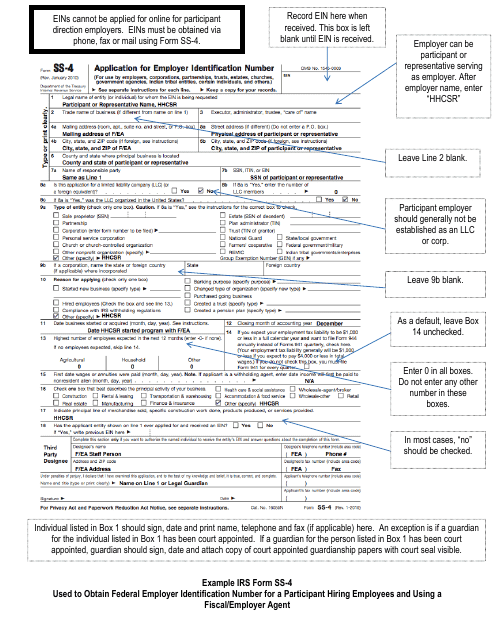

IRS Ss-4 Forms and Templates

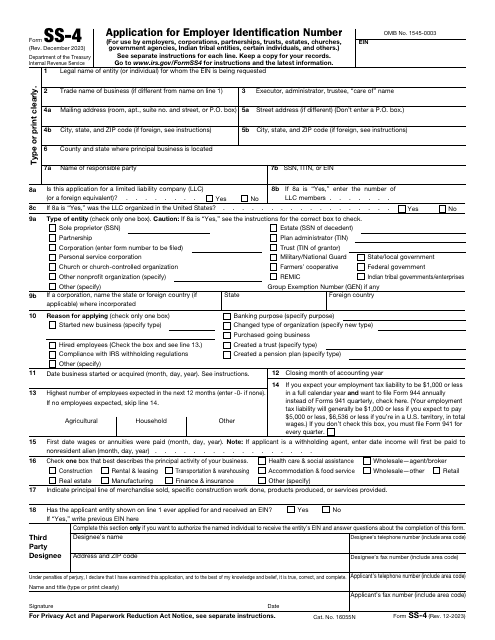

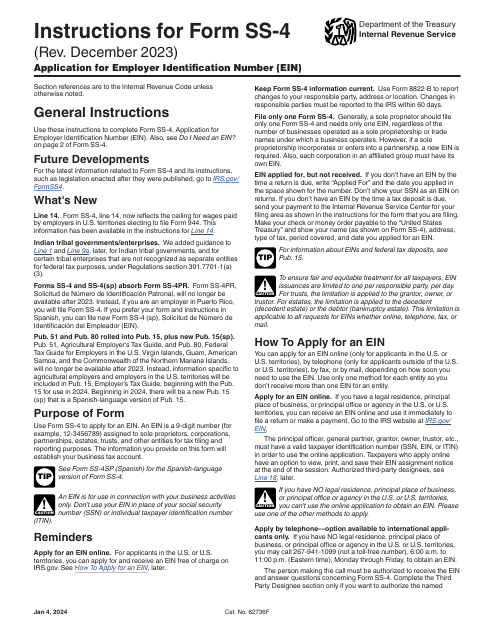

IRS SS-4 forms, also known as the Application for Employer Identification Number, are used to apply for an Employer Identification Number (EIN). An EIN is a unique identification number assigned by the Internal Revenue Service (IRS) to businesses, organizations, and other entities for tax filing and reporting purposes. The EIN is used to identify the entity when filing tax returns, making tax payments, and dealing with the IRS on tax matters. The SS-4 form collects information about the entity and its responsible party, including the legal name, address, and type of entity. The completed form is submitted to the IRS to request the assignment of an EIN.

Documents:

5

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.