IRS Ct-1 Forms and Templates

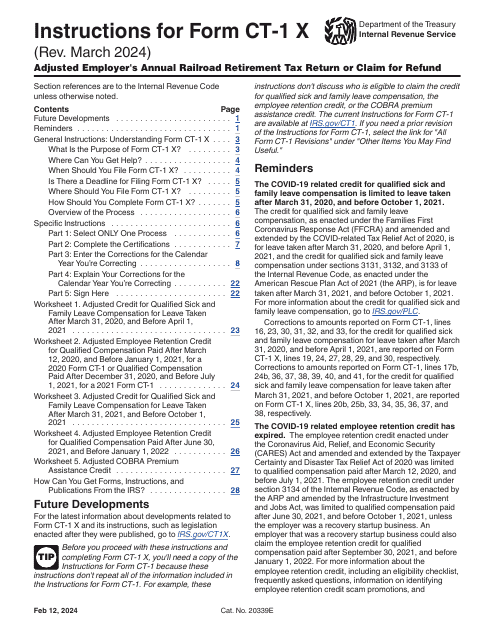

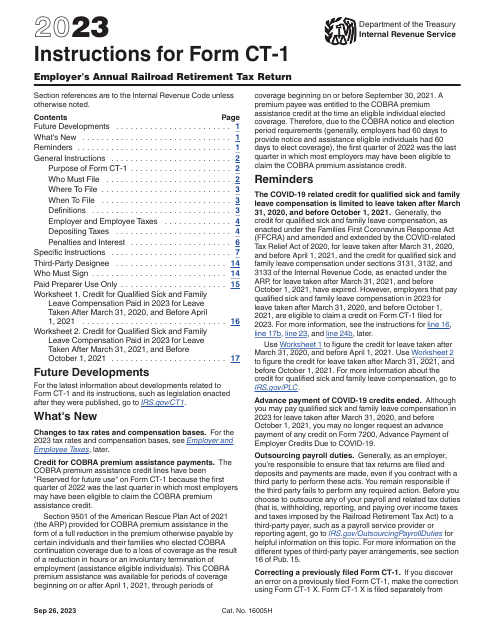

IRS CT-1 forms are used by employers in the railroad industry to report their annual railroad retirementtax liabilities. These forms are specifically designed for the railroad industry and are used to calculate, report, and pay the taxes employers owe based on their railroad employees' compensation.

Related Articles

Documents:

3

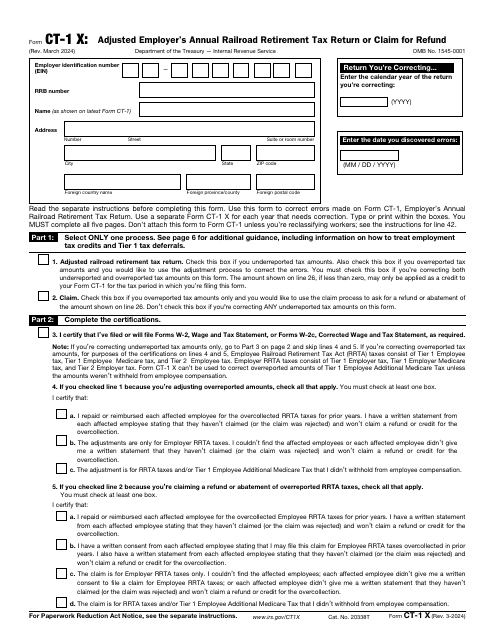

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.