Fill and Sign Nebraska Legal Forms

Documents:

3595

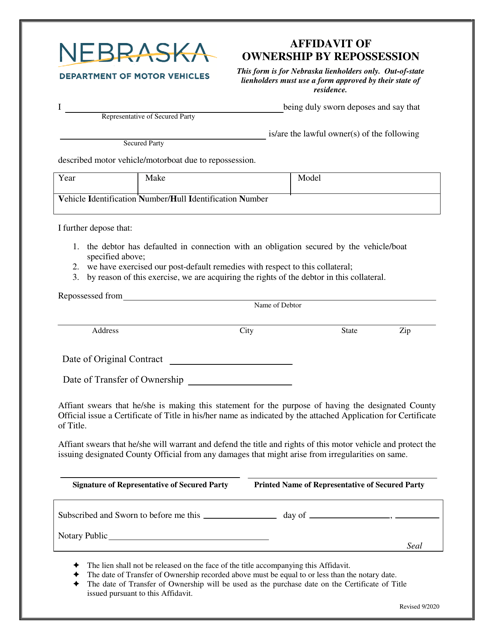

This form is used for asserting ownership of property that has been repossessed in the state of Nebraska. It is typically used by the party who has repossessed the property to legally claim their ownership rights.

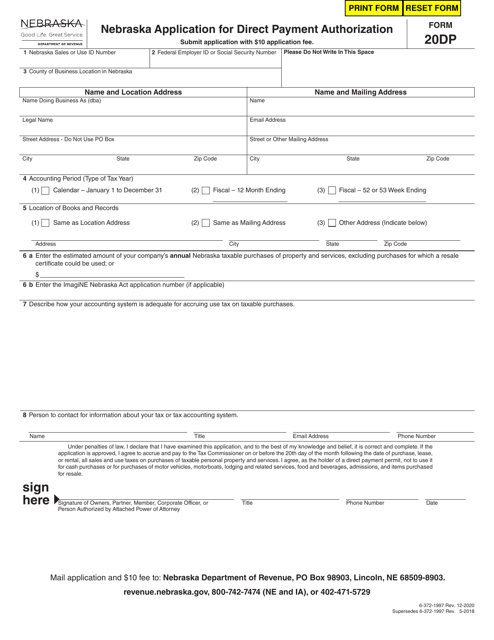

This form is used for Nebraska residents to apply for direct payment authorization for certain taxes and fees.

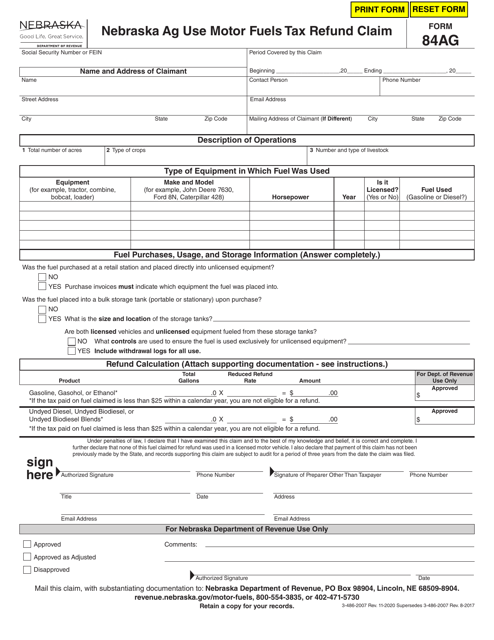

This Form is used for claiming a refund of motor fuels tax paid on ag use in Nebraska.

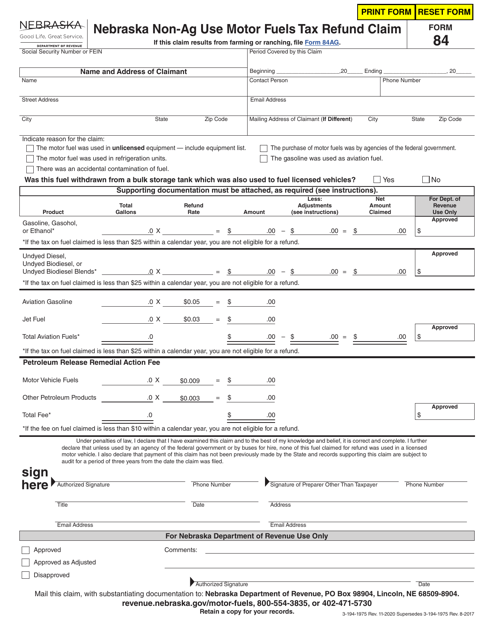

This form is used for claiming a refund on the non-agricultural use motor fuels tax in Nebraska.

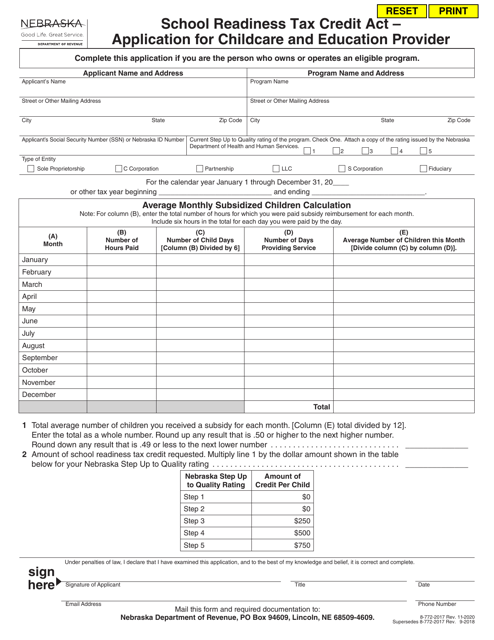

This form is used for applying for the School Readiness Tax Credit Act in Nebraska. It is specifically for childcare and education providers.

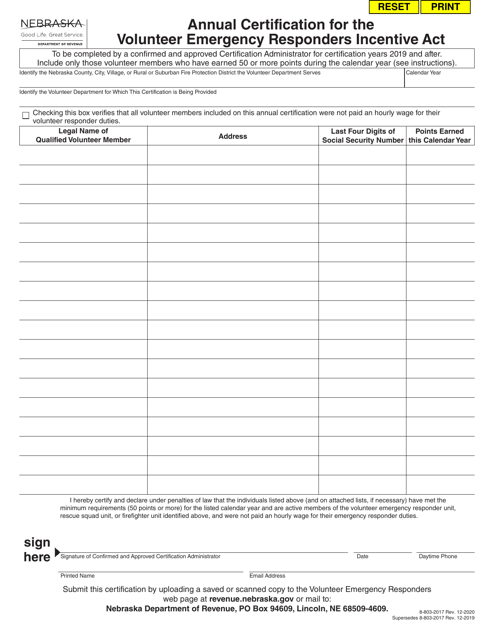

Form 8-803-2017 Annual Certification for the Volunteer Emergency Responders Incentive Act - Nebraska

This form is used for the annual certification of volunteer emergency responders under the Volunteer Emergency Responders Incentive Act in Nebraska. It allows these responders to qualify for certain incentives and benefits.

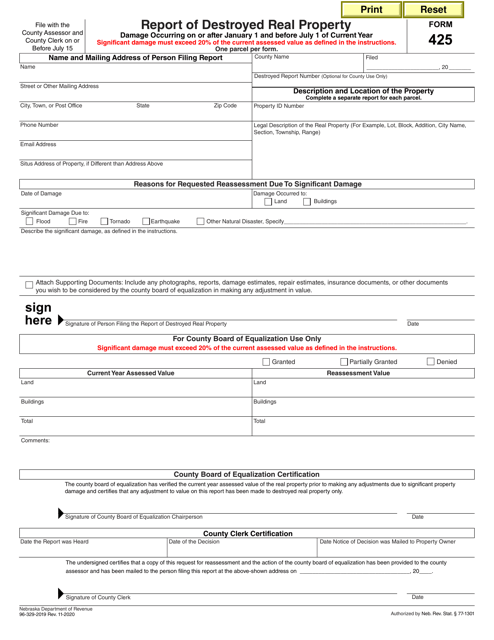

This type of document is used for reporting destroyed real property in the state of Nebraska.

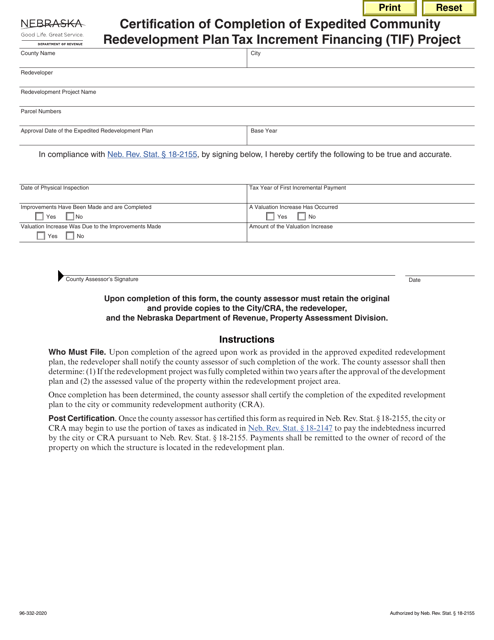

This Form is used for certifying the completion of an expedited community redevelopment plan tax increment financing project in Nebraska.

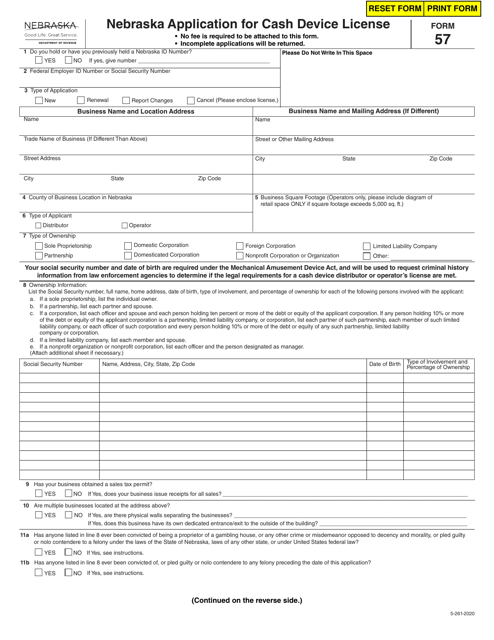

This Form is used for applying for a cash device license in Nebraska.

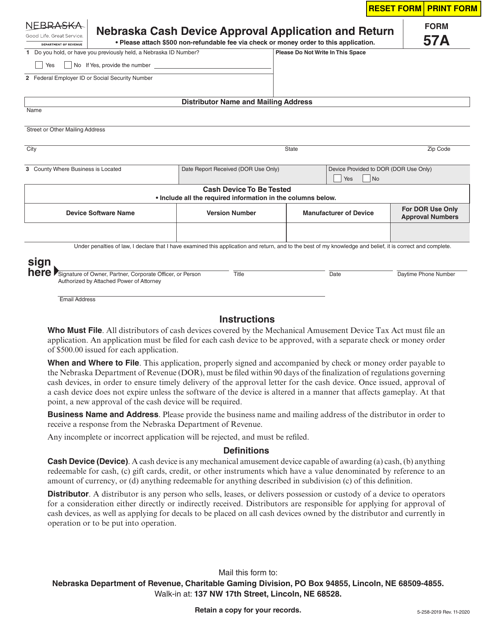

This form is used for applying for approval and returning cash devices in Nebraska.

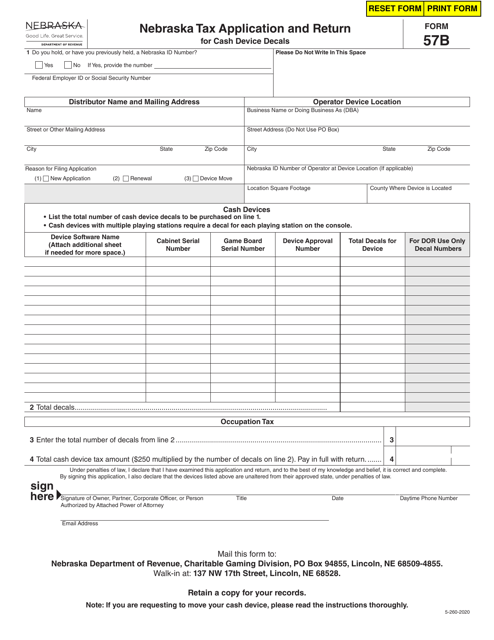

This Form is used for Nebraska residents to apply for and file their tax return for cash device decals.

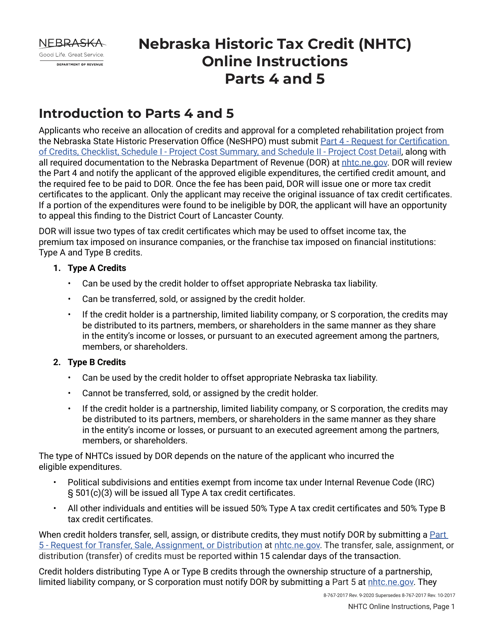

This Form is used for claiming the Nebraska Historic Tax Credit (NHTC) in Part 4 and Part 5. It provides instructions on how to properly complete the form and claim the tax credit for historic properties in Nebraska.

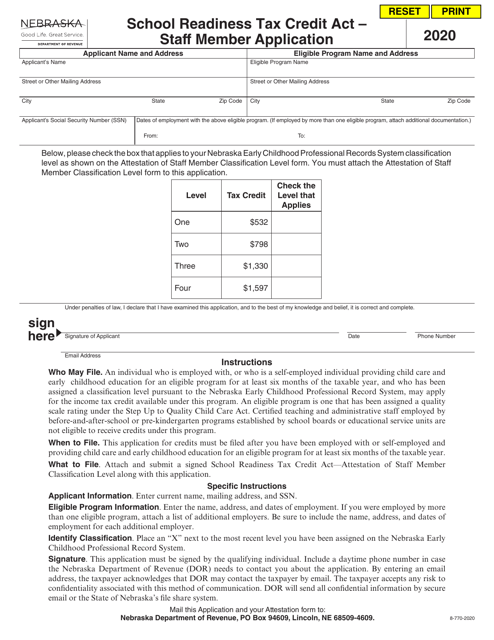

This form is used for staff members applying for the School Readiness Tax Credit Act in Nebraska.

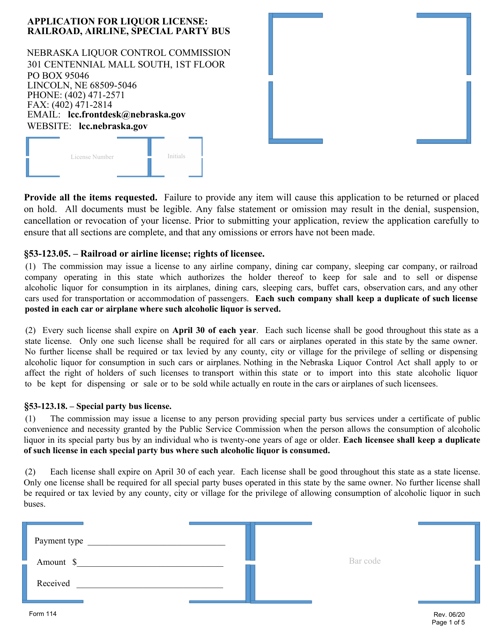

This form is used for applying for a liquor license in Nebraska for businesses that are related to railroads, airlines, or special party buses.

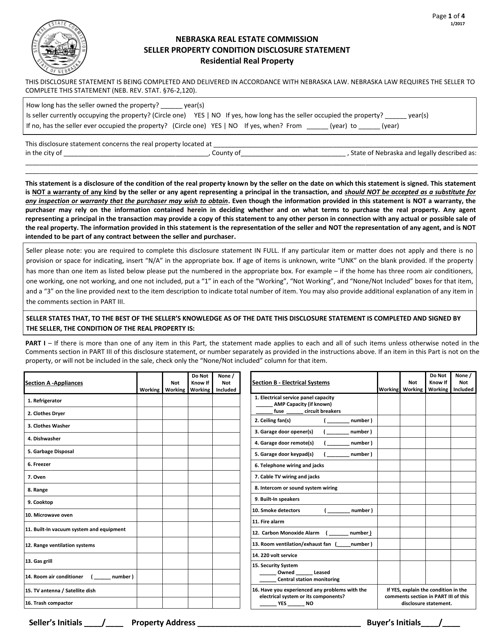

This Form is used for sellers in Nebraska to disclose the condition of residential real property. It provides information on any known defects, repairs, or other issues with the property.

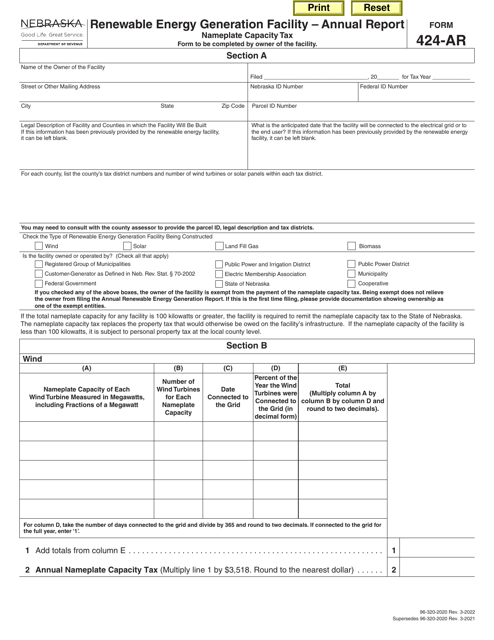

Form 424-AR Renewable Energy Generation Facility - Annual Report - Nameplate Capacity Tax - Nebraska