Fill and Sign Nebraska Legal Forms

Documents:

3595

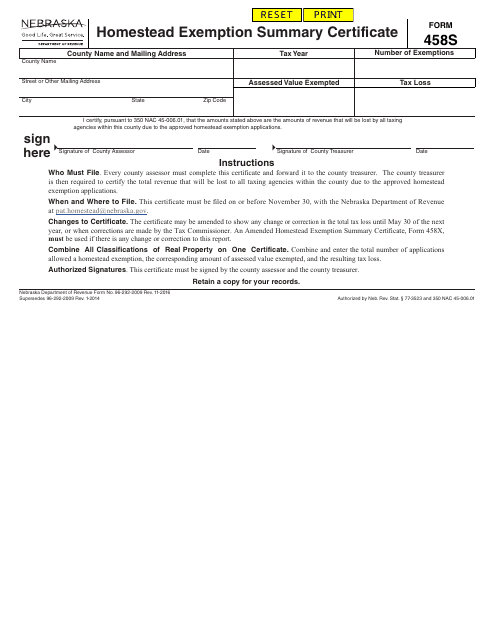

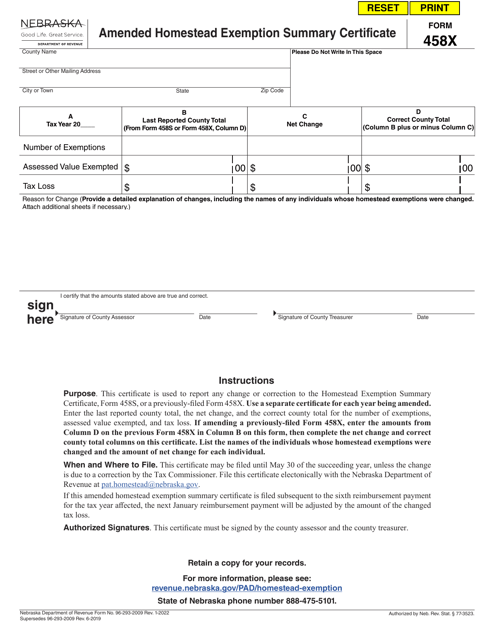

This Form is used for claiming a homestead tax exemption in Nebraska. It provides a summary certificate for the exemption application.

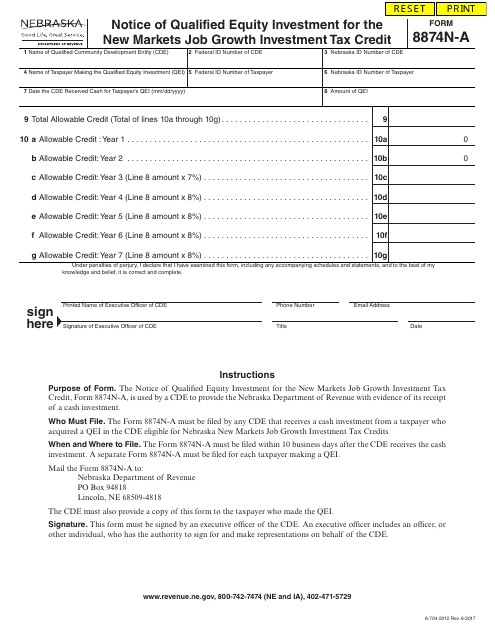

This form is used for reporting qualified equity investments for the New Markets Job Growth Investment Tax Credit in Nebraska.

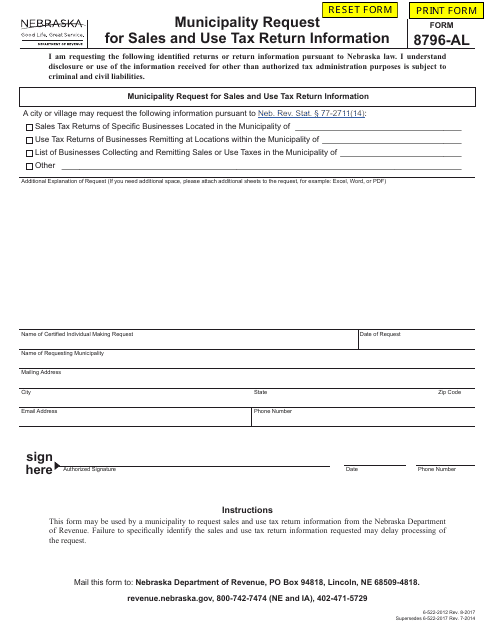

This type of document is used by municipalities in Nebraska to request sales and use tax return information.

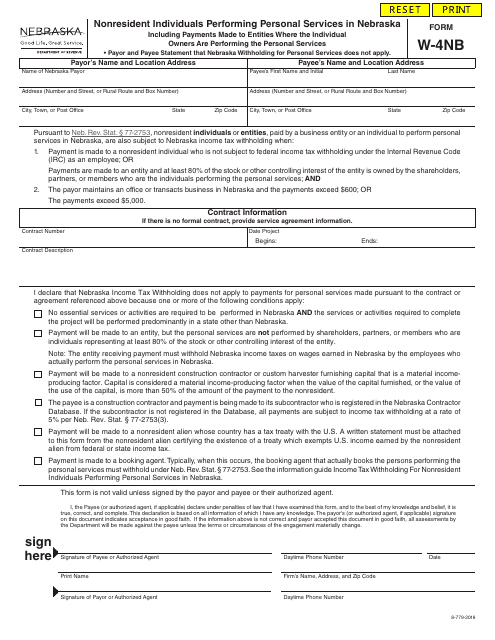

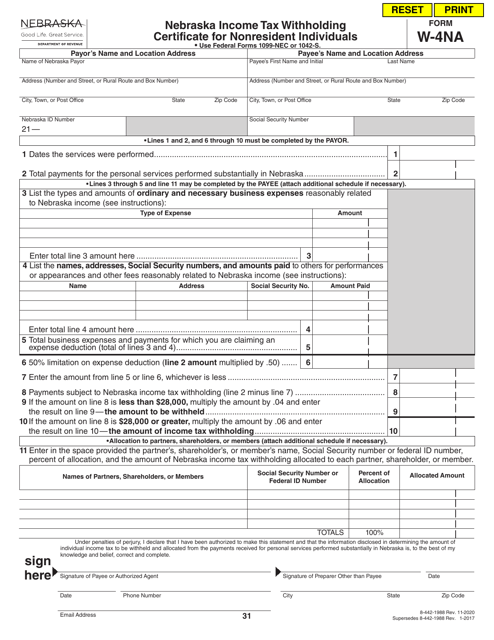

This form is used by nonresident individuals who are performing personal services in Nebraska. It is specifically for reporting and withholding state income taxes in Nebraska.

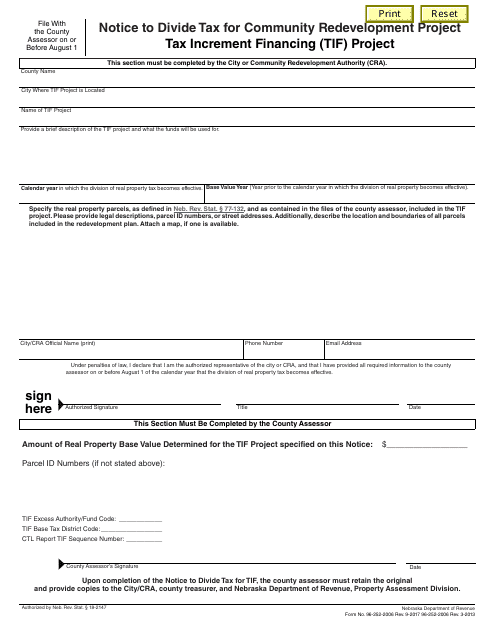

This Form is used for notifying taxpayers about the division of taxes for a Community Redevelopment Project Tax Increment Financing (TIF) Project in Nebraska.

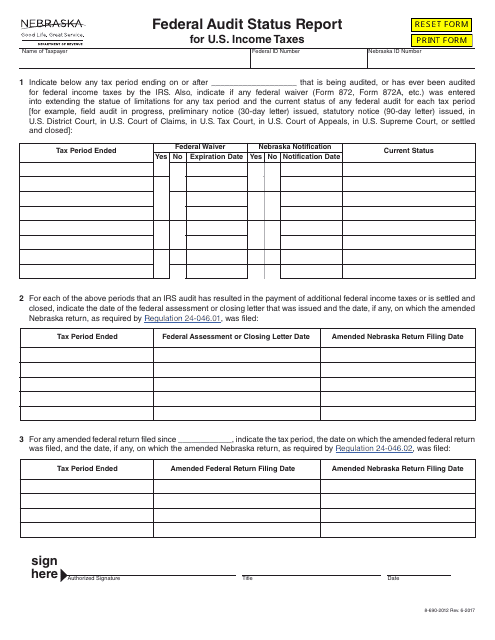

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

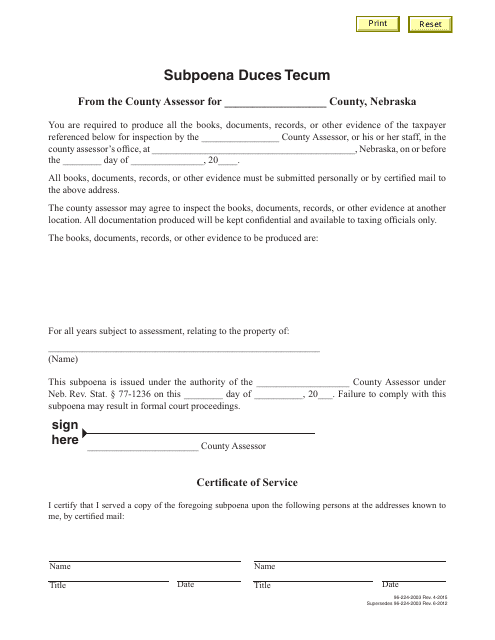

This document is used in the state of Nebraska to compel a person or organization to produce specific documents or evidence for a court case.

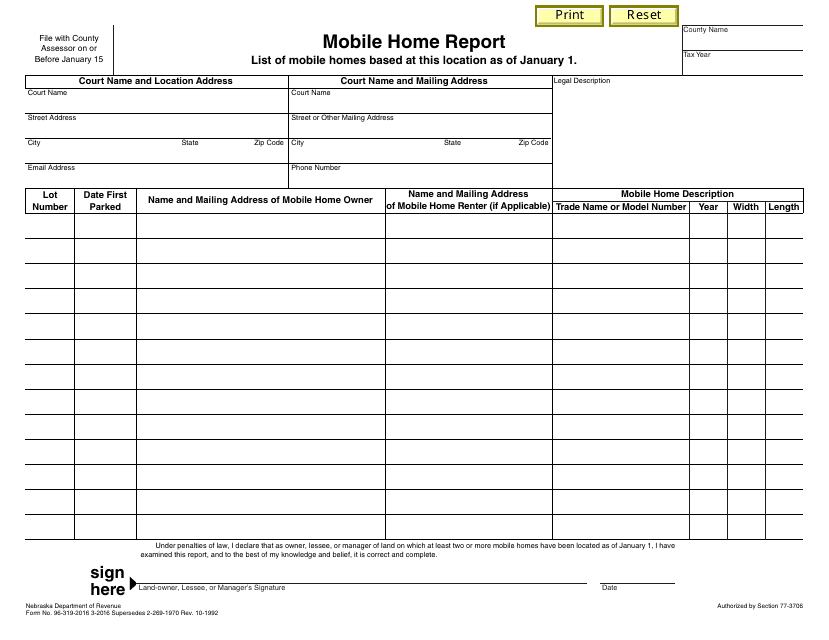

This document is used for reporting information about mobile homes in Nebraska. It is used to gather details and data related to the condition and quality of mobile homes across the state.

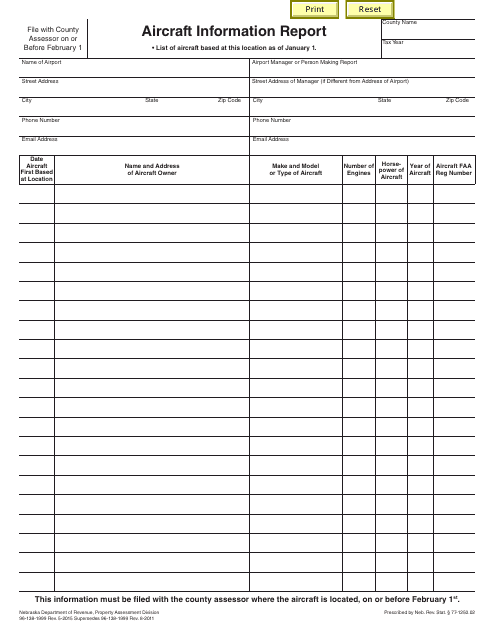

This form is used for reporting aircraft information in the state of Nebraska. It gathers important details about the aircraft and its owner for regulatory purposes.

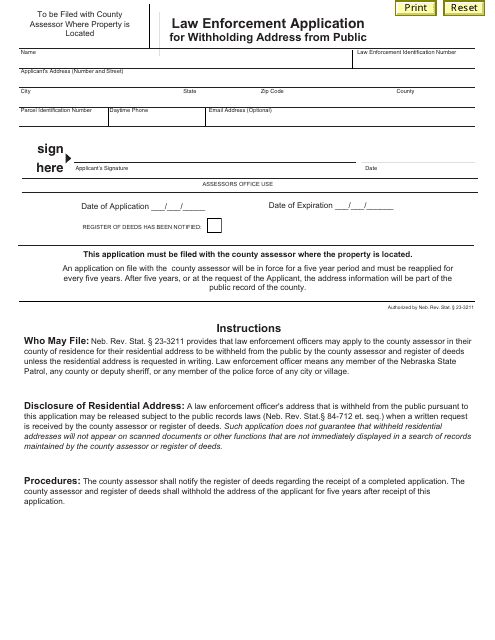

This Form is used for law enforcement officers in Nebraska who wish to withhold their home address from public records.

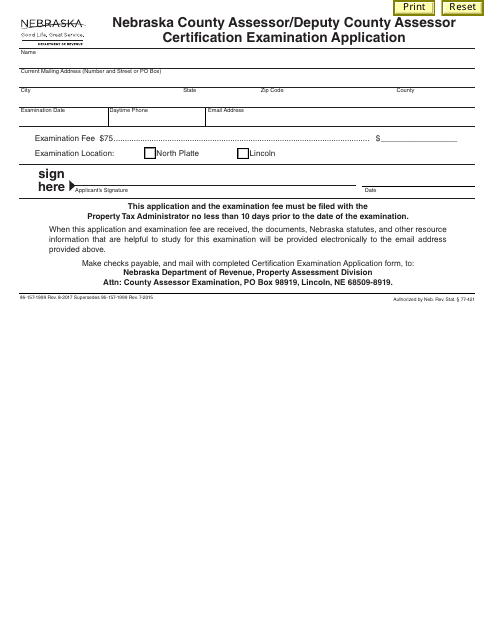

This type of document is an application form for individuals seeking certification as a Nebraska County Assessor or Deputy County Assessor.

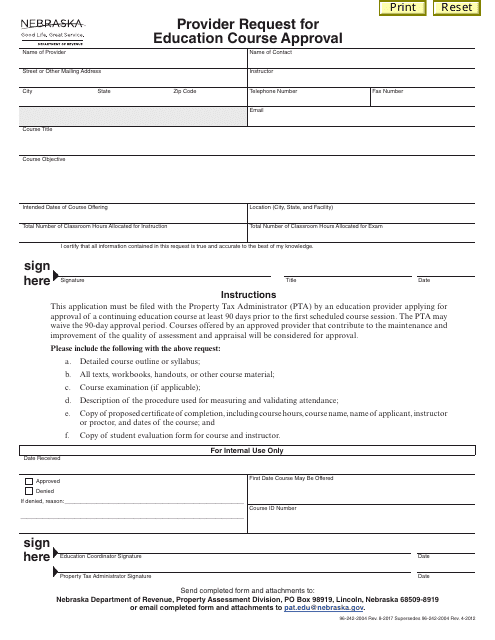

This document is used by providers in Nebraska to request approval for education courses. It is necessary for ensuring that courses meet the required standards and can be used for professional development or continuing education credits.