Jammu and Kashmir Commercial Taxes Department Forms

The Jammu and Kashmir Commercial Taxes Department is responsible for the administration and collection of commercial taxes in the region of Jammu and Kashmir in India. This department ensures the proper implementation of tax laws related to the sale of goods and services, including the levy and collection of value-added tax (VAT), central sales tax (CST), and other taxes applicable to businesses operating in Jammu and Kashmir.

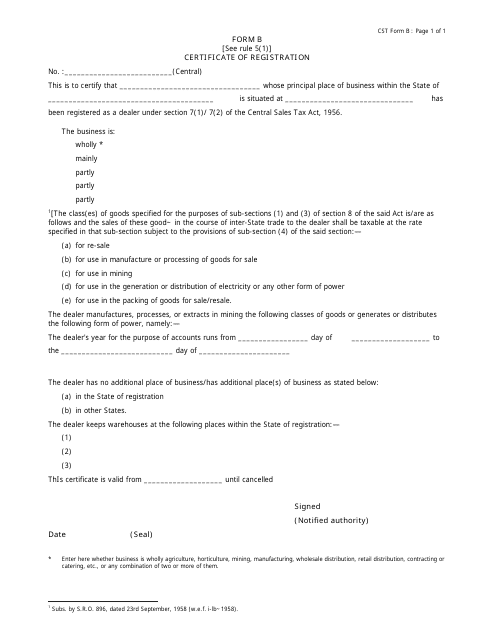

Documents:

1

This document is required for registering a business in the state of Jammu and Kashmir, India.