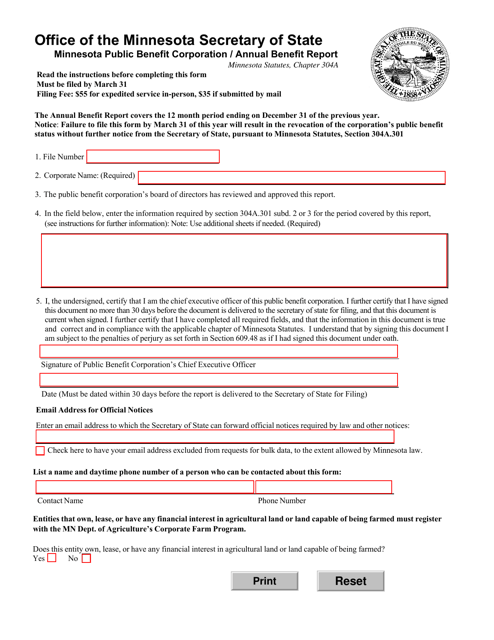

Minnesota Form Etr Templates

Minnesota Form Etr is a form used for reporting estimated tax payments in the state of Minnesota. Individuals and businesses who expect to owe more than a certain amount in income tax for the year are required to make estimated tax payments throughout the year. The Form Etr is used to calculate and report these estimated tax payments to the Minnesota Department of Revenue.

Documents:

2

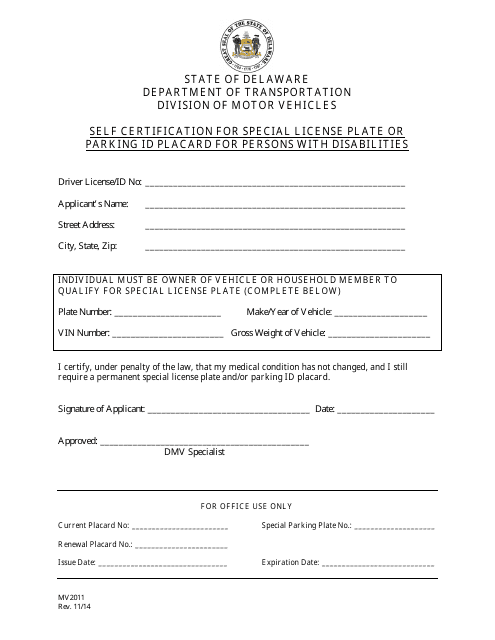

This form is used for individuals with disabilities in Delaware to self-certify their eligibility for special license plates or parking ID placards.