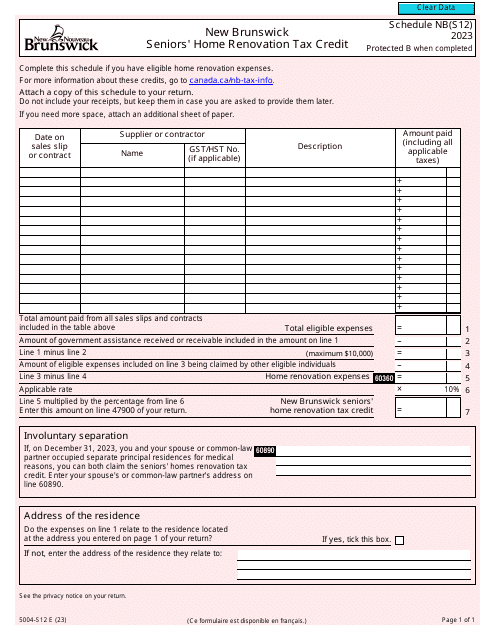

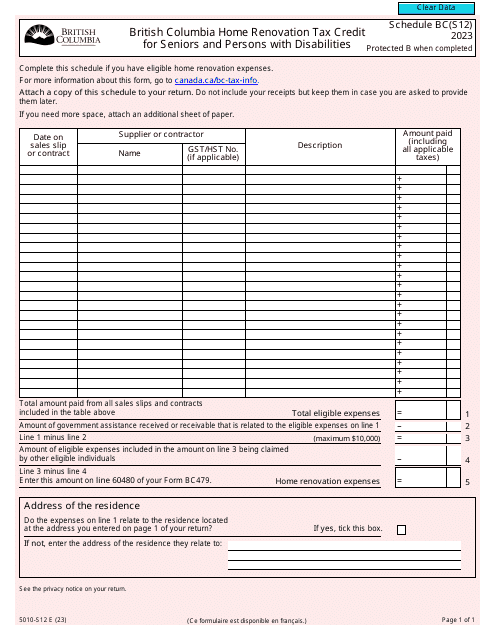

This form is used for claiming the New Brunswick Seniors' Home Renovation Tax Credit for residents of New Brunswick, Canada. It is specifically designed for seniors who are eligible for the tax credit and need a large print version of the form.

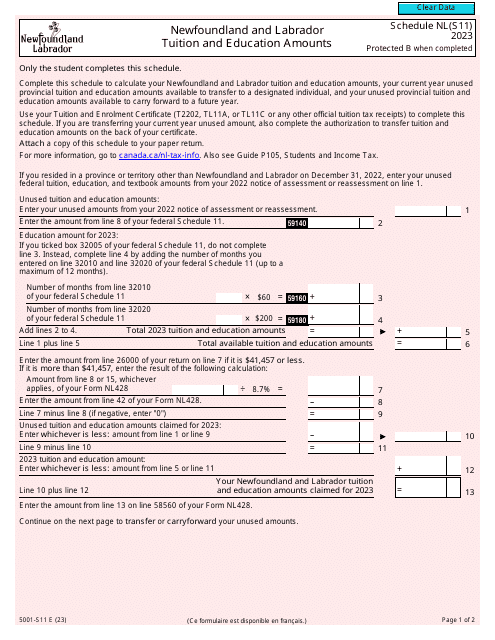

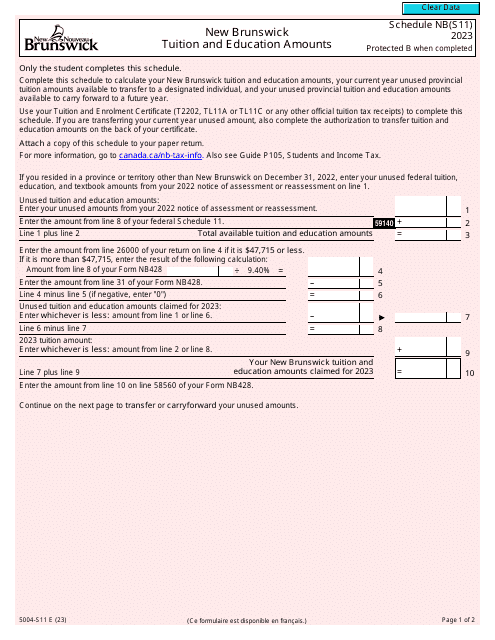

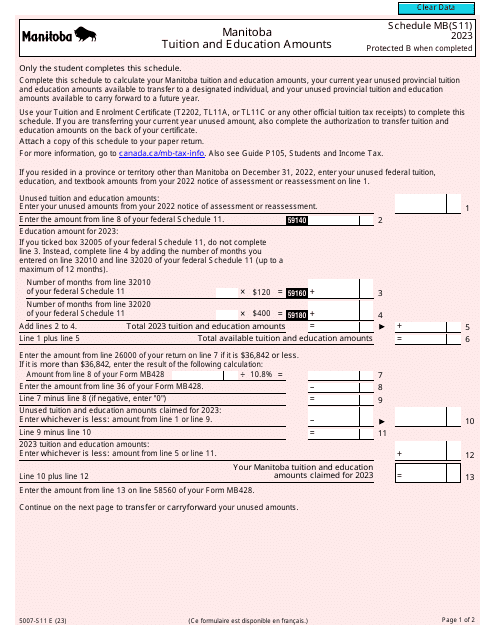

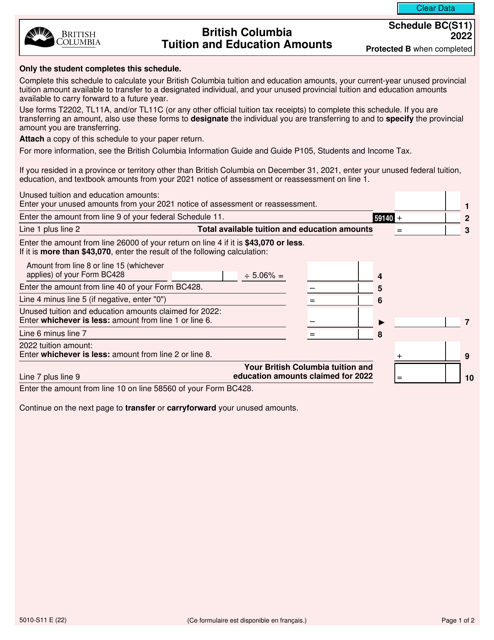

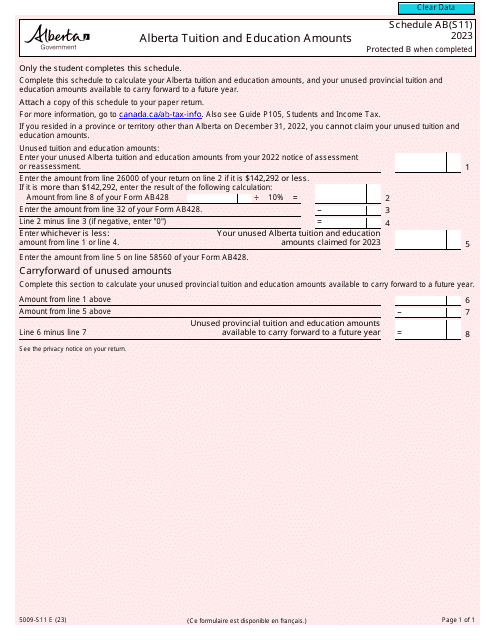

This form is used for claiming tuition and education amounts on your tax return in New Brunswick, Canada. It is in large print format for ease of use.

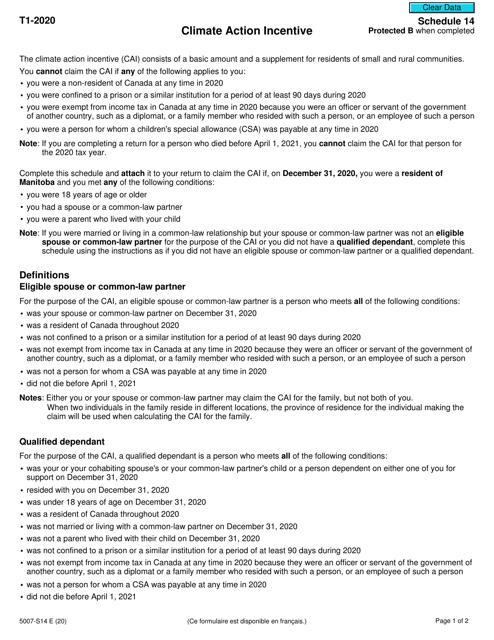

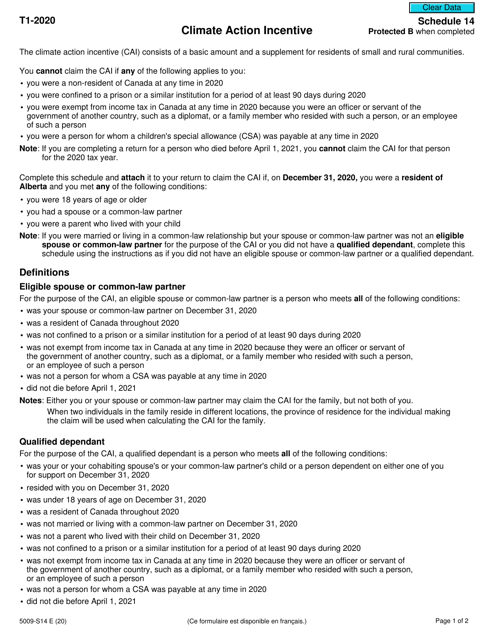

This form is used for claiming the Climate Action Incentive in Canada. It helps individuals and families receive tax credits for taking environmentally-friendly actions.

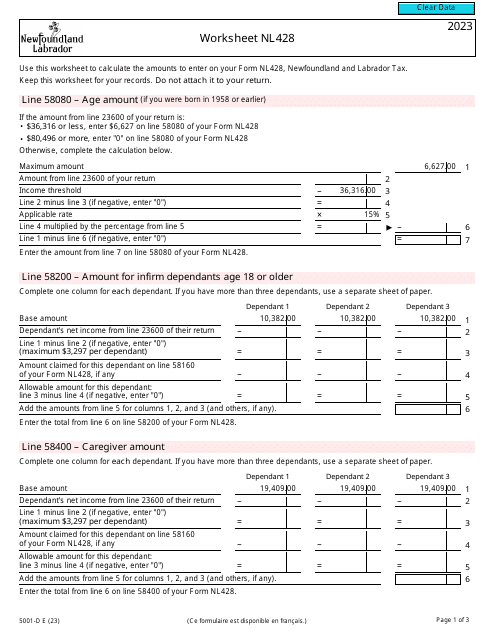

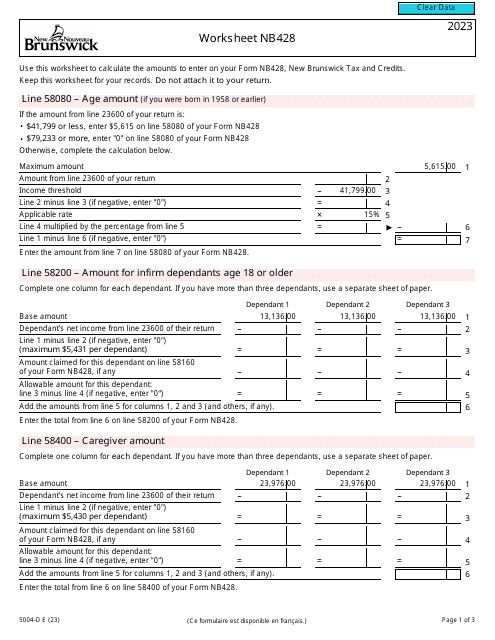

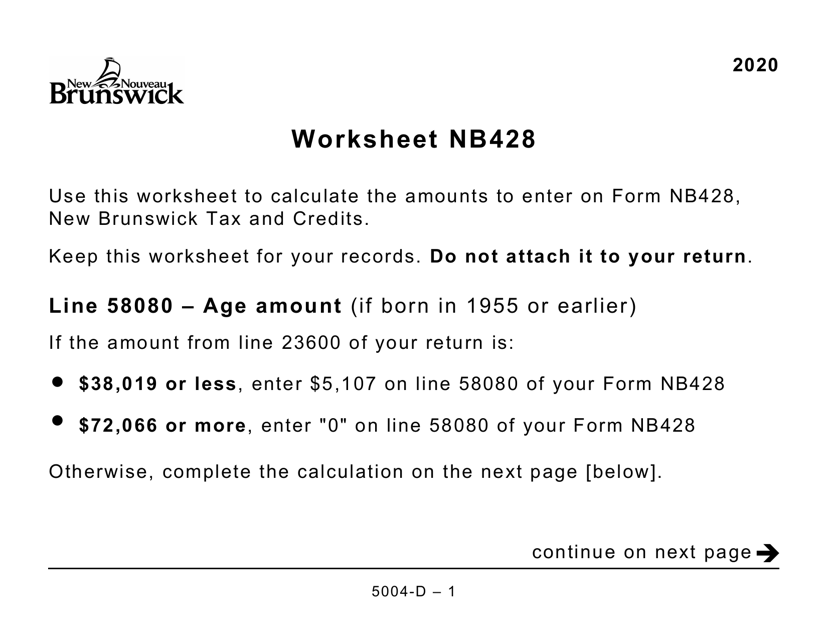

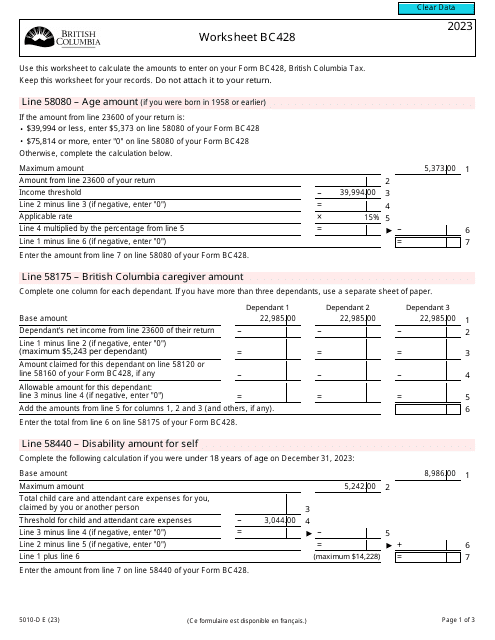

This form is used for completing the NB428 Worksheet for residents of New Brunswick in Canada. It is provided in a large print format for easy reading and accessibility.

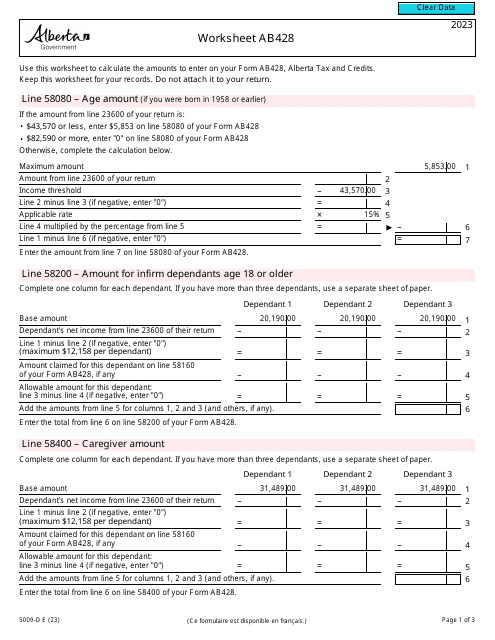

This form is used for claiming the Climate Action Incentive for residents of Alberta, Canada.

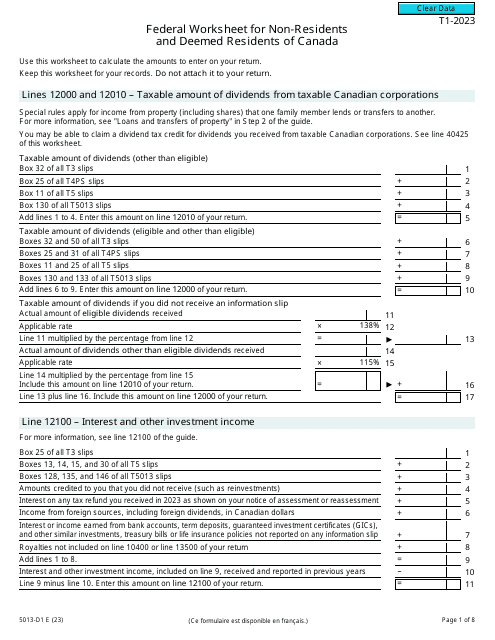

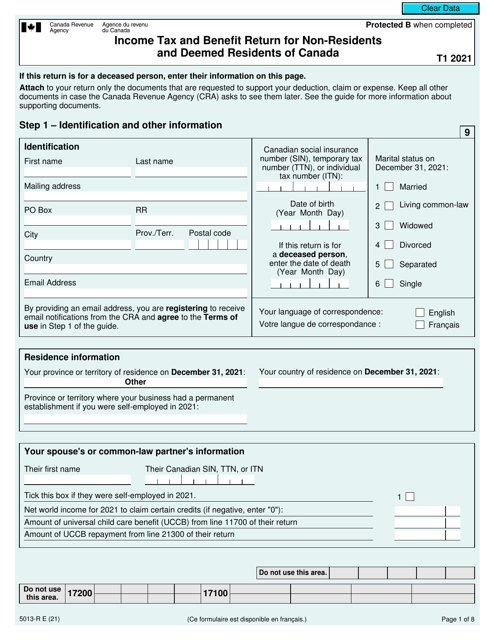

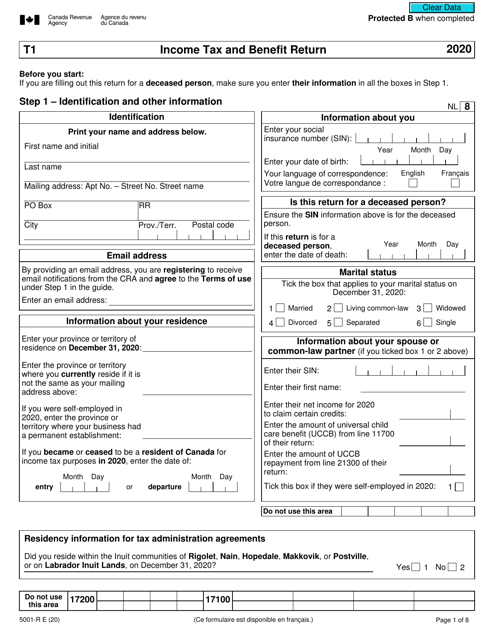

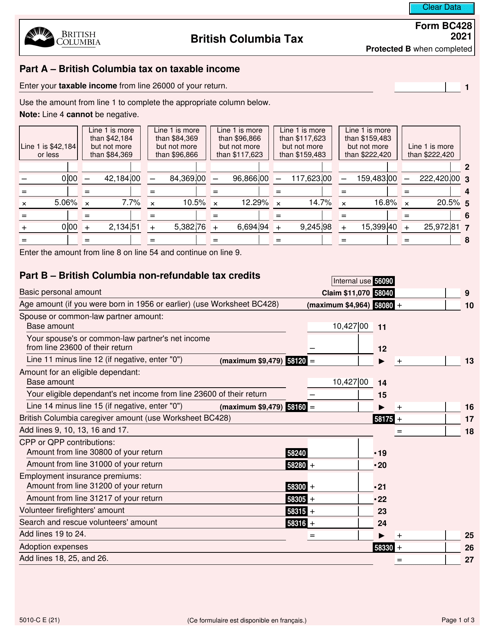

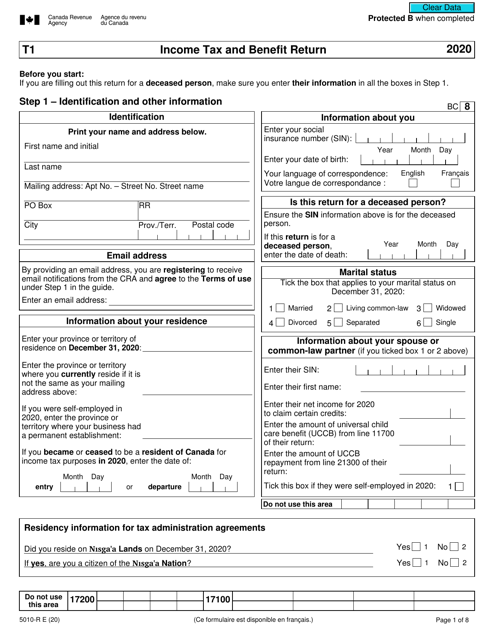

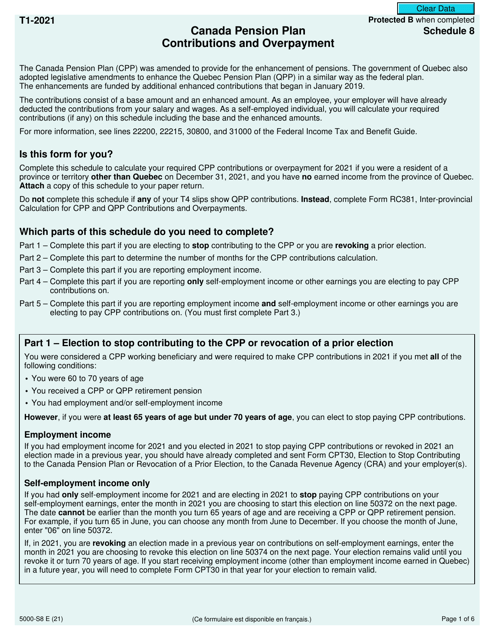

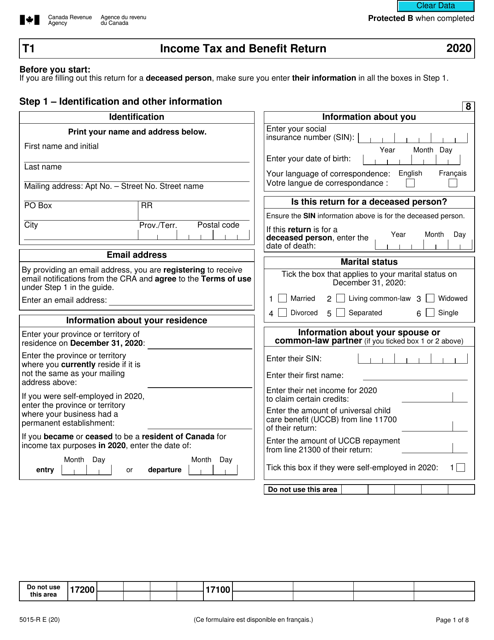

This form is used to report income, deductions, and tax credits for individuals in Canada filing their income tax and benefit return.

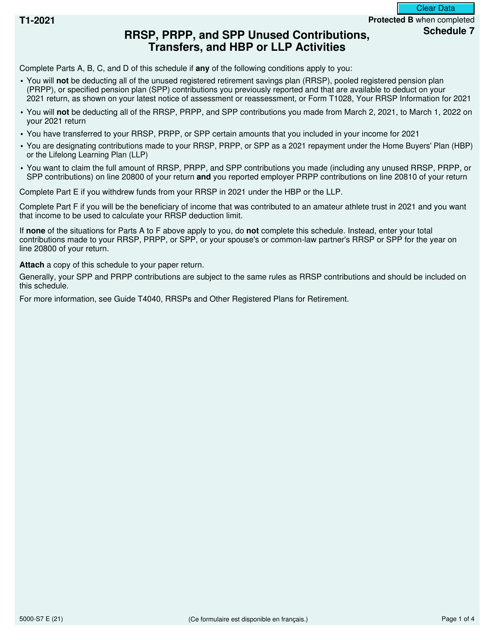

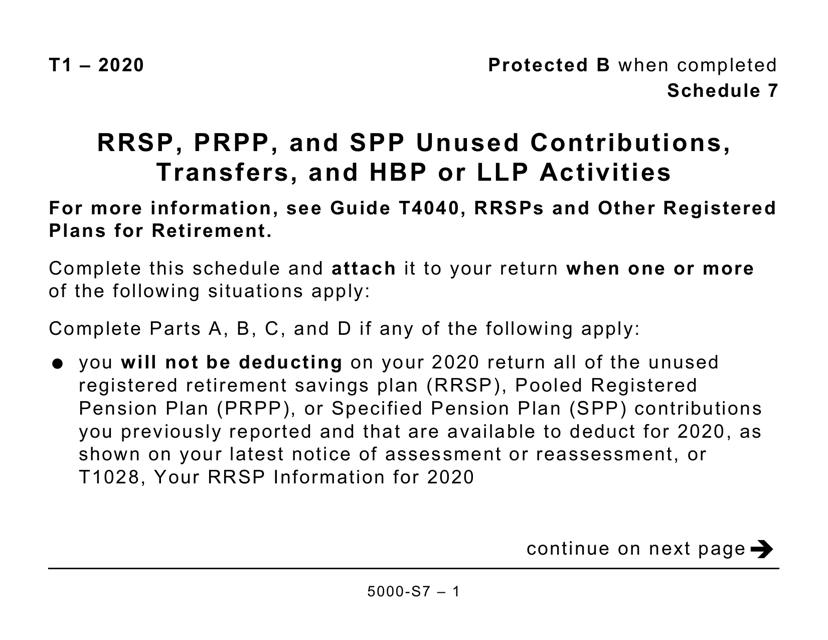

This form is used for reporting RRSP, PRPP, and SPP unused contributions, transfers, and activities related to HBP or LLP in Canada.

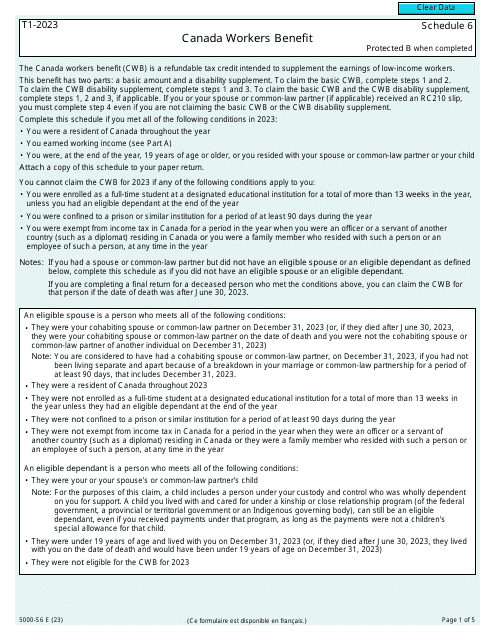

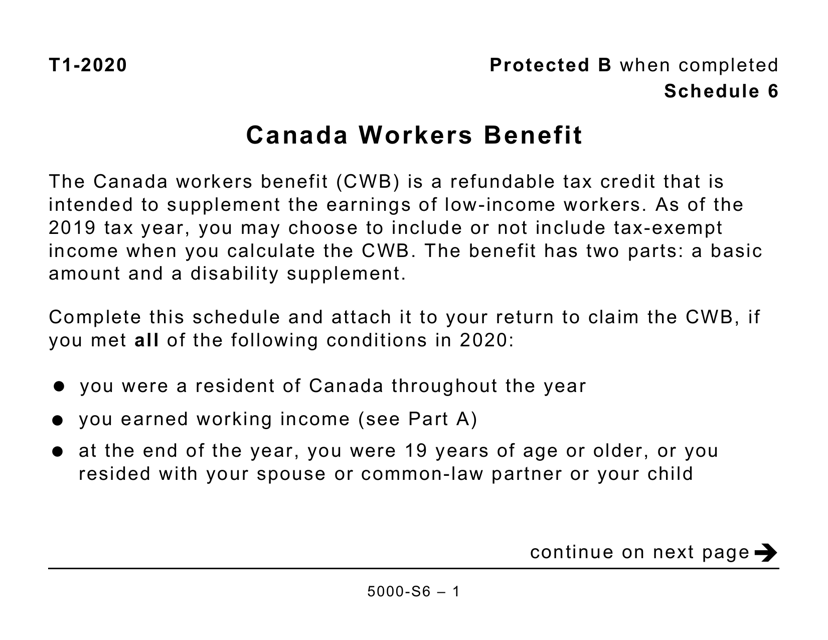

This Form is used for reporting the Canada Workers Benefit for taxpayers in Canada.

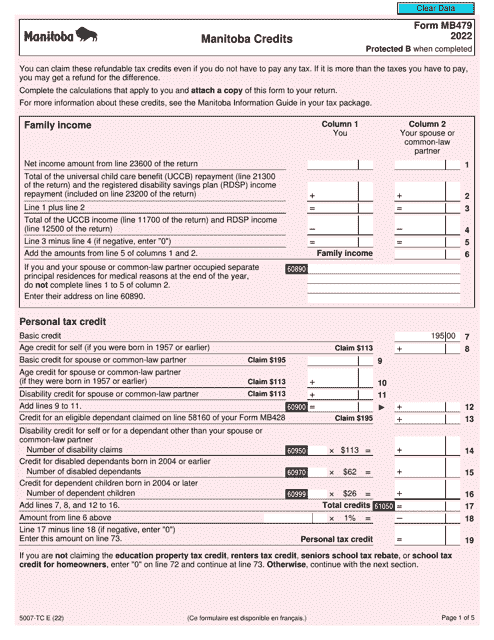

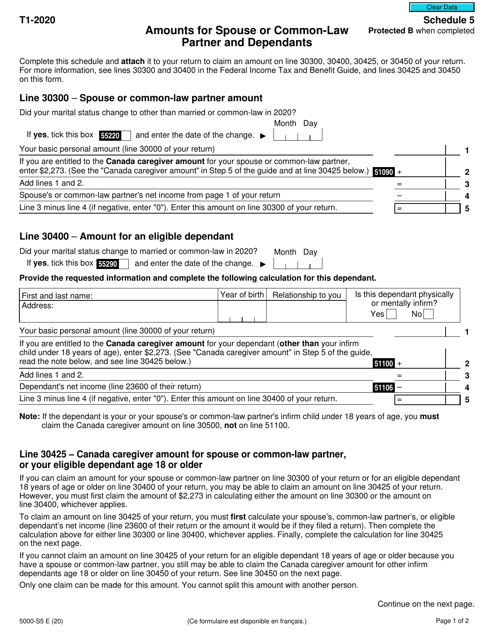

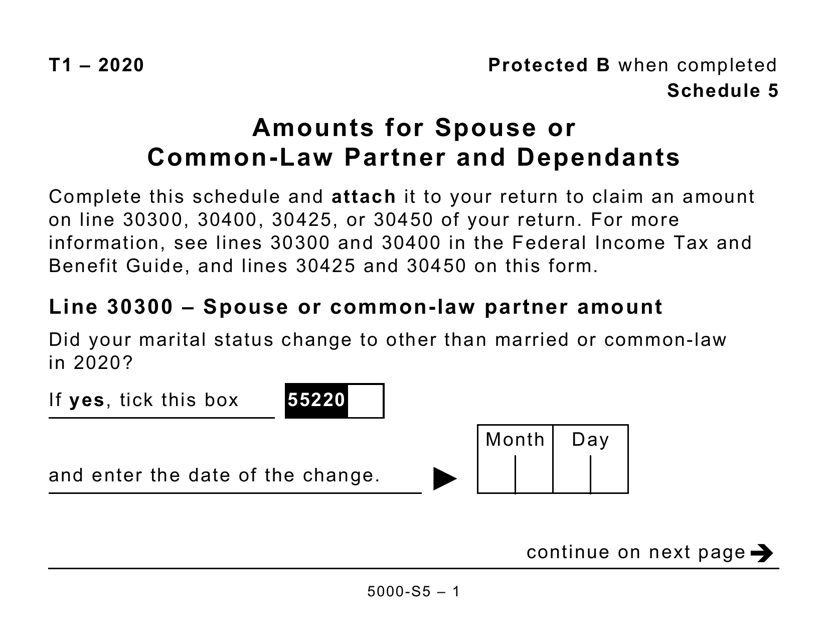

This document provides the amounts for spouse or common-law partner and dependants in a large print format for tax purposes in Canada.