Delaware Department of Finance - Division of Revenue Forms

The Delaware Department of Finance - Division of Revenue is responsible for collecting and administering various taxes and licenses in the State of Delaware. They are responsible for ensuring compliance with tax laws, processing tax returns, and collecting revenue for the state government.

Documents:

390

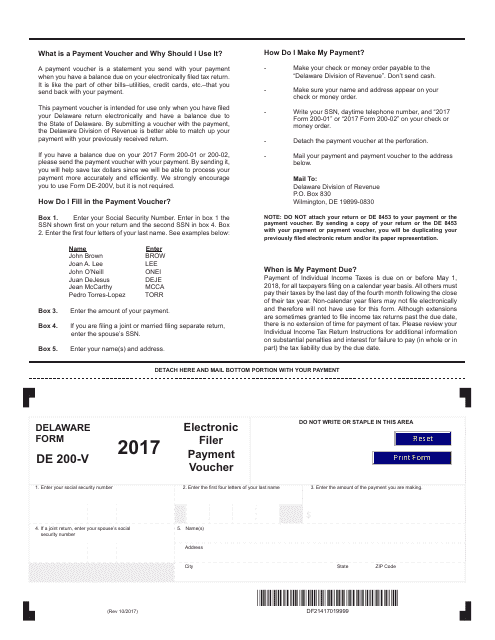

This form is used for making electronic payments for various taxes to the state of Delaware.

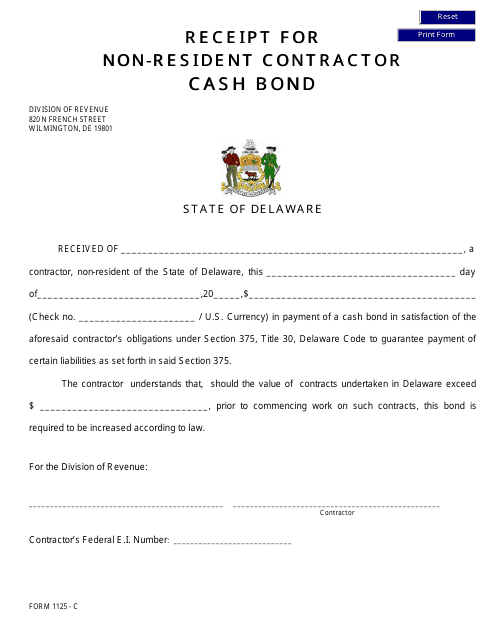

This form is used for non-resident contractors in Delaware to provide a receipt for their cash bond.

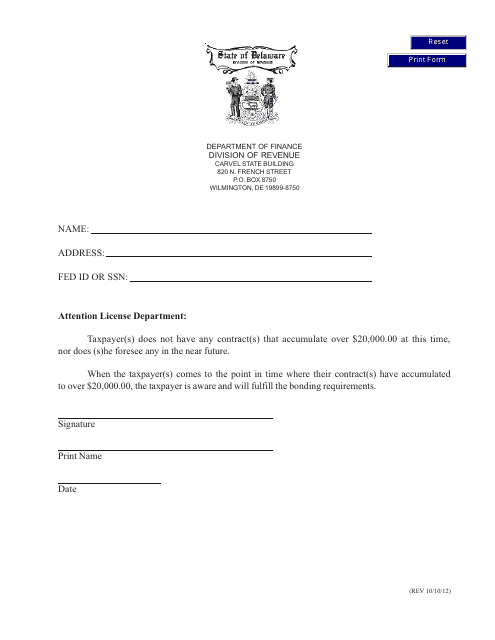

This document is for non-resident contractors in Delaware who are entering into a contract with a value of less than $20,000. It contains important information and terms for the contract agreement.

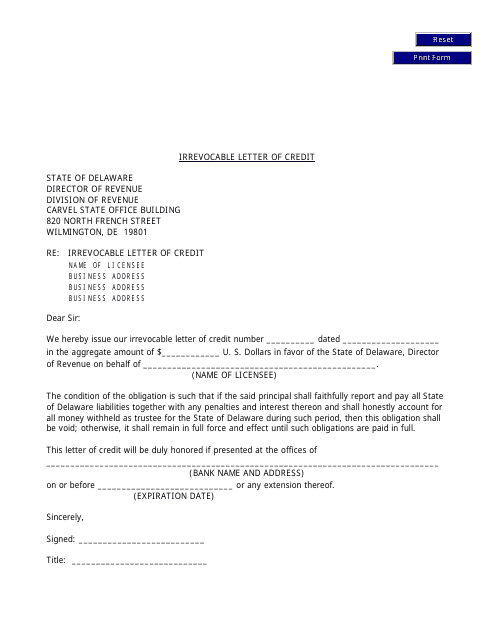

This document is for a non-resident contractor and is specific to an Irrevocable Letter of Credit in the state of Delaware. It is used to ensure payment and protect both parties involved in a contract.

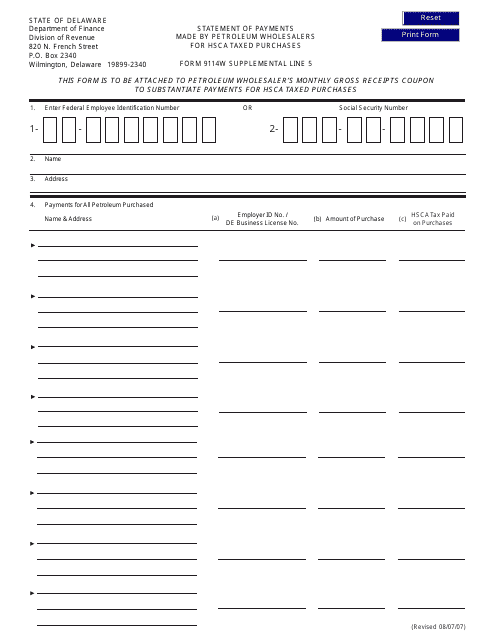

This form is used for petroleum wholesalers in Delaware to report the payments made for HSCA taxed purchases.

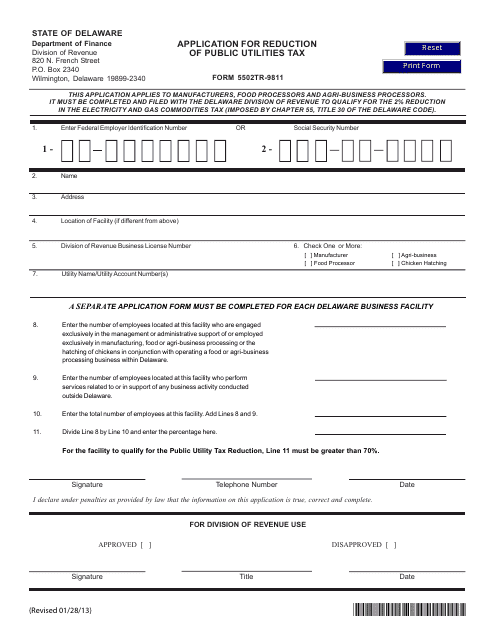

This form is used to apply for a reduction of public utilities tax in the state of Delaware. It is for businesses to request a lower tax rate for their utility services.

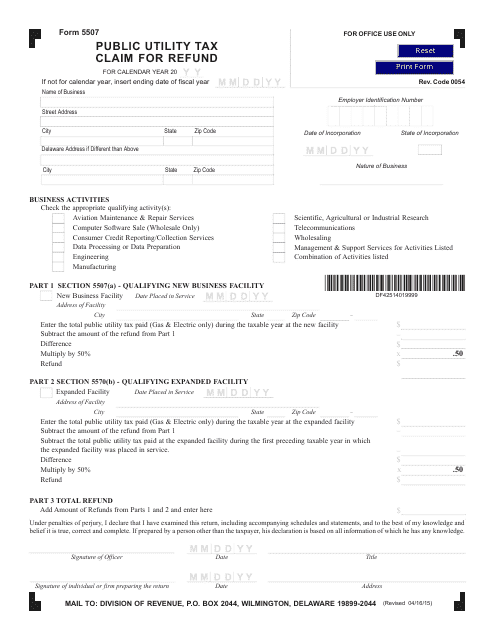

This Form is used for claiming a tax refund related to public utility in the state of Delaware.

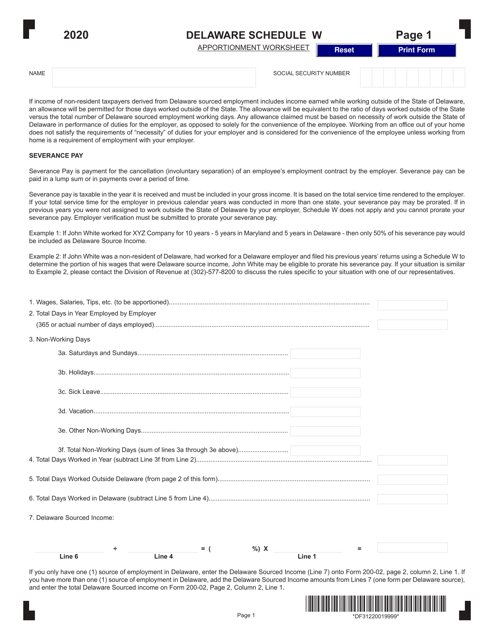

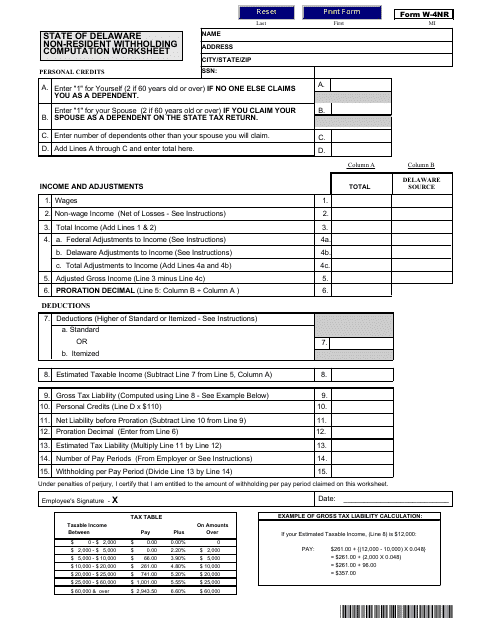

This form is used for calculating withholding taxes for non-resident taxpayers in Delaware.

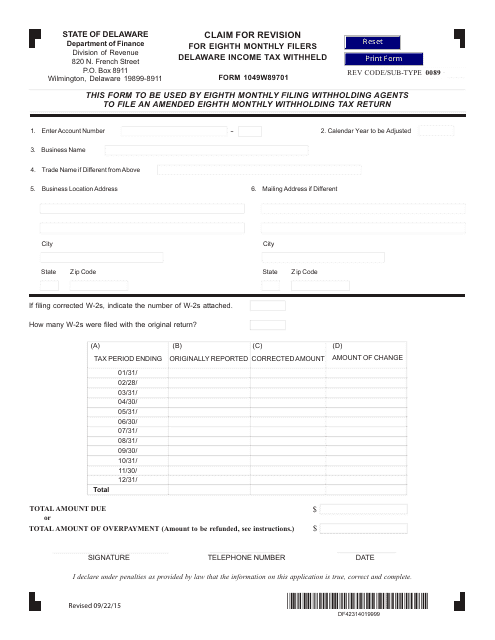

Form 1049W89701 Claim for Revision for Eighth Monthly Filers Delaware Income Tax Withheld - Delaware

This form is used for claiming a revision for eighth monthly filers of Delaware Income Tax Withheld.

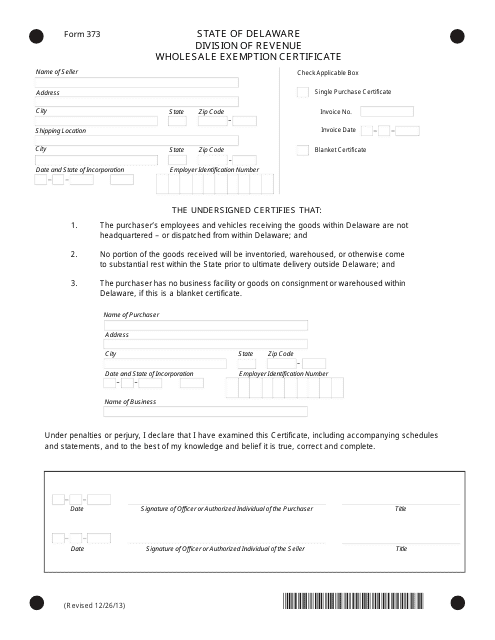

This form is used for wholesalers in Delaware to claim an exemption from sales tax when purchasing goods for resale.

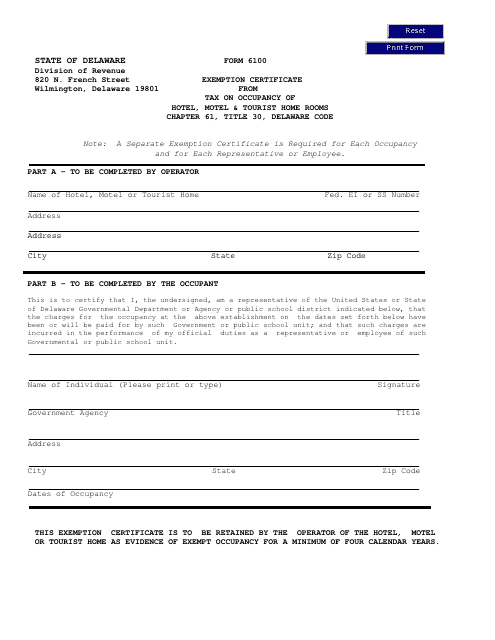

Form 6100 Exemption Certificate From Tax on Occupancy of Hotel,motel & Tourist Home Rooms - Delaware

This Form is used for claiming exemption from tax on occupancy of hotel, motel, and tourist home rooms in Delaware. It is used by certain organizations to certify that they are exempt from paying this tax.

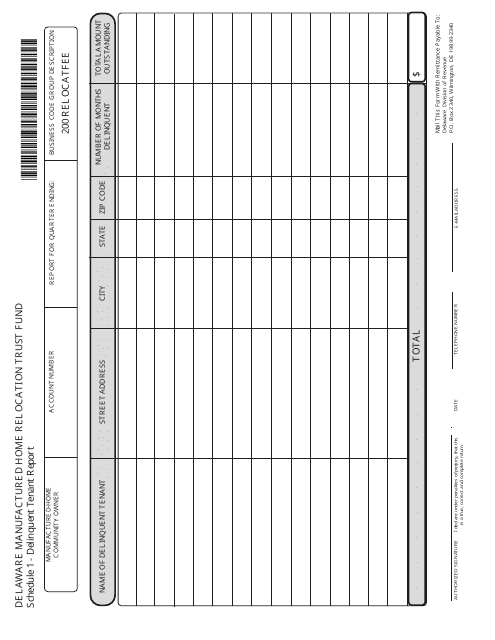

This document provides a report of delinquent tenants in the state of Delaware.

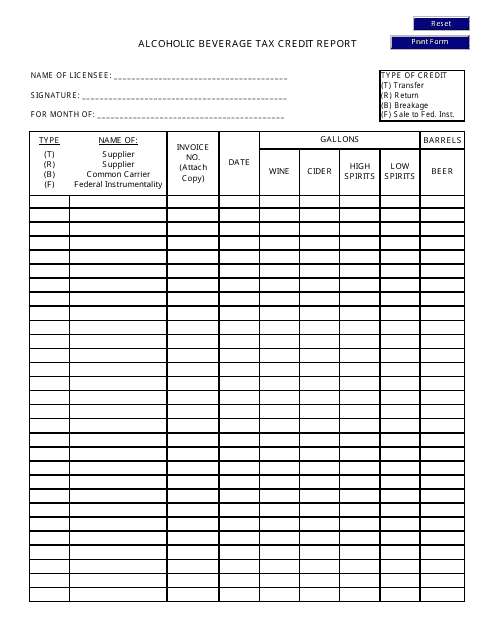

This document is used for reporting and claiming the alcoholic beverage tax credit in the state of Delaware.

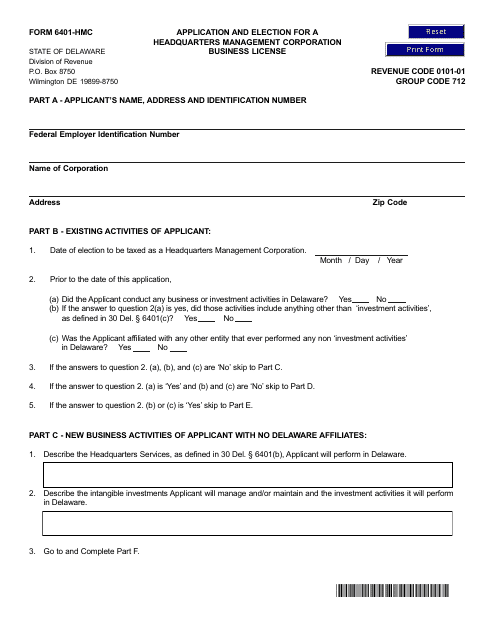

This document is used for applying and electing a business license for a Headquarters Management Corporation (HMC) in Delaware.

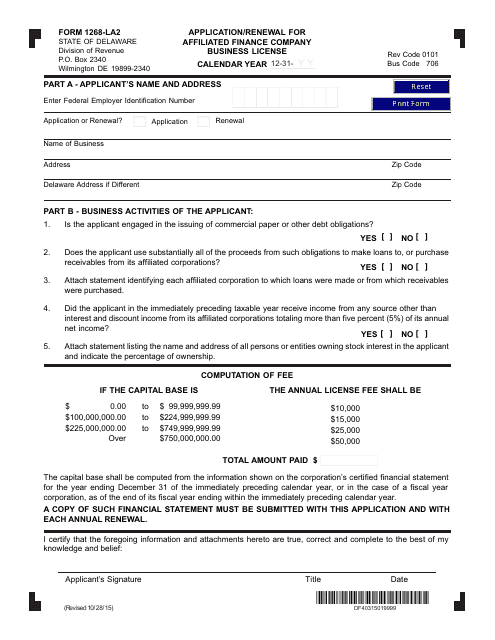

This Form is used for applying or renewing the business license for an affiliated finance company in Delaware.

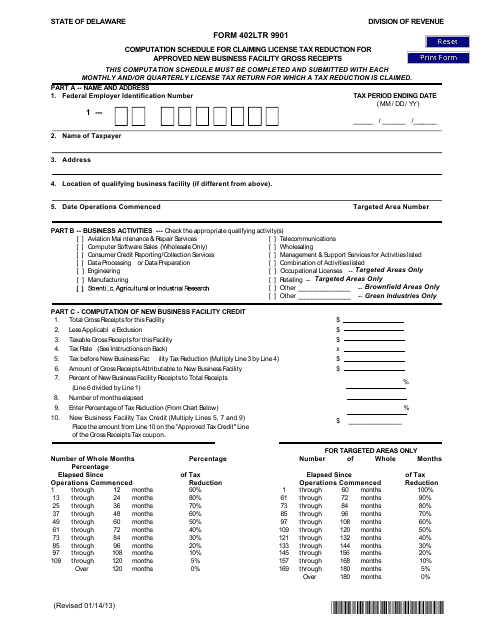

This form is used for claiming a license tax reduction for approved new business facilities in Delaware based on their gross receipts.

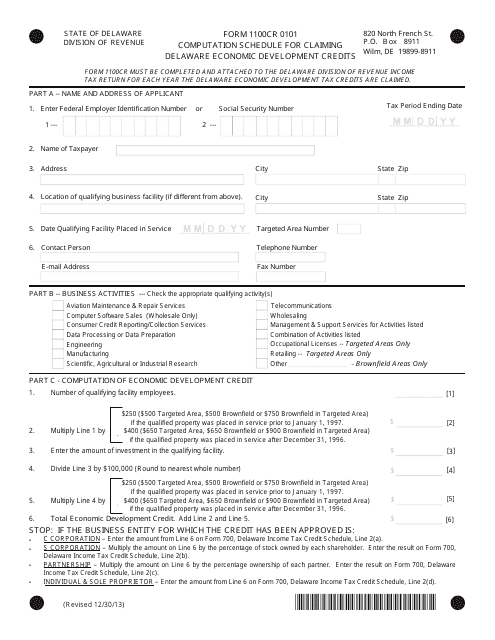

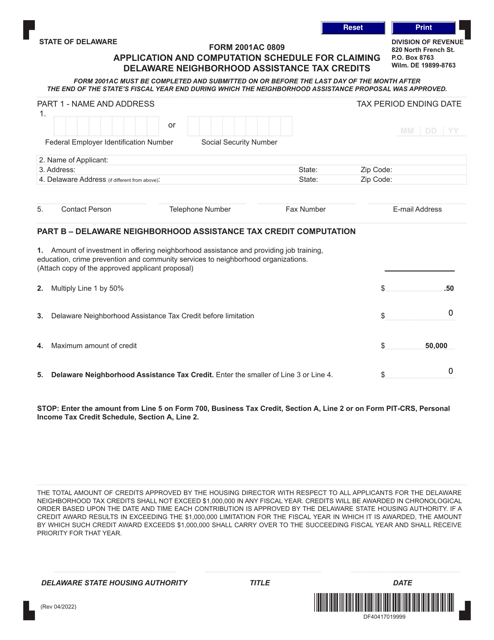

This Form is used for claiming Delaware Economic Development Credits in Delaware.

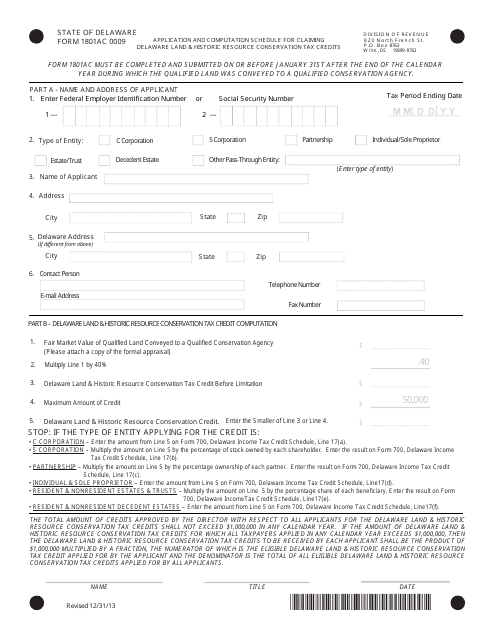

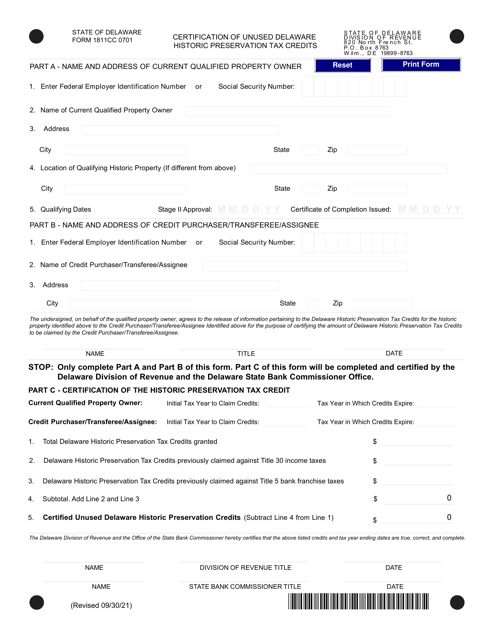

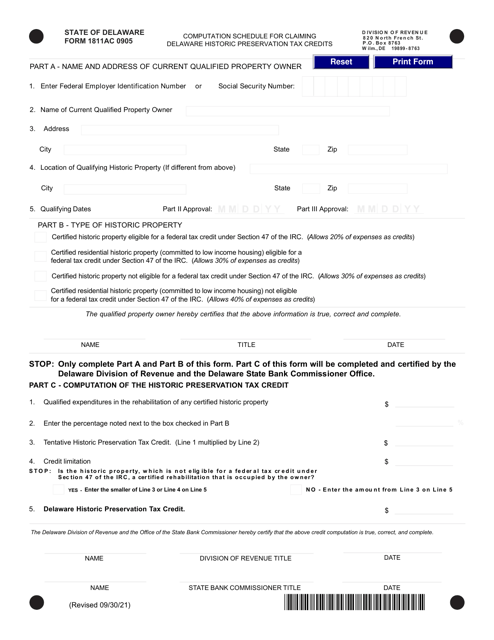

This type of document is used for claiming Delaware Land & Historic Resource Conservation Tax Credits in Delaware.

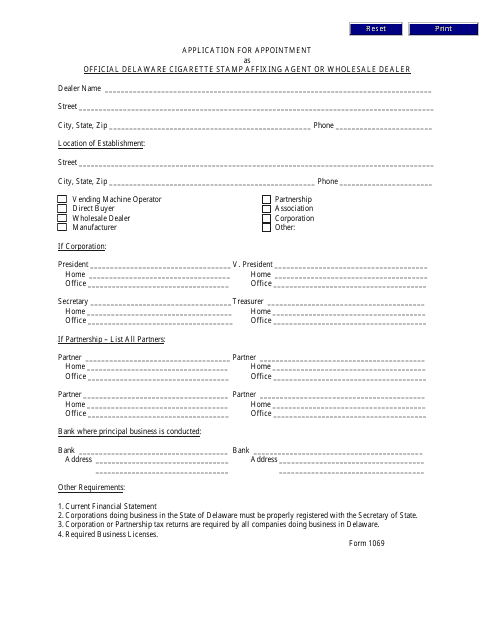

This form is used for applying to become an official Delaware Cigarette Stamp Affixing Agent or Wholesale Dealer.

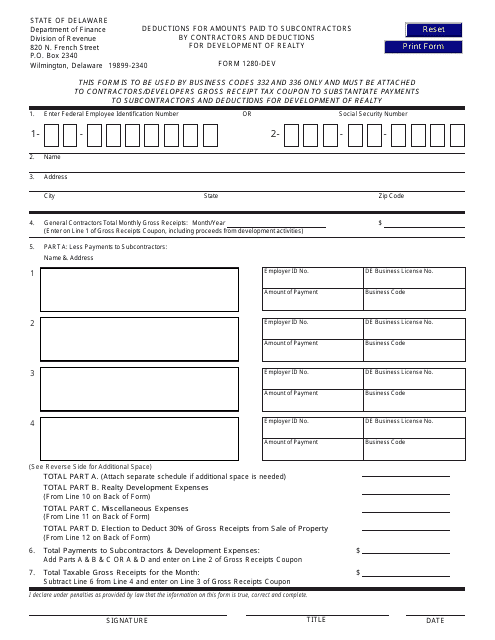

This form is used for deducting amounts paid to subcontractors by contractors and deductions for the development of realty in Delaware.

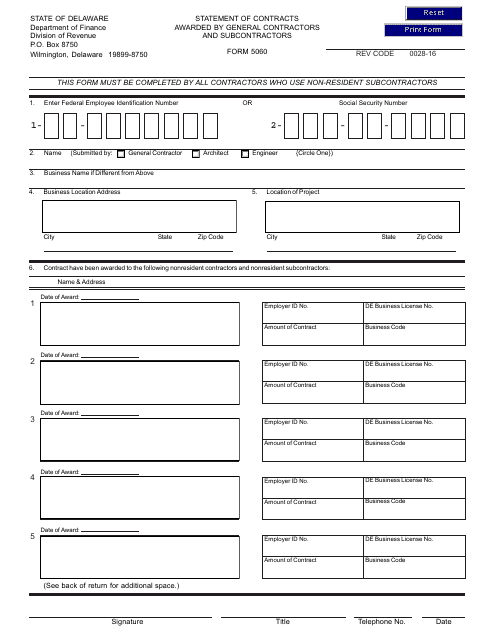

This form is used for reporting contracts awarded by general contractors and subcontractors in the state of Delaware. It provides information about the awarded contracts, including the contractor's name, contract value, and project details.

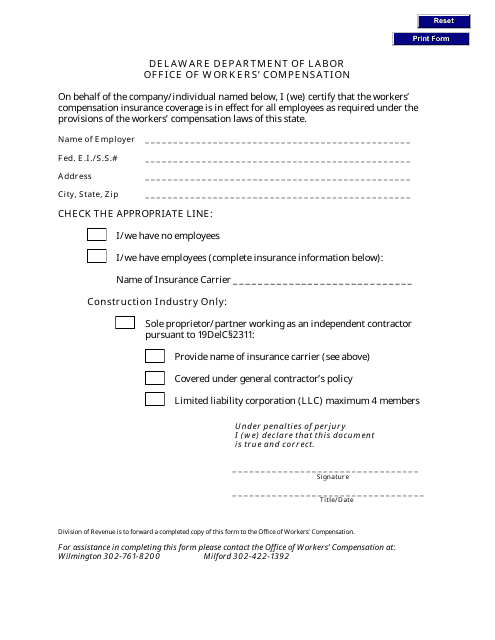

This document is used for providing proof of insurance for workers compensation in the state of Delaware.

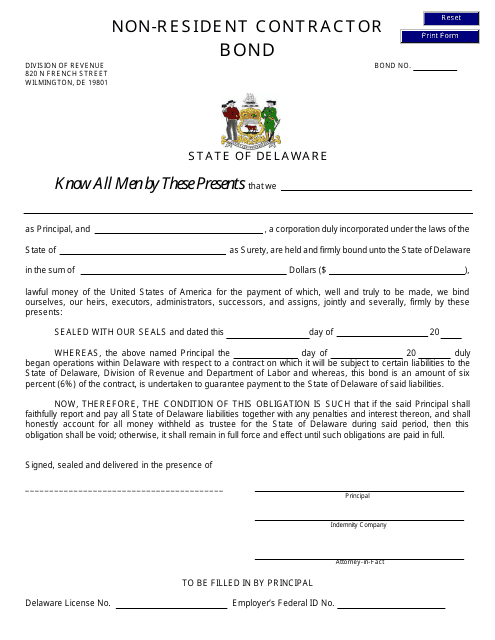

This document is for contractors who are not residents of Delaware and need to secure a bond for their construction projects in the state. The bond provides financial security to the project owner and ensures that the contractor will fulfill their contractual obligations.

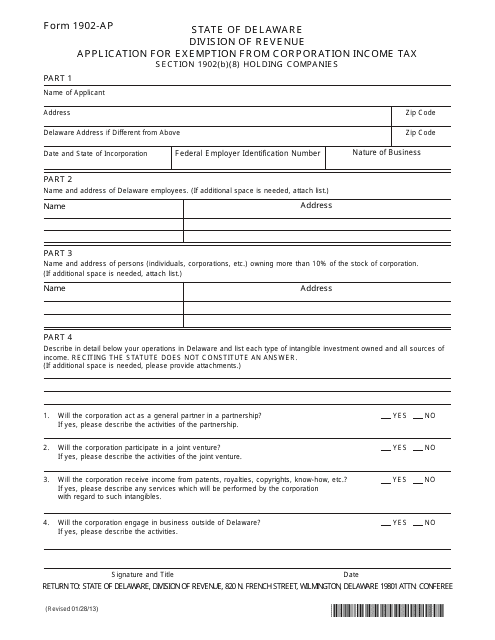

This form is used for applying for an exemption from corporation income tax for a holding company in Delaware.

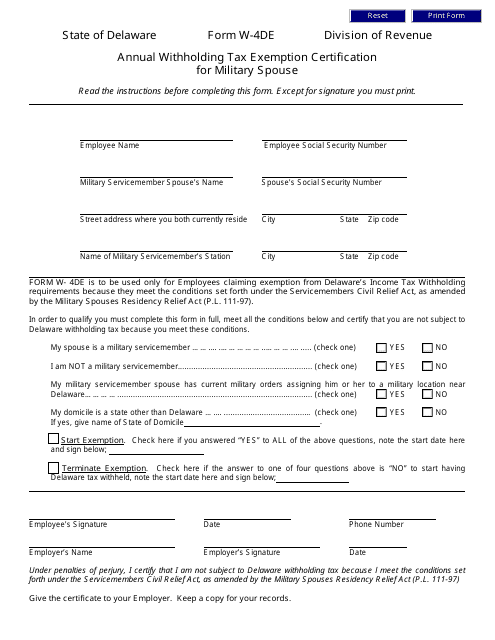

This document is used to certify tax exemption for military spouses in Delaware. It helps determine the amount of federal income tax to be withheld from their paychecks.

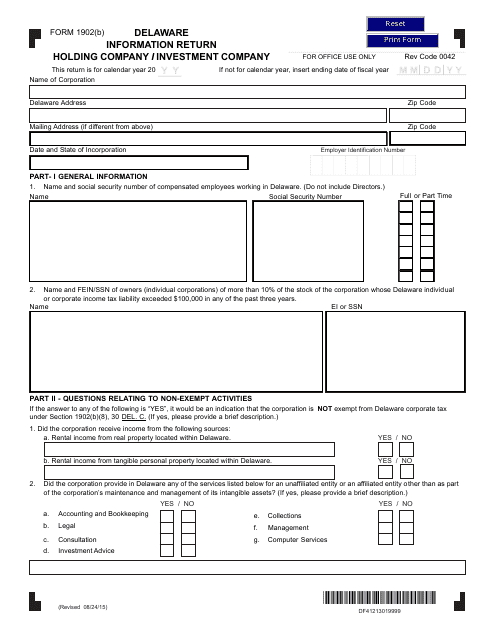

This Form is used for reporting information about a Delaware holding company or investment company.

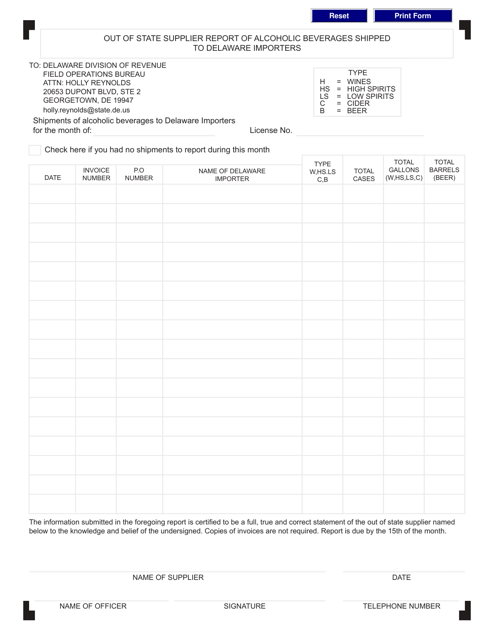

This document is used for reporting of alcoholic beverages shipped from out-of-state suppliers to importers in Delaware. It allows the authorities to track the import of alcoholic beverages for regulatory purposes.

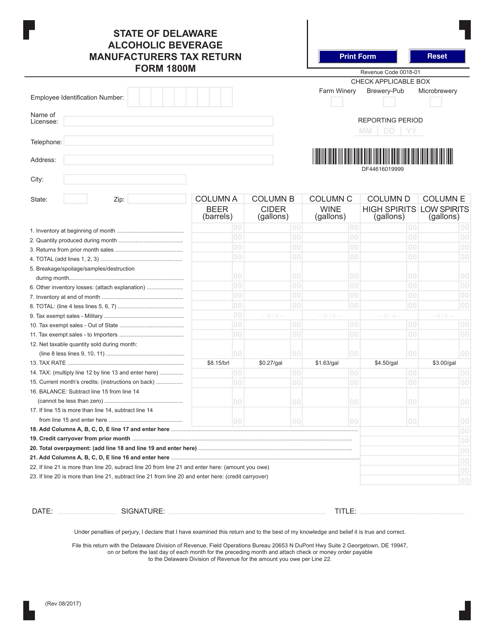

This Form is used for alcoholic beverage manufacturers in Delaware to file their tax return.

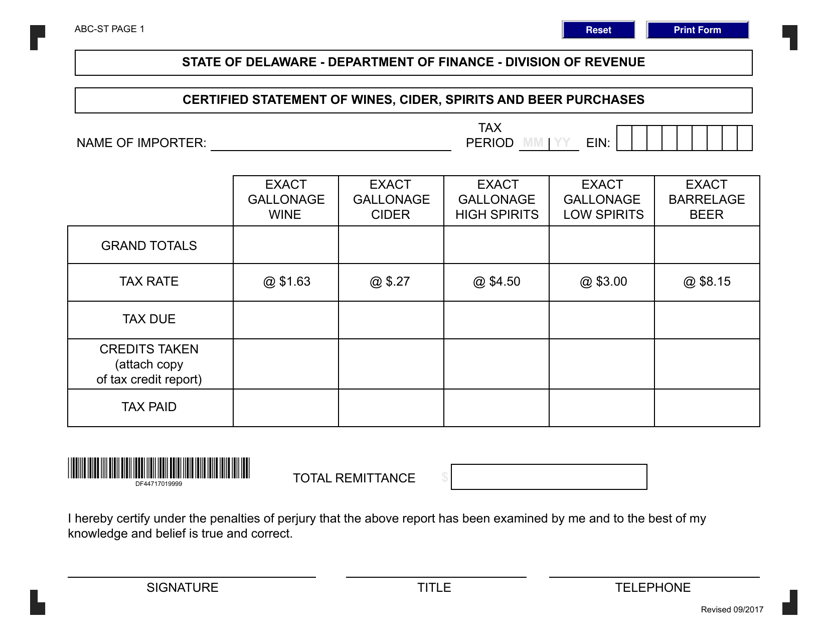

This form is used for certifying the statement of purchases of wines, cider, spirits, and beer in the state of Delaware.

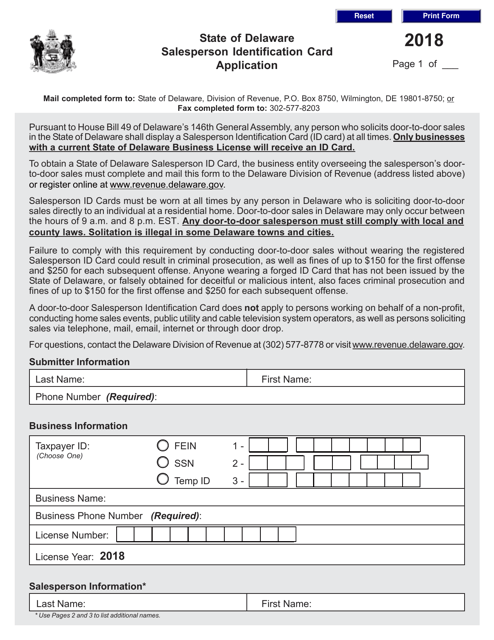

This Form is used for applying for a Salesperson Identification Card in the state of Delaware.

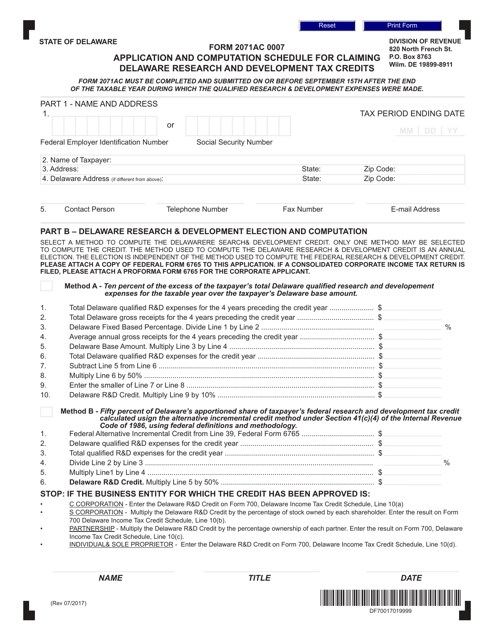

This form is used for applying for and calculating research and development tax credits in the state of Delaware.

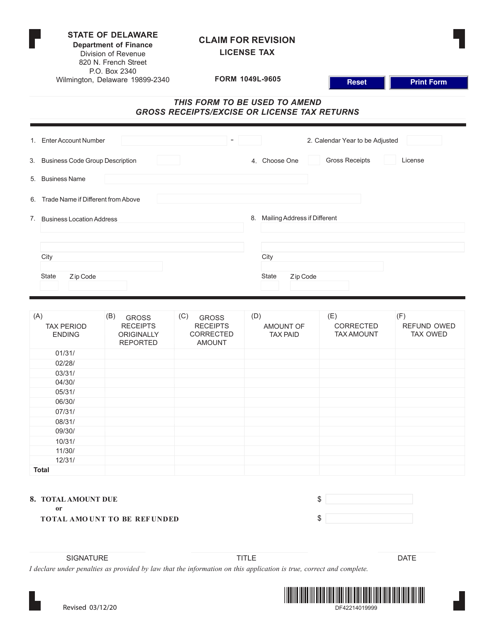

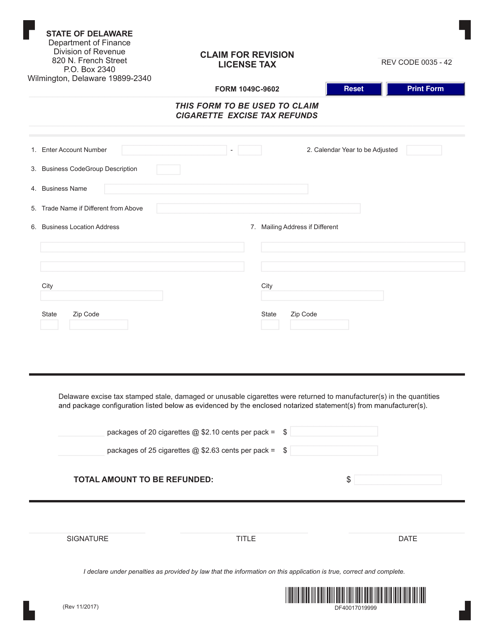

This form is used for claiming a revision of a license tax in the state of Delaware.

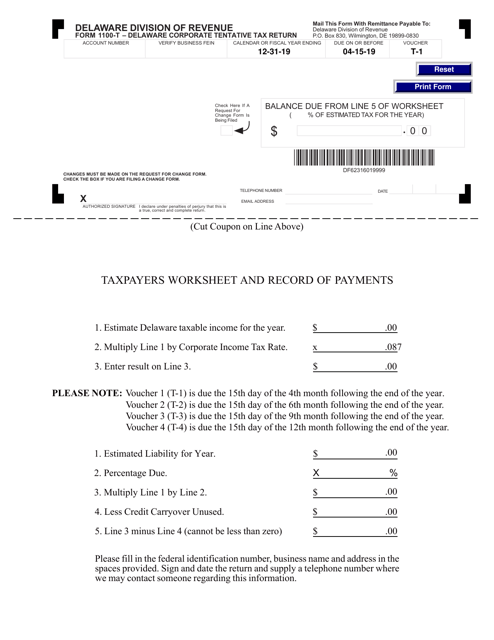

This form is used for making the tentative tax payment for Delaware corporate taxes.