Canadian Federal Legal Forms and Templates

Documents:

5112

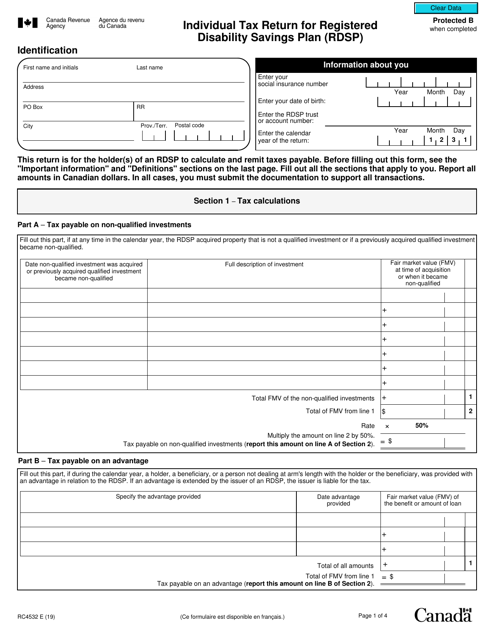

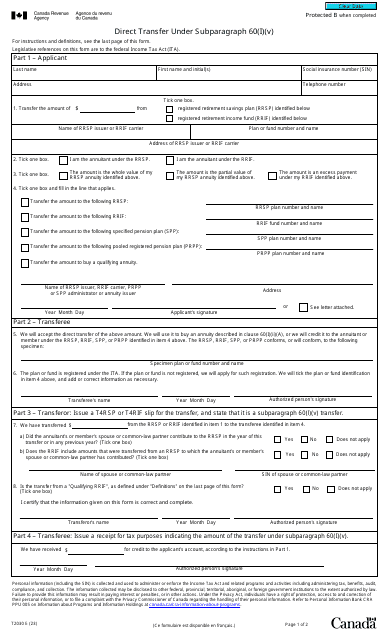

This form is used for Canada's Individual Tax Return for Registered Disability Savings Plan (RDSP). It helps individuals report their income, deductions, and credits related to their RDSP account.

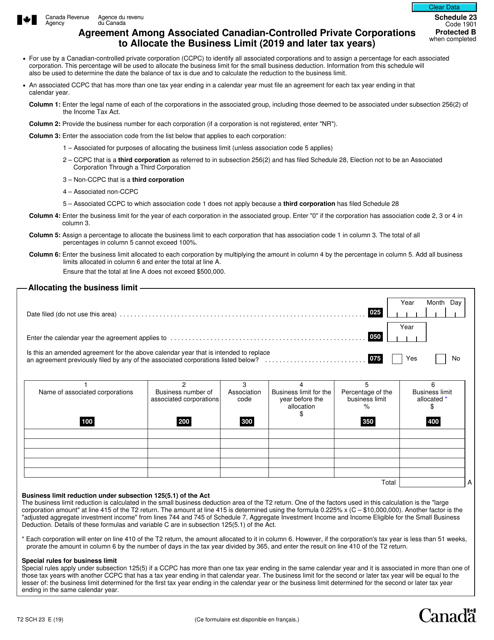

This form is used for Canadian-controlled private corporations to allocate the business limit among associated corporations.

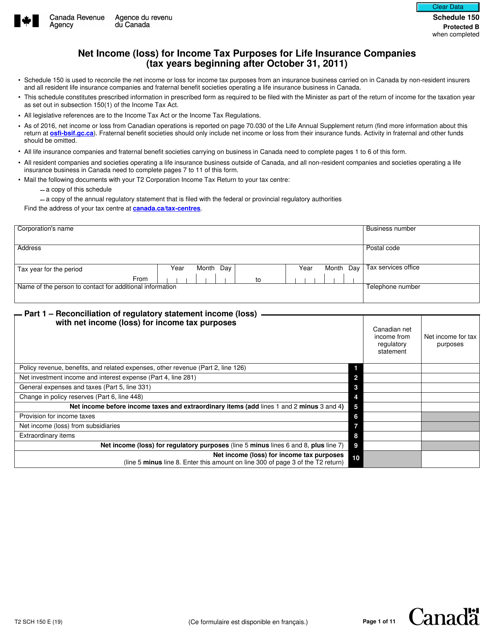

This form is used for calculating the net income or loss for life insurance companies for income tax purposes in Canada. It applies to tax years beginning after October 31, 2011.

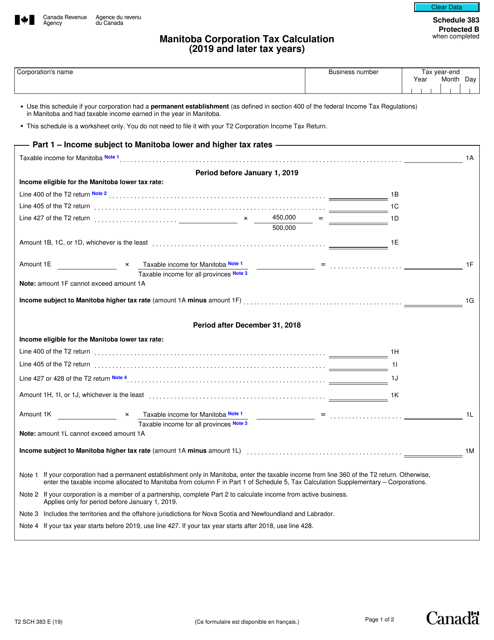

This form is used for calculating the Manitoba Corporation Tax for corporations in the province of Manitoba, Canada.

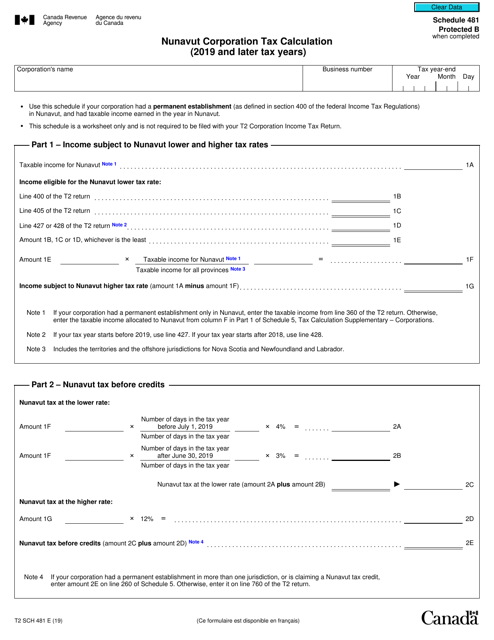

This form is used for calculating the Nunavut Corporation Tax for Nunavut, Canada.

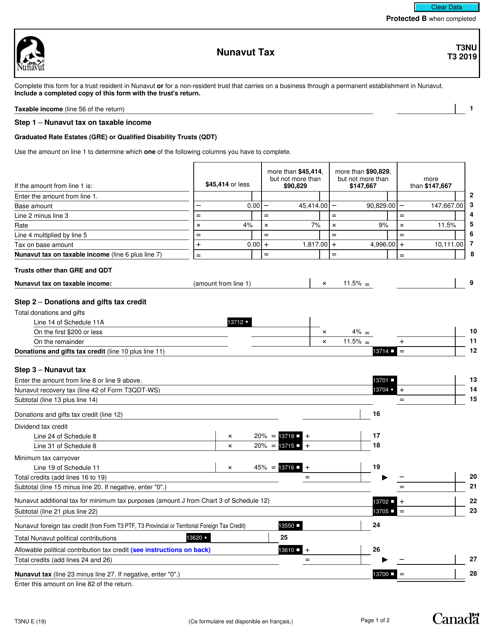

This form is used for reporting Nunavut taxes in the Canadian province of Nunavut. It is specifically designed for residents and businesses based in Nunavut to calculate and pay their tax obligations.

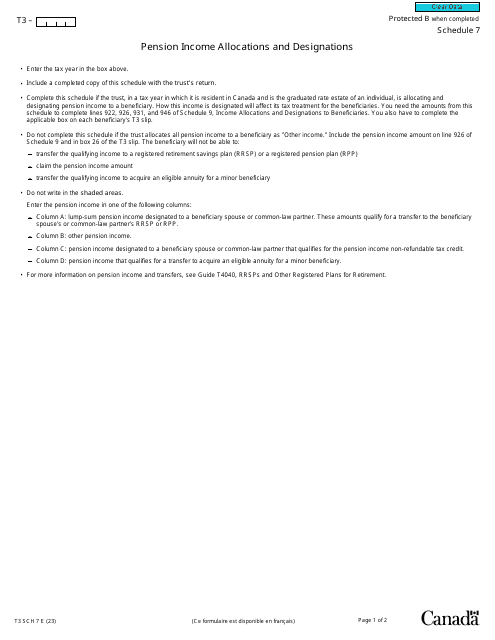

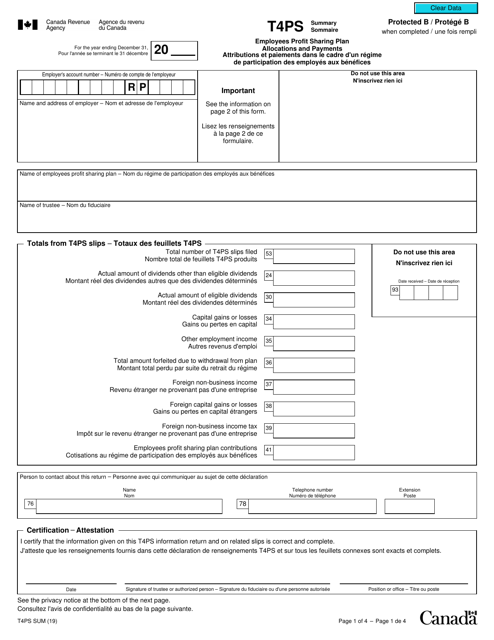

This form is used for reporting employees' profit sharing plan allocations and payments in Canada. The form is available in both English and French.

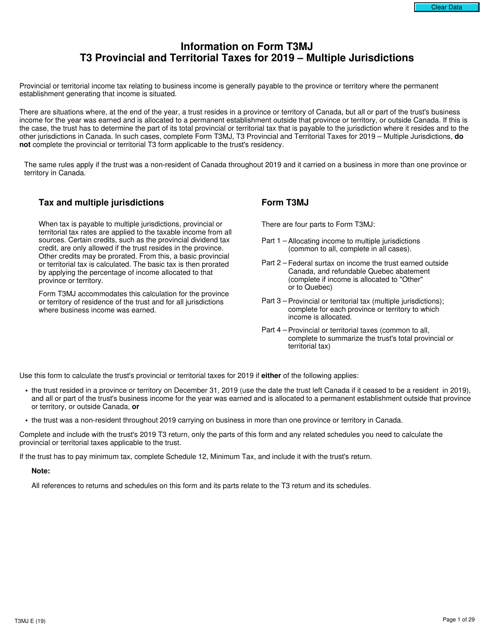

This form is used for reporting provincial and territorial taxes for the year 2019 in Canada, specifically for multiple jurisdictions.

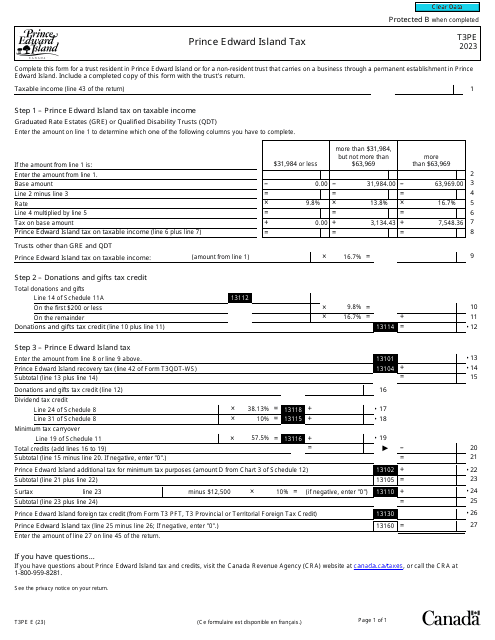

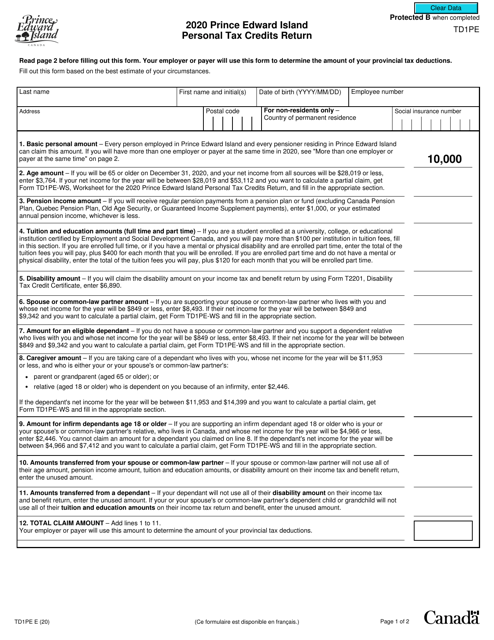

This Form is used for claiming personal tax credits in Prince Edward Island, Canada. It helps individuals calculate the amount of tax they can reduce from their income.

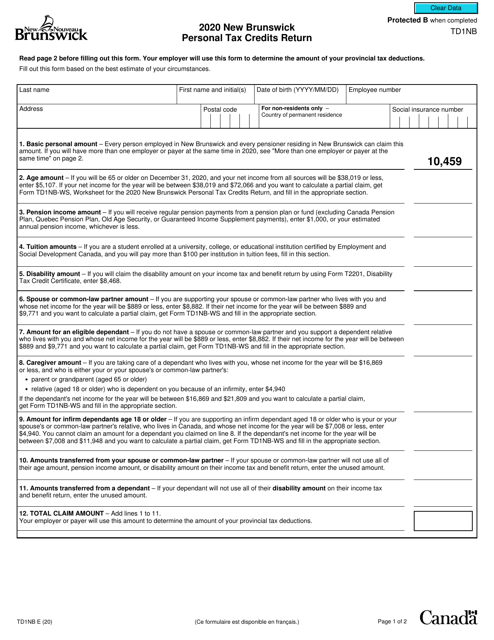

This form is used for claiming personal tax credits in New Brunswick, Canada.

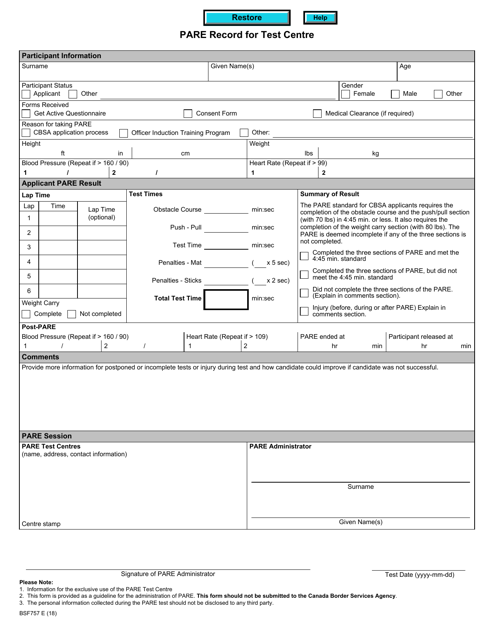

This form is used to document the performance and test results of individuals at a testing center in Canada.

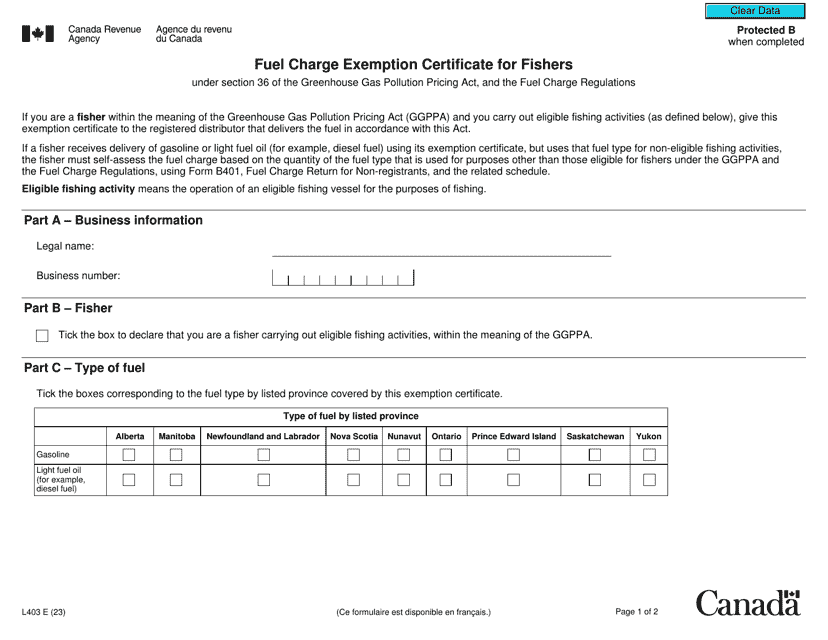

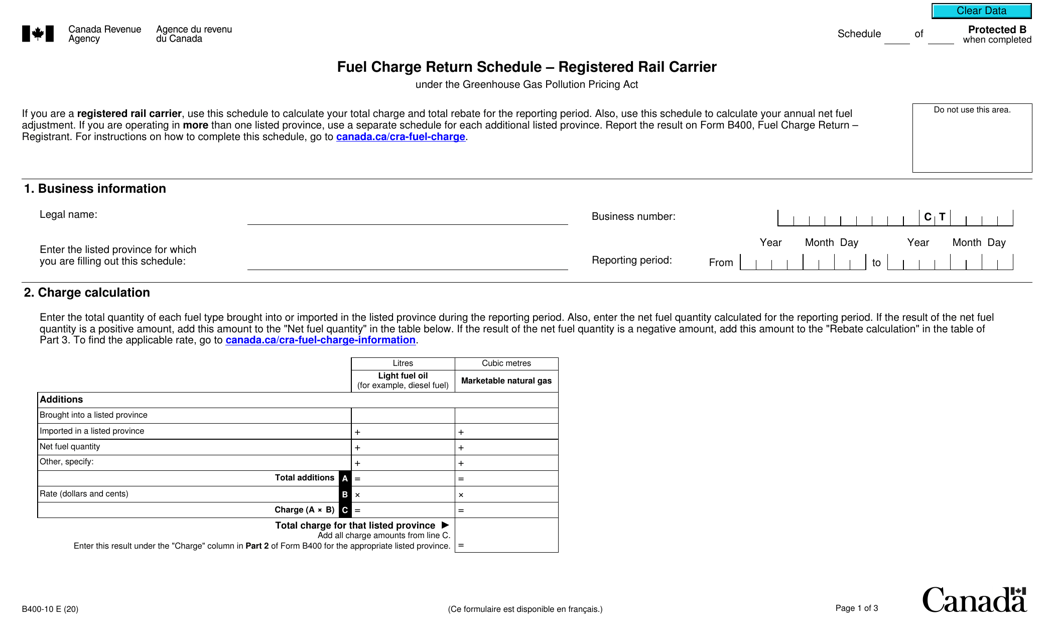

This form is used for reporting the fuel charges for registered rail carriers in Canada.