Fill and Sign United States Federal Legal Forms

Documents:

24261

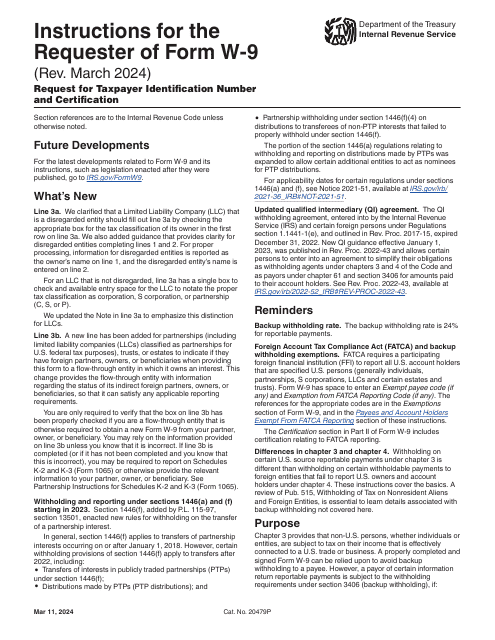

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.

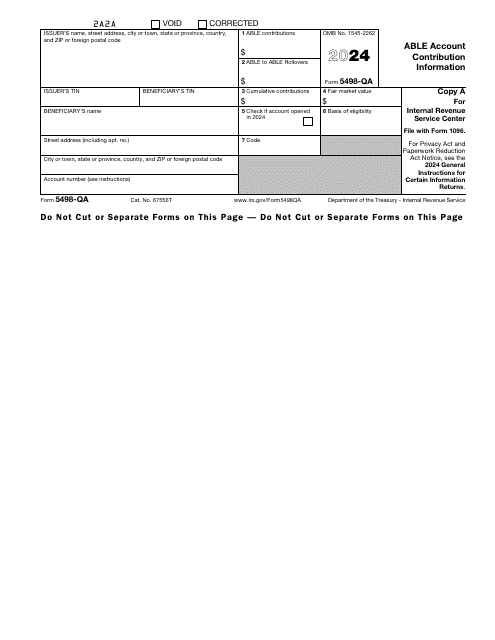

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

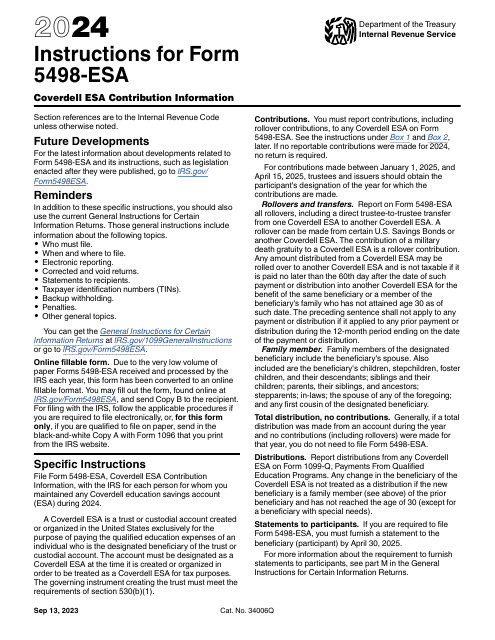

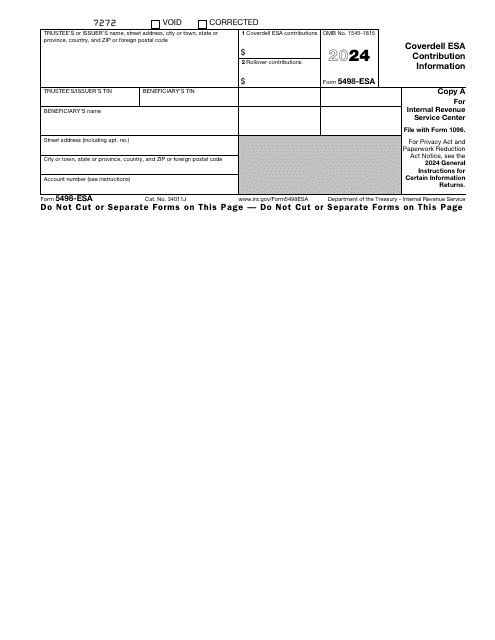

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.